VALENTIN VOLOSHCHAK

OCTOBER 2, 2020

I. INTRODUCTION

In this Special Report, Valentin Voloshchak reviews Russian economic policy as it pertains to electricity sector interconnections in Northeast Asia, including a review of previous discussions of grid interconnections in the region, potential future relationships among grid interconnection participants, and challenges related to grid interconnection from a Russian perspective.

Valentin Voloshchak is a Teaching Assistant, Department of International Relations, Oriental Institute — School of Regional and International Studies, Far Eastern Federal University, Vladivostok, Russian Federation.

This report was produced for the Regional Energy Security (RES) Project funded by the John D. and Catherine T. MacArthur Foundation and presented at the RES Working Group Meeting, Tuushin Best Western Premier Hotel, Ulaanbaatar, Mongolia, December 9-11, 2019.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

This report is published under a 4.0 International Creative Commons License the terms of which are found here.

Banner image border of China, DPRK, Russia, Nautilus Institute photo

II. NAPSNET SPECIAL REPORT BY VALENTIN VOLOSHCHAK

RUSSIA’S PERSPECTIVE ON NORTHEAST ASIA ELECTRICITY INTERCONNECTIONS

VALENTIN VOLOSHCHAK

OCTOBER 2, 2020

Summary

The development of electricity interconnections in Northeast Asia constitutes an ambitious project that can have a significant impact on multilateral cooperation in the region. The present study is focused on the Russian perspective on various aspects of international cooperation with regard to regional electricity interconnections projects. The research covers the questions of how electricity grid interconnections fit with Russia’s economic plans and its policy to develop the Far Eastern region, what discussions with neighboring countries have occurred in the past and what projects are seen by the Russian side to be of priority importance. Particular attention is paid to the challenges faced in building Northeast Asia grid interconnections, the most relevant of which are political obstacles and the factor of economic uncertainty affecting the growth of demand for Russian electricity in the Northeast Asian market. The author argues that Russia views itself as an energy donor and as a core of the future regional grid supplying electricity to all other Northeast Asian states.

1 Introduction

Electricity interconnections in Northeast Asia (NEA) can become a significant element of energy and economic security for the nations in the region. With regard to the role of the Russian Federation in the process of Northeast Asian power grid integration, it can be concluded that Russia perceives itself as a core of a future regional power grid and a key exporter of electricity to the other participants in the interconnection. Russia’s interest in this plan stems from a number of factors, ranging from the changing situation in the world’s energy market to the need for modernization of energy infrastructure and to stimulate economic development of the Russian Far East region. The present research covers the questions of how electricity grid interconnections fit with Russia’s overall economic plans, including its “Turn to the East” policy, what specific projects Russia sees as priorities within the context of a future Northeast Asia Grid, and what preliminary courses of action could be adopted in this field. The research also focuses on the previous experience of Russia and its partners in discussions between Russia and countries of the Northeast Asian region on grid interconnections and the substance of existing partnerships. Particular attention is paid to the challenges of building a Northeast Asia Grid interconnection, the most relevant of which are political obstacles and economic uncertainty as it may affect the growth of demand for Russian electricity in the Northeast Asian market.

2 The Northeast Asia Grid and Russia’s Turn to the East Policy

The strategic goal of Russia’s energy policy is to ensure the most efficient use of natural and energy resources in order to develop energy supply infrastructure in multiple subsectors (oil, gas, coal, and electricity) sufficient to maintain sustainable economic growth, improve the quality of life for the Russian people, and gain a firm foothold in the international energy market. In terms of the establishment of ties with foreign partners, Russia’s energy policy focuses on the following objectives as outlined in the current Energy Strategy for the period up to 2030: geographic and product diversification of Russian energy exports under conditions of stable and increasing energy supplies to the world’s largest consumers, reasonable reductions over time in the shares of fuel and energy resources in overall Russian exports, switching from selling abroad raw materials and energy resources to selling highly processed value-added products, and further integration of the Russian energy sector into the world’s energy system.[1]

These policy directions have made the idea of establishing electricity interconnections with the countries of Northeast Asia increasingly influential in recent years, and Russia has expressed enthusiasm about being integrated into the Northeast Asia Grid project on various occasions. As noted in official documents, the rationale behind Russia’s interest in grid interconnections lies in the existence of emerging challenges to sustainable economic development and energy security in Russia. The draft Energy Strategy for the period up to 2035 pays particular attention to increasing global competition in the energy field and the shift in energy demand to the developing countries, where Russia’s economic presence is not quite as considerable as it is in Europe and in the former Soviet states. These global trends are among the major factors stimulating Russia’s interest in the Northeast Asian energy market.[2] Russia’s Energy Security Doctrine, published in 2019, also refers to the shifting of the center of the global economy to the Asia Pacific region, and the subsequent shrinking of conventional markets (mostly European and CIS states).[3] It is worth pointing out some of the general concerns that stimulate Russian interest in the Northeast Asia Grid plan. Among them is the relatively slow growth of per capita electricity consumption in Russia. Domestic electricity consumption per capita grew just 9,8% overall between 2005 and 2016, thus falling short of target levels described in Russia’s energy policies (13% by 2015 and 43% growth for the period 2016-2022). Another important attribute is the energy intensity of the Russian economy, which has steadily decreasing relative to the target range set in previous energy policy and now stands at a bit more than 78% of the 2005 level of domestic energy consumption per unit of GDP.[4] The key indicators of energy efficiency in Russia’s energy supply infrastructure are stable, and along with an acceptable degree of wear and tear of power generation assets, this stability in domestic conditions and lack of strong growth in domestic energy markets has caused Russian attention to focus on the option of entering foreign markets, the most promising of which are Asian.

