PARK JIN HO, LEE SUNGKYU AND CHUNG WOONGTAE

SEPTEMBER 18, 2020

I. INTRODUCTION

In this Special Report, Park Jin Ho, Lee Sungkyu, and Chung Woongtae summarize the roles of state energy companies in the Republic of Korea (ROK) and in the other countries of Northeast Asia. They describe the roles of state energy companies in previous discussions of regional energy infrastructure, such as trans-boundary powerlines and gas and oil pipelines, and present some of the likely challenges and barriers to involvement of state energy companies in future regional discussions and arrangements for Northeast Asia regional energy interconnections.

The full report may be downloaded in PDF format here

Park Jin Ho is a Research Fellow, Lee Sungkyu is a Senior Research Fellow, and Chung Woongtae is a Senior Research Fellow with the Korea Energy Economics Institute (KEEI). Park Jin Ho is also a Visiting Professor at the Institute of Economics and International Trade, Pusan National University.

This report was produced for the Regional Energy Security Project funded by the John D. and Catherine T. MacArthur Foundation and presented at China Foreign Affairs University, April 8–10, 2019

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

This report is published under a 4.0 International Creative Commons License the terms of which are found here.

Banner image: Hankyung Magazine published on Jan-03- 2019

II. NAPSNET SPECIAL REPORT BY PARK JIN HO, LEE SUNGKYU AND CHUNG WOONGTAE

NATIONAL ENERGY COMPANIES IN NORTHEAST ASIA, ROLES IN DEVELOPING AND OPERATING NATIONAL AND INTERNATIONAL ENERGY INFRASTRUCTURE

SEPTEMBER 18, 2020

Summary

Northeast Asia is one of the largest energy consuming regions. In particular, South Korea, China, Japan and Russia together account for one-third of global energy consumption. Despite long and intensive discussions, it has been difficult, due to political and economic reasons, for Northeast Asian countries to implement not only regional energy trade for stable energy supplies, but also energy interconnection projects. When it comes to Northeast Asia power interconnection projects, the NEA countries’ governments and state-owned power companies have taken the lead in conducting technical and economic feasibility studies, helping the projects make progress. By contrast, in the case of gas pipeline interconnection projects, all but a China-Russia gas sales contract remain in the early stages of discussion. South Korea and Russia have also discussed gas supply through pipeline interconnections, but sanctions on North Korea made the plan prognosis bleak. During the discussions, state-owned energy companies of each NEA country have taken leading roles in these energy interconnection projects because the state-owned companies of NEA countries (except Japan) have been responsible for stable energy supplies in their domestic markets. The roles of state-owned companies, however, have made Northeast Asia fall behind the US and European countries in energy market liberalization. When Northeast Asian countries come to have energy interconnections and relevant infrastructure in place, trade flexibility and liquidity among the NEA countries would improve. Accordingly, private companies also would have more and better opportunities for participating in energy trade. This evolution would prompt the liberalization and deregulation of energy markets, stimulating energy trade in Northeast Asia.

1 Introduction

Northeast Asia (NEA) is an energy consuming region: in terms of annual energy consumption, China is in first place among the nations of the world, followed by Russia (4th), Japan (5th) and South Korea (9th). Energy consumption in four countries—South Korea (the Republic of Korea, or ROK), China, Japan and Russia—accounted for about one-third of global energy consumption in recent years. Northeast Asian countries, however, have not to date actively promoted regional energy trade to help to stabilize energy supplies, and have largely neglected energy interconnection projects as well. Political confrontations with North Korea and Japan’s geopolitical issues made it hard for South Korea to be connected with energy supplies from its neighbors on the continent, which puts regional energy interconnections in an unfavorable situation. Despite those challenges, Northeast Asian countries have created consensus on the necessity of energy interconnections. Accordingly, the governments, private sectors and academic circles of each NEA country have started to work together to explore possible energy interconnection options.

Energy grid interconnection projects in Northeast Asia (NEA) are largely divided into two types: the first is power grid interconnections, and the second is natural gas pipeline interconnections. NEA power grid interconnections start with the concept that electric power is generated in regions with abundant energy resources, namely in Russia (Eastern Siberia and the Far East) and Mongolia, and interconnections are expected to enable the efficient use of energy resources in the region, respond to climate change through expansion of renewable energy use, and improve welfare of participating countries through reductions in electricity prices.

Northeast Asia boasts a high level of complementarities for power supply and demand, thanks to the characteristics of the available resources, the different power load structures (including timing of peak loads and of power availability) in the countries of the region, and the generation mix. Furthermore, the economic effects that could be provided by NEA power interconnections could be greater than for interconnections in any other country or region, including the US and Europe. The designs for Northeast Asia power interconnections, however, tend to be different according to which country or which institution will lead the project, and are changing based on regional geopolitical situations.

In addition, gas pipeline interconnections are becoming more and more important for NEA countries. Regional cooperation is needed as demands for natural gas are projected to increase further. As natural gas combustion emits less greenhouse gas per unit of fuel energy than combustion of other fossil fuels, natural gas can help to bridge the energy transition from fossil fuels to new and renewable energy. In the case of Japan, natural gas demands have been significantly growing since the Fukushima nuclear plant disaster. Moreover, China has been reducing coal-fired generation, and expanding the use of natural gas to address concerns over fine dust (particulate) emissions from coal combustion. South Korea has closed old coal-fired power plants and it changed the input fuel to LNG (liquefied natural gas) for six existing coal-fired power plants. On top of that, South Korea plans to expand the share of LNG in its generation mix from 16.9% in 2017 to 18.8% by 2030. South Korea, already the world’s third largest LNG importer, is considering imports of Russian pipeline gas and participation in gas development projects in the Russian Far East. If the security situation improves on the Korean peninsula, it would be possible that the Trans-Korea Gas pipeline project would be realized.

Although needs for energy grid interconnection projects are growing, it will take time to realize such projects. The projects have progressed to some extent as relevant countries’ governments and state-owned companies have taken the lead to review those projects’ technical and economic feasibility. However, discussion between project partners in the participating nations must be undertaken to finalize and implement the projects. Until now, each government and its state-owned energy companies have participated in the discussion. Recently, the energy market is changing as Japan liberalized its electricity and gas markets, and needs for other means of organizing cooperative projects is emerging. Still, state-owned energy companies are leading the cooperation discussions in South Korea, China and Russia.

When it comes to power grid interconnection projects, the Korea Electric Power Corporation (KEPCO) has actively worked toward NEA interconnections. KEPCO was established by the government on December 1981 to manage domestic ROK electric transmission and distribution networks. For natural gas projects, the Korea Gas Corporation (KOGAS), Korea’s largest LNG importer and sole wholesaler, has led discussions of natural gas pipeline connections including PNG (pipeline natural gas) interconnections. KOGAS imports more than 90% of the total LNG imported to South Korea. Also, it manages natural gas distribution pipelines in the ROK, operating large-scale LNG storage facilities.

Based economic theory, networking businesses (including electricity and natural gas networks) have natural monopolies and provide public goods, so the role of public corporations would be greater in the early stage of market development. On the other hand, however, the monopoly advantages of public corporations also can bring about negative factors such as the tendency for suppression of competition and distortions of markets (product prices). In order to solve these problems, developed regions and countries such as Europe and the United States have liberalized the electricity and gas market, and under the influence of liberalizing policies the dominant position of public corporations is gradually disappearing. The role of government entities has thus been to a large extent transformed into roles of surveillance and support activities (for example, as regulators of energy systems) to make the market work better and to promote fair market participation by private companies.

On the other hand, the roles of public corporations in Northeast Asian countries are still largely pre-eminent in their sectors. Accordingly, in this study, we take a close look at South Korea’s state-owned companies for each energy source, and also review major state-owned energy companies elsewhere in Northeast Asia. Furthermore, this study presents the achievements of state-owned companies of South Korea and their potential roles in a future energy interconnected region. This study also focuses on challenges and barriers that could undermine the participation of state-owned energy companies. This study also aims to discuss the roles and future prospects of Korean companies in domestic and overseas power networks and gas networks.

