by Woo Jin Chung

Korea Energy Economics Institute, Republic of Korea

22 July 2014

I. ABSTRACT

This paper presents the status of energy supply and demand in the Republic of Korea (ROK), as well as a description of current and recent policies related to the future of the Korean energy sector. The paper outlines the past and current energy situations of Korea, showing the trends in and features of energy demand, as well as the current structure of energy supply and the ROKs dependence on overseas sources of fuels. Also explored are the energy policies and factors affecting Korea’s future energy supply and demand. The Korean government has for the past five years pursued a “Low carbon, Green growth” policy, featuring goals including reducing fossil fuel use, improving energy efficiency, and expanding the supply of nuclear power and renewable energy. A market-based approach was adopted as a key means to attain the targets of energy policies established in the first national energy plan in 2008. The Korean government, however, has failed to raise tariffs, a step that is required in order to achieve the desired impacts from market-based pricing systems in the public electricity and gas industries. Energy efficiency in the ROK, since 2008, has not improved, but rather deteriorated, with overall sharp increases in electricity and gas consumption. The disaster, initiated by the tragic Sendai earthquake and tsunami, that destroyed several units of Japan’s Fukushima nuclear power plant in March, 2011, has had an impact on Korean energy policy in that it has significantly delayed, and possibly even permanently affected, plans for expanding nuclear power capacity as a means to achieve a society with “low carbon energy and an energy efficient economy” in Korea. There is a likelihood that the proportion of nuclear energy projected in the first national energy plan will fall in the future energy mix. If so, Korea’s use of fossil fuel energy will likely increase, which will create a conflict with low carbon policies. The second national energy plan, setting out general energy policies through the year 2035, was scheduled to be released at the end of 2013. Though it has yet to be released, as of this writing, it is likely to be quite different from the first one. The Park Geun-hye government, which took office in February of 2013, is facing a host of challenges, including resistance to raising electricity tariffs and determining how to reduce carbon dioxide (CO2) emission under circumstances where nuclear electricity output is lower, and fossil fuel use is higher, than targets set in the first energy plan.

II. INTRODUCTION

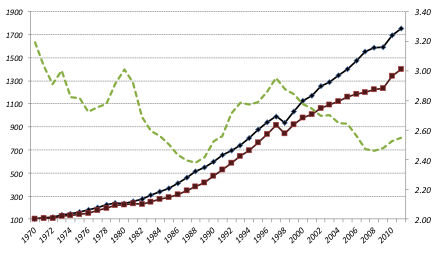

The land area of the Republic of Korea is comparatively small, at 98,480 km2, but the ROK economy is the world’s twelfth largest in terms of GDP, and the world’s seventh largest in terms of energy consumption. The ROK has limited natural resources and is highly dependent on external sources of energy. The country has no oil and very limited reserves of natural gas. The ROK currently produces only small amounts of anthracite coal, though anthracite was the ROKs main energy source before the last few decades. Korea’s economy has grown rapidly, with an average annual growth rate of 7.1% during the period from 1970 through 2012. Accompanying this high economic growth, the ROK’s energy consumption has also shown rapid growth. During the 1970-2012 period, the ROK’s economy and energy consumption rose by factors of 18 and 14, respectively, as shown in Figure 1.

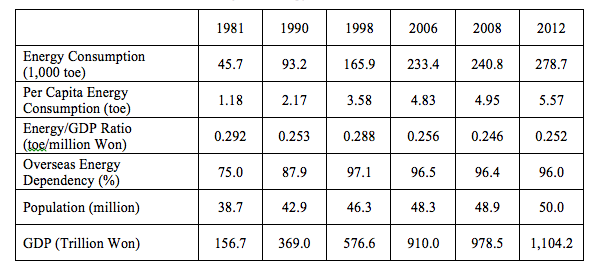

Korea consumed 279 million toe (tonnes of oil equivalent) of primary energy in 2012 and imported 96.0% of the energy consumed. Energy efficiency, as indicated by energy consumption per unit of GDP, rose from the mid-1980s through 1997 as a result of the economic growth led by energy-intensive industries such as petrochemical, steel and cement sectors. The Korean economy, however, suffered from the impacts of the Asian financial crisis of 1997. From 1998 through the global financial crisis of 2007/8, there has been an effort to change Korea’s industrial structure to make it less energy intensive. Although energy efficiency (energy per unit of GDP)slowly improved as a result of these policies, as well as other global economic shifts, it has deteriorated (that is, energy per unit of GDP has increased) since 2008, mainly as a result of pricing policies that have maintained low tariffs for energy products such as electricity and town gas. Energy consumption per capita grew very rapidly from 1970 to 2000, but the rate of increase of energy use per capita has slowed since 2000 as the ROK economy has shifted to less energy-intensive industries, and as the economy has matured to developed-country status. Table 1 shows the trends in major energy and economic indicators for the ROK since 1981.

Figure 1: Economic and Energy Consumption Growth in Korea

Source ; KEEI, Yearbook of Energy Statistics, 2013

Table 1: Major Energy/Economic Indicators

Source ; KEEI, Yearbook of Energy Statistics, 2013

II. trends in energy demand and supply

Energy Demand

Oil is the dominant energy source in Korea, but its share of total energy demand has fallen from the peak of 63% of total primary energy consumption (TPEC) in 1994 in response, in part, to strong measures taken by the Korean government to reduce the consumption of oil products, particularly in industry and for electricity generation. The share of oil stood at just 38.1% in 2012, and is projected to continue falling over time, but at a decreasing rate. Coal has the second highest share of total primary energy use. Anthracite coal produced in Korea accounted for the major part of coal use before the mid-1990s, but the production of domestic coal has sharply decreased since that time as a result of the implementation of policies to close most coal mines due to low productivity and high labor costs as the depth of mines increased. The consumption of bituminous coal has significantly increased as the use of anthracite coal was reduced, and in response to the need of Korean industry for coal with a higher heat content than typical domestic anthracite coals. Korea imports all of the bituminous coal that it uses from a number of supplier nations, with Australia and Indonesia being key suppliers in recent years. Coal is accounted for 29.1% of TPEC in 2012, as shown in Figure 2, including 2.1% as anthracite coal. The third major fuel type used in the ROK is natural gas, which accounted for 18.0% of primary energy use in 2012. Natural gas was introduced in the ROK in 1986 when Korea Gas Company (KOGAS) imported it in the form of liquefied natural gas (LNG) from Indonesia. Since that time, natural gas consumption has rapidly increased as the industry and household sectors prefer natural gas to other forms of fossil energy because it is clean and convenient to use.

Figure 2: Trends in Primary Energy Shares by Source

Source ; KEEI, Yearbook of Energy Statistics, 2012

The share of nuclear energy was 11.4% of TPEC in 2012. The first nuclear power plant in Korea was built in 1979 using technologies imported from France. The ROK government has encouraged policies to raise the share of nuclear energy because nuclear power is considered a means to reduce overseas energy supply dependency, and emits no greenhouse gases. Nuclear power has become a major source of base load generation, but nuclear energy’s shares of TPEC has fallen slightly in recent years, from 13.1% in 2009, because the consumption of other energy forms, such as natural gas and bituminous coal, have increased faster than that of nuclear energy. The contribution of hydroelectric energy to TPEC is negligible (0.6% in 2012) because the ROK has very limited hydro resources. Renewable energy accounted for 2.9% of TPEC in 2012, though the government has tried to significantly increase its share through various programs of subsidies for developing renewable energy technologies generally, and for promoting the adoption of distributed renewable energy systems in particular. Currently, the largest source of renewable energy is municipal solid wastes used for electricity generation.

The total final energy consumption (TFEC) in the ROK was recorded at 208 Mtoe (million tons of oil equivalent) in 2012, and has more than doubled over the last 20 years. Oil products hold the largest share of final energy consumption, just as oil does as in primary energy use, accounting for 48.9% of TFEC in 2012. The second largest share of final energy consumption is use of electricity, which accounted for 19.3% of TFEC in 2012. Almost all direct consumption of coal is in the industrial sector, accounting for 15.4% of overall 2012 final energy consumption. The share of town gas is 11.9%; town gas is mainly used for cooking and heating in households and buildings. Renewable energy contributes 3.4% of TFEC. Biofuels and wastes derived from biomass are still the main sources of renewable energy at the end-use level, with solar photovoltaic (PV) and wind power energy just beginning to contribute to energy use at the end-use level. Heat energy accounted for less than 1% of TFEC in 2012. Heat in the ROK is produced in boilers fired by bituminous coal and natural gas, and distributed through pipelines to households and buildings for heating in Seoul, the capital city of Korea, and its neighboring cities.

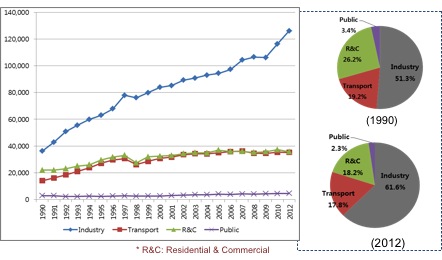

As shown in Figure 3, the industrial sector absorbs the largest share of TFEC, accounting for 61.7% of energy demand in 2012. The transport and residential & commercial sectors accounted for 17.8% and 18.2% of 2012 TFEC, respectively, and other sectors accounted for the remaining 2.3% of the total. This pattern of energy demand by sector contrasts with past shares of demand in some key sectors. For example, shares of TFES were 51.3% for industry and 26.2% for residential & commercial in 1992. In the past two decades, the demand share of industry has significantly increased, while the share consumed by the combined residential& commercial has decreased due to a combination of improved efficiency and reduced growth rate due to a combination of declining population growth in the ROK, and as the adoption of new energy-using devices by ROK households has moved toward saturation as ROK incomes have increased to developed-country status.

Figure 3: Trends in Final Eenergy Consumption

Fossil Fuels Supply and Imports

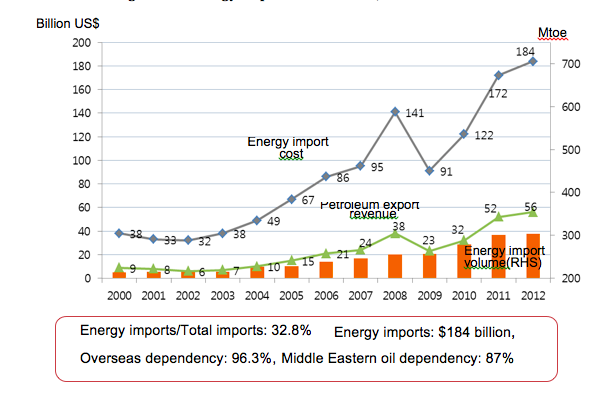

Korea imports almost all of the energy it consumes except for anthracite coal, which is the major fossil fuel produced in Korea, and a very small volume of natural gas produced in South Korea’s East Sea. The ROK’s dependency on overseas energy has remained above 90% for the past 20 years, and was 96% in 2012. Along with this high overseas energy dependency, the ROK’s energy import costs have sharply increased since 2004, when international oil prices began to rise. The ROK’s bill for energy imports amounted to 184 billion dollars in 2012, an increase of nearly five-fold from the 38 billion dollars paid for imported fuels in 2004. As shown in Figure 4, the volume of energy imports, on the other hand, increased just 1.5 times during the same period, which means that the sharp increase in overall energy import costs has been due primarily to the rise of energy prices, rather than increases in energy demand. Korea`s energy import cost accounted for 32.8% of its total imports of goods and services in 2012, and constituted a significant burden to the economic policies and management.

Figure 4: Energy Imports to the ROK, Cost and Volume

Korea spent 129 billion dollars for imports of crude oil and petroleum products in 2012, with an additional 27 billion dollars spent for natural gas imports, and 15 billion dollars spent on coal imports. 84% of the crude oil imported by the ROK was delivered from Middle Eastern countries such as Saudi Arabia and Kuwait. These suppliers were used due to lower transport costs from the Gulf region, and also because the properties of Middle East crude oils are well suited to the technical requirements of Korean refinery facilities. Korea has for a number of years tried to diversify the regions from which it sources crude oil imports, but the high dependency on the Middle East has not improved markedly. Although Korea has poor indigenous oil resources, it has oil refining facilities with a total capacity of 2.8 million barrels per day, surpassing average domestic petroleum consumption (about 2.2 million barrel per day). With this surplus capacity, Korea has the capability to export a lot of petroleum products, and its export have significantly increased as world petroleum prices have risen. The ROK’s oil product exports were recorded at more than 56 billion dollars in 2012, making oil products the number one export commodity by value in Korea. The petroleum products refined in Korea are exported mainly to Asian market like Japan, China and Singapore, but smaller amounts of ROK oil products are sometimes exported to the USA and other regions.

Natural gas imports have shown a rapid increase since Korea first began importing gas in 1986. The ROK imported 46.8 bcm (billion cubic meters) of natural gas from nine countries, such as Indonesia and Qatar, in 2012. Gas was imported as LNG (Liquefied Natural Gas) in tanker ships. Imported LNG is regasified, then distributed throughout the country via a nationwide gas pipeline networks. Regasification takes place at the four gas import terminals located in the western and southern areas of Korea. KOGAS (Korea Gas Corporation, a company owned by the ROK government) is the sole gas importer, except for some industrial companies that import gas directly, typically in smaller volumes for their own uses. KOGAS is also the wholesaler that owns and operates gas trunk lines and storages in Korea. In recent years, 80-90% of LNG imports have been purchased under mid-to-long-term contracts, which usually included take-or-pay clauses (requiring the ROK to accept specific volumes of gas annually) and contract prices are indexed to oil prices such as like Japan’s oil import prices.

In order to diversify its sources of gas, and to reduce its gas costs, KOGAS has contracted for 3 million tons of LNG, derived in part from shale gas, to be supplied to Korea in 2017 via LNG exports from a US company Cheniere[1]. It is the first time that KOGAS has arranged to import LNG from North America. The price in the contract is linked to the price of natural gas at the Henry Hub, where prices of gas on the spot market in the United States are set. KOGAS and Gazprom (Russia’s state-owned gas company) signed a memorandum for 25 years of supply of natural gas starting in 2017, with gas to be sourced from fields in East Siberia to the ROK. Under this arrangement, the ROK would receive gas, via pipeline passing through North Korea, or via pipeline to Vladivostok, with transport to the ROK by sea. The plan to import Russian gas to the ROK has been under discussion for many years, but progress has been limited due to the political sensitivities between the two Koreas. A delay in the start date for imports of gas from Russia beyond 2017 seems likely.

KNOC (the Korean National Oil Corporation) is producing 0.41 bcm of natural gas, less than 1% of total natural gas consumption in Korea, from a field offshore of the Korean East Sea, which is the ROK’s only gas producing field. Proven natural gas reserves in Korea were estimated at a little more than 1.0 bcm as of the end of 2012. Korea is also exploring gas in the deep sea area of the East Sea area where huge reserves of gas hydrates are estimated to exist.

As of 2012, Korea’s coal imports were the world`s third largest, following Japan and China. Coal imports have been rapidly increased as coal power generation has become the backbone of the Korean power system. 80.6 million tons of fuel coal (steam coal and anthracite coal) were supplied for power generation (43% of the fuel input to power generation) and industries (24.2% of industrial energy use) in 2012. Major coal exporters to Korea are Australia, Indonesia, Canada and Russia. All coal is imported by Korean companies that use and by coal trading companies. Five anthracite coal mines are operating in the ROK; together they produced less than 2.3 million tons of coal in 2012, a substantial decrease from 23.6 million tons of production in 1986. The Korean government has made a policy of closing most domestic coal mines since the late 1980s as the productivities of most mines had significantly declined over time. The ROK government does, however, intend to keep a small amount of domestic coal production active as an energy security measure, as anthracite coal is the only significant fossil fuel produced in Korea. In order to keep domestic coal mines operating, the ROK government subsidizes the production of coal, though production costs at mines in the ROK are higher than the prices of imported coal, and also higher than the prices paid for coal (imported or domestic) by ROK consumers.

Electricity and Nuclear Power

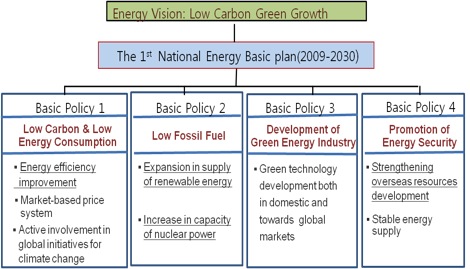

The total electricity generating capacity in Korea increased by more than a factor of three over the past 22 years, from 21 GW in 1990 to 81.8 GW in 2012. Coal-fired power plants constitute the largest portion of capacity (at 25.1 GW), followed by natural gas-fired plants (21.9 GW, most of which are combined-cycle plants ) and nuclear power plants (20.7 GW). The remainder of generating capacity is made up by hydro (6.4 GW, of which 4.7 GW are pumped-storage hydroelectric plants used to store energy for use during times of peak power demand[2]), oil-fired capacity (5.3 GW) and a very small amount of capacity based on non-hydro renewable energy sources. Electricity generation in the ROK reached 510 TWh in 2012, meaning that an average annual growth rate in output of 3.8% has prevailed since 1990. 65% of the ROK’s electricity was generated in coal-fired (35.5%) and nuclear (29.5%) power plants, with most of remainder coming from natural gas (22.4%), complemented with smaller shares produced from hydro (1.5%) and non-hydro renewable energy (1.7%). 53% of electricity is consumed by the industrial sector, followed by the combined residential and commercial sector (40%) and the public sector (5%). Figure 5 shows the current patterns of electricity capacity and generation by source in the ROK.

Figure 5: Electricity Capacity and Generation by Energy Source (2012)

Source : Korea Power Exchange, 2013.7

The state-owned Korea Electricity Power Corporation (KEPCO) has historically dominated all aspects of electricity generation, transmission and distribution in the ROK. Under an electricity sector reform and restructuring policy begun in 1999,[3] KEPCO’s generation holdings were broken up into six separate subsidiary power generation companies. Although the initial restructuring policy nominally included plans to subsequently divest KEPCO of these generation companies, excluding the Hydro and Nuclear Power Company, KEPCO continues to wholly own each of the subsidiaries, it continues to act as the nation’s electricity retailer, and also continues to control electricity transmission and distribution.

The Korea Power Exchange (KPX), established in 2001 as a part of the electricity sector reform efforts, serves as the system operator and coordinates the wholesale electricity power market. KPX regulates the cost-based bidding-pool market and determines the process whereby power is sold between generators and the KEPCO grids. The market is based on a cost-based pool with prices reflecting generation cost. All generators must submit their production costs to KPX. With this information, KPX prepares a price setting schedule (PSS) and calculates the system marginal price (SMP), which is most expensive generating cost at any given time. The SMP values for each trading period (one hour) during the year are calculated. After a process of real-time dispatching, settlements for the energy produced and purchased take place according to the prices set in the market (SMP plus a capacity payment). The capacity price is calculated yearly and is based on the unit construction cost and unit maintenance cost of a new gas turbine. The participants in the power market must meet a specific set of technical requirements, comply with the obligations of market rules, and register as KPX members.

Although wholesale prices are set in the KPX, all changes in end-use electricity tariffs must be approved by the government. In principal, the end-user tariff is determined at a level that compensates the distribution companies for the overall cost required to supply power to consumers. In practice, however, the actual tariffs have not reflected the full cost of electricity production, resulting in big losses for KEPCO. In June 2009, the government announced plan to introduce a new electricity pricing system that moves in line with global energy prices and allows KEPCO to pass fuel costs on to consumers. This plan, however, has been suspended, and KEPCO continues to accrue financial losses as a result of average tariffs remaining lower than costs of generation.

Korea has the sixth-largest nuclear generation capacity in the world. The government has tried to increase nuclear power capacity as a part of its effort to reduce the imports of fossil fuels since the first nuclear plant came on line in 1978. Korea Hydro and Nuclear Power (KHNP) currently operates all of the nuclear power units located at the four nuclear power plant sites in Korea. At present, there are 23 nuclear power units in operation and five more are under construction. Four of the 23 units are pressurized heavy water reactors (PHWRs), while the rest are pressurized water reactors (PWRs). Four of the reactors under construction are advanced PWRs. According to the Korean government’s fifth basic plan of Electricity Supply and Demand, as announced in 2010, additional reactors are scheduled to be completed by 2024, with the goal of generating nearly half of the nation’s power supply from nuclear sources. All Korean nuclear reactors have maintained over 90% availability, making their performance well above the world average of around 80%. Korea is fully dependent on foreign countries for its supply of natural uranium, as well as for uranium conversion and enrichment services. The Korea Atomic Energy Research Institute (KAERI) has a pilot plant for converting yellow cake (U3O8) to uranium dioxide (UO2), but because it is politically sensitive, this plant is not yet in operation.

Spent nuclear fuel in Korea is currently stored at the reactor sites. Spent fuel totaling about 13,000 metric tonnes of uranium (MtU) was in storage as of September of 2013, with the total on-site pool capacity being 16,927 MtU. The amount of spent fuel in storage is expected to reach the existing spent fuel storage capacity by 2016, and this may limit future nuclear power expansion unless policy decisions are taken soon to address the storage issue. The Korea Radioactive Waste Agency(KORAD)[4] was established in 2009 as an organization to resolve Korea’s waste management and waste disposal issues, and particularly to forge a national consensus on high-level radioactive waste (HLW) management. Before 2009, KHNP was responsible for managing all of Korea’s radioactive wastes. A site for the low-and intermediate-level radioactive waste (LILW) was chosen in November 2005 in Gyeongju, adjacent to the operating Wolsong nuclear power station, after a twenty-year effort by the Korean government to find a site for a radioactive waste facility. Construction on the LILW facility was started, and initial plans called for it to be completed in 2010, but its construction has been delayed due to findings of weak bedrock underlying the site and groundwater problems, thus the LILW facility is currently expected to be completed in June 2014.

Renewable Energy

Renewable energy in Korea remains relatively underdeveloped, though the proponents of renewable energy in the ROK have tried to promote the development of renewable energy supplies for a long time. Renewable energy contributed only 3.18% of TPES (including hydro), a very small portion of total consumed energy, in 2012. Biofuels and renewable wastes are the largest current contributors to renewable energy supplies, and represented almost 82.8% of renewable energy production, with the balance coming from small hydro (9.2%) and to a lesser extent solar photovoltaic (PV) and wind power. With only 1.5% of electricity supplies coming from renewable sources, as of the end of 2012, solar PV capacity stood at 1.0 gigawatt (GW) while onshore wind capacity was 0.46 GW. The 254 megawatt (MW) Sihwa Lake tidal power station, the world’s largest tidal power project, was commissioned in August 2011.

Korea has introduced feed-in tariffs (FITs) in which the government compensated producers for the gaps between the costs of electricity generated from renewable sources and fossil-fuel thermal generation to encourage the production and distribution of power from renewable sources. In 2012, however, the Korean government replaced its FIT scheme with a renewable portfolio standard (RPS) scheme that forces power producers to supply a certain amount of their total power generation portfolio from renewable sources. Faced with budget restrictions, the Korean government wanted to make the renewable energy market more competitive by introducing the RPS, thus reducing the government’s financial burden for FIT subsidies while inducing private investments.

In 1987, the Korea established the Korea Energy Management Corporation (KEMCO), which is responsible for promotion of the renewable energy industry, as well as for renewable energy policy development and dissemination, and also put in place the Act on the Promotion of the Development, Use and Diffusion of New and Renewable Energy, which was introduced in 1997 and revised in 2004.

III. ENERGY POLICY AND RELATED ISSUES

The First National Energy Basic Plan

In 2008, Korean president Lee Myung Bak proclaimed “Low Carbon, Green Growth” as a national vision to lead the country’s long-term economic development, with the goal of making Korea not only an environment-friendly country but also a strong green industry country. The government established the Presidential Committee on Green Growth (PCGG) in 2009[1] in order to ensure effective implementation of the new vision. The Korean government also presented a very aggressive policy for the reduction of the country’s greenhouse emissions to 30% less than emissions under a BAU (Business As Usual) scenario by 2020, and enacted its Framework Act on Low Carbon, Green Growth, which addresses climate change mitigation, energy policy and sustainable development.

Under the national Low Carbon, Green Growth vision, the government enacted the Basic Law for Low Carbon, in 2008 which provided for the establishment and implementation of a national energy basic plan every five years over a period of 20 years. According to the law, the plan shall be developed in Ministry of Energy and finalized after examination by a Cabinet council and the Committee on Green Growth. Even before the enacting of the basic energy law, many plans for various energy subsectors (electricity, gas, renewable energy and so on) have already been put into place and activated. The national energy basic plan is designed to cover all fields related to energy, to be systematically connected with other high priority energy-related plans, and to be coordinated at a high level and provide principles and directions for the plans for each energy source and in each sector. As such, the national energy basic plan is based on other energy plans, including plans for long-term electricity supply and demand and plans for natural gas supply and demand, which are prepared every two years.

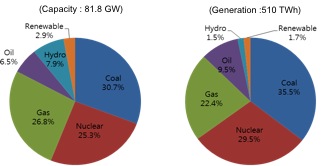

In compliance with the direction of the basic energy law, the first national energy basic plan was established in 2008. The core policies of the basic plan were to reduce national greenhouse gas emission and the consumption of fossil fuels through improving energy efficiency and strengthening market energy prices, and by expanding supplies of nuclear energy and renewable energy. The energy policy directions in the plan are as follows:

- Achieve low carbon and low energy consumption by improving energy efficiency, strengthening market-based pricing systems, and through active involvement in global initiatives for addressing climate change.

- Reduce the consumption of fossil fuels by expansion of renewable energy supplies and increasing the capacity of nuclear power.

- Develop a green energy industry by developing green technologies for use in domestic markets as well as for export to global markets.

- Promote energy security by strengthening overseas resources development and stabilizing energy supplies.

Figure 7 provides a schematic of the policies included under the first national energy basic plan.

Figure 7: Policy Directions in the First National Energy Basic Plan

Energy Demand Projection toward 2030 in the First National Energy Basic Plan

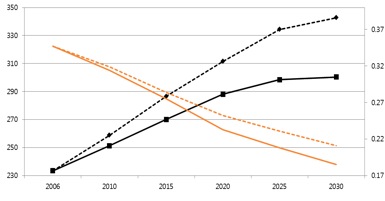

Primary energy demand in Korea was projected to increase from 233.4 Mtoe in 2006 to 342.8 Mtoe in 2030 under the business as usual scenario of the First National Energy Basic Plan. This projection assumed that the average annual growth rates (AAGR) of key drivers of energy use over the period would be 3.7% for GDP (nominal) and 0.03% for population. In the BAU scenario, energy efficiency, expressed as toe of primary energy use per unit of GDP in million Korean Won), would improved from 0.347 in 2006 to 0.211 in 2030, at a -2.1% AAGR, equivalent to the average rate of improvement experienced in the recent past.

The Korean government also described a target scenario under which more aggressive energy policies are implemented in order to achieve the energy policy directions set forth in the National Energy Basic Plan. Under the Target scenario, demand for primary energy would increase from 233.4 Mtoe in 2006 to just 300.4 Mtoe in 2030, yielding a 1.1% AAGR. 42.4 Mtoe of energy are saved by 2030 in the target scenario relative to energy demand in the BAU case. This saving comes from additional improvements in energy efficiency in the Target scenario. In the Target case, as shown in Figure 8, Korea’s toe of primary energy use per million won of GDP improves from 0.347 in 2006 to 0.185 in 2030, at an AAGR of -2.6%. This scenario result showed the strong desire of the Korean government to improve energy efficiency and promote energy savings. In June 2009, in response to this Target case result, the government created an Energy Efficiency Bureau in the Ministry of Energy. The primary duties of the Energy Efficiency Bureau are to establish an energy efficiency plan and related policies, implement sectoral energy efficiency measures to address greenhouse gas (GHG) emissions and energy use reduction commitments.

Figure 8: Energy Demand Projection through 2030, BAU and Target Scenarios

Source: The first national energy basic plan, Ministry of Knowledge Economics, 2008

Source: The first national energy basic plan, Ministry of Knowledge Economics, 2008

With regard to the future energy mix in Korea, government policies were to develop a more environment-friendly energy sector by reducing the share of fossil energy and increasing the shares of renewable energy and nuclear power. Under the BAU scenario, the share of fossil energy (oil, gas and coal) was projected to fall from 81.6% in 2006 to 74.7% in 2030, while the combined shares of nuclear and renewable energy would grow from 17.8% in 2006 to 24.9% in 2030. In the Target scenario of the National Energy Basic Plan, however, the share of nuclear and renewable energy rises to 39.5% in 2030, increasing 14.6% more than in the BAU scenario. On the other hand, as shown in Figure 9, the share of fossil energy in 2030 falls from 74.7% in the BAU to 60.8% in the Target, decreasing 13.9% point.

As a part of the changes in the energy mix under the National Energy Basic Plan, nuclear power plants will account for 41% of the nation’s power generation capacity by 2030 under the Target scenario, increasing from 26% in 2006. In order to achieve this level of capacity, five policies for facilitating construction of nuclear reactors were identified as follows: i) securing new sites for nuclear power plants; ii) preparing a management system for radioactive wastes; iii) strengthening the public’s acceptance of nuclear energy; iv) establishing a stable supply system for nuclear fuel; and v) promoting the export of nuclear power plants and international cooperation.

Figure 9: Projection of Energy Mix through 2030, (BAU and Target Scenarios)

Source: The first national energy basic plan, Ministry of Knowledge Economics, 2008

The National Energy Basic Plan also set a target share of renewable energy sources in the ROK’s total primary energy supply, with the fraction of renewables increasing from 2.4% in 2006 to 11% in 2030. Solar, wind and bio energy were expected to be the key renewable energy sources playing significant roles in achieving the target share in the plan, while in developing other renewable energy sources like geothermal energy and wood pellet fuel. The Korean government also aimed to make the renewable energy industry a new growth engine for the economy as well as transforming Korea into a low-energy-consuming “green” country. With a goal of becoming the nation with the world’s fifth largest renewable energy generation output by 2015, the Korean government has pushed stronger policies to boost the renewable industry and development of renewable energy technologies through the use of stimulus funding, tax incentives, and greater R&D spending. The government has also tried to create a stable market for the commercialization of renewable energy by encouraging schools, ports and public buildings to install clean energy facilities. The government also pushed a project called “one million green homes” with a target of installing PV, solar thermal or wind energy systems on 1 million houses, and supported small-and medium-sized companies in establishing many test-beds for renewable energy.

The National Energy Basic Plan included policies to accelerate more market-based approaches in order to strengthen the competitiveness of Korean energy industries and move Korea toward a more energy-efficient economy. These policies focused on price system and tariff reform, along with various deregulation programs to lower entry barriers to the electricity and gas sectors, which have traditionally been dominated by state-owned utilities. The Plan also pursued tax reform so that the environment problems derived from fuel consumption and social issues would be better reflected in the tax code, reducing many taxes in the energy tax system in order to further clarify and achieve the policy purposes to be achieved via taxes. Energy taxes in Korea include various taxes such as customs duties, a consumption tax, an education tax, a driving tax and value-added taxes.

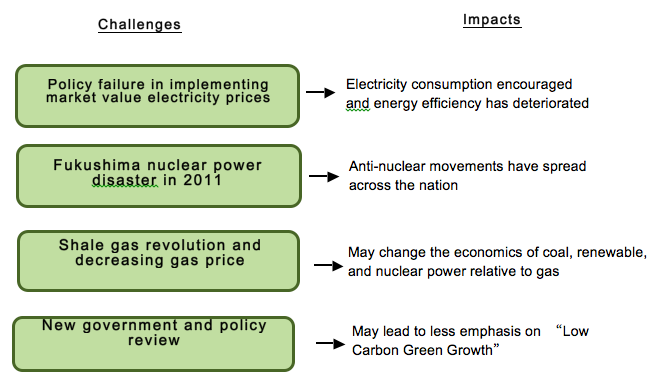

Challenges in Implementation of the First National Energy Plan

The National Energy Plan has been faced with significant challenges in implementation since its establishment in 2008.

First, the Korean government has failed to strengthen the market price system in the electricity and gas industries, due to the reluctance on the part of policymakers to raise tariffs. As a result, the electricity and gas prices paid by end-users have been not only increased much less than the costs of imported fossil fuels such oil and LNG, but also are not fully reflective of the fuel costs and other costs associated with for electricity generation. The low utility prices boosted the consumption of electricity and town gas, and consequently resulted in a decrease in the energy efficiency of the economy.

Second, the Fukushima Daiichi nuclear disaster, initiated primarily by the tsunami produced by the Tohoku earthquake on March 11, 2011 in Japan, has provoked a nation-wide anti-nuclear movement in Korea. Not only have NGOs such as environmental groups and religious groups strongly demonstrated in the streets against nuclear power, but also the number of people expressing doubts about the safety of nuclear power plants has rapidly increased. This shift in public opinion encouraged the view that the “nuclear renaissance” plan to increase the ROK’s reactor fleet should be discarded or, at least, downscaled.

Third, gas prices have sharply decreased in the USA as the production of shale gas has increased, thanks to the development and deployment of fracking technologies to extract gas trapped in shale formations. Given the trend toward falling prices of natural gas, it was expected that gas prices would undercut the prices of coal and oil, as well as renewable energy in the future. This US gas price trend has pressured the government to consider changing the energy mix in the National Energy Plan to anticipate the availability of cheap LNG from North America, and possibly elsewhere, though it is not yet clear to what extent the facilities to export large quantities of LNG from North America will be developed, and when.

Fourth, the government administration changed in February of 2013, and though the Park Geun-hye administration is from the same political party as the previous government, the new administration may place less emphasis on the Low-carbon Green Growth when it completes its review of national energy policies.

Figure 10 shows schematically the challenges that have arisen in implementing the National Energy Basic Plan.

Figure 10: Challenges Faced in Implementingthe National Energy Basic Plan

Korea’s Policy of Low Energy Prices and its Impacts on Energy Demand

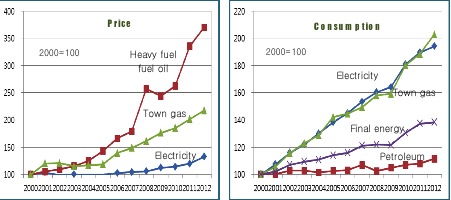

Most wholesale energy prices, including prices of petroleum products, are deregulated in Korea, but the taxes applied to energy products significantly affect end user’s energy prices. End user’s tariffs for electricity and town gas, in contrast, are nominally set by rate of return regulation. Rates for electricity for agricultural and industrial users are set below the costs of electricity production, while those for other users are above cost. As a result, residential and commercial consumers pay higher tariffs for electricity in order to subsidize agricultural and industrial consumers. Industrial consumers account for more than half of Korea’s electricity consumption. The tariffs for electricity and natural gas have been at lower levels than the costs of generation/supply for several years, leading to massive financial losses for the two state-run utilities, KEPCO and KOGAS. The government and the National Assembly, which approve tariffs for power and gas, have been very reluctant to hike tariffs not only in an effort keep a lid on inflation, but due to the concerns that high electricity prices will deteriorate the competitiveness of Korean industry. As noted earlier in this report, the government had announced in 2009 plans to introduce a new electricity pricing system that would move in concert with global energy prices, but the implementation of the new pricing system has been suspended due to the politicians’ concerns regarding inflation. As a result, there have been only limited hikes in electricity and town gas tariffs for many years, while world energy prices have significantly increased in real terms since 2003. This has made electricity and town gas relatively cheaper forms of energy, when compared with oil, coal and other fuels. The low utility prices have, in part, prompted consumers to change the energy sources they use for heating and cooking from fossil energy to electricity, and has nurtured an industrial structure that consumes a great deal of electricity.

As shown in the Figures 11, electricity prices rose less than 50% and town gas prices doubled from 2000 to 2012, while petroleum prices jumped by almost a factor of four during the same period. The gaps between petroleum prices and electricity and town gas prices have widened further since 2008, when the first National Energy Plan was established by the government. The consumption of electricity and town gas have increased in recent years more than was expected in the national plan, just as ROK consumption of other energy forms has increased, despite actual economic growth rates (in terms of GDP growth) having been lower than was assumed in the Plan, as a result of the global economic recession. This increase in energy use frustrated the Korean government’s desires to reduce the growth in energy demand by taking strong measures for improvement of energy efficiency. Since 2008, energy efficiency in Korea (energy per unit of GDP produced) has declined, rather than improving.

Figure 11:Trends of Prices and Consumption for Oil, Electricity and Town Gas in the ROK (Index: year 2000 = 100)

Due to the combination of low electricity prices and increasing personal incomes, the peak demand for electricity has also risen rapidly, driven in part by a sharp climb in air-conditioning demand in the summer, and a surging of electricity consumption for space heating in the winter as many residential and small commercial consumers purchased electric heating appliances. Electricity reserves, measured as the difference between generation capacity and peak demand, have significantly declined in recent years, from more than 9% in 2006 to 5.5% in 2012, as building of the new power generation capacity has failed to keep up with rapidly increasing electricity demand. On 15, September 2011, a rolling power outage blacked out 2.1 million homes and many industrial plants across the country. The blackout was caused by unseasonably hot fall weather during a period in which some power plants were shut down for regular maintenance. The blackout would not have happened, however, if the electricity reserve rates had been kept at reasonable levels at that time. Figure 12 shows the decline in reserve margin for the ROK electricity system, along with the Energy Plan and actual levels of power demand in recent years.

The blackout was unusual for the ROK, and it made Korean people aware that the nation was in a state of power shortage. Since 2009, the annual peak demand, has occasionally been recorded during the winter, as electric heating demand has surged. Annual peak demand in Korea historically had usually been recorded during the summer, with the winter peak considerably lower. After the blackout hit the nation, the government raised electricity tariffs twice in an attempt to restrain soaring electricity demand, but the increases in tariffs had little effect on power conservation because the price hikes were still quite limited in their scope. The revision of tariff systems, including further price hikes and resolving cross-subsidy issues between consumers, is a frequent topic of discussion among government staff, other energy experts, NGOs, and other interest groups in Korea.

Figure 12: Peak Power Demand and Reserve Ratio (Actual vs. Plan)

Key Elements Likely to Affect Future Energy Demand

The disaster at Japan’s Fukushima nuclear power plant in March, 2011 delivered a heavy blow to the ROK’s plan to expand nuclear power plants capacity as a key means to achieve a society based on low carbon energy with an energy-efficient economy. Concerns as to the safety of nuclear reactors have spread throughout the nation, as protests against building new nuclear power plants have increased. Another challenge faced with regard to the future of nuclear energy in Korea is to develop secure storage facilities for highly radioactive spent nuclear fuel, which has been piling up in temporary storage pools at the sites of the nuclear power plants now in operation. These at-reactor pools may be full before 2016.[2] The Korean government is negotiating agreements related to enriching uranium and recycling of spent fuels with the US government. In part related to sensitive military issues related to North Korea, the ROK has been operating its nuclear energy facilities under an agreement with the US not to try to enrich uranium or to recycle spent fuel, an agreement signed when the ROK introduced nuclear energy technologies imported from the US.

With growing opposition against nuclear energy, the Korean government vowed to review the role of nuclear power in Korea to reflect its “social acceptability” during the preparation of the Second National Energy Plan, an early draft of which was released in October of 2013, although the final draft has not yet, as of early 2014, been published. The expert working group for the plan has recommended that the share of nuclear power in total generation should decline from the 41 percent by 2030 included in the First Plan to between 22 and 29 percent, although the recommendation of the expert working group is not binding for the government’s ultimate decision regarding the Second Plan. Reducing the share of nuclear power, however, would not be a straightforward measure in that the shares of electricity provided by fossil fuel-based power generations would have to be increased, meaning a probable increase in generation costs and a certain increase in greenhouse gas emissions from the electricity generation sector. There are also strong voices to support expanded nuclear power development. Nuclear proponents contend that concerns regarding nuclear accidents are exaggerated, and that reducing nuclear energy supplies would leave the Korean economy with higher energy costs than other countries with cheaper electricity, with a negative impact on the ROK’s industrial competitiveness. The government’s policy direction to nuclear power will be set again in the Second National Basic Energy Plan.

Natural gas prices have trended down as the shale gas production has rapidly increased, thanks to the hydraulic fracturing and horizontal drilling technologies employed in the United States. On the other hand, significant environmental and technological issues regarding shale gas production have emerged even as shale gas output has increased dramatically. As such, there are many uncertainties with regard to the future supply and prices of shale gas, and particularly with regard to how changes in the North American gas market will translate to changes in the gas market in Asia. KOGAS, the only gas importer and public wholesaler in Korea, has reached agreement on a contract with a US company for supplies of 3.2 million tons of LNG annually, with deliveries starting in 2017. The contract price for these purchases is linked to the Henry Hub price on the gas spot market in the USA, in contrast to other LNG contract prices, which are usually linked to oil prices. Korea, as a big importer of natural gas, is closely watching the trends in world gas prices, especially the Henry Hub price index in the USA. If gas prices are forecast to be lower in the long-term future, with continuous increases in shale gas production, the portion of total energy supplies in Korea provided by natural gas will likely increase in the future, further affecting demand for coal and nuclear energy, as well as renewable energy, in the Second National Energy Plan.

The Second National Energy Basic Plan under the New Government

A new government administration took power in February 2013 when the new President of Korea, Park Geun-hye, took office. It is thought that the new government will follow the previous government’s energy policies in general, because the new president is from the same political party as the previous government. The specific areas of focus or underlying policies for the energy sector in the new government, however, may change, based in part on the changing situation in world and domestic energy markets. For example, the new government has placed a higher priority on the safety of nuclear power, as well as that of other energy facilities, than did the previous government. On the other hand, the policy of “Low Carbon, Green Growth” proclaimed by the previous president may be weakened as a reaction to recent critiques suggesting that the previous government’s green energy policies have not had an impact on the ROK’s energy structure, commensurate with the amount of financing that was provided to implement the policies.

The new government announced several overall energy policy directions at the time that it came into office. These included:

- Strengthen safety management and supervision in energy facilities, including nuclear power facilities.

- Encourage more competitive markets and market-value pricing in energy industries.

- Establish a societal system emphasizing resource circulation, for example, with extensive recycling of materials

- Work to implement energy cooperation with Northeast Asian countries through electricity and gas grid networks and energy trading.

- Increase support for basic energy services for low income-households.

The new government has not as yet, however, prepared a comprehensive energy policy or detailed directions for implementation of its energy policies. The Park administration is preparing the Second National Energy Basic Plan, and it is expected that detailed energy policies will be included in the plan.

In preparing the Second Plan, the government has organized an expert working group consisting of some 60 experts from the public and private sectors, including representatives from NGOs. The main goal of the working group is to advise and recommend policy directions to the government as the government prepares the Second National Energy Basic Plan. The working group includes five sub-working groups, each organized around important energy issues as follows; Energy Mix, Energy Demand, Electricity, Nuclear Power and Renewable Energy.

IV. CONCLUSION

Korea, relying almost entirely on energy from overseas, is standing at an energy crossroads. Korea finds itself in this situation both due to ongoing debates with regard to its own domestic energy policies and because its energy fortunes are to a large extent embedded in the global energy economy. Further, the future of world energy is at present arguably more uncertain than usual, as a result of the continuing impacts on policies of the Fukushima nuclear disaster in Japan and of the uncertain ultimate impacts on international gas trade of the shale gas revolution in North America, among other energy policy issues. If the proportion of nuclear energy in the ROK’s energy mix decreases over time, consumers will likely pay higher electricity tariffs due to the higher energy costs for fossil energy imports that KEPCO would have to pay to meet national electricity needs as a tradeoff for reducing public anxieties regarding nuclear accidents. On the other hand, many consumers may be reluctant to pay higher tariffs, and think that the concerns regarding nuclear accidents are exaggerated. These polarized viewpoints have resulted in conflicts between defenders and opponents to nuclear power that as of this writing are far from resolved.

Natural gas use in the ROK could significantly increase, and the Korea’s use of other energy forms such as coal, nuclear energy and renewable energy would be reduced, if the shale gas revolution that has arisen in the USA expands to other nations such as China and Europe, lowering the natural gas prices paid by the ROK. The futures of shale gas as well as other nonconventional energy are, however, still uncertain due to geological barriers—it is unknown, for example, whether gas can be extracted from shale formations on other continents using the same technologies used in North America—technical problems, and environmental issues. Future energy policy directions in Korea are scheduled to be established in part with the upcoming publication of the Second National Energy Basic Plan. At present, there is a likelihood that the proportion of nuclear energy included in the ROK’s plans for its future energy mix will decline in the new plan, meaning that shares of fossil fuels such as coal and gas would rise.

Increasing fossil energy consumption in the ROK would create a conflict with the low carbon policies that are now in place. Solutions to this problem include increasing renewable energy use and/or significantly improving energy efficiency. It is not expected, however, that the proportion of renewable energy will rise to more than the target proportion for renewable energy included in the First National Plan, because the renewable target has been regarded as too ambitious by many energy analysts and policymakers.

Energy pricing policies should be core tools for improving energy efficiency. The previous government announced and tried to strengthen policies to support a more market-based energy price system, with the goal of achieving a less energy-intensive economy, but that plan has failed, and energy efficiency has further deteriorated since the plan was put into action in 2009. This indicates how difficult it is for governments to raise energy prices to reasonable levels in Korea. The new government has also announced an intention to undertake strong improvements in energy pricing systems, especially for electricity tariffs, since the public electricity company financial losses are increasing due to the widening gap between tariffs and generation costs. As a result, the, Korean government must take a strong position with regard to tariff hikes in order to improve the energy efficiency of the Korean economy, as well as implementing policies, including tax, regulation, and incentive polices, to actively encourage improvements in efficiency of energy use by industrial, residential, commercial, and other energy consumers in Korea.

V. REFERENCES

Han J. H (Vice minister in Ministry of Industry, Trade and Energy), “Energy policy direction of new government in Korea”, Presentation prepared for the Forum of Future Energy and Resources, March, 2013.

Her Ga Young, Problems and challenges in the sixth plan for electricity supply and demand, National Assembly Budget Office of Korea, April. 2013.

Kang In Sang, Jin-Kyu Oh, Hongseok Kim, Korea’s low-carbon green growth strategy, working paper No.310, OECD Development Center, 2012.

Kang Y.Y, “Energy mix and policy direction of new government in Korea”, Presentation prepared for the seminar of resource engineering study, May, 2013.

KEEI, Yearbook of Energy Statistics, 2013.

KOMEC, Renewable energy statistics 2013, available as http://www.energy.or.kr/knrec/14/KNREC140310.asp?idx=51&page=1&num=15&Search=&SearchString=#.

Korean government, The first national basic energy plan, August, 2008

Korea Power Exchange, 2012 Yearbook of Electricity statistics, 2013

Margaux CHANAL, “How is 100% Renewable Energy Possible in South Korea by 2020”, Global Energy Network Institute (GENI), August 2012

MOTIE, The eleventh plan for long-term supply and demand of natural gas, April, 2013

National information center for law, 2013, “The basic law for green growth”, available as http://www.law.go.kr/lsSc.do?menuId=0&p1=&subMenu=1&nwYn=1&query=%EC%A0%80%ED%83%84%EC%86%8C%EB%85%B9%EC%83%89%EC%84%B1%EC%9E%A5&x=33&y=15#liBgcolor0.

OECD, Regulatory Reform in Korea (Electricity sector), 2000.

VI. NAUTILUS INVITES YOUR RESPONSES

The Nautilus Peace and Security Network invites your responses to this report. Please leave a comment below or send your response to: nautilus@nautilus.org. Comments will only be posted if they include the author’s name and affiliation.