North America’s shale gas revolution has fundamentally changed North America’ s energy market, thereby bringing new opportunities and challenges to the Northeast Asian LNG market.

For North America, due to the increase in shale gas production, the export-import structure of gas in the US has been reversed, and the possibility of energy independence has increased. In the meantime, Canada, being almost fully dependent on the US for gas export, can not help but explore new markets, which is in fact the Asian market.

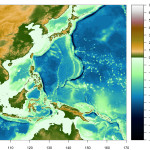

For major Northeast Asian gas importers, such as Japan and Korea, which are heavily dependent upon the Middle East and East Asia, Russia’s East Siberia is considered a new alternative for the purpose of diversifying LNG import sources for the past decade. Therefore, Northeast Asian countries tried their best to secure East Siberian gas through enhancing their bilateral relationships with Russia. However, due to the recent shale gas revolution in North America, the Northeast Asian region now encounters new opportunities in LNG contracts, which is totally different from the situation in the past.

In the mean time, once the negotiation on gas prices between Russia and China is settled, 38bcm of Russian gas will be introduced to China, In this regard, Korea and Japan should pay attention to the possible revamp in the Northeast Asian energy market and the impact related to securing energy supplying sources.

Under these circumstances, the introduction of American shale gas with a cheap price and favorable conditions Ci.e., Henry Hub price, without the clauses of take or pay and destination, etc.), or Canadian gas with relative advantages in terms of transportation distance and gas reserves, is predicted to exert a significant impact on the Northeast Asian LNG market.

Given that Northeast Asia has been significantly dependent on the Middle East or neighbouring East Asia in terms of energy security, if the region become the beneficiaries of North America ‘s shale gas revolution, the most notable thing would be that America and Canada, which have been alliances in political and military contexts, will become alliances of Korea and Japan in energy security as well. It can be referred to as a grand paradigm shift.

Apart from North America, Australia and East Africa have huge potential in gas production, which can enhance the buyers’ power in the Northeast Asian LNG market.

For Korea, the implication of East Siberian gas is not simply limited to the area of energy security, since the PNG project (gas pipeline linking Russia and South Korea via North Korea) based in East Siberian gas fields are considered as important methods to secure peace and prosperity on the Korean peninsula and in Northeast Asia. However, this project is thought to have missed a good time to be commenced, and Russian gas is losing its price competitiveness s compared to North America and Australia.

In conclusion, it is necessary to establish new rules and policies in the Northeast Asian energy market and within the regional situation as a whole. Initiatives on the LNG trading hub in the Asian region should be pushed forward through closer regional cooperation. In particular, Korea, Japan, and China, as major consumers, have to share common interests and make the maximum use of the favorable conditions of the shale gas revolution. Furthermore, the scope of cooperation should not be limited to Northeast Asia, which includes Korea, Japan, China, etc., but be expanded to the Asia Pacific region including North America.

Go to the article