Somewhere Over the Rainbow: The Australian Defence White Paper, economic vulnerability, and China

Introduction

Richard Leaver and Alex Stephens of Flinders University write that in the Vietnam era Australian policy attitudes to China “begged the question ‘when is your enemy not your enemy?’ and delivered the seemingly obvious answer: ‘when he’s your fifth biggest trading partner’.” Yet in its recently released Defence White Paper, “the Australian government has peered out over the time horizon to dimly detect the makings of a distant Chinese strategic threat. Meanwhile, on a different stage, the government looks to trade with this very same China to ignite the domestic growth that will produce the revenue streams to pay for this capital spending in Defence.” Beijing, Leave and Stephens conclude, “has been given a very loud speaking part in this Australian defence debate. Chinese authorities will therefore have, if they so choose, a string of opportunities to make Australian governments pay a high economic price for singling them out.”

Essay: Somewhere Over the Rainbow: The Australian Defence White Paper, economic vulnerability, and China

Four decades ago, around the height of Australia’s 1962-1973 Vietnam commitment, Liberal-Country Party Coalition governments found themselves engaged in an audacious China gambit. On the one hand, the public purpose of their military effort in Vietnam was to contain the regional expansion of Chinese influence. But on the other hand, this threat had never been so large or important as to preclude commercial contacts, and Coalition governments had not followed America’s Cold War policy of imposing broad spectrum economic sanctions against Beijing. Indeed, Australian sales of wheat to China were reaching an all-time high at more or less the same time as Australian ground troops were being inserted into Vietnam. Consequently, over the following years, a native linguistic convention was fashioned in government circles to help disguise this inconsistency. When talking about strategic affairs, China was commonly referred to as ‘red’ or ‘communist’ China – but when talking about wheat sales, the very same political entity suddenly morphed into ‘mainland’ China.

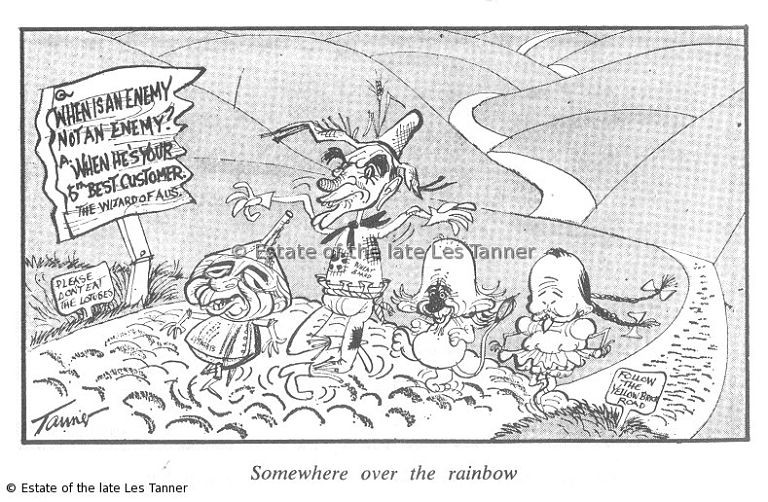

This novel ‘two-China policy’ may have helped conceal the cross-purposes of Canberra’s strategic and commercial policies, but the cartoonists of the nation saw right through the veil of appearances. One of that profession’s best, Les Tanner of The Age, depicted Holt (Prime Minister), McEwan (Trade and Industry, wearing a Wheat Board vest), McMahon (Treasury) and Hasluck (External Affairs) as the main characters from The Wizard of Oz, treading the yellow brick road to the caption of ‘Somewhere Over the Rainbow’. On the side of the road was a sign that begged the question ‘when is your enemy not your enemy?’ and delivered the seemingly obvious answer: ‘when he’s your fifth biggest trading partner’.

Figure 1: Somewhere over the rainbow by Les Tanner [1]

Perhaps, in spite of all this, some inattentive Australians were able to fool themselves, but no one north of the equator was remotely deceived. For a time, Beijing lived with this Australian irritant; wheat imports, after all, served their own purposes, and their own political elite had been profoundly wracked by uncertainties about how to respond to the coming of the second IndoChina War. But once the Tet offensive clarified their near-term strategic horizon, they immediately decided to wind back commercial contacts with Australia in an exemplary manner. Measured by value, wheat purchases halved in 1969, with Canada being the main beneficiary – and then halved again over the next three years. So an export market that had once accounted for six per cent of Australian foreign sales – about one third the size of exports to Japan and the UK at that time – suddenly became a destination of no great importance.

Times change, and circumstances are different; the Cold War and the Vietnam War are both long gone. And China is no longer just Australia’s fifth biggest trading partner; indeed, measured in terms of two-way trade, it is now Australia’s largest. But some things also appear to remain much the same. In its recently released Defence White Paper, the Australian government has peered out over the time horizon to dimly detect the makings of a distant Chinese strategic threat. [2] There is nothing more than the skimpiest outline of this threat, which does not enjoy the backing of any of the intelligence communities in Canberra or Washington. [3] It is nonetheless sufficiently clear to warrant a twenty per cent increase in defence spending in the next financial year followed by four years of 3.9 per cent increases – an impressive front-loading on a A$146 billion acquisitions programme over the full timeframe.

Meanwhile, on a different stage, the Australian economy teeters on the brink of recession – and the government looks to trade with this very same China to ignite the domestic growth that will produce the revenue streams to pay for this capital spending in Defence.

And this, we are asked to believe, is the best that strategic thinking can offer? One almost begins to admire the uncomplicated duplicity of the 1966 version.

The debate so far

There has, of course, been plenty of instant debate about the defence White Paper, mostly focussed on the relativities between winners and losers in the budget carve up. The Army, although expanded by a battalion and given additional ground support, does not benefit from the same largesse delivered to the Navy and Air Force, thereby breaking an implicit norm about the relative equality between the services. The Navy gets a doubling of the submarine fleet, an additional surface air warfare destroyer, plus a new range of patrol boats and customs vessels. The Air Force gains 100 Joint Strike Fighter combat aircraft, more C-17 Globemaster III large transport aircraft, and a replacement for the P-3C Orion anti-submarine planes. The critical reaction was therefore predictable. Greg Sheridan suggested that the White Paper seemed to be a patchwork quilt of bureaucratic notes cobbled together as a coherent document, whilst still seeing the rationale for the increase in power and platforms. [4] Hugh White, Neil James, Alan Dupont, Andrew Davies and Rod Lyon all basically agreed, with each of them noting that the growth in air and navy power was not replicated in a similar boost in army capability. [5] For Dupont and James, with significant army careers behind them, their obvious problem with the White Paper was the lack of extra funding for land-based platforms, whether in the form of armoured personnel carriers, tanks or ‘extra boots on the ground’. Lyon and Davies were particularly interested the overall ‘hedging’ strategy employed to deal with all the thorny issues in defence policy: strategic interests, capability, manpower and funding. And all of them largely avoided mention of China.

In that respect, all of these gentlemen were falling in line behind one of the greatest achievements of the Defence of Australia doctrine, which always insisted that it was right and proper for defence policy to avoid naming names. ‘Threats without enemies’ became the new zeitgeist of the post-Dibb era, offering welcome relief from the ‘named’ defence scares of earlier times. [6] It was not, however, entirely without costs of its own. For when the names of potential strategic rivals were held in reserve, then policy attention fell upon the need for Australia to maintain what Paul Dibb called ‘the technological edge’ across key domains in the defence realm. And the maintenance of this edge was never an easy or a cheap thing.

It was arguably within reach at the beginning when strategic threats were regarded as coming ‘from or through’ Southeast Asia, for relative size and technological sophistication had already endowed Australia with an initial margin of regional advantage. Soon, however, Lee Kuan Yew’s old image of Australia as the ‘poor white trash’ of Asia was haunting Canberra’s view of its own future as miracle rates of economic growth started appearing throughout the region. But then, just as this initial advantage looked like slipping completely away, it had new life breathed into it by the Asian Financial Crisis of 1997-98. All regional defence budgets were suddenly assigned a lower priority and most took a sharp downturn, leaving Australia standing as ‘the strong man’ of the region in an economic sense. [7] Barely a year later, Australia’s leading role in the East Timor intervention had the effect of reapplying this relative advantage to the politico-military realm as well. Consequently, the 2000 Defence White Paper caught Australia on the crest of a wave of all-round self-satisfaction, albeit a wave largely built out of the weaknesses of others rather than strengths on our own account.

Two bets gone wrong

One of the novelties of the 2009 White Paper is that it breaks comprehensively with this traditional trade-off – that is to say, it reverts to naming names while still pursuing the technological edge. And why, it might be asked, has this worst of all worlds outcome been produced? The answer seems to lie in two turn of the century bets that both went bad.

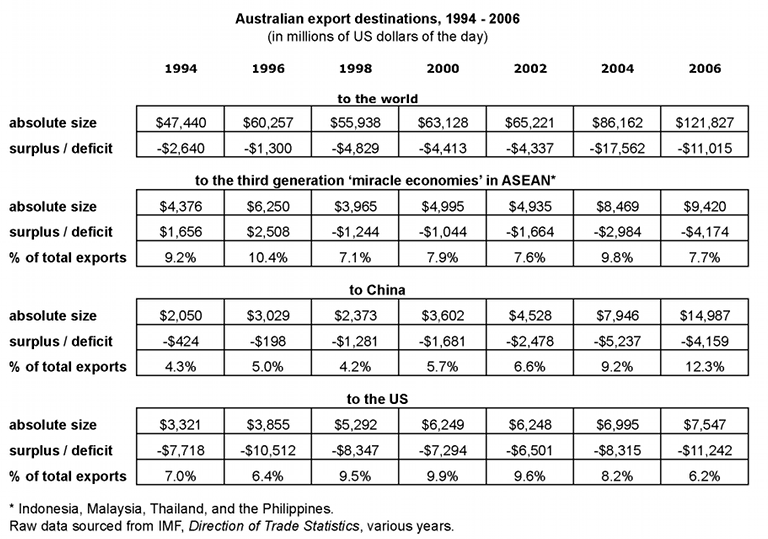

The first of these bets consisted of an oversight in Canberra’s official reading of the meaning of the Asian Financial Crisis. One of Asia’s third generation miracle economies stood up throughout the crisis – China. Its domestic growth, admittedly, took a modest hit, but Beijing kept its markets open to receive the distressed exports from its neighbours – and thereby won the lion’s share of the battle for hearts and minds around the region. And relatively strong growth had two direct implications for Australia: China’s defence spending was not interrupted; and down the road a little, Australian resource exports would also be pulled into this dynamic regional vortex. By the new millennium, Australian exports to China were up by twenty per cent since 1996, while exports to the third generation miracle economies were still twenty per cent down (see Table 1).

Table 1: Australian export destinations, 1994 – 2006.

Looking back, these two gaps opened up by the Asian Financial Crisis now look very much like the makings of the current White Paper dilemma. But the White Paper produced in the year 2000 made nothing out of them – and for two main reasons. First, that White Paper was still framed largely within the terms of Defence of Australia thinking – and this located China well outside Canberra’s area of primary strategic interest. Second, the Howard government was at that time laying an even bigger wager on the strategic supremacy of the United States. In that year, the US was just coming out of the most pronounced peacetime growth boom in its whole twentieth century history, and the Howard government was looking forward to the likely return of a Republican administration in the forthcoming elections. In particular, it was already planning to lock Australia into the dynamic ‘new economy’ of the US through a bilateral agreement on free trade. And in narrow military terms, this bet appeared even more certain, for the decade-long ‘peace dividend’ of the post-Cold War era was now revealing one of its most interesting consequence: that the US share of global military spending was closing fast upon fifty per cent.

But once it had put down its money, the Howard government was forced to watch many counter-trends come to the fore during the first term of the new Bush administration. The dotcom bubble burst all over the place, slowing growth; the US trade deficit virtually doubled, with China as the biggest beneficiary; and tax cuts, the Republican instrument of choice for each and every economic ailment, had squandered the budget surplus of the late Clinton era, placing Washington back on course for future big deficits. Normally, a combination of set-backs like this would lead Canberra to lay off a good-sized portion of its compound strategic risk, and even the Howard government engaged in a subtle hedging strategy through a side-deal with China. This, however, was altogether too small and subtle to shift the overall course of much more powerful forces, and the risks inherent in Canberra’s millennial wager largely continued to accumulate. Well before the end of George W. Bush’s second administration, the Republican formula for American greatness had delivered Washington to the edge of a fundamental crisis in the financial underpinnings of global capitalism.

And this, of course, has global implications which affect and connect all sorts of seemingly unrelated domains. But for the new Rudd government in Australia, one of the primary consequences was to return the country to the conjunction suggested more than a decade earlier by the Asian Financial Crisis – the regional strategic shadow of China’s continuing growth, and Australia’s fast-rising reliance on exports into that black hole. The second time round management of this conjunction was, however, going to be more difficult as a consequence of the more serious recessionary conditions at home and abroad.

Recession as problem and solution

As is well known, preparatory work on a new Defence White Paper was one of the earliest signs of life in the new Rudd government. And its delay, ultimately by six months, then proved emblematic of the difficulties that new governments have in turning vision into policy. There were, of course, many smaller reasons that contributed to this overshoot, but the major one stemmed from the storm clouds of the global financial crisis that constantly deepened and darkened on the near-term horizon. Given that governments and international institutions alike were having increasing difficulty with any kind of economic forecast, the task of divining the outlines of a large budget twenty years out became well nigh impossible.

In public, it seemed as though the main impact of the crisis would fall upon the massive offshore procurement programmes that the Howard government had rather casually entered into for the Joint Strike and the Super Hornet fighters in particular. And there was no question that the projected future costs of these acquisitions suddenly went through the roof as the Australian dollar entered into freefall in July 2008, declining at a pace that was without precedent over the next few months. In many other sectors of the Australian economy, the inflationary impact of this fall was cushioned by intense price competition for local market shares. But competitive forces had largely been squeezed out of the US defence industry sector many decades previously, and foreign customers would have no option but to stump up with more cash in the future.

This, however, was first and foremost a problem for the Rudd government as a whole rather than for the Defence Department in particular. Defence was insulated from the effects of exchange rate risk by a ‘no win, no loss’ policy that covered offshore procurement. Under this policy, the previous year had seen Defence return more than A$100 million to the Treasury as the dollar rose towards parity with the greenback. The July fall of the Australian dollar therefore began to make that reimbursement look like a timely premium on a large insurance policy.

Despite this ‘future-proofing’ on the external account, Defence nonetheless was made to suffer in a secondary sense. With Treasury committed to picking up the bill for exchange rate risk, Defence’s relationship with the government as a whole took a body blow that was reflected in rising demands for defence reforms – a polite euphemism for cost savings. Consequently, by the time the White Paper was finished, the Department was being asked to deliver A$20 billion from this source to the aggregate pre-2030 procurement fund of A$146 billion.

Even after the dollar’s fall, however, the Australian economy continued to look in relatively good shape. In public and in private, the official line held that Australia might well escape the recession that was proclaimed in many other countries in the second half of 2008. Indeed, just as the Australian economy had not been severely afflicted with American-style sub-prime lending, so local interest rates were still rising after the middle of 2008. At this same time, one hundred per cent price rises in contracts for iron ore and coal exports to China and Northeast Asia were agreed for the next Japanese financial year. The July fall of the dollar then served to pump up the local currency values of those US dollar export prices. With all of these different boosters coming into play one after another, public talk of deficit and recession was slow to break in Canberra, arriving respectively in late November 2008 and early March 2009. And even after all that, the second largest monthly trade surplus on record in the following month continued to suggest that the trade sector might buffer against, if not entirely foreclose, the Australian dip into recession. [8]

Given that they were looking for big capital expenditure budgets, the progressive rollout of talk about deficits and then recession was inevitably disconcerting to the drafters of the White Paper. But at the depths of the pre-Christmas Australian gloom, Paul Dibb, once again, suggested the makings of an exit from these compound worries. Short-term budgetary pressures, he argued, should not be allowed to deflect long-term capability planning: one should instead be looking for ways to use spending to stimulate economic growth. [9] This was a prescient reminder that the eventual government acceptance of deficit spending would change the nature of the procurement funding problem.

And so it has. In the one hundred and forty page Defence White Paper, only one and a half rather thin pages were given over to the financing of the new force structure. This made it clear that efficiency savings would not cut in until five years down the road – by which time there would be another White Paper that might well qualify what critics saw as too ambitious targets along this front. Any further questions about what would happen in near term financing were simply flicked on to the federal budget due in a few more weeks. In the event, that budget also proved to be a regressive exercise in public transparency, with defence spending as one of its biggest beneficiaries. The budget’s genius lay in the active programme of deficits that would prevail through the near term – the period when defence spending increases would begin at twenty per cent in the first year before dropping to a still-healthy 3?9 per cent for another four years. So, as Dibb had earlier suggested, the roll-out of a federal rationale for budget deficits affected a timely rescue of the questionable economics of the Defence White Paper.

Complicating the strategic rationale

In marginally different circumstances, all this would be capable of being regarded as good and clever policy. Indeed, Rudd has recently talked about the policy process in terms of babushka dolls:

The outer shell of the babushka doll is national security. The public has to be able to look you in the eye and have confidence that you will maintain security. Peel that layer off. Next, people want confidence that the economy will be well managed and that you can provide them with the basics of life – a job and an income. [10]

The problem with this conception of policy is that babushka dolls, unlike the regime in Beijing, do not talk back. And Beijing has been given a very loud speaking part in this Australian defence debate, because the very same recession that saved the economics of the White Paper can only be overcome in Australia when Chinese growth resumes. Chinese authorities will therefore have, if they so choose, a string of opportunities to make Australian governments pay a high economic price for singling them out.

As previously mentioned, the Australian economy has been coming to exhibit an acute reliance on China for bulk commodity sales, with iron ore as the most important. Chinese demand of unprecedented vigour caused both volumes and prices to boom intermittently in the half decade up to 2008, by which stage iron ore exports alone accounted for some eleven per cent of total Australian exports. It also became clear over that period that not all Chinese purchases were going into current production; in 2006, most notably, there was a forty per cent jump in Australian exports to China, which was more than twice the size of the increase in Chinese steel production. The discrepancy suggested that, as in many other minerals, a sizeable strategic stockpile of iron ore was being accumulated in and around some Chinese ports. Indeed, even as the Australian economy began sliding into technical recession, Chinese stockpile accumulation continued apace in spite of a dramatic slowdown in steel production.

While there is much about Rudd’s global financial crisis that is novel, the main point of Australian vulnerability is decidedly old-fashioned – namely, a sudden shift in the terms of trade. It was, recall, a nine per cent decline in this index which brought on Paul Keating’s ‘banana republic’ crisis of 1986. Against this standard, it is notable that the 2009 federal budget now anticipates a decline of thirteen per cent over the coming year – and that a figure nearly twice as large again has recently issued forth from the Reserve Bank. Furthermore, both of these local estimates seem only to assume a relatively ‘normal’ unwinding of the commodity boom-time, with an iron ore price decline of around forty per cent or so eventually anticipated for contract sales in the current financial year.

There are, however, two pressure points available to Beijing that could be used to accelerate this rate of decline in the terms of trade through the medium term. First, there is the short term option of shifting sourcing policy towards stockpile draw-downs that would substitute for some portion of Australian exports. Second, there is the medium term possibility of increasing domestic production of iron ore at the expense of imports – and indeed the current Rio-Chinalco deal includes a line of credit to bring Rio into China’s domestic mining scene. Either one of these – or, indeed, both – could be used to express their displeasure at being returned to the front line of strategic threats.

They may also, of course, decide that nothing is certain about the economics of Australian policy beyond five years, and that a wait and see attitude on their part would be prudent. Save for the room that still exists for future cuts in interest rates, the Rudd government now seems to have run out of further space for stimulation. If the measures it has pre-emptively rolled out do not halt the local slide into serious recession, then those points of external vulnerability will grow in size as Beijing waits. As in the Vietnam era, time is on its side.

References

[1] Somewhere over the rainbow is copyright Estate of the late Les Tanner. Reproduced with permission, and with our thanks.

[2] Defending Australia in the Asia-Pacific Century: Force 2020, Defence White Paper 2009, Department of Defence, 2009.

[3] Indeed, US Secretary of State Hilary Clinton felt compelled to say that ‘[w]e want Australia, as well as other nations to know that the US is not ceding the Pacific to anyone’: Anne Davies, ‘US not ‘ceding the Pacific’: Clinton’, The Age, May 20th 2009, (accessed May 21st 2009).

[4] Greg Sheridan, ‘A battle of words’, The Australian, May 2nd 2009, (accessed May 18th 2009).

[5] The Australian, ‘Too few boots on ground‘, May 4th 2009, (accessed May 18th 2009) and Rod Lyon and Andrew Davies, Assessing the Defence White Paper 2009, May 7th 2009, (accessed May 10th 2009).

[6] This apposite phase was coined by Gary Smith and St. John Kettle to grace their edited collection of essays about the wash-up from the 1987 White Paper: see Threats without Enemies: Rethinking Australia’s Security, Pluto Press, Leichhardt, NSW, 1992. More recently, it has been rehabilitated by Christopher Chung, ‘Threats without Enemies: Are Australia’s alliances and alignments still relevant?’, in Brendan Taylor (ed.), Australia as an Asia-Pacific regional power: Friendships in Flux? Routledge, London, 2007.

[7] The phrase was first used by Peter Costello in early 1998 when talking up the implications of the lowest inflation result in Australia since the 1960s: see ‘Treasurer talks up inflation, Asia’, PM Programme, ABC Radio National, 28th January 1998, (accessed September 1999).

[8] For a reasonable slice of the debate on this at the time, see David McLennan, ‘Deficit unavoidable despite trade surplus’, Canberra Times, 3rd April 2009.

[9] See Paul Dibb, ‘Now is not the time to beat retreat’, The Australian, 29 November 2008.

[10] Peter Hartcher, To the Bitter End, Allen & Unwin, Crows Nest, NSW, pp. 206-7.

About the authors

Richard Leaver teaches International Relations at Flinders University in Adelaide. His main interests lie with the economic aspects of international relations (particularly in regard to oil and energy); the history of nuclear proliferation and non-proliferation; and Australian foreign policy, especially in relation to all the above. Comments welcome: Richard. Leaver@flinders.edu.au.

Other articles by Richard Leaver:

- Nuclear Safeguards: some Canadian questions about Australian policy, Richard Leaver, Austral Policy Forum 09-5A, 23 February 2009.

Alex Stephens is a visiting fellow at the Flinders University School of Political and International Studies and an Adjunct Professor of International Relations at Pannasastra University of Cambodia. His research is focused on the International Political Economy of the Asia Pacific, with Australian and Japanese Trade Policy, and capacity building in 3rd World States as particular interests. Email: alex.stephens@flinders.edu.au.

Nautilus invites your response

The Austral Peace and Security Network invites your responses to this essay. Please send responses to the editor, Arabella Imhoff: austral@rmit.edu.au. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent.

The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on contentious topics in order to identify common ground.

Produced by the Nautilus Institute at RMIT, Austral Peace and Security Network (APSNet). You might like to subscribe to the free APSNet twice weekly newsletter.