DAVID VON HIPPEL AND PETER HAYES

NOVEMBER 2, 2018

I. INTRODUCTION

In this Special Report, the authors find that “the data on generator imports …reinforces a picture of a DPRK in which a more vibrant, modernizing, increasingly (at least functionally) market-based economy is providing households, business, and institutions with the wherewithal to invest in both off-grid electricity supplies and increased transport services…To the extent that private purchase of generation equipment has rendered DPRK decision-makers less vulnerable to the impact of oil supply sanctions—the implication IS that other modes of working toward “denuclearization” of the DPRK, particularly engagement on energy issues, are likely to be more effective than attempts to further ratchet up sanctions.”

David von Hippel is Nautilus Institute Senior Associate. Peter Hayes is Director of the Nautilus Institute and Honorary Professor at the Centre for International Security Studies at the University of Sydney.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

This report is published under a 4.0 International Creative Commons License the terms of which are found here.

Banner image: Chinese genset sold to DPRK, from here.

II. NAPSNET SPECIAL REPORT BY DAVID VON HIPPEL AND PETER HAYES

DPRK IMPORTS OF GENERATORS IN RECENT YEARS: AN INDICATION OF GROWING CONSUMER CHOICE AND INFLUENCE ON ENERGY SUPPLY DECISIONS?

NOVEMBER 2, 2018

Introduction

Although anecdotal evidence, including informal reports from recent visitors to the Democratic People’s Republic of Korea (DPRK), suggest that supplies of electricity have been improving somewhat in recent years, at least in some areas of the country, many areas of the country reportedly continue to experience periodic blackouts. These episodes are caused by a combination of factors that vary place to place. Factors affecting power supply include the poor condition of the transmission and distribution grid and related power losses. Lack of power supplies due, for example, to seasonal reductions in hydroelectricity output, lack of fuel for and/or technical problems at coal-fired power plants, and/or a general lack of sufficient operable power generation to meet demand, result in the rationing of electricity to certain areas by allocating available supplies to priority areas and organizations. The historical lack of a pricing system that collects from consumers even a fraction of the cost of generating power does not help to provide incentives for improvement of central electricity supplies, which are in any event government controlled. As a result, some cities, most notably Pyongyang, have relatively reliable supplies of power (though even there, blackouts remain not uncommon), whereas more remote areas can be without power much of the time.[1]

At the same time, the last few years have generally seen (again, largely based on anecdotal evidence, as few statistics are available) an uptick in economic activity, as more DPRK citizens are participating in a market economy that has been increasingly tolerated by DPRK officials. The expanding market economy, in turn, has increased the ability of some individuals to access and afford imported goods and fuel, and to seek expanded access to energy services such as lighting, the use of personal electronics, and personal mobility.

In an earlier NAPSnet Special Report, we described a large increase over the last five or so years in the imports of vehicles—ranging from heavy trucks to personal autos and motorcycles, bicycles, and perhaps most interestingly, electric scooters and electric bicycles—reported in customs statistics.[2] A parallel increase has occurred in the imports of devices—mostly diesel- or gasoline-fueled generators, but also solar photovoltaic (PV) and wind-power generators—that allow North Koreans to generate their own power for businesses and households. The combination of these trends suggest to us that increasingly North Korean households—at least the wealthier ones—and perhaps businesses have taken the provision of both transport services and electricity provision into their own hands.

This situation implies that consumers must make their own trade-off–to the extent that fuel supplies are squeezed by United Nations Security Council (UNSC) sanctions–between fueling transport or fueling back-up power supply, but by devolving these choices to individual households and work units, it also implies that North Koreans’ responses to scarcity of electricity (and public transport) have ended up providing additional resilience, at least for the most elite North Koreans, to weather the potential hardships of the sanctions regime.

Imports of Small Petroleum-fueled Generators to the DPRK

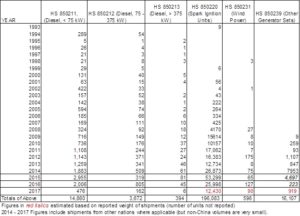

The DPRK has imported small generators, particularly diesel generators, for at least 25 years. All but a small handful of these generators have been imported from China. Imports of generators under the general category HS 8502, based on trade statistics available through the United Nations “Comtrade” data system[3] numbered mostly in the tens of units until 2000, when they began to rise to hundreds and then over a thousand units per year by the late 2000s. Since then, and particular in the last five years, imports of generators have expanded dramatically, to tens of thousands of units per year (albeit mostly of smaller capacity), with the peak year for reported imports being 2015, when the value of the DPRK’s imports for HS 8502 totaled over $25 million (US dollars). Table 1 shows the reported number of generators exported to the DPRK by its trade partners (almost all from China). These imports are divided into several types and categories, namely:

- Diesel-fueled generators of less than 75 kilowatts (kW) capacity (or, more accurately less than 75 kilovolt-Amps, which is effectively the same as kW). These would be sufficient, at the low end (say 10 kW), to power a reasonably large home, and at the high end, to power a cluster of homes or a smaller apartment building, or a smaller business (such as the marketplaces that have opened up throughout the DPRK) or institution (school or hospital). Nearly 3000 of these units were imported in the peak year of 2015, and nearly 15 thousand were imported since 1993, of which two thirds were imported after 2010.

- Diesel-fueled generators of between 75 and 375 kW. These would be sufficient to power, for example, a medium-sized business or institution, or a moderate-sized apartment building. Over 800 of these were imported in 2015, and nearly 3700 since 1993, with over 70 percent of the totals brought in after 2010.

- Diesel-fueled generators of more than 375 kW. These could be sufficient to run a light industrial facility, or a larger office building, apartment complex, or institution (a military base comes to mind as an example of the latter), or even a village of a few hundred to a few thousand inhabitants. Nearly 400 of these were imported since 1993, including 81 in 2015, and 290 after 2010.

- Spark ignition (largely gasoline-fueled) unit. The HS category for these provides no guidance as to capacity, but we infer that they are mostly small units of 500 Watts to a perhaps a few kW of output, used to provide emergency or back-up power for key end-uses (lighting and communications) and for charging batteries to run lighting and smaller appliances in homes and/or, for example, for powering one or several stalls at a night market. Although hardly any of these were reported imported to the DPRK in the 1990s, by 2015, the DPRK imported a staggering 53,000 of these units, or nearly one for every hundred DPRK households in that year alone. By 2017, imports in this category were almost 200,000 units, of which over 80 percent had been purchased since 2010.

- Wind power generators, numbering nearly 600 since 1993, but almost all imported since 2007, with peak imports of 175 units in 2012.

- Purchase of about 16,000 generators of unspecified type and size, but assumed to mostly be diesel generators, have been reported starting in 2009, and with peak purchases of 4,700 units in the year 2015.

Table 1: Number of Generators Imported to the DPRK by Year and HS Category

We were interested in how these trade statistics for generators, which provide information on the cost, number, and sometimes weight of shipments, but not the total capacity of generators shipped, might translate into figures for total capacity of generators imported. To estimate capacity by year, we adopted estimates of the average kW per unit in each trade category, then tuned those estimates so that the cost of capacity per kW ($/kW) approximately matched the costs of generators offered for sale in the various size and fuel categories by vendors, and in particular, by Chinese companies advertising generators on Alibaba.com. This procedure cannot hope to exactly reproduce the capacity imported in each year, but we feel it provides a reasonable estimate. As an example, our analysis suggests that in 2015, the aggregate cost of the 53,000 spark-ignition generators imported would be consistent with an average unit size of about 2 kWe and an average cost of about $160 per unit ($80 per kW), well within the range of sizes and costs of small Chinese-made generators offered for sale on Alibaba and, significantly, probably within a range of affordability for at least more well-to-do North Korean households.

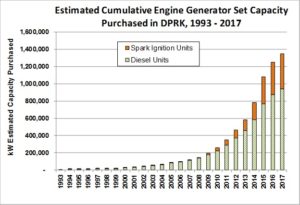

Figure 1 shows the results of our estimates in terms of cumulative capacity of the diesel- and gasoline-fueled generators imported to the DPRK since the early 1990s. Notable here is the significant ramp-up of capacity since 2000, and particularly since 2010. Also notable is the estimate of total capacity—at over 900 MW of diesel gensets and 400 MW of gasoline generators, they total 1300 megawatts (MW), or 1.3 GW, of (presumably) operable generation capacity. This is similar in magnitude to what we estimate may be the actual operable capacity of the DPRK’s thermal (mostly coal-fired) power plants,[4] and perhaps a quarter or more of the total operable capacity of the DPRK’s central power plants in total, thermal plus hydroelectric. This means that by 2017, the amount of generation capacity in these individual generators was starting to be a significant fraction of the usable capacity of central station power generation.

Figure 1:

Although the total cumulative capacity represented by these (largely) diesel generators imports is estimated to be over 1 GW, a significant difference between these units and central-station coal and hydro power is their much higher fuel costs.

Fuel Use by Diesel and Gasoline Generators

As petroleum products in the DPRK are either imported (mostly from Russia and China) or refined from the limited crude oil supplies imported from China, fueling diesel or gasoline generators represent significant costs to their owners—on the order of $0.30 per kWh generated for diesel-fueled generators, and $0.80 per kWh for gasoline generators, based on recent anecdotal reports of fuel prices in the DPRK ($0.85 per kg for diesel, and $1.24 for gasoline).[5] These per-unit fuel costs are compounded by the relatively low average efficiencies of diesel- and gasoline-fired generators, particularly when operating at less-than-full loads. On the other hand, even at low capacity factors, the relatively low cost of these generators makes their capital costs per unit of output quite low, on the order of a few US cents per kWh. In addition, even though the fuel cost per unit output is high, if the annual use is low—maybe even 30 minutes per night, to charge batteries, which in turn provide power for lighting, small appliances, and charging electronic devices throughout the day. As such, for example, homes using gasoline generators may face annual fuel bills on the order of a few hundred to a few thousand dollars—significant, but probably affordable for richer households.

Although we have not yet completed our analysis of the DPRK energy sector for 2017, if we assume that average capacity factors for the cumulative stock of imported diesel and gasoline generators are even in the single digits in percentage terms (hundreds of hours per year) it implies that a very substantial fraction of the diesel and gasoline thought to be available to the DPRK, even including off-books trades, is being used by individuals, businesses, and organizations to generate power. This implies a competition for what fuel supplies do get to the DPRK between this off-grid electricity generation and the provision of services for passenger and freight transport.

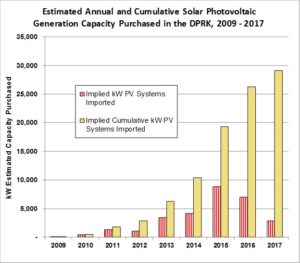

Imports of Photovoltaic Panels

Another, even lower-cost approach that many DPRK households, businesses, and institutions have taken to provide small amounts of power when grid electricity is unavailable is the use of small solar photovoltaic panels, which provide electricity at zero fuel cost.[6] Coupled with batteries and increasingly efficient LED (light-emitting diode) lightbulbs and fixture, these panels have sprouted from rooftops, balconies, and the sides of buildings in many locations throughout the DPRK over the last decade. Costs of PV panels, and of batteries and LED lights, particularly from China, have fallen significantly over time, and as a consequence, imports of these devices to the DPRK (almost all from China) rose significantly through 2016. Figure 2 shows estimated annual and cumulative imports of PV panels from 2009 through 2017. In the peak year of imports, 2015, approximately $8.5 million of devices in the solar PV trade category were imported by the DPRK. Over time, the average size of panels imported appears to have risen, from panels averaging a watt or less (perhaps 10 cm by 10 cm) to an average of over 10 watts (20 cm by 50 cm or so) by 2015. The total estimated cumulative capacity of PV panels imported by the DPRK, at nearly 30 MW by the end of 2017, remains quite small relative to both the DPRK’s overall power needs and the capacity of diesel and gasoline generators imported, but these affordable units—perhaps on the order of $10 to $40 each—provide much-needed energy services to DPRK households at a reasonable price. We estimate that the per-unit-output costs of ownership of these PV panels had fallen to on the order of $0.11 per kWh by 2017.[7] By way of comparison, this cost is still more expensive than DPRK grid electricity, which has historically been mostly un-metered; households have typically been charged a flat rate per month, sometimes based on an estimate of their usage, and sometimes not. Recently, electricity meters have started to be installed in Pyongyang, in some cases with prepaid cards allowing the use of a specific quantity of electricity, and the historically negligible charges for electricity have risen. Still, reports suggest that the base price of electricity charge is on the order of the equivalent of 0.45 US cents per kWh, rising to a still-low 4.5 cents per kWh for consumption over 100 kWh (presumably, per month).[8] Power provided by PVs therefore remains above even these recent higher electricity prices being charged in Pyongyang, but is much less costly, for example, than the outlays required if disposable batteries are used to power small devices.

Figure 2:

Note that it is our assumption that the vast majority of PVs used in the DPRK are imported from China, not manufactured in the DPRK. A KCNA [check] YouTube video shows an assembly line for PV panels in the DPRK, but we do not know what the capacity of this facility, and other similar plants, might be. We suspect, however, that whatever the capacity of these plants, they are significantly less than the volume of PV panel imports by the DPRK, and it seems highly likely that the basic PV cells assembled into panels by these plants are imported from China.

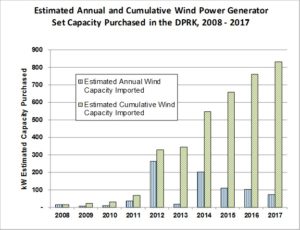

Imports of Wind Power Generators

The DPRK has significant wind resources in a few regions, including along the mountainous “spine” of the country and in the far Northeast, near the Russian border. Much of the rest of the nation has only moderate average annual wind resources. Although wind power has long been of interest to the DPRK, imports of wind power units have been modest relative to PV panels or diesel/gasoline-fueled generator sects. Figure 3 shows DPRK imports of wind power generators over the last decade. These peaked at an estimated 300 kW in 2012, and add up to a cumulative value of a bit over 800 kW by 2017. This is likely an under-estimate of the total wind power capacity in the DPRK, as there will likely be some domestically-produced (both factor-made and homemade) wind power generators. The operability of these domestically-made units, however, at least based on Nautilus’ visit to a factory in Pyongyang in 2000 (admittedly a potentially dated observation), may not be similar to that of imported units.

Figure 3:

Reported Imports of Generators, PVs, and Wind Power Have Fallen since 2015

An element of each of the graphs shown above is a decline in the imports of generating devices reported in customs statistics since 2015 (earlier for wind power). Exactly what has caused this decline we cannot say, but we expect that it is the result of a combination of factors, possibly varying by product, including:

- Possible saturation of the market for, in particular, small fuel-fired generators and solar PVs, as most of the households that can afford such units have already purchased them.

- Saturation in the market for the households and organizations that can afford the market costs for diesel and gasoline, or who have access to fuels through state distribution channels, as well as perceptions by potential generator buyers of possible restrictions in fuel supplies. It may be that the higher prices of diesel and gasoline experienced by DPRK consumers in the last two years (though prices have fallen again) have deterred potential buyers of generators.

- Slightly better supplies of grid electricity, and/or lower cost, higher-capacity batteries, allowing households to use grid electricity for more of their needs and/or use intermittent grid electricity, when available, to charge batteries for use during blackouts.

- A reduction in funds available to pay for imported generation equipment due to reduction in national and personal incomes due to UNSC sanctions on DPRK export commodities such as coal.

- Restrictions on imports to the DPRK due to enforcement of UNSC sanctions by Chinese authorities, and/or due to a reduction in exports by Chinese firms concerned about running afoul of sanctions by trading with the DPRK.

As our information on volumes of imports comes exclusively from customs statistics, it is possible, of course, that some or all of the decline in imports of these devices is not actually a decline at all, but merely reflects an increase in trades that occur “off-books”. Without admittedly difficult-to-obtain information on the extent of these trades (if they occur), we have no way of knowing how important this factor may be in explaining the overall reduction in reported exports to the DPRK.

Conclusions

Taken together with the recent trends in customs statistics on transport equipment that we described in earlier Special Reports, the data on generator imports described above reinforces a picture of a DPRK in which a more vibrant, modernizing, increasingly (at least functionally) market-based economy is providing households, business, and institutions with the wherewithal to invest in both off-grid electricity supplies and increased transport services. As these trends continue, it is possible that:

- A set of trade-offs for DPRK authorities and citizens/organizations buying fuels on the (partially open) market are coming into play (or already existing), in which there is a choice between generating power when the grid is not available or using more transport services. These choices will become more stark (or less) to the extent that UNSC sanctions on oil supplies are effective (or are not) in reducing the availability of fuels in the DPRK.

- Although it is unlikely to be important on a national scale, at least at present, the combination of solar PV purchases and the recent vast increase in the purchase of what are probably electric scooters and similar electrified personal transport (see our earlier Special Report) brings up some intriguing questions. Are DPRK households using solar PVs to charge scooter batteries? Are they using scooter batteries, charged by PVs, generators, or the grid, to provide other services, such as power for lighting, small appliances, and/or personal electronics (cell phones, DVD players, TVs)? If so, then the DPRK may be ahead of the curve in integrating electrified personal transport and electricity supply.[9]

- By spurring imports of off-grid generation equipment, the unreliable nature of the DPRK grid itself appears to have contributed to a degree of resiliency to the impact of sanctions on the part of, at least, relatively well-off households (including, for example, well connected party and military families). This means, that at least for these families—who control much of politics and the economy in the DPRK—the personal impact of sanctions on their lives may well be buffered significantly, depending in large part on the degree to which off-books oil supplies make it into the DPRK.

- Similarly, the purchase of generation equipment, including larger solar arrays and diesel generators, may have made some of the institutions targeted by sanctions, including military installations, more flexible in terms of energy supply, and less vulnerable to the impacts of sanctions.

- To the extent that the above turns out to be true—that private purchase of generation equipment has rendered DPRK decisionmakers less vulnerable to the impact of oil supply sanctions—the implication would be that other modes of working toward “denuclearization” of the DPRK, particularly engagement on energy issues, are likely to be more effective than attempts to further ratchet up sanctions.

- These individual purchases suggest that proceeding to refurbish the grid from “bottom-up” using micro-grids powered by renewables and limited coal-fired backup power may be more efficient than reconstructing the DPRK grid “top down” with a focus on large-scale generators.

III. ENDNOTES

[1] See, for example, Andrei Lankov (2017), “How North Korea’s electricity supply became one of the world’s worst”, NKNews.org, dated May 31, 2017, and available as https://www.nknews.org/2017/05/how-north-koreas-electricity-supply-became-one-of-the-worlds-worst/.

[2] David von Hippel and Peter Hayes (2018), “DPRK Motor Vehicle Imports from China, 2000-2017: Implications For DPRK Energy Economy”, NAPSNet Special Reports, August 23, 2018, available as https://nautilus.org/napsnet/napsnet-special-reports/dprk-motor-vehicle-imports-from-china-2000-2017-implications-for-dprk-energy-economy/.

[3] Available as https://comtrade.un.org/data.

[4] Nautilus’ updated estimates of overall electricity generation in the DPRK are still in process, but for 2014 we estimated the total output of DPRK coal-fired and hydroelectric generators at about 14,000 TWh (terawatt-hours, or billion kilowatt-hours), the equivalent of about 3 GW of capacity operated an average of about 50 percent of the time at full capacity (that is, at a 50 percent annual capacity factor).

[5] Hyonhee Shin (2018), “Exclusive: North Korean fuel prices drop, suggesting U.N. sanctions being undermined”, Reuters, dated July 24, 2018, and available as https://www.reuters.com/article/us-northkorea-economy-exclusive/north-korean-fuel-prices-drop-suggesting-u-n-sanctions-being-undermined-idUSKBN1KE15F.

[6] See our earlier Special Report on this topic: David Von Hippel and Peter Hayes, “Private Purchases of Solar Photovoltaic Panels in the DPRK: Signs of Green Growth on the Way?”, NAPSNet Policy Forum, dated January 13, 2015, and available as, https://nautilus.org/napsnet/napsnet-policy-forum/private-purchases-of-solar-photovoltaic-panels-in-the-dprk-signs-of-green-growth-on-the-way/.

[7] This calculation assumes an average PV unit lifetime of 15 years, and an average effective interest or discount rate of 15 percent/yr.

[8] See, for example, Joonho Kim, Leejin Jun, and Richard Finney (2017), “North Korea Installs Power Meters, Raises Rates in Pyongyang”, Radio Free Asia, dated 2017-11-07, and available as https://www.rfa.org/english/news/korea/power-meters-11072017112708.html.

[9] That is, the DPRK may already be implementing, after a fashion, the use of electric batteries as storage for intermittently-generated electricity, as has been proposed in many nations in recent years. We would be delighted to hear from colleagues who might have first-hand knowledge of any of these types of “crossover” uses of electric scooter or bicycle batteries, as they are just conjecture on our part, at this point.

IV. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent