By Samantha Mella

19 May 2015

I. Introduction

Samantha Mella writes that, despite climate concerns, the current Australian government is fixated on supporting and expanding the Australian coal industry. Mella argues that ‘Australia may benefit from reconsidering what it means to be an energy superpower in 2015. In the era of an altered climate and carbon constraints, the need to “think different” has never been greater.’

‘Challenges to renewable energy exports…. should not be underestimated. If an effective and substantial Asian Super Grid results from overcoming these challenges, however, access to that grid may help to pave the way for Australia’s transition to being an exporter of clean energy.’

Samantha Mella is a freelance writer and research consultant based in Hunter Valley, New South Wales, Australia. She has been following trends in international electricity grid integration, HVDC interconnection and the emergence of the renewable energy trade.

This paper was originally published with support from the Hanyang University’s Energy, Governance and Security (EGS) Center, available in Global Energy Monitor Vol. 3, No. 2 (February 2015).

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

II. Policy Forum by Samantha Mella

Does Australia Energy Export Future Lie with the Asian Supergrid?

A dominant narrative in Australia has been that Australian, Asian and global prosperity is inextricably linked to the production and consumption of coal. In 2014, Australia’s conservative Prime Minister, Tony Abbott made his position clear:

“Coal is good for humanity, coal is good for prosperity, coal is an essential part of our economic future, here in Australia, and right around the world … Energy is what sustains our prosperity, and coal is the world’s principal energy source and it will be for many decades to come.”[1]

Abbott’s position continues the trajectory of his conservative predecessor, John Howard. Howard’s vision was of an Australian energy super power – a global leader in the export of coal, gas, petroleum and uranium.[2] The Rudd-Gillard Labour government that served between the administrations of Howard and Abbott controversially introduced carbon pricing as a measure to reduce domestic greenhouse gas emissions. This administration, however, also shared the vision of an Australian economy dominated by fossil fuel exports. In 2011, when the price of Australian thermal coal reached its post-recession peak at $US136.30 per tonne,[3] the Gillard government’s position was: “Australian coal production is expected to continue its strong growth over the course of the decade and beyond. This will largely be to meet export opportunities in our region.”[4]

Australia began exporting coal to Asia during Japan’s post-war reconstruction in the late 1940s. Export markets grew to include South Korea, Taiwan and China. Abbott’s vision sees past and future coal export as a cornerstone to Asian economic growth.[5] Asian “energy poverty”—the relative paucity of domestic energy sources in many of the major economies in Asia—is frequently cited as a reason for the expansion of coal production and use.[6] The impact of Australian coal’s “downstream” emissions—that is, the emissions of greenhouse gases when Australia’s exported coal is consumed—is not acknowledged as Australia’s problem. This is despite the costly domestic impacts of extreme weather events in Australia that appear to be consistent with the climate predictions made by agencies such as the IPCC (Intergovernmental Panel on Climate Change), and the Australian Bureau of Meteorology and the CSIRO (Commonwealth Scientific and Industry Research Organization). Some of these climatic events affect the coal industry itself. Flooding has lead to mine closures, infrastructure damage, and billions in lost production in Queensland in 2008, 2009, 2011 and 2013.[7] [8] [9] In addition, bushfires have set alight the brown coal seam at Hazelwood in Victoria in 2006 and 2014.[10] The 2014 fire burned for 45 days, cost $100 million, and was subject to a state government inquiry due to local residents’ exposure to toxic fumes.[11]

The Climate Council’s 2014 report, Counting the Costs, Climate Change and Coastal Flooding, stated that $226 billion worth of Australian infrastructure was at risk with a 1.1m sea level rise.[12] This is includes ports, domestic and international airports, rail and light rail infrastructure, hospitals, schools, and housing. The flood maps for a 1.1m sea level rise are available on the Australian government’s own Department of Environment website[13]. The fossil fuel super power goal pursued by successive Australian governments can be viewed as highly damaging to Australia’s future. From the perspective of climate movement, the downstream emissions from Australian coal export are, “a menace to the planet and would have to be left in the ground if the world had any hope of avoiding catastrophic global warming.”[14]

In 2013-14 Australia exported 375 million tonnes of coal, valued at almost $A40 billion.[15] Meat, wheat, and wool combined yielded $A18 billion in export revenue. Only iron ore exports exceeded the value of exported coal. Given the importance of coal to Australia’s economy, the challenges posed by climate change and the need for greenhouse gas emissions reductions, both domestically and internationally, have been extremely difficult for Australia to assimilate into its energy policy. Serious incorporation of climate considerations would curtail Australia’s current fossil fuel exports-based superpower path.

As a consequence of this climate considerations/fossil-fuel export dependence mismatch, “business as usual” has prevailed. Australia continues to operate on the assumption that other nations won’t act to meet their emissions reduction targets, and as a result Australia’s coal exports will not be threatened by climate considerations. In China, the 2014 energy transition created a 3 % drop in thermal coal consumption, even with an overall 3.8% increase in electricity output. This has taken Australia and the coal industry by surprise, even though China’s transition was forecast in Australia by the well-known economist Professor Ross Garnaut.[16]

As Australia continues to invest in coal export infrastructure, Australian coal is in trouble. The global coal glut has caused a marked decline in prices, down to $US57.10 per tonne as of mid-January, 2015.[17] The industry has responded by increasing production volumes to make up for the low price, and by shedding workers to cut costs.

Climate change concerns and the impacts of the coal fuel cycle on health, environment, agriculture and tourism are driving local resistance to the coal industry and legal challenges to new coal mining and transport projects. A global divestment campaign, aimed at restricting the fossil fuel industry’s access to capital, is starting to gain traction. Pressure from activists led four European banks to rule out involvement in financing the expansion of the Abbott Point Coal Terminal in Queensland, based on concerns about the Great Barrier Reef.[18] [19]

Goldman Sachs has warned investors to pull out of stocks in thermal coal production companies.[20] Citibank, HBSC, and the Deutsche Bank acknowledge that the carbon in the world’s fossil fuel reserves, if extracted, burned, and emitted as carbon dioxide, exceed any safe limit for atmospheric carbon stabilisation, and warn investors about investing in projects that cannot be realised.[21] Carbon pricing—placing taxes on fossil fuels to reflect the potential costs of greenhouse gas emissions in fuel prices—is gradually gaining momentum. According to the World Bank, 40 countries and 20 cities and provinces are currently using or implementing some kind of carbon pricing mechanism.[22] This is a major global structural reform that will have a further impact on coal production and sales worldwide.

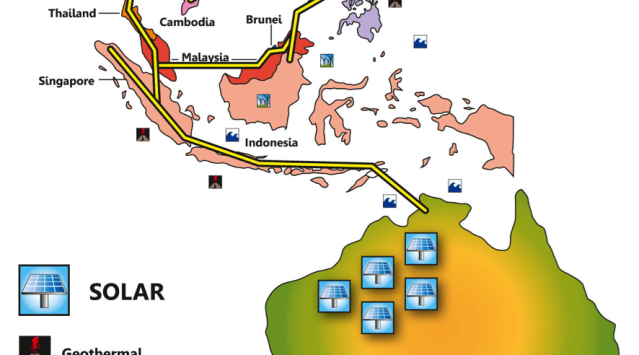

Australia may benefit from reconsidering what it means to be an energy superpower in 2015. In the era of an altered climate and carbon constraints, the need to “think different” has never been greater. Australia has vast reservoirs of solar energy within reach of South East Asia (SEA), where energy demand is forecast to increase by 80% by 2035.[23] The Asian Development Bank (ABD) has stated that “business as usual” in the energy sector is not sustainable for SEA, and calls for greater efficiency and increased rollout of renewable energy.[24]

A regional energy agreement between Australia and the ASEAN states to mobilise Australia’s desert solar resources to SEA via a subsea High Voltage Direct Current (HVDC) interconnector has the potential to address the key regional challenges of energy security and emissions reduction. In addition, ASEAN nations have committed to interconnect their electricity grids by 2020 to enhance energy security and sustainability. Realistically, fully realizing the ASEAN interconnection within that timeframe seems optimistic, however the goal of a regional grid exists.

A subsea HVDC interconnector between Australia and the ASEAN grid is an ambitious proposal with significant challenges, but does have historical precedents. In 1871, an 1100-mile subsea telegraph cable was laid by sailing ships from Jakarta to Darwin.[25] The subsea telegraph cable revolutionized Australian communications by connecting it to the global Morse code network.

Around the world, nations are connecting their electricity grids to create multi-lateral electricity markets. Grid integration is most advanced in Europe where interconnection stretches from Finland to Portugal. At 580 km, the “NorNed” powerline is currently the longest subsea HVDC Interconnector in the world. NorNed delivers Norwegian hydroelectricity to the Netherlands, where the power is sold by auction on the European market.[26]

Grid integration is also occurring in Asia. Bilateral electricity trade is occurring via single interconnectors in SEA, for example between Thailand and Malaysia, and between Russia and China in North Asia (NA). Many other interconnectors are planned or in across Asia.

The Asia Super Grid (ASG) is the concept of multilateral electricity trade in an integrated grid between Japan, Russia, China, Korea, Mongolia and beyond.[27][28] Mongolia has major ambitions to mobilise its wind and solar resources to become NA’s energy hub, and to export 100 GW of renewable energy into the ASG by 2030. It is interesting to note that despite Mongolia’s huge coal reserves, and recent large increases in its coal exports to China, it aspires to become a renewable energy superpower.

Is dependence on the fossil fuel economy a wise path for Australia in 2015 and beyond? Will the coal narrative lead to a 1.1m sea level rise and $226 billion in lost infrastructure, including the ports and railways that export coal? Does Australia’s political leadership have the courage to have a discussion about climate change, coal exports, and downstream emissions?

Will the ASG evolve to become an integrated electricity market as in Europe? Will Australia be isolated from Asia’s future electricity market if it continues to focus on coal exports? Is an HVDC interconnector with Asia more appropriate energy infrastructure than more coal loaders?

Transitions in energy supply and demand in SEA, and globally, are bound to continue. The need for electricity in the countries of SEA seems certain to persist, and likely expand. The rate of expansion will depend on the balance between energy efficiency improvement and expanding electricity service needs in SEA nations, but a large and persistent market for Australian renewable electricity exports seems highly likely.

Challenges to renewable energy exports—ranging from the technical challenges of configuring HVDC interconnections, to the environmental challenges of generation sites and powerlines, to the political and economic challenges of settling management and pricing arrangements with trading partners—should not be underestimated. If an effective and substantial Asian Super Grid results from overcoming these challenges, however, access to that grid may help to pave the way for Australia’s transition to being an exporter of clean energy.

III. References

[1]Australian Broadcasting Commission (ABC) (2014) Coal good for humanity, Prime Minister Tony Abbott says at $3.9b Queensland Mine opening” ABC, 13 October 2014. available at : http://www.abc.net.au/news/2014-10-13/coal-is-good-for-humanity-pm-tony-abbott-says/5810244

[2] Wendy Frew (2006), “We’ll be an energy superpower: PM”. Sydney Morning Herald, July 18, 2006, available as http://www.smh.com.au/news/national/well-be-an-energy-superpower-pm/2006/07/17/1152988475628.html

[3] Edited by Ed Davies, (2014) “Australia’s coal sector defies all comers to keep on mining,” Sydney Morning Hearald, October 13, 2014 available at: http://www.smh.com.au/business/mining-and-resources/australias-coal-sector-defies-all-comers-to-keep-on-mining-20141013-1154av.html

[4] Department of Resources, Energy and Tourism (2011), Strengthening the Foundation for Australia’s Energy Future, Draft Energy White Paper 2011. Department of Resources, Energy and Tourism Australian Government. Available as http://www.afr.com/rw/2009-2014/AFR/2011/12/12/Photos/70eee99a-250a-11e1-a799-d611028b2128_Draft-EWP.pdf.

[5] Tristan Edis (2014), “Abbott’s kinda right – coal was ‘good for humanity’”, Business Spectator, 14 Oct 2014, available as http://www.businessspectator.com.au/article/2014/10/14/renewable-energy/abbotts-kinda-right-%E2%80%93-coal-was-good-humanity.

[6] Brendan Pearson (2014), “Coal the answer to energy poverty”, The Drum, 7 April, 2014, available as http://www.abc.net.au/news/2014-04-08/pearson-coal-the-answer-to-energy-poverty/5371462.

[7] Sarah Jane Tasker (2011) “Queensland floods cause another mine closure”, The Australian, 11 January, 2011

Available as: http://www.theaustralian.com.au/business/mining-energy/queensland-floods-force-another-coal-mine-closure/story-e6frg9df-1225985677568.

[8] Reserve Bank of Australia (2011) The Impact of the Recent Floods on the Australian Economy, Statement on Monetary Policy, February 2011. Accessed online: http://www.rba.gov.au/publications/smp/boxes/2011/feb/a.pdf

[9] Matt Chambers (2013) “BHP’s Bowen Basin Coal Mines hit by floods”, The Australian, 29 January 2013 http://www.theaustralian.com.au/business/mining-energy/miners-spared-but-queensland-storm-closes-rail-and-ports/story-e6frg9df-1226563790140.

[10] AAP (2006), “Massive coal mine blaze still burning”, The Age, 13 October 2006. Available at http://www.theage.com.au/news/National/Massive-coal-mine-blaze-still-burning/2006/10/13/1160246290407.html.

[11] James Fetts (2014), “Hazelwood mine fire inquiry: Authorities too late in warning Morwell residents of health risks”, Australian Broadcasting Commission, 2 September, 2014. Available at: http://www.abc.net.au/news/2014-09-02/authorities-too-late-with-hazelwood-fire-health-warnings-report/5713790

[12] Will Steffen, John Hunter and Lesley Hughes (2014), available as http://www.climatecouncil.org.au/uploads/56812f1261b168e02032126342619dad.pdf.

[13] The Australian Government, Department of Environment Available at : http://www.environment.gov.au/climate-change/adaptation/australias-coasts/mapping-sea-level-rise

[14] Bill McKibbon (2013) “How Australian Coal is causing global damage,” The Monthly, June 2013. Available at: http://www.themonthly.com.au/issue/2013/june/1370181600/bill-mckibben/how-australian-coal-causing-global-damage

[15] Australian Government Department of Foreign Affairs and Trade statistics, available from http://www.dfat.gov.au/about-us/publications/trade-investment/australias-trade-in-goods-services/Pages/australias-trade-in-goods-and-services.aspx#imports.

[16] Ben Potter (2015), “China cuts thermal coal use by 3pc”, Financial Review, 27 January, 2015, available as http://www.afr.com/Page/Uuid/6a490ad8-a5ce-11e4-9dae-b62d8445140

[17] Greg McKenna (2015), “CHART OF THE DAY: Newcastle Coal Is Quietly Crashing”, Business Insider Australia, January 14, 2015, available as http://www.businessinsider.com.au/chart-of-the-day-newcastle-coal-is-quietly-crashing-2015-1

[18] Julien Vincent (2014), “What I did on my ‘holiday’: European banks won’t fund Abbot Point”, Market Forces, May 27, 2014, available as http://www.marketforces.org.au/what-i-did-on-my-holiday-european-banks-wont-fund-abbot-point/.

[19] Coal wire (2014), “Congratulate the Royal Bank of Scotland for dumping Abbott Point”, enewsletter, dated June 19 June 2014.

[20] See, for example, Goldman Sachs (2013), “The window for thermal coal investment is closing”, dated July 24, 2013, and available as http://d35brb9zkkbdsd.cloudfront.net/wp-content/uploads/2013/08/GS_Rocks__Ores_-_Thermal_Coal_July_2013.pdf.

[21] Institute for Energy Economics and Financial Analysis (2014), Briefing Note Fossil Fuels, Energy

Transition and Risk, dated April 18, 2014, and available as http://ieefa.org/briefing-note-fossil-fuels-energy-transition-risk/.

[22] World Bank (2014), “What Does It Mean to Put a Price on Carbon?”, June 11, 2014, available as http://www.worldbank.org/en/news/feature/2014/06/11/what-does-it-mean-to-put-a-price-on-carbon.

[23] International Energy Agency (2013), Southeast Asia Energy Outlook, Executive Summary: World Energy Outlook Special Report, available as http://www.iea.org/publications/freepublications/publication/WEO_Special_Report_2013_Southeast_Asia_Energy_Outlook_Executive_Summary.pdf.

[24] Asian Development Bank (2013), “Power Swaps Can Help Asia-Pacific Manage Daunting Future Energy Needs – Report”, dated 14 October 2013, and available as http://www.adb.org/news/power-swaps-can-help-asia-pacific-manage-daunting-future-energy-needs-report

[25] Legislative Assembly of the Northern Territory, “History of Parliament House Site”, available as http://www.nt.gov.au/lant/about-parliament/history-of%20parliament-house-site.shtml#PortDarwinPostandTelegraphOffice.

[26] Tennent (2008), “NorNed turnover exceeds EUR 100 million”, dated 1 December, 2008, and available as http://www.tennet.eu/nl/news/article/norned-turnover-exceeds-eur-100-million.html.

[27] Mano S, Ovgor B, Samadov Z et al (2014) Gobitec and Asian Super Grid for Renewable Energies in

North East Asia, Energy Charter Secretariat, Available at http://www.encharter.org/fileadmin/user_upload/Publications/Gobitec_and_the_Asian_Supergrid_2014_ENG.pdf.