EDWARD YOON

APRIL 3, 2019

I. INTRODUCTION

In this essay, Edward Yoon describes DPRK’s mineral resources with a special focus on the coal mining and iron ore industries, and their exports to China, focusing on where minerals are found and how they might be developed with financial input by overseas investors, and addresses the difficulties typically encountered in trading between the DPRK and South Korean or foreign direct investors.

Edward Yoon is an expert on DPRK mineral sector development.

This study was paper prepared for the Regional Energy Security Project Working Group Meeting, China Foreign Affairs University (CFAU), April 8–10, 2019 and is funded by the MacArthur Foundation.

A downloadable PDF file of this report is found here.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

This report is published under a 4.0 International Creative Commons License the terms of which are found here.

Banner image: From CHOI Kyungsoo, North Korea Resource Institute, September 2010, here.

II. NAPSNET SPECIAL REPORT BY EDWARD YOON

RECENT ACTIVITIES IN THE DPRK MINERALS SECTOR

April 3, 2019

Executive Summary

The minerals industry is of great importance to the economy of the Democratic People’s Republic of Korea (DPRK), accounting for about 36.4% of its exports to China in 2016. In particular, the coal mining industries have been priority industries for DPRK economic development since 2010. Minerals industries in the DPRK have played prominent roles in North Korean National exports. The DPRK holds the great bulk of the total known mineral deposits on the Korean peninsula. It is estimated that some 200 of the minerals found in the DPRK have economic value. The value of North Korea’s known minerals deposits was estimated to be nearly thirty times of that of South Korea’s as of 2015. The DPRK’s mineral resources are of considerable interest to the Chinese market, as moving North Korean minerals to China is less expensive in comparison with the transportation costs involved in acquiring minerals from Australian. This paper describes and evaluates the DPRK’s mineral resources with a special focus on the coal mining and iron ore industries, and their exports to China, focusing on where minerals are found and how they might be developed with financial input by overseas investors. This study proposes various ways of effectively engaging in businesses in mineral resources development and investment in the DPRK by analyzing the mineral industries of the DPRK and exploring possible investment projects in the DPRK mineral industry. This study also addresses the difficulties typically encountered in trading between the DPRK and South Korean or foreign direct investors, possible solutions to those difficulties, and the economic effects of minerals trade in the DPRK.

Table of Contents

Contents

1.2 Sources and Methods Used in this Paper 4

1.3 Analysis of export trend of North Korean mining products to China. 5

1.4 Pattern of major mineral products exported to China. 6

2 Current status of the DPRK Minerals Sector 10

2.2 Exporting Anthracitic coal to China. 21

2.3 Production and Export Mechanism of Anthracite Coal 25

2.5 Rare mineral mines and production. 29

3 Transportation Infrastructure for the Mining and Minerals Sector 30

3.2 Road Transport Systems. 30

3.3 Major Ports and Related Facilities. 31

4 Alternative Strategies for South Korean and Overseas Investors. 34

4.1 The Most Fruitful Areas for Foreign Investment in the DPRK Minerals Sectors. 34

4.2 Mining Industry-related Organizations. 35

5 Conclusions Based on Assessment of Recent Trends in the Sector 36

5.2 Economic Effects of South-North Koreas Mineral Resources Cooperation. 39

1.1 BAckground

The minerals industry is of great importance to the economy of the Democratic People’s Republic of Korea (DPRK), accounting for about 36.4% of its exports to China in 2016 (KOTRA, 2018). In particular, the coal mining industries have been priority industries for DPRK economic development since 2010 (Jung, 2015). Minerals industries in the DPRK have played prominent roles in North Korean National exports as shown in Table 1, below. The DPRK holds the great bulk of the total known mineral deposits on the Korean peninsula. It is estimated that some 200 of the minerals found in the DPRK have economic value. The value of North Korea’s known minerals deposits was estimated to be nearly thirty times of that of South Korea’s as of 2015 (Kim, 2016).

Mining industries are very important to the DPRK. The mining subsector of the DPRK’s industry accounted for an estimated 13.2% (Jung, 2014) of the North Korean GDP and about 36.4% of total export revenues in 2016 (Kotra, 2017). The minerals production sector in North Korea has, however, been struggling because of the lack of modern technology and equipment, as well as a shortage of electricity. For these reasons, North Korea needs to rebuild its production lines by obtaining proper equipment and technology (Jung, 2015).

Based on a study conducted by Chung Woo Jin (Korea (South) Energy Economics Institute, 2014, 2015), exploitation of the DPRK’s mineral resources through linkages with South Korean and overseas consumer markets is likely to be the most profitable way for the DPRK to develop its minerals sector. There are likely to be strong markets for the DPRK’s gold, silver, lead, iron ore, zinc, tungsten, copper, and other metallic minerals. In addition, among the DPRK’s non-metallic minerals, magnetite, flake graphite, and limestone are valuable products.

The DPRK’s mineral resources are of considerable interest to the Chinese market, as moving North Korean minerals to China is less expensive in comparison with the transportation costs involved in acquiring Australian and Brazilian mineral resources (Chinese Source and Private source, 2018). This paper describes and evaluates the DPRK’s mineral resources with a special focus on the coal mining industry and iron ore industry, and their exports to China, focusing on where minerals are found and how they might be developed with financial input by overseas investors. This study will propose various ways of effectively engaging in businesses in mineral resources development and investment in the DPRK by analyzing the mineral industries of the DPRK and exploring possible investment projects in the DPRK mineral industry. It also addresses the difficulties typically encountered in trading between the DPRK and South Korean or foreign direct investors, possible solutions to those difficulties, and the economic effects of minerals trade in the DPRK.

1.2 Sources and Methods Used in this Paper

To prepare this paper, various methods have been used to gather facts and sources from the DPRK, China, and South Korea. First, statistical data and in-depth research papers were collected from North Korea Natural Resource Newsletters 2016–2018 published by “South-North Korea exchanges and Cooperation support Association” (www.irenk.net) and government-owned research institutes in order to analyze and to assess the DPRK’s natural resources from an objective view point. Second, sources providing trade data and other documents were collected from representatives of Chinese state-owned corporations and medium-sized businesses, as well as North Korea-related economic research institutes in China. Third, DPRK internal documents related to natural resources in the DPRK and their exploration were collected from contacts in the border region of the DPRK and China as private sources.

In addition, the author interviewed 11 current DPRK businessmen and defectors living in Seoul, Korea, and China who have work experiences in the minerals and coal mining industries in the DPRK (three being current DPRK businessmen living in China or North Korea and four being former DPRK workers or businessmen) and four Chinese businessmen, as a key method to collect information on the latest situation in the DPRK mining industry.

Data on trade experiences between the DPRK and China in the North Korea natural resources development and export area were also used to assemble background statistics to help inform potential overseas investors. To analyze the DPRK mineral industry development and investment from overseas including from China and South Korea, newspapers (South Korean, Chinese, and English-language newspapers), broadcast sources, and internet sources were collected during the period from 2013 to 2018 via the internet and through KOTRA (the South Korean Trading and Investment Agency) and were analysed by annual periods.

It is not possible to know exactly the specific types of minerals produced in North Korea and their accurate production quantities. Therefore, rather than making assumptions about total domestic DPRK minerals production by subsector, this research project will focus on the mineral products that are currently produced and exported overseas by North Korea, about which reasonably accurate information is available. Among the major mineral products that North Korea can export abroad under international economic sanctions, the research described in this paper focused on anthracite coal production and export to China, as well as iron ore production and export data.

1.3 Analysis of export trend of North Korean mining products to China

It is currently not possible, due to the lack of data published by North Korea and the lack of access to the DPRK by foreigners, to identify and analyze actual output statistics on mining production in North Korea. With the data available, however, it is possible to estimate the production situation in the mineral mines and coal mines of the DPRK based on figures available regarding the quantity and items exported to China. Therefore, this paper will attempt to analyze how the DPRK companies operate in order to acquire foreign currency under current international sanctions.

In 2017, more than 98% of the mineral resources exported by North Korea were exported to China, of which 80% of by value were anthracite coal. In this study, the major mineral resources that are exported to China — especially anthracite — will be examined in depth (Kotra.or.kr/news, irenk.net, 2018).

North Korea’s total exports in 2017 were valued at a total of $1.77 billion, 37.2% down from the previous year. The decline in minerals exports to China is attributable to the reduction in major export items such as coal and zinc concentrate due to United Nations Security Council (UNSC) sanctions. Mineral exports accounted for 38.5% of the DPRK’s total export value in 2017, 16.4% down from the previous year (Nam, 2017). North Korea’s total minerals exports to China amounted to $643.33 million, 55% down from the previous year, yet it accounted for 99.7% of the DPRK’s total minerals exports to all foreign countries combined. According to the statistics, the value of North Korea’s mineral resources exports to China is almost identical to the North Korea’s mineral resources export amount to the sum of all foreign countries (irenk.net, 2018). To sum up, China is the major importing country of the North Korea’s mineral resources.

1.4 Pattern of major mineral products exported to China

If we chose two of the most important elements of North Korea’s foreign trade recently, they are China, by far North Korea’ s largest trading partner, and anthracite coal, which occupies the largest share in exports to China on both a value and volume (tonnes) basis. In order to gain a better understanding of North Korea’s exports of mineral resources, it is necessary to examine each mineral resource individually as well as North Korea’s overall exports. Each mineral resource shows different export patterns depending on its share in North Korea’s export volume, geographical factors, its market share in the Chinese market, and the presence of competitors for the DPRK’s exports of specific goods.

The result of this analysis is summarised as follows:

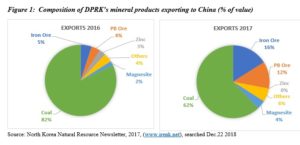

- North Korea’s mineral resource exports, due to rising raw material prices since the mid-2000s, have increased in overall in proportion to North Korea’s exports to China (see Figure 1 and

- Table 1. However, the effects of the UNSC sanctions in the second half of 2016were different for each item (irenk.net. ibid).

- Most of the mineral resources produced in North Korea are exported to five major provinces in China. Among them, the majority of the mineral resources are exported to Liaoning province or Jilin province, and only anthracite and iron ore are exported to Shandong, Hebei, and Jiangsu provinces across the West Sea (irenk.net. ibid).

- Each North Korean mineral resource commodity shows different share patterns in the Chinese import market. Out of the top 10 mineral resources exports, only anthracite and magnesia have significant shares of the market. On the other hand, other minerals hold relatively low or insignificant shares in the Chinese import market. Regardless of how insignificant their shares are in the overall Chinese import market; these minerals are still often sold by the DPRK in amounts sufficient to satisfy the needs of particular provinces for specific minerals (irenk.net. ibid).

Figure 1: Composition of DPRK’s mineral products exporting to China (% of value)

Source: North Korea Natural Resource Newsletter, 2017, (www.irenk.net), searched Dec.22 2018

Table 1: North Korea’s top five exports to China, 2008–2017 (Million US dollars)

| 2008 | 2009 | 2010 | 2011 | 2012 | |||||

| Product | Export | Product | Export | Product | Export | Product | Export | Product | Export |

| Coal | 201.30 | Coal | 208.6 | Coal | 390.40 | Coal | 1,140.9 | Coal | 1,198.5 |

| Iron ore | 172.30 | Iron ore | 48.50 | Iron ore | 194.30 | Iron ore | 324.50 | Iron ore | 248.60 |

| Molluscs | 36.10 | Pig Iron | 20.60 | Pig Iron | 64.40 | Men’s Jackets | 111.40 | Men’s Coats | 95.20 |

| Pig Iron | 35.00 | Molluscs | 19.30 | Molluscs | 53.20 | Pig Iron | 105.80 | Molluscs | 91.40 |

| Men’s Coats | 31.00 | Men’s Coat | 18.10 | Zinc Monster | 47.70 | Men’s coat | 85.30 | Men’s coat | 88.80 |

| 2013 | 2014 | 2015 | 2016 | 2017 | |||||

| Product | Export | Product | Export | Product | Export | Product | Export | Product | Export |

| Coal | 1379.8 | Coal | 1,135.7 | Coal | 1,049.8 | Coal | 1,180.9 | Coal | 401.70 |

| Iron ore | 298.7 | Iron ore | 221.9 | Men’s Coats | 168.5 | Men’s Jackets | 157.7 | Men’s Coats | 139.10 |

| Men’s Coats | 126.7 | Men’s coat | 157.3 | Men’s Jackets | 151.3 | Men’s Coats | 152.2 | Molluscs | 136.10 |

| Men’s Jackets | 122.2 | Men’s Jackets | 152.9 | Women’s Coats | 130.5 | Molluscs | 140.7 | Lady Coats | 128.60 |

| Women’s Coats | 116.5 | Women’s Coat | 137.1 | Women’s Jackets | 96.9 | Lady coat | 135.5 | Men’s Jackets | 104.30 |

Choi Young Yoon, 2018, www.Kita.net 2018.12.22

Coal export to China

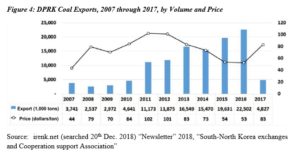

Between 2008 and 2017, the importance and volume (weight) of anthracite coal in North Korea’s exports to China increased dramatically, with the total export amount of anthracite reaching 80% by 2017. (Kim, 2018).

Total anthracite exports to China in 2017 dropped 66.5% year-on-year, relative to 2016, to $41.73 million. Exports totalled 4.83 million tons, down 78.5% from the previous year. The decline in coal exports to China was due to the establishment of a ceiling on imports of coal from North Korea imposed by the UN sanctions on North Korea No. 2321 and No. 2371; the temporary suspension of China’s coal imports from North Korea since February 19, 2017; and the total ban on coal imports from North Korea from September 5. The export unit price of coal to China has continued to decline from 2011 until 2016, but it has risen by 58.5% (US $ 30.7/ton increase) to US $ 83.2/ton in 2017. The surge in North Korean coal export prices to China is due to the supply shortage caused by the Chinese government’s coal reduction policy (irenk.net, 2018 and Kotra news, 2018).

Iron ore export to China

Iron ore exports in 2017 were US $103.4 million, up 39.0% from the previous year, and the iron ore export volume increased by 1.3% to 1.66 million tons, while export unit prices increased by 37.2%. The increase in iron ore exports is attributed to allowing the export of iron ore which was put in place to solve the coal shortage for the general public, caused by the ban on export of iron ore by the United Nations Sanction No. 2270. The export price of iron ore to China has continued to decline since 2011, but increased to US $ 62.3/ton in 2017, a 37.2% (US $ 16.9/ton) increase from the previous year. The DPRK’s recovery in export prices to China is due to a shortage of supplies caused by the Chinese government’s iron ore reduction policy (Kim, 2017).

Other mining exports to China

According to the supply-demand situation of China-related industries, there are increased demands for minerals and other resource imports, including: lead deposits 21.6% ↑, graphite 125.8% ↑, electrical energy 90.8% ↑, talc 119.7% ↑, silicate 180.9% ↑, fluorite 63.8% ↑, pyrite 8.0% ↑, tungsten 864.5% ↑, molybdenite 10.8% ↑, all measured year-to-year from 2016 to 2017 (see Table 2).

DPRK minerals showing decreased exports to China between 2016 and 2017 included a decline of 98.7% for zinc, 99.5% for copper, 98.2% for silver, 3.7% for magnesite, 49.4% for granite, and 29.3% for salt.

The precious metal and titanium mines performed well in 2016, but they have not produced the results seen in in 2017 (Kim, 2018).

Table 2: Comparison of other mineral products exported from DPRK to China

|

Item |

Year 2016 | Year 2017 | Variation | |||||||

| Amount

US$10,000 |

Volume

(ton) |

Unit price

(dollar/ton) |

Amount

US $10,000 |

Volume

(ton) |

Unit price

(dollar /ton) |

Amount | Volume | Unit price | ||

| Pb ore | 6,152 | 108,168 | 569 | 7,478 | 93,216 | 802 | ▲21.6% | ▼13.8% | ▲41.1% | |

| Magnesite ore

|

2,509 | 146,937 | 171 | 2,416 | 176,615 | 137 | ▼3.7% | ▲20.2% | ▼19.9% | |

| Graphite ore

|

616 | 46,883 | 131 | 1,391 | 140,008 | 99 | ▲125.8% | ▲198.6% | ▼24.4% | |

| Electricity energy | 576 | 167,233 | 34 | 1,098 | 319,681 | 34 | ▲90.8% | ▲91.2% | ▼0.2% | |

| Molybdenite

|

402 | 968 | 4,155 | 445 | 1,053 | 4,228 | ▲10.8% | ▲8.8% | ▲1.8% | |

| Tungsten | 41 | 99 | 4,111 | 395 | 597 | 6,611 | ▲864.5% | ▲503.0% | ▲60.8% | |

| Talcum | 53 | 4,160 | 128 | 117 | 11,817 | 99 | ▲119.7% | ▲184.1% | ▼22.7% | |

| Quartz | 39 | 14,407 | 27 | 109 | 41,090 | 27 | ▲180.9% | ▲185.2% | ▼1.7% | |

| Zink ore | 5,087 | 128,122 | 397 | 68 | 2,415 | 282 | ▼98.7% | ▼98.1 | ▼29.0% | |

| Granitic | 78 | 2,670 | 291 | 39 | 1,357 | 290 | ▼49.4% | ▼49.2% | ▼0.5% | |

| Salt | 55 | 5,465 | 100 | 39 | 3,893 | 100 | ▼29.3% | ▼28.8% | ▼0.7% | |

| Fluorite | 23 | 4,525 | 51 | 38 | 6,896 | 54 | ▲63.8% | ▲52.4% | ▲7.5% | |

| Iron Pyrite | 23 | 3,056 | 74 | 24 | 3,240 | 75 | ▲8.0% | ▲6.0% | ▲1.9% | |

| Silver ore | 692 | 14,093 | 491 | 13 | 300 | 418 | ▼98.2% | ▼97.9% | ▼14.9% | |

| Copper ore | 2,087 | 52,482 | 398 | 10 | 546 | 184 | ▼99.5% | ▼99.0% | ▼53.8% | |

| Precious metal | 607 | 12,296 | 493 | – | – | – | – | – | – | |

| Titanium | 26 | 3,805 | 67 | – | ||||||

www.irenk.net and www. kita.net, searched, Dec. 22. 2018

2 Current status of the DPRK Minerals Sector

Table 3 summarises the known reserves of major natural resources in the DPRK.

Table 3: Major Natural Resources in the DPRK

| Type of Minerals | Unit | DPRK Published. 1 | DPRK Published book 2 | |||

| Total amount of deposit | Confirmed & remaining | Forecasted | Total amount of deposit | |||

| Coal | Anthracite | One hundred million ton | 205 | 26 | 201 | 227 |

| Gold | tons | 2,000 | 317 | 655 | 972 | |

| Precious

Metals |

Silver | tons | 5,000 | 974 | 6676 | 7,650 |

| Copper | 1,000 ton | 2,900 | 1,438 | 3,523 | 4,961 | |

| Pb | 1,000 tons | 10,600 | 2,577 | 7,391 | 9,968 | |

| Zink | 1,000 tons | 21,100 | 9,477 | 18,706 | 28,183 | |

| Metals | Iron | One hundred million tons | 50 | 17 | 30 | 47 |

| Tungsten | 1,000 tons | 246 | 36 | 119 | 155 | |

| Molybdenum | 1,000 tons | 54 | 18 | 29 | 47 | |

| Nickel | 1,000 tons | 36 | 25 | 35 | 60 | |

| Graphite | 1,000 tons | 2,000 | 18,729 | – | 18,729 | |

| Non-

metals |

Limestone | One hundred million tons | 1,000 | 13 | 50 | 63 |

| Magnesite | One hundred million tons | 60 | 13 | 63 | 76 | |

| Apatite | tons | 1.5 | 0.8 | 1.7 | 2.5 | |

| Barite | tons | 2,100 | 2,399 | 2,426 | 4,825 | |

Jung, Woo-Jin, 2015 (Korea Energy Economics Institute)

2.1 Key Regional Mines

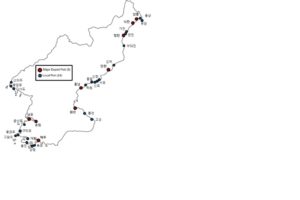

There are more than 360 types of natural resources in the DPRK, which are for the most part evenly spread out across North Korean regions. Among them, 220 types of resources are useful for economic purposes. For example, the DPRK’s reserves of tungsten, molybdenite, black lead, barite, and fluorite place the DPRK among the world’s top 10 countries in terms of reserves (irenk.net). Table 4 summarizes the estimated output of major minerals in the DPRK in recent years.

The DPRK has not only vast mineral resources, but also abundant energy resources such as coal and uranium, which play major roles in supplying power and industrial materials in North Korea.

Table 4: Output of Major mineral products in the DPRK (2013–2017)

| Item | Unit | 2013 | 2014 | 2015 | 2016 | 2017 |

| Coal | 1,000 tons | 27,861 | 27,081 | 31,115 | 35,741 | 21,738 |

| Iron ore | 1,000 tons | 5,716 | 5,487 | 4,020 | 4,280 | 4,473 |

| Magnesite | Tons | 143,848 | 179,450 | 149,599 | 160,935 | 172,488 |

| Copper | Tons | 33,429 | 38,563 | 42,826 | 62,768 | 8,749 |

| Zinc | Tons | 144,556 | 149,044 | 181,329 | 265,877 | 142,685 |

| Pb | Tons | 95,458 | 96,529 | 93,187 | 94,458 | 95,944 |

(North Korea Natural Resource Institute, 2018)

(1) Gold and Silver mining

Gold ore is being produced with silver ore and copper ore in the DPRK (private source, 2018). Gold and silver ore reserves total a few million tons of raw ore, according to a recent private source, with gold ore reserves estimated at 3,000 tons (private source, 2018) as 100% gold and silver reserves at 3,000–5,000 tons as 100%. Silver. The estimate of deposits of 3,000 tons of Gold, however, is based on interviews with DPRK businessmen, and is thus unofficial information (private source, 2018).

Major gold mines in the DPRK are the Soo-An Mine (Soo-an-gun, Hwang Buk province), the Hol-dong mine (Yonsan-gun, Hwang Buk province), the Dae-yoo-dong mine (Dongchang–gun, Pyungbuk province), the Woon-san mine (Woonsan-gun, Pyong-Buk province), the Sung-hong mine (Hoi Chang-gun, Pyongnam province), the Sang-nong mine (Huh-chon-gun, Hamnam province), the Ong-Jin Gold mine (Hwang-Hae province) and the Kum-kang mine (Kumkang-gun, Kangwon province) (private source, 2018). The total production from these 7 major gold mines and others in total has not been officially reported, however it is clear that the annual gold production capacity is approximately 17–19 tons in these major mines, and annual silver production is approximately 70 tons (private source, 2018). In particular, the annual production capacity of the Woon-San gold mine is about 2 tons, according to private sources (2018). This mine’s capacity is estimated to be over 10% of the DPRK’s gold production capacity. The Woon-san mine’s deposits of gold ore are estimated as 1,500 tons alone, which is almost 50% of North Korean gold reserves (private source, 2018).

Deeper and deeper strata in the gold mines described above have been worked due to the mines having been operated for more than 50 years, and the increasing depth of pit (tunnel depth) is making it more complicated and difficult to extract gold ore from these mines (private source, 2018).

The following are examples of proposals for investment of foreign country (China) in DPRK mining ventures:

- Proposal for a joint venture between Kangsung Trading Company and China to develop a gold mine in Dong-chang-gun, North Pyongan Province

Despite sanctions against North Korea, North Korea is pursuing underground resources development by attracting Chinese capital. The Channel A broadcasting company has learned of a proposal from a Chinese company to invest in North Korea’s gold mining development. A 50-year long-term contract was being discussed in the context of a proposal to invest in the development of mines that ‘Kang Sung Trading Company’, which operates under the North Korean People’s Army. This proposal was offered by Chinese investors to North Korea. This is a joint venture proposal for the development of the gold mines in Dong Chang, North Pyongan Province. Reportedly North Korea has the right to exploit it, but the production facilities and the operation facilities will be invested in the ratio of 51% in North Korea and 49% in China. At the same time, investors have secured an annual income guarantee of about 23.4 million dollars and about 26.5 billion won for their money. A source in North Korea met with Channel A and said, “The development period is 50 years and the long-term contract is underway.” (Channel A News source)

- Supporting the exclusive development of North Dae-bong Gold Mine

Local sources say that North Korean authorities are concentrating their investment in Dae Bong Mine located in Rojung-Ri, Yangkang Province. Daebong mine, in which mining began in the mid–1990s, is a mine that produces high-quality gold, tungsten, and quartz, according to sources. Dae Bong Mine belongs to the Daesung Administration, which belongs to the Room No. 39 of Labor Party, which controls the secret funds of Kim Jong Eun. In the mid–1990s, the monthly production of pure gold rose to 40 kg, and the income from this production played an important role in getting the DPRK out of “The March of Suffering” period under Kim Jong Il regime, the source explained. According to another source in Yanggang Province interviewed recently, “The monthly production of Daebong Mine, which was sent down from the center this year, is 25 kg of pure gold. And the annual production plan is 300 kg of pure gold. [Producing this volume of gold] is not a difficult task if transportation and electricity is guaranteed.” Presently, North Korea’s gold production is strictly authorized by the Daesung Administration operating under the Room No. 39. The source added that if other foreign currency-earning-institutions wanted to produce gold they needed to be approved by the Daesung Administration and give a certain amount of produced gold to the Daesung Administration in return. (Radio Free Asia, Jan. 13, 2017)

Silver ore

Proposal for Gu-jang silver mine joint venture investment

The quality of ore reserves of the silver mine in Gujang, North Pyeongan province was reported at 0.06% (about 600g of pure silver per 1 ton of silver ore), and it was confirmed through geological exploration that the mine has 4 million tons of reserves. It is estimated to be 2,400 tons of silver products with 100% purity. The reserves are estimated to be valued at close to 1.2 billion dollars (1.2 trillion won) at current silver prices.

Power supply and silver concentrate sales plan:

Electricity supply can be supplied by electric power from China, as the mine is located 50 kilometers from the border of China, or electricity can be supplied by a self-generator.

Investment method and operation plan:

Establishment of joint venture (enterprise) mine and joint operation method: Profit distribution: ration 6:4 (Investor 60: Chosun Daebang 40) 60% of silver ore is exported to overseas and 40% is managed by DPRK business partner.

Guarantee and operation method for investment:

Issuance of guarantee certificate by the Chosun government and the second economic committee for 100% of the investment fund, national institutional certificate for joint development and operation rights (60%)

(2) Iron Ore

Table 5summarizes the major iron ore mines in the DPRK, including their location, the reported size of their deposits, and the reported grade of their ore bodies, as well as estimates of their output as of 2011 as there has been no significant developments on new mines in the last 5 years according to a private source (private source, 2018).

Table 5: Major Iron Ore Mines of the DPRK

| Area | Mine name | Location | Deposit | Grade | Notes |

| East | Moo-san | Moo-san, Ham-kyung province | 1.5 billion tons | 25–35 % | 8 million tons. (30%), 3 million tons (60%) |

| Lee-Won | Lee-won Ham-Nam, prov. |

20 years operation |

49% | ||

| Poong-San | Poong-San, Ran-gang prov. | 120 M tons | 45% | ||

| Hur-Chon | Hur-chon, Ham-nam | 150 M tons | 48% | ||

| Dan-chon | Dan-chon, Hamnam | 100 M tons | 45% | ||

| Jang-Gang | Ja-Gang province | unknown | 50% | ||

| West | Eun-Ryul | Hwang-nam province | 100 M tons | 48% | Open mine 1.6 million tons |

| Jae-Ryung | Hwang-nam province |

100 million tons | 50% | Open mine 500,000 ton |

|

| Chon-Dong | Gae-chon Pyong-Nam province |

50 million tons | 50% | 1 million tons | |

| Suh-hae-ri | Eun-Ryul Hwang-Nam province |

unknown | 55% | Under development | |

| Hah-Sung | Shin-Won Ham-Nam province |

15 million tons | 45% | Open mine 500,000 ton |

|

| Duck-Hyun | Eui-Joo Pyong-Buk, province |

unknown | 50% | Iron & copper 500,000 tons |

|

| An-Ark | Hwang-nam province |

unknown | 50% | Newly developed | |

| Song-rim | Hwang-buk province |

unknown | 55% | Newly developed | |

| Hwang-Joo | Hwang-buk province |

unknown | 55% | Newly developed | |

| Yon-San | Hwang-buk province |

unknown | 55% | Newly developed | |

| Tae-Tan | Hwang-nam province |

unknown | 55% | Newly developed | |

| Gae-chon | Pyong-Nam province |

17.5 million tons | 45–55% | Developed 1976 |

Source: “DPRK’s Industry,” Korea Industrial Bank (ROK), 2001; “M” denotes “million”

The overall size of deposits of iron ore in the DPRK is estimated at 3.5–4.0 billion tons (including ores of quality in the 22–50% Fe range) according to a Korea Mining Corporation (ROK) report (2008). Major iron ore regions are the Moo-san, Lee-won, Buk-Chong, Hur-chon areas (Ham-Kyung province), Eun-Ryul, Shin-Won, and Jae-Ryong (in Hwang-Hea province) (Korean Mining Corporation, ibid, p. 16). Details of key mines and factories using iron ore are provided below.

Moo-san Iron Ore Mine

The reserves of the Moo-san mine are estimated at 1.5–2.0 billion tons as Magnetite (FeOFe2O3) containing Fe at 23–30% (Korean Mining Corporation, ibid, p. 16). The mine’s reserves are considered low-grade ore (average 25%), but as it is a strip mine (an open pit mine). It is a well-known mine worldwide and offers iron ore production at a low cost. There are 3–4 mineral veins in the Moo-san mine. The first vein is 400 meters in width, 3,000 meters in length, and 1,000 meters deep. Another three veins are known to be similar in structure to the first, but further details on those veins are not available (Korea Mining Improvement Corporation report, p. 17, 2008, private source, 2018).

In the mine, 28–30% iron ore is refined to an iron content of 60%–65% through a dressing (separation of higher-grade ore products) procedure in the mine area. Ore produced from an open surface is sent to six ore separators in 25-ton and 50-ton heavy trucks (which were mostly imported from Sweden). The ore is then sent to dressing plants (for selecting out) by gravity separation methods at a location near the ore separator (private source, 2018).

Eun-Ryul Mine

This mine has iron ore in the form of limonite (Fe(OH)n H2O) and is located in Eun-Ryul-Gun, Hwang-Hae province. Deposits in this mine are estimated to total 200 million tons. Due to their high grade of iron ore (Fe 44%) and the convenience of transporting ore in ships (the Eun-Ryul mine is within 20 km of Hae-Joo port) the Eun-Ryul mine and the nearby Jae-Ryong mine described below are likely possible destinations for overseas’ investment funds (Kim, 2014 and private source, 2018).

Exporting Iron ore to China

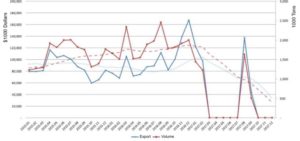

The share of iron ore in North Korea’s exports to China (as of 2016) is not high compared to other mineral resources. In 2016, North Korea’s iron ore exports to China amounted to $7.33 million. This was not a large proportion compared to other mineral resources exported to China, but it sharply increased in 2014, and shrank to zero for several months after April 2017, then fell again sharply from September 2017 when sanctions began. As a whole, the value of North Korea’s iron ore exports to China in 2017 (the “Export” line in Figure 2) totalled US $100 million, an increase of 43% over 2016 (irenk.net, 2018).

Figure 2: North Korea’s Export of iron ore to China

Source: Choi, Young Yun, KDI, 2018, www.Kita.net

(3) Copper Mines

North Korean authorities have been deliberately reluctant to reveal information about North Korea’s copper mines and copper production capacity to outsiders, including to China and South Korea, since copper has been a significant material for producing military equipment, including copper cable, bullets, shells, and missile-related materials (private source, 2018). Thus, it is not easy to gather data related to copper mines and copper production in North Korea. There are three major copper mines in Northern part of the DPRK: Hur-Chon Copper Mine, Hye-San copper mine and Yong-Heong Copper Mine (private source, 2018).

The information available on these mines are as follows.

Hye-San Youth Copper Mine

This mine is located in the Hye-San region in Ryang-Gang province. The copper ore deposit for this mine is known to contain 20 million tons of ore, the mine’s annual production capacity is 30,000 tons (of 30% copper concentrate), and its employees number about 2,500. Copper ore from the mine is processed in a concentrator unit at the mine, and the concentrated ore is carried by freight train to Dan-Chon refinery (DPRK published document, 2017 and private source, 2018). There are two copper mines in this region: Gap-San copper mine and Shin-Pa copper mine in Ran-gang province.

North-China joint venture Hyesan Youth Mine normalizing operation

‘Hyejung Mining Co.’, which Hyesan Youth Mine in Yanggang Province, North Korea and China Wanxiang Group have jointly established, is reported to be greatly expanding production as they have been operating normally in recent years. Hyejung Mining Co., Ltd., a joint venture between Wanxiang Resources Co., Ltd. and Hyesan Youth Mine in Yanggang Province, North Korea in 2011, has secured annual production of 5,000 tons of copper concentrate this year, local sources said. Hyejung Mining Co., Ltd. was established in 2007 with the condition that China Wanxiang Resources Co., Ltd. owned 51% of the shares, and Hyesan Youth Mine of North Korea secures 49% of the shares. Due to a conflict between North Korea and China over mining operation rights, it was only in September 2011 that the venture was officially launched. Sources have said that the ‘Hyesan Youth Mine’ was almost the only copper production mine in North Korea. ‘Hyesan Young Mine’ was introduced as a successful example of foreign investment attraction, and the sources contacted have gathered that the operation is normalizing and the production is rapidly increasing (private source, 2018; Radio Free Asia, 2014-10-17)

Hur-Chon Copper Mine

This mine is located in the Hur-Chon region of Ham-Kyung province. The known copper ore deposits for the mine are estimated as 15 million tons, and gold and other rare minerals are also found in the deposit. The annual production capacity of the mine is 20,000 tons (copper concentrate at 40%) and it employs 5,500 personnel. Copper ore is processed in a concentrator at the mine and is carried by trucks and freight trains to the Dan-Chon refinery (private source, 2018). This mine is located in the Yong-Heong region in Ham-gyung province. The known copper ore deposit is 12 million tons, and is also associated with gold and rare minerals. The annual production capacity of the mine is 10,000 tons (copper 40%), and it employs 1,500 workers. Copper ore is concentrated in concentrator units at the mine and is carried by trucks and freight trains to the Dan-Chon refinery (private source, 2018).

Rim-gang District Copper Mine Joint Venture Investment Plan

Copper ore reserves in the Rimgang District, Yang-gang Province are 12% grade, with 20 million tons of reserves, confirmed by geological exploration. Reserves in this area are estimated to be the equivalent of 24 million tons at 100% copper. The value of the total reserves thus amounts to $1.7 billion (1.7 trillion won) at current copper prices. Production plans based on investment estimate that 3 months after the first investment, 3,000 tons / month of copper concentrate (300 tons/month of net tons of copper) can be produced, with the value of the planned monthly output at international prices estimated at 300 * $7100 = $ 2.13 million

Power supply and copper concentrate sales plans are as follows. As the mine is located within 3 km of the Chinese border, supplies of electricity will come from China, but it is possible to supply electricity with the mine’s own generator. The copper concentrate produced (ore dressing by 30% or more) is exportable to China. It can be transported via the Hyesan-Dancheon railway line and exported from Dancheon port (private source, 2018)

(5) Magnesium oxide (ore)

The DPRK’s reserves of the non-metallic mineral magnesite are estimated at 3.5–4 billion tons (Mg 45%) and are mostly located in the Dan-Chun area, Ham-Kyung province, which is the largest deposit in the world. In particular, as a strip mine and large scale mine, the deposit in the Baekgumsan area is approximately 3.6 billion tons and is 7,660 meters in length, and 7–100 meters in depth. North Korean production of Magnesite as of 2005 was estimated at 1 million tons of concentrated ore (Kim, 2007 & private source, 2018).

Ryong-Yang Mine

This mine is located in Don-san dong, Dan-Chun city and is a subsidiary of the Dan-Chon Regional Mining Group. The Magnesite ore grade is MgO 30%, and the mine’s capacity to produce Magnesium ore is 8 million tons per year, which after concentration of the ore (to 55–60% Mg) is 3 million tons. Mining operations use two methods, terraced strip mining and underground mining. Heavy trucks operate from inside the mine to transfer points outside of the mine tunnels, and freight trains are used as major carriers to move ore from the mine area (Korea Mining Improvement Corporation report 2015). A major ore separator was built within the mine in 1988, and the capacity of the separator is 8 million tons of ore per year. This mine is operating as a subsidiary of the Korea Magnesia Clinker Industry Group (KMCIG), and this parent company has three mines and three clinker manufacturers with 30,000 employees. In addition, the KMCIG operates four kilns for CCM (caustic calcined magnesia) and dead burned magnesia, and its capacity of production is 750,000 tons per year (Kim, 2007 and private source, 2018). Double railways were built early in the 1990s as infrastructure for this mine. Freight railways operating from the seaside (Dun-chon City) to the mining sites are, however, on steep slopes, and alternative freight methods need to be considered to serve the mine (private source, 2018).

(6) Lead and Zinc Mines

Most lead and zinc deposits are found in Ham-Kyung, Pyong-An and Hwang-Hea provinces, and the total reserves are approximately 600,000 tons (Pb 100%) and 15–20 million tons (Zn 100%), respectively. The national total output of lead and zinc are approximately 60,000 tons and 100,000 tons per year respectively (Kim, 2015 and private source 2018). Most zinc and lead ore is smelted at the Moon-Pyong Refinery (located in Moon-Chon City, Kang-Won province).

Gum-Dock Mine

This mine is located in Dan-Chon area in Ham-Kyung province. As the largest zinc mine in the DPRK, this mine has rich vein of ore 9 km in extent, and its deposit is estimated at 8 million tons (Zn 100%), accounting for half of the DPRK’s total deposits (private source, 2018).

(7) Energy resources: Coal

Table 6 lists the major coalfields in the DPRK, providing the type of coal mined and the estimated size of coal deposits for each.

Table 6: Deposits in Major Coalfields of the DPRK (unit: million tons)

| Type of Coal | Name of coalfields | Deposits of coal |

| Anthracitic

|

Northern Pyong-An coalfield | 3,670 |

| Southern Pyong -An coalfield | 1,260 | |

| Ko-Won coalfield (Kang-won province) | 320 | |

| Others | 6,490 | |

| Sub-total | 11,740 | |

| Brown coal

|

Northern Ham-buk province | 1,910 |

| Southern Ham-buk province | 570 | |

| Others | 520 | |

| Sub-total | 3,000 | |

| Total | 14,740 |

Source: Korean Central Bank, 2015

Coal in the DPRK’s economy has been recognized as a major strategic energy resource and an economic development engine, as well as an industrial material for thermal power plants and factories, railway operations and even households (Jung, 2016, Private source, 2018). Approximately 70% of North Korea’s energy is provided by coal, thus coal mines have been recognized as having a significant position in resource development plans for the DPRK’s economy (Joung 2016 and Private source, 2018). Coal reserves in the DPRK include the coal types Anthracite and Brown coal, but reserves of bituminous coal are not found in the DPRK, according to irenk.net.

The total of the DPRK’s coal deposits sum to approximately 14.7 billion tons, including 3 billion tons of lignite coal (soft coal) and 11.7 billion tons of Anthracite coal, mostly in Pyong-an province and Ham-Gyung province (irenk.net, 2018). In terms of anthracite coal reserves in North Korea, major coal production areas are classified into two areas: North Pyong-An coalfields (deposits of 3.7 billion tons) and the South Pyong-an coalfields (deposits of 1.23 billion tons) (irenk.net. 2018).

Reasons why the DPRK’s anthracite is used in the Chinese market and its advantages

According to studies by Jung Woo-Jin, North Korea’s export of coal to China have found to have increased as a result of changes in the Chinese anthracite market rather than the political ties between North Korea and China. In China, the North Korean anthracite market has been formed according to pure private trade and commercial conditions without policy intervention. However, the trading method of “first supplying equipment and materials then receiving anthracite coal” is different from the usual form of international trade. Compared with the price of imported anthracite coal in China and the price of trade between North Korea and China, the export price of coal in North Korea is also in line with the supply and demand of the market (Jung, 2015 and Joung, 2016).Since China, however, is also a large producer of anthracite coal, some price reductions for DPRK anthracite are likely to be in place to allow imports to enter the Chinese market in a competitive position with domestic Chinese coal and other imported coal (Jung, 2015 and Joung 2016). The DPRK’s anthracite coal is considered to be highly competitive, considering that North Korea’ s replacement was the most popular substitute for Vietnam’s decline in exports to the Chinese market compared to other exporting countries. This was confirmed by interviews with Chinese traders who imported North Korean anthracite coal. However, mismanagement during production and transportation of coal from the DPRK, in addition to North Korea’s commercial practices, which do not conform to international practices, may deteriorate the competitiveness of North Korean anthracite, which can be a disadvantage in pricing. In particular, these practices may have a stronger impact on the market when the market is the seller’s market (Joung, 2016).

Major coal information from books published in DPRK

North Korea’s coal resources are mostly in deposits in the western region. In particular, anthracite coal deposits are concentrated in the western district, and lignite coal deposits are concentrated in Anjutan mudflat. In this regard, coal resources have a severe imbalance in distribution by province. More than 95% of the total coal reserves are concentrated in South Pyongan and North Hamgyong provinces. In the remaining provinces, only 4% of the total national reserves are distributed (“Chosun Geography — Industrial Geography,” Pyongyang Educational Books Publisher. 1989. (DPRK), p. 86). The North Pyongnam coalfield is located in a large area of 39 km in east-west and 42 km in north-south dimensions, covering a total area of 816 km2. The coalfield is spread out over Gaechun-city, Deokchun-city, Bukchang-gun, and Sunchun-city in South Pyongan, and Gujang-gun in North Pyongan. The coalfield is the largest coalfield in North Korea for anthracite reserves (“Chosun Geography — Industrial Geography,” Pyongyang Educational Books Publisher. 1989. (DPRK), p. 102, and Joung, 2016).

The Sin-chung coal mine, Ryungdae coal mine, Chunsung Youth coal mine, 2.8 Jik-dong Youth coal mine, which belong to the Sun-cheon District Coal Mine Union Enterprise in the Sun-cheon district, produces more than one million tons of anthracite coal. 63 other small and medium scale coal mines are also situated in the district (“Chosun Geography — Industrial Geography,” Pyongyang Educational Books Publisher. 1989. (DPRK), p. 102.24)

The 2.8 Jik-dong coal mine is located in Jik-dong, Suncheon city of South Pyongan, and has 30 million tons of reserves. The quality of coal from the mine is 6,100–6,900 Kcal/kg. The mine was first developed in 1977. Electricity is supplied from the Buk-chang Thermal Power Plant and Suncheon Thermal Power Plant, and the railroad connects the mine site to Nam-po Port. The coal produced is supplied to the Pyongyang thermal power plant, and 10% of the mine’s output is exported to China by land and sea for normalization of production. Production capacity is 1.5 million tons per year (“Chosun Geography — Industrial Geography,” Pyongyang Educational Books Publisher. 1989. (DPRK)).

Chun-sung and 2.8 Jik-dong Youth coal mines are large-scale coal mines with an aggregate 2.5 million tons capacity. The Shin-chang and Ryung-dae coal mines, which were developed earlier, have reached 2 million tons capacity. In the 1970s, the coal mines of Shinchang and Ryung-dae were the largest anthracite mines in the country, but by the 1980s, they had yielded their first place to the newly developed 2.8 Jik-dong and Chun-sung Youth coal mines. (“Chosun Geographical Manual — Transportation Geography” Pyongyang Educational Publishing House, 1988 and “Chosun Geography —Industrial Geography,” Pyongyang Educational Books Publisher. 1989. [DPRK))

It has been reported that the An-Joo coalfield has produced coking coal (high heat content coal used as coking coal), which was exported to China in 2008. By contrast, South Korean research papers on the topic have so far denied the existence of coking-quality coal production at An-Joo (private source, 2018). Annual nationwide coal production was 38.3 million tons in 1989 but production of coal declined sharply after 1990, leaving annual coal production at 18.6 million tons in 1999. Estimated nationwide coal production capacity, however, is said to have been 53.50 million tons in 1986. (Jung, 2007, p. 18).

Regarding coal quality, DPRK-produced anthracite coal from the Duck-Chon coal mine is reported by Chinese importing authorities and shipping business sources to have the following characteristics Coal Specifications: Caloric value: 6,300 kcal/kg (min.) Fixed Carbon: 81.00% (max.) Ash contents: 12.5% (max.)Volatile material: 6.0% (max.) Sulfur: 0.2% (max.) Moisture (max): 6.0% (max.) Size: 0–30 mm (100%. min.) (Source: Invoice from DRPK exporting company, 2018). Coal of this type has recently been exported to Chinese thermal power plants in Tien-jin and Dai-lian (above DPRK book and private source, 2018). This coal is of much better quality from a caloric value standpoint than normal coal produced by the DPRK.

2.2 Exporting Anthracitic coal to China

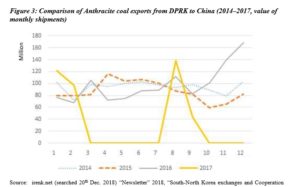

North Korea’s anthracite coal exports have risen sharply since the second half of 2016, and the DPRK exported a total of $1.18 billion worth of coal to China in 2016. Anthracite was an important item that accounted for about 45% of North Korea’s exports in that year by value. North Korea’s anthracite coal mine exports to China peaked in 2016, however, and in 2017, it exported only $400 million worth of coal, a drop of 66% from the previous year. Except for January, February, August and September, the monthly volume of coal imported by China as recorded in Chinese customs statistics was zero (0) (irenk.net,2018), as shown in Figure 3. Table 7 shows the share of Chinese coal imports in 2017 accounted for by each of four major importing provinces, with the change in values since 2016.

Figure 3: Comparison of Anthracite coal exports from DPRK to China (2014–2017, value of monthly shipments)

Source: irenk.net (searched 20th Dec. 2018) “Newsletter” 2018, “South-North Korea exchanges and Cooperation support Association”

Table 7: Major province of DPRK Anthracite export (amount, volume and unit price, 2014)

| Province | Share of Anthracite exported (%) | Value

(million dollars) |

Volume

(1,000 tons) |

Unit price

(Dollars/ton) |

| Shandong province | 44.6 | 504.7 (-14.1) | 7,149 (-1.7) | 70.6 (-12.6) |

| Hebei province | 20.5 | 232.0 (-25.9) | 3,217 (-16.3) | 72.1 (-11.4) |

| Jiangsu province | 17.6 | 199.6 (-2.8) | 2,545 (6.0) | 78.4 (-8.3) |

| Liaoning province | 12.7 | 143.8 (-36.6) | 1,842 (-27.5) | 78.1 (-12.6) |

Source: “Newsletter” 2018, “South-North Korea exchanges and Cooperation support Association”

Anthracite coal exports from DPRK rose relatively smoothly from 2014 to 2016, as shown in Figure 4, but as noted above there were no recorded exports from March to July in 2017 due to economic sanctions on North Korea in 2017, with exports only in the months of January, February, August and September in 2017. This shows that the trend of DPRK’s anthracite exports fluctuated by season and time.

Figure 4: DPRK Coal Exports, 2007 through 2017, by Volume and Price

Source: irenk.net (searched 20th Dec. 2018) “Newsletter” 2018, “South-North Korea exchanges and Cooperation support Association”

DPRK’s coal expert market analysis: North Korea’s domestic market

A North Korea and China field survey carried out by the author suggests that “7 to 3” practices have been settled upon as an acceptable anthracite payment method between North Korea and China. Here, “7 to 3” means that when a Chinese importer takes over a shipment of anthracite coal at North Korea’s port, he immediately pays 70% of the price to the exporter. Then, the remaining 30% is paid after the anthracite coal is transported to China and has undergone quality inspection, such as testing the coal ash content. This is a differential payment method that depends on the quality of anthracite. This kind of payment method is favourable to the buyers (Joung En-Lee, 2016 and Private source, 2018).

According to the results of interviews with DPRK and Chinese businessmen, the reasons why a settlement method that is favourable to China was established are as follows: 1) Decline in China’s economic growth, 2) Decline in international commodity export prices 3) Increase in China’s coal imports from Russia due to the fall of the Russian currency, 4) Changes in China’s use of household fuels. As a result, China’s demand for anthracite from North Korea has decreased (Joung, 2016)), creating a market that is favourable to buyers.

Increase in Anthracite Export to China and Comparative Advantage

DPRK Exports of anthracite coal to China remained below 1% of total Chinese anthracite coal imports through 2001. These exports rose to 8.4% of Chinese anthracite imports in 2004 and drastically increased to 20% in 2005. DPRK anthracite exports to China continued to rise, reaching over 45% of Chinese anthracite imports in 2011. The sharp increase in anthracite exports to China thus really began in 2005 (irenk.net). According to the results of the author’s interviews with businessmen from China and the DPRK, the reasons for the increase in Chinese demand for North Korean anthracite coal are as follows;

First, the change is closely related to the evolution of China’s economy. China, which has maintained an economic growth rate of 8% annually until recently, is facing an energy shortage due to economic growth. For example, a Chinese trader was nervous about securing coal supplies, so the trader agreed to pay 30 percent of the coal price to a North Korean coal carrier upfront to secure the quantity of North Korean coal at that time. But as growth in the Chinese economy slowed, anthracite coal prices fell from $60–65/tonne in 2015 to $43/tonne in February 2016 due to declining resource demand amid the Chinese economic downturn. In contrast, in 2013, DPRK anthracite was trading at up to $100–120 per tonne (Joung, 2016, private source, 2018).

The second reason for strong demand for DPRK anthracite in China was that it was available at an affordable price. North Korea’s anthracite coal is trading at about 60% of Chinese anthracite coal prices, and can be conveniently transported by sea. Generally, in China the price of coal is determined based on the distance and means of transportation required to get the fuel to its final destination. Based on the intermediate value of ash 14 each time the number goes below 14, the anthracite unit price increases by $5–6. Conversely, each time the number goes up above 14, the anthracite unit price goes down by $5–6. But the anthracite price paid by a Chinese importer is the FOB (free on board) price, which is the local arrival price that includes shipping costs (Joung, 2016. Therefore, the unit cost of a high-volume commodity varies greatly depending on the transportation method employed. For example, suppose 60 tonnes of coal can be loaded into one train car, then 1000 train cars are required to transport 60,000 tonnes of coal at one time. If a 20-ton truck is used, more than 3,000 trucks are needed for transportation (Joung, 2016). Moreover, the longer the distance to the destination, the longer the time required and the higher the logistics costs. Therefore, if a buyer relies on land transportation the cost of coal will rise sharply, whereas the costs of importing by sea are less.

The third reason that DPRK anthracite is preferred by Chinese buyers is that North Korea and China lie in close proximity to one another, which has many advantages in terms of communication, transportation, and commerce. The importers can travel back and forth frequently to check the goods themselves. It is also possible to handle coal supplied by the DPRK according to the demand. The biggest problem the Chinese importers face to import coal from North Korea is that although the unit price is good, it is difficult to secure the volumes needed due to unstable supply conditions in North Korea. When Chinese importers want to import North Korean coal, they generally prefer to go to the local area with the money themselves to check the goods to be imported, to secure the quantity to be imported from various mines, and to make payments according to the market price. Therefore, the payment system is relatively simple. Currently North Korean banks such as Gangsung Bank, Goryeo Bank, and Hanna Bank are operating in Dandong city, China. According to a Chinese businessman, Mr. K, the method of payment for coal is to open a bank account in both North Korea and Dandong, China. The payment can be withdrawn from the bank in North Korea at a fee of about 6% (Joung, 2016). When coal is imported from Australia to China, the seller expects to export large quantities at one time, due to the transit distance and shipping costs., since North Korea is close by, however, it is possible to import only the small amount required, and there is therefore no need for a large sum of money to do business (Jung. 2016).

2.3 Production and Export Mechanism of Anthracite Coal

Dual Structure of “Plan” and “Private Market” (the DPRK Trading Company as a Foreign Currency-Earning Production Base)

In addition to companies operating as economic units under the Cabinet, North Korea has also established trading companies under the umbrella of privileged organisations belonging to the military department, the Central party and the cabinet to trade with foreign countries. In other words, trade in North Korea is carried out under several systems that the Cabinet, the party, and the military manage separately. The main reason that a privileged agency in the DPRK can trade with a foreign country is because it has been issued a “Waku.” A “Waku,” however, is not permanent. In addition to the items that can be imported and exported, and the quantity and total value of those items, the “Waku Certificate” also specifies the period for which the trade can be made, that is, the validity period. Thus, “Wa-ku (Quota)” is a very flexible entity. In other words, a privileged organization must satisfy certain conditions to establish and maintain a trading company. In particular, securing the export source base is the key (Joung, 2016).

In an interview, a North Korean defector from the North Korean Trade Representative, said, “In North Korea, ‘the act of distribution’ [in which an entity] sells products from other companies, is treated as a sort of brokerage. The act is considered to be unethical as to be thought as stealing other people’s hard work.” This statement is also supported by the fact that a “patent” system exists for specific products produced by companies. The patent system has been getting stronger since the currency exchange in 2009 (private source, 2018. This kind of operating structure implies that it is important for the trading company not only to acquire “Waku” but also to figure out how to make a profit through the acquired “Waku.” The level of profit is determined by how many foreign exchange-earning production bases the trading company has under its wing.

North Korean Trade Representatives dispatched to China spend their time collecting market information, such as the quality and price of local products, and in contract preparation and arranging terms of payment. DPRK Trade Representatives also typically expend a great deal of effort to discover and attract good partners in China to invest in the production base of their home country (Joung, 2016).The author’s survey, however, found that although a trading company with “Waku” typically has many foreign earning bases/facilities under its wing, many trading companies move independently when they actually purchase the resources/product for export. Originally, the trading company purchases the product/resources from the production base of export purpose under its direct control and exports them. The common practice nowadays, however, is that the trading company receives money (in foreign currency) in return for the permission (Wa-Ku) to earn foreign currency from the foreign currency-earning company under its wing. And then it goes onto purchasing resources/products from a different company (the large foreign currency-earning production unit or social enterprise) that has a large volume of resources and buys the products from them. This eliminates the process of collecting export resources from the foreign currency earning companies under its wing and therefore making the process simpler. The trading companies prefer this simpler process, which makes it easier to access the product/resources ready for export whenever the demand arises from the importers (Joung, 2016 and private source, 2018).

State-owned coal mines and private owned coal mines

Coal is generally divided into anthracite, bituminous coal, lignite (brown) coal, and coking coal. Geologically, North Korea mainly produces only anthracite coal and lignite coal. Among these types of coal, anthracite is distributed in the southern part of North Korea such as North Pyeongan province, while the lignite coal is distributed in northern parts such as North Hamgyong province. Most of the coal exported to China is anthracite coal, mainly sourced from the northern part of North Pyongnam province (Joung, 2016 and private source, 2018). Among DPRK coal mines, the Suncheon District Mine Union Enterprise, which is located in South Pyongan province, is a Top-Class Enterprise with about 30,000 employees and produces significant amount of anthracite. It has five mines operating under it. They are named “2.8 Youth Jikdong Coal Mine,” “Shinchang Coal Mine,” “Chunsung Youth Coal Mine,” “Ryungdae Coal Mine,” and “Songnam Coal Mine.” Among the coal mines, the “2.8 Youth Jikdong Coal Mine,” developed in 1977, is the best Top-Class Enterprise within the Top-Class Enterprises, and has about 10,000 employees. It has large reserves and production (Joung, 2016).

Regarding the export of anthracite coal to China, it should be noted that much of the coal produced at Sun-cheon District Coal Mine Union Enterprise is supplied to the Pyongyang Thermal Power Plant and the East Pyongyang Thermal Power Plant in order to stabilise power supplies to Pyongyang City. According to a businessman who is a former manager at Sun-cheon District Coal Mine Enterprise, an average of about 600 tons of coal a day is sent to Pyongyang Thermal Power Plant. Ten coal cars, capable of carrying 60 tons per car, carry the coal to the power plant. In addition to this domestic use, however, the authorities have installed an export department within the enterprise (private source, 2018), which exports 10% of the mine’s production. Thus, although the Suncheon Mining Enterprise accounts for a large portion of the coal industry, there is a limit to the amount of production that can be exported to China (Joung, 2016).

Which mines, then, are responsible for producing the bulk of North Korea’s coal exports? Based on interviews with Chinese and DPRK businessmen, many “Self-Contained Coal Mines,” which are also called “Medium and Small Coal Mines” or “Residual Coal Mines,” are producing significant amounts of coal. As can be deduced from the name, a “Self-Contained Coal Mine” is actually a kind of private company that earns its own foreign currency. A collection of such small and medium coal mines is formed around a main state-owned coal mine. These are small coal mines that can be operated with flexible number of employees. The number of employees in these mines can vary from as big as100 to as small as 5 to 6 employees. These coal mines are small in size, but their contribution is by no means small in terms of total exports. According to the author’s survey, the presence of these coal mines in the Suncheon district was highlighted around 2015. At that time, more than 100 Self-Contained Coal Mines were crowded around main coal mines (Joung, 2016 and private source, 2018).

2.4 Increases in and the Impacts of Foreign Currency-earning Companies: Revitalization of Local Economies and “Dollarization”

Coal export have led to a variety of market development in the DPRK. The Chinese say that there is no need to invest when importing North Korean coal, unlike in other mines—traders need only to arrange for coal purchase with upfront payments. The coal market in the DPRK is a competitive structure. All that is required is getting the funds to make the purchase, buying the coal, and storing it. For this reason, many companies organized for foreign currency earning get into the coal mining sector. Companies for foreign currency earning also promote production, private retail businesses, and private businesses’ production activities. This has led to an increase in transactions in foreign currency. Ordinary people like labourers, the general public, as well as the trading businessman have easy access to foreign currency, which has contributed to the trend toward “dollarization” (meaning, for example, trades in US dollars, Euros, or RMB). The impacts of this trend on local economies in the DPRK have been significant, as follows:

A first impact has been the emergence of the coal export middleman (broker) and coal storage yard. As exports to China have increased, a new job called coal middleman has emerged in response to the high demand for coal exports. Coal middlemen buy coal directly from the producers and transport it to domestic export ports such as Nampo Port or Songrim Port. This is the beginning of a niche market that draws attention to the fact that there is a considerable difference in prices between the producer and the port. In order to make a profit this way, middlemen need sufficient funds at hand to purchase coal, transport it, and store it until a buyer can be found. In other words, the coal middleman is a kind of “money master.” What is noteworthy here is the capitalist market behaviour of the coal middleman. Coal middlemen buys the coal at the producer and transports it. They do not, however, sell it straight away. Rather, they buy the coal when the price goes down and sell it when the price goes up. In the meantime, they need a place to store the coal. The coal storage yard was introduced to accommodate the market demand. It is a kind of warehouse.

The second impact has been in response to the exporters facing difficulties in finding transportation for coal, and the high price of shipping was a problem as well. Thus, companies for foreign currency earning joined the transportation business. According to an interview with a former DPRK businessman who was involved with such a business, if the price of exporting coal to China is $100 per ton, the price at the producer would be $35 and the price at Nampo Port or Songrim Port would be $70. One of the reasons why such a large price difference exists is because of the costs involved in transportation due to a scarcity of means of transport and the poor conditions of the roads in the DPRK. All of these factors contributed to the high cost of transportation (Jung, 2014, private source, 2018). As a result, there emerged companies for foreign currency earning that took advantage of the situation by going into the transportation business. Vehicles carrying coal from Suncheon to Nampo Port are mostly Chinese-made trucks that are imported from China for $40,000 per vehicle. The cost for an anthracite exporter to hire a truck to transport coal from the producer to the port is about $300-$400 per truck per delivery. Only 15–20 tons of coal can be loaded per truck due to poor road conditions (Jung, 2014). If the cost of hiring a truck is $300, the transportation cost of anthracite per ton is $15 per ton, or $20 per ton if the hiring cost is $400. This is far more than the production cost, since the production cost per ton of coal is less than $15. This means that the anthracite exporters will need 500 truck-trips carrying 20 tons each to transport 10,000 tons of anthracite to the port for export. The total transportation cost would be (10,000 ton ÷ 20 ton) x $400 = $200,000. On the other hand, a truck owner can earn enough money to buy a truck with just a few coal deliveries. If the truck delivers 100 loads, with each load being 20 tons, it would mean that the truck owner could make $400 x 100 =$40,000 (Jung, 2017, private source, 2018), the cost of the truck.

