DAVID VON HIPPEL AND PETER HAYES

JANUARY 3, 2018

I. INTRODUCTION

In this essay, David von Hippel and Peter Hayes conclude that: “A package of such engagement measures, starting small and building as agreements on nuclear weapons security issues are made and implemented, should be a key component of negotiations toward settlement of the DPRK nuclear weapons stalemate, creation of a nuclear weapons-free zone in Northeast Asia, and related issues.”

This report may be downloaded as a PDF file (1.5MB) here. It is published in abbreviated form as an Asia Pacific Leadership Network Policy Brief here.

This report was prepared with funding from Open Society Foundation and Ploughshares Fund for the 2017 Institute for Foreign Affairs and National Security (IFANS) Conference on Global Affair, “Nuclear-Free Korean Peninsula: Strategies and Action Programs for the Moon Jae-In Administration”, Korea National Diplomatic Academy (KNDA), Seoul, Republic of Korea, December 11 and 12, 2017. Hosted by IFANS and KNDA, co-organized by IFANS, Nautilus Institute, and the Open Society Institute, and sponsored by the Republic of Korea Ministry of Foreign Affairs and the Asia Pacific Leadership Network.

David von Hippel is Nautilus Institute Senior Associate. Peter Hayes is Director of the Nautilus Institute and Honorary Professor at the Centre for International Security Studies at the University of Sydney.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

Banner image: Painting of Kim Il Sung and Kim Jong Il at the dedication of the West Sea Barrage and associated tidal energy facility (Nautilus Institute photo)

II. NAPSNET SPECIAL REPORT BY DAVID VON HIPPEL AND PETER HAYES

ENERGY INSECURITY IN THE DPRK: LINKAGES TO REGIONAL ENERGY SECURITY AND THE NUCLEAR WEAPONS ISSUE

JANUARY 3, 2018

Energy demand and supply in general—and, arguably, demand for and supply shortages of electricity in particular—have played a key role in many attempts to achieve a negotiated settlement of the nuclear issue with the Democratic Peoples’ Republic of Korea (DPRK). Should the parties to the Korean conflict, in particular the United States and the DPRK, return to negotiations on nuclear and other urgent issues that divide them, it is certain that DPRK energy insecurity will be one of the most important concerns on the table. The DPRK’s energy insecurity is both a key driver that contributes to and a key element of a negotiated settlement of the DPRK nuclear weapons crisis.

Symptoms of the current energy insecurity of the DPRK include:

- Per capita energy use as of 1990, before the impacts of the collapse of the Soviet Union on the DPRK economy had been felt—was about 70 gigajoules (GJ). By 2010, by our estimates, per capita energy use had fallen to about 26 GJ, indicating a severe restriction in the energy services—such as heated homes, lighting, kilometers traveled, and industrial products manufactured—available to the DPRK populace.

- Biomass (including wood) energy use has risen to fill the gap in commercial energy (electricity, oil, and coal), albeit only partially and at low efficiency. Heavy biomass use has led to deforestation and soil degradation.

- Coal, of which the DPRK holds billions of tonnes (hereafter, tonnes are always metric) of reserves, remains the dominant form of energy use in the DPRK, but is often used inefficiently.

- Although the DPRK grid nominally has a capacity of 8,000 to 10,000 MW (megawatts), the total generation capacity is limited by the poor state of repair of generation, transmission, and distribution equipment, as well as by seasonal water flows for hydroelectricity production. Total available generation is therefore in on the order of 2000 to 3000 MW, and annual electricity actually consumed by 2014 in the nation of 24 million people was comparable only to that used in Washington DC, and generation in the Republic of Korea (ROK) was a factor of 35 greater than in the DPRK.

- As of 2010, the fraction of total available oil products used by the DPRK military was an estimated 31 percent, and the military used an estimated 24 percent of available electricity by 2014.

- The scale of investment required to repair, refurbish, and/or replace the elements of the DPRK energy system is considerable. Bringing the electricity grid alone up to modern and fully operable standards will cost tens of billions of US dollars. Given the current isolation of the DPRK economy, it will be impossible for North Koreans to achieve this recovery without international assistance. At best, the DPRK can hope to continue to make do with existing infrastructure augmented with some small hydropower additions and tiny distributed generation systems for individual homes and businesses, resulting in very slow growth in energy availability.

Despite the DPRK’s energy insecurity, recent UNSC sanctions will have limited, if any, effect on North Korea’s nuclear weapons and missile programs. Targeting the DPRK’s coal exports, most recently through Resolution 2321, will reduce the DPRK’s foreign exchange income somewhat, but there are various ways that the DPRK and the nations (principally China) and traders that it sells coal to can work around the sanctions to reduce their effect. Coal export sanctions are likely to have a much greater humanitarian impact on individual DPRK workers than on the DPRK’s nuclear weapons and missile programs. Similarly, Resolution 2375, and the more recent and more restrictive Resolution 2397, both designed to restrict the DPRK’s imports of oil products, are likely to be blunted by “off-books” trade and smuggling, as well as by the continuing availability of oil products refined in the DPRK, and at any rate will be felt last, if at all, by the DPRK elites and the nuclear and missile programs,

Engaging the DPRK to help to move forward some of the Northeast Asia regional energy projects that have been under consideration for many years offers opportunities to create regional energy interdependence linking the DPRK’s economy to that of its neighbors, while also improving DPRK energy security. Candidate initiatives include international gas and oil pipelines and transmission lines, shared liquefied natural gas (LNG) import facilities, and oil refineries, as well as shared projects to improve energy efficiency and deploy renewable energy systems throughout the region.

The DPRK will continue to view membership in the “nuclear energy club” as essential for securing its status among nations, and, given the history of nuclear power being a part of previous negotiated agreements on the DPRK’s nuclear weapons program, in receiving what it has previously been promised, There are various forms of nuclear energy sector engagement with the DPRK—ranging from training in nuclear safety and regulation, to regional cooperation on uranium enrichment and other fuel cycle activities, to joint ventures in development and deployment of small modular reactors—that could be elements of an energy assistance package that is part of a comprehensive security settlement of the DPRK nuclear issue, while simultaneously serving to help to bring the DPRK’s nuclear facilities under international supervision.

With regard to energy sector assistance, there are a wide variety of energy sector engagement measures, ranging in scope from training in energy efficiency measures for a small DPRK delegation to renewable energy/humanitarian pilot projects to refurbishment of the DPRK T&D grid, in which North Koreans have expressed keen and consistent interest. A package of such engagement measures, starting small and building as agreements on nuclear weapons security issues are made and implemented, should be a key component of negotiations toward settlement of the DPRK nuclear weapons stalemate, creation of a nuclear weapons-free zone in Northeast Asia, and related issues.

Contents

EXECUTIVE SUMMARY

1 Introduction. 6

2 Summary of the Overall Energy Situation in the DPRK: History, Problems, and Resources.

3 The Likely Impact of Recent UNSC Resolutions on the Energy Sector

4 The DPRK as a Participant in Regional Energy Infrastructure.

5 Opportunities for North Korean Engagement on Regional Nuclear Safety and Security Cooperation

6 DPRK Energy Sector Engagement Options for the International Community.

7 Conclusions.

A-1. Overall Energy Sector Situation in the DPRK.

DPRK Energy Sector Problems.

Energy Resources in the DPRK.

Estimates of DPRK Energy Supply and Demand.

Focus on Electricity Demand and Supply.

A-2. DPRK Coal Exports to China under New UN Sanctions: Potential Impacts and “Work-Arounds”

Background of DPRK Energy Supply and Demand Situation.

Estimated Impact of New Sanctions on DPRK Coal Exports, IF Sanctions Operate as Intended.

Potential “Work Arounds” for DPRK, China, and Chinese Traders to Soften the Impact of New Sanctions

What Might China’s Overall Approach Be To the New Sanctions?

Conclusions and Comments.

A-3. Sanctions on North Korean Oil Imports: Impacts and Efficacy.

Current Oil Supply and Use in the DPRK.

Military Use and Stockpiles.

DPRK Response to Loss of Oil Imports.

Conclusions.

A-4. Impact of UNSC Resolution 2375 on DPRK Oil Imports.

Ambiguities in the Resolution.

Estimating the oil sanctions.

Impacts of oil and textile sanctions.

A-5. Regional Energy Sector Cooperation Options and Benefits.

Regional Cooperation Options in the Energy Sector

Benefits of the DPRK’s Involvement in Regional Energy Cooperation.

A-6. Regional Cooperation on Nuclear Energy with the DPRK..

A-7. DPRK Energy Sector Engagement Options for the International Community.

Key Energy Sector Needs and Cooperation Approaches.

The Simpo Reactor Deal as an Engagement Value Precedent

ENDNOTES

1 Introduction

During the decade of the 1990s, and continuing into the second decade of the 21st century, a number of issues have focused international attention on the Democratic Peoples’ Republic of Korea (DPRK). Most of these issues—including nuclear weapons proliferation, military transgressions, provocations, and posturing, economic collapse, transboundary air pollution, food shortages, floods, droughts, tidal waves—have their roots in a complex mixture of Korean and Northeast Asian history, global economic power shifts, environmental events, and internal structural dilemmas in the DPRK economy. The focus of the international community on the DPRK has become even sharper in the past 12 months, with the consolidation of power by the third generation of the Kim dynasty, Kim Jong Un, and the latter’s ratcheting up of the tempo of both threat rhetoric and nuclear weapons/ballistic missile tests, matched in some respects by countervailing threats from the Trump Administration. A series of United Nations Security Council (UNSC) resolutions have, in part, targeted the DPRK’s energy sector in an attempt to reduce the DPRK’s hard currency earnings and limit oil products supplies, thereby reducing the resources available for the DPRK’s nuclear and missile programs, and, ultimately, bring the DPRK leadership back to the bargaining table—or so the argument goes.

In our view, the energy sanctions resolutions passed to date are, for various reasons, unlikely to have the desired effects.[1] Nonetheless, energy demand and supply in general—and, arguably, demand for and supply shortages of electricity in particular—have played a key role in many attempts to achieve a negotiated settlement of the nuclear issue with the DPRK. Should the parties to the Korean conflict, in particular the United States and the DPRK, return to negotiations on nuclear and other urgent issues that divide them, it is certain that DPRK energy insecurity will be one of the most important concerns on the table. In short, the DPRK’s energy insecurity is both a key driver that contributes to and a key element of a negotiated settlement of the DPRK nuclear weapons crisis.

In a comprehensive security settlement, we contend that energy and economic assistance to the DPRK will ultimately be one of six critical conditions that must be met to convince the DPRK to reduce its level of threat.[2] Carefully-designed energy sector assistance projects of modest scale, particularly those that combine economic development and humanitarian focus, should be sought out, designed, and as soon as conditions permit, undertaken. The Republic of Korea (ROK) is in a unique position to develop and deliver such projects, and it stands to gain considerably if such projects are successful. For the ROK, engagement with the DPRK on energy issues offers many possible benefits, including an opportunity to improve its relationship with and understand its neighbor, a chance to potentially improve the environment that the two nations share, an opening for the ROK to invest in and benefit from the development of the North’s economy, opportunities to potentially link its energy system with potential resource suppliers, most notably the Russian Far East, and an opportunity to markedly improve the ROK’s security by promoting peace on the Korean Peninsula.

It is critically in the interest of the Republic of Korea and its international allies to know as much as is possible to know about the energy resources and needs of the DPRK, so as to be ready, when the opportunities arise, to assist the people of the DPRK in energy and economic redevelopment that, while it will most certainly not be either easy, straightforward, or inexpensive, is as smooth and as sustainable as possible. It is also essential to not repeat the errors of past energy assistance. The essence of so doing is to provide only that energy assistance that meets international energy development standards for aid; and to insist that the bulk of the assistance be in forms that help to create regional energy interdependence between the DPRK and its “energy neighbors,” that is, China, Russia, and Mongolia to the north and west, and the ROK and Japan to the south and east.

To that end, this paper provides a brief summary of what is known and/or inferred about the status of the DPRK energy sector, as well as suggestions as to how the DPRK’s energy insecurity might be addressed in ways that could also contribute toward productive engagement with the DPRK on nuclear weapons and related issues.

The remainder of this paper is organized as follows.

- Section 2 provides a brief overview of the current status and recent past of the DPRK energy sector, including a description of ongoing problems in the energy sector;

- Section 3 summarizes our conclusions about the likely net impacts of recent UNSC resolutions on the DPRK economy and energy sector;

- Section 4 provides a description of how including the DPRK in regional energy cooperation projects might provide a useful means of engaging the DPRK as a part of discussions on reducing nuclear weapons threats;

- Section 5 focuses on options for engaging the DPRK on regional nuclear energy safety and security issues;

- Section 6 provides an illustrative list of energy sector engagement options that the international community could consider negotiating with the DPRK if and when discussions on reducing the nuclear threat on the Korean Peninsula recommence.

- Section 7 offers our overall conclusions regarding addressing DPRK energy insecurity as a possible opportunity for providing a pathway to engagement.

Attachments to this paper provide additional detail on the topics covered in the main text.

2 Summary of the Overall Energy Situation in the DPRK: History, Problems, and Resources

Overall energy use per capita in the DPRK as of 1990 was relatively high, primarily due to inefficient use of fuels and reliance on coal. Coal is more difficult to use with high efficiency than oil products or gas. Based on our estimates, primary commercial energy use in the DPRK in 1990 was approximately 70 GJ per capita, approximately three times the per capita commercial energy use in China in 1990, and somewhat over 50 percent of the 1990 per capita energy consumption in Japan (where 1990 GDP per-capita was some ten to twenty times higher than the DPRK). The dissolution of the Soviet Union, however, deprived the DPRK not only of its main source of energy supplies provided at concessional pricing, but also of its main source of spare parts for its factories, of markets for its industrial goods, and of the technical assistance that was used to build much of its infrastructure. Without this support, the DPRK was forced to rely on its own energy resources, and on what energy (especially oil) imports from the international market it could afford to pay hard currency or barter goods for. The result was a fairly rapid decline in energy supply and demand in the DPRK through 2000, with energy use by that year less than half, by Nautilus estimates, of what it was in 1990. Significant substitution of “commercial” fuels—oil products, electricity, and coal—with wood and other biomass has occurred, contributing to erosion, and deforestation, and also reducing the efficiency of energy use. Energy-using infrastructure itself, particularly in the industrial sector, but also in buildings, has become dilapidated and under-utilized over time, contributing to the inefficiency of energy use. Energy supply infrastructure, including power plants and, most notably, the transmission and distribution grid, have suffered similar degradation, despite diligent and inventive attempts by DPRK engineers and technicians to keep them operating.

Since 2000, some years have seen some improvement in energy supplies, for example, in years with good river flow for hydroelectric production, when investment (typically from China) has come in to fund coal mining for export, or when new (typically smaller) hydroelectric facilities have come on line, and some have seen declines, but the DPRK had not come close to matching 1990 energy availability by 2017.

Facing severe energy security problems, and with little to sell on international markets, the DPRK ramped up production of the one commodity on which it could reliably trade in the international community: threat, including the threat of instability and even collapse arising from energy deficits and critical shortages with massive humanitarian impacts inside the DPRK itself. Attempts at addressing the DPRK’s energy insecurity as a part of agreements to freeze the DPRK’s nuclear weapons program have provides some interludes of rapprochement, but 2017 finds the DPRK’s nuclear and missile programs as active as they have ever been, and the DPRK energy sector, despite improvement in some areas and investment in devices like diesel generators and solar photovoltaic panels by businesses and households, still providing North Koreans with, on average, only a small fraction of the energy services that its neighbors in the region enjoy (see Figure 2‑1).

Figure 2‑1: Solar PV Panels in Rural and Urban Installations in the DPRK[3]

A brief sketch of the DPRK energy sector and some of its problems is provided in Attachment A-1 to this paper. Much more detailed reviews/estimates of energy demand and supply in selected years in the DPRK are provided in a number of Nautilus Institute publications prepared over the years.[4]

In sum, the key to understanding the current energy insecurity of the DPRK is found in the following status report:

- Per capita energy use as of 1990, before the impacts of the collapse of the Soviet Union on the DPRK economy had been felt—was about 70 gigajoules (GJ). By 2010, by our estimates, per capita energy use had fallen to about 26 GJ, indicating a severe restriction in the energy services—such as heated homes, lighting, kilometers traveled, and industrial products manufactured—available to the DPRK populace.

- Biomass (including wood) energy use has risen to fill the gap in commercial energy (electricity, oil, and coal), albeit only partially and at low efficiency. Heavy biomass use has led to deforestation and soil degradation.

- Coal, of which the DPRK holds billions of tonnes of reserves, remains the dominant form of energy use in the DPRK, but is often used inefficiently.

- Although the DPRK grid nominally has a capacity of 8,000 to 10,000 MW (megawatts), the total generation capacity is limited by the poor state of repair of generation, transmission, and distribution equipment, as well as by seasonal water flows for hydroelectricity production. Total available generation is therefore in on the order of 2000 to 3000 MW, and annual electricity actually consumed by 2014 for a nation of 24 million people was comparable to that used in Washington DC.

- As of 2010, the fraction of total available oil products used by the DPRK military was an estimated 31 percent, and the military used an estimated 24 percent of available electricity by 2014.

- The scale of investment required to repair, refurbish, and/or replace the elements of the DPRK energy system is considerable—bringing the electricity grid alone up to modern and fully operable standards will cost tens of billions of US dollars. Given the current isolation of the DPRK economy, it will be impossible for North Koreans to achieve this recovery without international assistance. At best, the DPRK can hope to continue to make do with existing infrastructure augmented with some small hydropower additions and tiny distributed generation systems for individual homes and businesses, resulting in very slow growth in energy availability.

3 The Likely Impact of Recent UNSC Resolutions on the Energy Sector

In the past year, the UNSC has adopted resolutions targeting coal exports from the DPRK and oil imports to the DPRK (resolutions 2321, dated November 30, 2016, and 2375, passed September 11, 2017). The intent of these resolutions are to reduce the DPRK’s access to hard currency earned through sales of coal, historically mainly to China, and to restrict the DPRK’s access to oil products used to fuel its military and its nuclear weapons development activities. In three essays, published in 2017 and provided as Attachments A-2 through A-4 to this paper,[5] we argue that these resolutions will have largely have humanitarian impacts on the DPRK citizenry, but will do little to deter the DPRK from continuing to develop missile technologies or nuclear weapons. A brief summary of our conclusions follows.

The coal import cap included as part of the sanctions described in UNSC Resolution 2321 has the potential to decrease the DPRK’s coal export earnings by on the order of one billion dollars, which would be about a third of their overall reported exports and thus hard-currency earnings. Such a reduction would reduce the DPRK’s ability to purchase all types of goods on the international market, though its effect on support for the DPRK’s nuclear weapons program would depend on how the DPRK government chooses to allocate the drop in revenue. In practice, however, the effectiveness of the sanctions depends considerably on how China ultimately interprets the sanctions, and how stringently China chooses and/or is able to enforce the letter and spirit of the resolution. In addition, as Stephan Haggard notes, the DPRK is “deft” at avoiding and working around sanctions,[6] and actions such as off-the-books trades in coal may cut into the actual reduction in the DPRK’s revenues that the sanctions provide, to the extent that the DPRK can adequately finance off-the-books export coal production.[7]

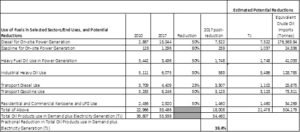

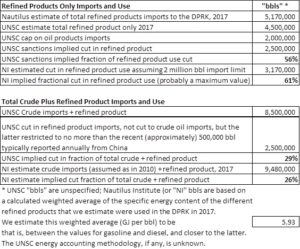

In our estimate, the sanctions included in Resolution 2375 would cut refined product imports to the DPRK by about 60 percent, but would not affect crude oil imports. Additional sanctions just released, those included in UNSC Resolution 2397,[8] adopted December 22, 2017, further restrict oil products exports to the DPRK at 500,000 barrels per year, a significant reduction from recent years. These latest sanctions also cap crude oil exports to the DPRK at 4 million barrels per year, but that level is essentially the same as China’s typical exports to the DPRK for most of the last decade and more, so should not change the supplies of domestically-refined products in the DPRK. As a result, the overall availability of refined products (including from domestic refining and imported products) would fall by about 25 to 30 percent as a result of Resolution 2375, and by perhaps 40 to 50 percent including the impacts of Resolution 2397.[9] Even factoring in the December 22, 2017 UNSC oil product export restrictions, the resulting levels of reduction are unlikely to have a significant impact on the DPRK military or nuclear weapons/missile programs. The military sectors will have priority access to refined fuels, including likely fuel from caches of significant volume that have already been stockpiled and provide a substantial buffer against the sanctions. Primarily these sanctions will affect the civilian population, whose oil product uses are of lower priority to the DPRK state. Moreover, and as evidenced by the images in Figure 3‑1, the DPRK can and likely will quickly effect a combination of additional energy end use efficiency, outright cuts, and substitution of non-oil energy forms to manage the cuts. We estimate that seven measures along these lines could cut the equivalent of 3.7 million barrels of crude oil use per year—more than enough to offset the cuts imposed by the sanction under Resolution 2375, and almost enough, even without considering other possible measures, to offset the further restrictions imposed under Resolution 2397.

Although the latest UNSC Resolution on the DPRK also seeks to strengthen maritime measures to address the DPRK’s illicit exports of coal and imports of oil products, in practice the overall sanctions may make more lucrative and thus induce further smuggling of these products, including attracting the interest of smuggling gangs that have operated in the Northeast Asia region for many years.[10] The more that the DPRK invests now in these workarounds to oil product restrictions, ranging from curtailment of oil product end-uses and of lower-priority users/geographic areas to fuel switching, producing liquid fuels from coal, and smuggling, the more resilient it becomes against future sanctions-driven cuts.

Figure 3‑1: Examples of Routine Fuel Substitution/Energy Use Reduction in the DPRK[11]

Although, as noted, the latest round of UNSC sanctions may not be as effective as hoped in curbing the DPRK’s spending on its nuclear weapons program, it is clear that sanctions are one of the few peaceful means that the international community has to express its dismay at DPRK behavior, and to try and influence that behavior. That said, other (non-military) options for addressing the DPRK nuclear weapons program must proceed concurrently with sanctions. Energy sector engagement with the DPRK, starting small with training projects on, for example, renewable energy and energy efficiency, and building to pilot projects in the DPRK, are a way of opening channels of communication that can be built upon over time.

In summary, the UNSC sanctions targeting the DPRK’s coal exports, most recently through Resolution 2321, will deprive the DPRK of a source of foreign exchange income, but there are various ways that the DPRK and the nations and traders (principally China and Chinese) that it sells coal to can work around the sanctions to reduce their effect. Coal export sanctions are likely to have a much greater humanitarian impact on individual DPRK workers than on the DPRK’s nuclear weapons and missile programs. Similarly, Resolution 2375, designed to restrict the DPRK’s imports of oil products, are likely to be blunted by “off-books” trade and smuggling,[12] as well as by the continuing availability of oil products refined in the DPRK, and at any rate will be felt last, if at all, by the DPRK elites and the nuclear and missile programs,

4 The DPRK as a Participant in Regional Energy Infrastructure

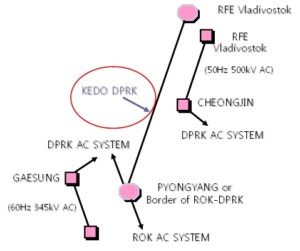

Resolution of the DPRK nuclear weapons issue would open opportunities for regional cooperation on energy issues that has heretofore been stymied, at least in part, by the difficulties in including the DPRK in regional projects. There remain, however, many different opportunities for developing regional energy infrastructure and for energy cooperation activities—many of which could involve the DPRK—that would potential benefit a number of regional parties on many levels. For example, as the DPRK economy becomes more integrated with the economies of the region, pipelines and transmission lines could be developed to pass through the DPRK to the ROK, providing service to the DPRK as well. Figure 4‑1 shows a potential routing for a major Russia/DPRK/ROK transmission line that has long been considered, together with smaller import lines serving local areas of the DPRK from Vladivostok and the ROK, respectively. Additional markets for all types of technologies (and services) would open as the DPRK is redeveloped. In fact, the redevelopment of the DPRK will provide a considerable opportunity to install efficient end-use equipment and renewable energy systems, as the DPRK economy (and infrastructure) will need to essentially be rebuilt from the ground up. In the process the DPRK may in a way provide a “laboratory” for application of energy efficiency and renewable energy measures in a way that nations with infrastructure that has been more recently updated cannot. Regional cooperation on energy sector initiatives also provides an opportunity to utilize DPRK labor, and to help to build a sustainable economy in the DPRK.

Figure 4‑1: Potential Routing for International Electricity Transmission Lines on the Korean Peninsula

Finally, under international rules for applying Clean Development Mechanisms (CDM),[13] which allow nations to take credit for financing greenhouse gas emissions reduction in other countries, redevelopment in the DPRK may provide a host of opportunities for countries within and outside the region to apply CDM in energy sector investments in the DPRK. Attachment A-5 to this paper provides a summary of possible regional cooperation options in the energy sector, and of the potential benefits, both to the DPRK and to nations engaging with the DPRK, of regional cooperative projects.

In summary, engaging the DPRK to help to move forward some of the Northeast Asia regional energy projects that have been under consideration for many years offers opportunities to create regional energy interdependence linking the DPRK’s economy to that of its neighbors, while also improving DPRK energy security. Candidate initiatives include international gas and oil pipelines and transmission lines, shared liquefied natural gas (LNG) import facilities, and oil refineries, as well as shared projects to improve energy efficiency and deploy renewable energy systems throughout the region.

5 Opportunities for North Korean Engagement on Regional Nuclear Safety and Security Cooperation

At its nuclear complex at Yongbyon, the DPRK has an operating reactor based on gas-cooled “magnox” technology, fueled with natural uranium and used to produce plutonium (and some heat), and an experimental light-water reactor fueled with enriched uranium that was constructed over the last eight or so years but apparently has yet to operate (see Figure 5‑1, below). Apart from the direct threats posed by the DPRK’s nuclear weapons programs, North Korea’s current and planned use of nuclear technologies may present severe regional and international problems with regard to nuclear security and safety. Possible loss of control of nuclear materials due to instability in the DPRK itself associated with a leadership transition, for example, may make the DPRK a source of fissile material and even weapons that may no longer be under strict central control. This possibility presents an extreme imperative to neighboring states and to other parties to the Korean conflict to intervene to ensure that nuclear materials do not cross borders or fall into the hands of individuals likely to use them.

Under conditions whereby the DPRK returns to the denuclearization and nuclear disarmament pathway, it is almost certain that the DPRK will insist on a meaningful element of nuclear power development as part of an overall energy assistance package. Engaging the DPRK on nuclear energy topics related to its two main reactors at Yongbyon and other nuclear infrastructure could range from training and regulatory assistance on nuclear safety to development of small modular reactors suitable for deployment in the DPRK electricity grid to participation in a regional uranium enrichment consortium. These options are discussed at greater length in Attachment A-6 of this paper.

In summary, the DPRK will continue to view membership in the “nuclear energy club” as essential for securing its status among nations, and, given the history of nuclear power being a part of previous negotiated agreements on the DPRK’s nuclear weapons program, in receiving what it has previously been promised, There are various forms of nuclear energy sector engagement with the DPRK—ranging from training in nuclear safety and regulation, to regional cooperation on uranium enrichment and other fuel cycle activities, to joint ventures in development and deployment of small modular reactors—that could be elements of an energy assistance package that is part of a comprehensive security settlement of the DPRK nuclear issue, while simultaneously serving to help to bring the DPRK’s nuclear facilities under international supervision.

Figure 5‑1: Plutonium Production (top center with stack) and ELWR (white dome, bottom center) Reactors at Yongbyon (Google Earth Image, probably from July or August 2017, downloaded 11/2/2017)

6 Options for the International Community

A selection of suggested energy sector technologies and processes for energy sector redevelopment in the DPRK are provided in Attachment A-7 to this paper. These energy sector options address DPRK energy insecurity in a variety of ways, and would be logical elements to offer as inducements to the DPRK for engagement and, in a coordinated, consistent, and stepwise fashion, as benefits to offer the DPRK in return for concessions on its nuclear weapons and related programs.

Most of these options—all of which, in our view, are crucial pieces of the redevelopment puzzle for the DPRK—have elements that can be implemented in the short-term (for example, capacity-building and humanitarian aid), and medium-term (for example, demonstration projects), but all, ultimately, will require a concerted program of assistance over many years.[14] The options suggested range from wholesale replacement of the DPRK’s electricity transmission and distribution grid to development of renewable energy systems, deployment of energy efficiency throughout the DPRK economy, and rebuilding rural infrastructure to allow the DPRK to better feed its people. Notably, many of these options are also of keen interest to the DPRK. This interest was evidenced in Nautilus Institute’s interactions with DPRK delegations from 1997 through 2014 (as indicated, for example, in Figure 6‑1), but also appears to a large extent in the document Intended Nationally Determined Contribution of Democratic People’s Republic of Korea, dated September 2016, and submitted to the United Nations Framework Convention on Climate Change (UNFCCC).[15] The DPRK’s “INDC” submission provides insights on topics such as the official policies on climate change and other environmental issues, on the DPRK’s intended energy-sector (and more broadly, economic) growth through 2030, and the DPRK’s “wish list” of energy-sector and other technologies—at least those with potential to reduce greenhouse gas emissions—for which it would propose to seek international assistance in implementation. This “wish list” has many commonalities with the listing of potential cooperation projects described in Attachment A-7 and in numerous papers and reports by Nautilus authors.[16]

Figure 6‑1: Images from Nautilus Institute’s DPRK Wind Power Cooperation Project, 1998 and 2000

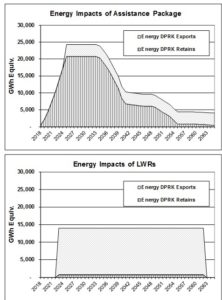

A possible benchmark for judging the minimum value of a package of energy aid are the values of energy aid packages that were part of previous agreements, and most notably, the value of the two light water (LWR) reactor units that were being built at Simpo by the Korean Peninsula Energy Development Organization (KEDO) under the terms of the 1994 Agreed Framework. It is possible to design a package of energy sector aid that has approximately the same perceived value to the DPRK (based on total cost) as the two never-completed LWRs, but in fact offers much more to reduce DPRK energy insecurity than the two LWR units ever could. As shown in Figure 6‑2, below, the two-LWR-alternative package provides energy earlier than the LWRs, and over time provides more than 15 times as much energy that can be used in the DPRK economy than do the LWRs.[17]

Figure 6‑2: Comparison of the Energy Outputs of Kumho LWR Completion (two units) versus an Equivalent-value Energy Assistance Package to the DPRK

In summary, there are a variety of energy sector engagement measures, ranging in scope from training in energy efficiency measures for a small DPRK delegation to renewable energy/humanitarian pilot projects to refurbishment of the DPRK T&D grid, in which North Koreans have expressed keen and consistent interest. A package of such engagement measures, starting small and building as agreements on nuclear weapons security issues are made and implemented, should be a key component of negotiations toward settlement of the DPRK nuclear weapons and related issues.

7 Conclusions

Helping the DPRK to implement sustainable solutions to its long-term energy problems is a necessary, though not sufficient, condition for enduring success in getting the DPRK to give up or place under international oversight its nuclear weapons, nuclear materials, and nuclear weapons programs, including joining a NWFZ. Conversely, failing to address the DPRK’s underlying needs for energy services now unmet (or poorly met) will virtually guarantee that any solution to the nuclear weapons issue will be unachievable and unsustainable. Sanctions, even if fully implemented by the UNSC signatories, will likely make life more difficult for ordinary North Koreans, leaving yet more energy services unmet, but are unlikely to dampen the resolve or significantly reduce the wherewithal of North Korean leadership to pursue its missile and nuclear weapons programs.

The options for a sustainable solution to the linked DPRK nuclear weapons and energy insecurity issues are to develop small- and large-scale conventional energy supply options, both domestic-DPRK and regionally networked, to assist with renewables and demand-side management (energy efficiency) options; and to develop nuclear fuel cycle support and possibly joint, safe small LWR options. We do not believe that the KEDO LWR project itself or anything resembling it will be ever resumed and completed, both because the United States and its partners are unlikely to agree, but also because the DPRK itself may have decided that the KEDO approach is no longer viable, given the mismatch of such large reactors with its now (and even in the late 1990s/early 2000s, when the KEDO project was ongoing) fragmented and relatively small power grid. Nonetheless, the deal that the DPRK made with the international community in 1994 that included the KEDO reactors remains a benchmark against which the DPRK will inevitably measure other engagement offers; and may form a useful precedent and prior agreement on which to “size” an updated energy assistance package as part of a comprehensive security settlement that also resolves the DPRK nuclear issue.

Engagement options that involve energy efficiency and renewable energy initiatives are generally “robust” for application in the DPRK, fulfilling many different considerations with few “downsides”. One aspect of such options that should not be overlooked, however, is that they will require a good deal of organization and coordination per unit of cost—relative, say, to work on a single major power plant, or provision of tankers of heavy fuel oil. This requirement has many benefits, in terms of capacity-building and intercultural interactions, but will need good communications between the groups providing assistance, and between those groups and their DPRK counterparts, to be effectively implemented and administered. Patience and consistency on the part of all parties in developing and implementing these and all cooperation options will also be vital.

Larger-scale options involving regional energy networks that contribute to regional economic integration, as well as economic integration of the Koreas, may have significant benefits, but will likely be candidates for longer-term application. They have the advantage that they are based on projects that are inherently economic from the perspective of regional participants, and which also provide some benefit to the DPRK, rather than projects that treat the DPRK as a separate energy problem to be solved solely in terms of local energy economics onto which are superimposed geo-strategic imperatives related to nuclear weapons by all parties.

Generally, we suggest that smaller, local projects that entail extensive human capacity-building will generate more development and more political good-will than very large, long-term projects. Considering the energy import/export needs and goal of regional players—such as the Russian Far East, China, and the ROK, will help planners to understand how to best integrate the DPRK into the regional energy economy while avoiding problems in doing so. This will take careful, site-specific and project-specific joint design, including access to sites and information that the DPRK has hitherto been loath to provide.

The DPRK’s interest in and current efforts to develop nuclear energy systems cannot be overlooked in developing plans for energy sector engagement. There are approaches to regional nuclear cooperation, starting with capacity-building on nuclear safety and related issues, that could, over the next two to three decades—and assuming favorable political conditions—build toward integrating the DPRK with other nations in the region in cooperative nuclear energy projects. These projects would support the goals of a Korean Peninsula Nuclear Weapons Free Zone with regard to transparency of nuclear materials handling and non-proliferation of nuclear weapons materials.

To address the inextricably linked issues of the DPRK nuclear weapons and missile programs and its fundamental energy insecurity, it is imperative that the international community develop a set of options for DPRK energy sector assistance that can be offered in return for reciprocal, carefully calibrated, and precisely defined commitments on the DPRK side to meet its nuclear disarmament obligations. These options must be designed to be phased in to match the scale, speed and importance of whatever actions the DPRK agrees to take, and subsequently verifiably implements, to reduce its threat of nuclear weapons and missile development, deployment, and use.

The DPRK’s obligations likely will come in three phases, with overlap between them. The first is freezing its missile and nuclear testing, and possibly its fissile material production. The second would be dismantling its missile and nuclear testing facilities, and possibly its missile production and nuclear fuel cycle capabilities, including enrichment. The third phase would be the incremental dismantlement and removal of all nuclear weapons-related hardware and software, and full disclosure of weapons-related activity and capacities, including nuclear-capable personnel. The DPRK’s fulfillment of the obligations in each of these phases would also require full monitoring and verification acceptable to and likely implemented by the three NPT-nuclear weapons states that are directly parties to the Korean conflict, and by international agencies such as the International Atomic Energy Agency (IAEA).

In phase 1, a package of fast (delivering energy services in 3-6 months from start of work), small, and affordable energy assistance using diverse technologies would provide the ability for the five parties plus other partners such as the EU to demonstrate their good faith intention for follow-on assistance to the DPRK. Other steps might entail providing assistance for the DPRK to resume coal exports to China based on provision of clean coal technology and occupational health and safety training and equipment critical to meet the basic human rights of the DPRK workforce working in the coal mines.

In the second phase, in addition to expanding the package of small, fast, cheap items implemented at the outset, a set of more valuable, larger-scale but still discrete options might be offered. Examples include provision of a floating power barge, perhaps either using one or more small nuclear reactors (from Russia, or from the ROK, when units from the latter are available) or a gas-fired unit fueled with liquefied petroleum gas (LPG), to provide electricity for a coastal DPRK city, such as Nampo or Rason, or another designated economic zone in the DPRK. Such power plants (and fuel for same) could be rapidly delivered, and, if the DPRK does not live up to the terms of its freeze agreement, equally rapidly withdrawn, and the energy delivered would be designed so as to avoid any diversion for direct DPRK military use. These are projects that could be brought on-line within a year, and could be implemented fully over the 2-3 year period likely required in phase 2 for completion of facility dismantlement.

In phase 3, which make take as much as a decade to complete or even longer, large-scale and capital-intensive projects might be undertaken. This would include refurbishing the DPRK’s hydro-electric dams, its coal-fired generators where economically justified, and its existing grid, also where electricity end-uses justify the investment in social and economic terms. The core of the assistance that would be provided in phase 3 would be to create or complete regional energy networks from Russia, Mongolia, and China to the ROK and even Japan, including electric power tie lines, gas pipelines, coal trade, etc., which serve the economic and energy security interests of all of the states in the region, not just that of the DPRK. Such projects would embed the DPRK in networks of regional interdependence that insulate each of the two Koreas against political manipulation by the other due to the interest of the two great powers integrated into these energy schemes.

Energy from these networks can also be provided, where economically justified and technically possible, to the DPRK’s own energy consumers. Energy from international networks, however, is unlikely on its own to be sufficient to support rapid energy development and energy infrastructure needs in the DPRK’s domestic energy economy. For that purpose, large-scale funding, likely from external partners such as Japan, using intermediaries such as the development assistance and infrastructure development banks, will likely be deeply involved in the DPRK’s energy sector with a view to the long term, once its nuclear disarmament is determined to be complete and certified to be so by the UNSC and other key parties.

As we noted at the outset, the DPRK has spent more than two decades developing its nuclear and missile “deterrent”, and will not trade it away cheaply, if at all. There is no question that bargaining to scale back the threat that the DPRK poses will be difficult and slow. As a consequence, the international community must be ready with a thought-out set of energy assistance options, varied widely in magnitude, speed of deployment, and type, that are ready to offer and implement in a “plug and play” fashion as the process of negotiations with the DPRK demands, as part of the sequencing needed to freeze, dismantle, and disarm the DPRK’s nuclear weapons program.

ATTACHMENTS

A-1 Overall Energy Sector Situation in the DPRK

DPRK Energy Sector Problems

The DPRK’s energy sector needs are vast, and at the same time, as indicated by the only partial listing of problems below, many of these needs are sufficiently interconnected as to be particularly daunting to address. As one example of the interrelations of energy problems in the DPRK, renovating the DPRK’s coal mining sector is made more difficult because coal mines lack electricity due to electricity sector problems, and electricity generators in some cases have insufficient coal to supply power demand because of coal mine problems and problems with transporting coal to power plants.

Key energy-sector problems in the DPRK include:

- Energy supply difficulties due to infrastructure degradation. Degradation of electricity generation and transmission and distribution (T&D) infrastructure, and other supply-side infrastructure, has been ongoing for many years, due largely to lack of spare parts and modern technologies. Much of the DPRK power generation and almost all of its substation equipment needs rebuilding or, more likely, replacement, as does much of its coal mining and oil refining capacity. In the last decade there has, however, been modest local rehabilitation of power plants and T&D systems in a few areas and for key purposes (including, reportedly, military facilities), as well as completion, sometimes with mixed results, of some new hydroelectric plants (megawatts to tens of megawatts). The DPRK’s forest stocks have been severely depleted by excessive fuelwood use caused by the lack of other fuels for household cooking and heating.

- Inefficient and/or decaying demand-side infrastructure: Much of the energy-using infrastructure in the DPRK is reportedly (and visibly, to visitors to the country) antiquated and/or poorly maintained. Buildings apparently lack significant, and often any, insulation, and the heating circuits in residential and other buildings for the most part apparently cannot be controlled by residents. Industrial facilities are likewise either aging or based on outdated technology, and often (particularly in recent years) are operated at less-than-optimal capacities (from an energy-efficiency point of view), if they are operated at all, and likely require upgraded or replacements to coal-fired boilers and electric motors and drives. Many transport systems are similarly antiquated. Recent years has seen some new building, however, particularly in Pyongyang and also associated with newly-developed markets for (mostly imported) manufactured goods and foodstuffs.

- Suppressed and latent demand for energy services: Lack of fuels in many sectors of the DPRK economy has apparently caused demand for energy services to go unmet. Electricity outages are one obvious source of unmet demand, but there are also reports, for example, that part of the DPRK fishing fleet has periodically been idled for lack of diesel fuel. Residential heating is reportedly restricted in the winter to conserve fuel, resulting in uncomfortably cool inside temperatures. Some observers report that some public-sector and residential buildings have not received heat at all in recent years.

The problem posed by suppressed and latent demand for energy services is that when and if supply constraints are removed there is likely to be a surge in energy (probably particularly electricity) use, as residents, industries, and other consumers of fuels increase their use of energy services toward desired levels. This is a further argument for making every effort to improve the efficiency of energy use in all sectors of the DPRK economy as restraints on energy supplies are reduced.

- Lack of energy product markets: Compounding the risk of a surge in the use of energy services has been the virtual lack of energy product markets in the DPRK. Without pricing reforms—particularly, at present, for electricity, coal, and for petroleum fuels distributed by the state—there will be few incentives for households and other energy users to adopt energy efficiency measures or otherwise control their fuels consumption. Recent years have seen limited attempts by the DPRK government to reform markets for energy products. Some private markets exist for local products like firewood, and some commercial fuels have in recent years reportedly been traded “unofficially” (on the black market) as well as, at least in cities, openly, at vehicle fueling stations. For the most part, however, energy commodity markets in the DPRK do not exist as they do in most industrialized nations. Energy consumers are also unlikely, without a massive and well-coordinated program of education about energy use and energy efficiency, to have the technical know-how to choose and make good use of energy efficiency technologies, even when and if such technologies are made available.

Energy Resources in the DPRK

The major primary energy resources currently used in North Korea are as follows:

- Coal, almost all of which is domestically produced. The types of coal mined in the DPRK are anthracite and brown (or lignite) coals. Since about 2000, and until the recent constrictions caused by UNSC sanctions on DPRK coal sales, coal production for export to China had been rising annually in volume, reaching nearly 20 million tonnes—on the order of half of national output—by 2015. The DPRK’s coal reserves are large, probably in the billions of tonnes.

- Petroleum, including crude oil imported (all or nearly all) from China, and typically a smaller amount of imported refined petroleum products from China, Russia, and in some cases other sources. The DPRK has two major refineries, only one of which (in the DPRK’s Northwest) has reportedly been operating in recent years.

- Wood and Biomass, including fuelwood and commercial wood harvested from the DPRK’s extensive but degraded forest area, and crop residue biomass.

- Hydroelectric power from a number of hydroelectric plants situated along the major and smaller rivers in the DPRK.

The DPRK has additional energy resources that are not yet widely used:

- Crude oil and natural gas resources exist in North Korean territory, though these are not yet well characterized, appear to be located mostly in offshore areas, and have been only tapped in a limited fashion to date.

- Geothermal resources, in which the DPRK has shown an active interest, though the extent of geothermal resources in North Korea are not well known.

- Wind power, though the average wind speeds in the DPRK are fairly modest, with the most favorable wind regimes located offshore (particularly in the Northeast) and along the high ridges in the middle of the country.

- Solar energy resources, though the DPRK’s solar regime is no more (or less) favorable than that of the ROK, Japan, or the more temperate areas of the United States (for example, the mid-Atlantic States or Pacific Northwest).

- Tidal energy resources, though these too have been tapped to only a limited extent.

- Nuclear energy resources, namely, uranium and thorium.

Estimates of DPRK Energy Supply and Demand

In our over 20 years of undertaking analyses of the DPRK energy sector, Nautilus has been using all available information, including indirect data, estimates, and comparisons with other nations using similar technologies, to assemble coherent—though doubtless not entirely accurate—quantitative estimates of energy supply and demand in the DPRK as an input to the knowledge base underlying discussions of engagement with North Koreans.[18] Below we provide the highlights of our estimates of historical and more recent—albeit rough—energy supply and demand in the DPRK.

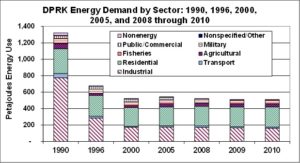

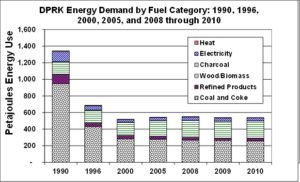

As shown in Figure A‑1, the industrial sector is the largest consumer of all commercial fuels—particularly coal—in the DPRK. The transport sector consumes a substantial fraction of the oil products used in the country. Most transport energy use is for freight transport; the use of personal transport in the DPRK is very limited, relative to most industrialized nations, but seems to have been increasing in recent years. The residential sector is a large user of coal and (in rural areas, though more recently, reportedly, in urban and peri-urban areas as well) biomass fuels. The military sector (by our estimates) consumes an important share of the refined oil products used in the country. The public/commercial and services sectors in the DPRK consume much smaller shares of fuels supplies in the DPRK than they do in industrialized countries, due primarily to the minimal development of the commercial sector in North Korea. Wood and crop wastes are used as fuels in the agricultural sector, and probably in some industrial subsectors as well. Figure A‑2 shows the increasing importance of biomass fuels to the DPRK economy since 1990.

Figure A‑1:

Figure A‑2:

Focus on Electricity Demand and Supply

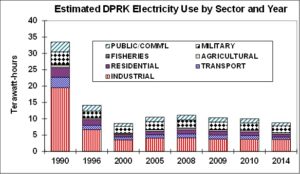

Electricity, or rather, the lack of same, has arguably the most important energy-sector driver of DPRK policies toward the outside world. The estimated per-capita electricity end use in the DPRK in 1990 was about 1,500 kWh per capita. By comparison, overall 1990 electricity demand in South Korea was about 2,200 kWh per capita.[19] Per capita electricity consumption in the DPRK has declined very substantially since, due largely to reduced availability of power, though also as a results of reduced economic activity.[20] As with coal, the bulk of the electricity demand in the DPRK has traditionally been in the industrial sector, with the residential and military sectors (by our estimates) also accounting for significant fractions of electricity use. Figure A‑3 shows our estimates of electricity demand by sector in selected years since 1990.

Figure A‑3:

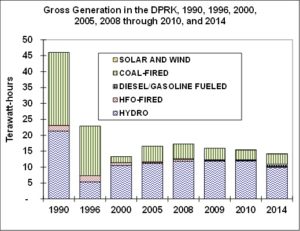

Electricity generation as of 1990 was primarily hydroelectric and coal-fired, in approximately equal proportions, with a small amount of oil-fired electricity generation capacity associated with the oil refinery at Sonbong and in two other plants. Much of the generation capacity was installed in the 1970s and 1980s, although a significant portion of generation facilities—particularly hydroelectric facilities—date back to the Japanese occupation[21]. Many of the hydroelectric facilities in the DPRK are reported to be of the “run-of-river” variety, which means that their output is more subject to variations in stream flow than plants that rely on larger impoundments with greater water storage. Since 1990, the ratios of hydro to “thermal” power production have varied from year to year, based on the availability of hydro power (including low output in the mid-1990s following plant damage due to flooding) and on the condition and fuel supply for coal-fired power plants. Figure A‑4 presents our estimates of electricity output by fuel type in the DPRK over the last two decades.

Figure A‑4:

The DPRK has the coal resources necessary to expand thermal power generation, but it is not clear that the coal mining or transport infrastructure is capable of supplying coal to power stations at a rate much greater than that prevailing in 1990. In fact, given problems in the coal industry, only a fraction of this rate of coal supply is currently achievable. In a series of vicious spirals, electricity and coal infrastructure problems feed back on each other and link to problems throughout the economy. For example:

- No or sporadic electricity availability means that lights and pumps in coal mines don’t stay on, reducing coal output;

- No or sporadic electricity means difficulties with coal (and other goods) transport, meaning less coal is made available for power plants and industry

- Lack of power and coal for industry limits production of spare parts for transport, generation and mining infrastructure;

- Lack of power makes outside investment in mining, manufacturing more difficult/less attractive; and so on.

Recent years have seen many citizens and businesses/organizations in the DPRK take electricity provision into their own hands. Doing so has taken the form of purchase and operation of diesel and gasoline-fired generating sets—totaling, by our estimates, on the order of 1000 MW of capacity through 2016—as well as purchase of hundreds of thousands of small solar photovoltaic panels (PVs), which have been seen blooming from the roofs and balconies of apartment buildings and other dwellings all over the country. The generation capacity of these PVs, imported from China and/or assembled in the DPRK from components imported from China, may total on the order of 20 MW, and their aggregate output is thus not significant with respect to the country’s overall energy balance. For each panel or system, however, the small amount of power that they provide mean a great deal to individual households, where they provide power for LED (light-emitting diode) lamps and for personal entertainment/information and communications electronics.[22]

A-2 DPRK Coal Exports to China under New UN Sanctions: Potential Impacts and “Work-Arounds”

Background of DPRK Energy Supply and Demand Situation

Though the Democratic Peoples’ Republic of Korea (the DPRK or “North Korea”) has been chronically short of many commercial forms of energy since the breakup of the Soviet Union in 1990, one resource that it does have in abundance is coal. Electricity supply problems, due to a combination of aging infrastructure, lack of access to/funds for technological updates, and, often, fuel supply constraints, have rendered electricity supplies unreliable or worse in most parts of the nation. Similarly, the lack of indigenous oil and gas production (though apparently some resources do exist, including offshore) have made North Koreans dependent on imports of crude oil and oil products, mostly from China and Russia.

Per capita, by our estimates (the DPRK does not publish regular energy statistics), North Korea consumed about one thirtieth (1/30) as much electricity as South Korea, and a tenth as much as China, in 2014, along with a tenth as much overall energy supply per capita as South Korea (despite heavy use of biomass, which burns with low efficiency) and less than a third as much as China.[23]

The DPRK does, however, have billions of tonnes of coal resources. Since 2000, and particularly since 2010, North Korea has been increasingly exporting anthracite coal, primarily to China. Coal has thus been a major source of export earnings for the DPRK, and as a consequence constitutes a large target for the increased economic sanctions recently imposed on the DPRK by the United Nations Security Council (UNSC) in response to the DPRK’s most recent nuclear weapons test. The effect of these most recent sanctions on the DPRK’s economy, and relatedly (but not necessarily directly) their effectiveness in positively influencing DPRK behavior, depends in large part on the rigor with which this particular set of sanctions will be implemented by China.

DPRK’s Recent Coal Exports to China in Context of Overall Coal Production

The DPRK’s coal exports to China, as reported in China’s customs statistics, were less than a million tonnes (Mt, all tonnes herein are metric tonnes) annually until 2004, when exports began to rise markedly, averaging about 3 Mt per year from 2005 through 2009. By 2013, DPRK coal exports to China were nearly 17 Mt, and reached their peak at 19 Mt in 2015. Full-year statistics for 2016 are not yet available as of this writing, but will be similar to 2015, even with sanctions beginning in the last month of 2016.[24] Placed in the context, the level of China’s imports of coal from the DPRK in 2015/2016 amounted to over half of our estimate of the DPRK’s total coal production even in 2014, when China’s imports from the DPRK were over 15 million tonnes. This means that a large portion, possibly even a majority, of the DPRK’s coal output has been routed to China in the last three years.[25]

Coal Exports in the Context of the DPRK’s Export Earnings and Trade Balance

The value of the DPRK’s official trade for 2015, as indicated in the UN Comtrade reporting system, was somewhat less than USD 3.1 billion, of which China accounted for 82 percent, or $2.5 billion. (India was a very distant second, at about $100 million.). Of this total, just under $1.1 billion, or 42 percent, were from China’s imports of coal from the DPRK. Almost as large were China’s imports of items of clothing from the DPRK, which totaled over $800 million, although it is our guess, based on customs statistics that show the DPRK importing on the order of $600 million worth of goods from China in categories related to textile production (such as “Manmade Filaments, Including Yarns And Woven Fabrics Thereof”), that these clothing imports represent mainly goods made in the DPRK for China using North Korean labor and Chinese materials. Beyond coal and clothing, most of the remainder of the value of DPRK’s exports to China fell into the categories of iron and steel, non-metallic mineral products, metal ores, and “fish and crustaceans, molluscs and other aquatic invertebrates”.[26][4] China’s exports to the DPRK for 2015 sum to a value of just under $3 billion, meaning a trade imbalance between the two nations of about $500 million.

Recent UN Resolution and Sanctions Focusing on DPRK Coal Exports

United Nations Security Council (UNSC) Resolution 2321, dated November 30, 2016, imposes additional sanctions on the DPRK stating “The Security Council strengthened its sanctions regime against the Democratic People’s Republic of Korea today, condemning that country’s 9 September nuclear test in the strongest terms”.[27] The main impact of the sanctions with regard to the DPRK’s coal exports, is that it is designed to reduce the DPRK’s annual coal exports by “about 60 percent with an annual sales cap of $400.9 million, or 7.5 million metric tonnes, whichever is lower”, starting in 2017.[28] In addition, for immediate effect, the Resolution limits December, 2016’s exports of coal from the DPRK to about 1 million tonnes, or a value of $53.5 million, whichever is lower. The coal “cap” is in the context of an overall statement that the DPRK “should not supply, sell or transfer coal, iron and iron ore (surprisingly, steel is not specifically listed), and that all States should prohibit the procurement of those materials from that country, with the exception of total coal exports to all Member States” as above. Also exempted are “transactions in iron and iron ore intended exclusively for livelihood purposes”. Additional elements included in the Resolution were summarized as follows:

“By other terms of the resolution, the Council prohibited Pyongyang from exporting copper, nickel, silver and zinc, new helicopters and vessels, as well as statues. It decided further that all Member States shall take steps to limit the number of bank accounts held by diplomatic missions and consular posts, as well as diplomats of the Democratic People’s Republic of Korea within their respective territories. Member States should further close existing representative offices, subsidiaries or bank accounts in the Democratic People’s Republic of Korea within 90 days, unless required for the delivery of humanitarian assistance.

“The Council decided further that all Member States shall suspend scientific and technical cooperation with persons or groups officially sponsored by, or representing, the Democratic People’s Republic of Korea except for medical exchanges. It added 11 individuals to the list of those subject to a travel ban and asset freeze, as well as 10 entities to the list of entities subject to an asset freeze. The Council also added 11 items to the list of nuclear- and/or missile-usable items and three to the list of chemical/biological weapons-usable items[29][7] of which Member States should prevent the supply, sale or transfer to the Democratic People’s Republic of Korea.

“Concerned that the country’s nationals were working in other States to earn hard currency for use in its nuclear and ballistic missile programmes, the Council called upon States to exercise vigilance over that practice.”

Estimated Impact of New Sanctions on DPRK Coal Exports, IF Sanctions Operate as Intended

Estimated Impact on Coal Exports and Revenues

Assuming that DPRK coal exports for the first 10 months of 2016 were, as reported, 18.6 million tonnes, and that the final two months of the year would in the absence of sanctions have produced the same average monthly level of exports as the first 10 months—albeit probably at higher prices, due to various changes in the coal market in China—limiting the DPRK’s exports over the final month of 2016 to 1 million tonnes would have reduced DPRK coal exports by about 900 thousand tonnes, worth on the order of $90 million. In 2017 (and, presumably, beyond), assuming an average price for coal over the next year in the range of prices prevailing in the latter half of 2016 (about $80-$100 per tonne), reducing the DPRK’s coal exports to 7.5 million tonnes annually would reduce exports by on the order of 9 to 10 million tonnes, and revenues by on the order of $700 million to $1 billion.[30]

Loss of Revenue Relative to DPRK Income from Trade

Losing up to a billion dollars in annual coal revenue would decrease the DPRK’s overall income from reported exports to all countries by on the order of 23 to 33 percent, and income from exports to China by about 28 to 40 percent. If not compensated for by other changes in imports or exports, this loss of trade income would increase the DPRK’s trade deficit by on the order of 150 to 230 percent—that is, would double or triple its trade deficit—with similar impacts on the DPRK’s trade deficit with China (which accounts for over 95 percent of the DPRK’s overall trade deficit).

Relative Importance of Loss of Coal Revenue to DPRK Economy

The closed nature of the DPRK’s economy, and the difficulty of valuing goods and services in an official economy that is not market based, coupled with an unofficial economy that is (probably largely) market-based but keeps no records, makes estimation of overall GDP in the DPRK a difficult task. Indeed, 2015 estimates of the DPRK’s GDP by the ROK’s Bank of Korea and Hyundai Institute appear to differ by about 50 percent, and do not even agree on whether the DPRK’s economy expanded or contracted in 2015.[31] Based on estimates of the overall size of the DPRK economy, the loss of coal revenue due to sanctions would amount to on the order of 3 to 7 percent of overall GDP, depending on whose estimate of North Korean GDP (and which estimate of future coal price) one uses.

This is certainly a significant impact, but understates the overall effect of the coal export cap on the DPRK economy because the loss in export revenue represents a loss of hard currency[32] that cannot easily be compensated for by domestic economic activity. That is, the loss of export income means that the DPRK cannot buy international goods at the same level, and there are many international goods for which domestic substitutes are difficult to obtain in the DPRK. This, of course, is the whole point behind sanctions—that the DPRK will be denied the hard currency needed to be able to purchase desired international goods, including those related to its nuclear weapons program. It is unlikely, however, that the reduction in the DPRK’s hard currency earnings would be felt uniformly across all of the types of goods it imports. Given the DPRK’s emphasis on the military, one would expect that to the extent that the coal export cap affects the imports of commodities, those related to the military—and in particular the nuclear—sector would be the last to be affected by the need to economize. Moreover, as noted below, there may be a number of “work-arounds” that the DPRK and its trade partners (mostly China) might use to blunt the actual impact of the new UNSC sanctions on the DPRK’s economy.

Potential Impact of Resolution on Coal Use in the DPRK

The DPRK’s own coal use in 2010, by our estimates, amounted to about 17 Mt, of which about 3 Mt was for power generation and district heat, 7 Mt for the industrial sector, 5 Mt for the residential and commercial/institutional sector, and 1 MT for the military.[33] In practice, admittedly, separating military and industrial coal demand is not straightforward, since much of the industrial sector is operated by or for the military (or both). In a more “normal” economy one might think that if DPRK coal exports are dramatically reduced, as they would under full compliance with the November UNSC resolution, prices of coal for local consumption might fall, and availability of coal for district heating, home heating, and power generation might rise. This may well come to pass, to some degree, depending on the extent to which coal markets are price-controlled, and conversely, the amount of coal that is sold in official or unofficial markets. But it is also possible that the mines that have been producing probably higher-than-average-quality coal for export to China,[34] especially those run by Chinese companies, would simply shut down in response to the export cap, thereby reducing overall DPRK output, and negating all or a portion of any domestic supply benefit that might accrue to DPRK consumers as a result of the resolution. This is in part because many of the supplies that allow the operation of DPRK coal mines producing export coal, including spare parts for equipment and even clothes and food for miners, are imported by the Chinese companies running the mines, and when the companies pull out, supplies of those essentials will dry up. Almost certainly, there is substantial suppressed demand for coal and substitutes in the DPRK due to the non-market allocation and distribution system to households and enterprises. Some portion—perhaps 20 percent—of coal not exported to China might end up used domestically even if the domestic coal price were to increase to recover the full cost of switching the supply from export to China to local users. This switch represents the upper limit on the “humanitarian dividend” that might follow from limiting exports via sanctions.

This dividend would be offset, however, by lost household and enterprise income due to the shutdown of mines closed due to the reduction in coal exports due to sanctions. As a rough estimate of this lost income, we assume (as described above) that the overall annual reduction in DPRK coal exports due to sanctions is 10 Mt, and that the domestic economy absorbs 2 Mt of this reduction. This means that overall annual DPRK coal output is reduced by about 8 Mt. Further assuming that coal miners working in these for-export mines earn a wage of $100 per month,[35] work 25 days per month, and produce about 4 tonnes of coal per day,[36] a reduction of 8 Mt means a reduction of $8 million in annual income for miners’ households (only). Add in reductions for other mine workers, for businesses servicing the mine, and for indirect economic activity around the mine, and a multiplier of 10 seems plausible, arguably resulting in an annual reduction in humanitarian welfare on the order of $80 million. This amount, though obviously a very rough estimate, is still a small portion of the overall reduction in the DPRK’s income from coal exports, as most of the coal income reduction would fall on the DPRK state, Chinese mine operators, and DPRK elites, in some probably un-knowable combination.

Potential “Work Arounds” for DPRK, China, and Chinese Traders to Soften the Impact of New Sanctions

The sanctions placed on the DPRK by the United Nations Security Council (UNSC) in response to the DPRK’s most recent nuclear weapons test include restrictions on the exports of coal from the DPRK to other nations. These sanctions will affect the DPRK’s coal trade with China almost exclusively, since China is virtually the sole importer of DPRK coal. Although the new sanctions, under UNSC Resolution 2321, dated November 30, 2016, could reduce the DPRK’s hard-currency income by on the order of a billion dollars annually, and coal exports by 9 to 10 million tonnes (Mt) per year, there are a number of “work-arounds” that could be employed by the DPRK and China to soften the blow on the DPRK’s coffers. These “work-arounds” could include “off-books” coal trade between the partners, lack of enforcement of restrictions on export and transport of coal by local Chinese customs and other officials, the designation of China’s exports (for example, of food, fuel, and clothing) to the DPRK as “humanitarian”, and/or China allowing DPRK to import goods from China on a concessional (or deferred payment) basis. In addition, it is possible, given recent trends in China’s coal market, that the restrictions under UNSC Resolution 2321 are in line with what China would have done anyway with respect to DPRK coal imports, and thus do not represent much of a change in plans for China overall. Each of these possibilities is discussed briefly below.

“Off-books” Coal Trade by the DPRK

China—or more specifically, Chinese businesses—could import coal from the DPRK on an “off-books” basis, that is, without recording the trades in China Customs Statistics. These imports, though of course difficult to find evidence for without specific testimony from traders on one or both sides of the border (which is unlikely to be forthcoming), could occur with the tacit acceptance of Chinese officials or without their knowledge, including shipments crossing the border (by land or sea) through routes where customs officials are not present. Such “off-books” trades of coal by the DPRK could boost the DPRK’s hard currency earnings without counting towards the sanctions total. Alternatively, coal could be bartered for Chinese goods, therefore avoiding the exchange of hard currency but displacing the need for hard currency by the DPRK. A barrier to such off-books trades is the fact that most coal traded between the two nations travels by sea, and sea-going freighters and barges are hard to conceal from satellites tracking marine traffic. Also, as DPRK/China coal trade uses many, and busy, ports in China, coordinated collusion on a broad scale to avoid customs rules and sanctions might need to involve so many officials and traders as to be implausible, particularly, for example, if it were on the level of several million tonnes per year of off-books shipments.

Potential Lack of Enforcement of Restrictions by Local Chinese Customs Officials