OLGA DYOMINA AND ALEXANDER IZHBULDIN

AUGUST 28, 2020

I. INTRODUCTION

In this Special Report, Olga Dyomina and Alexander Izhbuldin describe the current status and recent trends in energy supply and demand in the Russian Far East (RFE). RFE energy policies are considered, and current and planned projects for exporting energy resources to the countries of Northeast Asia are also summarized.

A summary of this report follows. A downloadable PDF file of the full report is here.

Olga Dyomina is a Senior Research Fellow at the Economic Research Institute FEB RAS, Khabarovsk; Alexander Izhbuldin is the Lead Specialist of the Laboratory of Energy Supply to Off-grid Consumers, Melentiev Energy Systems Institute (ESI) SB RAS, Irkutsk.

This report was produced for the Regional Energy Security Project funded by the John D. and Catherine T. MacArthur Foundation and presented at China Foreign Affairs University, April 8–10, 2019

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

This report is published under a 4.0 International Creative Commons License the terms of which are found here.

Banner image: Lake Baikal in summer, photo by Olga Dyomina.

II. NAPSNET SPECIAL REPORT BY DYOMINA AND IZHBULDIN

ENERGY SECTOR CURRENT STATUS, RECENT CHANGES, AND ENERGY POLICIES IN THE RUSSIAN FAR EAST (RFE)

REPORT OF THE RUSSIAN FAR EAST WORKING GROUP TO THE NAUTILUS INSTITUTE REGIONAL ENERGY SECURITY PROJECT

OLGA DYOMINA AND ALEXANDER IZHBULDIN

AUGUST 28, 2020

Summary

The fuel and energy sector of the Far East of Russia provides about 20% of its gross regional product and almost 50% of its industrial production. The following features of the functioning of the fuel and energy complex of the region are highlighted in this Report: products of the mining and oil and gas producing industries dominate in the output structure of the complex; new industries (gas processing and gas chemistry) will develop in the near future; export orientation of production and infrastructure restrictions to increase the physical volume of exports; the main fuel and energy companies in the Far East of Russia are part of vertically integrated companies. A feature of the power industry of the Far East is the lack of communication with the country’s unified power grid, and the presence of isolated and remote areas of power supply. China, Japan and the Republic of Korea are traditional markets for products of the fuel and energy complex of the Russian Far East. Since 2013, the development of the Russian Far East has been identified as one of the priorities of Russia’s state policy. As a result, several measures were taken to stimulate development: reduction of electricity tariffs for industrial consumers in the Far East, preferential taxation of oil production and export customs duties on oil for some new fields in the region. Two scenarios in the LEAP model of the Russian Far East are considered: Reference Scenario (business as usual) and Resource-Transit Scenario. Both of these are based on assumptions that the current trends in the economy will continue, and specialization in the extraction of mineral resources and the use of transit opportunities will form the basis of the development of the region. Under the second scenario, additional export-oriented energy projects are considered without taking into account restrictions on the demand for Russian energy resources in the NEA countries.

1 Introduction

1.1 The Russian Far East’s Physical, Demographic, and Economic Setting

The total area of the Russian Far East is 6169.3 thousand km2 that accounts for 36% of the area of the Russian Federation. The Far Eastern Federal District (the Russian Far East) is divided into 9 Russian Federation subjects: the Sakha Republic (Yakutia), the Khabarovsk Territory, the Primorsky Territory, the Kamchatka Territory, the Amur Region, the Jewish Autonomous Region, the Magadan Region, the Sakhalin Region and the Chukotka Autonomous Region (Zabaykalsky Krai and the Republic of Buryatia became a part of the Far Eastern Federal District since 2018 in accordance with the Decree of the President of Russia No. 632 of November 3, 2018). In this research, the composition of the Russian Far East is considered without taking into account the Zabaykalsky Krai and the Republic of Buryatia, because they are regarded as a part of the Far Eastern Federal District only due to the provision of benefits that exist in the Far Eastern territories, but there are no links between the fuel and energy sector of the Russian Far East and this two regions in energy supply. The Russian Far East has land borders with China and the DPRK and sea borders with Japan and the USA.

The population of the Russian Far East is 6182.7 thousand people (4.2% of the Russian population). The average density of population is 1 person per square kilometer. The Russian Far East accounts for 4.6% of Russian industrial output and 5.4% of the total gross regional product. Traditionally, the Russian Far East has specialized in mining in order to maintain the rates of increase of the national economy (non-energy recourses) and resource exports (energy and non-energy resources).

In the period from 2008-2016 the economy of the Russian Far East developed more rapidly than the economy of Russia as a whole. The (average annual growth rate of GRP (gross regional product) of the Far Eastern Federal District was 2.0% during this period, while the gross domestic product of the Russian Federation grew at an average rate of 1.6% annually. The higher growth in the region in recent years can be explained by the realization of large investment projects in the Russian Far East.

GRP growth in the Russian Far East has been driven by the growth of industrial production, primarily, the increase in extraction of natural resources. In 2008-2016, the average annual growth rate of industrial production in the region was 4.2%, and the average annual growth rate of natural resources extraction was 5.4%.

The Russian Far East receives about 8% of all investment funds in Russia, while the annual average growth rate of investments in the region matched almost exactly the growth rate of investments nationally (1.5% and 1.3% respectively).

Despite the positive dynamics of the key macro indicators, the population in the region has continued to decrease. In 2008-2016 the annual average population dropped by 284.4 thousand people, and the annual average population decrease rate was 0.5%.

1.2 Energy Demand and Supply in the RFE

The volume of extraction of primary energy resources in the Far East in 2008-2016 increased as follows: coal – 1.2 times, oil – 2.1 times, and natural gas 3.5 – times.

The increases in extraction were caused by the increase in export volume of Russian energy resources to the NEA (Northeast Asian) countries. In 2016, the export volume of energy resources from the Russian Far East increased by a factor of 2.4 compared to 2008, yet due to the changes in energy prices in the global market, the value of exports in 2016 had fallen to 95% of that in 2008.

Transport infrastructure has been built in the region to provide for the export of coal, oil, and electricity; the respective infrastructure for export of Russian gas to NEA countries (China) is under construction as of 2019.

The domestic demand for energy resources in the region remains stable at a level of about 25 (±5) million tonnes of coal equivalent. The most energy-intensive industry in the region is the energy industry itself.

1.3 Key Energy Policy Issues for the RFE

The current and future development of the economy and energy sector of the Russian Far East is determined by two main factors: Russian state policy in the Russian Far East, and the international situation concerning Russia. The first factor has had a positive effect: starting from 2013 the development of the Russian Far East was stated to be a priority of Russian state policy (Presidential Address to the Federal Assembly of the Russian Federation, 2013). The second factor has had a negative effect: the slowing of the global economy and decrease of global prices for raw materials, especially oil, coupled with sanctions that were put into effect in 2014 concerning Russian companies and businesspeople, has been followed by the loss of FDI (foreign direct investment) and access to international capital, and the limited availability of cutting-edge technologies for deployment in the Russian Far East. The second factor complicates the realization of technologically complex and capital-intensive projects in the Russian Far Eastern energy industry. The main mechanisms that serve to advance the development in the region that have been introduced in the Russian Far East are the following: advanced development zones, Free Port Vladivostok, infrastructural support of investment projects, free provision of land (“Far Eastern Hectare”[1]), and an emphasis on Far Eastern sections in state programs. The major support tool in the energy industry is infrastructural support of investment projects, where the state subsidizes transport and energy infrastructure construction.

Specific features of Russian economic development in a new economic environment have caused the need to revise priorities adopted earlier in the economic and energy policy of the country. The national interests of Russia require intensification of mutually-beneficial energy cooperation between Russia and China, Japan, Korea and the other countries of East and Northeast Asia. In Russian official documents, this priority direction in the energy development of the country is referred to as the “Eastern Vector of Russia’s energy policy”. The central tenets of this direction can be briefly summarized as follows:

- Creation of new energy centers in the East of the country will increase the energy security of Russia, restore and strengthen energy ties among the regions, and help to solve many crucial federal, interregional and regional problems;

- Creation of a wide energy infrastructure including interstate gas and oil pipelines, and transmission lines in the east of Russia and Northeast Asia will reduce the cost of energy, improve reliability of energy supply to consumers in different countries, and help to solve environmental problems.

The Eastern energy policy of Russia, being part of regional economic policy, is not an end in itself but a tool for solving many critically-important federal, interregional and regional problems.

2 Energy Demand in the RFE—Current Status and Recent Trends

The economy of the Russian Far East is heavily skewed towards the energy industry. The energy sector accounted for 20.2% of GRP and 49.8% of industrial production as of 2016. At the same time, the branches of the energy industry are the largest consumers of energy resources in the region. For example, 49.5 million tonnes of coal equivalent (tce) of energy resources were used for processing of fuels.

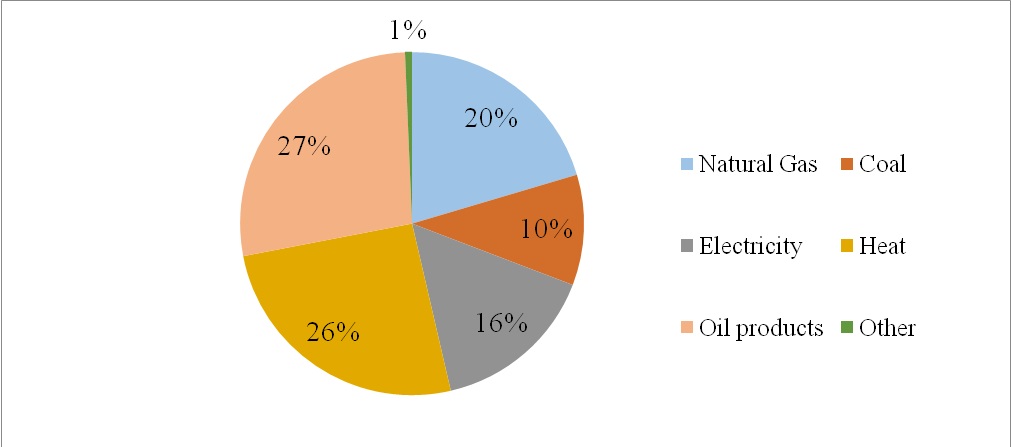

In 2016 the total final energy consumption in the region was 30.7 million tce. The largest shares belong to: petroleum products – 27%, thermal power – 26%, natural gas – 20%, and electricity – 16% (Figure 1).

Figure 1: Final Energy Consumption in the Russian Far East by Type of Energy

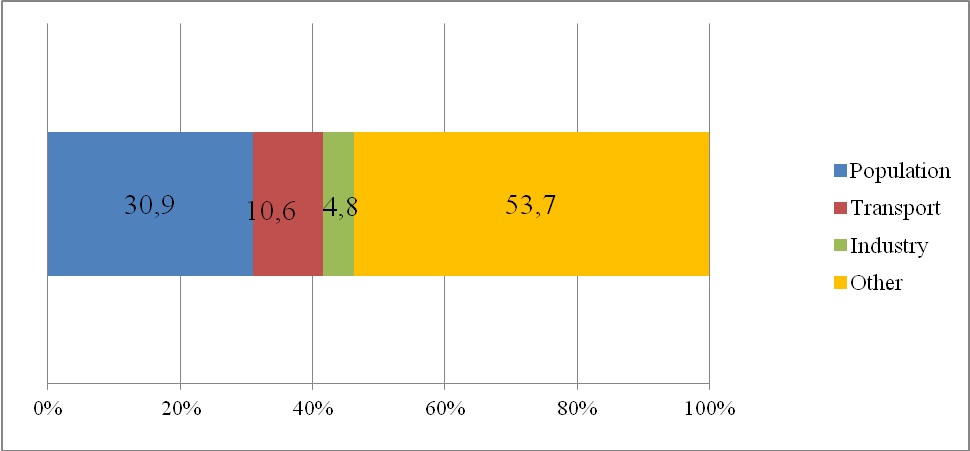

As the energy-intensive processing industries haven’t seen much development in the Far East to date, the highest-volume consumers of energy are the residential (“population”) and transport sectors, plus “other” (see Figure 2).

Figure 2: Final Energy Consumption in the Russian Far East by Sector

The “other” sector is a residual that results by subtracting the residential, transport, and industrial sectors from the total reported final consumption. The largest share of the “other” sectors belongs to the public (government) sector and services (commercial), which cannot be disaggregated and analyzed as separate sectors due to insufficient statistical data.

2.1 Transport

Freightage in the Far East is carried via several different transport modes. Railways service large-scale long and ultra-long-distance freight routes, and sea transport serves international markets. One of the specific features of the regions is the lack of a unified railway network and the presence of local systems of pipelines. Road vehicle (trucks and automobiles) transport acts as an intermediate between other kinds of transport and services intra-regional freight and short and medium distance hauls.

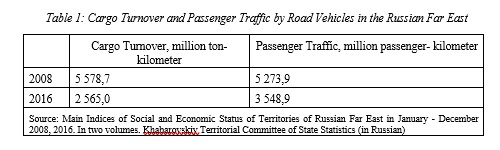

The key transportation means for the region is the automobile. It takes up the leadership spot in terms of volume of freight in the region (about 90% in 2017 – 138.7 million t). As such, it also consumes the most energy resources among other transportation means (78.5%). Since this kind of transport consumes mostly petroleum products, those fuels represent the largest share in the structure of the energy resources consumed by the transport sector as a whole (more than 78%). Automobile traffic has retained the top place among transport subsectors despite the decrease of freight turnover and passenger traffic between 2008 and 2016 (see Table 1).

The second largest consumer of energy resources in the transport sector is the railway. Since a huge part of this transport is electrified, it is one of the largest consumers of electricity. There is an active project of electrifying the “Khabarovsk – Sovetskaya Gavan” railway in order to increase the freight turnover by a planned factor of 3 by 2030. This goal is the priority policy for regional transport net development: transit networks providing access to natural resources deposits and further transportation of goods to North Eastern Asia markets.

2.2 Residential Sector

The dynamics and structure of energy consumption by the residential sector is primarily driven by regional population figures, the area and specifics of housing, and the number of private cars.

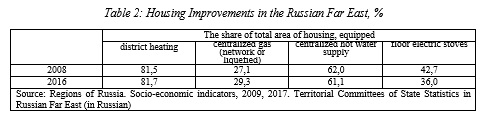

During 2008-2016 the population of the Far East decreased from 6.46 million to 6.18 million people. However, during this period there was also rapid housing construction in the region, as a result of which the total area of housing has increased from 134 to 145 million square meters. These opposite trends explained the growth of total housing area per capita, from 20.8 m2 in 2008 to 23.5 m2 in 2016. At the same time, the quality of housing hasn’t changed significantly with respect to access to centralized heat or gas supplies (see Table 2).

The characteristics of the Far East are: harsh climate conditions, which define long duration of the heating period (5 to 9 months), a large share of housing with central heating (Table 2), and the centralized provision of housing with gas or electric stoves. Thus, gas and electricity for the residential sector are competing resources used in cooking.

Most of the housing in the region was put into operation during Soviet times and has no heat meters. As a result, most households receive heating bills based on calculations. These calculations depend on the area of the home and a unit norm of consumption GCal per m2, which is developed for each municipality depending on the natural and climate conditions and housing specifics (number of floors, building materials, year of construction, etc.). Only a minority of the residential consumers (representing, in the Far East, 41.6% of the total volume of heat consumption) pays for heat based on meters. As a result, residences have no control over the volumes heat they consume, unlike other energy resources. The consumption of electricity and gas is mostly measured with meters (with metered homes accounting for 94.9% and 75.5%, respectively, of the total consumption volume).

There has been, however, growth in the total consumption of electricity, and a decrease in the total consumption of heat. These opposite dynamics can be explained by changes in shares of resource consumption:

- As a result of using modern building materials and energy-saving technologies in construction, repair and modernization of housing, the share of heat consumption has been falling;

- As a result of population income growth and increases in the quality of life, including access to quality housing and household appliances, the share of electricity consumption has been increasing.

The dynamics of consumption of petroleum products in the Far East by households is explained by the number of private cars. During 2008-2016 the number of personal cars has increased from 206.6 to 314 cars per 1000 people, which in turn increased the consumption of petroleum.

The structure of energy resources consumption by the residential/household sector therefore looked as follows as of 2016: 51% – heat, 30% – petroleum products, 14% – electricity, and 4.5% – natural gas. The share of gas in the structure is minimal, since the level of gas supply to homes in the Far East is only 13%, while gas redistribution networks are loaded only partially. The average network load in the Far East is the minimum in the country, at 43%, compared with the country average of 72%.

As a result, household behavior in the Far Eastern energy services market is defined primarily by the specifics of the services themselves, the specifics of their supply and consumption in the region, and only then by price.

2.3 Industry (Excluding Energy Industry)

Excluding the energy industry, when looking at the structure of industrial production, the largest share belongs to the extraction industries (58%). The region traditionally mines diamonds, gold, silver, tin, lead, zinc, and tungsten. These industries mostly consume petroleum products. The structure of Russian energy statistical records does not allow separating the consumption of these industries from those of other industrial consumers.

Based on available information on industrial production excluding the energy industry, it is clear that energy consumption by processing industries has not yet developed significantly in the region. These industries occupied only 4.7% of GRP and 20% of total industrial production as of 2016.

Some of the largest consumers of energy resources among the processing industries are: production of other non-metal mineral products, the food industry, and the wood and wood products industry. The processing industry mostly consumes electricity, accounting for 58% of its energy use.

3 Primary Energy Supply in the RFE—Current Status and Recent Trends

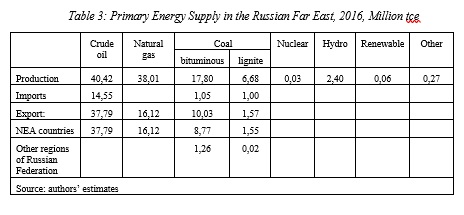

Resource extraction dominates in the structure of the Russian Far Eastern energy industry. In 2016 the total volume of primary energy was 105.7 million tonnes of coal equivalent (tce), the volume of secondary energy – only 30.7 million tce — was 3.4 times lower (see Table 3).

3.1 Oil and Natural Gas

The Far East has two main centers of oil and natural gas extraction: Sakhalin Oblast and Sakha Republic. In 2016 the volume of oil and natural gas condensate extraction was 28.3 million t, with natural gas production of 32.9 billion m3. The largest producers of hydrocarbons in the Russian Far East are the consortiums “Sakhalin-1” and “Sakhalin-2”, which account for more than 60% of oil and about 90% of natural gas extraction in the region.

During 2008-2016 the volume of oil extraction in the region increased by a factor of 2.1 and comprised 5.2% of the total Russian volume of extraction, while natural gas extraction in the Far East increased by a factor of 3.5 and comprised 5.1% of the total volume of Russian gas as of 2016.

The growth of oil extraction was provided by starting industrial exploitation of the Talakan deposit in 2008-2009 in the Sakha Republic, year-round oil extraction as part of “Sakhalin-2” project in 2009, exploitation of the Odoptu deposit on the Sea of Okhotsk shelf in 2010 (“Sakhalin-1” project) and of the Arktun-Dagi deposit in 2015 (“Sakhalin-1”). The growth of oil extraction volumes was synchronized with the concurrent development of transport infrastructure.

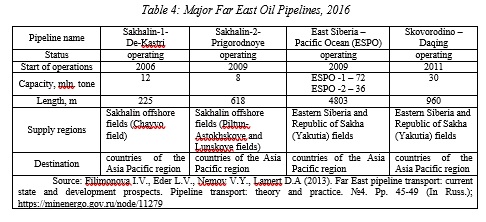

The transportation of oil in the region is carried out through a system of oil pipelines, including the “East Siberia – Pacific Ocean” (ESPO), the “Sakhalin-1-De-Kastri”, and the “Sakhalin-2-Prigorodnoye” pipelines, which connect the largest deposits of the regions with seaports, and are oriented to the export of Russian oil (see Table 4). The construction of ESPO was carried out in stages: “Tayshet-Skovorodino” (ESPO-1) and the special oil port Kozmino were put into operation in 2009, and “Skovorodino-Kozmino” (ESPO-2) in 2012. The planned capacity of the pipeline is 80 million t annually, and an expansion project is now underway.

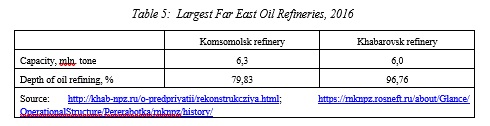

Oil processing in the Far East is carried out by two large oil refineries — Komsomolsk refinery (Rosneft Oil Company) and Khabarovsk refinery (“Independent Oil Company”) (Table 5), and two small refineries belonging to “Petrosakh” and “Transbunker”. The total annual capacity of the Far Eastern refineries in 2016 was 14.2 million t, and the level of capacity utilization was 85.3%. Since Sakhalin products are aimed at oil export markets as part of agreements on production division, the raw materials for refining in the region are imported from the Ural and Siberian Federal Districts. Small volumes of oil from the land-based deposits of Sakhalin are transported to the Komsomolsk refinery for processing (up to 2 million t annually).

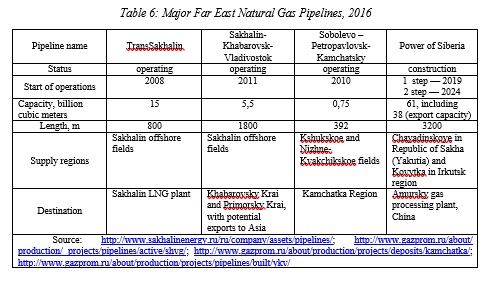

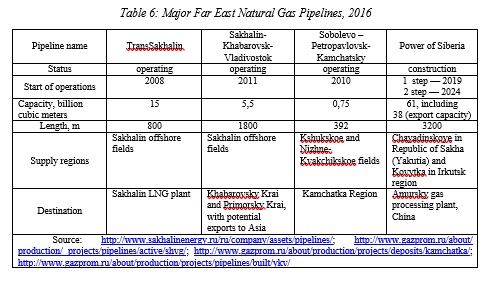

Presently there are only local gas transportation systems under development in the Far East: 1) underwater gas pipelines for gas supply of certain settlements and industrial enterprises “Zapadno-Ozyornoye Gas Condensate Deposit – Anadyr” in the Chukotka Autonomous Okrug); 2) four local gas transportation systems that operate separately and independently from each other in Sakha Republic, for example, “Kysyl-Syr – Mastakh – Berge – Yakutsk” and “Mirny – Aykhal – Udachny”, 3) the gas transportation system of the Kamchatka center of gas extraction (“Sobolevo – Petropavlovsk-Kamchatsky”); and 4) gas transportation systems (“Sakhalin – Khabarovsk – Vladivostok”) in the southern part of the Far East, and the trans-Sakhalin pipeline system (Table 6).

The Sakhalin Oblast, Sakha Republic, Kamchatka Krai, and Chukotka Autonomous Okrug have their own natural gas resources. Gas from Sakhalin Oblast that is not used in production of liquefied natural gas (LNG) and not pumped back into reservoirs is sent to consumers in Sakhalin Oblast, Khabarovsk Krai, and Primorsky Krai through a system of pipelines. Gas supply to the Amur Oblast will, once Phase I of the “Power of Siberia” project is complete, be coming from the Sakha Republic. Discussions are underway to supply the Magadan Oblast with LNG from Sakha Republic, although in the future it is may develop its own gas resources.

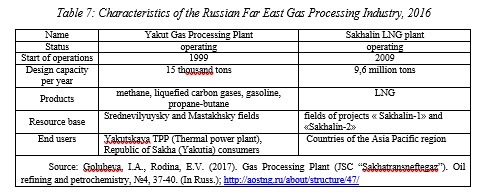

The gas processing industry in the Far East is represented by two factories: the Yakutsk gas processing plant and an LNG plant in Sakhalin (Table 7).

Primary gas processing is carried out in only one enterprise – the Yakutsk gas processing plant, with a capacity of 15 thousand t per year. The plant produces dry gas, liquefied hydrocarbon gases and petrol. The products are consumed inside the region. There is an LNG plant as part of “Sakhalin-2” with a rated capacity of 9.6 million t per year. In 2016 the volume of production was 10.9 million t of LNG.

3.2 Coal

Coal extraction is active in all of the Far Eastern jurisdictions of Russia except for the Jewish Autonomous Oblast. The volume of extraction in 2016 was 40.0 million t, including black coal – 58.5%, and lignite – 41.5%. The extraction of coke only takes place in the Sakha Republic, which comprises 32% of the total coal extraction volume in the Far East.

During 2008–2016 the capacity of coal mining facilities in the Far East increased by a factor of 1.5 and reached 51.3 million t. During 2008-2016 the volume of coal extraction increased 1.2 times and was 10.4% of the national total. The growth of coal extraction came about by the entry into operation of two of the largest projects: the modernization of “Urgalugol” (Khabarovsk Krai) since 2005, and the expansion of the Elginskiy coal mine (Sakha Republic). The capacity of the first line of the Elginsky project is 11.7 million t of coal annually. The capacity of “Uralugol” during 2008-2016 increased by a factor of two and reached 5.5 million t per year.

There are 5 coal beneficiation plants in the region (Table 8), whose annual capacity in 2016 was 17 million t, and the volume processed was 13.5 million t. In addition to the largest plants in the table below there are two small plants in Primorsky Krai, namely Vostochnoye with a processing capacity of 0.6 million t per year, and in Sakhalin (“Enrichment Processes”) with capacity of 0.2 million t per year.

The coal mined in the Far East is mostly consumed by the population of the region and exported.

4 Electricity Supply in the RFE

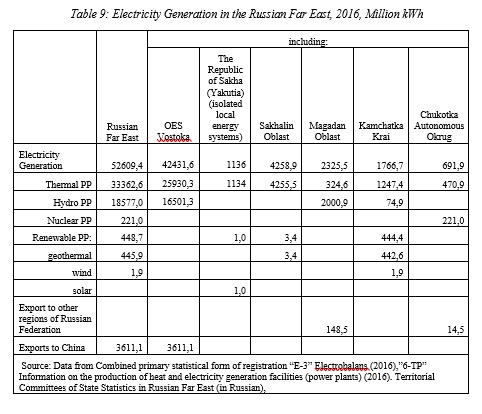

The electrical industry of the Far East is comprised of the unified energy system, including the energy systems of Amur Oblast, Khabarovsk Krai, Primorsky Krai and South-Yakutsk energy district of Sakha Republic, and isolated local energy systems and hubs in Sakha Republic (Western and Central energy districts), Kamchatka Krai, Magadan Oblast, Sakhalin Oblast, and Chukotka Autonomous Okrug. Starting from 2019, in accordance with the Decree of the government of the Russian Federation dated December 8, 2018 №1496, the Western and Central energy districts of the Republic of Sakha (Yakutia) will be attached to the Unified energy system of Russia. The data in Table 9are based on these changes.

The Unified Power Grid of the Russian Far East (OES Vostoka) includes 27 power stations with a total capacity of 11 264.7 MW (excluding the Nikolaevsky energy district), 110 to 500 kV power lines with combined length of 33 025 km, and 110 to 500 kV substations with a total capacity of 38.8 million kVA.

“RusHydro” manages the power supply of the Far East. The company owns power stations with total capacity of over 13 GW, providing more than 90% of all power in the Far East. Also, the company provides transportation of electricity, as it also manages more than 100 thousand km of power lines, and the distribution of electricity supplies to end consumers.

Starting from April 1, 2017 there were changes in managing the assets of the “RusHydro” subsidiary – “RAO ES Vostoka”. The management of the subsidiaries was transferred to the division of “RusHydro” named “Far East”. The integration of the executive offices of “RusHydro” and “RAO ES Vostoka” is one of the steps in the “RusHydro” strategy of improving the financial situation of the Far Eastern power industry and the quality of management.

There are branches of “RusHydro” in Amur Oblast – including the largest-in-the-Far-East hydroelectric plant, Bureyskaya (2010 MW), and the Zeyskaya hydro plant (1330 MW). The construction of Nizhne-Bureyskaya hydroelectric dam is still in progress; the first three turbines were put into operation in August 2017. In addition to producing energy, these hydroelectric dams protect the region from floods.

The “RusHydro” subsidiary “Far Eastern Generation Company” (FEGC) uses thermal power stations with a total capacity of about 6 GW in Primorsky and Khabarovsk Krai, the Amru Oblast, the Jewish Autonomous Oblast, and in the south of the Sakha Republic. Aside from producing energy, FEGC provides heat for large settlements and factories. The “Far Eastern Distribution Network Company” (FEDNC) manages transportation of electricity in these regions, and the “Far Eastern Energy Company” (FEEC) covers distribution and sales.

“Yakutskenergo” and its subsidiaries provide electricity supply in the Sakha Republic. One of the characteristics of the region is a large number of remote, hard to reach settlements, isolated from the energy system, and the task of supplying those settlements with electricity falls on diesel power stations.

“Kolymaenergo” (part of the Kolymskaya hydroelectric plant and still-under-construction Ust-Srednekanskaya hydroelectric plant) and “Magadanenergo” provide power supply in Magadan Oblast, and “Chukotenergo” provides power in the Chukotka Autonomous Okrug. “Sakhalinenergo” is responsible for supply electricity and heat in Sakhalin Oblast.

The energy industry of Kamchatka Krai is based on the “Kamchatskenergo” (thermal power plants and distribution networks), “Geoterm” (geothermal plants) and “Kamchatka Gas Energy Complex” (which uses the Tolmachevsky hydroelectric plants).

The production of electrical energy in the Far East in 2016 was 52.6 billion kWh, 71% of which (37.5 billion kWh) happened in the unified energy system. 63% of energy is provided by thermal power plants, 35% by hydroelectric dams (Table 9).

Heat supply in the Far East is mostly provided by centralized heat supply systems, of which there are more than one thousand. In the Far East there are only two large systems of centralized heat supply, in Khabarovsk and Vladivostok (serving populations more than 500 thousand people in each city). 20 large settlements have thermal power plants, and others population centers have local systems of heat supply based on boilers.

Heat supply in the Far East is mostly provided by centralized heat supply systems, of which there are more than one thousand. In the Far East there are only two large systems of centralized heat supply, in Khabarovsk and Vladivostok (serving populations more than 500 thousand people in each city). 20 large settlements have thermal power plants, and others population centers have local systems of heat supply based on boilers.

5 Energy Projections and Energy Policy

5.1 Large-Scale LNG Projects

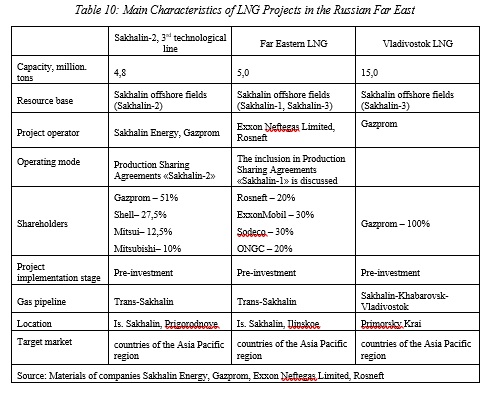

There are several planned large-scale projects for development of LNG production and the creation of natural gas-based chemical manufacturing plants in the Far East, primarily aimed at export.

The new projects for LNG production in the FEFD are:

“Sakhalin-2”, 3rd technological line; “Far Eastern LNG”; and “Vladivostok LNG”.

The resource base for these projects is gas from Sakhalin shelf deposits. There are also proposals to use Irkutsk and Yakutsk gas for Vladivostok project (table 10).

5.1.1 Development of “Sakhalin-2”

The chairman of the board at “Gazprom”, A. Miller, and the CEO of Shell, Ben van Beurden, met on September 30, 2014. They considered the outlook for cooperation between the two companies positive and noted the prospects of increasing the volumes of LNG production as part of the project. Objectively, increasing the production of LNG of “Sakhalin-2” is an attractive goal thanks to availability of gas reserves (their own and those of their main shareholder, “Gazprom”), gas transportation infrastructure, a shipment terminal, an available industrial zone, and a tanker fleet. The efficiency of placing the LNG plant in Prigorodnoye has been validated – the existing plant is loaded to capacity, with the full volume of gas contracted for and regularly shipped to consumers.

5.1.2 “Far Eastern LNG” – “Rosneft”

On September 23rd, 2014, the vice-president of Rosneft, V, Rusakova, declared that Rosneft considers the construction of “Far Eastern LNG” plant as part of the Sakhalin-1 project optimal.

The advantages of the “Far Eastern LNG” project are similar to those related to the expansion of “Sakhalin-2”, apart from the availability of gas transportation infrastructure. Presently, Rosneft is fighting for the access to trans-Sakhalin gas transportation system through the Russian court system.

It should be noted that the capacity of the trans-Sakhalin gas pipeline of “Sakhalin-2”, taking into account construction of additional compressor stations should be, according to our estimates, sufficient to provide raw materials even to the 3rd line of the LNG plant in Prigorodnoye and the Far Eastern LNG plant.

Sakhalin Island is the most attractive location for LNG plants due to the close proximity of raw materials and potential markets, and the availability of ice -free ports that allow year-round shipments.

5.1.3 “Vladivostok LNG” – “Gazprom”

The “Vladivostok LNG” project was announced by “Gazprom” in 2011 as part of the strategy of increasing the share of the company in the global market for LNG. The potential capacity of the plant is 15 million t annually. “Gazprom” doesn’t rely on the resources of other gas producers in its projects, which is why at first the resource base of the project was declared to be the Irkutsk and Yakutsk gas extraction centers – as the resources on the Sakhalin shelf had not yet been discovered. At the end of 2011 the Research Institute “Gas Economy” analyzed the plan for developing the Eastern gas program and offered corrections. The results of the analysis were that the price of LNG from the plant near Vladivostok would be 568 USD/1000 m3 (if using Yakutsk gas), while the price of Sakhalin LNG was 312 USD/1000 m3. These estimates show at the very least the unprofitability of “Vladivostok LNG” and non-competitiveness of its products relative to operations at Sakhalin.

On September 10, 2014, during APEC summit in Beijing, the chairman of “Gazprom”, Miller, suggested that Russia and China consider the shipments of Russian gas to China from the Far East. Later it was noted, that there is also the possibility of delivering gas from Dalnerechensk to North-East China, that is, gas formerly intended for LNG processing (Vladivostok LNG), with further export to Japan and other North-East Asia countries.

Thus, the Vladivostok LNG project competes with the possibility of pipeline gas shipments to China. These shipments could start soon, thanks to the presence of existing transport infrastructure. It would be necessary, however, to attract “Sakhalin-1” gas, at least, at the very beginning. But this project would be bilateral, aimed only at the Chinese market. A project that includes LNG production, on the other hand, would allow diversifying shipments to other countries. The announced estimates of the costs of LNG from the Vladivostok project, however, make it very risky.

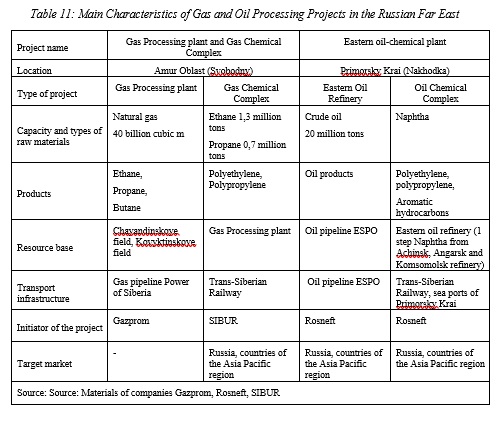

5.1.4 Creation of Gas and Chemical Clusters in the FEFD

Thanks to putting into operation extraction of the deposits of “fat” natural gas[2] in the south-west of Yakutia and north-east of Irkutsk Oblast, with large-scale exports, there is a project under development to creating a gas processing and chemical plant in the Amur Oblast (Svobodny) to process the gas delivered through the gas transportation system “Strength of Siberia”, which has a capacity of 40 billion m3 per year. In addition, “Rosneft” is still considering the possibility of building an Eastern oil-chemical plant in Primorsky Krai that is part oil refinery and part chemical plant. The capacity is to be 12 million t oil annually. The main indicators of all of the projects described above are shown in Table 11.

5.2 State Regulation of Energy Industry Branches

The regulation of the energy industry branches in the Far East is part of the general energy policy of Russia. Since 2008, most changes in regulation have been made with regard to the electricity, heat and oil industries.

5.2.1 Electricity

For almost two decades Russia has been reforming its electrical energy industry. The state regulation of the industry has changed: vertically-integrated companies have been replaced by organizations specializing in separate activities, with the separation of the potentially competitive spheres (production, supply, repair and service) and the natural monopolies (transportation, operative management). A competitive market for wholesale and retail electricity has been created.

There are two levels for the electricity and power market in Russia: wholesale and retail. The wholesale market mostly operates in the regions combined into price zones — first (European Russia and Ural) and second (Siberia) — and non-price zones (Khabarovsk Krai, Primorsky Krai, Amur Oblast, Jewish Autonomous Oblast, Arkhangelsk and Kaliningrad Oblast, Komi Republic). There is a special pricing mode in non-price zones. In the local isolated energy systems of the Far East pricing is based on the producers’ costs as reported.

In order to comply with the directive of the President of Russia V.V. Putin, on December 28, 2016 Federal Law №508 “On introducing changes into Federal Law On electrical energy industry” was adopted. The law is designed to lower tariffs for electricity for the industrial consumers of the Far East to the country average level by January 1, 2020. On June 30, 2017 another law was adopted, Federal Law № 129, to develop and clarify this mechanism.

To realize these federal laws the Government of the Russian Federation has adopted several necessary legal acts. The Far Eastern regions have reviewed the tariffs on electricity for the first and the second half-year 2017 with a goal of decreasing the average tariff in 2017 to the country average. There were agreements on contributions between “RusHydro” and Far Eastern regions in order to distribute surcharges, meaning from the wholesale market to the regions, to compensate for the loss of income of energy suppliers.

Starting from July 1, 2017, the mechanism of lowering energy tariffs was put into action in 5 regions of the Far East that historically had the highest levels of tariffs: Chukotka Autonomous Okrug, Magadan Oblast, Kamchatka Krai, Sakha Republic, and Sakhalin Oblast.

The Chairman of the Government of Russia, Dmitri Medvedev, signed a directive on setting the basic tariff on electricity for nine regions included in the Far Eastern Federal District (FEFD) for 2018. According to the directive, the tariff for the Far East will be 4.3 rubles per kWh (6.8 cents per kWh), excluding the added value tax.

The main documents that determine the development of the energy industry of the Far East and Transbaikal are the following: the “Strategy of socio-economic development of the Far East and Baikal region through 2025”, adopted by order of the Government of the Russian Federation № 2094-r on December 28, 2009; the “Scheme of territorial planning of the Russian Federation in energy industry”, adopted by order of the Government of the Russian Federation № 2084-r on November 11, 2013; the “General scheme of placing the objects of electrical energy industry in place through 2035”: adopted by order of the Government of the Russian Federation № 1209-r on June 9, 2017; and “Scheme and program of development of the Unified energy system of Russia 2017-2023”, adopted by the order of the Russian Ministry of Energy № 143 on March 1, 2017.

5.2.2 Heat Energy

There is no separate body that ensures unified regulation of heat energy in Russia. The powers to regulate heat provision are divided between different federal, regional, and municipal structures. Up until 2010, when the Federal law №190 “On heat supply” was adopted, there were no basic state documents regulating heat energy and its supply.

The levels of tariffs on heat are expected to change in Russia and the Far East due to changing of the pricing mode for heat, as introduced into Federal law on July 29, 2017 № 279 “On introducing the changes to the Federal law ‘On heat supply’ and other legal acts of the Russian Federation regarding the issues of improving the system of relations in heat supply industry”. The new method includes setting top price levels on heat for the final consumer based on the level of heat provided by an “alternative boiler room”, which is equal to the price of the alternative source of heat based on the best available technology. This new method is supposed to work in the framework of “price zones of heat supply” that must fulfill the following criteria: half or more of heat supplies are produced during the combined production of electricity and heat; the availability of one or several heat supply companies with production volume of more than 50% of the total production of heat energy in the area; the presence of a confirmed scheme of heat supply; and the agreement of regional and municipal authorities.

Since only the systems that produce a combination of electricity and heat energy based on thermal power plants or co-generation stations will be reformed, these changes will affect approximately 150-165 cities and 209 settlements. In the Far East, the 22 largest settlements that have thermal power plants and 25 local systems of heat supply can be potentially come under these price reforms.

Unlike for electricity, there is not a uniform strategy for development of central heat supply systems in the country or in the Far East. In accordance with federal law, however, the cities and settlements develop local schemes of heat supply.

5.2.3 Oil Extraction and Refining

As the traditional deposits of oil are running out in Russia, the oil industry is forced to move to the eastern regions of the country, and are seeing the worsening of geological conditions for oil extraction. Special measures were taken to stimulate the extraction of oil, including tax breaks for those tapping oil deposits. When calculating the tax on extracting oil and gas condensate certain coefficients are used, which are also used when calculating tax breaks (coefficients, for example, related to the specifics of oil extraction, the level of depletion of a site, the volume of resources on a site, the level of difficulty of oil extraction, the level of depletion of a deposit, the region of extraction, and the properties of the oil in the deposit). In the Far East, half of all taxable oil meets the tax break conditions, since oil extracted from offshore deposits is suitable for tax breaks. The plan for the stimulation of exploitation of hydrocarbon deposits on the continental shelf of Russia and in the Russian part of the Caspian Sea is to be realized in accordance with the order of the Government of the Russian Federation published on June 7, 2014, № 987-r.

In addition, in 2014, according to the decree of the Government of the Russian Federation on September 26, 2013, № 846, a mechanism of breaks on the export customs tariff for oil extracted from the deposits in new regions (East Siberia and Far East) was put into action.

The tax rates on extraction of oil and export duties are changing according to the Federal law № 366 from November 24, 2014, which suggests simultaneous decreases of customs duty on oil and petroleum products and compensation of lost income for the state budget at the expense of increasing tax rates on oil and gas condensate extraction (“Big tax maneuver”). The main goal of these policies is to stimulate an increase in oil processing by Russian oil refineries since their profitability mainly depends on the difference in export duties on crude oil and petroleum products.

The development of the oil industry operates in accordance with the “Energy strategy of Russia through 2020”, adopted by the order of the Government of the Russian Federation on August 28, 2003, № 1234-r; the “General scheme of oil industry development through 2020”, adopted by the order of the Russian Ministry of Energy on June 6, 2011, № 212; and the “Scheme of territorial planning of the Russian Federation of federal transport” (namely, pipelines), adopted by the order of the Government on August 13, 2013, № 1416-r.

The development of gas industry in the Far East operates in accordance with the “Energy strategy of Russia through 2020”, adopted by the order of the Government of the Russian Federation on August 28, 2003, № 1234-r; the “Program of creation of a unified system of gas extraction, transportation and supply, with possible export to China and other Asia-Pacific countries in the Eastern Siberia and the Far East (Eastern gas program)”, adopted by the order of Ministry of industry and energy of the Russian Federation on September 3, 2007 № 340; the “General scheme of development of gas industry through 2030”, adopted by the order of the Russian Ministry of Energy on June 6, 2011, № 213; and the “Plan of development of gas and oil chemical industry of Russia through 2030”, adopted by the order of the Russian Ministry of Energy on March 1, 2012, № 79.

The development of the coal industry operates as part of the “Energy strategy of Russia through 2020”, adopted by the order of the Government of the Russian Federation on August 28, 2003, № 1234-r; and the “Program of coal industry of Russia through 2030”, adopted by the order of the Government on June 21, 2014, № 1099-r.

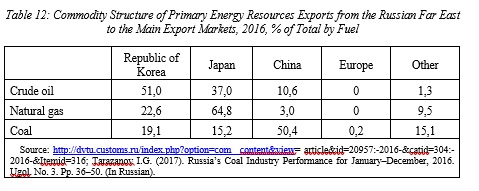

6 The RFE’s Involvement in Discussions on Regional Energy Sharing

Energy resources produced in the Far East comprise 40% of primary energy resources exported by Russia to the East. The role of the Far East macroregion is explained, first, by the large-scale exploitation of large deposits in the region, and second, because the region serves as a transit corridor to the East for transporting energy resources from Siberia. The main factor that defines the dynamics of energy resources extraction in the region is external demand. More than half of the energy resources produced in the region are exported. The growth of energy resources production in the region is explained by the growth of operations to take advantage of newly-developed deposits of energy resources, and development of the transport infrastructure needed to get the resources to markets. The traditional markets for export of energy industry products from the Far East are China, Japan, South Korea (Table 12).

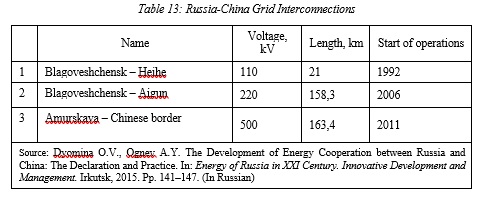

6.1 Electricity

The export of Russian electricity increased by a factor of 6.4 between 2008 and 2106, and the volume of electricity exported by OES Vostoka increased by a factor of 1.3. The supply of resources to external markets required additional development of the transmission network. In 2011 the international powerline “Amurskaya – PRC Border” was put into operation, with a voltage of 500 kV, allowing an increase in the capacity of export lines from 1.2 to 6-7 billion kWh annually (table 13). Today the annual volume of electricity exports is on average 3.3 billion kWh per year.

6.2 Oil Processing, and Oil Storage

In 2014 “Gazprom” and the Chinese National Oil and Gas Corporation signed a 30-year agreement on the supply of Russian gas to the East, with the volume of trade to be 38 billion m3 annually. Fulfilling the conditions of the agreement is tied to the operation of Chayandinskoye deposit and the construction of the gas pipeline “Strength of Siberia” (the segment from the Chayandinskoye deposit to the Chinese border near Blagoveshchensk). Construction began in September 2014, and by 2017, 700 km of pipeline had been built, and the estimated completion time was 2019. The planned volume of Russian natural gas exports to China once the pipeline is completed is 38 billion m3 annually, which is 1.6 times larger than the present export volume. Since the natural gas from the Sakha Republic deposits has a complex composition, in order to extract valuable components of the gas the Amur gas processing plant is being constructed. The projected capacity of the plant is 42 billion m3 of natural gas annually, and the estimated time of start of operations is 2021. The plant will use traditional technologies to extract ethane, propane and butane, and helium condensates from the raw gas stream. The plant’s is 42 billion m3 capacity will be divided into 6 operating lines, each with capacity of 7 billion m3. The lines will be put into operation in stages: 2 lines in 2021, and then 1 line per year through 2025. Besides dry gas (39.1 billion m3), the plant will produce ethane (2500 thousand t per year), liquefied hydrocarbon gases (1700 thousand t), and helium (60 million m3). The planned volumes of helium production at the Amur plant will be 12 times higher than the current Russian production and will be equivalent to 40% of the global volume as of 2015. The capacities for manufacturing final products at the Amur plant are many times higher than demand for those products by the Russian national economy, so the degree to which the plant’s capacities to produce these products is used will be determined by the dynamics of external demand. There are plans for construction of a helium logistics center (helium hub) to export LNG and helium, the planned capacity of which is 60 million m3 of helium annually and could be increased up to 120 million m3. The center would include helium liquification apparatus, and technological blocks for operating cryogenics iso-containers.

6.3 Oil, Oil Processing, and Oil Storage

The routes for transporting crude oil to the Asia-Pacific countries involve a combination of transportation modes, through pipelines, by railway, via seaports, including:

- Shipments through the ESPO and “Russia – China” oil pipelines (Skovorodino – Daqing);

- Shipments through oil pipelines to De-Kastri (“Sakhalin-1”) and Korsakov (“Sakhalin-2”) ports; and

- Shipments via the railway to China.

Today the share of Far Eastern oil in the export pipelines is about 17%, the rest is Siberian oil.

The capabilities for exporting natural gas from Russian to the Asia-Pacific countries are presently limited by the capacity of LNG plants and the lag in construction of gas pipelines. Natural gas from the Sakhalin shelf deposits is transported through the trans-Sakhalin pipeline system to the LNG plant. Most of the volume of gas from the plant is exported to Japan by LNG tanker.

6.4 Coal

The export of coal occurs mostly through seaports; the bottleneck in coal exports from the Russian Far East is the capacity of the railway that provides coal delivery to the seaport. The existing capacity of Far Eastern seaports for coal transportation is estimated to be 60 million t annually.

When internal demand falls, the growth of exports allows the volumes of energy resources extraction in the Far East to be sustained or increased. The present supply channels of Russian resources to the Asia-Pacific markets, however, are currently working at almost full capacity, while the existing potential of production capacities for extracting and producing energy resources still has a growth reserve.

7 Report on Development of RFE LEAP Model

7.1 Draft Overall Structure

The LEAP Model for the Russian Far East includes energy demand and supply components. The Final Demand modules in the model do not, at present, include detailed information on the sectors, sub-sectors, or end-uses in which fuels are consumed. This is due to the severe shortage of statistical information on energy consumption in Russia. The details of demand structure were determined on the basis of the major statistical formats used for the creation of energy balances. Electricity consumption data were taken from the “E-3” (Electricity Balance) form and revised with the help “4-TER” forms (see references below). The data on heat consumption was taken from the forms “1-TEP” and “4-TER”. The main source of data on consumption of energy resources by industry, types of transport was form “4-TER”.

The draft demand structure consists of following sectors: industry (manufacturing), transport, households (population) and non-specified other. The last sector, “non-specified other” is a residual that is generated by subtracting demand in the sectors above from the total final consumption provided in the energy statistics. The largest shares of the “non-specified other” sector belong to the public (government) and services subsectors, which cannot be disaggregated and analyzed as separate sectors due to insufficient statistical data.

In manufacturing industries, the following subsector branches are included: Food industry, Wood manufacturing, Metal industry, Production of Non-Metallic mineral products, and Other manufacturing.

The transport subsectors include automobile transport, railway, pipelines and other.

Household populations can be broken down into urban and rural. Most statistical sources show data for the whole households (residential) sector except for heat and electricity (where data can be viewed for urban and rural populations separately). The authors used expert estimates to derive data for urban and rural populations for oil consumption for private transport by estimating demand as proportional to private car ownership per 1000 people and populations in urban and rural areas. Natural gas use was estimated taking into account the level of housing improvements since natural gas networks exist primarily in urban areas. Residential firewood use was estimated by assuming that virtually all consumption takes place is in the rural areas where homes are not provided with network gas or central heating.

As output units for industrial subsectors, the value of annual gross regional output is used (million dollars). For assessing freight and public transport activity, cargo volumes (in million ton-km) and passenger volume (million passenger-km) are used.

Thus, the Final Energy Demand portion of the RFE LEAP model in draws upon the following primary energy resources: Coal (unspecified), Wood (unspecified), Natural Gas, LNG (liquefied natural gas), and Crude Oil. Also, the LEAP model includes the following secondary fuels: Gasoline, Diesel, Residual Fuel Oil, Other Oil Products, Electricity UPG, Electricity Sakhalin, Electricity Magadan, Electricity Kamchatka, Electricity Yakutia, Electricity Chukotka, Heat Yakutia, Heat Sakhalin, Heat Magadan, Heat Kamchatka, Heat Chukotka, Heat UPG, with separately-defined electricity and heat “fuels” for each of the major electricity and heat networks in the RFE.

7.1.1 Electricity Generation and Heat Production

There is one relatively large power grid in the Southern part of the RFE, namely the Unified Power Grid (UPG) of the RFE or “OES Vostoka”, as well as about 20 small power systems (so-called “power districts”), and a large number of isolated distributed generators within the RFE. This technological pattern of the power industry in the RFE determined our approach to the modeling of Electricity Generation. We decided to group all electricity suppliers into six modules. One – Electricity UPG – including power plants from territories covered with the Unified Power Grid of the RFE (OES Vostoka), including separate power districts and distributed power units. These territories are Khabarovskiy Krai, Primoriye, Amurskaya oblast, Jewish Autonomous Oblast and the Republic of Yakutia (South-Yakutsk energy district, and the Western and Central energy districts). The other five modules correspond to the remaining administrative territories of the RFE. These additional five modules represent the power sectors of Sakhalin (Electricity SES), Kamchatka (Electricity KES), Magadanskaya Oblast (Electricity MES), Chukotskiy Autonomous Okrug (Electricity Chuk), and the rest of Yakutia Republic (Electricity YES).

Every Electricity Generation module includes processes that identify one or more power plants of specific types. Accordingly, for the six electricity generation modules we created six new fuels.

As we split Electricity Generation into six modules, we had to do the same with Heat Production using boilers and at Combined Heat and Power Plants. We decided, for simplicity, to separate the production of heat and electricity in CHP units. One module includes industrial and municipal boilers from the territories covered by the Unified Power Grid of the RFE (OES Vostoka), and the other five modules correspond to the rest of the administrative territories of the RFE. The Dispatch Process Rule is set to “Process Shares”, meaning that we specified the share of overall electricity generation in each module that would be provided by specific processes (power plants or power plant types).

7.1.2 Oil Refining

In the RFE there are two large Oil Refineries in Khabarovskiy Krai, and several small refineries in Sakhalin, Yakutia and Khabarovskiy Krai as well. All of the refineries are represented under one module. The underlying assumption made is that the structure of output in the refineries is effectively identical. Estimates of output product shares are taken from data for the the large refineries, which dominate output of refined products in the region. The smaller refineries are not able to influence the structure of overall refined products output in a significant way.

7.2 Key Sources of Data

The information sources used in the project can be classified into two groups.

The first set of sources was used for constructing the RFE energy balance for 2016 (the Base Year) and included the following.

The most important statistical data available

- Data from the Combined primary statistical form of registration “1-nature”, providing Industrial production in real terms by a full range of manufacturers (2016). Territorial Committees of State Statistics in Russian Far East (in Russian).

- Data from Combined primary statistical form of registration “1-nature-BM”, with data on production, shipment of goods, and the balance of production capacity. (2016) Territorial Committees of State Statistics in Russian Far East (in Russian).

- Data from Combined primary statistical form of registration “E-3” “Electrobalans” (2016). Territorial Committees of State Statistics in Russian Far East (in Russian)

- Data from Combined primary statistical form of registration “4-TER” “Data on use of energy and fuel” (2008). Territorial Committees of State Statistics in Russian Far East (in Russian)

- Data from Combined primary statistical form of registration “1-TEP” “Data on heat supply” (2016). Territorial Committees of State Statistics in Russian Far East (in Russian)

- Data from Combined primary statistical form of registration “6-TP”, providing information on the production of heat and electricity generation facilities (power plants) (2016). Territorial Committees of State Statistics in Russian Far East (in Russian)

- Data from Combined primary statistical form of registration “1-oil product”, with information on the shipment of petroleum products to consumers. (2016). Territorial Committees of State Statistics in Russian Far East (in Russian)

- Data from Combined primary statistical form of registration “1-export “, with information on the sale (shipment) of products (goods) at the location of buyers (consignees)” (2016). Territorial Committees of State Statistics in Russian Far East (in Russian)

- Main Indices of Social and Economic Status of Territories of Russian Far East in January – December, 2016. In two volumes. Khabarovskiy Territorial Committee of State Statistics (in Russian)

A second group of data sources was used for modeling scenarios of the RFE’s energy futures, and included the following.

The most important official materials (authorities, private companies)

- Strategy of socio-economic development of the Far East and Baikal region up to 2025: adopted by order of the Government of the Russian Federation № 2094-r from December 28, 2009;

- Scheme of territorial planning of the Russian Federation in energy industry up to 2025, adopted by order of the Government of the Russian Federation № 2084-r from November 11, 2013;[3]

- General scheme of placing the objects of electrical energy industry up to 2035: adopted by order of the Government of the Russian Federation № 1209-r from June 9, 2017;

- Scheme and program of development of the Unified energy system of Russia 2017-2023: adopted by the order of the Russian Ministry of Energy № 143 from March 1, 2017;

- General scheme of oil industry development up to 2020, adopted by the order of the Russian Ministry of Energy from June 6, 2011, № 212

- Scheme of territorial planning of the Russian Federation of federal transport (namely, pipelines), adopted by the order of the Government from August 13, 2013, № 1416-r.

- “Eastern Gas Program (The Development Program for Integrated Gas Production, Transmission and Supply System in Eastern Siberia and the Far East, Taking Account of Potential Gas Exports to China and Other Asia-Pacific Countries)” adopted by the order of Ministry of industry and energy of the Russian Federation from September 3, 2007 № 340

- General scheme of development of gas industry up to 2030, adopted by the order of the Russian Ministry of Energy from June 6, 2011, № 213;

- Plan of development of gas and oil chemical industry of Russia up to 2030, adopted by the order of the Russian Ministry of Energy from March 1, 2012, № 79.

- Program of coal industry of Russia up to 2030, adopted by the order of the Government from June 21, 2014, № 1099-r.

- “Forecast of the socio-economic development of the Russian Federation up to 2036” developed by the Ministry of Economic Development of Russia (2018)

- Strategy socio-economic development Republic of Saha (Yakutia) for the period until 2030 with determination of the target visions to 2050 (project). Ministry of economy of the Republic of Sakha (Yakutia) 2016.

The most important reports and papers on energy futures of the RFE and its territories

- Dyomina O.V. “Prospects for the Development of Russian Electricity Exports to NEA Countries”. Regionalistica [Regionalistics]. 2018. Vol. 5. No. 3. Pp. 59–67. DOI: 10.14530/reg.2018.3.59 (In Russian)

- Saneev Boris, Sokolov Alexander, Lagerev Anatoly, Popov Sergei, Ivanova Irina, Izbuldin Alexander, Korneyev Anatoly, Muzychuk Svetlana, and Sokolov Dmitry. “A shift in the paradigm of energy cooperation between Russia and Northeast Asia countries facing new global and regional challenges: from predominant sale of energy resources to innovation and technology cooperation”. 2018. E3S Web of Conferences 27, 02001. DOI: 10.1051/e3sconf/20182702001

- Plakitkina L.S., Plakitkin Yu.A. “New Scenarios for Russian Economy Development: Updated Forecasts of Coal Mining Development until 2025”, 2018. Ugol’-Russian Coal Journal No. 5 Рр. 65-71. DOI: 10.18796/0041-5790-2018-5-65-71(In Russian)

The most important other materials used

- Estimates of research fellows of Melentiev’s Institute of Energy Systems of Siberian Branch of Russian Academy of Sciences (Irkutsk), Institute of the Geology of Oil and Gas of the Siberian Branch of the Russian Academy of Sciences (Novosibirsk), the Energy Research Institute of the Russian Academy of Sciences (Moscow).

- Projections from private companies (RAO “UES of Russia”, JSC “SUEK”, JSC “NK “Rosneft”, JSC “Gasprom”, Sakhalin Energy Investment Co, Exxon Neftegas, JSC “Yakutugol’”, JSC “El’gaugol’”, etc.)

Also consulted were proceedings of the conferences, seminars, congresses held in the last five years that have been devoted to perspectives of energy futures of the Russian Far East and Northeast Asia.

7.3 Proposed Energy Pathways [LEAP Scenarios]

Scenarios of the RFE’s energy development are regarded as possible strategies for the region’s energy sector development, supported with reasonable quantitative energy and economic assumptions, as well as assumptions about priorities for energy policy.

General economic assumptions (exogenous parameters)

- GDP growth rates, industrial output growth rates,

- population dynamics, and

- the character of economic cooperation development between the RFE (and Russia as a whole) and the other countries of Northeast Asia.

We developed two energy scenarios: Reference Scenario (business as usual) and Resource-Transit Scenario. These scenarios were used to provide the general outlines of the quantitative energy paths implemented in LEAP.

7.3.1 Reference Scenario (Business As Usual)

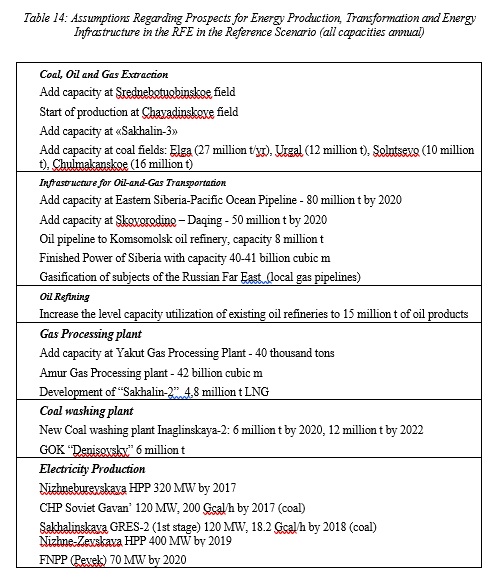

The economy of the Far East is based on the extraction of natural resources and usage of transit capabilities. The reference, or current policies, scenario suggests the perseverance of current trends in the economy and the realization of the large-scale projects currently planned or in process, which would strengthen the current structure of GRP. At the same time, no increased cooperation between the Far East and SEA countries in energy industries is suggested, rather the scenario remains purely focused on export of primary Russian energy resources in contractual volumes. Since the current capacities of fuels transport infrastructure are loaded almost to their limits, there are plans to expand the capacity of the East Siberia – Pacific Ocean (ESPO) project, and to construct the “Strength of Siberia” gas transportation system (Table 14).

The policy of energy conservation and increase of energy efficiency in this scenario are assumed not to be developed further and boils down to the increased use of measuring devices for consumers (mostly metering of electricity and heat). In this case there is a modest increase in energy efficiency, which is a side effect of the general growth of efficiency in the economy tied with the gradual introduction of modern technologies in different industries.

The growth of domestic consumption will be primarily determined by the demand of new projects in the energy industry, with electricity demand growing most dynamically.

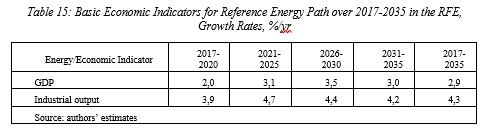

The population is assumed to stabilize at the current level of 6.2 million people in 2020 and then gradually increase to 7 million by 2035 (2025 – 6.5 million, 2030 – 6.7 million). Annual GRP growth rate of the Far East is assumed to be 2.9%/year through 2035, and the annual industrial production growth rate through 2035 is assumed to be 4.3%/year (Table 15).

7.3.2 Resource-Transit Scenario

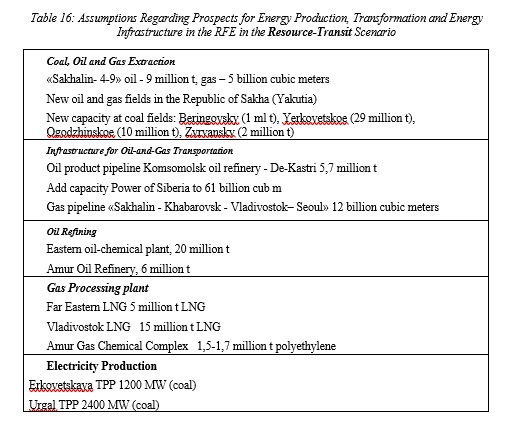

This scenario suggest that the development of the regional economy is determined mostly by the projects of the energy industry. These projects are oriented toward the maximal exploitation of the industrial potential of energy resources extraction, with the intent of serving mostly external markets and of increasing exports to Asia-Pacific countries. The limitations of demand in those countries, however, are not taken into account. All of the projects planned as part of the reference/current policies scenario remain, and in addition more export-oriented projects are added to the scenario (see Table 16).

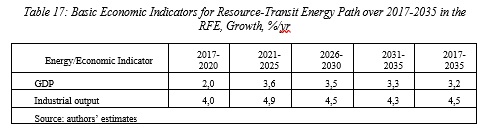

The dynamics of the population is the same as in the Reference/Business as Usual scenario. The differences between scenarios are mostly in the rates of industrial production, and GRP will change due to the increase in the number of projects (Table 17). The growth of domestic consumption of energy resources is also mostly determined by new projects in the energy industry, again with electricity demand growing most dynamically.

8 Conclusions

8.1 Key Issues and Constraints in Regional Energy Sharing from the RFE’s Perspective

The existing channels for exporting Russian energy resources to the Asia-Pacific markets are working at almost full capacity at present, and the construction of new energy infrastructure requires large investment and creates additional risks for Russian companies because of the customers’ significant market power.

The expectations of growth for the Russian Far East economy generated by the prospects for energy resource sharing projects (creating energy transit infrastructure) may have been overstated due to the fact that many of the large energy companies that might participate are not regional residents, leading to the redistribution of financial results of their activities outside of the Russian Far East, which may be problematic from a financial and policy perspective.

As a result, at present, the possibilities for development of the Russian Far East through physical increases in the volumes of energy exports have been almost exhausted, and new ways of developing resource transit projects with potential partners will need to be developed if exports are to increase significantly.

8.2 Next Steps in RFE Energy Analysis

Next steps in the analysis of the RFE energy situation will include supplementing the analysis of information about the production costs of energy resources in the Russian Far East, and adding additional detail on export prices of Russian energy resources to Asia-Pacific countries, as well as further detailing the structure of RFE energy demand. With regard to the latter, among other additions, highlight energy consumption by education and health institutions that are among the largest energy consumers in the RFE.

8.3 Next Steps in Analysis of Regional Energy Sharing Possibilities from the RFE’s Point of View

It is possible to highlight the following most promising areas for future energy cooperation between Russian companies and their Asia-Pacific partners:

- long-term contracts for the supply of energy resources;

- project financing;

- supply of equipment and service support;

- joint construction of infrastructure facilities (pipelines, electric network, roads);

- participation in hydrocarbons exploration and production;

- implementing joint projects in mining, the construction of power plants on the territory of third countries;

- joint scientific and technical developments in the field of energy.

There are, however, certain restrictions for the development of energy cooperation from the perspective of the RFE. The expansion of energy supplies from Russia to the markets of the Asia-Pacific countries may be limited by the following factors:

- insufficient exploration;

- the high cost of mining and transportation of energy resources, requiring the appropriate level of export prices to return on investments;

- the lack of investment resources, due to the scale of their involvement for simultaneous implementation of several capital-intensive projects;

- the lack of funds and technologies for the development of energy projects by virtue of sectoral sanctions by a number of foreign countries;

- underdeveloped transport infrastructure.

The development of joint scientific and technical projects can be constrained by the general lag in the level of Russian energy technologies, with the exception of certain areas (for example, in nuclear energy). The development of more complex forms of cooperation are connected with the formation of strategic alliances and the exchange of assets at the company level. In this situation, a restriction on cooperation could relate to the rule of “Symmetry of Positions”, meaning that if the partners from the Asia-Pacific countries have access to the hydrocarbon production and transportation assets in Russia, it is necessary to provide for the participation of Russian companies in exploration, production, transportation and marketing projects to the final consumers in the Asia-Pacific countries.

Despite the restrictions, nowadays all the forms of cooperation are being fulfilled to different extents. The first direction of cooperation has been developed at maximum. The consistently high demand on energy resources in the Asia-Pacific countries and the possibilities for diversifying the directions of export energy supplies determine the growing interest of the Russian energy companies in the markets of these countries. The presence of significant reserves of energy resources, proximity to markets and diversification of suppliers determine the counter interest of partners from the Asia-Pacific countries in obtaining access to Russian energy resources.

There is a significant potential for increasing the supply of Russian energy resources — gas (to China, Japan, the Republic of Korea), oil and oil products (primarily naphtha) (to the Republic of Korea), oil and coal (to China). Projects to create of interstate transmission lines[4] and the Russia-Republic of Korea gas pipeline, as in previous explorations of these possibilities, will depend on the assessment of transit risks by Russia and the other international participants.

III. ENDNOTES

[1] In accordance with Federal Law 01.05.2016 No. 119-FL every citizen of the Russian Federation is provided an opportunity to obtain free land with a total area of not more than a hectare. This land has to be in state or municipal ownership and must be located on the territory of one of the 9 subjects of the Russian Far East (except Zabaykalsky Krai and the Republic of Buryatia).

[2] That is, natural gas resources that also include hydrocarbons such as ethane, propane, butane, and pentane, as well as helium.

[3] A new version of this document is Scheme of territorial planning of the Russian Federation in energy industry up to 2030, adopted by order of the Government of the Russian Federation № 1634-r from August 1, 2016.

[4] Voropayi N.I, Podkovalnikov S.V, Saneev B.G. “Interstate Energy Cooperation in Northeast Asia: Current State, Potential Projects, Energy Infrastructure”, Energeticheskaya politika [The Energy Policy]. 2014. No 2. Pp. 55-64. (In Russian); Asia Pacific Energy Research Centre. Electric Power Grid Interconnection in Northeast Asia. Available at: https://aperc.or.jp/file/2015/11/27/FinalReport-APERC-Electric_Power_Grid_Interconnection_in_NEA.pdf

IV. NAUTILUS INVITES YOUR RESPONSE

The Nautilus Asia Peace and Security Network invites your responses to this report. Please send responses to: nautilus@nautilus.org. Responses will be considered for redistribution to the network only if they include the author’s name, affiliation, and explicit consent.