2 Summary of the Roles of State Energy Companies in South Korea

In its early stages of economic development following the Korean War, South Korea did not have the capital and technologies necessary to establish large-scale energy facilities for the supply and consumption of energy. Therefore, the Korean government attracted overseas capital through direct loans and loan guarantees and established state-owned enterprises by channeling financial resources. To foster the development of heavy and chemical industries that consume a large amount of energy, stable energy supply was a prerequisite condition, and hence the establishment of energy supply enterprises was a high priority.

As a result of energy policies that put an emphasis on stable energy supply, each energy industry was monopolized by state-owned enterprises. The ROK government formulated mid-to-long term plans for energy supply, mainly centering on state-owned enterprises in the areas of electricity, coal, mineral resources and oil. Based on these plans, the government expanded capacity and facilities and promoted economic development. The government and state-owned enterprises took charge of laying the groundwork for a stable energy supply, but the private sector was almost a non-existent in the early stages of economic development of the energy system. The government supported state-owned enterprises by making investments, providing loan guarantees and drawing capital from other countries in the form of foreign loans. State energy corporations implemented the expansion of electricity supply and infrastructure facilities such as the electricity grid based on the government’s mid- and long-term plans.

2.1 Korea Electricity Corporation (KEPCO)

The state-owned Korea Electric Power Corporation (KEPCO) is the primary electricity producer in South Korea and dominates the country’s retail sales, transmission and distribution. It was established by the government on December 1981 as a statutory juridical corporation in Korea. Before 2001, a single company, KEPCO, owned the entire electricity supply chain from generation to sales and took all monopoly market power. In 1999, the initial reforms by government were aimed at introducing market competition to every single process in electricity generation, transmission and retail marketing by allowing subsidiaries of generating companies to own their separate transmission networks. However, due to the changing political environment and fear of price volatility and unstable supply in the electricity wholesale market at that time, the reforms ended up with an incomplete separation of generation from monopoly electricity system , but the distribution and retail divisions of the electricity industries were ultimately not privatized in 2001.

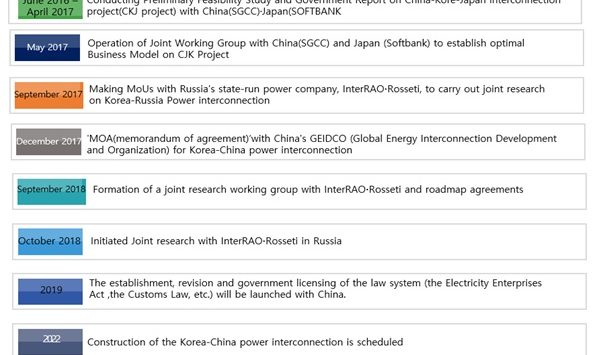

Since then, KEPCO has retained a monopoly role in electricity transmission and distribution, while electricity generation is undertaken by six KEPCO subsidiaries and regional independent power generators. As of December 31, 2017, KEPCO and its subsidiaries accounted for approximately 77.1% of the total power generated in 2017 and owned 70.3% of the total power generation capacity in Korea (excluding plants generating electricity for private or emergency use). The remaining share was owned by 17 independent power producers in South Korea, excluding renewable energy producers. A minimal amount of electricity (less than 1% of that of KEPCO’s generation subsidiaries in the aggregate as of March, 2018) is supplied directly to consumers on a localized basis by independent power producers. Figure 1 shows the structure of Korea’s electricity market and KEPCO’s role within it.

Figure 1: Korean Electricity Market and KEPCO’s Role

Source: KEPCO’s web page

Under applicable laws, the government is required to directly or indirectly own at least 51% of KEPCO’s issued capital stock. As of March, 2018, the Government, directly and through the Korea Development Bank (a statutory banking institution wholly owned by the Government), owned 51.1% of KEPCO’s issued capital stock. Accordingly, without changing in the current Korean law, it may be difficult or impossible for KEPCO to undertake its business without involvement of the government.

The government, which owns a majority of its shares and exercises significant control over KEPCO’s business and operations, may from time to time pursue policy initiatives that could directly or indirectly affect KEPCO’s business. Since the government regulates the rates that KEPCO’s charges electricity consumers, KEPCO is not able to pass on fuel costs variations to its customers without government approval. If fuel prices increase rapidly and substantially, the government is typically quite reluctant to increase tariffs to levels sufficient to offset the impact of high fuel prices, due to government concerns about economic inflation or for other reasons such as citizens’ objections to tariff hikes. On the other hand, if fuel prices decrease, the public may demand a corresponding decrease in electricity tariff rates, and as a result the government may decrease electricity tariff rates rather than allowing KEPCO to retain them. The government may also set or adjust electricity tariff rates to serve particular policy goals that may not be necessarily responsive to fuel price movements. KEPCO provides electricity to low income people and night time industrial users at lower prices than would be sufficient to recover production costs in order to improve welfare related to energy usage and to maintain industrial competitiveness, respectively. This means that the more power KEPCO provides to those consumers, the larger the economic losses it bears. In addition, a temporary rate discount has been applied from 2017 to 2020 for eco-friendly facilities using energy storage systems and renewable energy in the industrial and commercial sector. Such government’s adjustments will negatively affect KEPCO’s profit or even cause their business, financial condition and operation to suffer. It was reported that KEPCO’s operating loss and net loss for 2019 were estimated at 2.4 trillion won (US$2.13 billion) and 1.9 trillion won (US$1.69 billion), respectively. Many experts in Korea claimed that these losses seem to be largely due to the current tariff system, which may not be adjusted to a level sufficient to ensure a fair rate of return in a timely manner or at all parties.

2.2 Korea Gas Corporation (KOGAS)

Korea Gas Corporation (KOGAS) was established as a state-owned company in 1983. KOGAS builds receiving terminals and gas supply pipelines, imports liquefied natural gas from around the world, and regasifies it in its receiving terminals to supply it to city gas companies and power generation plants in a stable way. KOGAS imports LNG mainly from the Middle East (Qatar, Oman, Yemen and Egypt), Southeast Asia (Indonesia, Malaysia and Brunei), Russia (Sakhalin), Australia and the US. Since it first imported Indonesian LNG in October, 1986, the LNG imports by KOGAS have consistently increased each year, reaching 33.063 million tons in 2017. KOGAS imports LNG from many countries, including Indonesia, Malaysia, Brunei, Qatar and Oman, in order to ensure stable LNG imports. LNG is transported from natural gas-producing countries around the world via LNG carriers to LNG terminals, where it is stored in storage tanks. The stored LNG is regasified and transported to a nationwide pipeline network. Regasified natural gas is supplied from each LNG production plant to local headquarters, to each governor station (compressing the gas to pressures of 0.85-4 MPa—or Megapascals) and then flows to and through pipelines that city gas companies operate.

KOGAS imports almost 95% of the LNG demand in the wholesale sector, and is the sole wholesale supplier providing gas to large-scale consumers and city gas companies. It is a dominant gas market player and a public corporation with over 50% ownership by the government, like KEPCO. The Urban Gas Business Act grants exclusive selling rights to KOGAS, as the single wholesaler, and to 34 gas retailers. All city gas companies procure their gas from KOGAS, and consumers buy gas from city gas companies in their region. Large-scale consumers are those who own power plants larger than 100 megawatts (MW) and are eligible for a direct contract with KOGAS. Large-scale consumers such as power producers and manufacturers are allowed to import LNG for their own use, and are collectively called “direct importers.” LNG imports by direct importers are allowed for new gas demand only, that is, demand not committed to KOGAS supplies. The only eligible demand is that from newly commissioned facilities or that released from commitment due to termination or expiration of existing contracts with KOGAS. Under the Urban Gas Business Act, LNG imported by direct importers is not allowed to be sold to other domestic consumers. Importers can, however, swap their directly imported LNG among the direct importers to offset fluctuations in their own LNG demands.