In this regard, Russia is actively promoting its Turn to the East policy, which is aimed at strengthening Russia’s position in Asia Pacific by maintaining cooperative relations with its Asian neighbors as well as stimulating economic growth in the Russian Far East region. The elaboration of this policy began in the early 2000s in the context of China’s economic rise: as Russian President Vladimir Putin famously said, “…I am convinced that China’s economic growth is by no means a threat, but a challenge that carries colossal potential for business cooperation – a chance to catch the Chinese wind in the sails of our economy. We should seek to more actively form new cooperative ties, combining the technological and productive capabilities of our two countries and tapping China’s potential <…> in order to develop the economy of Siberia and the Russian Far East”.[5] Whereas at the beginning the prospect of expanded trade with China and other Asian nations looked like a good opportunity to establish new and mutually beneficial partnerships, later the forced nature of Turn to the East has become evident due to the introduction of Western sanctions against Russia after the 2014 Ukrainian crisis. There is a common view that Turn to the East should be taken as a pragmatic approach allowing Russia to overcome the difficulties caused by the deterioration of relations between Russia and the Western states and the subsequent decline of economic cooperation with traditional partners.

Although the Turn to the East is not yet firmly formalized and Russia has no comprehensive strategy in support of the achievement of the stated objectives of the strategy, one can assess the major directions of state policy by examining documents focused on different areas of economic policy. Thus, with regard to Russia’s energy policy, the National Projects program for 2019-2024 suggests a number of activities related not only to overall electricity supply infrastructure improvement in the Russian Far East, but also to the development of new power grids as part of Baikal-Amur and Trans-Siberian mainlines extension projects. The construction of new power grids is also required for increasing the capacity of the Power of Siberia gas transmission system,[6] as additional electricity is needed to power compressor stations. The “Executive Order on National Goals and Strategic Objectives of the Russian Federation through to 2024” notes these objectives and specifies that achieving them would require the development of centralized electricity grids and modernization of thermal, hydro and nuclear power plants in Siberia, the Far Eastern region, and other parts of Russia.[7]

The above-mentioned projects are of international significance, and Russia’s engagement in Northeast Asia Grid would fit perfectly with Russia’s interests, inasmuch as it meets both the goals of improving internal infrastructure and facilitating international projects. It should also be mentioned that, according to the Energy Strategy, Russia is seeking to increase the share of its energy exports sent to Asian states to 31% by 2035. Along with that, Russia is interested in diversifying its energy export structure by selling more electricity in order to reduce its dependence on income from oil and gas sales.

3 Previous Discussions between Russia and the Northeast Asian States

It is no surprise that Russian policymakers in many ways perceive the Northeast Asia Grid as one of the most forward-looking projects on the horizon for the promotion of national energy security. Russian officials have been referring to this initiative since the late 1990s, but in more recent years, notably the 2000s, discussions stalled until the Fukushima nuclear accident in 2011 provided a new impetus for the countries of the region to return to the issue. Vladimir Putin addressed the Northeast Asia Grid idea once more in 2016, when he expressed support for the project of grid interconnections among Russia, China, the Republic of Korea and Japan in his keynote speech at the Eastern Economic Forum in Vladivostok. He particularly noted that Russia is ready to sell electricity to its Northeast Asian partners at competitive and fixed prices, and suggested the establishment of an intergovernmental working group to facilitate international efforts in the grid interconnection field.[8]

However, as was noted above, Russia does not have a comprehensive strategy or a long-term plan for the construction of the regional grid, rather Russia focuses on strengthening bilateral ties by promoting already-existing cooperation with China as well as establishing new partnerships. When discussing the Northeast Asia Grid issue, scholars often refer to the positive experience with similar projects in Europe, but unlike Europe, Northeast Asian states do not share the experience of collaboration and building of shared infrastructure that is required for commencing the interconnection of electricity supplies. That is why Russia’s primary goal is to build bilateral electricity transmission lines with China and other states first, and only then to start pursuing a regional electricity interconnections project. It is therefore logical, when considering the prospects for grid interconnections from Russia’s perspective, to focus on interactions with specific partners and highlight the experience in previous discussions between Russia and Northeast Asian states on grid interconnections, as well as try to assess prospects for Russia’s efforts in the development of bilateral contacts.

