by Katherine Keil

January 2013

This Special Report was originally published as a Working Paper 2013-3 by the Center for Energy, Governance and Security at Hanyang university, Seoul.

I. Introduction

Against the background of a growing demand for energy worldwide, many claim that the hydrocarbon resources of the Arctic region have become an important variable for future energy security. Multiple factors seem to render Arctic energy resources attractive: the expected persistence of fossil fuels (especially oil and gas) in the global energy mix, instability in oil-supplying countries in the Middle East, and the unclear future of nuclear energy after the Fukushima disaster. Nonetheless, the complexity of resource exploitation in such a remote region as the Arctic, as well as the potential for environmental disasters, raises significant questions about such a proposition. Rather, how promising Arctic resources really are for future energy security concerns is an empirical question requiring careful evaluation. How many resources are actually in the Arctic relative to resources farther south? What are the conditions under which they could be viably and commercially exploited? What interest do the states possessing Arctic hydrocarbons, i.e. the five Arctic littoral states US, Canada, Russia, Norway and Denmark/Greenland, have in exploring and exploiting their Arctic resources? Only after answering these questions is it possible to come to tangible conclusions about the role of Arctic oil and gas for future energy security concerns.

Kathrin Keil is currently a PhD Candidate at the Berlin Graduate School for Transnational Studies(BTS) at the Freie Universität Berlin. She is writing her dissertation on the international politics of the Arctic, with a focus on international regimes and institutions in the areas of energy, shipping and fishing.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

II. SPECIAL REPORT BY Katherine Keil

The role of arctic hydrocarbons for future energy security

The Attraction of Arctic Oil and Gas

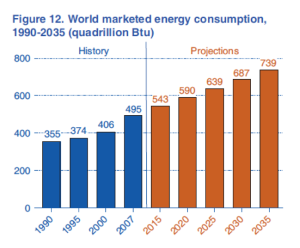

Although scientists, activists and politicians remind us repeatedly that the world has to switch to low carbon and preferably renewable energies in order to prevent the crossing of possible irreversible tipping points and to keep global warming below 2°C, at the same time all studies forecast a growing demand for energy worldwide, which is expected to be met for a long time to come also and predominantly with the help of fossil fuels. According to the International Energy Agency (IEA), world primary energy demand will increase by 36% between 2008 and 2035, or 1.2% per year on average (IEA 2010, 2012). The U.S. Energy Information Administration (2010b, 9, 2011a, 60) expects world energy consumption to increase by even 49% or 1.4% per year – from 495 British thermal units (Btu)[1] in 2007 to 739 Btu in 2035 (see figure below).

Fossil fuels like they exist in the Arctic are expected to continue supplying much of the energy used worldwide, despite efforts to switch to renewable and more climate-friendly sources of energy. Oil and gas continue to provide more than half of the global energy mix (BP 2011, 18; Netzer 2011, 1). Although especially the share of oil of world primary energy is expected to decrease further (to 27% in 2030), natural gas is expected to increase its share and to level with oil in 2030. While renewable sources are expected to increase, oil, gas and coal remain the predominant energy sources with around two thirds. While it is less than in the last 20 years, fossil fuels will still contribute remarkable 64% of the growth in energy up to 2030 (BP 2011, 18 f.). The IEA even forecasts demand for natural gas to surpass that for other fossil fuels due to its more favourable environmental and practical attributes (IEA 2010).

Progress in technology concerning for example drilling gear and logistics as well as Arcticcapable ship design have made Arctic waters more and more accessible for offshore hydrocarbon exploration and exploitation (Koivurova and Hossain 2008, 3). Another factor for the attraction of Arctic oil and gas is that in contrast to other oil-rich regions in the world, the Arctic is politically stable. As the AMAP (2007a) report states:

Compared with many other oil-producing regions of the world, the arctic nations are politically stable. Transparent regulatory systems provide additional consistency, reducing uncertainty for industry. In turn, this can make large, long-term investments in exploration and infrastructure comparatively more attractive in much of the Arctic, despite its remoteness and harsh weather

The recent events in the Middle East amply demonstrate the political instability of traditional hydrocarbon regions. Further, the Fukushima nuclear power plant disaster in Japan following a severe earthquake in March 2011 has triggered a renewed debate about nuclear energy. Some analysts even call the hazardous incidents in Japan a watershed event for international energy policies, because Fukushima would have showed that the risks and dangers connected to nuclear energy production could not be controlled despite all technological progress and safety measures (Netzer 2011). For example, the European Commissioner for climate change, Connie Hedegaard, has said that EU decisions on commissioning new nuclear energy capacity are very likely to be influenced by the nuclear disaster in Japan, primarily because the public support for nuclear means of energy generation will definitely be gone (EurActiv 2011a). Some therefore expect an increase of European gas demand in the near future (EurActiv 2011b) and a boost for gas infrastructure projects like the Nabucco Pipeline (EurActiv 2011c). Natural gas from the Arctic could contribute to satisfying this increasing demand (e.g. Nilsen, 2011b). This will surely not happen quickly, given that many countries rely to a bigger or smaller extent on nuclear energy, and also because many countries have extensive plans to widen their nuclear programmes. For example, France operates currently 58 nuclear reactors that produce around 75% of the countries’ electricity; Belgium’s seven reactors produce half of the country’s electricity needs; the US operates 104 reactors; China is currently building 27 new reactors while planning to build another 50, and proposals have been made for up to 110 new reactors by 2030; India has 18 new reactors in the planning stage and up to 40 in the more distant future; Russia is currently building ten new reactors, planning 14 more and suggesting up to 30 by 2030 (World Nuclear Association 2011). Further, in times when the fight against climate change and the subsequent reduction of greenhouse gas emissions, especially CO2, is on top of the political agenda, many countries and organisations like the European Union have classified nuclear energy as a low-carbon and thus climate friendly technology[2].

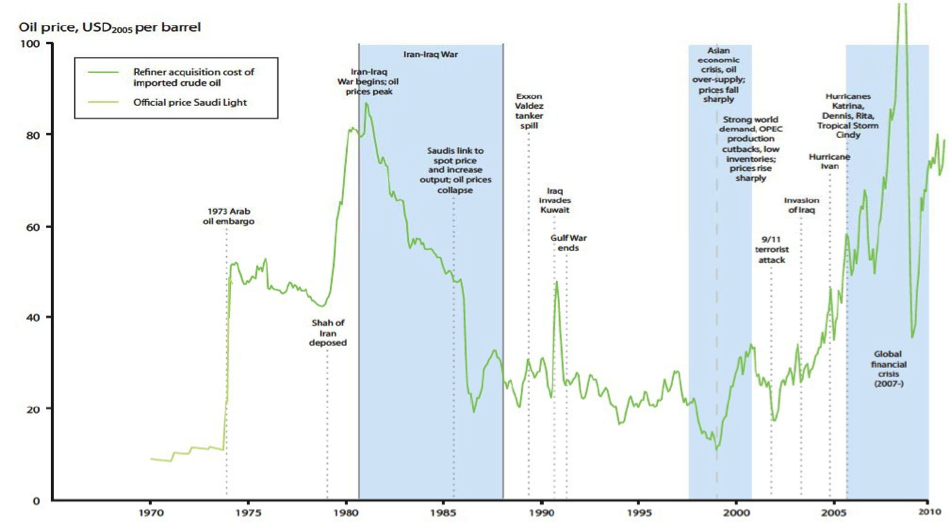

However, the instable situation in the Maghreb countries and the debate surrounding nuclear energy have already resulted in increasing oil and gas prices, which is a if not the crucial factor for Arctic oil and gas resources to be explored and developed. Energy companies respond to high oil and gas prices with an increasing interest in developing new discoveries, and the higher the prices the more companies are willing to invest in exploration and exploitation activities also in inhospitable and remote regions like the High North. For example, Russian oil firms responded to the oil price increase by massively increasing their oil exports. Deputy Energy Minister Sergei Kudryashov is quoted to have said that Russia exported 3 million tons of oil products in the first four months of 2011; the same amount which has been exported in the whole of 2010. This has even led to a gasoline shortage in some parts of Russia where fuel prices are kept low by the government (RIA Novosti 2011). Also Norway’s Statoil benefitted from higher oil and gas prices. The company’s net operating income in the first quarter of 2011 was 28% higher than in the first quarter 2010. Growth from the third quarter 2011 to 2012 was still 4%. This is mainly due to a 33% increase in average oil prices and 20% increase in average gas prices since 2010 (Statoil 2011, 2012). Finally, Russia’s Gazprom had a record profit in 2010 of nearly one trillion roubles (RUB 981 billion, up 27% from 2009 levels) or approximately €24.2 billion thanks to high prices, which were higher incomes than ExxonMobil and Chevron had. But also ExxonMobil and Chevron’s earnings rose substantially, up 57% from 2009 for ExxonMobil ending 2010 and up 81% for Chevron (Rapoza, 2011; Exxon Mobil Corporation, 2011). The outstanding importance of oil and gas prices adds a significant amount of uncertainty to prospective Arctic oil and gas activities given the volatility of oil and gas prices. The graph below illustrates the erratic development of the oil price from 1970 until 2010.

Adding to the uncertainty is that Arctic countries’ oil and gas activities in the High North have in the past not continuously followed oil price developments. The AMAP Report ‘Oil and Gas in the Arctic: Effects and Potential Effects’ shows that leasing/licensing, seismic activity and drilling of exploration and discovery wells have not always tracked closely with oil prices (AMAP 2007b, 2_3).

Arctic Oil and Gas Expectations

Many onshore areas in the Arctic have already been explored, in total 400 oil and gas fields by 2007, containing 40 billion barrels of oil, 1136 trillion cubic feet of natural gas and 8 billion barrels of natural gas liquids (NGL), mostly in the West Siberian Basin and on the North Slope of Alaska (Gautier et al. 2009, 1175 f.). These numbers account for approximately 240 billion barrels of oil and oil-equivalent natural gas, which is almost 10% of the world’s known conventional petroleum resources (Bird et al. 2008).

Despite these impressive numbers, most of the region, especially offshore, remains essentially unexplored with respect to petroleum resources (Bird et al. 2008). At the same time, expectations are high concerning the so far undiscovered resource potential of the region and with increased accessibility and rising global demand as well as the desire for stable and secure supplies, oil and gas activity in the region is expected to increase (AMAP 2007a, xi, 32 f.). According to the U.S. Geological Survey (USGS) from 2008, the Arctic holds about 22% of the world’s undiscovered conventional oil and natural gas resources, which amounts to about 30% of the world’s undiscovered natural gas, 13% of the world’s undiscovered oil and 20% of the world NGL. Of these resources, 84% are expected to be offshore. Included in the assessment were those geological areas that were considered to have at least a 10% chance of one or more significant oil or gas accumulations, which means concretely volumes larger than 50 million barrels of oil or 300 billion cubic feet of gas (Bird et al. 2008; Gautier et al. 2009, 1175 ff.). These percentage numbers translate into a total amount of 412 billion barrels of oil equivalent (bboe)[3], i.e. hydrocarbon resources, whereas 22% of those resources are expected to be oil resources (ca. 90 billion barrels) and 78% natural gas (ca. 1669 trillion cubic feet (tcf)) and NGL (ca. 44 billion barrels)[4]. The biggest reserves are estimated to be in the West Siberian Basin, Northern Alaska, the East Barents Basin and the East Greenland Rift Basin (Bird et al. 2008; Byers 2009, 10; Gautier et al. 2009, 1175, 1178).

Arctic undiscovered oil and gas resources are concentrated in just a few provinces. The biggest share of oil is expected in Arctic Alaska (ca. 30 bboe) with larger reserves also in Canada (ca. 10 bboe) and Greenland (ca. 9 bboe). The biggest share of natural gas (ca. 652 tcf) and NGL (ca. 20 bboe) are in the West Siberian Basin. In terms of total undiscovered Arctic hydrocarbons the West Siberian Basin alone already holds 32%. Together with Arctic Alaska, the second largest resource province, 50% of the total undiscovered resources are covered (Budzik 2009, 6). Also, given that the Arctic contains more than three times as much undiscovered gas as oil and the estimated largest undiscovered gas accumulation is almost eight times the estimated size of the largest undiscovered oil accumulation, Arctic natural gas reserves have a higher likelihood of actually being developed (Gautier et al. 2009, 1178).

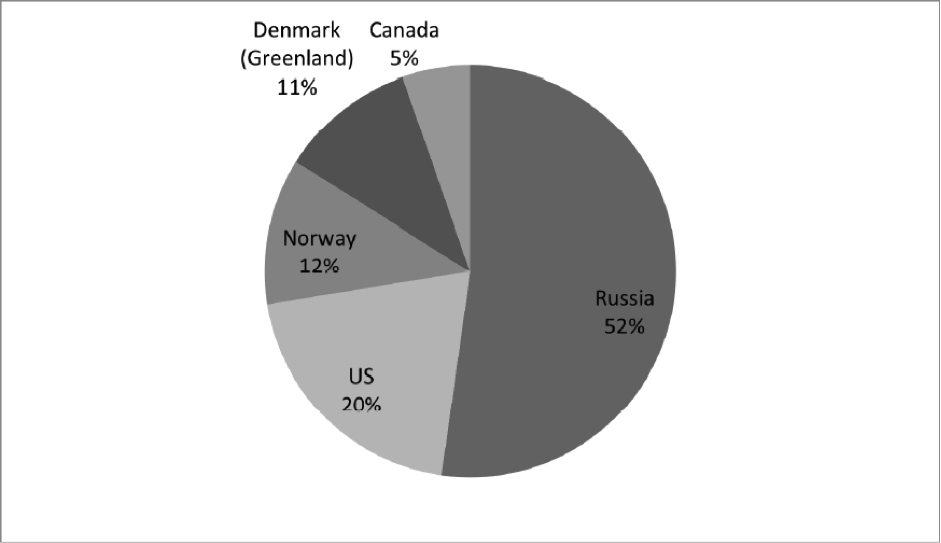

According to the USGS, Eurasia is estimated to hold about 63% of the total Arctic resource base, while North America holds about 36%. The Eurasian resource base consists mainly of natural gas and NGL accounting for around 88% of its total resource base. So while the Eurasian Arctic is richer in gas resources, the North American Arctic possesses the largest share of Arctic oil (for all numbers Budzik 2009, 7). Based on data from Budzik (2009, 5), the following graph outlines how estimated Arctic hydrocarbon resources are distributed among the five Arctic coastal states or how much of these resources are located within the jurisdiction of the respective countries[5].

Arctic vs. non-Arctic Reserves

Despite these impressive numbers (which are up to now only expectations!), this has to be contrasted with the resource base in other parts of the world in order to get an idea about the actual relevance of Arctic hydrocarbon resources for global energy security. While the USGS numbers refer to a whole region with the main resource areas distributed between the northern rims of two continents (Eurasia and North America), a substantial amount of today’s known proven reserves is located in single countries. Concerning oil, Venezuela and Saudi Arabia dominate the picture with 18% and 16% of the total proven reserves as of 2011. Canada is also significant with around 11% and Russia with 5%. All OPEC countries together control 72% of the world’s proven oil reserves. Generally, the Middle East and South America are the key regions for oil reserves, accounting together for more than two-thirds (for all data BP 2012, 6 f.). The picture looks different for production levels, where OPEC and non-OPEC countries are about even at 42% and 41%, respectively. Arctic countries play a significant role here, predominantly Russia (13%) and the US (9%), and Canada with around 4% and Norway at least with 2% (ibid., 8). In terms of oil exports Russia is second after Saudi Arabia with 5.4 million barrels per day, Norway 7th (1.8 million) and Canada 11th (1.4 million)[6]. For the relevance of Arctic resources within these countries see below.

Concerning natural gas, Russia is indeed the most important resource base with a fifth of the world’s proven reserves, followed by Iran (16%), Qatar (12%) and Turkmenistan (12%). The Middle East and Eurasia hold around the same amount of proven gas resources, each ca. 38%. The US plays a decisive role for gas production, mostly due to its recent shale gas revolution. At the end of 2011 it produced a fifth of global gas, followed by Russia (18.5%). Canada contributes 5% and Norway at least 3% of global gas production (for all data BP 2012, 20–2). Russia is by far the largest gas exporter (204 billion cubic metres (bcm) by 2011), followed by Norway with 98 bcm. Canada is rank 5 of gas exporters with 93 bcm and the US 8th (43 bcm)[7].

3.1 Interests of Arctic Coastal States

So Arctic countries do play a role in terms of global oil and gas reserves and production, especially Russia and the US. But how much of these resources are actually in their Arctic regions? Or in other words, how competitive are Arctic hydrocarbons in comparison to non- Arctic reserves within the Arctic countries? And what interest do the states possessing Arctic hydrocarbons have in exploring and exploiting their Arctic resources?

3.1.1 US

US crude oil is produced in 31 states and US coastal waters. In 2011, Texas produced the biggest share with 21%[8], followed by Alaska with 11%. The Gulf of Mexico area is most important for US oil production. It provides half the liquid fuel production, 29% of total US crude production, and over 40% of the total US refining capacity is located along the Gulf coast. A dense pipeline system allows Texas petroleum products to reach major consumption markets (U.S. Energy Information Administration 2010a, 2011g, 2012).

Given US concern about decreasing production and high dependency on foreign oil, Alaska could potentially play an important role to make the US more self-reliant. The Prudhoe Bay oil field on Alaska’s North Slope is the highest yielding oil field in the US and Alaska has long been the second-ranked oil-producing state after Texas. However, production at the field has since its peak in 1988, when it produced 25% of total US production, declined by more than two-thirds and the trans-Alaska pipeline operates at less than one-third capacity (Graham et al. 2011; U.S. Energy Information Administration 2009, 2011b). As a result of decreasing production, in March 2012 North Dakota overtook Alaska in terms of monthly oil production and became the second-highest yielding oil state (U.S. Energy Information Administration 2011c).

Additional Alaskan oil is also likely to face competition from other oil sources, especially Canada’s oil sands (see below). As Huebert (2009, 9) observes, “the North American Free Trade Agreement (NAFTA) basically treats all oil and gas as a part of a common market in energy, [thus] any new Canadian supplies would help to address US demand and reduce US dependency on “foreign” supplies”. The planned Keystone XL pipeline would carry oil from Alberta’s oil sands to refineries in Texas. Keystone XL was rejected by Obama in January 2012 after having been put under a 60-day timeline to decide on a permit for the pipeline company TransCanada, imposed by Congress at Republicans’ insistence. Obama has however emphasised that this decision “is not a judgment on the merits of the pipeline, but the arbitrary nature of a deadline that prevented the State Department from gathering the information necessary to approve the project and protect the American people” (Goode 2012). It is thus likely that the issue appears on the agenda again.

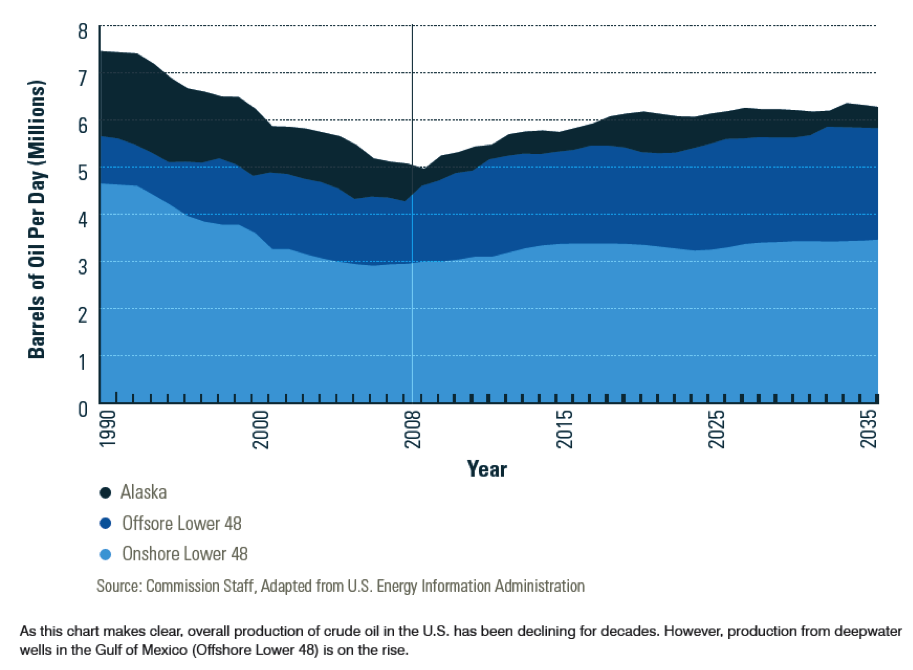

Overall, despite likely potential in Alaskan offshore waters, Arctic oil resources are not and are not expected to become a major part of US oil production. As the following figure shows, the biggest part of US crude oil production has been and still is onshore production in the lower 48 states, although these sources are declining. In contrast, offshore resources in the lower 48 states are on the rise, especially due to production from deepwater wells in the Gulf of Mexico. The figure also shows the peak of Alaskan oil production in the late 1980s and its decline since then. Declining Alaskan output in comparison to increasing US production elsewhere is also a consequence of Alaska’s long distance to world markets and associated high transportation costs.

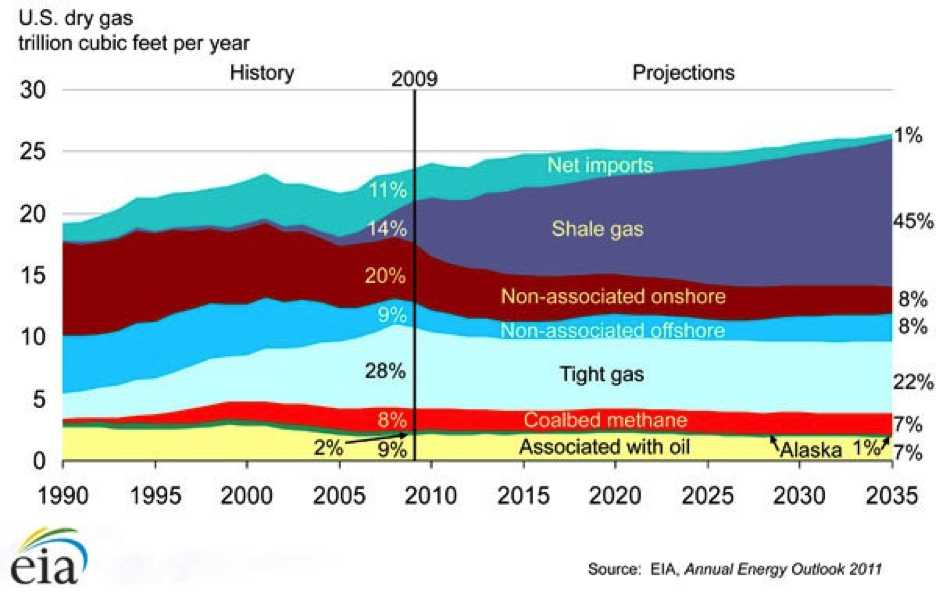

The US gas market is experiencing a dramatic shift from conventional to unconventional sources. While in 1990, unconventional gas, i.e. shale gas, coal-bed methane and tight gas, was about 10% of total production it is today around 40%, and growing fast with shale gas by far the biggest part. New technologies such as horizontal drilling and so-called ‘fracking’ make the plentiful natural gas supplies locked up in shales accessible (Yergin and Ineson 2009). According to the EIA’s Annual Energy Outlook 2011 the average annual growth rate of shale gas production in the US was 48% during the period 2006-2010. The outlook also projects that shale gas will account for about 47% of the total US natural gas production in 2035, estimating 827 tcf as technically recoverable unproven shale gas resources (U.S. Energy Information Administration 2011a).

A huge increase in US gas production can cause oversupply of the gas market, which pushes prices down. This will make the exploitation of conventional hydrocarbons especially in such remote and challenging regions like the Arctic less profitable and thus less likely. Shale gas deposits are mainly found in Texas, which is also the US’ leading gas producer, and in states in the eastern United States (U.S. Energy Information Administration 2011d, 2011e, 2012). Although Alaska has a substantial natural gas production most of which is extracted during oil production in the North Slope, this supply is not commercially feasible and thus has no way of reaching consumption markets. The gas is pumped back into the ground for repressurisation and used as fuel to operate oil production facilities (National Petroleum Council 2011, 45; U.S. Energy Information Administration 2009). The following figure illustrates the low relevance of Alaskan gas, especially given the huge prospected growth of shale gas production.

Over the last three decades there have been plans to build a natural gas pipeline transporting Alaskan North Slope gas to markets in the lower 48 states. The Denali Gas Pipeline project withdrew their pipeline application in May 2011 due to a lack of customer support. The Alaska Pipeline Project is planned to transport gas from Alaska’s North Slope to Alberta but industry interest has been low mostly due to low gas prices and abundant gas available from unconventional gas resources in the lower 48 states and in non-Arctic Canada. An alternative plan exists to reroute the pipeline from the North Slope straight to Alaska’s southern shore, where it would be shipped to Asia’s expanding energy market by tanker as LNG, or even to build a liquefaction plant on the North Slope and use LNG tankers with ice-breaking capabilities to transport the gas straight from the North Slope (Munson 2012; National Petroleum Council 2011, 47 f.).

3.1.2 Canada

The main Canadian gas-producing region is the Western Canadian Sedimentary Basin (WCSB) that extends from south-western Manitoba to southern Saskatchewan, Alberta, northeastern British Columbia and the southwest corner of the Northwest Territories (NWT). The WCSB accounts for 98% of total Canadian gas production. Alberta accounts with approximately 80% for most of the gas production in the WCSB; British Columbia provides around 16%, Saskatchewan 4%, and Yukon and the NWT less than 1% (National Energy Board 2008, 2 f.). Other basins, the Arctic Canadian Beaufort Sea, the Arctic Islands and Newfoundland Offshore and the Scotian Shelf, are only of second order importance given the dominance of the WCSB (Natural Resources Canada 2009a).

The biggest part of Canada’s gas production, 90%, is classified as conventional[9] natural gas. But conventional gas production is declining and the Canadian natural gas portfolio is undergoing a dramatic diversification with the addition of unconventional gas resources especially from shale gas. The unconventional gas share of the Canadian natural gas supply mix has increased from 9% in 2000 to 25% in 2010 and is expected to grow further. The estimated recoverable potential of Canadian shale gas is 128 tcf. Currently, Canadian shale gas is primarily produced in northeast British Columbia (Canadian Gas Association 2010, 2 f.), so again outside Arctic areas. However, in comparison to the US, unconventional natural gas production in Canada is only in its early stages of development and the focus remains for now on conventional gas production.

Gas production in Canada is faced with a number of challenges such as decline in output, upward cost pressures, competition for capital from oil and oil sands projects, and competition for investment with US natural gas regions that are experiencing rising production (National Energy Board 2008, 4). WCSB production has indeed declined by 15% between 2002 and 2010 mostly due to lower gas prices due to the US shale gas boom. However, production has already begun to recover, and tight and shale gas exploitation in Alberta and British Columbia have approached or even surpassed historical activity levels (Canadian Gas Association 2010, 5; National Energy Board 2010, 1 f.).

The most important oil area is, like for gas, the WCSB. Most of the established oil reserves, more than 95%, are in the form of oil sands, a mixture of crude bitumen, silica sand, clay minerals and water. The oil sands are found primarily in northern Alberta, the potential of which is estimated at 315 billion barrels. Conventional oil reserves account for only approximately 3% of the proven oil reserves, the bulk of which is found in Alberta, Saskatchewan and the east coast offshore. Northern Canada hosts an estimated 30% of Canada’s conventional oil resources, so overall a very minor share (Natural Resources Canada 2009a, 2009b).

Alberta has the highest production of crude oil, followed then by also non-Arctic provinces Saskatchewan and Newfoundland and Labrador. Crude oil production has been increasing steadily during the last two decades. Production from conventional resources is expected to decline while the output from the oil sands is forecasted to triple increasing its share of Canada’s total oil supply to 86% by 2035 (National Energy Board 2011; Natural Resources Canada 2009a). After the Keystone XL pipeline project to deliver oil from Alberta to the US has for now been halted, Canada is exploring alternative ways to bring its oil to costumers, particularly in Asia (Park 2012).

3.1.3 Russia

While US and Canadian Arctic oil and gas resources face fierce competition from non-Arctic North American resources, Russia’s northern resources are of crucial importance to the whole country. Most of Russia’s oil and gas reserves are located in Arctic Russia making it the country’s most important resource base (Russian Federation 2008). Western Siberia, especially the Yamalo-Nenets and Khanty-Mansi Autonomous Okrug in the Tyumen Oblast, accounts for the biggest share with more than two-thirds of Russian oil and gas production. Deputy Transport Minister Viktor Olersky is quoted to have said that 95% of Russian gas and 75% of Russian oil resources are in the Arctic (Kravtsova 2011). According to Melvin & Klimenko (2012, 9) over 80% of natural gas and 70% of oil reserves are expected in the Russian Arctic, and 90% of the recoverable hydrocarbon resources of the continental shelf of Russia are concentrated in the Arctic, 70% of which on the shelf of the Barents and Kara Seas. Koivurova and Hossain (2008, 8 f.) quote estimates expecting up to 80% of Russia‘s potential oil and gas reserves on the Arctic shelf. Russia in fact accounts for most of the expected Arctic resource potential. Eurasia is estimated to hold about 63% of the total undiscovered Arctic resource base, mostly consisting of natural gas and NGL (88%) (Budzik 2009, 7). While these numbers are a helpful tool to assess the importance of the Arctic region in energy terms, one has to remember that there is still a significant lack of knowledge of the region’s geology. Collected data has tended to focus on the West Arctic and the Far East and less so on the East Arctic (Melvin and Klimenko 2012, 10). Consequently, much more potential resources could be identified in the Arctic as more data is collected.

Russia is eager to develop new reserves to offset the depletion of principal mainland fields, especially in Western Siberia’s Nadym Pur Taz Region with its three super-giant fields, Medvezhe, Urengoy and Yamburg, which have all been producing for over 20 years (Øverland 2008, 8). Three regions in northwest Russia with commercial oil and gas reserves have been singled out for exploration: the oil-bearing Pechora Sea and the gas-bearing central Barents and South Kara Sea (Bellona 2007).

Despite ambitious plans the production of oil and gas in Arctic Russia has increased only little in recent years and future growth is projected to be slow. This is due to a number of factors. Federal Law No. 177 establishes a monopoly for Gazprom to transport and export all forms of gas from all Russian fields (Bellona 2007). State-owned Transneft has the federal monopoly over Russia’s oil pipeline system, i.e. no private pipelines are allowed and consequently not enough infrastructure is built to handle increased production (Koivurova and Hossain 2008, 8). A decisive hurdle for new development projects is taxation, which has contributed to the postponement of a number of projects such as the Shtokman gas project.

3.1.4 Norway

Of the Norwegian hydrocarbon fields that were producing at the end of 2010, 55 are located in the North Sea, 13 in the Norwegian Sea and one in the Barents Sea, i.e. the majority of Norwegian offshore petroleum production is still outside Arctic waters. The Norwegian sector of the Barents Sea is considered as an immature petroleum province (Bambulyak and Frantzen 2011, 25 f.; Ministry of Petroleum and Energy 2011, 28). However, while fields are depleting especially in the North Sea, Norway’s Arctic waters are expected to hold significant potential. The Norwegian Petroleum Directorate believes that the largest undiscovered gas resources are located in the Barents Sea with 37% of the expected undiscovered total (the North Sea and the Norwegian Sea follow closely with 33% and 30%, respectively) (Ministry of Petroleum and Energy 2011, table on 30, 32). In reaction to recent new oil field findings Statoil expects that the daily gross production at oil fields in the Norwegian Barents Sea could reach half a million barrels by 2020. This should be achieved by developing known fields, opening new ones ready for development such as the second phase of the Snøvit field as well as the Norvarg, Goliat, Skrugard and Havis field, and through likely new discoveries in the formerly disputed Barents Sea area (Stolen 2012). Seismic mapping of the Norwegian part of the formerly disputed area in the Barents Sea has begun right after the agreement came into force in July 2011. Drilling is expected to start in 2014 (Gilja 2011; Pettersen 2011).

In order to make up for depleting sources, Norway is investing heavily in mapping potential petroleum resources and has been very active in granting exploitation licenses for oil and gas resources. Oil and gas investments will reach a record high in 2013 with NOK 9.8 billion (US$ 1.68 billion) (Aftenbladet 2012a). In 2011, 51 new blocks were offered for exploration in the Barents Sea and 43 in the Norwegian Sea, which was already announced in June 2010, a time when the moratorium for new deepwater drilling introduced by the Ministry of Petroleum and Energy after the oil rig accident in the Gulf of Mexico in April 2010 was still in place. In 2012, the government offered another 72 new blocks in the Barents Sea and 14 in the Norwegian Sea (BarentsObserver 2010; OilVoice 2012; Olje- og Energidepartmentet 2010). These developments have by some been interpreted as a ‘drilling and investment boom in the Barents Sea’ (Harbo 2010; Nilsen 2010). State company Petoro has already proclaimed that the “steep decade-long decline in Norwegian oil output is levelling off” due to substantial potential for improving recovery from mature fields, several small developments and the discovery of large oil fields (Aftenbladet 2012b; see below).

3.1.5 Denmark/Greenland

As of today, Greenland has no proven oil or gas resources (CIA 2012). The importance of oil and gas resources to Greenland lies in the potential of future development and realisation of profits from licensing and extraction. The official Arctic strategy estimates that 31 billion barrels of oil and gas off the coast of northeast Greenland and 17 billion barrels of oil and gas in areas west of Greenland could be discovered, though the probability is greater for discoveries in northeast Greenland (Kingdom of Denmark 2011, 24; also National Petroleum Council 2011, 38–41). The importance of mineral and hydrocarbon exploitation to Greenland’s long-term objective of independence gives contracting companies confidence that the Greenlandic government will keep its positive attitude towards their activities, resulting in a predictable investment climate.

Since 2002 the Bureau of Minerals and Petroleum has issued licensing rounds approximately every two years. More than 200,000 km2 are now covered by licences held by Cairn, EnCana, Exxon Mobil, Chevron, DONG, Husky Energy, Shell, Statoil, GDF, Conoco-Phillips and Maersk. The next licensing round in 2012/13 will focus on offshore northeast Greenland in the Greenland Sea. The area on offer is around 50,000 km2 big divided into 19 blocks (Bureau of Minerals and Petroleum 2012a, 2012b; Hammeken-Holm 2012). British Cairn Energy has placed the greatest stakes in Greenland so far holding 11 leases covering over 100,000 km2 off the coast (Cairn Energy 2011). In 2010, Cairn completed three drilling wells offshore west Greenland, two of which encountered hydrocarbons, but only in uncommerical quantities. During summer 2011 Cairn drilled five more wells, which all did not reveal a commercial discovery and were thus plugged and abandoned (Cairn Energy 2012a). Given the vast expenditures, around € 965 million for the eight wells, with no credible results yet, Cairn now plans to share financial exposures with other companies. A license in the Baffin Bay area shall be deplored in cooperation with Statoil, however not before 2014. Cairn is also planning to participate in a joint deep borehole drilling programme in the Baffin Bay area together with Shell, ConocoPhillips, Statoil, GdF and Maersk (Cairn Energy 2012b; Sharp 2012; Zander and Flynn 2012).

Overall, to date the Greenland continental margin is largely unexplored. Offshore west Greenland is comparable in size to the North Sea where 15,000 wells have been drilled. The licensing areas in northwest and northeast Greenland have very challenging ice conditions during winter and summer demanding ice-strengthened equipment (Government of Greenland 2010, 19). In case hydrocarbons were found, the limited oil and gas export infrastructure in Greenland in combination with difficult offshore development conditions increase the challenges even more (National Petroleum Council 2011, 63).

Risks and Challenges of Arctic Hydrocarbon Development

In addition to the concrete state interests in digging out their Arctic hydrocarbon resources, a number of significant risks and challenges of Arctic oil and gas development have to be taken into account, which also influence states’ decision to invest in Arctic endeavours.

4.1 Uncertainty of resource estimates

While the USGS numbers are considered most accurate of such kind of estimates, it has to be emphasised that they are all subject to considerable uncertainty because they are based on geological probabilities and not actual finds (e.g. Ingimundarson 2010, 7). Budzik (2009, 7 f.) gives a good overview of the wide variation in oil and gas resource estimates using the example of the West Siberian Basin. There is a 95% probability that (only) 158 tcf of natural gas are located in Assessment Unit 2 of the West Siberian Basin, whereas there is a 5% probability that 1409 tcf are there. This amounts together to a mean estimate of 622 tcf. On average, the 95% probability estimates are about one-fourth the mean estimate, while the 5% probability estimates are over twice the mean estimate and about 10 times the 95% probability estimate (Budzik 2009, 7 f.).

Further, one has to state the limitations of the USGS study itself. As Gautier et al (2009, 1178) emphasise:

It is important to note that these estimates do not include technological or economic risks, so a substantial fraction of the estimated undiscovered resources might never be produced. Development will depend on market conditions, technological innovation, and the sizes of undiscovered accumulations. Moreover, these first estimates are, in many cases, based on very scant geological information, and our understanding of Arctic resources will certainly change as more data become available.

Also, resources were assumed to be recoverable even in harsh conditions such as the presence of sea ice or oceanic water depths and the results did not take costs of exploration and development into consideration. Finally and more generally, concerning the prospect of Arctic resource exploitation in the farther future, estimates become increasingly speculative as “the pace of activity is affected by a number of factors including economic conditions, societal considerations, regulatory processes, and technological advances” as well as processes of global climate change (AMAP 2007a, v).

4.2 Economic Viability and Socio-Cultural Effects

Arctic oil and gas projects need considerable larger investments, for example in infrastructure, than comparable projects in other parts of the world. One reason is that Arctic oil and gas reserves are a far away from major markets. Higher wages are required to induce personnel to work in the isolated and inhospitable Arctic. The dangerousness of an Arctic workplace was shown on 18 December 2011 with the capsize of a floating oil platform off the coast of Sakhalin Island in the Far East of Russia, which saw at least 14 workers dead. Also long supply lines from manufacturing centres require equipment redundancy to insure reliability. Special technology and equipment, like ice-resistant tankers, are needed that can withstand harsh winter conditions like very low temperatures and harsh wind, ice and snow conditions. Onshore, poor soil conditions, also because of intermittent permafrost, can require additional site preparation to prevent production structures like buildings, roads and pipelines from sinking and bursting. Offshore rigs, tankers and other offshore facilities are confronted with dangerous drifting sea ice, icebergs and storms. Further, expensive icebreaker escorts are necessary and shipment of personnel, materials, equipment and oil can be interrupted for long time periods. External events like the huge oil spill in the Gulf of Mexico from April 2010 after the explosion of the oilrig ‘Deepwater Horizon’ can make offshore production in the Arctic more costly due to environmental concerns and increasing insurance rates. Risk assessments concerning possible environmental accidents definitely affect a company’s investment decisions, which not only concerns financial matters but also reputational effects. The business environment can change substantially between a project’s initiation and its completion. Most striking are hereby changing, especially falling, oil and gas prices. Unforeseeable events can significantly increase the costs of Arctic oil and gas projects, such as delays in the supply chain, abnormal weather conditions and court challenges from environmental groups[10]. While economic and social benefits can occur, for example in form of jobs, better health care and infrastructure, exploitation projects can also have negative social and economic effects on the local communities, for example in form of disruption of traditional ways of life by affecting the quality, quantity or availability of traditional foods and hunting, fishing and herding grounds (AMAP, 2007, v ff., cf. also 26 ff.).

4.3 Environmental Risks

Even under the most stringent control systems and with state-of-the-art technology risks to the Arctic’s fragile ecosystem cannot be entirely eliminated such as pollution and physical disturbances through tanker spills, pipeline leaks and other accidents. Hydrocarbons also persist longer in the Arctic environment due to the low temperatures, which means that the environment would only recover very slowly; this is also because a cleanup in such remote regions like the Arctic is very difficult (cf. AMAP, 2007, 29 f.). Techniques that have successfully been deployed for example during the Deepwater Horizon oil spill in April 2010, such as skimming, burning and the application of chemical dispersants, could turn out to be ineffective or less effective in Arctic waters. Suction devices to absorb the oil could be clogged by ice, booms could freeze, and depending on the time of year daylight can be scarce hampering clean-up efforts. The lack of infrastructure and the general remoteness of the Arctic region also contribute heavily to the difficulties of an oil spill response (Cappiello, 2011; Mayeda, 2010; OSPAR Commission, 2009; for a detailed account on oil spill prevention and response in the US Arctic Ocean cf. Nuka Research & Pearson Consulting, 2010). Many experts are meanwhile sceptical that the oil industry is prepared to deal with a large spill in difficult circumstances like the Arctic. The National Commission on the BP Deepwater Horizon and Offshore Drilling released a report in which it concludes that appropriate clean-up capabilities are currently not existent (Graham et al., 2011). The current debate about Shell’s ability to curb any oil spill in Arctic waters off the Alaskan coast is a case in point (cf. e.g. Los Angeles Times, 2011; Murphy, 2011).

4.4 Regulatory Challenges

While national legislation for the prevention and mitigation of pollution incidents in relation to oil and gas activities exist in the five Arctic littoral states, they have more often than not been assessed as not sufficient. This is mainly because environmental risks in connection to Arctic oil and gas activities, especially offshore, are transboundary in character. Therefore, the differences that exist in the laws, regulations and regulatory regimes and their implementation among oil and gas producing countries in the Arctic pose a regulatory challenge to Arctic oil and gas exploitation (AMAP, 2007, v ff., cf. also 22 ff.). Regulations on the international level have also been found to be incoherent and incomplete. As Koivurova and Molenaar (2010, 5) conclude,

[t]he legal instruments relevant to protecting the Arctic’s marine environment are numerous, yet incoherent and incomplete. […] The existing framework is too focused either on individual issues, or individual places, to adequately cover the entire Arctic. It does not take into account the reality of ecosystems that cross sectoral and geographical boundaries. The existing framework also fails to take into account the cumulative effects of different offshore activities such as fishing and oil and gas.

Budzik (2009, 12) concludes from all this that “[t]he high cost of doing business in the Arctic suggests that only the world’s largest oil companies, most likely as partners in joint venture projects, have the financial, technical, and managerial strength to accomplish the costly, long lead-time projects dictated by Arctic conditions.” Ingimundarson (2010, 4) concludes more generally that

Arctic oil resources are generally not considered sufficient to shift the world oil balance from the Middle East. Moreover, they would only be produced incrementally. Despite the huge gas resource potential in the Arctic, the shale gas “revolution” in the United States, which could spread to Europe[11], and high development and production costs have made it uncertain whether the production of Arctic gas will become viable in the foreseeable future. This development has kept LNG prices relatively low and raised serious questions about the profitability of huge Arctic gas fields.

Conclusion

This paper shows that a one-sits-fits-all approach to the role of Arctic hydrocarbons for future energy supply and security is not appropriate. A close look at the concrete factors making Arctic oil and gas interesting for energy security concerns, the distribution of expected Arctic hydrocarbons, and importantly the concrete Arctic states’ interest in developing their Arctic resources show a more concrete picture. Of crucial importance is hereby the competitiveness of Arctic with non-Arctic oil and gas resources predominantly in the five Arctic coastal states US, Canada, Russia, Norway and Denmark/Greenland. The analysis above shows that single state interests in the development of their Arctic hydrocarbon resources varies to a significant extent, with little relevance on the North American side of the Arctic and substantial interest on the Eurasian side. Most proven and expected Canadian oil and gas resources are located outside of Canada’s Arctic region, predominantly in the WCSB, making Arctic oil and gas not competitive at all with southern resources. While also Alaskan gas is little competitive to the vast shale resources in the lower 48, Alaskan oil reserves could be attractive given the US wish to become more independent from oil imports. However, declining Alaskan production, many uncertainties and regulatory challenges together with increasing offshore production especially in the Gulf of Mexico put a question mark behind Alaskan oil competitiveness. In contrast, most of Russia’s oil and gas reserves are located in Arctic Russia, especially in Western Siberia, making Arctic resources the country’s most importance hydrocarbon resources. While most of Norwegian hydrocarbon exploitation is still taking place outside Arctic waters, future prospects and recent findings indicate that the Barents Sea will play a dominant role for Norway’s future hydrocarbon production. While no oil or gas production is currently taking place in Greenland, licensing and exploration activities have started again in the early 2000s, but so far with no commercial results.

Significant risks and challenges abound for hydrocarbon development all around the Arctic, ranging from uncertainty about the concrete resource base available to economic, social, regulatory and especially environmental concerns, given that the majority of prospected exploitation will take place in offshore areas, which are particularly vulnerable. Finally, it has to be kept in mind that the Arctic is only one of many hydrocarbon resource areas and especially in terms of oil reserves plays a rather minor role in comparison to the dominating regions of South America and the Middle East. Russia’s Arctic gas reserves and potential sticks out as the only significant Arctic resource base on a global level. Overall, the promise of Arctic oil and gas resources to contribute to global energy security is inflicted with a substantial amount of uncertainties, risks and challenges, curbing any high hopes for Arctic hydrocarbons to change the global energy security equation.

II. References AND NOTES

[1] A ‘British thermal unit’ is a measure of the quantity of heat, defined as approximately equal to 1,055 joules or 252 gram calories. It was defined formerly as the amount of heat required to raise the temperature of one pound of water 1° F (cf. Encyclopedia Britannica at http://www.britannica.com/EBchecked/topic/80372/Britishthermal- unit-BTU).

[2] Cf. for example the Commission Communication “An Energy Policy for Europe” (esp. pp. 17 ff.), which assigns nuclear energy generation an important role in the bloc’s transition to a low-carbon economy (http://eurlex. europa.eu/LexUriServ/LexUriServ.do?uri=COM:2007:0001:FIN:EN:PDF, accessed 23 March 2013).

[3] The USGS uses a natural gas to oil conversion factor in which 6000 cubic feet of natural gas equals 1 barrel of oil (Budzik 2009, 5).

[4] For all numbers consult the tables in Bird et al. (2008) and Budzik (2009, 5).

[5] Provinces that are shared by two or more countries have been divided equally (for the location of the USGS Arctic provinces compare appendix B in Budzik 2009, 17).

[6] Data from US Central Intelligence Agency ‘The World Factbook’, accessible at www.cia.gov.

[7] Data from US Central Intelligence Agency ‘The World Factbook’, accessible at www.cia.gov.

[8] Louisiana produces even more oil than Texas if production from the Louisiana section of the federally administered Outer Continental Shelf is included in its state production total (U.S. Energy Information Administration 2012).

[9] Natural gas is usually classified into conventional and unconventional gas. Conventional gas is contained in sandstone or limestone formations with high levels of porosity and permeability and can be developed with traditional vertical wells. Unconventional natural gas is contained in low porosity formations usually spread over larger geographic areas than conventional gas formations. Shale gas and coal bed methane are classified as unconventional gas (Canadian Gas Association 2010, 2 f.).

[10] Such challenges have already been successful. The most famous is a 2007 ruling in Alaska in response to law suits filed by the North Slope Borough and the Alaska Eskimo Whaling Commission that suspended plans of Shell Oil to drill three wells in its Beaufort Sea leases. In total, Shell Oil had paid $2.2 billion since 2005 to secure oil and gas development leases offshore of Alaska (Budzik 2009, 10).

[11] If shale gas becomes a prominent energy resource in Europe is still an open question. First of all, in comparison to the US and Asia, Europe has only few shale gas reserves to exploit. Poland is so far the only country appearing enthusiastic about exploiting its (so far unproven) shale gas reservoirs in order to reduce its heavy dependency on coal. In contrast, in France expansion of the shale gas industry has been banned and drilling operations in the UK have also been halted after two small earthquakes near the exploration sites. There have already been voices in the EU calling for a strict regulation of unconventional energy sources such as shale gas and oil sands given their potential adverse environmental impacts. This is related to scientific studies that have found that shale gas is not the environmentally friendly alternative as which it has been proclaimed by the oil and gas industry. A study by the Cornell University found that gas indeed burns in power stations only with about half the carbon dioxide produced when burning coal; however, if one takes into account all associated emissions, for example during the very extensive exploration phase, this benefit disappears resulting in the same or even a worse carbon footprint than goal (Black 2011; EurActiv 2011d, 2011e; Harvey 2011a, 2011b; Howarth, Santoro, and Ingraffea 2011).

IV. NAUTILUS INVITES YOUR RESPONSES

The Nautilus Peace and Security Network invites your responses to this report. Please leave a comment below or send your response to: nautilus@nautilus.org. Comments will only be posted if they include the author’s name and affiliation.

5 thoughts on “The role of arctic hydrocarbons for future energy security”