The previous ROK government planned to expand the country’s nuclear and coal generating capacity. However, the newly-inaugurated administration has announced its intention to reduce the shares of coal and nuclear power in the energy mix. The Moon administration aims to transform the energy system into a safer and cleaner one by promoting efficient energy utilization on the demand side and expanding renewables on the supply side while phasing out nuclear and coal-fired power generation. This would lead to an increase in the use of natural gas, at least in the short to medium term. The 8th Basic Plan for Long-term Electricity Supply and Demand (MOTIE, 2017) reflects the new government’s intention to reduce its reliance on coal and nuclear in the future energy mix. According to this plan, renewable energy will receive government support to meet the increased target of a 20% share in the generation mix by 2030. LNG is also likely to create benefits as a lower-emission fuel source by replacing generation losses from coal-fired power plants during periods when coal-fired power is suspended to address air quality concerns.

A major constraint for developing the natural gas market of South Korea is that the market structure has not been liberalized as of yet. The South Korean government has promoted gas market reforms since the late 1990s to allow market competition. However, the plan was unrealistic because many stakeholders, including the KOGAS labor union, were reluctant to make changes. KOGAS is the sole LNG wholesale supplier and importer of most LNG, so the number of market players is limited. There is no wholesale competition, so there is less incentive to reduce LNG import prices.

KOGAS and the South Korean government have tried to reduce LNG import costs. In a competitive market, however, players may have more incentives to reduce import prices to maximize their profits. It is difficult for KOGAS to manage demand uncertainties in the domestic market as it has many long-term contracts with destination clause (that is, the buyers who made a long-term contracts should receive the LNG in designated receiving terminals in a country and not allowed for resale to the other consumers). If the wholesale market competition in the ROK opens up and trade is allowed among market players, it is possible that spot purchases would increase to manage demand uncertainties. Another constraint is the system of third-party access (TPA) rules. Third party access policies require owners of natural monopoly infrastructure facilities to grant access to those facilities to parties other than their own customers. KOGAS owns and controls most gas facilities, thus the TPA rules including the tariff system need reforms so that they are fair for all market participants. KOGAS provides bundling services to large-volume consumers that use its facilities. Prices for these are lower than the pipeline access prices imposed on small-volume direct importers under the current TPA rules. Setting up fair TPA rules would be a first step for market players to create a platform of fair market competitions.

2.3 Korea Hydro & Nuclear Power Co., Ltd. (KHNP)

The Korea Hydro & Nuclear Power Co., Ltd. (KHNP) was established on April 2, 2001 when it was separated from the Korea Electric Power Corporation (KEPCO) as a subsidiary in accordance with the Act to Accelerate Restructuring Electricity Industry. Since KHNP initiated commercial operation of the Kori #1 nuclear power plant in 1978, it has operated more than 20 commercial nuclear reactors across the country. Currently, Shin-Kori #4 and Shin-Hanul #4 are under construction, and KHNP has also received construction permits for Shin-Kori #5 and #6. KHNP operates hydroelectric power plants such as Cheonpyong Dam and Paldang Dam as well. KHNP generates approximately 32% of the total electric power produced in South Korea and promotes the construction and export of nuclear power plants.

KHNP has business operations for nuclear, hydro, and new and renewable energies, and also participates in overseas projects. As of December, 2017, KHNP operated 24 nuclear power plants, 35 hydro and small hydroelectric power plants, 16 pumped-storage power plants, 8 solar power plants and one wind power plant, all of which contributed to its 31.5% share of generation in 2017.

KHNP’s total power generation based on nuclear energy came to 148,427 GWh in 2017, which represented more than 26.8% of the total power generation in South Korea. KHNP operates 21 hydroelectric power plants and 14 small hydroelectric power plants, and their installed capacity is 606.73 MW. Furthermore, KHNP has 16 pumped-storage power plants in Cheonpyong, Samrangjin, Muju, Sancheong, Yangyang, Cheongsong and Yecheon, and the installed capacity of these plants is 4,700 MW. KHNP supplies electricity in a stable way during peak times based on these pumped-storage power plants. As the South Korean government plans to expand the share of renewables of its generation mix to 20% by 2030, the KHNP is making efforts to support the government’s energy policy and promoting new and renewables-related projects to play an important role in meeting the goals of the ROK’s Renewable Portfolio Standard (RPS). The KHNP will invest approximately KRW7.3 trillion in newly constructing new and renewable facilities with 7.6 GW of installed capacity.

2.4 Korea National Oil Corporation (KNOC)

Stable oil supply has been a matter of national energy security in the ROK for many years. The Korea National Oil Corporation (KNOC) was founded to stabilize the national economy of South Korea by securing stable oil supplies through strategic petroleum stockpiling and petroleum source development.

Since its establishment, the corporation identified oil industry trends at home and abroad as it supported government policies, and also focused on securing the rights to oil fields and to exploration services to provide resources for oil development projects. In 1987, gas was found for the first time on the continental shelf of South Korea and, since then, tests had been conducted to keep updating data on the continental shelf oil and gas resource. Up to the present, KNOC has developed gas condensate wells in ‘Donghae-1,’ South Korea’s offshore gas field, and has supplied the output of the field to the domestic market. Currently, the corporation is actively seeking to develop overseas oil fields by participating in promising oil development projects. In particular, the corporation played a leadership role in the Vietnam 15-1 field project from the exploration stages. KNOC participated in exploration/drilling projects in Russia’s Western Kamchatka offshore oil fields from 2003 to 2008 with a 40% ownership stake (the remaining 60% went to Rosneft). As of now, the KNOC is not participating in any energy development projects in Northeast Asia. As of 2018, however, KNOC promoted 27 projects in 16 countries, including 20 producing projects, two development projects and five exploration projects. KNOC’s total reserves now reach almost 1.4 billion barrels, and daily production comes to 170,000 barrels. Meanwhile, KNOC has developed a mid-to-long term plan for technology development and technology independence. The corporation’s Exploration and Production Technology Institute is supporting research activities for oil development and is providing an education program for oil sector technicians and engineers.

South Korea is the fifth-largest oil net importer and the eighth oil consumer in the world. The ROK, however, depends largely on supplies of oil from the Middle East, and its self-development rate is still low. As such, the ROK’s ability to respond to an emergency in which oil supplies are cut off or restricted, and/or in which oil prices rise dramatically, is insufficient compared with other major oil importing countries. As a result, the government officially started to build its strategic oil reserve in the 1980s to promote national economic development and also to stabilize domestic oil supply and oil prices. Based on its technological prowess and experiences in managing oil stocks, the corporation is engaging in international activities such as overseas strategic oil stockpiling in China and India, where there is an oversupply of refining capacity and oil storage. KNOC is making efforts to achieve the reserve target set by the government on schedule and in an efficient way by effectively managing oil stocks through joint oil stockpiling or stocks trading. As of the end of December, 2018, the KNOC operated nine reserve facilities with a total capacity of 146 million barrels and has 96 million barrels of reserve oil (excluding joint stockpiling). Among its reserve facilities, four are for crude oil, another four for petroleum products and one for LPG reserves.

3 Summaries of Roles of State Energy Companies in Other Northeast Asian Countries

3.1 China

To meet the demand for energy consumption in China and provide energy to the widespread Chinese territory, the role of national energy companies is crucial.

