David von Hippel and Peter Hayes

September 12, 2017

I. INTRODUCTION

In this essay, David von Hippel and Peter Hayes review estimates of the fraction of North Korean refined product imports and total oil imports that will be affected by UNSC Resolution 2375. They find that (assuming the sanctions contained in the Resolution function as designed), refined product imports will be cut by about 60 percent; and total oil imports by about 26 percent (relative for a pre-sanctions forecast for DPRK 2017 oil usage). They also note that the DPRK can quickly adjust its refined product use by substantially as much as, perhaps more than the cuts imposed by the sanctions. They conclude that oil sanctions are likely to have little or no impact on the DPRK’s missile or nuclear program.

Note: this essay was updated and revised on September 12, 2017, at 6pm Pacific Standard Time. Also, UNSC Resolution 2375 text is now available here.

David von Hippel is Nautilus Institute Senior Associate. Peter Hayes is Director of the Nautilus Institute and Honorary Professor at the Centre for International Security Studies at the University of Sydney.

Acknowledgment: This report was funded by MacArthur Foundation.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

Banner image: North Korean diesel tractor, Unhari village, Nautilus Institute photo.

II. NAPSNET POLICY FORUM BY David VON HIPPEL AND PETER HAYES

IMPACT OF UNSC RESOLUTION 2375 ON DPRK OIL IMPORTS

September 12, 2017

On September 11, 2017, the United Nations Security Council (UNSC) passed Resolution 2375 (2017), which strengthens sanctions on the Democratic Peoples’ Republic of Korea (DPRK) in the wake of the latter’s sixth nuclear weapons test on September 2, 2017. As of time of writing, the approved text of the resolution and any explanatory annexes it may contain are not on-line and press reports have varying and sometimes contradictory accounts of what it says.

However, the US Mission to the UN stated that: “This resolution reduces about 30% of oil provided to North Korea by cutting off over 55% of refined petroleum products going to North Korea.”[1]

This outcome will be achieved, the US Mission to the UN continued, by “imposing an annual cap of 2 million barrels per year of [imports of] all refined petroleum products (gasoline, diesel, heavy fuel oil, etc.).”

The US Mission to UN Fact Sheet added that North Korea “currently receives about 8.5 million barrels of oil/petroleum: 4.5 million in refined form and 4 million in crude form.” The Factsheet also notes: “The resolution freezes the current amount of crude oil provided to North Korea by banning countries from providing additional crude oil beyond what China provides through the Dandong-Sinuiju pipeline.”

The Dandong-Sinuiju pipeline has historically, for most of the last two decades, been the major source of crude oil imports to the DPRK. Crude oil passing through the pipeline is refined in the DPRK’s refinery at Sinuiju. This clause pertaining to imports of oil to the DPRK through the pipeline is the key to interpreting the sanctions.

The resolution also bans importation outright of all natural gas and condensates to prevent North Korea from obtaining substitutes for oil imports.

Ambiguities in the Resolution

There are some ambiguities in this Resolution, at least as described in the Fact Sheet, that cannot be readily resolved without additional information, though the overall meaning seems relatively clear. First among the ambiguities, there is no such thing as a “barrel of refined product” as each type of refined product has a different energy content and density. For example, gasoline, being lower in density (though higher in energy content per unit mass) than diesel oil or heavy fuel oil, has a lower energy content per barrel than those fuels. Thus, there is no simple and precise way to interpret a cap on such as “2 million barrels per year of all refined petroleum products”. As stated, it means North Korea could import any mix of these fuel types provided that the volumetric sum is no greater than 2 million barrels.

In practice, this may not be too much of an issue, as the DPRK may not be able to quickly change the relative proportion of the fuels it would use for its existing equipment and vehicles, but there may be some difficulties arising from the ambiguous description of the sanctioned products when it comes time to enforce this clause. The accounting methodology related to implementation may be stated in an annex to the resolution; but if not, this phrasing presents problems for monitoring and tracking energy flows and determining compliance.

