By David Von Hippel

6 July 2015

I. Introduction

In this Policy Forum David von Hippel writes “With an eye on the Asian market, developers have proposed two LNG export terminals for the state of Oregon. Terminal developers and gas producers argue that there are substantial environmental and employment benefits to exporting LNG to Asia. The challenges faced by these proposed projects in receiving the myriad necessary construction and operation permits from federal, state, and local authorities, however, as well as consideration of the arguments going on between Oregon stakeholders at the state and local level, suggest caution is in order for East Asian nations in depending on substantial future LNG exports from the US before these (and other) terminals are actually built.”

David von Hippel is a Nautilus Institute Senior Associate working on energy and environmental issues in Asia, as well as on analysis of the DPRK energy sector.

This paper was originally published with support from the Hanyang University’s Energy, Governance and Security (EGS) Center, available in Global Energy Monitor Vol. 3, No. 4 (April 2015).

The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on contentious topics in order to identify common ground.

Banner image: Calistomon under under the Creative Commons Attribution-Share Alike 4.0 International license.

II. POLICY FORUM BY DAVID VON HIPPEL

Despite a recent drop in the prices of liquefied natural gas (LNG) in Korea,[1] as of late 2014/early 2015, Korean LNG costs remained more than three times the “citygate” price of natural gas in Oregon, in the US Pacific Northwest. As production of natural gas in the United States continued to climb over the past several years, this huge price differential has caused gas buyers in Korea and other major Asian LNG-using nations (Japan, China, and Taiwan), as well as gas producers in the US and Canada, to seek to export LNG from the US to East Asia. To minimize transport times and costs, LNG shipments from the US West Coast are preferred. With an eye on the Asian market, developers have proposed two LNG export terminals for the state of Oregon. Terminal developers and gas producers argue that there are substantial environmental and employment benefits to exporting LNG to Asia. The challenges faced by these proposed projects in receiving the myriad necessary construction and operation permits from federal, state, and local authorities, however, as well as consideration of the arguments going on between Oregon stakeholders at the state and local level, suggest caution is in order for East Asian nations in depending on substantial future LNG exports from the US before these (and other) terminals are actually built.

Pipelines are usually used to ship large quantities of natural gas over land from producers to consumers. Although undersea pipelines are sometimes used to cross stretches of ocean—the Langeled pipeline from Norway to the UK being a case in point—laying an undersea pipeline from North America to Asia remains impractical. Liquefied natural gas is natural gas that has been cooled to minus 160 degrees C. LNG has 600 times the density of natural gas at room temperature and pressure (and about half the density of water), making it possible to ship it around the world in ships fitted with huge refrigerated tanks that are essentially insulated thermos bottles. LNG is sent from and received by LNG terminals. There are two basic types of LNG terminals—import and export. Import terminals require berthing and off-loading facilities for LNG tankers (which are typically very large ships), huge tanks to store the offloaded LNG, “regasification” equipment to convert the LNG back into gaseous form, additional gas storage, and connections to distribution pipelines. Terminals for LNG exports require similar berthing and LNG storage facilities, and connections to incoming natural gas pipelines, but must also have “liquefaction” equipment that cools and compresses gas. The cooling and compression of natural gas require a significant amount of energy, supplied either as electricity to the plant, or with gas burned to drive compressors. Import terminals cost hundreds of millions to billions of dollars, while export terminals typically cost five to ten billion dollars or more. The energy needed to drive liquefaction means that export terminals typically have significant greenhouse gas emissions.

The two proposed export terminals in Oregon, were, when originally conceived, were slated to be export terminals. The first of the two terminals is the $6 billion “Oregon LNG” venture in Warrenton, Oregon, with export capacity of up to 9 million tonnes of LNG per year.[2] Oregon LNG is to be located near the city of Astoria in the northwest corner of the State, where the Columbia River meets the Pacific Ocean.[3] The second proposed terminal, the $5 billion, 6 million tonnes/year “Jordan Cove” facility is to be sited near the port of Coos Bay on the central Oregon coast. Although both are located close to natural and scenic areas, the sites for both have been zoned and previously used for industrial use.

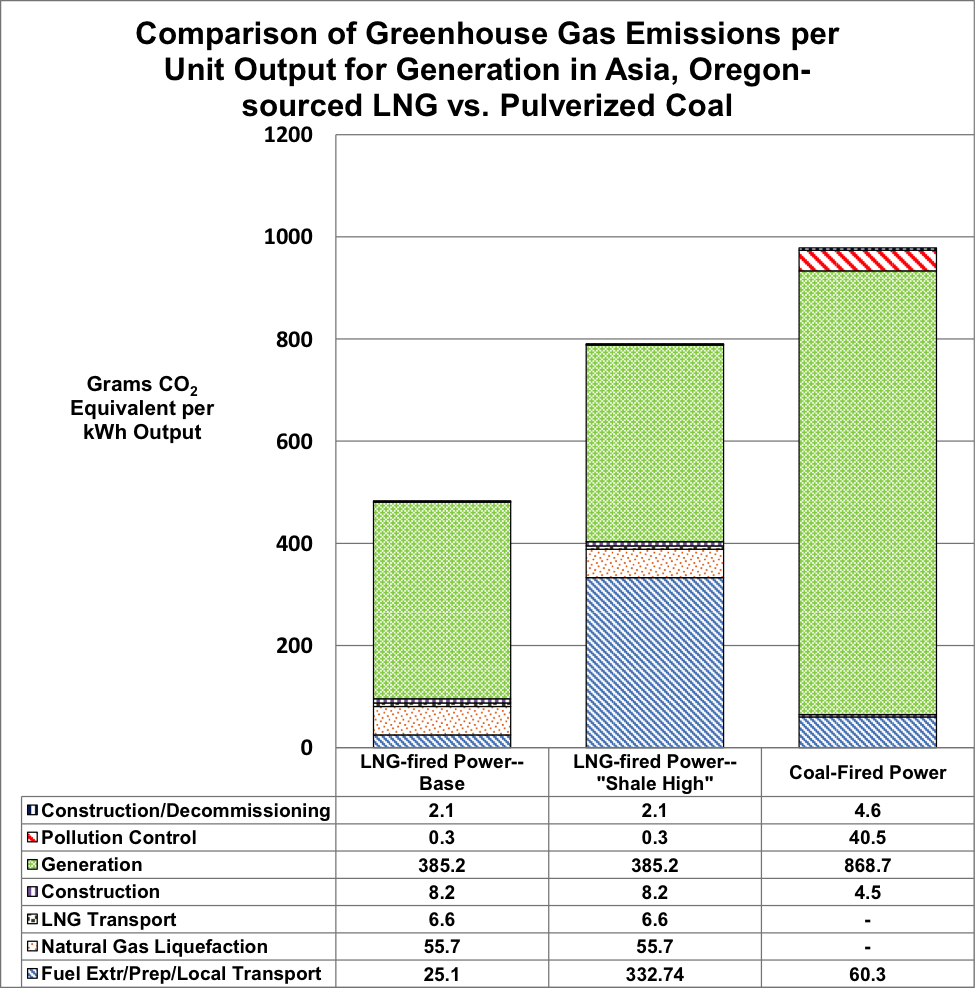

The developers of these projects tout their potential for reduction of emissions of carbon dioxide, as well as regional and local air pollutants, in Asian consuming nations, by displacing coal-fired power. The Chinese government’s stated goal of reducing coal-fired power use is cited by proponents of LNG exports as an indicator of the potential market for US LNG in Asia. The benefits of substituting gas for coal are indisputable for local and regional pollutants such as nitrogen oxides, sulfur oxides, and particulates. Estimating, however, the net difference in greenhouse gas (GHG) emissions between Asian coal-fired power plants or plants fueled with US natural gas is a more complex calculation. To do so, it is necessary to add to the emissions from operating gas-fired plants in Asia (emissions mostly associated with gas combustion) the emissions from processing and liquefying natural gas in the US, transporting gas to the export terminal by pipeline and from the export terminal by tanker, and leakages of methane to the atmosphere during gas extraction, processing, and transportation and distribution. The graph and table below compare the life-cycle GHG emissions from coal-fired power in China—assuming the use of fairly modern power plants and coal from China or nearby nations—with those associated with fueling gas-fired power plants (using combined-cycle technology) with LNG from the US Pacific Northwest.[4] When the comparison assumes average emissions of methane from conventional gas wells, the greenhouse gas emissions associated with generation of power in Asia using LNG from the US are about half of those from coal-fired power on a per kilowatt-hour (kWh) basis. This difference in emissions rates means that the gas from a terminal like those proposed for Oregon could fuel 7 to 10 gigawatts (thousand megawatts) of gas-fired power, and reduce annual GHG emissions by 20 to 30 million tonnes of carbon dioxide equivalent (CO2e). Put in perspective, the gas from one of these terminals could fuel on the order of 10 percent of the Republic of Korea’s generation fleet, or less than a percent of China’s.

The advantage LNG holds over coal with respect to GHGs, however, is eroded significantly if, as some investigations have suggested, natural gas produced by hydraulic fracturing (“fracking”) from shale formations in the US release much more methane per unit gas captured than typical gas production systems. Using one of the published higher estimates for methane emissions, as shown in the graph, reduces the GHG emissions benefits of LNG over coal by more than 60 percent. The average methane emissions from fracking per unit of gas output are not well-known—a limited number of measurements of leakage have been performed, and current estimates of leakage rates span a wide range—but will be an important factor affecting the net GHG emissions benefits to Asian nations of generating electricity with US LNG rather than coal.