For the oil sector, China established three major national oil companies in 1980—China National Petroleum Corporation (CNPC), the China Petroleum and Chemical Corporation (Sinopec), and China National Offshore Oil Corporation (CNOOC). CNPC was put in charge of most of the country’s onshore upstream assets, and Sinopec was given responsibility for downstream activities such as refining, distribution and petrochemicals. CNOOC is responsible for exploring and developing oil and gas assets in the offshore areas of China and overseas. However, all three firms are now technically vertically integrated firms that own both upstream and downstream assets. For the trans-national oil pipeline, CNPC was in charge of pipeline projects with Kazakhstan’s KazMunayGas (KMG) for Kazakhstan–China pipeline and also with Russia’s Gazprom for Eastern SiberiaPacific Ocean (ESPO) Pipeline. As with oil, the natural gas sector is dominated by the three principal state-owned oil and gas companies. CNPC is the key operator of the main gas pipelines, and holds nearly 80% of the gas transmission in China.

CNPC moved into the downstream gas sector recently through investments in gas retail projects as well as investments in several pipeline projects to facilitate transportation for its growing gas supply. Sinopec is also a major player in the downstream transmission sector, operating long pipelines from the Sichuan Province to Shanghai and the north central region to Shandong along the northeastern coast. CNOOC operates pipelines mainly along the coastal areas of China and is a key LNG player in China as the pioneering developer of LNG regasification terminals.

Although CNOOC has held a competitive advantage on China’s LNG market, the other national oil companies and private companies have made inroads into the LNG industry. CNPC and Sinopec entered the LNG market through regasification terminals projects in 2011 and 2014, respectively.

China’s coal industry consists of three main types of businesses: large state-run coal mines, local state-owned coal mines and thousands of town and village coal mines. The top state-owned coal companies, including Shenhua Group and China National Coal Group (China’s largest coal companies), produce about half of the country’s coal. Local state-owned companies produce about 20%, and small-town mines 30% of the coal output each year. China has about 10,000 small local coal mines that typically suffer from insufficient investment, outdated equipment and poor safety practices. Therefore, most inefficient small mines are or will end up closing down their operations, while the share of production from large state-owned companies is likely to increase.

For the power sector, the Chinese government dismantled the monopoly State Power Corporation (SPC) into separate generation, transmission and distribution service units in 2012. Since the reform, China’s electricity generation sector has been controlled by five state-owned generation companies, namely as China Huaneng Group, China Datang Corporation, China Huadian Corporation, China Guodian Corporation and China Power Investment Corporation. These five companies generate nearly half of China’s electricity. Much of the remainder is generated by locally-owned enterprises or by independent power producers (IPPs), often in partnership with privately listed arms of the state-owned companies. The Chinese government has attempted to open the electricity sector to enhance the foreign investment through deregulation and other reforms, although thus far such investments have been limited.

Regarding China’s electricity transmission and distribution, the China Southern Power grid company and the Grid Corporation of China operate the nation’s seven power grids. The State Grid Corporation of China operates power transmission grids in the north and central regions, while China Southern Power Grid Company handles those in the south.

3.2 Russia

3.2.1 Gazprom

Under Russia’s local laws and regulations, Gazprom has a monopoly on gas-related businesses: it has exclusively developed strategically promising onshore and offshore gas fields, operated and managed local gas transport networks and export pipelines, and sold gas in the local and international markets. The Russian government recently authorized rights for LNG exports to gas producers and private gas companies in order to expand LNG exports. Despite that, Gazprom has yet to open gas exports via pipeline to the participation of other companies. As a result, Gazprom is a contracting party to contracts for gas sales to other countries and for gas transport via pipelines to other nations. Gazprom is world’s top gas company by many measures, including gas reserves, production, sales and exports. In addition, it has subsidiaries in various sectors including petroleum, gas chemistry, gas-fired generation, finance and media.

Gazprom, a state-owned enterprise, was established under the Gorbachev administration in 1989 (in the former Soviet Union). The Russian government (along with state-owned companies and national institutions) is the major shareholder with more than a 50% stake in the company. Under current Russian laws, any foreign investment in basic industries such as the gas industry shall not be greater than 50%. Gazprom sells approximately 40% of its gas production to local markets and exports the rest via pipelines, with exports governed by long-term agreements, oil price index adjustments for gas prices, destination clauses, and take-or-pay clauses. Today, it can be said that the Russian government, and in particular President Putin, largely dominates the governance of Russia’s state-owned enterprises. For Gazprom, this is because some of President Putin’s closest allies have held key posts as Gazprom Chairman and Chief Executive Officer. Furthermore, the Russian government is diplomatically using Gazprom as one of its methods to maintain Russia’s profits in gas export agreements with European and former Soviet countries.

Projects for Russian gas development and exports are policy-conscious, especially when a state-owned company is involved. The Russian government sticks to resource nationalism. For promising onshore gas fields, foreign companies’ investment is restricted to equity participation. When it comes to development of offshore gas fields, only joint investment with state-owned oil and gas companies is allowed. Also, planned or on-going projects for gas fields development and export pipeline construction have been canceled or delayed. This is because the current low oil prices in the international market have undermined the economic feasibility of some gas fields development projects. Western sanctions have also kept Russia’s energy companies from accessing global financial markets and importing important gas field development technology and equipment. In addition, the Russian government has been reducing government expenditure for the energy sector in general.

In the 2000s, the Russian government started to develop energy resources in the Far East to spur regional economic growth. Gazprom announced the Eastern Gas Program in 2007, purchasing the development rights to major gas fields in Eastern Siberia and the Far East. This accelerated Russian gas import projects with South Korea and China. Gazprom’s strategy for gas exports is to use the Unified Gas Supply System (UGSS), which is to connect a single transport pipeline with many gas fields in Russia to supply gas to local and international markets.

Based on its great potential of gas production and exports and exclusive rights to export, Gazprom adheres considerably to a strict negotiation strategy. Gazprom as a gas producer and exporter requires importers to accept destination clauses, take or pay clauses, oil indexation and long-term contracts in order to minimize investment risks to Gazprom. Furthermore, Gazprom prefers bilateral negotiation strategies and offers each importer different gas supply prices. As a result, Russia’s counterparts often end up importing Russian gas at relatively higher prices.

Gazprom transports Russian gas to local and international markets through the UGSS. In particular, the eastern UGSS consists four gas production centers (Irkutsk, Yakutia, Krasnoyarsk and Sakhalin) and gas pipelines (Power of Siberia I and II, Sakhalin-Khabarovsk-Vladivostok) connecting these centers with each other, and also includes the Russia-China pipeline under construction and the planned Trans-Korea gas pipeline and Russia-Japan gas pipeline.

Gazprom plans to transport gas produced in the Far East gas fields (Chayanda and Kovykta) to other nations in the Northeast Asian region in the medium and long term. Later, if the West withdraws sanctions on Russia, Gazprom would develop the Sakhalin III gas fields, exporting LNG or PNG to South Korea and other Asia-Pacific countries.

Interconnected oil pipelines are in operation between Russia and China, and gas pipelines are being constructed. Furthermore, LNG production facilities and export terminals are being established in Sakhalin. In May, 2014, the two countries’ governments and state-owned gas companies (Gazprom and CNPC) signed a 30-year gas supply deal. Under this agreement, for 30 years, Russia will supply the Chinese market with 38 bcm (billion cubic meters) of gas per year by pipelines. Furthermore, Russia also agreed that it would supply an additional 68 bcm of PNG per year to China. It took more than ten years for Russia and China to reach this agreement, and the decade-long negotiations was necessitated because the two countries initially offered quite different gas prices for the deal. The Chinese government and the CNPC are expected to lend Gazprom a large amount of investment funds, and in return, get Russian gas at a discounted price. This was possible because Gazprom faced difficulties in funding because of Western sanctions.

In addition, South Korea and Japan have been supplied from the LNG plant within Sakhalin II (current operator: Gazprom) since mid-2006. The US and European oil and gas companies have carried out several projects to develop oil and gas fields in the offshore Sakhalin region. Currently, oil and gas resources produced from the Sakhalin I and Sakhalin II projects goes to the Russian Far East via pipelines and to the Northeast and Asia-Pacific regions via LNG vessels. Rosneft, Russia’s state-owned oil company, has participated in the Sakhalin I project (Operator: US ExxonMobil); Gazprom, the state-owned gas company, is an operator of the Sakhalin II project (by purchasing operating rights from Shell).

3.2.2 Rosseti

Before 2006, the electric power industry was monopolized by two state-owned companies: RAO-UES (Unified Energy Systems of Russia), which controlled generation, and the Federal Grid Company (FGC), which controlled the power transmission grid. Later, the Russian government restructured the electrical power industry, and since June of 2006, the monopoly system had been phased out. Today, the industry consists six large thermal power generators, one hydro power generator, one nuclear power generator and 18 territorial generating companies (TGCs). Among the major state-owned generating companies are RusHydro, Gazprom Energoholding, Inter RAO UES and Rosnegoatom Concern. Moreover, EuroSibEnergo and T Plus are important private generating companies. In particular, Inter RAO UES represents 11% of the total generation and 17% of total electric power sales, and its installed capacity is 28.5 GW.

In addition, there are 65 Power Sales Companies (PSCs) which were established when the RAO-Energo companies were restructured.

Russia’s Power Grid System consists of seven regional grids—North-West, Center, Middle Volga, North Caucasus, Urals, Siberia, and Far East—and these grids are interconnected. In 2006, the transmission and distribution sectors were separated into the Federal Grid Company of the Unified System (FGC), eight Interregional Distribution Grid Companies (IDGCs) and 51 Distribution Grid Companies (DGCs). The FGC is a state-owned transmission grid company, and the IDGCs are responsible for managing distribution grids operating at less than 330 kV. In 2013, the FGC and IDGCs were merged as one corporation under the Public Joint Stock Company Rosseti (PJSC Rosseti). The Russian government announced the merger in Decree No.1567 “About Open Joint Stock Companies ”Russian Grids” on November 22, 2012. The aim of the structural reforms combining of main and distribution power networks is to create a single point of responsibility to shareholders, coordinate economic efficiency of investment activity, develop uniform standards and indicators of quality, and improve the operational efficiency of the power grid enterprise complex of PJSC Rosseti.

Rosseti is Russia’s largest public grid company, and it managed 2.34 million-kilometer-long transmission lines and 781 GW of transmission capacity, transmitting 7,580 kWh of electricity as of 2017. Rosseti has 35 subsidiaries and affiliates, and the government has an 88.04% stake in Rosseti. In addition to Rosseti, some of the grid is managed by private small transmission operators such as BESK and SIENKO.

In 2001, Vostokenergo, the RAO-UES subsidiary for the Far East, discussed the potential for power grid connections with North Korea on several occasions. In 2009, Inter RAO UES and KEPCO signed an MOU to cooperate in the generation and transmission sectors, and the cooperation included joint research on a grid connection between Russia and South Korea via North Korea. Furthermore, in March, 2016, South Korea (KEPCO), China (SGCC), Japan (SoftBank) and Russia (Rosseti) signed an MOU to cooperate in establishing the NEA “Super Grid”.

3.3 Japan

In Japan, the electricity market is divided up into ten regulated companies:

(1) The Chugoku Electric Power Company, Incorporated is an electric utility with its exclusive operational area of Chūgoku region of Japan. It is the sixth largest by electricity sales among Japan’s ten regional power utilities. It operates the Shimane Nuclear Power Plant.

(2) Chubu Electric Power Co., Inc. abbreviated as Chuden in Japanese, is a Japanese electric utilities provider for the middle Chūbu region of the Honshu island of Japan. Chubu Electric Power ranks third among Japan’s largest electric utilities in terms of power generation capacity, electric energy sold, and annual revenue.

(3) The Hokuriku Electric Power Company supplies power by a regulated monopoly to Toyama Prefecture, Ishikawa Prefecture, the northern part of Fukui Prefecture and northwestern parts of Gifu Prefecture.

(4) The Hokkaido Electric Power Company is the monopoly electric company of Hokkaidō, Japan. The company is traded on the Tokyo Stock Exchange (first section), Osaka Securities Exchange (first section), and Sapporo Securities Exchange. Hokkaido only has one nuclear power station, the Tomari Nuclear Power Plant.

(5) Kyūshū Electric Power is a Japanese energy company that provides power to 7 prefectures (Fukuoka, Nagasaki, Ōita, Saga, Miyazaki, Kumamoto, Kagoshima) and recently to some parts of Hiroshima Prefecture.

(6) The Kansai Electric Power Co., Inc is an electric utility with its operational area in the Kansai region of Japan. The Kansai region is Japan’s second-largest industrial area, and in normal times, its most nuclear-reliant. Before the Fukushima nuclear disaster, a band of 11 nuclear reactors — north of the major cities Osaka and Kyoto — supplied almost 50 percent of the region’s power. As of January 2012, only one of those reactors was still running. In March 2012, the last reactor in the area was taken off the power grid.

(7) The Okinawa Electric Power Company, Incorporated is an electric utility with its exclusive operational area of Okinawa Prefecture, Japan. It is the smallest by electricity sales among Japan’s ten regional power utilities.

(8) Tokyo Electric Power Company Holdings, Inc., also known as TEPCO, is a Japanese electric utility holding company servicing Japan’s Kantō region, Yamanashi Prefecture, and the eastern portion of Shizuoka Prefecture. This area includes Tokyo. As TEPCO is a holding company, there are several major wholly owned subsidiaries:

- TEPCO Power Grid – Responsible for managing the power grid around the Kantō region, and transmits and distributes electricity between electricity wholesaler and retailer.

- TEPCO Energy Partner – Electricity retailer operating under “TEPCO” brand throughout Japan, except Okinawa.

- TEPCO Fuel & Power – Operates fossil fuel power stations mainly for TEPCO Energy Partner.

- Tokyo Electric Generation Company – Generates wholesale electricity for the electricity market.

- Tokyo Electric Power Services Co. Ltd (TEPSCO) – Provides consulting services for electric power industry.

(9) Tohoku Electric Power Co., Inc. is an electric utility, servicing 7.6 million individual and corporate customers in six prefectures in Tōhoku region plus Niigata Prefecture. Tohoku Electric Power is the fourth-largest electric utility in Japan in terms of revenue, behind TEPCO, KEPCO and Chubu Electric Power.

(10) The Shikoku Electric Power Company is the electricity provider for the 4 prefectures of the Shikoku island in Japan with few exceptions.

Also, there are 13 natural gas suppliers in Japan. Tokyo Gas, Osaka Gas and Toho Gas are the largest of these.

(1) Tokyo Gas Co., Ltd. founded in 1885, is the primary provider of natural gas to the main cities of Tokyo, Kanagawa, Saitama, Chiba, Ibaraki, Tochigi, Gunma, Yamanashi and Nagano. As of 2012, Tokyo Gas is the largest natural gas utility in Japan.

(2) Osaka Gas Co., Ltd. based in Osaka supplies gas to the Kansai region, especially the Keihanshin area. Osaka Gas is also engaged in upstream, midstream and downstream energy projects throughout the world, including LNG terminals, pipelines and independent power projects, particularly in Southeast Asia, Australia and North America.

(3) Toho Gas Co., Ltd. engages in the gas, heat supply, and electricity businesses in Japan. It is also involved in the development, purchase, and sale of natural gas and other energy resources.

In Japan, high energy prices have become a social issue, which triggered liberalization of the energy sector, especially the electric power and gas markets, in the mid-1990s. Until the mid-2000s, the liberalization level in retail electricity and gas markets was about 66%, however further work on liberalization of the energy markets had been stalled. However, energy prices soared because of the Fukushima disaster in 2011, and discussions on innovation possibilities for Japan’s energy system resumed in earnest. Japan completely liberalized its retail electricity market on April 1, 2016. After a year, on April 1, 2017, it also completely liberalized its retail gas market. Liberalization made the regional monopoly system disappear, and new energy companies entered the markets. As a result, it is expected that sales competition to secure customers will become fierce in the coming years.

