by Yun Zhou

October 23, 2012

Nautilus invites your contributions to this forum, including any responses to this report.

CONTENTS

I. Executive Summary

II. Report by Yun Zhou

III. References

IV. Nautilus invites your responses

I. Executive Summary

Nuclear waste is one of four issues associated with nuclear energy with which the public is most concerned, as summarized in the 2003 MIT (Massachusetts Institute of Technology) report The Future of the Nuclear Power.[1] No large-scale nuclear energy development in any country can be sustainable without a solid nuclear waste management program in place. Although China’s nuclear power industry is relatively young, and the management of its spent nuclear fuel and nuclear waste is not yet a major concern, China’s commitment to nuclear energy and its rapid pace of nuclear generation capacity development require detailed analyses and planning of its future spent fuel management and nuclear waste policies. Specially, China is moving forward on its commitment to operate a closed nuclear fuel cycle, a policy that was first articulated in the 1980s. Figuring out how to manage and store the high-level nuclear waste resulting from reprocessing—a necessary part of a closed nuclear fuel cycle—could be a challenge for China.

This report reviews China’s spent fuel management policy, including its plans for reprocessing, including and China’s nuclear waste management plan, and explores the feasibility of deep borehole disposal (DBD) as an alternative to at-reactor, centralized surface- and near-surface storage, or mine geologic storage of spent fuel and high-level nuclear waste. The DBD feasibility study will review China’s geological features, seismic regions and population distribution. Potential candidate areas where DBD facilities might be located are recommended. This report also provides an overview of China’s commercial and research drilling technologies and capabilities. In addition, potential costs of building DBD facilities for two different nuclear fuel cycle scenarios are estimated in the study.

More than three-fourths of the number of reactors built to date in the world went online before 1990, while all of China’s reactors went online after 1990. As a result, unlike in other major nuclear energy countries such as Japan and the United States, spent fuel management in China has yet to pose any major issues related to declining available storage capacity. In addition, China has advantages over nations such as Japan in that China has large areas with sufficient geological stability and other required attributes that it could potentially store its nuclear waste without significant space restrictions. Actually, China could fulfill its need for off-site storage in the medium-term by simply building interim spent fuel storage pools; a 3,000-ton pool would satisfy needs for away-from-reactor spent fuel storage in China through 2035. Indeed, China is considering building a 3,000-ton spent fuel storage pool as part of its commercial reprocessing plant. The combination of additional off-site storage and plans to include ample on-site dry storage at new nuclear plants suggests that China will experience little pressure to reduce the burden of storing spent fuel during the next 30 years.

China has had a long-term reprocessing policy since the 1980s, with a rationale based primarily on concerns of a uranium supply shortage. China’s reprocessing plans call for the extraction of the remaining uranium and the plutonium produced during reactor operation from spent fuel, and use them to fabricate nuclear fuel for use in fast breeder reactors. The high-level waste from reprocessing will be vitrified and disposed of at a permanent waste disposal site. Although China is moving forward to develop its large-scale commercial reprocessing site and its fast reactor R&D program, the long-term construction period, huge investments involved, technology immaturity, and various other uncertainties make the actual date and other details of the planned reprocessing and fast reactor programs still unforeseeable. Once China starts its reprocessing pilot program, however, high-level wastes and will be produced from reprocessing. The pilot reprocessing plant aims to reprocess 50 tons of spent fuel per year initially.

Although the Chinese government does, nominally, have a long-term nuclear waste management plan, it has not as yet deployed much in the way of financial resources or technical effort to develop a sound nuclear waste management R&D program. China does aim to open a geological repository (a mined repository) by 2050 for its high-level nuclear waste. Since China’s nuclear waste management R&D program is still in its early stages, China could still consider and evaluate a range of options to pursue in addressing its future nuclear waste management problems. Recently, the DBD concept for storing/disposing of nuclear wastes, spent fuel, and other radioactive materials has been receiving increasing attention internationally due to its potential technical and cost advantages when compared with “normal” geologic disposal, due to DBD’s potential technical and cost advantages when compared with geologic mined disposal. In the DBD concept, a borehole is drilled in crystalline basement rocks to a depth on the order of 5 km. Crystalline basement rock is found at those depths in stable geological formations in many countries. The great depth of DBD could offer less dynamic hydro-geological conditions than in mined geological disposal facilities, which reduces the interaction of nuclear waste with groundwater that might find its way to the biosphere. In addition, after deep boreholes are filled with wastes and sealed, it is technically difficult for terrorists or others who misuse radioactive materials to drill to and access the buried wastes. In addition, initial investigations suggest that DBD is likely to offer a less expensive option relative to mined geologic repositories.

Criteria for siting of DBD facilities include having candidate sites where crystalline rock exists at the surface or within 1 km of the surface, and in areas that are tectonically stable, located away from population centers, and not near international borders.[2] Based on these criteria, better sites in China would be toward the north and northwest of the country, which matches the candidate locations for China’s high-level nuclear waste repository. Although there is not any information about the cost of the proposed waste repository in China, in this study, some cost estimates are provided for two different fuel cycle scenarios, which might provide some economic information for policy makers.

Considering China’s tremendous projected energy demands, its huge commitment to nuclear energy, and its infrastructure in nuclear science and technology, China should place more emphasis on building its nuclear waste R&D program both financially and technologically. Only a solid back-end solution will provide China with a long-term sustainable nuclear power program. Since China’s nuclear waste management R&D program is still at an early stage, it could still consider and evaluate a range of options to pursue nuclear waste management solutions. Further investigation and feasibility studies of DBD are recommended. In addition, although the Chinese public might not at present be generally aware of nuclear waste issues, China should allow for more public participation in nuclear waste management decisions, which could result in a more effective and efficient decision-making framework.

Yun Zhou is a postdoctoral research fellow at the Belfer Center’s Project on Managing the Atom and International Security Program.

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground

An Initial Exploration of the Potential for Deep Borehole Disposal of Nuclear Wastes in China

by Yun Zhou

1. Introduction

With ambitious plans for its nuclear energy program before, and continuing after, the Fukushima nuclear power plant accident in March of 2011, China has become the central focus of the international nuclear industry. Although China’s nuclear industry is relatively young in comparison with other major nuclear power states, nowhere else in the world today are there so many nuclear power plants being built and so many more under consideration. Currently, China has a relatively small fleet of 15 nuclear reactor units in operation with a total capacity of 12.5 GWe. China, however, absolutely leads the world in new reactor construction, with 27 units under construction representing a capacity of 29.49 GWe and about 42 percent of the new total new reactor construction going on worldwide. In addition, Chinahad another 5 units approved and awaiting construction, and another 16 units planned, representing a capacity of 21.88 GWe. All together, the units in operation and under construction represent a total nuclear capacity of 41.41 GWe, which ensures that China will meet its stated target of 40 GWe of nuclear capacity by 2020.[3] The pace of construction in recent years has been much faster than was expected by the government. Although China has not officially revised its medium- and long-term nuclear development goals, the Chinese government seems to accept the rapid development of China’s nuclear industry, and included an additional 40 GWe of capacity planned during the 12th Five-year Plan period (2011-2015) beyond the previously existing 40 GWe goal.[4] The National Development and Reform Commission (NDRC) planned to update the 2007 medium and long-term nuclear energy development plan after the National People’s Congress Meeting in March of 2011. This plan, however, was suddenly thrown off schedule by the Fukushima accident.

As part of its nuclear energy policy, China is moving forward on its commitment to operate a closed nuclear fuel cycle, a policy that was first articulated in the 1980s. China’s main rationale for a closed fuel cycle that includes the capability to reprocess spent nuclear fuel has been its inadequate supply of uranium resources.[5] China’s decision to reprocess its spent fuel will result in high-level radioactive waste from the reprocessing process.

Since China’s nuclear industry is relatively young and still small compared to the world leaders, the nuclear waste industrial sector is not well-developed and organized. This calls for more attention and financial support from the Chinese government and nuclear industry. Although China is not facing an immediate pressure to manage its nuclear waste, it definitely needs a solid waste management plan to ensure a large-scale and sustainable nuclear power program from a long-term viewpoint. China has previously proposed deep geological disposal for its high-level radioactive waste from reprocessing. Recently, DBD has been studied and considered as an alternative to store spent fuel and high-level radioactive waste (HLW) globally.

This paper is divided into four sections: the first section discusses in general terms the various alternative spent fuel management strategies, and describes current Chinese’ spent nuclear fuel storage practices; the second part examines China’s current nuclear fuel cycle policy and future reprocessing scenarios; the third provides an overview of China’s nuclear waste management policies, including strategies for managing high-, intermediate-, and low-level nuclear wastes. The fourth part of the paper explores the concept and feasibility of using DBD as a nuclear waste disposal alternative in China. The paper also offers a review of the institutions, laws, and possible social issues related to spent fuel management in China. The final section of the paper provides conclusions and policy recommendations.

2. China’s spent fuel storage management

2.1. China’s spent fuel management policy

As previously mentioned, China officially has a closed fuel cycle policy for its civilian nuclear energy program. As such, the aim for the country is to reprocess its spent nuclear fuel and extract the resulting uranium and plutonium, then fabricate these elements into nuclear fuel for use in fast breeder reactors. In October 2010, China issued interim measures for a spent fuel disposal funding imposition, which requires commercial nuclear power plants operating for more than 5 years to pay a 0.026 Yuan/kWh spent fuel disposal fee. The fund will be applied to the transportation and storage of spent fuel, reprocessing, high-level waste management and other “back-end” fuel-cycle requirements.

2.2. Current spent fuel storage

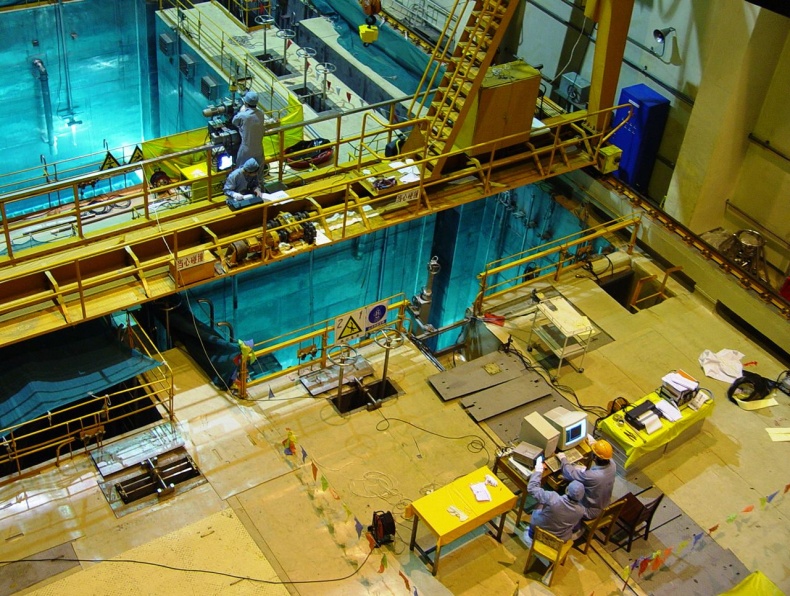

In general, the on-site spent fuel storage capacity at operational Chinese nuclear power plants built before 2005 can accommodate 10 years of spent fuel, while newly planned reactor designs usually include a 20 year on-site spent fuel storage capacity. Currently, all spent nuclear fuel at NPPs is stored onsite in the plants’ spent fuel pools, except the spent fuel from the Daya Bay NPP. Figure 1 shows the spent fuel pool at Qinshan phase I, which is China’s oldest operating reactor.

Since 2003, China had transported 104 assemblies of spent fuel from the Daya Bay nuclear power plant twice a year to the interim storage pool at the pilot-scale test reprocessing plant at Lanzhou in Gansu province. A large-scale commercial interim spent fuel storage facility with a possible 3000 tU storage capacity has not been built in China yet, although studies and plans are underway.

Figure 1. On-site Spent Fuel Storage Pool at Qinshan I (Source: CNNC)[6]

Table 1 shows the current status of spent fuel storage at the Chinese reactor sites that began were connected to the grid from 1991-2012. Note also that while the Daya Bay units are shown as having reached their full storage capacity nearly 10 years ago, this is certainly not the case, as some of their spent fuel has been shipped to the Lanzhou interim storage facility.

| Table 1. Current Status of Spent Fuel Storage at NPPs in China | ||||

|

Reactor |

First Grid Connection |

Spent Fuel Storage Method |

On-site Spent Fuel Storage Capacity |

Storage Expected to Reach Capacity |

|

Qinshan I-1 |

12/1991 |

Dense-pack/ Pool size expansion |

35 years |

2025 |

|

Daya Bay 1 |

08/1993 |

Wet storage |

10 years |

2003 |

|

Daya Bay 2 |

02/1994 |

Wet storage |

10 years |

2004 |

|

Qinshan II-1 |

02/2002 |

Dense-pack/ Wet storage |

20 years |

2022 |

|

Qinshan II-2 |

03/2004 |

Dense-pack/ Wet storage |

20 years |

2024 |

|

Lingao1 |

02/2002 |

Dense-pack/ Wet storage |

20 years |

2022 |

|

Lingao2 |

09/2002 |

Dense-pack/ Wet storage |

20 years |

2022 |

|

Qinshan III-1 |

11/2002 |

On-site wet/dry storage |

40 years |

2042 |

|

Qinshan III-2 |

06/2003 |

On-site wet/dry storage |

40 years |

2043 |

|

Tianwan 1 |

05/2006 |

Wet storage |

20 years |

2026 |

|

Tianwan 2 |

05/2007 |

Wet storage |

20 years |

2027 |

|

Qinshan II-3 |

08/2010 |

Wet storage |

20 years |

2030 |

|

Lingao 3 |

09/2010 |

Wet storage |

20 years |

2030 |

| Lingao 4 | 08/2011 |

Wet storage |

20 years |

2031 |

| Qinshan II-4 | 04/2012 |

Wet storage |

20 years |

2032 |

Dry cask storage at NPP sites is not yet being used in China, except at the Qinshan Phase III (two CANDU units) due to the fact that China has no plans to reprocess any spent fuel from heavy water reactors. Construction started atan on-site interim dry-storage facility in 2008. There are plans to construct 18 MACSTOR-400 concrete storage modules at a rate of 2 modules every 5 years, which could expand the on-site spent fuel storage capacity to 40 years.[7] Since China will not face any significant pressure to lessen the burden of spent fuel storage in the next three decades with the current interim spent fuel storage facilities and plans, the application of dry casks might be dependent on the progress of its reprocessing programs in the more distant future.

Atomic Energy of Canada Limited (AECL) was awarded a C$12 million, three-year contract to supply engineering services and equipment for the construction of the MACSTOR 400 spent fuel dry storage system at the Qinshan Phase III site, which is shown in Figure 2.

2.3. Spent Fuel Discharge Forecasts

The spent fuel accumulated from Chinese reactors from 1991 to 2007 totals about 1,300 tons based on information in the public domain. The amount of spent fuel that is expected to be unloaded between 2008 and 2030 can be estimated by calculating the mass of fuel loaded into one reactor annually. Table 2 estimates the amount of spent fuel in MTHM that will accumulate by 2030 for each of three nuclear power growth scenarios.

Figure 2. Dry Cask Spent Fuel Storage Pool at Qinshan III NPP (Source: CNNC) [8]

| Table 2. China’s Spent Fuel Discharges, 1994-2030 | |||

|

MTHM |

1994-2007 |

Forecasts[9] |

2008-2030 |

|

Accumulated Spent Fuel |

~1,300 |

Base Growth Case (300 GWe) |

30,432 |

|

High Growth Case (450 GWe) |

36,480 |

||

|

Low Growth Case (150 GWe) |

28,193 |

||

As discussed before, new Chinese NPP designs include on-site spent fuel storage in spent fuel pools with a capacity of 20 years of spent fuel. To simplify calculations, this paper assumes that on-site spent fuel storage is fully occupied before spent fuel needs to be transported to off-site storage facilities. Under these parameters, operational nuclear plants will have sufficient on-site storage for spent fuel until 2020, except for Daya Bay. After 2020, current plants will gradually run out of space for spent fuel storage.

Those reactors constructed before 2010 will need off-site spent fuel storage space or on-site dry cask storage after 2030. By 2030, the accumulated amount of spent fuel that will be needed to be stored off-site or in dry casks will grow to more than 2,000 tons.[10] The 500 ton off-site spent fuel storage facility at the pilot reprocessing site should fulfill China’s storage needs until around 2015. Additional interim spent fuel space will be required thereafter. Figure. 3 shows the cumulative off-site spent fuel storage that will be needed from 2005 to 2035, as well as off-site storage capacity options.[11]

Figure 3. Cumulative additional storage demands under three difference storage scenarios from 2003 to 2035 in China.

Indeed, China is considering building a 3,000-ton spent fuel storage pool as part of its commercial reprocessing plant at Lanzhou. The combination of additional off-site storage and plans to include ample on-site storage at new nuclear plants, suggests that China will experience little pressure to reduce the burden of storing spent fuel in the next 30 years. Moreover, if a move is made towards the use of dry casks, then the question of adequate storage space at NPP sites should not be a problem for a long time.

3. China’s reprocessing policy and future nuclear fuel cycle scenarios

3.1. China’s reprocessing policy

As mentioned before, China first decided to develop a closed nuclear fuel cycle in the early 1980s. With an anticipated shortage of uranium supplies and limited uranium exploration activities, China developed a policy to reprocess spent nuclear fuel from its commercial light-water reactors (LWR), extract the resulting uranium and plutonium, and use the resulting fissile materials to fabricate nuclear fuel for use in fast breeder reactors. In 1986, the State Council approved the construction of a pilot-scale test reprocessing plant with an annual reprocessing capability of 50 tons at the 404 factory in Gansu Province. Nearly 25 years later, the pilot-scale plant is nearing operation. Chinese scientists have conducted a hot test at the facility in December 2010.[12] The plant contains an interim spent fuel storage facility on site with a storage capacity of 550 tons of fuel (500 tons for commercial reactors and 50 tons for research reactors).

China initially planned to build a commercial-scale reprocessing plant with a capacity of 800 tons per year by 2020. In November 2007, CNNC signed an agreement with the French consortium Areva covering cooperation on spent fuel reprocessing and MOX fuel technologies. Currently, CNNC is still negotiating with Areva on the purchase of the commercial-scale plant (CNEIC, 2011).[13] Recently, CNNC postponed the projected date of operation of the commercial-scale reprocessing plant until 2025 (Deng, 2010).[14]

China’s development of fast-neutron reactors has similarly fallen behind schedule. China expects fast neutron reactors to become the predominant commercial reactor type in operation around the country by mid-century. To get to that point, Chinese nuclear policy includes plans for a three-stage development process that started with a 20-MWe (65 MWt) experimental fast neutron reactor (CEFR) project that is currently in operation at the China Institute of Atomic Energy (CIEA) (see table 3).[15] The reactor conducted its first startup in July 2010.[16] The CIEA project mainly relies on fast reactor technologies developed from the Russian BN-600 reactor design. The design accommodates MOX fuel, which bridges the gap between the types of fuel used in light water reactors and fast neutron reactors. The development of two demonstration fast reactors (CDFR) constitutes the second stage of the development process. In October 2009, China signed a high-level agreement with Russia to collaborate on the development of two BN-800 fast neutron reactors.[18] Construction on these reactors was expected to start in August 2011[17], but China has had to postpone the purchase of the Russian BN-800 fast neutron reactors due to a disagreement over the price of the technology transfer, as well as other considerations.[19]

Before commercializing fast neutron reactors, China plans to construct a commercial MOX fuel fabrication site by 2020 to couple with the proposed commercial reprocessing plant. The manufacturing of MOX fuel is a crucial step in the development process because it will permit China to use the separated uranium and plutonium that results from reprocessing and provide feed fuel to its CEFR and CDFRs. A pilot-scale MOX manufacturing facility with an annual capability of 0.5 tons is currently under construction. China is exploring potential partnerships to develop MOX fuel manufacturing projects with Areva.[20]

|

Table 3. China’s three-stage development of fast neutron reactor |

||||

|

Reactor type |

Power level (MWe) |

Estimated Startup |

Fuel type |

|

|

The first stage |

Experimental fast reactor (CEFR) |

20

|

2009

|

UO2 (first load) MOX |

|

The second stage |

Demonstration fast reactor (CDFR) |

800~900

|

2020~2025

|

MOX Metal alloy |

|

The third stage |

Commercial fast breeder reactor (CCFR) |

≥900 |

2030~2035 |

Metal alloy |

3.2. Future nuclear fuel cycle scenarios

As discussed in earlier sections, spent fuel management is not yet a major concern for China’s relatively young nuclear industry. Though China has a long-standing policy to eventually reprocess its spent nuclear fuel, due to the long-term construction period, huge investments involved, and technological immaturity, various uncertainties make the future of China’s reprocessing and fast reactor programs still unpredictable. This section explores three spent fuel management options that China could implement between now and its intended commercialization of fast reactors in 2035, each of which would address China’s long-term fuel-cycle needs in different ways:

1) No reprocessing scenario. In this scenario, Chinese reactors send all spent fuel that they cannot store onsite to off-site interim dry or wet storage.

2) A needs-based reprocessing scenario. This scenario assumes that China will start reprocessing spent fuel at a rate of 50 tons per year in 2011, and reprocess additional fuel based on its needs to supply fuel for its fast reactor R&D program.

3) A capability-based reprocessing scenario. In this scenario, China would operate its reprocessing facilities at 100% capacity. China’s planned commercial-scale facility could give China the capability to start reprocessing 800 tons of spent fuel per year as soon as the commercial plant is ready.

Overall, considering China’s tremendous projected energy demands, its huge commitment to nuclear energy, its infrastructure in nuclear science and technology, and its estimated uranium resources, it is not surprising that China insists on a long-term policy of reprocessing spent fuel and operating fast neutron reactors. China certainly will start reprocessing for its fast reactor R&D program in the near future due to the fact that the pilot reprocessing plant and CEFR are ready to operate. The Fukushima accident, however, will certainly slow down the commercial reprocessing project due to the fact that the Chinese government has reallocated more financial and human resources to nuclear power plant safety and related design issues in response to consideration of the potential safety problems exposed by Fukushima. If implementation of China’s demonstration fast reactors moves forward smoothly, China might reprocess more spent fuel to prepare the feed fuel for the two demonstration reactors. In the meantime, interim storage capabilities will be expected to increase.

4. China’s radioactive waste management

4.1. High-level radioactive waste management

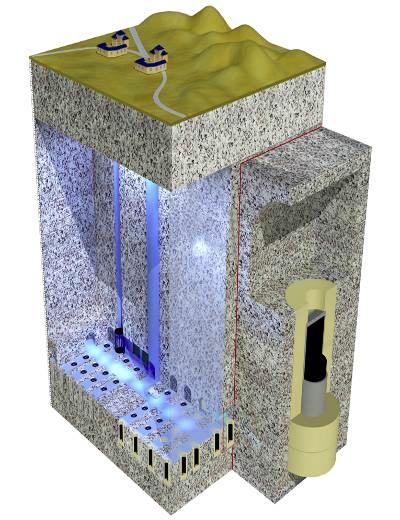

In 1985, CNNC began working on a program to develop deep geological disposal for its HLW resulting from reprocessing. The preliminary repository concept is a

shaft-tunnel model, located in saturated zones in granite, while the final waste form for disposal is vitrified high-level radioactive waste.[21] In 2006, the government published a long-term research and development (R&D) plan for geological disposal of HLW.[22] Figure 4 shows the conceptual model for a HLW repository in granite.[23]

Figure 4. The conceptual model of a HLW

This program has gone through several stages. Although China has not finalized the permanent location and is still conducting site research in Xinjiang and Inner Mongolia, the Beishan site located in Gansu province has already been indicated as the most likely potential host area for China’s HLW repository. Three granite sites are being further studied in the Beishan area. Six deep boreholes and eight shallow boreholes were drilled in three sub-areas in the Beishan area during the period 2000-2009. The results showed that the rock mass in the area has characteristics of high integrity, low fracture density, low hydraulic conductivity, and moderate in-situ stresses, indicating that the Beishan area has a good potential for the construction of future geological repositories.[24] Engineered barrier studies targeted Gaomiaozi bentonite as barrier material to be used in hindering the migration of emplaced nuclides. A mock-up facility, which will be used to study the thermo-hydro-mechano-chemical (THMC) properties of the bentonite as a barrier material, is under construction. Several projects to test the mechanical properties of Beishan granite are also underway.[25]

Although progress has made in many aspects of repository development, the key remaining scientific challenges to developing long-term waste include reliable prediction of the evolution of a repository site, characterization of the deep geological environment, behavior of deep rock masses, behavior of groundwater and engineered materials under coupled conditions, geochemical behavior of transuranic radionuclides at low concentrations and their migration with groundwater, and safety assessment of the disposal system.[26]

It is expected that China will finish the siting selection process and build an underground laboratory around 2020. On-site research activities at the underground laboratory should take place between 2020 and 2040, with the actual HLW repository to be constructed around 2050.

Currently, all HLW from the military weapons program is believed to be stored in temporary facilities, which are very likely located Gansu province (near the Lanzhou fuel cycle facilities) based on what is publically known about the history of the weapons programs.

4.2. Low- and Intermediate-level radioactive waste management

Two disposal facilities are being built for low-level waste (LLW) and intermediate level waste (ILW) – together LILW. The Guangdong Beilong LILW disposal site is located near the Guangdong Daya Bay NPP and hosts LILW coming from Daya Bay and from the LingAo NPPs. The Beilong site has a waste storage capacity of 80,000 cubic meters. The site is operated by Guangdong Nuclear Power Environmental Protection Co. (GNPEP), which is a subsidiary of CGNPC. Figure 5 shows a photo of the the Beilong Low and Intermediate Level Waste Facility in Guangdong province.

Figure 5. Beilong Low and Intermediate-Level Waste Site (Source: CNNC official website)

A second site LILW site is the Northwest China LILW Disposal Site, located in Gansu province in the northwest of China. It is believed that the LLW from the current CGNPC plants goes to the Beilong facility, while CNNC ships its LLW from the Qinshan Phase I, II, III NPPs and the Lanzhou nuclear complex to the Gansu disposal facility. Besides these two facilities, China has plans to build another three facilities to accommodate LILW waste in East, North, and Northeast China over the next 10 years. The Chinese government has not yet, however, finalized the locations for these facilities.

5. Deep Borehole Disposal concept in China

DBD of nuclear materials is not a new concept, but has attracted a resurgence of interest in recent years. In this concept, boreholes of 0.5 to 0.8 meters in diameter would be drilled on the order of 5 km deep into stable, crystalline basement rocks. Nuclear materials to be permanently and (essentially) irretrievably disposed of—potentially including spent nuclear reactor fuel, high level nuclear waste from spent fuel reprocessing and similar processes, and separated or partially-separated plutonium—would be placed in canisters and buried in a disposal zone at depths of 3 to 5km in the borehole, which would be capped (see schematic in Figure 6).[27] [28]

The DBD concept of storing nuclear waste and material has been receiving increasing attention internationally due to its potential technical and cost advantages when compared with “normal” geologic disposal (in mined repositories). In the DBD concept, as mentioned above, a borehole is drilled in crystalline basement rocks to a depth on the order of 5 km, a geological structure found in many countries. The great depth is often accompanied by less dynamic hydro-geological conditions, that is, stable, stratified saline aquifers that mix on an extremely long time scale, if at all, with aquifers in strata above. This limited mixing means that any radioactive compounds from materials placed at those depths that are dissolved or entrained in the surround aquifer will mix only very slowly, if at all, with groundwater that interacts with the biosphere. In addition, after a borehole is sealed, it is technically difficult for terrorists or others seeking covertly to use the radioactive materials that have been emplaced to drill and access the wastes. In addition, initial investigations have suggested that DBD is likely to be less expensive than traditional mined geologic repositories.

The DBD approach would avoid many of the proliferation-prone steps involved with reprocessing and recycling fissile material from spent fuel. It also could prove to be more acceptable socially and politically, more economic in the short and long run, and less hazardous with respect to the technological and ecological risks arising from the disposition of large amounts of radioactive material.

5.1. Potential siting of DBD in China

Appropriate siting of DBD facilities is very important to assure the safety of disposal of spent fuel or HLW. The site used should have characteristics suitable to prevent or retard the potential movement of radionuclides from the disposal system to the biosphere. The natural geologic characteristics of the site play an important role in the disposal concept.

A past study provides the following guidelines on desirable site characteristics of DBD, ideally favoring a combination of:

(1) Crystalline rock at the surface or within 1 km of the surface;

(2) A region that is tectonically stable;

(3) An area located away from population centers; and

(4) A region not near international borders.[29]

Figure 6. Schematic of Deep Borehole Disposal

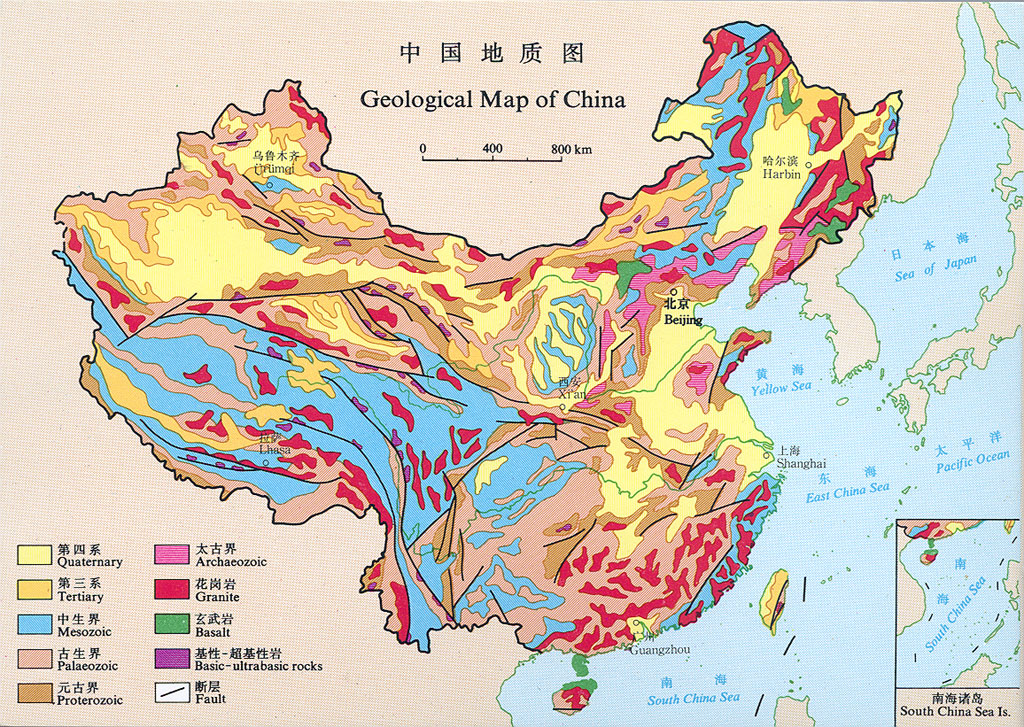

China, situated in the southeast part of the Eurasian Continent, occupies a region where several intercontinental tectonic elements are superimposed on one another. In terms of history of history of the continental tectonic platess, China belongs largely to the “North Continent”, except for the Himalaya region of China, which lies on the north edge of the Indian massif of the “South Continent”. The greater part of the Oinghai-Xizang Plateau (Chinghai-Tibet Plateau) belongs to the middle segment of the huge-type Tethys tectonic zone, and the east part of China belongs to the Circum-Pacific tectonic zone of the Meso-Cenozoic era. [30] The 2008 Sichuan earthquake occurred along the Longmenshan fault, a thrust structure along the border of the Indo-Australian Plate and Eurasian Plate. China’s geological structure is shown in Figure 7.[31]

Figure 7. Geological Map of China

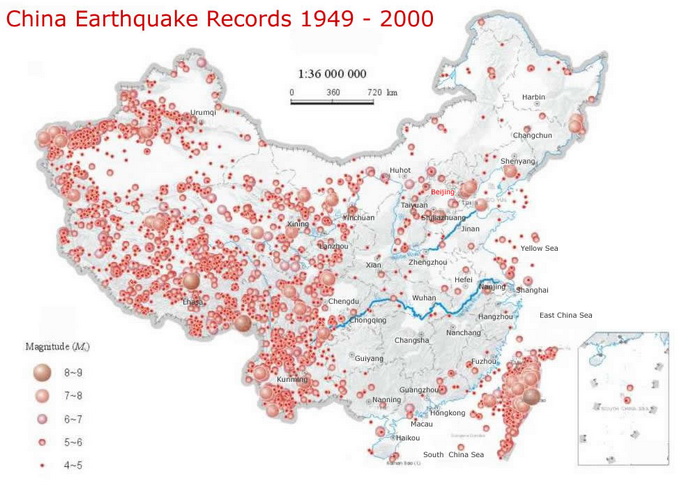

Siting of DBD facilities for disposal of nuclear materials requires tectonic stability. The locations for DBD sites need to be away from faults to avoid earthquakes. Figure 8 shows the earthquake record in China from 1949 to 2000, which indicates that a large portion of the quakes during that time happened along the Longmenshan fault, a thrust structure along the border of the Indo-Australian Plate and Eurasian Plate.

Figure 8. China earthquake records from 1949 to 2000[32]

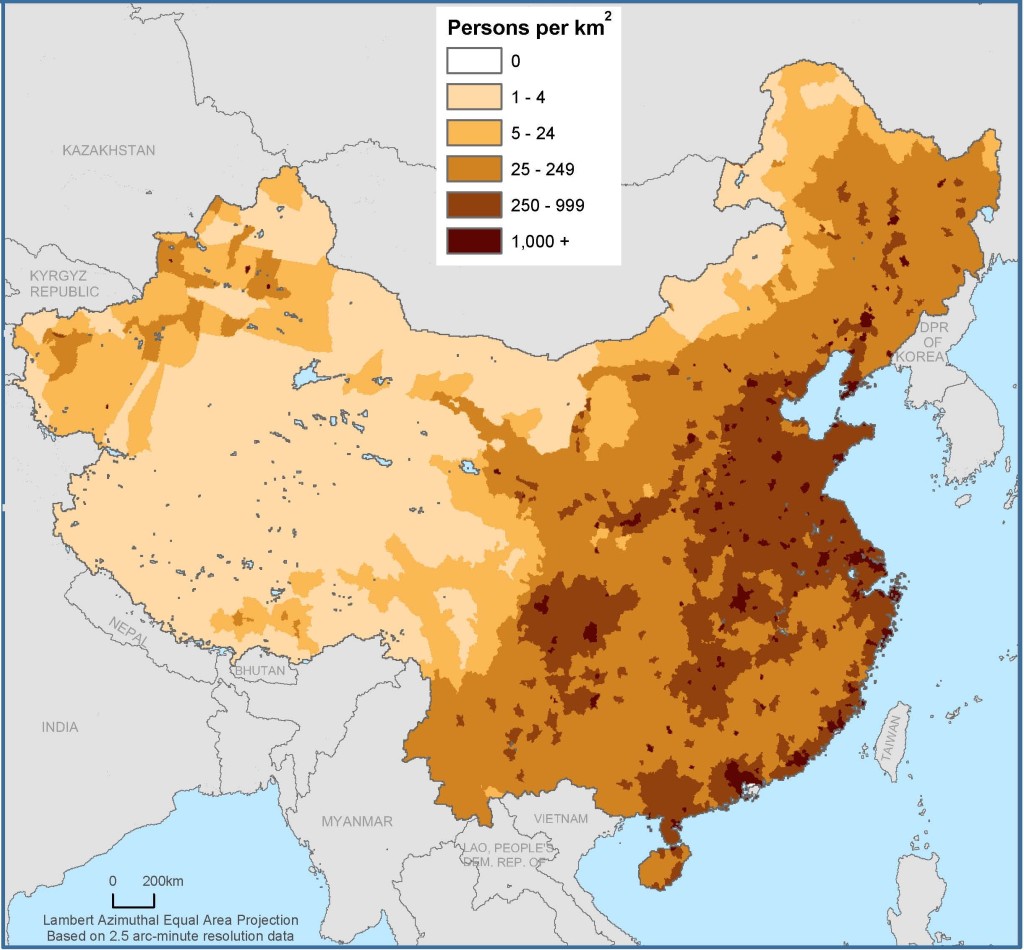

In addition, it is desirable that DBD facilities be located away from population centers. Figure 9 shows population densities in China as of 2000. Combining consideration of the tectonic provinces and the areas of low population density in China, the northwest part of Gansu province and north part of Inner Mongolia could be site candidates for further studies, which matches the candidate areas for potential geological (mined) repository facilities that have been under consideration by Chinese authorities.

Figure 9.The population densities in China as of 2000

5.2. Technical capability for borehole drilling in China

Currently, commercial drilling technologies in China allow a 4km depth and mainly focus on mining exploration. [33] However, the Chinese Continental Scientific Drilling (CCSD) Project, as one of China’s Key Scientific Engineering Projects, had been working on drilling a 5000 meter deep hole at the eastern part of Dabie-Sulu ultra-high pressure metamorphic belt for geological science R&D purposes. In addition, the project aims to develop a complete and completely new system and technique for deep and hard rock drilling, with the goal of advancing China’s commercial drilling technologies to a new level. The project’s deep well CCSD-1 project was begun on June 25, 2001, and the drilling operation of the project was successfully completed on March 8, 2005, with a final depth reached 5158 m for a borehole of 157 mm in diameter. This kind of drilling project, the drilling of a 5000 m deep continuously cored borehole in extremely hard crystalline rock, had never been carried out in China before.[34]

5.3. Potential storage capacity and cost estimate of DBD implementation

In this section, estimates of the potential nuclear materials storage capacity and costs for DBD implementation in China are provided and analyzed. In general, DBD could be deployed as a storage solution for spent fuel and/or for high-level nuclear waste resulting from reprocessing. Although the reprocessing process can significantly reduce the total volume of waste from spent fuel to be disposed of, it cannot reduce the decay heat and radioactivity from the fission products that are contained in the wastes. Therefore, in this paper, the general assumption is made that whether China uses DBD for disposal of HLW resulting from reprocessing or for spent fuel that has not been reprocessed, it will make no significant difference in terms of the overall storage capacity and costs of DBD facilities required, because the number of boreholes needed for a given amount of waste is determined primarily not by the volume of the wastes, but by its decay heat the waste produces. In this case, the amount of spent fuel is used to estimate the storage capacity needed and costs of DBD implementation in China.

As mentioned before, boreholes will be on the order of 5 km (~16,400 ft) deep, with a 1-2 km long waste disposal zone (the lower portion of the borehole). Each borehole might conceivably hold 200-400 canisters, which could contain one PWR or BWR spent fuel assembly per canister.[35] Each spent fuel assembly is about 0.5 ton. Based on the calculation, each borehole might hold 100-200 tons spent fuel (for simplicity, the HWR spent fuel in the spent fuel inventory is ignored in this analysis because the production of HWR spent fuel in China is limited). Before either spent fuel or HLW is to be disposed of in a permanent repository, it will be usually cooled and stored for 40 to 60 years to reduce its radioactivity and decay heat. In this study, spent fuel or HLW is assumed to be stored for 40 years before emplacement, and it is also assumed that boreholes will be available for emplacement activities by 2045. There are two scenarios considered here: 1) Scenario 1: China will not reprocess any spent fuel; 2) Scenario 2: China will reprocess 50 tons spent fuel per year starting in 2010, and will reprocess 800 tons per year of spent fuel when the commercial-scale reprocessing facility comes on line, assumedly starting in 2025 as planned. In Scenario 2, DBD is deployed for use in disposing of the HLW resulting from reprocessing. In the meantime, spent fuel that has not been reprocessed is assumed to be stored in interim store facilities.

Table 4 and Table 5 show the roughly-estimated annual costs of DBD construction through 2070 to accommodate spent fuel that has cooled for approximately 40 years to that date for Scenario 1 and Scenario 2, respectively.

These costs are based on a cost of about $20 million for construction of each 5 km-depth borehole.[36] The costs shown do not include any additional costs for items such as administration cost, and no real cost escalation (or reduction in costs due to learning) is assumed. Although 2045 is assumed to be the start year for spent fuel borehole disposal, 2051 is assumed to be the start year for borehole disposal of HLW that has completed its 40-year cooling period, due to the fact that China might start reprocessing in 2011. Table 8 shows the amount of spent fuel disposed of annually, as well as the number of boreholes needed to dispose of cooled spent fuels using DBD from 2045 through 2070 and the construction cost of the boreholes (in constant 2009 US dollars).

Table 4. Estimates of Annual Cost of DBD Construction from 2045 to 2070 for Scenario 1

|

Year |

Spent fuel (tons) |

Boreholes |

Cost (Millions) |

|

2045 |

1100 |

5.5 |

110 |

|

2046 |

166.5 |

0.8 |

16.6 |

|

2047 |

190.8 |

1.0 |

19.1 |

|

2048 |

208.2 |

1.0 |

20.8 |

|

2049 |

221.9 |

1.1 |

22.2 |

|

2050 |

235.5 |

1.2 |

23.6 |

|

2051 |

252.5 |

1.3 |

25.3 |

|

2052 |

276.3 |

1.4 |

27.6 |

|

2053 |

310.4 |

1.6 |

31.0 |

|

2054 |

358.2 |

1.8 |

35.8 |

|

2055 |

423.2 |

2.1 |

42.3 |

|

2056 |

508.9 |

2.5 |

50.9 |

|

2057 |

618.7 |

3.1 |

61.9 |

|

2058 |

756.1 |

3.8 |

75.6 |

|

2059 |

924.6 |

4.6 |

92.5 |

|

2060 |

1127.6 |

5.6 |

112.8 |

|

2061 |

1243.6 |

6.2 |

124.4 |

|

2062 |

1359.6 |

6.8 |

136.0 |

|

2063 |

1475.6 |

7.4 |

147.6 |

|

2064 |

1591.6 |

8.0 |

159.1 |

|

2065 |

1707.6 |

8.5 |

170.8 |

|

2066 |

1823.6 |

9.1 |

182.4 |

|

2067 |

1939.6 |

9.8 |

194.0 |

|

2068 |

2055.6 |

10.3 |

205.6 |

|

2069 |

2171.6 |

10.9 |

217.2 |

|

2070 |

2287.6 |

11.4 |

228.8 |

|

total |

25335.4 |

126.8 |

2533.9 |

Table 5. Estimates of annual cost of DBD construction from 2051 to 2070 for Scenario 2.

|

Year |

Spent fuel reprocessed (tons) |

Boreholes |

Cost (Millions) |

|

2051 |

50 |

0.25 |

5 |

|

2052 |

50 |

0.25 |

5 |

|

2053 |

50 |

0.25 |

5 |

|

2054 |

50 |

0.25 |

5 |

|

2055 |

50 |

0.25 |

5 |

|

2056 |

50 |

0.25 |

5 |

|

2057 |

50 |

0.25 |

5 |

|

2058 |

50 |

0.25 |

5 |

|

2059 |

50 |

0.25 |

5 |

|

2060 |

50 |

0.25 |

5 |

|

2061 |

50 |

0.25 |

5 |

|

2062 |

50 |

0.25 |

5 |

|

2063 |

50 |

0.25 |

5 |

|

2064 |

50 |

0.25 |

5 |

|

2065 |

800 |

4 |

80 |

|

2066 |

800 |

4 |

80 |

|

2067 |

800 |

4 |

80 |

|

2068 |

800 |

4 |

80 |

|

2069 |

800 |

4 |

80 |

|

2070 |

800 |

4 |

80 |

|

Total |

5500 |

27.5 |

550 |

Overall, the estimates above show that the undiscounted cost of disposing of spent fuel using DBD after a 40 year cooling period prior to disposal are in the range of about $2.5 to $5 billion total for all spent fuel cooled sufficiently for disposal in the years 2045 through 2070 in scenario 1, and increasing to about $230 million per year by 2070,while the same cost of disposing of HLW after a 40 year cooling period are in the range of about $0.55 to $1.1 billion in total during the years from 2051 to 2070. These lower costs shown for Scenario 2, however, do not include the capital or operating costs of reprocessing facilities, which are substantial in their own right. Placing these DBD costs in perspective, if China’s nuclear fleet in 2050 is on the order of 200 GWe, which is probably on the lower end of the range of capacity expansion scenarios, its nuclear electricity output would be on the order of 1500 TWh/yr. At an assumed average retail price of $100 per MWh (just above today’s non-residential electricity price in China [37]), revenues from nuclear generation would be on the order of $150 billion per year in 2050 (and overall electricity sector revenues would probably be ten times that). Even the largest of the annual cost estimates for DBD shown in Table 4, about $230 million in 2070, is therefore only a small fraction—approximately 0.1 to 0.2 percent—of electricity sales from nuclear power plants in 2050.

6. Regulatory issues and public opinion towards nuclear power and waste

Overall, China’s budget expenditures on HLW R&D activities have been relatively low. The HLW R&D program has not to date been listed as a key national R&D program. Going forward, however, it is likely that China will pay more attention on its nuclear waste management in response to the rapid pace of China’s nuclear power development and its ambitious plan for the future.

China has not issued a major law to govern the use of nuclear energy and related activities (something akin to Japan’s Japanese Atomic Energy Basic Law). The one nuclear-related statute currently in force in China is the Law on Prevention and Control of Radioactive Pollution, which was published by the Chinese State Environmental Protection Administration (SEPA) in 2003 and focuses on radioactive pollution, but does not cover nuclear waste or spent fuel management. The Fukushima accident had the impact of spurring calls in china for a more effective and updated regulatory system for nuclear materials management. As a result, the first draft of a proposed atomic energy law was submitted to the Ministry of Industry and Information (MII) for review in December 2011. The law aims to provide a legal basis for all nuclear related activities in China, covering both front-end and back-end activities including nuclear waste management and storage.

While public opinion in Western countries has generally had a chilling effect on the development of nuclear power, the Chinese public seems to accept and embrace nuclear technologies for several reasons. Nuclear power plant development, for instance, provides thousands of local jobs. Local Chinese governments have been scrambling to build nuclear power plants, in part, because they believe that nuclear power projects will significantly benefit the local economy, increase local tax revenues, and resolve persistent electricity shortfalls. In addition, since China’s nuclear power industry is relatively young, spent fuel and nuclear waste management issues have not become sufficiently urgent as to have become public concerns yet.

Still, facilitating China’s nuclear energy development plans will require a higher degree of sustained support among the general public. In the past, the Chinese public was not an integral part of nuclear energy decision-making, but this situation is changing. The MEP has released a tentative measure that outlines increased public involvement in the environmental impact assessment (EIA) process.[38] As part of the measure, local governments are required to release EIA reports and allow public feedback before the construction of large-scale projects can commence. Despite these positive developments, this process has not been effective or efficient as, for example, the public review period is presently 10 days long—an insufficient time to understand an assessment of a nuclear energy project. Additionally, the public is generally unaware of how to participate in these consultative processes. For example, according to the first national environmental protection and livelihood index released in 2006, 80 percent of respondents were unaware of the existence of China’s free phone hotline for reporting environmental problems. In the nuclear field, the level of public participation and involvement in the licensing process is very limited in comparison with public involvement in nuclear issues in other major nuclear energy states.

As a consequence of the Fukushima accident, the public’s awareness of China’s nuclear energy development and related safety issues has increased. For example, internet bloggers started the internal Chinese debate on safety issues related to nuclear energy. In the near future, the Chinese government will have to improve public participation during the licensing processes of nuclear energy projects so as to make the decision making process more transparent and enforce the regulatory system more effectively.

7. Conclusions

This study reviews China’s current spent fuel management policies and practices and China’s future plans for nuclear waste management. In addition, this study provides an initial exploration of a potential role of DBD in nuclear waste management in China.

In conclusion, this study finds that: 1) China’s geology, seismology, geography, and population destruction suggest that DBD facilities will in all likelihood be mostly located in the northwest part of China, in areas such as the northern part of Gansu province. This matches the potential locations that are already under consideration for geologic mined repositories for spent fuel and high-level wastes from reprocessing; 2) Unlike other nuclear energy countries, China will be experiencing very little pressure to lessen the burden of at-reactor (pool-type) spent fuel storage in the next three decades due to its young industry and relatively plentiful potential sites for geological repositories. China could use on-site/off-site dry storage facilities or the current and planned off-site wet storage facilities to meet storage demand, diminishing the impact of this issue on China’s spent fuel management and nuclear waste program; 3) due to the possible economic benefits from DBD when compared to mined geological repositories for spent fuel and HLW, further study is desirable to further identify, explore, and reach a more detailed understanding of the relevant technical and economic issues associated with the development and use of DBD.

Considering China’s tremendous projected energy demands, its huge commitment to nuclear energy, and its infrastructure in nuclear science and technology, China should place greater emphasis on its nuclear waste R&D program, both from the financial and technological perspectives. Only a solid back-end solution will allow China to develop a nuclear power program that is sustainable in the long term. Since China’s nuclear waste management R&D program is still at its early stage, China still has the flexibility to consider and evaluate a range of options to pursue in providing future nuclear waste management solutions. Further investigation of and feasibility studies on DBD are recommended. In addition, although the public might not be aware of nuclear waste issues now, China should allow for more public participation in nuclear waste management policy development, which could result in a more effective and efficient decision-making framework for the development and siting of back-end nuclear fuel cycle facilities.

[1] Available as http://web.mit.edu/nuclearpower/pdf/nuclearpower-summary.pdf.

[2] Brady, P.et al, 2009. Deep Borehole Disposal of High-Level Radioactive Waste. SAND2009-4401, August 2009.

[3] National Development and Reform Commission (NDRC), 2007. “China’s Medium and Long-term Nuclear Energy Development Plan”. Available from: http://www.etiea.cn/data/attachment/123%284%29.pdf.

[4] China Daily, 20 December 2008. “Nuclear Power to Get a Big Boost”. Available from: http://www.chinadaily.com.cn/bizchina/2008-12/20/content_7324967.htm

[5] Xu, M., 2008. “Fast reactor development strategy targets study in China”. Journal of Nuclear Science and Engineering 28 (1), 20–25 (in Chinese).

[7] Zheng, L.M., Shen, C., 2005. “Status and technology of interim spent fuel dry storage facility for PHWR nuclear power plants”, 2005. Nuclear Safety 1 (1), 39–44 (in Chinese).

[8] Photo from Beijing Starbecs Engineering Management Co, Ltd, (2009), http://www.cnpe-bsem.com/shownews.asp?newsid=290.

[9] The forecast cases assume China’s installed nuclear power capacities will be as shown by 2050. Details of these forecasts are provided in Zhou, Y. “China’s Spent Nuclear Fuel Management: Current Practices and Future Strategies.” Energy Policy 39, no. 7 (2011): 4360-4369, which is also the source of other materials presented in this report.

[10] Due to the Fukushima accident, China slowed down its nuclear power development pace. A 60 GWe nuclear power capacity is assumed by 2020.

[11] Zhou, Y. “China’s Spent Nuclear Fuel Management: Current Practices and Future Strategies.” Energy Policy 39, no. 7 (2011): 4360-4369.

[12] CNNC, 22 December 2010. “China successfully conducted its first hot test at its reprocessing pilot plant”. Available from: http://www.cnnc.com.cn/publish/portal0/tab293/info51006.htmS

[13] CNEIC, 12 April 2011. “China and France’s first formal negotiation on the spent fuel reprocessing project”. Available from: http://www.cneic.com.cn/gongsixinwen/zhongfaheranliaohouchuli-item-jinhangshoucizhengshitanpan-job/S

[14] Deng 2010 Deng, G., 2010. “Overview of spent fuel management in China”. In: International Conference on Management of Spent Fuel from Nuclear Power Reactors. International Atomic Energy Agency (IAEA). Available from: http://www-ns.iaea.org/meetings/rw-summaries/vienna-2010-mngement-spent-fuel.aspS

[15] Xu, M., 2008. “Fast reactor development strategy targets study in China”. Journal of Nuclear Science and Engineering 28 (1), 20–25 (in Chinese).

[16] Xinhua News Agency, 22 July 2010. “China starts up first fourth generation nuclear reactor”. Available from: http://news.xinhuanet.com/english2010/china/2010-07/22/c_13409085.html

[17] CNNC, 26 March 2010. “China and Russia sign a memorandum on fast reactors”. Available from: http://www.cnnc.com.cn/tabid/283/InfoID/47670/Default.aspxS

[18] Pavel Podvig. 18 May 2012. “China delays purchase of Russian fast neutron reactors”. Available from: http://fissilematerials.org/blog/2012/05/china_delays_purchase_of_.html

[19] WNN, 30 April 2010a. “Joint venture launched for Chinese fast reactor”. Available from: http://www.world-nuclear-news.org/C-Joint_venture_launched_for_Chinese_fast_reactor-3004104.html

[21] Wang, J. 2010. “High-level radioactive waste disposal in China: update 2010”. Journal of Rock Mechanics and Geotechnical Engineering. 2010, 2 (1): 1–11.

[22] National Development and Reform Commission (NDRC), 2007. China’s Medium and Long-term Nuclear Energy Development Plan. Available from: http://www.etiea.cn/data/attachment/123%284%29.pdf.

[23] Wang, J. 2010.” High-level radioactive waste disposal in China: update 2010”. Journal of Rock Mechanics and Geotechnical Engineering. 2010, 2 (1): 1–11.

[24] Wang, J. 2010. “High-level radioactive waste disposal in China: update 2010”. Journal of Rock Mechanics and Geotechnical Engineering. 2010, 2 (1): 1–11.

[27] Brady, P.et al, 2009. Deep Borehole Disposal of High-Level Radioactive Waste. SAND2009-4401, August 2009.

[28] David von Hippel and Peter Hayes, 2010, Deep Borehole Disposal of Nuclear Spent Fuel and High Level Waste as a Focus of Regional East Asia Nuclear Fuel Cycle Cooperation. Nautilus NAPSnet Special Report, December, 2010, available as https://nautilus.org/wp-content/uploads/2012/01/von-hippel-hayes3.pdf.

[30] Li, T,. 1980. “The Development of Geological Structures in China”. GeoJournal, Vol. 4, No. 6, Recent Research in China (1980), pp. 487-497

[31] Wang, J. 2010. “High-level radioactive waste disposal in China: update 2010”. Journal of Rock Mechanics and Geotechnical Engineering. 2010, 2 (1): 1–11.

[33] Chinese Continental Scientific Drilling Project, China geological survey. Available from: http://old.cgs.gov.cn/Ev/ccdp/ccdp.htm

[35] Kang, J. 2010, An Initial Exploration of the Potential for Deep Borehole Disposal of Nuclear Wastes in South Korea. Nautilus Institute Special Report, available as https://nautilus.org/wp-content/uploads/2012/01/JMK_DBD_in_ROK_Final_with_Exec_Summ_12-14-10.pdf

[36] Brady, P.et al, 2009. Deep Borehole Disposal of High-Level Radioactive Waste. SAND2009-4401, August 2009.

[37] See, for example, “China to Increase Power Prices”, Wall Street Journal Asia, November 30, 2011, available as http://online.wsj.com/article/SB10001424052970204397704577069981733346656.html

[38] Liu, Y.L., 2006. SEPA releases new measure on public participation in environmental impact assessment process. Worldwatch Institute Available at: http://www.worldwatch.org/node/3886S

IV. Nautilus invites your responses

The Nautilus Peace and Security Network invites your responses to this report. Please leave a comment below or send your response to: napsnet@nautilus.org. Comments will only be posted if they include the author’s name and affiliation.