Kae Takase

June 23 2017

I. INTRODUCTION

In this essay, after tracing the evolution of Japan’s energy policy and economy in the years after Fukushima, Kae Takase concludes: “The Japanese electricity sector will undergo dramatic and disruptive changes in the coming years. The future of nuclear reactor restarts, retail market deregulation, unbundling of transmission and distribution from generation, and of the renewable electricity business all remain unclear as of this writing, with significant additional debate at the national and local levels likely before any of these issues are fully settled.”

Kae Takase is Director of Governance Design Laboratory in Japan.

This Special Report was prepared for the Project on Reducing Risk of Nuclear Terrorism and Spent Fuel Vulnerability In East Asia. It was presented at a Nautilus Institute Workshop at International House, Tokyo, September 14-15, 2015, funded by The Macarthur Foundation.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

Banner Image Credit: Thanks for image to Tsuyoshi Yoshioka and Iidate Electric Co established in Iidate village. See Iidate Electric

II. SPECIAL REPORT BY KAE TAKASE

JAPANESE ENERGY POLICIES AFTER FUKUSHIMA

June 23 2017

1 Japanese Energy Situation

1.1 Energy and Economy Overview

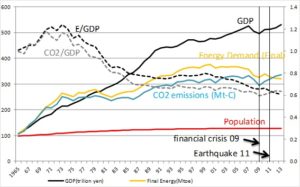

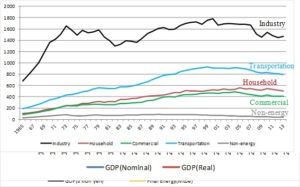

Although gross domestic product (GDP) in Japan grew by a factor of 5 during the period from 1965 through 2013, energy demand and carbon dioxide (CO2) emissions increased by only a factor of 2 to 2.5 during the same period. This decoupling of growth in energy use, CO2 emissions and GDP was realized due in large part to efforts in Japan to improve energy efficiency and to implement nuclear power during the period after the oil crisis of 1973.

Starting in 2008 and continuing into 2009, the global financial crisis that began in the United States had a major influence on the Japanese economy as well. As a result of the financial crisis, Japanese industrial sector production and energy use declined dramatically by one measure, by nearly 40 percent between mid-2008 and February 2009—before recovering to about 15 percent below mid-2008 levels by early 2011.[1] Then, in March 2011, the Great East Japan Earthquake, followed by the Fukushima Daiichi nuclear power accident, shocked Japan. In the wake of the earthquake and Fukushima accident, almost all of Japan’s nuclear reactors were shut down, prompting warnings of impending electricity blackouts. The Japanese household sector reacted to these warnings by markedly decreasing its energy demand, and especially its electricity demand. This household reduction in energy use, together with several months of lower industrial production in Japan following the earthquake, helped to avert the expected massive power outages. National CO2 emissions in Japan, however, increased following the earthquake and Fukushima accident, due to the fact that all nuclear power plants in Japan were either shut down for safety reasons immediately after the earthquake, or were shut down within a period of a few weeks for routine periodic inspection and additional safety inspections, and very few of the plants were restarted. As a result, fossil fuel-fired power was ramped up to replace the power from the off-line nuclear plants, and to fuel electricity demand, resulting in an increase in power sector CO2 emissions.

More recently, in order to shore up Japan’s government finances, the national consumption tax was raised from 5% to 8% in April, 2014. This tax increase caused a drop in domestic consumption from which the Japanese economy has yet to recover. Although none of Japan’s nuclear power plants produced power for the grid during 2014, one unit, namely Sendai #1 in the Kyushu area, was restarted in August of 2015, and Sendai #2 was restarted in October of 2015. There remains a major uncertainty as to how many units in Japan’s nuclear power fleet will succeed in being allowed to restart, whether Japanese economy will “recover” again, and how those factors will influence the future of the historical trends in Japanese GDP, CO2 emissions, and energy use shown in Figure 1, below.

Source: EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 1: Trends in Population, GDP, Energy Demand, and CO2 Emissions in Japan (1965-2013)

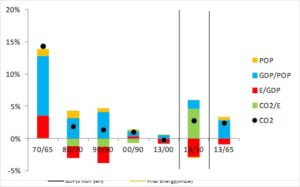

Using the “Kaya Identity”[2] to separate the factors that influence increases and decreases in CO2 emissions, it can be clearly shown (Figure 2) that the ratio E/GDP (energy use per unit of GDP) decreased during the period of 2010-2013, but that an increase in CO2/E (CO2 emissions per unit of energy use), driven by the replacement of nuclear generation with fossil-fueled generation, was large enough to cause an overall increase in CO2 emissions. Figure 2 also shows that the falling trend in E/GDP that started after the 1973 oil crisis halted during the 1990s, before continuing a more gradual decline after 2000. Notable in Figure 2 are the dramatic changes in overall final energy demand following the 2011 earthquake in Japan, and the increase in CO2 emissions that started during the recovery from the financial crisis has continued in the post-Fukushima era, even as energy demand has fallen.

Source: EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 2: Factor Analysis of CO2 Emissions in Japan (Kaya Identity with logarithm definition) (1965-2013)

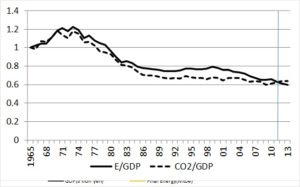

Figure 3 focuses on trends in the E/GDP and CO2/GDP ratios from 1965 through 2013. These parameters show very typical decreasing curves after the first oil crisis in 1973. CO2/GDP decreased slightly more than E/GDP until the earthquake (denoted by the vertical blue line in Figure 3) resulted in the halting of most (and by 2014, all) nuclear power generation in Japan, but the CO2/GDP ratio did not increase markedly even after the earthquake. The future of these trend lines depend substantially on future trends in energy efficiency improvement and low-carbon energy deployment in Japan.

Source: EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 3: E/GDP and CO2/GDP, Indexed to 1965=1(1965-2013)

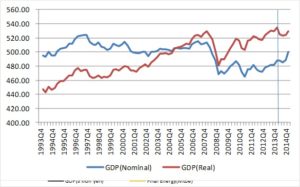

Nominal and real term quarterly GDP in Japan is shown in Figure 4, below. It is clear how the financial crisis in late 2008 greatly shocked the Japanese economy, but the recent rise in the consumption tax from 5% to 8% in April, 2014 (denoted by the blue line in Figure 4) also has had a substantial effect on the economy over the past year (to late-2015). Nominal GDP grows after the tax was raised, but GDP decreased in real terms, meaning that prices have been increasing, consistent with the government’s policy of “Abenomics” (Prime Minister Abe’s Economic policy) to increase prices (increase the rate of inflation), while lowering value of the yen relative to other major currencies in international currency markets.

Source: Economic and Social Research Institute, Cabinet Office, “Preliminary Quarterly Estimates of National Expenditure”

Figure 4: Quarterly GDP in Japan in Nominal and Real Terms (1993 Q4-2014 Q4)

1.2 Demand and Supply

Energy demand has been on a decreasing trend, as shown previously in this paper. This decreasing trend is most obvious in the household and transportation sectors, as shown in Figure 5.

Source: EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 5: Final Energy Demand by sector, 1965- 2013 (1010kcal)

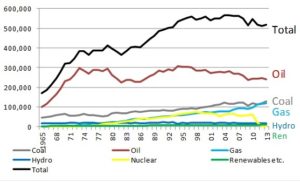

Primary energy supply in total also decreased following the Fukushima accident in 2011. Considering Japan’s energy supply by energy source over time (Figure 6), a sharp drop in the use of nuclear energy, and a corresponding overall increase in the use of gas and coal is evident in 2011 and thereafter. Due to the relatively high prices of transportation petroleum fuels in Japan and decreasing energy use trends in the transportation sector as Japan’s population declines, oil demand has not increased in recent years as demand for natural gas (imported to Japan as liquefied natural gas, or LNG) has.

Source: EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 6: Final Energy Demand by Energy Source, 1965- 2013 (1010kcal)

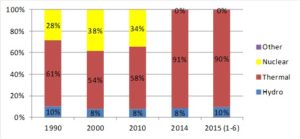

The shares of Japan’s electricity supply by source changed dramatically between 2010 and 2014, mainly because of the results of the Fukushima accident followed by gradual decrease of nuclear power as reactors were taken off line for safety reviews. As shown in Figure 7, generation by nuclear power has been mostly replaced by thermal power generation from fossil fuels (gas, coal, and oil), with some additional replacement through the growth in electricity generation powered by renewable energy, particularly solar. In addition, in the wake of the Fukushima accident, some electricity generation was effectively displaced by strong efforts to increase energy efficiency and conserve electricity on the part of Japanese households and businesses.

Source: METI, “Monthly Statistics of Electricity Supply and Demand”

Figure 7: Electricity Supply by Sources (% of kWh generated, 10 major utilities)

2 Recent Energy Policy Situation in Japan

Following the Fukushima accident, Japan’s previous Strategic Energy Plan, which was approved by the cabinet in 2010, and which put emphasis on additional deployment of nuclear power, had to be revised to reflect the changing national attitudes about nuclear energy. Strong public opinion in favor of renewable energy led the government to set feed-in tariffs (FITs) for all sources of renewable energy during 2012. As a result of the high FITs offered, a big boom in orders for and deployment of “mega-solar”— solar photovoltaic power systems of over 1MW — has occurred.

Prime Minister Abe, who took office in late 2012, has put forward two major energy policies. The first is to deregulate the electricity market in Japan, and the second is to restart most of the nuclear power plants that have been largely offline since the Fukushima accident. The resulting “New Strategic Energy Plan” was published in April, 2014, and a new ”Long-term Energy Outlook” was published in June, 2015. In the New Strategic Energy Plan, a stronger policy emphasis on renewable energy than on nuclear was declared, but in fact the ratios of renewable and nuclear electricity generation projected in the long term energy outlook for the year 2030 are very similar: 22-24% and 20-22%, respectively.

Japan is also under pressure from the international community to show a commitment to serious reductions in future greenhouse gas (GHG) emissions. In 2014, Global Warming Prevention Headquarters in the Japanese government declared that Japan would reduce its GHG emissions by 26% as of 2030 compared with 2013 emissions levels. Some critics of government policies charge that using 2013 as the base year for emissions reduction served the government’s interests by making the percentage reduction in emissions appear higher than if another base year, such as a pre-Fukushima year, were used, The higher apparent fraction of reductions—relative to a fractional reduction computed with the same absolute decrease in emissions and a different base year, occurs because carbon dioxide (CO2) emissions increased after 2011 due to progressively less (and, subsequently in 2014, no) nuclear power generation in the years after the Fukushima accident.

With the success of the FIT program, a problem of too much solar power in the Kyushu and Hokkaido areas appeared in 2014. METI (the Ministry of Economy, Trade, and Industry), has asked utilities to calculate the maximum solar photovoltaic (PV) and wind capacity that the utilities can connect to the power grid. In compiling these renewable capacity limits, however, the utilities assumed the full restarting of the existing newer nuclear power units. As a result, the maximum connectable capacities of wind and PV shown by the utilities’ analysis were significantly smaller than they could be under the current, post-Fukushima situation in which much more fossil fuel power is in the generation mix. More wind and PV power can be deployed in a utility grid using more fossil-fueled (and in particular, gas-fired) generation because these units can be “ramped up” and down (generation increased or decreased) rapidly to adjust for the intermittent availability of wind and solar generation and changing loads. The electricity output of a nuclear reactor cannot typically be rapidly ramped up and down to follow loads and adjust for the availability of intermittent resources.

In January, 2015 the FIT was amended to eliminate the limitation of the curtailment of renewable electricity without compensation for utilities receiving more renewable generation than the capacity calculated to be required. That is, utilities were allowed to reject, and to avoid paying for, inputs of renewable electricity covered by the FIT in periods where the total renewable electricity supplies plus other supplies—including baseload power from nuclear plants if they are restarted—exceeds the demand for electricity.

The following provides a listing of the major changes in energy policy in Japan over the last several years.

- A New “National target to reduce GHG emissions” was announced.

- The target calls for a 26% reduction in annual emissions by 2030 compared to 2013 levels.

- A new Strategic Energy Plan (April, 2014) and a new Long term Energy Outlook (June, 2015) were published.

- Some of the nuclear plants shut down for safety reviews and retrofits are being restarted.

- The Sendai #1 and #2 nuclear power units were restarted in 2015.

- 24 plants already have applied for safety examinations that are a condition for approval to restart operation; 4 plants have already passed.

- Accelerating plans that have been on the books for some time, but have been implemented only slowly and with periods of reevaluation over the past two decades, the electricity market is to be deregulated.

- The retail market to be fully open by April, 2016.

- The legal “unbundling” (separation) of the transmission & distribution sector from electricity generation is to be completed in 2020.

- Renewable electricity feed-in policies have been modified.

- In September, 2014, utilities in Kyushu, Hokkaido, Tohoku, and Shikoku suspended the acceptance of applications to connect additional renewable power generation to their grids.

- In January, 2015, the FIT was modified to allow unlimited curtailment of renewable generation by utilities without obligations on the part of the utilities to pay for the renewable power not accepted.

2.1 New Strategic Energy Plan (2014) and Long-Term Energy Outlook (2015)

In April, 2014, the New Strategic Energy Plan was approved by the Cabinet. This was the first official energy plan with cabinet approval since the Fukushima accident. In the two years following the Fukushima accident Japan’s government at the time (controlled by DPJ, the Democratic Party of Japan) hosted a major public debate about the nation’s future energy policy. This debate resulted in the preparation of a report by a stakeholder group assembled by DPJ, a report that included several potential scenarios of future energy policy, some with and some without nuclear power. Because of the unstable political situation in those years, however, the report prepared under the DPJ administration was never approved by the Cabinet. The Long term Energy Outlook was prepared and published in June, 2015 to provide the quantitative background for the declaration of Japan’s GHG reduction target in international climate change negotiations. Japan has announced a goal of reducing 2030 GHG emissions by 26% relative to 2013 levels.

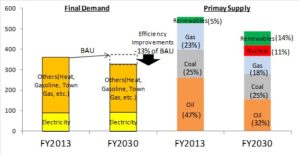

Figure 8 shows the projection of final energy demand and primary energy supplies in 2030 relative to 2013 as described in the government’s 2015 Outlook report. Final energy demand is assumed to increase, but factoring in ongoing energy efficiency improvement, it is estimated that 13% of the total energy demand will be offset. Primary supply has been calculated using final demand estimated net of energy efficiency improvement. The shares of oil and gas in total energy supplies (including electricity and other end-use fuels) will decrease compared to 2013, but the nuclear and renewables shares are expected to increase under current policies.[3]

Source: METI, “Long term energy outlook” (July, 2015). EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 8: Government Long Term Energy Outlook (July, 2015) (Unit: 104 tons of crude oil equivalent)

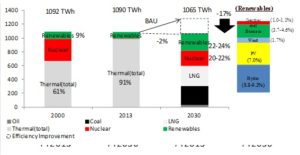

Figure 9 shows historical and projected electricity generation by source. Data for the year 2000 are added to show the comparison of generation in 2013 and 2030 with the “before Fukushima” structure of electricity supply. Since a high level of energy efficiency improvements are assumed from 2013 through 2030, overall net electricity demand will decrease. Renewable electricity will account for 22-24% of total generation by 2030, and nuclear power is expected to provide 20-22% of BAU (business-as-usual) electricity demand. Also evident in Figure 9 is the expectation of a large share of biomass-fired generation among renewable electricity sources. It is assumed that the relatively large fraction of biomass power—the output of which can be adjusted to respond to changes in electricity demand more or less to the same extent as fossil fuel-fired power—was included by METI in the Outlook in response to criticism by utilities of about the difficulties of incorporating too much PV in the Kyushu and Hokkaido areas. The inclusion of large shares of biomass generation allows the incorporation of significant shares of renewable energy in the 2030 outlook, while reducing the rate of growth of wind and solar PV generation relative to recent trends.

Source: METI, “Long term energy outlook” (July, 2015). EDMC/IEEJ, EDMC Handbook of Energy & Economic Statistics in Japan 2015

Figure 9: Historical and Projected Electricity Generation by Source in Japan (Units, terawatt-hours–TWh)

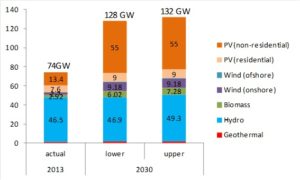

Figure 10 shows the capacity of renewable and nuclear electricity generation as included in METI’s Outlook in 2030, relative to 2013 conditions. There were 74 gigawatts (GW) of renewable capacity in Japan in 2013, 60% of which was hydroelectric power—mostly larger plants built many years ago. By 2030, non-residential PV is assumed to grow to provide 40% of renewable capacity, and biomass power is assumed to more than double its current capacity by 2030.

Nuclear power generation in METI’s Outlook implies a projected capacity of around 36 GW in 2030, if a 70% capacity factor (consistent with recent pre-Fukushima experience) is assumed. This means approximately 28 nuclear units (assuming an average 1.3 GW unit size) will be operating at that time.

Source: METI, “Long term energy outlook” (July, 2015).

Figure 10: Renewable Capacity in the Outlook (GW)

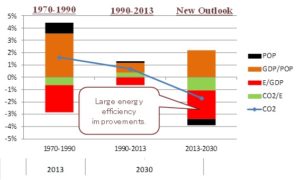

Using the Kaya equation, factor analysis of the growth in CO2 emissions in Japan based on underlying energy, economic, and technical drivers was done for the historical periods 1970-1990 and1990-2013, as well as for 2013-2030 using results from METI’s 2015 Outlook. Notable among factor results derived from the New Outlook is the decrease of E/GDP (energy use per unit of gross domestic product) from 2013 through 2030, which implies energy intensity improvements will be very large for the future period, at almost same level as was experienced during the 1970-1990 period that included two oil crises, and significantly greater than the average level of energy intensity improvements experienced during 1990 through 2013.

Figure 11: Factor Analysis of Historical and Future CO2 emissions (Annual change %)

METI’s Long-term Energy Outlook has been developed to balance public opinion with government policies to utilize existing nuclear power. The Outlook assumes large energy efficiency improvements, but whether the economy will grow over 2013 through 2030 at the pace METI assumed in preparing the Outlook (1.7%/year, average) is questionable, and more debate is needed to help to identify means of fostering a sustainable economy, and what implications meeting sustainability goals will have on Japan’s economic structure.

2.2 Nuclear Plant Restart Policies

In August, 2015, the Sendai nuclear power plant unit #1 started generation after a long period during which there was no nuclear power generation in Japan. As of this writing (late 2015) both Sendai #1 and 2 have restarted generation (the latter in October 2015), and 3 more plants have passed their safety examinations. There are 20 more plants that are under examination, and 21 additional plants that have not yet applied for the safety examination. Including the 6 plants of Fukushima Daiichi, there are a total of 11 plants nuclear power units in Japan that are slated to be decommissioned. Table 1 summarizes the status of the Japan’s reactor fleet as of late 2015.

Japan’s national government and the electric utility companies have strong political and financial incentive to restart as many nuclear power plants as possible. Doing so is effective in reducing CO2 emissions with at what is arguably a smaller cost, relative to other means to reduce net GHG emissions, and also reduced fossil fuel costs for the utility companies.

Table 1: Number of Nuclear Plants Versus Status of Safety Examinations

| Status | # of Plants | Plants Included | |

| Already Restarted | 2 | Sendai #1, Sendai #2 | |

| Passed | 3 | Ikata #3, Takahama#3,#4 | |

| Examinations Ongoing | Final Phase | 4 | |

| Mid Phase | 6 | ||

| Early Phase | 10 | ||

| Not Yet Applied | 21 | ||

| To Be Decommissioned | 11 | Fukushima-1 #1-6, Mihama #1,2, Genkai#1, Tsuruga#1, Shimane#1 | |

| Total | 57 | ||

2.3 Deregulation of Electricity Markets

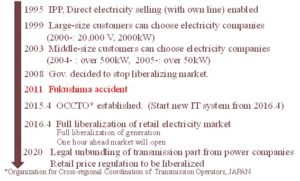

The Electricity Market Reform Plan was approved by the Cabinet in 2013. The Plan has three major steps with a timeline for completion of each. First, establishment of an Organization for Cross-regional Coordination of Transmission Operators, Japan (OCCTO) is planned to enable nation-wide grid operation, and interconnection between the 9 electricity grid regions (each currently associated with a single electric utility company) operating in mainland Japan. OCCTO was scheduled to start in April, 2015. Second, full deregulation of retail markets for electricity was planned. The law to enable full retail deregulation passed in June, 2014, and called for the opening of retail markets in April, 2016. Under this law, small consumers as well as large electricity users can also choose their electric companies. Finally, legal “unbundling” of the transmission part of the electricity grid was planned to start in 2020, based on a transmission unbundling law passed in June, 2015. As shown in Figure 12, the recently passed electricity deregulation laws follow on from earlier deregulation efforts started in the 1990s, but largely abandoned before the Fukushima accident.

Figure 12: History of and Current Plans for Deregulation of Electricity Markets in Japan

2.4 Renewable Energy Policy

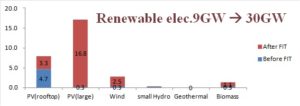

After the FIT was implemented for all renewable electricity sources in July, 2012, many large companies and local builders entered the “mega-solar” business. By the end of May, 2015, renewable generation capacity had tripled, and PV capacity rose to five times its level before the FIT was implemented. By the end of May, 2015, the total capacity of renewable power generation in Japan—not including large conventional hydroelectric plants—had risen to 30 GW out of Japan’s total generation capacity of Japan of around 280 GW. Figure 13 compares renewable electricity generation capacity before and after the implementation of renewable feed-in tariffs.

Source: METI

Figure 13: Renewable Generation Capacity in Japan as of the End of May, 2015 (GW)

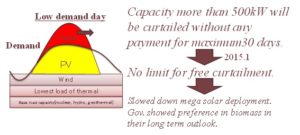

In September, 2014, Kyushu Electric Company started suspending receiving applications for additional renewable power to be connected to its grid, justifying its decision by noting that the capacity of renewable power installations that had been applied for in the Kyushu service territory exceeded the power demand during low-demand daytime periods. Since the mega-solar business has been very active in the Kyushu area, companies who had already borrowed money from the banks in anticipation of selling power to Kyushu Electric at FIT rates faced financial trouble, and Kyushu’s refusal to continue receiving applications thus became a major issue.

Four electric companies, Kyushu, Hokkaido, Tohoku, and Shikoku, suspended accepting applications to connect renewable power to their grids in September, 2014, and METI assembled a committee to discuss the problem. As input to the committee’s deliberations, electric companies were asked to calculate the amount of renewable power they could connect to their systems, but the operating assumption in making these calculations was to include maximum amount of nuclear power restarts. Although it remains unclear, perhaps unlikely, that the maximum nuclear restarts will come to fruition, the limit for renewable electricity connection was set by the committee on that basis, and as a result renewable electricity projects applying for connection above the amounts that the utilities calculated could be rejected, unless they accept the utility’s right to uncompensated unlimited curtailment when renewable generation exceeds the demand for power, with consideration of short-term demand fluctuations. Figure 14 illustrates conditions under which surplus generation can be curtailed by the utilities.

Figure 14: Diagram of Capacity Curtailment on Low Demand Days as a Result of Amendment of the FIT in January, 2015

3 Conclusion

In the wake of the March, 2011 Fukushima accident, energy sector stakeholders in Japan have engaged in a major debate about the future of Japan’s energy system and energy policy. Even Japanese citizens with no previous experience in energy matters joined the debate, and anti-nuclear sentiment has grown in Japan, even among major politicians and economic leaders.

After DPJ lost control of the Diet and its administration ended in December, 2012 following criticism of the DPJ’s economic policy and foreign policy toward China, as well as the DPJ’s handling of problem associated with the United States Army bases in Okinawa, the Abe administration that took its place promised electricity market reforms and the restarting of nuclear power plants taken offline during post-Fukushima safety inspections and retrofits.

The feed-in tariff policy for renewable power has been sustained by the Abe administration, but due to the strong will to restart nuclear power plants, limits on renewable power connections have started to be implemented by electric utilities, even though only 2 nuclear power plants had been restarted as of late 2015.

For management of the national mainland electricity transmission grid, OCCTO has been established, and is scheduled to start its operation to control and use interconnection lines between the 9 electric companies in April, 2016. At the same time, a retail market for electricity will be opened, and many companies—not just current electricity and gas utility companies, but also telecoms and electric appliance retail companies—have shown an interest in entering the new deregulated electricity retail market. There are also movements to sell “green” electricity to consumers.

The Japanese electricity sector will undergo dramatic and disruptive changes in the coming years. The future of nuclear reactor restarts, retail market deregulation, unbundling of transmission and distribution from generation, and of the renewable electricity business all remain unclear as of this writing, with significant additional debate at the national and local levels likely before any of these issues are fully settled.

III. ENDNOTES

[1] See, for example, Japan Macro Advisors (2015), “Industrial Production Japan”, available as http://www.japanmacroadvisors.com/page/category/economic-indicators/gdp-and-business-activity/industrial-production/.

[2] Yoichi Kaya (1988),”An Integrated system for CO2/energy/GNP analysis”, MIT/UT Workshop in Washington D.C..

[3] Post-Fukushima, the amount of nuclear generation in 2013 was about 9 TWh, just a few percent of the 269 TWh of nuclear generation in 2010.

IV. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent.

I don’t believe word he says, Japan should set no#1 priority to take care of Fuk ushima radiation poisoning the whole world, your government is hiding the fact that Fuk ushima Daiichi reactors being out of your control.

GE warned Daiichi 20 years ago that FUK Ushima reactors must be repair due to deterioration over age.

FUK Ushima said OH NO,,, GE quoted maintenance price tag was too expensive and Japan has a resource and knowledge to take care of reactor replacement of our selves. LOOK what you have done whilst try to save nickel and dime. All these FUK Ushima not go head seated on their ass until little jolts happened to reactors. I don’t want to insult Japan but you guys with gene deficient tribe with non intellectual but full blown greedy. Like I said you need to admit the messes you made and ask international help and set this mess as NO#1 priority of Japan.