Developers of the Oregon LNG and Jordan Cove facilities tout the employment benefits of the project. The projects are expected to provide on the order of a few thousand direct jobs, and thousands more indirect jobs, during the 4 or so years of construction. Following construction, the number of employees needed for routine operations decreases to 125 to 175 per terminal, with hundreds more indirect jobs created in the host communities to serve the facilities and their employees. In addition, the projects are expected to pay on the order of $50 million per year in property taxes, or, in the case of Jordan Cove, which is “eligible for a long-term, 19-year, exemption from local property taxes”, a voluntary payment of about the same magnitude in lieu of property taxes. As the host localities for these facilities have generally high rates of unemployment, and local governments that are chronically low on funds, the employment and income benefits offered by the facilities are a powerful inducement.

Even with local government backing—which is not necessarily universal—the developers of the two Oregon LNG projects must run a daunting gauntlet of local, state, and federal regulations before receiving final approval for and starting construction on the terminals. For example, while the overall decision as to where an LNG terminal in the U.S. may operate rests with the Federal Energy Regulatory Commission (FERC), the State of Oregon Department of Environmental Quality (DEQ) must review filings an sign off on permits for air quality (emissions of non-GHG air pollutants by the facility), wastewater and construction stormwater discharge permits, and emergency spill response contingency plans.[5] In addition, a number of federal agencies, ranging from the Army Corps of Engineers to U.S. Department of Transportation and U.S. Coast Guard, play roles in reviewing permit filings and plans related to the terminals. Finally, the counties and cities hosting the terminals and/or the pipelines feeding them must approve plans for everything from the siting of pipelines to the siting and operation of temporary workers’ housing. In all, over a dozen federal, state, and local agencies are involved in dozens of required filings and legal/administrative processes related to the terminals.

Agency consideration of almost all of the required filing and plans offer opportunities for input by the public, including from the community and non-governmental organizations such as environmental groups. These groups have raised concerns about issues ranging from the heavily local—such as the impact of temporary workers camps on traffic, local infrastructure, and community quality of life[6]—to the global, such as the impact of the terminal on global greenhouse gas emissions. In between these two poles of concern are arguments and apprehension about land use in pipeline right-of-ways, the impacts of LNG exports on gas prices for US consumers, the effect of LNG terminals on the State of Oregon’s plans to meet GHG emissions reduction targets,[7] the safety of LNG terminals (located on low-lying land that, in at least the Jordan Cove case, is in an earthquake and tsunami zone) in their small host communities, the vulnerability of terminals as terrorist targets, and many other issues. Further, although the difference between US gas prices and LNG spot prices remains sufficient to yield plenty of profits to be shared between exporters and importers, after the costs of liquefaction and export—on the order of $3 per GJ of gas energy,[8] or about 20 percent of current LNG costs in Asia— both LNG and US gas markets are volatile. There is therefore no guarantee that profits will remain as attractive as they are today throughout the 25-or-more year lifetime of the LNG export facilities.

One or both of the Oregon LNG or Jordan Cove gas export terminals may yet be built, but given the gauntlet of required approvals and opposition facing them, their path to being complete, operational, and operating is unlikely to be either smooth or quick. As such, for the sake of energy security, it seems prudent for the potential East Asian consumers of US LNG to press forward with the domestic programs for energy efficiency, renewable energy, and “green growth” that feature, to varying degrees, in each of their national energy plans. Doing so will serve the Republic of Korea and its neighbors well whether or not US LNG exports ultimately provide the economic and GHG emission benefits to Asian consumer that export proponents predict.

Image: Reuters

III. References

[1] See, for example, Andrew Walker (2015), “South Korea records big drop in LNG prices”, Natural Gas Daily, dated

23 February 2015, and available as http://interfaxenergy.com/gasdaily/article/15339/south-korea-records-big-drop-in-lng-prices.

[2] See the description on the Oregon LNG website, http://www.oregonlng.com/.

[3] The Jordan Cove project, which is being developed by the Canadian gas pipeline and gas processing/storage company Verensen, is descripted on the project’s website, http://jordancovelng.com/.

[4] Results shown calculated by the author based on data and results from a number of sources, including data on coal- and gas-fired power from Matthias Fripp (2009), Lifecycle Greenhouse Gas Emissions from Clean Coal, Clean Gas and Wind Generators, dated April 30, 2009, and “shale high” GHG emissions estimates from Robert W. Howarth, et al. (2011), “Methane and the greenhouse-gas footprint of natural gas from shale formations”, Climatic Change, June 2011, Volume 106, Issue 4, pp 679-690, as summarized in Figure ES-1 of Mark Fulton, Nils Mellquist, Saya Kitasei, and Joel Bluestein (2011), Comparing Life-Cycle Greenhouse Gas Emissions from Natural Gas and Coal, which is available as http://www.worldwatch.org/system/files/pdf/Natural_Gas_LCA_Update_082511.pdf. The calculations shown assume average efficiencies for newer coal and gas plants in China, but are similar to average efficiencies for similar plants in the Republic of Korea.

[5] See, for example, Oregon DEQ (2014), Oregon LNG Questions and Answers, available as http://www.oregon.gov/deq/NWR/Documents/ORLNG/ORlngQA.pdf.

[6] As two of many examples, see Citizens Against LNG (2015), “LUBA Remands Jordan Cove Worker Camp permit back to the City of North Bend”, available, along with links to other news articles about the Jordan Cove project, at http://citizensagainstlng.com/wp/2015/02/02/luba-remands-jordan-cove-worker-camp-permit-back-to-the-city-of-north-bend/; and Portland Business Journal (2014), “Astoria LNG opponents: Developers may not have permission to build terminal”, dated Dec 23, 2014, and available as http://www.bizjournals.com/portland/blog/sbo/2014/12/astoria-lng-opponents-developers-may-not-have.html.

[7] Under typical rules for accounting of GHG emissions, for example, the additional emissions from LNG liquefaction on Oregon soil would be counted as Oregon emissions, but any savings in GHG emissions in Asia through importing of LNG instead of Coal would not contribute toward Oregon’s emissions reduction targets. The Jordan Cove facility would be one of the biggest emitters of GHGs in the state. The Oregon LNG project near Astoria would use mostly hydroelectric Northwest grid power to compress LNG (unlike Jordan Cove, which will build its own gas-fired power plant), but to the extent that the additional 400 MW required by the Oregon LNG facility would increase gas-fired grid power generation, the net GHG emissions difference between the plants might not be that large.

[8] Rough estimate by the author based on a number of literature sources.