A third impact has had to do with the price competition between domestic and export coal, and the promotion of individual business activities. Companies for foreign currency earning would be forced to sell coal to the North Korean domestic market at a low price, if coal exports to China were blocked (for example, by sanctions), in order to maintain production bases in the DPRK. If employers are unable to provide employees with food and wages, there would be a risk of bankruptcy for the private mine owner. Therefore, although the prices might be half of the normal price, mines and the companies that run them are forced to sell coal to the domestic market in order to maintain their production bases (Joung 2016, private source, 2018). When establishing their base in the early stages, the company for foreign currency earning selects specialist personnel who will be able to pioneer domestic sales channels. These personnel should be especially market-oriented. Their role is to sell coal to the domestic market. The revenue from domestic sales is then used to fund the maintenance of the production base and pay the workers’ wages and food costs. If for some reason the export of coal to China is not possible, their role becomes even more important. For example, defector Mr. K who worked at the coal production base of the company for foreign currency earning the was operating under the People’s Armed Forces Department 4, used to be in charge of pioneering a domestic market. If exports to China were stalled, he had to move faster (Joung, 2016). He normally sold coal to the domestic market three times per month using an average 20–30-ton-capacity truck (Joung, 2016). However, when the export to China was blocked, he had to take the coal to other areas in order to keep the production base running. Domestic coal price is usually sold locally half the price of the coal exported to China. However, if the coal is sold in DPRK areas not near its origin, it has been sold at price 2–3 times higher than usual (Jung, 2016, private source, 2018).

2.5 Rare mineral mines and production

North Korea exports large quantities of rare earth minerals to China … value around 1.9 billion won

North Korea has exported large quantities of rare earth mineral ores, a source of elements (examples are yttrium and neodymium) important for but used in small quantities in the production of high-tech products, to China in recent years. According to trade statistics published by the Korea International Trade Association (KITA) in 2014, North Korea exported about $550,000 of rare mineral ore to China in May of 2016, followed by exports of $1,329,000 in June (Yeonhap, 2016). North Korea exported its first rare earth mineral ore (worth $24,700) to China in January of 2015 and after 15 months of no recorded trades, the company resumed to exporting about US$1.879 worth of rare minerals over the following two months.

Apart from rare earth mineral ores, North Korea has been exporting rare earth-containing carbonate mineral compounds to China since 2011.Up until the However first half of 2016, however, the export volume was small, remaining at around $170,000 for three years and six months up until the first half of 2016 (Yeonhap, 2016).

North Korea’s Rare Earth Minerals Development in Cooperation with International Private Equity Funds: Establishment of a Joint Venture Company

It has been reported (VOA, December 9th, 2013) that North Korea has established a joint venture with international private equity funds in order to develop rare earth mineral resources in the DPRK. The International private equity fund SRE Minerals announced that it has signed a joint venture agreement with North Korea ‘s Chosun Natural Resources Trading Company to develop rare minerals in Jung-ju, North Pyongan Province (VOA, 2013). According to a press release made available on April 4 of 2013, Pacific Century, a joint venture located in the British Virgin Islands, has been granted the rights to develop all rare minerals in Jungju over the next 25 years. It was also given the right to extend the contract for 25 years (VOA, 2013).

SRE Minerals has announced that it has been able to build a rare minerals processing plant in Jungju in accordance with the agreement and has already conducted preliminary surveys in Jungju and planned to conduct further exploration work in March of 2014. SRE Minerals said that it was possible that Jung-ju, North Korea, is the largest rare mineral reserve in the world. The company website estimated that the value of Jungju rare minerals will reach about $ 65 trillion (source: Voice of America, Dec. 9, 2013). Another source places SRE’s estimate of rare earth ores at 6 billion tons, with 262 million tonnes of rare earth oxides (Creamer Media’s Engineering News, 2013). Other articles published since, however, have suggested that SRE and related companies have “opaque” ownership structures (see, for example, J.R. Mailey, 2016), and may be making dubious claims.

Foreign investment companies that invested in North Korea’s mines

A total of 38 investment contracts were signed by foreign companies to enter the North Korean mineral resources development business. Of these 38, 33 (87%) of them are in China. This pattern raises a concern that China is monopolizing business with North Korean mines. According to the Korea Mineral Resources Corporation’s “Contract status of mineral resource investment contract between foreign investment and North Korea,” the mines that China is currently investing in that are producing are six, including Hye-san Youth mine, 3.5 Youth Mine, Moo-San mine, and Oh-Ryong mine (Source: Economy Business Newspaper (Korea), Oc. 7. 2018).

3 Transportation Infrastructure for the Mining and Minerals Sector

Infrastructure in mine areas can be classified into 3 categories: 1) transportation facilities including trucks, roads and railways, 2) power facilities for mining and related industrial operations, and 3) metal refining industries including refineries and iron manufacturers. Each of these is discussed below.

3.1 Railway systems

Most mines are linked with freight railways. The railways are single lines in most areas in the DPRK, although, double track railways have been built over the 97 km between Moo-San (iron mine area) and the Choing-Jin refining facilities (private source, 2018). Open freight cars have been used for carrying iron ore and other ore materials. The DPRK’s railway system is experiencing deterioration in its technology and operational system. For instance, most locomotives are electric-powered, and thus rely on consistent supplies of electricity. Most mining operations cease when sufficient supplies of electricity, typically generated by thermal power plants, are unavailable (private source, 2018).

Regarding the condition of railroads, the tracks are so old (built in the 1940s and partially replaced in the 1970s) that fatal accidents have occurred annually (private source, 2018). The system and operating conditions should be improved or replaced within 3 years if transporting of products from mines is to be sustained (private source, 2018). As a result of the generally poor condition of the road system, freight trains have become the major means of transportation for iron ore and coal. Most open cars of freight trains are 60-ton capacity for heavyweight cargoes, but some 30 tons cars are also used as coal carriers (private source, 2018).

3.2 Road Transport Systems

The status of the DPRK’s road system is becoming a critical factor due to the major role of road transport in mineral products logistics as a result of the problems with the operation of the railway system since 2010 (private source, 2018). According to a private source, approximately 65% of exported products, including mineral products — even coal — are carried out to ports using trucks (private source, 2018).

Regarding facilities for truck transport of mine products, the North Korean roads system identifies roads linking provinces as 1st class roads. Second class roads link counties within a province, and 3rd class roads link towns within the county (private source, 2018). Most roads covered in this paper fall into the 2nd or 3rd road classes. Ore products are sent typically via railway facilities, as previously noted, but some products are not sent via freight trains due to safety concerns. Gold and other rare metal ores are carried using heavy trucks, made in the DPRK or imported from Russia, Sweden, and more rarely China (private source, 2018). Thus 2nd and 3rd class roads should be considered as important elements of the infrastructure serving mines. In fact, although 1st class roads have been paved with asphalt since the 1990s, 2nd class roads were not paved with asphalt due to a shortage of asphalt, which must typically be imported from China or Russia. Most 3rd class roads are also not paved with asphalt, so the operation of trucks on those roads entails higher costs for repair, tires and fuel. For instance, trucks operating on unpaved roads have more than 20% higher maintenance, fuel, and tires expenses according to a DPRK research centre (private source, 2018).

3.3 Major Ports and Related Facilities

Key to the export of minerals and mineral products from the DPRK are the port facilities available to handle these materials. Brief summaries of the specifications of the major North Korean ports used to handle minerals and mining products are provided below.

- Nam-Po Port

Located in Nam-Po City, this port is the largest port and the most important facility for infrastructure in the DPRK. According to private source 2018, 78% of trade cargo and containers are coming to DPRK through this port. The port plays the role of exporting mineral ores and coal produced from the Pyong-an coalfields, as well as metallic materials refined in the Nam-Po refinery, to China and South Korea (private source, 2018).

- Na-Jin Port:

Na-Jin port is located in the Na-Jin Sun-bong (also known as Rajin-Sonbong) Free Trade area. The port is specialized in importing and exporting bulk oil and mineral ores. Approximately 100,000 ton capacity cargo ships can be handled at this port. The port was modernized in 2013 with support from Chinese and Russian enterprises. (Private source, 2018).

- Chong-Jin Eastern & Western Port:

The Chong-Jin Port is one of the 3 major ports in the DPRK and is located in Chon-Jin, Shin-am district and Po-hang district. The port is important for iron ore and iron-related products exports. Approximately three 100,000 ton cargo ships can be handled by this port at the same time. The port was modernized in 1984 underwent a second modernisation in 2001 (private source, 2018).

- Heong-Nam Port