David Von Hippel

26 February 2014

Nautilus Institute

David von Hippel is a Nautilus Institute Senior Associate working on energy and environmental issues in Asia, as well as on analysis of the DPRK energy sector.

This paper was prepared with support from the Hanyang University’s Energy, Governance and Security (EGS) Center, available in Global Energy Monitor Vol. 2, No. 3 as http://www.egskorea.org/common/download.asp?downfile=GEM_2014-3.pdf&path=board .

As the Keystone XL Debate Rages in the US, What Does it Mean for Other Resource Exports to Northeast Asia?

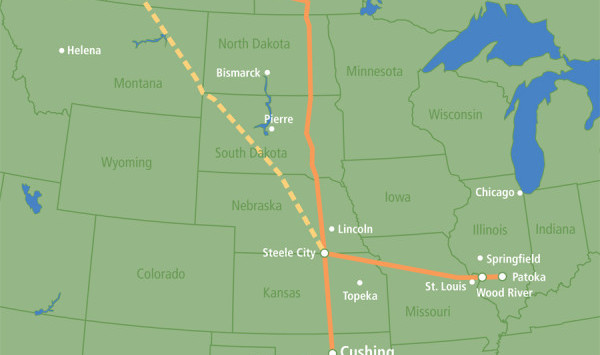

The proposed Keystone XL pipeline project has been a fixture in the news media in recent weeks and months. This project, with a current price tag of $5.4 billion, would transport crude oil derived from tar sands in Alberta, Canada through the United States southward to oil refineries on the Texas Gulf Coast. The new pipeline, which has been under discussion since at least 2008, would carry “dilbit” a form of bitumen—a heavy oil product in this case derived from tar sands—that is diluted with lighter oil products such as benzene, on its first 1900-km leg through the Canadian provinces of Alberta and Saskatchewan and the U.S. states of Montana, North Dakota, and Nebraska to the town of Steele City on the Nebraska/Kansas border. From there, oil would flow through existing pipelines to the Gulf Coast, where it would be refined for use in the United States and for export. The Keystone XL project requires the approval of numerous federal and state agencies, which in turn has required extensive reviews and made the project a focus for considerable debate among pipeline advocates and foes on both sides of the border. The Keystone XL debate raises a number of issues about energy exports and environmental risk, particularly climate change, that transcend the particular characteristics of the pipeline itself, with possible implications for Northeast Asia’s future energy imports and energy security.

Because the pipeline crosses an international border, approval from the U.S. Department of State is required. The State Department’s Final Supplemental Impact Statement on pipeline developer TransCanada’s application for a Presidential Permit was released in January 2014, and concluded that the pipeline project would be unlikely to significantly alter global greenhouse gas emissions, in part because if the pipeline were not approved, oil derived from tar sands would still be shipped by train and truck to refineries. The U.S. Environmental Protection Agency, which is tasked with review of the EIS under the National Environmental Policy Act, rated a previous version of the EIS as providing “insufficient information” in an April, 2013 letter to the State Department. The Obama Administration faces a number of difficult choices from a political perspective in ruling on Keystone’s application. Turn down the application, and the administration’s political opponents will redouble their charge that the President is anti-business, favors excessive regulation, and is not serious about reviving the U.S. economy. Approve the application, and the administration becomes vulnerable to charges that it is not fulfilling its environmental promises, both nationally and internationally, particularly with regard to addressing the issue of climate change.

Proponents of the Keystone XL pipeline in the United States tout the addition of nearly 2000 construction jobs to the economies of the states through which the pipeline will pass during the building of the pipeline, and approximately 50 jobs thereafter, as well as the benefits to the U.S. economy of an additional stable, reliable source of crude oil and additional refining business. Opponents of the pipeline note that tar sands produce 17 percent higher greenhouse gas (GHG) emissions than typical crude oil on a “well-to-wheels” basis (that is, counting all GHG emissions associated with extracting, processing, transporting, and refining the tar sands, and of burning a liter of the resulting petroleum products), voice concern about the potential environmental risks associated with pipeline ruptures—underscored by the still-ongoing, $1 billion-plus clean-up of a 2010 pipeline spill of dilbit in Michigan—and suggest that in the absence of the pipeline, tar sands development might be decreased, thereby reducing GHG emissions. Proponents counter that even if the pipeline were not built, the tar sands resources would simply be exported by rail and truck via Canada’s Atlantic and Pacific Coasts, as well as through the U.S. Gulf Coast, noting the huge increase in oil shipping by train and truck in recent years. The surge in rail and truck oil shipments is due in part to increased oil sands shipments, but also to the ongoing “oil boom” based on the application of hydraulic fracturing technology, or “fracking”, particularly to the Bakken Shale deposit in North Dakota. Pipeline opponents note that there are infrastructure capacity constraints that limit the rate and, perhaps, extent to which additional growth in the amount of oil transported by rail, and the less-favorable economics of rail and truck oil transport. Several high-profile derailments and explosions involving rail transport of crude oil have also been in the news, including a July 2013 accident in Quebec that resulted in 47 deaths.

A recent report by Peter Erickson and Michael Lazarus of the Stockholm Environment Institute’s U.S. Center uses a straightforward approach to look at the potential GHG emissions impacts of the Keystone project from another perspective. Using an analysis of global crude oil supply and demand, they compared scenarios that assumed that if the Keystone XL pipeline is not built, either as a result of failing to receive approval or for other reasons, “1) that the same amount of oil (100% of Keystone capacity) would reach the market anyway by other means; 2) that half of it would; or 3) that none would.” In a comparison of the first and third scenarios, Erickson and Lazarus found that though the impact of the Keystone project on global oil prices would be small in percentage terms—less than one percent—the impact on global oil consumption, because of the size of the global oil market, would be significant, increasing oil use by some 510,000 barrels per day, and corresponding GHG emissions by 93 million tonnes of carbon dioxide equivalent annually—slightly more than the annual national emissions of Greece, Chile, or the Philippines, and 15-20 percent of annual emissions in the Republic of Korea or Canada. These impacts are roughly halved if only half of the oil to be carried by the Keystone pipeline would have reached the market anyway.

To the extent that oil sent through the Keystone XL pipeline ultimately is refined into products consumed in Northeast Asia, or frees up supplies for Asia that would have otherwise have gone to the United States, the pipeline’s impact on the global oil market will also affect Asian oil supply and demand. Some of these changes arguably increase the energy security of Korea and its neighbors, for example, by potentially marginally reducing the dependency of Northeast Asian nations on oil suppliers in the Middle East. Some will have a mixed effect—reduced oil prices may somewhat improve economic competitiveness, but will also reduce incentives to invest in energy efficiency and low-carbon energy sources, and will increase consumption and GHG emissions.

Similar considerations, though with some key differences, apply to other proposed changes in fuel supplies to Northeast Asia. For example, the coal and liquefied natural gas (LNG) terminals that are proposed for the U.S. Pacific Northwest to serve Asian markets may, if subject to the same sort of supply/demand analyses, indicate similar increases in consumption associated with expanded fuel supply. Similarly, expanded fossil energy production for export in the Russian Far East (coal, and natural gas) and Mongolia (coal) could affect overall consumption of those fuels in Northeast Asia, with related impacts on GHG emissions. The analysis of the effects of coal and gas supply projects on demand is admittedly somewhat more complex than for changes in oil supply. The major user of oil is the transport sector, and potential substitutes for oil products for transport remain relatively limited, while coal and gas are, to some degree, substitutes for each other in, for example, industry and power generation. Still, from national, regional, and global perspectives, if climate change concerns are indeed to be effectively addressed, it will be important to understand and address not only the direct GHG emissions associated with fossil fuel supply projects—from, for example, the additional processing requirements of Canadian tar sands, the additional gas required to produce and ship LNG, and the energy required to move coal from the middle of the United States to Korea, China, and Japan—but the indirect GHG emissions impacts associated with the effects of big energy projects on global energy markets as well. Understanding these impacts on emissions can help decision makers to weigh the full costs and benefits of energy supply proposals, and to develop policies, ranging from, for example, blunt instruments such as denial of permission to construct infrastructure to more market-friendly approaches such as carbon taxes to increase the effective price of fossil fuels, with the proceeds reinvested in energy efficiency, renewable energy, and climate change adaptation.

References and Further Reading

Juliet Eilperin and Steven Mufson (2014), “State Department releases Keystone XL final environmental impact statement”, Washington Post, 31 January 2014. Available as: http://www.washingtonpost.com/business/economy/state-to-release-keystones-final-environmental-impact-statement-friday/2014/01/31/3a9bb25c-8a83-11e3-a5bd-844629433ba3_story.html.

Peter Erickson and Michael Lazarus (2014), Greenhouse Gas Emissions Implications of the Keystone XL Pipeline, Sockholm Environment Institute, Working Paper 2013-11, dated December 2013. Available as http://sei-us.org/Publications_PDF/SEI-WP-2013-11-KeystoneXL-price-effects.pdf.

Clifford Krauss and Jad Mouawad “Accidents Surge as Oil Industry Takes the Train”, New York Times, dated January. 25, 2014, and available as http://www.nytimes.com/2014/01/26/business/energy-environment/accidents-surge-as-oil-industry-takes-the-train.html?_r=0.

U.S. Department of State (2014), Final Supplemental Environmental Impact Statement for the Keystone XL Project, Executive Summary, dated January 2014. Available as: http://keystonepipeline-xl.state.gov/documents/organization/221135.pdf.