4 Past Involvement and Potential Roles for State Energy Companies in Northeast Asia Energy Interconnections.

4.1 Northeast Asia Power Interconnections

Discussions on the development of a Northeast Asia Power interconnection stemmed from the desire for more efficient distribution of electric power in the region. China, Japan and South Korea, each with high electricity consumption, face difficulties in meeting future energy demands by themselves. By contrast, Russia and Mongolia have great potential for development of natural gas, hydro power, solar and wind, and thanks to this, the two countries enjoy sufficient energy supplies. Against this backdrop, the discussion on the Northeast Asia Super Grid project began with an aim of transporting electric power from countries with large undeveloped energy resources to ones in need of additional energy supply.

South Korea came to have an interest in the power interconnection in Northeast Asia in 1998 when the Energy System Institute in Irkutsk of Russia and the Korea Electro-technology Research Institute (KERI) jointly studied and suggested the Northeast Asian Electrical System Ties (NEAREST). In the joint study, the two institutes reported that it is necessary to designate proposed transmission interconnections as Mainland Circle, East Sea Circle and Large NEA Circle in order to classify routings for electric power generated from Bureya hydroelectric power plant in the Russian Far East, nuclear power plants in the maritime provinces, coal-fired power plants in Eastern Siberia, and gas combined cycle power plants in Sakhalin. In particular, the East Sea Circle includes power grid interconnection between Russia and two Koreas and between South Korea and Japan. The suggested interconnections, however, were not realized at the time because of political issues in many countries and worsening inter-Korean relations.

Later, in 2004, the Korea Energy Economics Institute (KEEI) participated in the Northeast Asia Power interconnection project based on tapping renewable resources via solar energy generation and wind farms in the Gobi desert by cooperating with the Energy Charter, institutes in Russia and Japan, private institutions, and the Ministry of Energy of Mongolia. Until then, South Korea did not lead any interconnection projects, though academic institutes in South Korea participated in research projects initiated by other countries.

It was Russia-South Korea summit talks, in September, 2008, that prompted the South Korean government and state-owned companies to actively participate in discussions of Northeast Asia power interconnections. The summit talks provided an opportunity for the two countries’ governments and power companies to agree on forming a working group regarding power interconnections between Russia and South Korea. Based on the agreement, in 2009, KEPCO of South Korea and Inter RAO UES of Russia signed a memorandum of mutual understanding (MOU) to conduct a feasibility study for connecting power grids between Russia and South Korea via North Korea. Furthermore, Russia and South Korea reviewed the technical aspects of power interconnections between Russia and Koreas and the economic feasibility of the power cooperation. The study, however, was suspended because of strained inter-Korean relations in 2010. Later, North Korea continued nuclear development and NEA relations worsened markedly, which has hampered further discussions on the interconnection project.

When the Paris Agreement on climate change was signed in 2015, however, major countries in Northeast Asia including South Korea, China and Japan came to be required to reduce greenhouse gas emissions. In response, potential Northeast Asia power interconnections based on renewable sources of electricity and hydro power located in Mongolia and Russia drew much interest. Through the use of solar, wind, and hydro resources in these countries, it would be possible to expand renewable-based generation as a way to ensure stable power supplies in the region while reducing coal-fired generation. However, renewables such as wind or solar energy are intermittent, which could undermine the stability of energy grid operation. Therefore, intersupply of electricity through the Northeast Asia power interconnection could reduce GHG emissions more effectively by helping to manage the intermittency of wind and solar generation

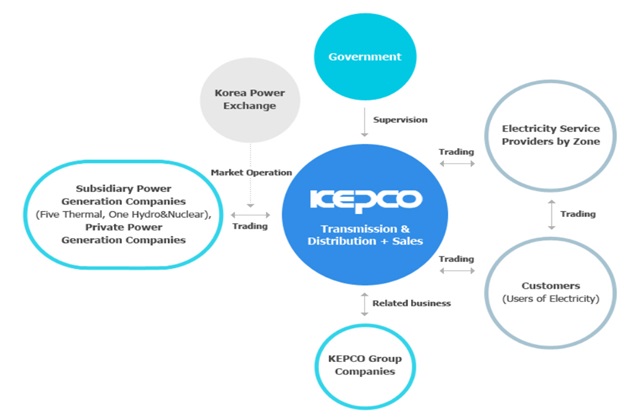

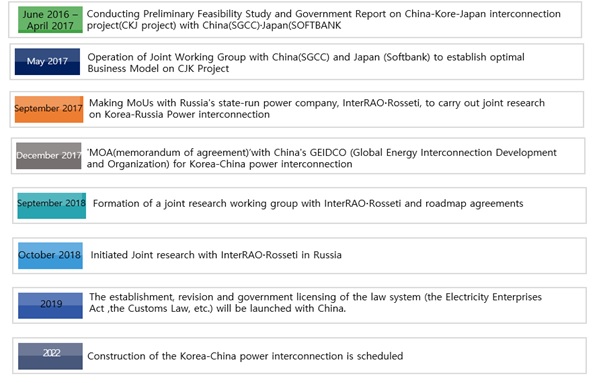

In this regard, KEPCO, the SGCC (State Grid Corporation of China), ROSSETTI and Japan’s SoftBank signed an MOU for establishing the Northeast Asia Super Grid in 2016. They agreed that the grid interconnection would be the first project, and their power companies jointly carried out a preliminary feasibility study from June, 2016 to March, 2017. The interconnection project would consist of two parts. The first part is to connect Weihai (China) with Incheon (South Korea) via marine cables that will cover approximately 370 km. The second is to connect Goseong (South Gyeongsang Province, South Korea) with Matsue (Japan) via marine cables that will cover about 460 km. The transmission capacity of each section is expected to be 2 GW, and HVDC marine cables will be planted for transmission. The crucial part of this joint study is to review the technical and economic feasibility of the proposal. For the technical aspects, researchers reviewed which system of interconnection was most efficient and cost-effective among three candidates, the converter (AC/DC/AC) type, the interconnection type, and the cable type. Meanwhile, to assess economic feasibility, researchers focused on estimating capital expenditures, the project internal rates of return (IRR) and payback periods calculated based in certain technical specifications. According to the preliminary feasibility study, interconnecting South Korea, China and Japan is technically possible and economically feasible as well, and the study results were reported to each of the participating governments. According to KEPCO, the Northeast power interconnection would help to ease and distribute domestic power supply and demand concentrated in metropolitan areas. It also secures around 2 GW of power reserves through the interconnection, which will contribute to reducing costs for building new generation facilities and setting up a stable power system. Furthermore, Mongolia’s eco-friendly energy such as solar energy would help reduce fine dust and greenhouse gas emissions from fossil-fueled power plants. By cutting costs for responding to climate change and developing relevant industries, more jobs would be created as well.

Afterwards, KEPCO formed a joint working group with China’s SGCC and Japan’s SoftBank to set up an optimal business model. The Japanese government, however, was somewhat passive about the grid interconnection because of strained South Korea-Japan relations. Given that, South Korea and Japan decided to cooperate in the private sector first and then expand the cooperation to a governmental business.

President Moon Jae-in took office in May, 2017, and the government has since promoted an energy transition policy centering on reducing coal-fired generation and nuclear energy use. At the end of 2017, the government unveiled the 8th Basic Plan of Long-Term Electricity Demand and Supply. According to the Basic Plan, Northeast Asian countries could use clean energy from the Russian Far East and Mongolia’s Gobi Desert by connecting grids between South Korea, China and Japan and between Russia and South Korea. Based on the interconnection, Northeast Asian countries could overcome geographical limitations, resolve concerns about unstable power supplies, and also contribute to easing regional tension in Northeast Asia, according to the Basic Plan. With this vision, the government suggested specific aims for starting the construction of parts of the interconnection and completing the joint study between South Korea and Russia.

To achieve the goal of the Northeast Asia grid interconnection, during the South Korea-China summit talks in December, 2017, KEPCO, SGCC and GEIDCO (GEI Development & Cooperation Organization) of China signed a memorandum of agreement (MOA) for a grid connection between South Korea and China. Also, as a follow-up, they have carried out a joint study since April of 2018 on technical issues, expected operating revenues, and expenses associated with grid interconnection between South Korea and China. The participating entities have carefully checked and reviewed the findings of the study by forming channels for negotiation. Currently, they are making a concerted effort to form a business model for the interconnection, and to review the project’s technical and economic feasibility. They are also seeking to enact or revise laws and regulations for the Northeast Asia grid interconnection. In addition, the partners would like to start to construct South Korea-China section of the interconnection in 2022.

South Korea-Russia summit talks were held in Vladivostok in September, 2017, which offered an opportunity for KEPCO to sign an MOU with Inter RAO ROSETTI, Russia’s state-owned power company, in order to conduct a joint study toward the delayed Russia-Koreas grid interconnection. As a result, the parties have been jointly reviewing the technical and economic feasibility of the interconnection project since October, 2018. KEPCO and RAO ROSETTI plan to complete the joint study by 2022, and from 2023 on, they would cooperate to develop an optimal grid connection route and business model while watching closely the process of development of inter-Korean relations, which could have a significant impact on how the interconnection proceeds, as well as when.

As stated, it is clear that KEPCO takes full charge of management of all of the multilateral and bilateral electricity sector cooperation projects in which South Korea is involved, and that KEPCO consistently acts as the counterpart to conduct studies with the power companies of China, Russia and Japan. Figure 2 summarizes KEPCO’s recent and ongoing roles in discussions of power interconnection projects.

Figure 2: The Role of KEPCO in a Recent Power Interconnection Project in Northeast Asia

Source: Hankyung Magazine published on Jan-03- 2019

4.2 Natural Gas Pipeline Interconnections

Korea Gas Corporation (KOGAS) has exclusive access to natural gas imports to South Korea and depends entirely on liquefied natural gas (LNG) imports from other countries including Middle Eastern countries, Australia and Southeast Asian countries to satisfy domestic demands for natural gas. KOGAS has consistently sought to diversify import channels and methods, and Russia played a significant role in helping South Korea achieve its aim. As of 2017, South Korea’s dependency on Middle East (Qatar and Oman) LNG was 42.1%, Australia LNG 18.6% and Malaysia and Indonesia LNG 19.4%. By contrast, dependency on Russia LNG was just about 5%, a relatively small amount despite the geographic proximity to South Korea.

Meanwhile, Russian gas export projects to South Korea, China and Japan have been promoted since the early 1990s. South Korea’s KOGAS and Chinese CNPC planned to connect gas fields (Kovykta, Chayanda, etc.) in Eastern Siberia and the Far East of Russia with South Korea and China. Three Northeast Asian countries agreed on the promotion of this project. However, at the time, the development rights to those gas fields were held by private companies (including international joint ventures), not by Gazprom. Gazprom had focused on gas field developments in Western Siberia and PNG exports to Europe and did not have much interest in the gas market in Northeast Asia. As Gazprom had exclusive rights to export Russian natural gas under Russia’s laws and regulations, the plan of KOGAS and the CNPC in the 1990s was opposed by Gazprom. In addition, high development costs, weak economic feasibility and an immature Chinese gas market also held back the plan.

Russia has bilaterally negotiated gas supply agreements with each of with Northeast Asian countries. Ministerial meetings between Russia and South Korea, Russia and China, and Russia and Japan have been held on a regular basis, and in those meetings the parties concerned negotiate comprehensive cooperation agendas not only on gas supply but also on economic cooperation, diplomacy and security. Accordingly, each pair of countries’ cooperation agendas on foreign and security policies could have an impact on gas cooperation. For example, the West sanctioned against Russia over the Ukraine crisis, and Russia had to overcome its diplomatic isolation. As a result, Russia partly yielded to conditions China suggested regarding gas supply and successfully completed a gas supply contract with China in 2014. Gas negotiations between Russia and Japan, however, has been in a stalemate for a long time. This is because Japan consistently links the northern territorial issue to cooperation in the economy and energy sectors. When it comes to the Trans-Korea gas pipeline project of Russia and South Korea, inter-Korean relations, UN sanctions on North Korea and the West’s sanctions on Russia have posed obstacles to the project. Thus, gas negotiations in Northeast Asia have been affected not only by gas supply/demand conditions or gas prices but also significantly by non-economic factors. It is somewhat inevitable that non-economic factors play a large role because the main players in these bilateral gas project negotiations are the governments and their state-owned companies.

In 2006, South Korea and Russia signed a Government Agreement for natural gas supply through pipelines, and KOGAS and Gazprom also signed a Gas Agreement as the main players in the project. In 2008, the two governments and their state-owned companies agreed on driving forward a project to pipe Russian gas (10 Bcm per year for 30 years) to South Korea via North Korea. After that, KOGAS and Gazprom jointly carried out a pre-feasibility test of possible Russian gas exports to South Korea. However, the PNG project was hindered and held back as North Korea conducted nuclear and missile tests and provoked South Korea, and the UN and the West imposed sanctions on North Korea and Russia, respectively.

The Trans-Korea PNG project was highly affected by South Korea’s policy toward the North and military threats from the North (nuclear and missile tests, etc.). It is understood that the PNG project cannot be promoted if there exists any potential risk of delivery between Russia and South Korea by the pipeline through North Korea’s territory. In consideration of these issues, KOGAS has adjusted the negotiation pace and intensity based on the government’s policy toward North Korea.

If the South Korean government does not guarantee the transit risk in any way (financial support, two Korea’s governmental agreement, etc.), companies cannot autonomously address the country risk—that is, cannot afford the risk of operating in North Korea while policies are uncertain. In this regard, state-owned companies could win direct and indirect support from the government more easily than their private peers could. State-owned companies, however, could be exposed to greater investment risks if the government works too hard to make a deal with a political purpose in mind, but with insufficient emphasis on the economic realities of the potential agreement.

The Trans-Korea gas pipeline project has been at a standstill for a long time. Inter-Korean relations, however, have improved since President Moon Jae-in took office, and working group meetings have been facilitated among the governments and project entities (KOGAS and Gazprom) of South Korea and Russia in order to restart the project. In June, 2018, KOGAS and Gazprom agreed on conducting joint studies to review economic feasibility and technical aspects of gas pipeline connections between the countries. Under the Moon administration, energy cooperation with Russia is seen as a key to help in diversifying energy import channels and securing energy sources promptly in case of emergency. Furthermore, given that the government plans to reduce the shares of nuclear and coal in generation mix, the cooperation with Russia contributes to stabilizing gas supply and demand and creating peaceful atmosphere in Northeast Asia. Having been sanctioned in the economy and energy sectors in the wake of the Ukraine crisis, Russia also wants to escape the isolation by stimulating cooperation with Asia-Pacific countries.

South Korea plans to secure 10 Bcm (7.5 million tons) of annual gas supplies through the Trans-Korea gas pipeline project. The amount would represent about 22% of the total projected national gas demand (34.11 million tons) in 2024. Therefore, when and if it secures imported gas in the future, South Korea may need to consider how much it will rely on Russian gas. On top of that, competition has been increasing in the Northeast Asian gas market among foreign LNG exporters (from the Middle East, Australia, the US, Canada, Eastern Africa and Russia). In particular, the US, under the Trump administration, has actively promoted its LNG exports to Northeast Asia. In this regard, it seems that the US would like to use sanctions to block the way of Russian gas to Northeast Asia, in part to boost US LNG exports.

With the West imposing sanctions on Russia and North Korea, Russia would like to promote cooperative projects in sanction-free sectors first. In this regard, the Russian government and gas companies plan to sell LNG to the Asia-Pacific region by developing the Yamal-LNG project and the Arctic LNG-2 projects along the Russian Arctic coast, and is soliciting foreign companies’ equity participation. Novatek, a private gas company, is the current operator of these two projects. The Russian government gives various tax benefits to Novatek and also offers diplomatic supports to help the private company sell LNG. Gazprom has a 9.4% stake in Novatek.

5. Challenges and Barriers to Involvement of State-owned Corporation

5.1 Power interconnections

The Northeast Asia power interconnection project has essentially been at a stalemate for the last three decades. For the past four years, however, relevant countries’ governments and state-owned power companies have put some effort into evaluating whether the project would be economically and technically efficient, and those efforts have helped to move project planning ahead. There is a long way to go, however. There are challenges and barriers, as described below, that the participating countries will need to overcome to develop the interconnection project into a more concrete one.

First, the parties to the project need to raise awareness about the necessity and convenience of the interconnections. As stated earlier, KEPCO found that the grid interconnection would create various economic benefits for South Korea. There is no specific research to date, however, indicating the overall economic effect the project will likely bring to South Korea and the other project partners. To assess the economic effect, relevant studies should be carried out based on many scenarios. In-depth and systematic research is necessary to allow the public to understand the benefits and costs of Northeast Asia grid interconnections.

Second, an asymmetry in information about the project needs to be addressed. To implement a grid interconnection project in Northeast Asia, relevant laws and regulations should be enacted in the participating countries. Based on such laws and regulations, companies could make agreements and the stability of projects could be guaranteed. For this, the necessary information and data should be provided to the relevant companies that will operate the project transparently and accurately from the other parties in the project. The main players of the project, however—state-owned companies from Russia, China and South Korea—are typically passive about making their own data and information available for sharing with each other. Indeed, each of these companies first conducted feasibility studies individually and shared the results afterward. Because of this, the accuracy of the studies could be in question. Therefore, each country should actively solve this problem by forming a higher-level governmental consultative body based on mutual trust to gather and verify the data needed for accurate technical and cost modeling of proposed grid interconnections.

Third, each country concerned should keep promoting the Northeast Asia grid interconnection. As mentioned earlier, the interconnection is a long-term project, which easily makes it fall to a lower priority behind more imminent policy issues. In the case of South Korea, within the larger paradigm of energy transition, the NEA grid interconnection emerges as a policy option. However, renewable energy expansion, the nuclear phase-out and finding a solution to the particulate matter pollution issue are currently being prioritized. It is therefore not possible for the government to maintain consistent interest and attention on the interconnection project, and the project is losing steam as a result. The same goes for governments in China and Russia. This is why a governmental consultative body should discuss the interconnection project frequently in order to maintain the project’s place on the policy priority list.

Fourth, a strong incentive should be made for participation in the Northeast Asia grid interconnection. Even though the incumbent government in South Korea highlights the Northeast Asia Super Grid as a major policy agenda, the project may not be welcomed by KEPCO, which has long exclusively operated a nationwide power system and maintained the power supply system in a stable way. KEPCO has great technologies for transmission and distribution, but has never traded electric power internationally. In this situation, KEPCO might worry that electric power from China or Russia would adversely affect the stability of domestic power supply and demand. Japan is passive about the project as well. Japanese power companies have traditionally monopolized the regional system, making profits in a stable way. This makes the interconnection with South Korea or Russia less attractive, as it potentially puts the favorable competitive position of Japanese companies at risk. Therefore, it is necessary for the South Korean government to support the development of various business models and provide incentives so that KEPCO would be willing play a significant role in the project. Similar incentives may need to be made available in other countries.

5.2 Natural Gas Pipeline interconnections

The design for the NEA gas pipeline interconnection centers on supplying gas resource from the Russian Far East (including Eastern Siberia) to neighboring large gas consumers—South Korea, China and Japan. Therefore, these three countries want gas resources that are being developed or underdeveloped to be fully developed on a large scale, while Russia wants to sign sales contracts for large volumes of gas with those three countries at the same price as they sell gas to Europe. Until now, however, only Russia and China have entered into a contract for gas trades through pipelines in NEA. The Russia-South Korea and Russia-Japan PNG projects are still being discussed among the gas companies. When it comes to consuming countries, China-South Korea and South Korea-Japan marine gas pipeline connections are at in the early stages of discussion. There are three factors hampering the connection of gas pipelines in Northeast Asia.

First, the vast Russian Far East is the most infrastructure and investment-deprived region in Russia. The region lacks SOC infrastructure for resource development and transport, and gas resources are mostly underdeveloped. Gas resources are found in frozen soil regions (permafrost areas) or in the deep sea, and the NEA’s major consumer markets for gas are also far from the Russian Far East. These and other factors make energy resources in the Russian Far East difficult to develop. This in turn suggests that it would take a long time and require enormous foreign investment at an early stage in order to develop sufficient gas resources and extraction facilities in the Russian Far East, and to transport the gas extracted to the major gas markets in Northeast Asia. However, as long as the Russian government sticks to resource nationalism internally and Western sanctions against Russia are not withdrawn externally, foreign companies from South Korea, China, Japan and the West will not be able to make active investments in Russia.

Second, the fiercer competition among LNG suppliers worldwide to capture pieces of the Northeast Asia gas market has threatened the competitiveness of Russian gas. In particular, the Trump administration of the US has diplomatically supported domestic shale gas development so that US shale gas supplies have actively made inroads into markets in China, Japan and South Korea. Indeed, gas companies of these three countries have concluded supply contracts with shale developers in the US. Meanwhile, gas pipeline connections and PNG supply projects have been discussed in the annual governmental talks between South Korea and Russia and between Japan and Russia. In spite of this, the northern territorial issue has dragged the projects down.

Third, gas pipeline interconnection between gas consuming countries—South Korea, China and Japan—should be carried out under the sea due to the geography of the three nations. As none of these countries have sufficient gas surplus enough to supply to each other. Therefore, the interconnection project is not economically feasible. Moreover, the imported gas for which these countries currently have long-term contracts is mostly subject to destination clauses, and gas companies in those three countries do not have sufficient expertise and experiences regarding overseas trading to readily develop the interconnection projects. On top of that, a regional gas hub has yet to be developed, and will likely be crucial to the success of gas interconnection projects in the region.

6. Conclusion

The Northeast Asia energy interconnection projects seek to escape from decades of discussion, advancing into an effective cooperation agreement and subsequent implementation. NEA countries’ governments and state-owned companies have checked the projects’ technical and economic feasibility. Further discussions are needed, however, to realize the final step of the projects.

Northeast Asian countries (excluding Japan) have stabilized their national energy supplies based on state-owned energy companies. This approach was designed to secure stable energy supplies by making public companies exclusively responsible for managing the energy supply industry under their governments’ support. Moreover, these companies were also tasked with improving energy supply security by acquiring overseas energy resources. As vertically-integrated public firms have operated electricity, gas, and other energy market for a long time, it was hard to expect that efficiency would improve by introducing market competition. As a result, liberalization of energy markets and energy trade in Northeast Asian countries came to fall behind similar energy market liberalization efforts in the US and European countries.

In the Northeast Asian countries (excluding Japan), the energy market has been regulated by state-owned firms. For example, the state-owned companies of South Korea, China and Russia own and operate major supply facilities. Against this backdrop, each country’s public companies are forced to promote the interconnection projects between NEA countries at an early stage. Unless the projects are held back by participating countries’ non-economic issues such as strained inter-Korean relations or the northern territorial issue, each government will be able to promote the projects swiftly by providing financial and administrative support. Meanwhile, the international energy grid interconnection would require considerable upfront costs. This is because the interconnection project development must be accompanied by discussion and consultation at the governmental level in each country.

When the international energy grid interconnection and relevant infrastructure have been established, the flexibility and liquidity of energy trade in the region will increase, which would give better opportunities for many private companies to participate in the regional energy market. Furthermore, this will help to liberalize each country’s energy market and lead to deregulation, boosting energy trade in Northeast Asia.

III. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent.