Peter Hayes and David von Hippel

September 9, 2017

I. INTRODUCTION

In this essay, Peter Hayes and David von Hippel analyze the impact of Chinese energy sanctions on the DPRK in response to its missile and nuclear testing. They conclude: “The DPRK could quickly cut its non-military use by about 40% of its annual oil use with a variety of end use reduction and substitution measures; There will be little or no immediate impact on the Korean Peoples’ Army’s (KPA’s) nuclear or missile programs; There will be little or no immediate impact on the KPA’s routine or wartime ability to fight due to energy scarcity, given its short war strategy and likely stockpiling; The DPRK has the ability to substitute coal and electricity for substantial fractions of its refined product use, as well as its heavy fuel oil use (the product of oil refining) for heat production; The immediate primary impacts of responses to oil and oil products cut-offs will be on welfare.”

David von Hippel is Nautilus Institute Senior Associate. Peter Hayes is Director of the Nautilus Institute and Honorary Professor at the Centre for International Security Studies at the University of Sydney.

The report cited below Foundations of Energy Security for the DPRK including the full technical analysis and workbooks is available as a PDF file here.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

Banner image: North Korean truck with coal gasifier unit, Onchon County, Nautilus Institute photo.

II. NAPSNET SPECIAL REPORT BY PETER HAYES AND DAVID VON HIPPEL

SANCTIONS ON NORTH KOREAN OIL IMPORTS: IMPACTS AND EFFICACY

SEPTEMBER 4, 2017

Introduction

After the sixth and largest nuclear weapons test by the DPRK on September 2, 2017, United States President Donald Trump released the following message on Twitter:

“The United States is considering, in addition to other options, stopping all trade with any country doing business with North Korea.”[1]

Taken at face value, this strategy implies that the United States would not trade with China or Russia, the DPRK’s two main suppliers of crude oil and petroleum products, unless those nations suspended their trade with North Korea.

Even ramping up a lesser version of partial energy sanctions, as was reportedly discussed by President Trump and Japanese Prime Minister Abe after the August 29, 2017 missile test,[2] and apparently seconded by ROK President Moon Jae-in after the September 3, 2017 nuclear test,[3] is highly unlikely at this time, for reasons explained below.

Leaving aside the insoluble difficulties that the United States would face in enforcing such trade restrictions (given that significant trades in oil products between those nations and the DPRK already bypass customs reporting), it is already crystal clear that China will not curtail the DPRK’s energy supply in response to these calls.

If and when the Trump Administration is incontrovertibly committed to sitting down with the representatives of the DPRK and other parties to discuss seriously how to denuclearize the Korean Peninsula—and were the DPRK baulking at coming to the table—then one might expect China to impose energy supply pain on the DPRK by a thousand cuts, including incremental cuts of oil supply.

Currently, there is no indication whatsoever that such talks will take place—indeed, President Trump tweeted after the missile test that talking is pointless.[4] China has already made it clear that it will not impose sanctions on the DPRK’s oil supply in a way that would lead to a conflict between the DPRK and itself while failing to halt the North Korean nuclear weapons program.[5]

Indeed, we conclude that to make such cuts now is premature, and would reduce whatever influence the Chinese have left in Pyongyang. Implementing energy strangulation with massive cuts now would simply terminate their residual influence completely.

The rest of this report examines what the DPRK might do to offset loss of oil if China and Russia were to accept US and Japanese demands to cut off some or all external energy supply to the DPRK.

Current Oil Supply and Use in the DPRK

Table 1, below, presents our previously-prepared best estimate for the year 2010 of crude oil and oil products supply and use in the DPRK.[6]

The refined products balance is presented in TJ, or terajoules, a unit of energy. (1 TJ = 10^12 joules, or a trillion joules). There are about 42.6 GJ or gigajoules (1 GJ = 10^9 joules, or a billion joules) in a tonne (metric ton) of crude oil imported to the DPRK.

Table 1: Estimated Refined Products Balance for the DPRK, 2010

Source: Unpublished Nautilus update of 2009 estimates in p. 147 of Foundations of Energy Security for the DPRK: 1990-2009 Energy Balances, Engagement Options, and Future Paths for Energy and Economic Redevelopment, by David von Hippel and Peter Hayes (2012), NAPSNet Special Reports, December 18, 2012, p. 147, at: https://nautilus.org/napsnet/napsnet-special-reports/foundations-of-energy-security-for-the-dprk-1990-2009-energy-balances-engagement-options-and-future-paths-for-energy-and-economic-redevelopment/

Since this table was last updated, the DPRK economy has grown significantly.[7] We model this growth by assuming that oil use has expanded economy-wide at roughly 2.5% per year over the 7 years since our last analysis, so the totals in the right hand column for final oil products use have likely grown about by about 19% since 2010.

Thus, total oil use in DPRK in 2017 assuming no sanctions would have been about (30,400 TJ * 1.19 ) / (2.6 GJ) = 36,100 TJ in 2017, or the energy equivalent of about 850,000 tonnes of crude oil imports.[8]

As is laid out in Table 1, the different supplies of each oil product (diesel, gasoline, heavy oil–which is basically liquid coal used in ship bunkers, power boilers, heavy industry to create heat, kerosene and jetfuel, liquefied petroleum gas—LPG or “propane”—and non-energy products such as bitumen) are shown relative to the big sectoral users of refined oil products. DPRK refined products use was, and still is, dominated by the industry, transport, and military sectors. Although we have applied a simple growth factor to all uses of petroleum products in the DPRK, it is likely, based on a qualitative analysis of recent news reports, that a similar refined products balance for 2017 would show a few differences relative to 2010:

- Expanded use of diesel fuel for power generation, mostly not associated with the electricity grid, but rather use of diesel generators by individual businesses, markets, and other organizations to substitute for intermittent grid power supplies.

- Greater use of oil products for transportation, especially in private vehicles.

- Likely expanded use of LPG for cooking, particularly in wealthier households in Pyongyang.

- Greater imports of refined products, probably with most of the increase in imports from Russia, either directly or, as indicated by a recent legal action by the US Department of Justice, indirectly through companies in Singapore and elsewhere.[9]

Although Chinese customs reports of Chinese crude oil shipments to the DPRK—most of which arrive by cross-border pipeline to the DPRK refinery in Sinuiju in the DPRK’s Northwest—have been irregular of late, our best guess is that Chinese crude shipments have not changed much in recent years on an annual basis. As a consequence, any increases in oil products use from 2010 to 2017 were likely to have been met by increased oil products imports.

Military Use and Stockpiles

In 2010, by our estimate, the military accounted for about 31%, say one third, of total DPRK oil use, closer to 40 percent of gasoline and diesel use, and nearly half of the use of kerosene and jetfuel (which we lump together, because they are similar products). Based on detailed analysis of DPRK military energy use,[10] we estimate that the DPRK can fight for about a month before it will run out of fuel; and it likely has stockpiles sufficient for a year of routine, non-wartime usage—could be more, but we doubt that it would be less. Thus, we can simply remove the DPRK military use or about one third of the estimated annual use from the analysis as it is already, we assume, buffered by stored products for at least a year against an energy supply cutoff by China and/or Russia.

That leaves the other two-thirds of oil end-use, or roughly the energy equivalent of 585,000 tonnes of crude oil, immediately vulnerable to a supply cutoff. Add to that the equivalent of an additional estimated 510,000 tonnes of crude oil used in electricity generation—most in on-site diesel generators, and the equivalent of over 1 million tonnes of crude oil demand might be vulnerable to a cutoff.

DPRK Response to Loss of Oil Imports

We estimate that the following measures could be taken by the DPRK line agencies to either substitute non-oil energy supplies for imported oil; or simply cut end use by fiat:

- Curtailment of diesel fuel availability for half of users of on-site generation.

- Curtailment of gasoline use in private generators for most users.

- A 50 percent reduction in the use of heavy fuel oil as a starter fuel for coal-fired plants, and in the few heavy-oil-fired power plants in the DPRK.

- A reduction in 80% of Minerals Subsector heavy fuel oil use due to sanctions, and a curtailment in heavy oil use in cement and other subsectors, as those sectors revert entirely to use of coal; or shut down anyway due to already imposed sanctions on minerals exports.

- A 15% reduction in diesel truck use by substitution for diesel with biomass/charcoal/coal in older gasifier trucks, plus a 10% reduction from use curtailment/mode shifting in diesel trucks, trains, and ships/boats.

- A 50% reduction in the use of gasoline in autos (and gasoline trucks) by imposition of curtailments for many vehicle owners.

- A shift (50%) in the residential and commercial sectors from use of kerosene to electricity (including from solar photovoltaic panels) use for lighting, and curtailment in some instances, plus a reduction of LPG use for cooking by half through the use of substitute fuels (biomass and coal).

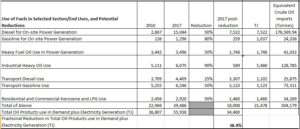

Note that these reductions do not touch either the military sector; nor the fisheries and agriculture sector, which are needed to feed the DPRK population. The estimated reductions from each of these measures are shown in Table 2, below. Please note that these are very rough and preliminary estimates, and should be set in the context of an updated estimate of supply and demand for oil products and other fuels in the DPRK, which is not yet available.

Nonetheless, these calculations reveal that should the DPRK choose to take these measures to reduce oil consumption in the face of a supply cut-off, the result could be an annual reduction in oil demand nearly equivalent to the DPRK’s typical imports of crude oil in recent years (500,000 tonnes), or nearly 40 percent of what we (albeit very crudely and preliminarily) estimates to be DPRK oil and oil products demand in 2017.

Table 2: Rough Estimates of Potential Reductions in Oil Products Use in Response to a Supply Cut-off in the DPRK

Thus, if China were to cut its roughly 500,000 tonnes of oil exports to the DPRK by 50 percent, that is, by 250,000 tonnes, the substitutions and cuts that the DPRK could achieve would enable it to buffer against major effects on its economy for at least a year—similar to the buffer that is already likely in place for the military users of oil in the DPRK by past stockpiling. This analysis assumes no prior stockpiling in the non-military sector, which is unrealistic. It also takes no account of very small-scale oil production in the DPRK itself, which may be on-going.

This is a very crude estimate of the possible impacts of implementing energy sanctions on the DPRK. It assumes that such drastic measures could be implemented in a few months by fiat—North Korea being one of the few places where such command directives could be undertaken with some hope of success. It also does not account for local resilience whereby local coal, hydro and biomass resources could be drawn on quickly by mobilizing labor. And, it does not reflect the additional resilience that the existence of private markets for fuels would lend to the overall system, with likely emergence of shadow prices and black markets that would drive supply towards those with the greatest purchasing power.

A detailed study is needed to understand more fully how various levels of cuts to Chinese and Russian oil supplies to the DPRK would play out.

Conclusions

Even these basic estimates, however, suggest the following with regard to even massive (say 50 percent) Chinese oil export cuts to the DPRK:

a) The DPRK could quickly cut its non-military use by about 40% of its annual oil use with a variety of end use reduction and substitution measures.

b) There will be little or no immediate impact on the Korean Peoples’ Army’s (KPA’s) nuclear or missile programs.

c) There will be little or no immediate impact on the KPA’s routine or wartime ability to fight due to energy scarcity, given its short war strategy and likely stockpiling.

d) The DPRK has the ability to substitute coal and electricity for substantial fractions of its refined product use, as well as its heavy fuel oil use (the product of oil refining) for heat production.

e) The immediate primary impacts of responses to oil and oil products cut-offs will be on welfare; people will be forced to walk or not move at all, and to push buses instead of riding in them. There will be less light in households due to less kerosene, and less on-site power generation. There will be more deforestation to produce biomass and charcoal used in gasifiers to run trucks, leading to more erosion, floods, less food crops, and more famine. There will be less diesel fuel to pump water to irrigate rice paddies, to process crops into foodstuffs, to transport food and other household necessities, and to transport agricultural products to markets before they spoil.

f) Past experience—including extensive field observations of the DPRK populace responding to prior deprivations—suggests that even these deep cuts and resulting scarcity and welfare impacts will not lead to social instability. North Koreans mostly will obey and endure the strictures resulting from these sanctions.

g) China cannot force the DPRK to the negotiating table by means of energy sanctions, and it is unreasonable to demand that it do so, at least not before the United States demonstrates incontrovertibly that it is closing on engagement of the DPRK. Indeed, such demands are highly unrealistic and reflect “strategic confusion” in American policy towards the DPRK.

h) If such demands were heeded and acted on now, the results would be counterproductive with respect to the overarching primary goals of avoiding war, resuming negotiations, and ending the North Korean nuclear threat.

III. ENDNOTES

[1] @realDonaldTrump, dated 9:14 AM – Sep 3, 2017, available as https://twitter.com/realDonaldTrump.

[2] “Abe, Trump vow to ‘make North Korea change its policies’” Nikkei Asia Review, September 3, 2017, at: https://asia.nikkei.com/Politics-Economy/Policy-Politics/Abe-Trump-vow-to-make-North-Korea-change-its-policies

[3] Bryan Harris, “South Korea looks to choke North with oil embargo, Beijing’s likely opposition highlights lack of options facing Seoul and Washington,” Financial Times, September 4, 2017 (behind paywall) at: https://www.ft.com/content/b4d37d7e-91d8-11e7-a9e6-11d2f0ebb7f0

[4] “‘Talking is not the answer’ with Pyongyang, Trump tweets in contradiction to Mattis, Tillerson,” The Japan Times, August 31, 2017, at: https://www.japantimes.co.jp/news/2017/08/31/asia-pacific/politics-diplomacy-asia-pacific/talking-not-answer-pyongyang-trump-tweets-contradiction-mattis-tillerson/#.Wa4-eT6GPcs

[5] “How should Beijing respond to Pyongyang’s new nuclear test?” (editorial) Global Times, September 3, 2017, at: http://www.globaltimes.cn/content/1064487.shtml

[6] For 2009 and earlier versions of this refined products balance, see (for example) p. 147 of Foundations of Energy Security for the DPRK: 1990-2009 Energy Balances, Engagement Options, and Future Paths for Energy and Economic Redevelopment, by David von Hippel and Peter Hayes (2012), NAPSNet Special Reports, December 18, 2012, at: https://nautilus.org/napsnet/napsnet-special-reports/foundations-of-energy-security-for-the-dprk-1990-2009-energy-balances-engagement-options-and-future-paths-for-energy-and-economic-redevelopment/

[7] See, for example, Jiyeun Lee (2017), “North Korea’s Economy Is Growing at Its Fastest Pace Since 1999”, Bloomberg, dated July 20, 2017, and available as https://www.bloomberg.com/news/articles/2017-07-21/north-korea-s-economy-rebounds-from-drought-amid-missile-focus.

[8] We adopt tonnes of crude oil-equivalent as the base unit in this essay in order to illustrate the impacts of cuts in Chinese crude oil supply to the DPRK, although it is an unusual energy unit to select for conventional energy-economic analysis.

[9] See, for example, Tomotaro Inoue (2017), “N. Korea procuring Russian fuel via Singapore dealers: defector”, Kyodo News, dated June 28, 2017, available as https://english.kyodonews.net/news/2017/06/6f47a07fd486-update1-n-korea-procuring-russian-fuel-via-singapore-dealers-defector.html.

[10] David von Hippel, Peter Hayes and Roger Cavazos, “An Updated Estimate of Energy Use in the Armed Forces of the Democratic People’s Republic of Korea (DPRK)”, NAPSNet Special Reports, August 04, 2015, https://nautilus.org/napsnet/napsnet-special-reports/an-updated-estimate-of-energy-use-in-the-armed-forces-of-the-democratic-peoples-republic-of-korea-dprk/

IV. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent

34 thoughts on “SANCTIONS ON NORTH KOREAN OIL IMPORTS: IMPACTS AND EFFICACY”