Second, although we assume that the resolution should be interpreted as limiting imports to the DPRK (or exports from other nations to the DPRK) of refined product to no more than 2 million barrels, the text of the Factsheet is somewhat ambiguous in its phrasing. If it refers to the DPRK as being able to import no more than 2 million barrels of refined product overall, whether imported as refined product, or produced in the DPRK from imported crude, then the sanctions are far more stringent than appears at first glance. This is unlikely, however, to be the case because the the level of current Chinese crude exports untouched by sanctions would give the DPRK more than 2 million barrels of refined product overall in any case—which would be contradictory. Therefore, we assume that the cap of 2 million barrels of refined product refers only to imports of refined product, not to overall use of products from imported oil, whether it is refined product or crude oil from which refined product is derived.

Finally, the figures given for total oil use in the DPRK of 8.5 million barrels, of which 4.5 million is refined product, and 4 million is in crude oil form, comes from an unstated source, though it is plausible based on our our rough estimates of overall 2017 DPRK oil use (see below).

Estimating the oil sanctions

Based on our September 5 2017 analysis,[2] a total of 2 million bbl of refined product is approximately the level of net imports (the DPRK also had some minor exports of oil products) that we estimated the DPRK to have had in 2010 (we estimate 2.2 million). The estimate in our September 5 report suggests that net oil products imports in 2017 would have been in the range of 4 to 5 million bbl, which is more or less consistent with the 4.5 million bbl stated in the US Mission to UN Fact Sheet.

Crude oil exports from China to the DPRK, as recorded in Chinese customs statistics, were in the range between about 470 and 580,000 tonnes in each year between 2001 and 2013, which was the last year that China reported crude oil exports to the DPRK. We estimate (based on end use analysis) that crude oil exports have continued at about 500,000 tonnes per year since 2013. Different crude oils have slightly different energy contents per unit volume, but using a conversion of 7.33 barrels or bbl/tonne for 500,000 tonnes of imports of crude oil from China yields about 3.7 million barrels per year.

Our estimate for 2010 was that the DPRK imported about 590,000 tonnes of crude oil which converts to about 3.4 million bbl. Summing our own estimates for crude oil and refined products imports for 2017 suggests that the US Mission to the UN estimate of 4 million barrels per year is plausible. And the total crude oil and oil products imports to the DPRK in 2017 really might be in the range of 8.5 million bbl, as the Fact Sheet indicates, especially if China and Russia provided the UNSC with current export information.

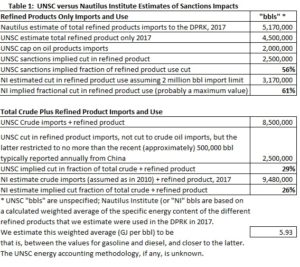

We summarize what is known and estimated in Table 1. We should emphasize again that our estimate of oil products imports is very rough, and is based on an assessment of what volumes of oil products the DPRK would have needed in 2017, assuming growth in end-uses from 2010 and oil product availability from the DPRK refinery similar to that of 2010. That is, our assessment of DPRK oil products imports is not based on a summation of the oil products known to have been exported to the DPRK (that is, appearing in customs statistics), because we believe that many oil products shipments to the DPRK are, in fact, not appearing in customs statistics.

In short, the results shown in Table 1 suggest that sanctions would cut refined product imports by about 56% (whereas our estimates suggest more like 61 percent if imports are limited to 2,000,000 barrels because we suggest imports were higher at 5,170,000 barrels to begin with–although this figure should be considered an upper-limit estimate. The difference is impossible to resolve without access to the energy accounting methodology used by the UNSC to aggregate refined products into “barrels,” and to the data used by the UNSC to accomplish their estimate of oil products imports.

The figures provided by the US Mission to the UN imply that the DPRK would forego about 29% of total imported oil from crude and refined product; whereas our estimate is lower at 26%, based on our rough estimate of pre-sanctions refined product demand in 2017, which yields a a total import figure slightly higher than that used by the UN (though, as noted above, it may well represent a maximum value for 2017 oil imports).

But overall, these figures generally align. If the sanctions work as intended (that is, are not circumvented in some of many possible ways by smuggling etc.), then sanctions significantly reduce the DPRK’s future oil products imports and use, relative to current levels (putting them back to where they were in about 2010); but will have no significant effect on crude oil imports, relative to recent levels.

The levels of reduction outlined above for refined product are unlikely, for the reasons we outlined in our September 5 report, to have a significant impact on the DPRK military or nuclear weapons/missile programs. These military sectors will have priority access to refined fuels, including likely fuel from caches of significant volume that have already been stockpiled and provide a substantial buffer against the sanctions. Primarily these sanctions will affect the civilian population whose oil product uses are of lower priority to the DPRK state.

Impacts of oil and textile sanctions

The DPRK will quickly effect a combination of additional energy end use efficiency, outright cuts, and substitution of non-oil energy forms to manage the cuts. We estimated in our September 5 report (Table 2) that seven measures along these lines could cut the equivalent of 3.7 million bbls of crude oil use per year—more than enough to offset the cuts imposed by this sanctions resolution.

Moreover, the more that the DPRK invests now in these workarounds, the more resilient it becomes against future sanctions-driven cuts. The cost of imposing these sanctions now when they will have little effect on the desired goal—reversing the DPRK’s missile and nuclear programs—is that the UNSC members will have even less leverage in the future when it is most needed—which is when the DPRK needs some “suasion” to meet the United States in talks over freezing, dismantling, and disarming its nuclear weapons over the coming years—or decades.

It is also noteworthy that the new sanctions also bans exports to the DPRK of natural gas and natural gas liquids. These fuels are not widely used in the DPRK, and the DPRK largely lacks the infrastructure to use, especially, natural gas. As a consequence, this ban will have no immediate effect on DPRK energy use, though it might cut off some options for fuel switching in the medium term (many months to years) that the DPRK might have implemented.

Finally, we note that the resolution added a ban on textile exports from the DPRK to cut off a source of foreign exchange earnings. The US Mission to the UN suggested that textile exports “earned North Korea an average of $760 million in the past three years.” Speakers to the UN Security Council deliberations suggested that this figure was $800 million.[3]

Although that may indeed be true, it is only part of the story. Textile exports from the DPRK are value-added goods for which components were imported from China (that is, cut cloth is exported to the DPRK, it is sown into clothing and other articles in the DPRK, then re-exported back to China). The value of those components imported to the DPRK for textile processing and then re-exported appear in China’s customs statistics. The net income to the DPRK—assuming that the labor used to finish the garments and other goods was paid relatively little by those running the factories in the DPRK—may have been in the range of few hundred million dollars annually. Thus, the net effect on income, if the sanctions are enforced and effective, will be much less than the $760 million annually implied in the US Mission to the UN Fact Sheet.

III. REFERENCES

[1] “U.S. Mission to UN (2017), FACT SHEET: Resolution 2375 (2017) Strengthening Sanctions on North Korea, dated 2017-09-11, 22:34 17.603, GMT”, available as https://usun.state.gov/remarks/7969.

[2] Peter Hayes and David von Hippel, “SANCTIONS ON NORTH KOREAN OIL IMPORTS: IMPACTS AND EFFICACY,” NAPSNet Special Reports, September 05, 2017, https://nautilus.org/napsnet/napsnet-special-reports/sanctions-on-north-korean-oil-imports-impacts-and-efficacy/

[3] “Security Council Imposes Fresh Sanctions on Democratic People’s Republic of Korea, Including Bans on Natural Gas Sales, Work Authorization for Its Nationals, Resolution 2375 (2017) Also Takes Humanitarian Situation into Account as Members Urge Resumed Talks on Denuclearizing Korean Peninsula,” September 11, 2107, at: https://www.un.org/press/en/2017/sc12983.doc.htm

IV. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent

10 thoughts on “IMPACT OF UNSC RESOLUTION 2375 ON DPRK OIL IMPORTS”