Undoubtedly, the main partner is China, with which Russia has well-established cooperation and to which it has sold an average of 3,3 billion kWh of electricity per year over the 2013-2017 period. Supplies of electricity from Russia to China first started in 1992, when the Blagoveshсhenskaya-Heihe transmission line with a capacity of 200 million kWh of electricity per year was constructed. Another project was pursued in the mid-1990s in the Baikal region by local authorities and companies, represented by the Irkutsk Oblast administration and by JSC Irkutskenergo with the support of the RAO UES holding company (Unified Energy System of Russia). This project included conducting a feasibility study on the construction of a ±600 kV Bratsk-Beijing transmission line with a planned transmission capacity of 5-6 million kW (5 to 6 gigawatts) and an estimated cost at the time of $1,8 billion. Due to the reduction of energy consumption in China after the 1997 Asian financial crisis, however, this project was halted at the initiative of the Chinese side.

The decade following the financial crisis was marked by a changing situation in the region: electricity consumption in China sharply increased and some studies revealed a projected shortage of electricity in Northeast China. Under these circumstances China expressed growing interest in importing electricity from Russia, and in the early 2000s parties were promoting a large-scale project to establish electricity interconnections between Russia’s Lower Angara region and China’s Anhui Province. This project, worth $1,5-2 billion, was associated with the reconstruction of the Boguchany hydro power plant in Krasnoyarsk Krai and the creation of and Eastern Siberia – Eastern China power interconnection. A transmission line with a total length of 3000 km was to be built starting at a point close to Kansk at the point of intersection of the 500 kV HVDC transmission lines that connect the Bratsk and Ust-Ilimsk hydro power plants from the east with the Sayano-Shushenskaya and Krasnoyarsk hydro power plants from the west, and also includes connections with the Beryozovskaya thermal power plant and the Boguchany hydro power plant. The estimated transmission capacity of the Eastern Siberia – Eastern China interconnection was about 6 million kW, which could provide an annual supply of 31-32 billion kWh of electricity. However, despite the huge potential for the development of Eastern Siberia energy infrastructure, this project has never reached an implementation stage.

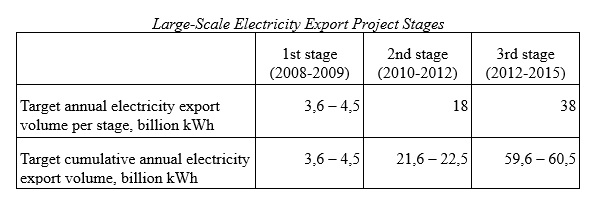

Nonetheless, Russia and China initiated a discussion on general terms of cooperation in the electricity field that resulted in the signing of an MoU (Memorandum of Understanding) between RAO UES and the SGCC (the State Grid Corporation of China) in March 2005. The MoU set the target electricity export volume at 20 billion kWh per year, and just two month later, this figure was increased to 30 billion kWh under a new Agreement on Long-Term Cooperation (signed in July 2005). In March 2006, the target level of electricity export volume for 2008-2018 was doubled to 60 billion kWh, as noted in a feasibility study on the “Large-Scale Electricity Export project”. This project divided target electricity sales into three stages from 2008 to 2018, as shown in the Table below, with export volumes planned to increase from 3,6-4,5 billion kWh per year in 2008-2009 to 38 billion kWh per year in 2015-2018 in order to reach the initial goals set by the 2006 feasibility study.[9]

In order to meet the requirements of agreements concluded as above, the capacity of the sole Blagoveshсhenskaya-Heihe transmission line was insufficient. In 2009, the parties added to the project plans to introduce a 26,6 km long 220 kV Blagoveshchenskaya-Aigun transmission line and thus increase the aggregate volume of electricity supply to China to 854 million kWh (2009 data). The construction of the 500 kV Amurskaya-Heihe transmission line was completed in 2012, which ensured the capacity to provide supplies of 6-7 billion kWh of electricity to China per year.[10] These three transmission lines now constitute the main infrastructure for Russia’s electricity exports to China, but actual supply volumes (3,9 billion kWh per year in 2018) have as yet been far below the target figures initially planned for the 2006 Large-Scale Electricity Export project (38 bn kWh for 2012-2015).

Several projects related to joint construction or modernization of power plants in Russia are important elements of the planned interconnection. In 2011, OJSC EuroSibEnergo (the operator of the En+ Group energy assets) signed an agreement with Yangtze Power (China’s major hydro power generation company) on the establishment of a joint venture (JV) aimed at the construction of additional hydro and thermal power generation capacity in Eastern Siberia.[11] The JV’s authorized capital totaled to $6 million, and the company was considering projects for the construction of one thermal and two hydro power plants with aggregate installed capacity of 3 million kW as well as projects for exporting electricity to China in accordance with the 2006 bilateral agreement. For the longer term, the parties set the goal to construct more power plants with a total installed capacity of 10 million kW. The list of power plants that were intended to be constructed was broad; it included the cascade of power plants located on the Vitim River in Buryatia (the Moksk hydro power plant with the Ivanovo counter-regulator), the Lower Boguchany hydro power plant in Irkutsk Oblast, and the Shilka hydro power plant in Zabaykalsky Krai.[12] Among the other plans related to the establishment of an integrated power grid, discussions also included consideration of the construction of thermal power plants in the Baikal region to provide export capacity. Russia was (and is) interested in the development of coal-fired power plants, such as the Olon-Shibir plant in Buryatia and the Tataurovo plant in Zabaykalsky Krai.

Moreover, Russia and China agreed to collaborate on the Troitskaya power plant modernization, which was completed in 2016 with funding that included Chinese investments. the roitskaya plant is a thermal power plant with an installed capacity of 2 million kW located in Chelyabinsk Oblast (in the Southern Ural region). Based on the bilateral agreements between the nations, China has established a consortium composed of Heilongjiang Province major energy equipment manufacturers (Harbin Boiler Company, Harbin Turbine Company, Harbin Electric Machinery Company), the Northeast Electric Power Design Institute, and the Heilongjiang Huodian No. 3 Engineering Company with financial support from the Bank of China. The work on modernization has included the construction of two new power generating units, each with a capacity of 660 MW.

Another prominent project is the construction of Erkovetskaya power plant located in Russia’s Amur Oblast, which has been under discussion by INTER RAO and SGCC for several years. The Erkovetskaya power plant, with a planned capacity of 1,2 GW (previously parties were considering 5-8 GW) is intended to provide electricity supply to Central China. The project, however, is yet to be implemented, and Russia and China are currently trying to resume the discussion on this matter.[13]

Perhaps, the most notable result of discussions between Russia and other Northeast Asian states has been the signing of the quadripartite MoU on cooperation and promotion of interconnected electric power grids in NEA. This MoU was signed in March 2016 by China’s SGCC, Japan’s Softbank Group, South Korea’s KEPCO (Korea Electric Power Corporation) and Russia’s Rosseti (Russian Grids). The four parties agreed to conduct feasibility and business evaluation studies on multinational power grid interconnections in order to propose their findings and suggestions to the relevant governments.[14]

4 Priority Projects as Seen from the Russian Perspective

Before attempting to identify the priorities of Russian electricity energy policy, it is necessary to highlight the structure of the national electricity industry and the roles of actors involved in exporting electricity. Since the 1990s, more than 70% of national generating assets (excluding nuclear power capacity) have been under RAO UES control, which has had a de-facto monopoly over power generation and distribution. To work toward making sure that the Russian electricity industry could adapt to a free and competitive market environment, the process of reforming RAO UES was initiated in 2003 and completed by 2008. The reform included the separation of the electricity generation and distribution companies that had operated under RAO UES. The generation capacities were largely privatized, while the grid operating companies remained under state ownership. As a result, RAO UES ceased to exist and was replaced with a group of independent companies, including 6 wholesale generating companies, 14 territorial generating companies, the OJSC Federal Grid Company of the Unified Energy System (FGS UES, a subsidiary of state-owned Rosseti), OJSC RusHydro, OJSC System Operator of the Unified Energy System (SO UES, an operational dispatch management company), OJSC Russian Grids (Rosseti, previously Interregional Distribution Grid Companies Holding), JSC RAO Energy Systems of the East (operating company of generating capacities in the Russian Far East, a subsidiary of RusHydro), and OJSC Inter RAO UES (electricity exporting company also operating some foreign generating assets) as well as a number of energy trade companies and R&D and maintenance organizations. It is important to stress that the major projects related to international electricity interconnections and the export of electricity are commonly being carried out by Inter RAO. In the meantime, most of the power generation capacity in the Far Eastern region is operated by RusHydro, and some of the major power plants in Krasnoyarsk Krai and in the Irkustsk Oblast are under the control of En+ Group. Rosseti, represented by FGS UES, holds the monopoly on national power grid operation.

If one tries to assess Russia’s general courses of action in recent years with regard to Northeast Asia electricity interconnections plans, one will likely come to a conclusion that the primary goal for Russia has been to develop smaller grid connections in collaboration with specific partners. Of the partners Russia is working with, there are the most solid foundations for cooperation with China, and it is reasonable for Russia to continue enhancing this cooperation by promoting new projects and further developing existing projects. The Erkovetskaya power plant project is thus of paramount importance, and it is expected to be introduced by 2020-2021. The construction of this coal-fired power plant had been being discussed since 2010, and Inter RAO was supposed to have completed a feasibility study on the project by 2015. The initial plan concerned joint extraction of 35 million tonnes of coal per year from the Erkovetskiy coal pit and the construction of the largest thermal power plant in Russia, with an installed capacity of 8 GW, in a collaboration between Inter RAO and SGCC. The project also included the construction of a 2000 km-long HVDC transmission line to China. According to SGCC’s estimates, the total cost of the project would be about $15 billion. The growth of electricity demand in China slowed by 2015, however, and the discussions on the Erkovetskaya power plant stalled.

The subsequent years demonstrated an improved situation with regard to China’s energy demand dynamics, and the parties once again turned to consideration of the Erkovetskaya plant project. The discussions have resumed, but the projected installed capacity has fallen to 4 GW with an estimated annual generation of 20-30 billion kWh. Taking into account the annual increase of electricity demand in China (about 200-400 billion kWh per year) and VEB.RF’s (Russia’s state development institute’s) interest in this project, it can be argued that prospects for construction of the Erkovetskaya plant have become brighter.[15] The project is also beneficial for China due to favorable trading conditions, since at present it is about 20-40% cheaper to buy Russian electricity rather than to consume domestically-generated power. The key question is the planned capacity of the plant: current plans call for it to be far less than expected earlier, and the parties are yet to reach an agreement on this issue. Another obstacle is the disagreement between stakeholders over prices for electricity exports, which has also been the cause of an absence of progress with regard to the construction of the planned export-oriented power plant adjacent to the Sugodino-Ogodzha coal deposit in the Amur Oblast.[16] The situation is further complicated by an ecological consideration: the fact that China is considering investment in the construction of coal-fired power plants in Russia while adhering to a policy of reducing the reliance of the Chinese energy industry on coal results in a certain degree of controversy.

Another promising direction for Russia’s bilateral conversations on electricity interconnections with NEA countries is the promotion of joint projects with Mongolia. Mongolia is the second Northeast Asian state that has electricity interconnections with Russia: the two countries operate the 220 kV Selenduma-Darkhan power transmission line. Mongolia is now actively pursuing participation in the regional Gobitec and Asian Super Grid projects, which are based primarily on the concept of expanded generation based on renewable energy in Mongolia and has the potential to become a core entity within a future interconnected Northeast Asian Grid. The plan for Russian participation in this project can be focused on the connection of Mongolian renewable energy assets in the Gobi desert to the generating capacities of power plants in the Russian Far East, with the long-term objective to connect to China’s power system.[17] For this purpose, proposals to construct the 500 kV Gusinoozersk-Darkhan-Ulaanbaatar[18] and Gusinoozersk-Ulaanbaatar-Fengzhen power transmission lines are being discussed. Most likely, this project would be implemented with the assistance of Inter RAO, since the Gusinoozersk thermal power plant is owned by this company. Rosseti proposed another similar project that involves the construction of a power grid connecting Russia’s Republic of Khakassia and Tyva Republic with China and Mongolia. This project would require a new 500 kV transmission line capable of providing carrying 1 GW of electricity.

As for cooperation with Japan and Korea, Russia is in principle ready to provide electricity supply to these countries and to participate in the development of grid interconnections with those nations. Technically, Japan’s and Russia’s grids can be interconnected via the La Pérouse Strait, which would require a submarine cable laying from Sakhalin to Hokkaido or Honshu. The cost of laying a cable in the Strait is estimated at $6 billion, and the cable’s transmission capacity would be 4 GW.[19]

The prospects for a grid interconnection between Russia and the Republic of Korea (ROK) are so far uncertain mostly due to factors of a political nature. However, both parties are conducting feasibility studies under the terms of a MoU signed between Rosseti and KEPCO in 2018. In addition, the political on the Korean Peninsula forced the parties to consider a submarine cable laying option, a possibility that was raised by Rosseti’s CEO Oleg Budargin in 2013.[20] As South Korean President Moon Jae-in has proclaimed a nuclear phase-out policy, the electricity import option will remain relevant for the ROK given its potential to replace some of the nuclear capacity that is slated be retired, and Russian Energy Minister Alexander Novak confirmed Moscow’s readiness to provide electric power supplies to both the ROK and the DPRK (Democratic People’s Republic of Korea).

5 Future Relationships Among Grid Interconnections Participants

The establishment of regional electricity interconnections is an ambitious project, implementation of which requires a high level of trust. But while trust remains a desired and, in some way, an ideal feature of potential integration, substantive consequences of any integration process will also include the emergence of interdependence. In the case of the Northeast Asia Grid project as seen from Russian perspective it is clear that interdependence can be based on the convergence of interests and a model of cooperation where Russia could act as an energy donor, supplying electricity to all other Northeast Asian states. In this model, China is seen as a major consumer of Russian electricity. which can allow China to mitigate the impact of seasonal spikes in its electricity consumption and reduce its dependence on coal-fired generation. The Republic of Korea and Japan could also make up for potential shortfalls in electricity supply caused by reduction of nuclear and coal generation capacities. The Mongolian energy industry can also benefit from cooperation with Russia in terms of development of its renewable energy infrastructure, and for the DPRK the involvement in Northeast Asian Grid project is potentially an important and powerful instrument in compensating for its domestic energy shortages and to help stabilize economic growth.

The emergence of interdependence, however, may have serious negative implications. Although it seemingly has positive impacts on regional cooperation by creating an electricity market (and thus, presumably, a comfortable environment for interaction between sellers and buyers), interdependence. especially in the energy sectors, increases a degree of vulnerability to the actions of others that, in practice, may lead to increased confrontation and competition. Such a possibility rests on the threat that one of the parties can acquire political leverage and take advantage of the situation, thereby converting interdependence into dependence.[21] The political situation in the DPRK makes its inclusion in an interconnection quite sensitive and challenging: even if a regional electricity interconnection scheme includes the DPRK, it will likely, at least initially, be the only channel of large-scale economic interaction with Pyongyang. For these reasons, while planning an engagement with the DPRK, parties should take into account that projected interdependence must be complex and rely not only on cooperation in the energy sector, otherwise the possibility of disagreements and eventual disruption of cooperation will increase significantly. Regretfully, such close cooperation requires a lot of time and efforts, and it is necessary to avoid quick solutions that may lead to less-than-durable agreements.

The ultimate creation of electricity interconnections in the Northeast Asian region would be an undeniable political success but would not imply the complete elimination of both political and economic risks. When discussing a future Northeast Asia Grid, we largely pay attention to its prospects or implementation challenges. But in order to estimate the impact of shifts in the regional geo-economic landscape caused by the creation of regional electricity interconnections, one needs to take into account the demand dynamics, the behavior of key market players and the changes in energy export structure among electricity suppliers (in this case, mostly Russia and Mongolia). Drawing on these factors, one should try to employ a scenario approach and thus come to an understanding of the general patterns of relations among Northeast Asian states.

It is also noteworthy that the development of an integrated regional electricity grid requires a high level of trust and confidence among the relevant participants. We would not go as far as arguing that the emergence of a regional security community (where the conflicts among states are unthinkable due to a high degree of interdependence) is a necessary prerequisite for the creation of Northeast Asia Grid. Rather, it would be fair to say that the very discussion on this matter is one of the reasons to draw attention to the Korean problem once more and therefore this discussion should be intensified. The importance of the regional grid interconnections concept should turn into an additional rationale for all of the Northeast Asian actors to address their common problems within a broader context.

6 The Challenges to Northeast Asian Grid Project Implementation

Despite all of the prospects of a Northeast Asia Grid project as perceived by the Russian side, however, the problems that will be encountered in designing a regional electricity interconnections plan are becoming increasingly evident. These problems can be broadly divided into the following categories:

- Infrastructural problems. Russia indeed has a fleet of power generating facilities large enough to both satisfy its domestic consumption and to consider the option of exporting electricity. But the projections of electricity consumption in China are too high for imports from Russia to make a significant impact at the supply level that Russia can offer at the moment, and therefore significant increases in electricity supplies to provide exports to China will likely be required. There are two ways to fulfill Russia’s objective of increasing its volume of electricity exports to China. The first is to expand power transmission from the European part of Russia via long-distance transmission lines, which is not feasible either economically or technologically. The second option is to construct new generating capacities in the Russian Far East, which is more realistic, but still would involve certain economic difficulties. The energy infrastructure of the Russian Far East remains underdeveloped, and Russia would be very interested in attracting foreign investment from China and other countries to accelerate RFE energy development, but this option has not as yet been discussed actively enough. With regard to Japan and the Republic of Korea, the geography factor (lack of shared land borders) complicates the situation because the parties are deprived of the possibility of arranging electricity interconnections in a traditional way, and thus have to rely on a submarine cable laying solution or transiting the DPRK, which, as noted above, has its own challenges. In addition, the majority of power generation in the Russian Far East region is concentrated in Siberia and the Amur Oblast, but not in Primorsky Krai, which is Russia’s closest territory to Japan and the Republic of Korea.

- Economic issues. It is not quite clear to what extent China is interested in electricity trade with Russia and in the Northeast Asia Grid idea in general, although Chinese organizations have taken the lead in several regional and even global interconnection initiatives. China is the world’s leader in electricity production and is ready to purchase electricity from Russia only under favorable trading conditions; Russia seems to be willing to sell electricity surpluses at a lower price than China faces domestically, making imports from Russia 20% cheaper for China relative to domestically generated energy. The fact that China has its own capacities in the electricity generation and transmission infrastructure field demonstrates the possibility of the emergence of some kind of competition with Russia, which would also explain why the volume of Russia’s exports still stand at 3,3 billion kWh per year instead of the 38 billion kWh that was planned initially a decade ago. As for Japan and Republic of Korea, electricity consumption in these countries is quite difficult to predict due to changes in demography (peaking/shrinking populations), and this can also have a negative impact on the future prospects for Northeast Asian electricity interconnections. And finally, Russia’s energy exports have to date mostly consisted of oil and gas. The interesting thing is that Russia’s oil-and-gas-dominated energy export situation is also a manifestation of an internal problem: there is no powerful electricity industry lobby in Russia, while oil and gas companies largely benefit from government support. The internal competition in Russia’s energy sector is quite intensive and the electricity industry is apparently not ready yet to participate in large-scale international projects. Also, the absence of regional markets, disagreement over electricity export/import prices, and a large number of potential stakeholders, both within Russia and regionally, does not reflect positively on the prospects for Northeast Asian Grid project implementation.

- Technical problems. Such an ambitious project as the Northeast Asia Grid would require an integration of the different types of national electricity systems currently operated by the Northeast Asian countries, and thus emerges the question of technological incompatibility. All of the parties will have to consider the very possibility of cooperation among numerous and various energy producers and consumers, the technical issues associated with of power transmission over long distances, and the need to develop intelligent systems of power and information distribution. The latter concerns the questions of cybersecurity and ICT, and these fields attract the particular attention of Russian energy producers and policymakers. For example, Rosseti CEO Pavel Livinsky mentioned in 2018 that “Rosseti and SGCC are carrying out joint project on digitalization which aims to implement ICT solutions not only in Russia and China but also, in the long run, in third countries”.[22] Such activity is aligned with Russia’s plan to complete the digitalization of the national power grid by 2030, and it would be also useful in overcoming some of the technological barriers related to the implementation of a Northeast Asian Grid.

- Political problems. Political issues in the region (and beyond) create perhaps the greatest obstacles for further development of a Northeast Asia Grid project. One can easily detect the lack of political will, because each party holds its own view on the Northeast Asia Grid model and formulates its policy in accordance with national interests. In order to overcome this gap, regular meetings and discussions between the parties would be required. But there are still some fundamental problems that would persist, most notably the nuclear issue on the Korean Peninsula and the related United Nations sanctions regime against the DPRK. The current situation on the Korean peninsula is not especially optimistic, since the diplomatic detente has stalled and there are still no significant results from previous ROK-DPRK and DPRK-US summit meetings. In practice, the DPRK will likely remain excluded from the planned Northeast Asia Grid framework until the Korean crisis is settled in one way or another (or at least sanctions are reconsidered or lifted), the possibility of which relates to a broader geopolitical context and is not quite clear for the time being.

7 Conclusion

In conclusion it must be said that despite the negative effect caused by the political obstacles and the absence of sustainable demand, the very discussion of the Northeast Asia Grid project is one of the powerful reasons to draw attention to the regional political problems once more.

It is worth noting that Russia has a strong interest in the idea of electricity interconnections in Northeast Asia, which overlaps with the essence of Russia’s Turn to the East policy. The tasks involved in the interconnection of power grids of Russia and other Northeast Asian states is consistent with Russia’s objectives in upgrading its electricity infrastructure and, in general, in promoting the economic growth of the Russian Far East region. What’s important is that Russia and China have laid a solid groundwork for further cooperation: the partners have constructed three power transmission lines and maintain electricity exports to China at a rate of 3,3 billion kWh per year. Russia is actively participating in international discussions on the Northeast Asia Grid, and is also a signatory of a number of agreements on cooperation with Northeast Asian states. Despite the fact that these agreements are mostly of a symbolic nature and confined to the feasibility study stage, the sheer articulation of the issue is important, in that it presents regional electricity interconnections as a priority interest and a prospective goal for Russia.

Nonetheless, numerous problems create obstacles to the successful implementation of the interconnection plans, including the political problems of the region and the absence of trust. In this sense, the Korean crisis is a fundamental problem affecting any form of multilateral cooperation in the region and requires special attention in designing a regional electricity interconnections scheme. Other important factors likely to affect plans for interconnection include high economic risks and uncertainty with regard to such indicators as electricity consumption and electricity demand in Northeast Asian states. Finally, technical and infrastructural issues, which are related to the inadequacy of Russia’s energy infrastructure in the Far Eastern region (relative to the projected level of China’s electricity demand), differences in technological standards, and the need to develop intelligent systems of power and information distribution also pose challenges to an interconnection effort.

In this regard, intensification and institutionalization of international efforts to create regional electricity interconnections are required, inter alia, in the form of regular and multilateral meetings. As a first step, the establishment of an intergovernmental working group can be suggested. Trust-building policies and measures to improve market transparency are essential for the promotion of multilateralism in Northeast Asia. Despite all of the political difficulties, Northeast Asian states must come to realize that they share common interests and that these interests will eventually overweigh current problems placed within the realm of high politics.

III. ENDNOTES

[1] “Energy Strategy of Russia for the Period up to 2030”, Institute of Energy Strategy, 2010, 172 p.

[2] “Draft Energy Strategy of Russia for the Period up to 2035”, Institute of Energy Strategy, 2015, 272 p. (In Russian).

[3] The Executive Order Approving Energy Security Doctrine, Kremlin.ru, 13 May 2019, http://kremlin.ru/acts/news/60516 (in Russian).

[4] Report on Implementation of Energy Strategy of Russia for the Period up to 2030 in 2018, Ministry of Energy of the Russian Federation, 2018 (in Russian).

[5] A. Bespalov, “Russia’s Turn to the East: Expectations and the Reality”, Valdai Discussion Club, 1 July 2019, https://valdaiclub.com/a/highlights/russia-s-turn-to-the-east-expectations-and-the-rea/.

[6] “National Projects: Target Indicators and Major Results”, The Russian Government Official Website, http://static.government.ru/media/files/p7nn2CS0pVhvQ98OOwAt2dzCIAietQih.pdf (In Russian).

[7] The Executive Order on National Goals and Strategic Objectives of the Russian Federation through to 2024, Rossiyskaya Gazeta, 9 May 2018, https://rg.ru/2018/05/08/president-ukaz204-site-dok.html (in Russian).

[8] O. Klimenko, “Putin Endorsed Asian Power Grid”, Zolotoy Rog Business Magazine, 3 September 2016, https://www.zrpress.ru/anews/vladivostok_03.09.2016_79647_putin-dal-dobro-na-aziatskoe-energokoltso.html (In Russian).

[9] A. Ognev, “Cooperation between Russia and China in the Electric Power Sector”, Regionalistics, 2015, vol. 2, no. 3, pp. 51–58 (In Russian).

[10] O. Dyomina, “Russia and China Energy Cooperation: Electricity Export from the Far East”, ECO, 2014, no. 6, pp. 56–65. (In Russian).

[11] “The Largest Russian Private Company and Largest China’s Hydro Power Corporation are to Establish a Joint Venture”, Renmin Ribao, 25 February 2011, http://russian.people.com.cn/31519/7300351.html (In Russian).

[12] G. Borisov, R. Zdarov, “The Interaction of the Energy Systems of Mongolia and Russia in the Framework of the Economic Corridor”, VI International Conference “Socio-economic Development of Russia and Mongolia: Problems and Prospects”, May 21-22, 2019, Ulan-Ude, Russia: Proceedings of the Conference, East Siberia State University of Technology and Management, 2019, pp. 50–55 (In Russian).

[13] S. Podkovalnikov, V. Saveliev, L. Chudinova, “Prospects of Electric-energy Cooperation between Russia and Northeast Asian Countries”, Studies on Russian Economic Development, 2015, no. 4(151), pp. 118–130 (In Russian).

[14] V. Abramov, S. Berlin, E. Loginov, A. Shkouta, D. Sorokin, “Russia’s Economic Interests in the Realization of Perspective Infrastructure Projects in Energetics in East Asia”, Finance: Theory and Practice, 2017, vol. 21, no. 5, pp. 82–89 (In Russian).

[15] A. Fadeeva, “China Can Expect the Construction of Russia’s Power Plant”, RBC, 29 May 2018, https://www.rbc.ru/newspaper/2018/05/30/5b0bc02b9a7947c60be91055 (In Russian).

[16] R. Turovsky, “Amur Oblast: A Region of Challenges and Great Prospects”, East Russia News Agency, 13 December 2019, https://www.eastrussia.ru/material/priamure-ot-depressivnoy-zony-k-tsentru-promyshlennogo-razvitiya/ (In Russian).

[17] S. Batmunkh, B. Bat-Erdene, C. Ulam-Orgil, A. Erdenebaatar, “Roles of Mongolia in the Interstate Electric Power Cooperation as of Asian Super Grid in Northeast Asia”, Automatics and Software Enginery, 2017, no. 4(22), pp. 52-61 (In Russian).

[18] G. Borisov, Z. Dondokov, “Energy Industry of the Republic of Buryatia: Current State and Prerequisites for Further Development”, International Conference “Regional Energy Policy of Asian Russia”, June 4 – 7, 2018, lrkutsk, Russia: Proceedings of the Conference, Melentiev Energy Systems Institute, 2018.

[19] S. Sevastianov, D. Reutov, “Energy Cooperation as a Driver in Russo-Japanese Relations”, Russia and Japan. Looking Together into the Future: Monograph, Far Eastern Federal University, 2016, pp.72–84.

[20] O. Samofalova, “A Sea is Better”, Vzglyad, 16 October 2013, https://vz.ru/economy/2013/10/16/655228.html (In Russian).

[21] A. Krickovic, “When Interdependence Produces Conflict: EU–Russia Energy Relations as a Security Dilemma”, Contemporary Security Policy, 2015, vol. 36, no.1, pp. 3–26.

[22] Interview with Rosseti’s CEO Pavel Livinsky, Russia-24, 12 September 2018, https://www.youtube.com/watch?v=Nm0a5XevRS8 (In Russian).

IV. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent.