The Mining Industry of North Korea

By Choi Kyung-soo

August 4, 2011

This paper was originally published as part of a special issue of theKorean Journal of Defense Analysis (Volume 23 Number 2 Summer 2011) on the DPRK Energy and Minerals Sectors.

Much of the material in the above special issue was adopted from research presented at the Nautilus Institute’s 2010 DPRK Energy and Minerals Working Group Meeting in Beijing. Additional reports from the workshop are available here.

Nautilus invites your contributions to this forum, including any responses to this report.

——————–

CONTENTS

I. Introduction

II. Report by Choi Kyung-soo

III. References

IV. Nautilus invites your responses

- Mine in North Hwanghae Province, North Korea.

I. Introduction

In this report Choi Kyung-soo, President of the North Korea Resources Institute in Seoul, evaluates the current status of North Korea’s substantial mineral resources. Some of these minerals, such as magnesite, zinc, iron, and tungsten, could create highly competitive markets. However, almost all North Korean mines suffer from a lack of electricity and equipment. To improve mine productivity, Choi recommends the construction of large-scale hydro plants, the remodeling of the overall power system and a cooperative policy with Russia and South Korea.

The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

II. Report by Choi Kyung-soo

– The Mining Industry of North Korea

By Choi Kyung-soo

Introduction

Considering its large mineral resources, there are many opportunities for mineral development in North Korea. There are many kinds of minerals in North Korea, including magnesite, zinc, iron, tungsten ore, graphite, anthracite coal, gold, barite, apatite, and molybdenite. These mineral resources can be found in most areas of North Korea, but especially in the provinces of Hamgyeong-do and Jagang-do. North Korea is exceptionally rich in magnesite, with total magnesite resources reported at 6 billion tons in 2009. These are the second highest magnesite reserves in world.

North Korea’s mining production increased until 1990, but thereafter it dropped due to lack of electricity, materials, equipment, and antiquated facilities. Since 2000, iron ore and anthracite production have increased slightly.

Mine operation rate remains very low in North Korea. The Musan Iron-ore Mine was operating at approximately 30 percent of capacity in 2006 and the Daeheung Magnesite Mine was operating at 60 percent in 2007. It is likely that the average operation rates of all existing mining facilities are below 30 percent of capacity due to restricted financial assistance and the deteriorating infrastructure of the mining facilities. The energy shortage is one of the main obstacles hampering North Korean mineral production. Due to its age and poor conditions, the power grid is also a limiting factor. As a result, almost all of North Korean mines suffer from a lack of electric power.

South Korea’s first mining investment project in North Korea began in 2001. About 10 mining projects have been pursued through 2010. However, eight out of these 10 projects have stopped and only two of the mining projects were invested in by South Korean companies. The Jengchon Graphite Mine was the first investment project in North Korea. This mine produces graphite concentrate; however, it has never operated at full capacity due to electricity shortages.

Foreign companies have participated in about 25 mining projects in North Korea. China, Japan, the United States, and the United Kingdom have participated in North Korean mining projects. Chinese companies, in particular, have been aggressively participating in North Korean mineral development since 2003. At present, China has participated in about 20 of these mining projects.

It is very difficult for foreign investors to participate in North Korean mineral development operations, as most foreign investors want to establish their own companies and operate the mines independently. Therefore, North Korea’s legal provisions, sovereign risk, and antiquated infrastructure are barriers to foreign investment.

It is hoped that in the near future, North Korea and South Korea will normalize relations and allow mining projects to be restarted. Inter-Korean mining cooperation is very important for both sides. These projects offer North Korea the potential to increase mineral production and reap the related benefits of economic growth through South Korean investment. South Korea could in-turn secure valuable mineral commodities. However, it is important that North Korea first creates favorable conditions for investment and upholds its contracts with South Korean companies.

Mineral Resources and the Mining Industry in North Korea

Mineral Resources

North Korea’s mineral resources are distributed across a wide area comprising about 80 percent of the country. North Korea hosts sizable deposits of more than 200 different minerals and has among the top-10 largest reserves of magnesite, tungsten ore, graphite, gold ore, and molybdenum in the world. Its magnesite reserves are the second largest in the world, following China, and its tungsten deposits are probably the sixth-largest in the world.

[1] [2]

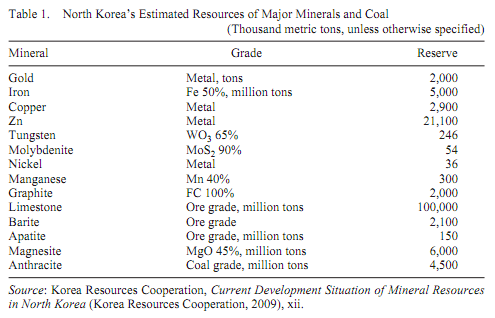

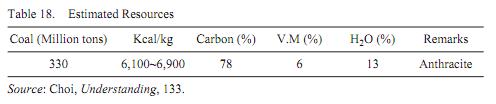

Of North Korea’s identified mineral resources, deposits of coal, iron ore, magnesite, gold ore, zinc ore, copper ore, limestone, molybdenite, and graphite are larger than other mineral commodities. These mineral resources all have the potential for the development of large-scale mines. Table 1 shows North Korea’s mineral resources data.

Table 1 shows that North Korea has many kinds of minerals, precious metals (gold), rare metals (Mo and Ni), ferrous minerals (Iron), non-ferrous minerals (Zn and Cu), non-metallic minerals (magnesite and limestone) and anthracite. Gold mines are located in Pyongan-do, magnesite mines are mainly distributed in the Hamgyeong-do, while iron ore is located in the provinces of Pyongan-do, Hamgyeong-do and Hwanghae-do.

The Mining Policy and Limits

North Korea’s mining policies are attempting to increase mine production, explore new mineral resources, and modernize its mining technology.

[3]

However, it is difficult for the country to develop its mines due to the shortage of equipment. To increase mineral production North Korea will need to exploit new mines and purchase new equipment (for example, Load Haul Dumps, jumbo drills, and conveyor systems). At present, its mines cannot do this due to the financial crisis in North Korea.

The energy shortage is one of the main obstacles hampering North Korean mineral production. The power grid has also become a limiting factor due to its age and general poor condition. Almost all North Korean mines suffer from a lack of electric power. According to the South Korea Mine Survey team’s data, it is assumed that North Korean mines have very weak electric systems and low-quality electricity (voltage values in North Korea are approximately 130–205V, normal voltage is 220V) and frequency variations are 39–54Hz (normal frequency is 60Hz). Under these circumstances, North Korean mines cannot operate the necessary mining equipment. Alternatives need to be sought in order to solve the electricity shortage. To improve mine productivity the construction of large-scale hydroelectric plants as well as the remodeling of the overall power system in cooperation with Russia and South Korea, is recommended.

The North Korea government has given special priority to the exploration and development of new mineral resources, especially ferrous and non-ferrous minerals. Recently, North Korean and Chinese teams have been cooperating to explore North Korea’s mineral resources. North Korea desires international assistance through joint projects to explore its mineral resources, and mainly its rare metal and rare earth minerals.

North Korea has also expressed an interest in mining technology innovation, including the development of mineral processing technology for oxide minerals, purification technology for raw metals and separation and purification technology for rare metal minerals. North Korea is interested in joint projects with other countries to develop these mining technologies.

The Mining Industry

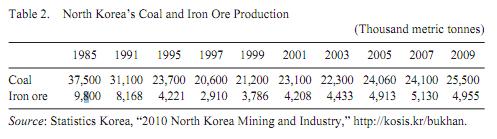

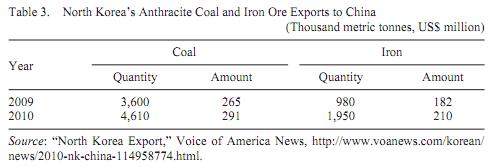

North Korean mining production has significantly decreased since the early 1990s. Recently, the North Korean mining industry seems to be slowly recovering. North Korea’s mining industry is one of the most important components of its economy. The mineral sector’s production has a limited capacity because of the lack of electricity, materials, equipment, antiquated facilities, and poor maintenance. According to the Bank of Korea, North Korea’s gross domestic product (GDP) decreased by 0.9 percent in 2009. Likewise, the value of mining production in 2009 fell by 0.9 percent. Iron ore production was 5,316,000 tons in 2008 and decreased to 4,955,000 tons in 2009; however, coal production increased by 440,000 tons in 2009.

[4]

North Korea’s mine operation rates have been very low. The Musan Iron-ore Mine was operating at approximately 30 percent of capacity in 2006 and the Daeheung Magnesite Mine was operating at 60 percent of capacity in 2007. It is likely that the average operation rate of existing mine facilities was below 30 percent of capacity due to restricted financial assistance, lack of production technology, and antiquated infrastructure. Table 2 shows North Korea’s coal and iron ore production data.

Mineral Trade

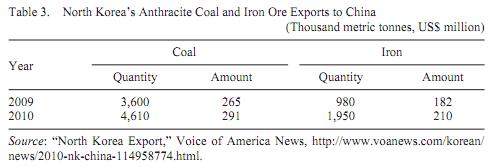

The mineral industry remains an essential part of North Korea’s economy and minerals are the most important export commodities in North Korea. China is the largest importer of mineral products produced in North Korea.

According to the Department of Commerce of China, the value of trade between China and North Korea increased by 30 percent in 2010, and North Korea’s imports from China increased by 20 percent. However, North Korean exports to China increased by 50 percent last year in comparison to 2009, mostly due to increases of anthracite coal and iron ore sales. Table 3 shows that anthracite coal exports to China were 4,610,000 tons in 2010 and is an increase of 78.1 percent over 2009. Iron ore exports to China were 2,100,000 tons in 2010. This value also increased by 86.7 percent since 2009.

Updates on Major Mines in North Korea

Sangnong Mine (Gold)

The Sangnong Mine is located in the Dancheon district of Hamgyeongnam-do, and is managed by the mining bureau of Dancheon, which holds the mining rights granted by the central government. The Sangnong Mine has been in operation since 1956.

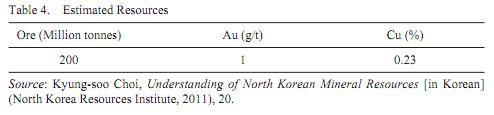

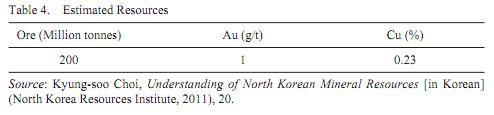

[5] The mine contains pyrite, chalcopyrite, magnesite, native gold, and native silver. Table 4 summarizes the resource data of the mine.

This mine is currently operating with underground mining methods. Gold bearing concentrates are recovered through conventional flotation methods. The plant was designed with a capacity of 2,800,000 tons per annum of gold ore. Annual production was 290,000 tons of concentrate at a grade of 30g/t of gold in 2008. The gold bearing concentrates were hauled by truck to the Heungnam 7.27 Smelter. This smelter produces the base metal and electrolytic copper.

The power required for the mine is supplied by the Heocheon River Hydroelectric Power Plant, which is 1.3km from the mine site. Fresh water supply for the plant site facilities is obtained from a reservoir that was developed by damming a natural valley in a catchment area at the Heocheon River. There is a 69km railway from the Sangnong Mine site to the Gimchaek Port. The loading capacity of Gimchaek Port was about 800,000 tons in 2007.

The Dongdae Custom Mill Plant processes the low-grade concentrate of the Sangnong Mine. This plant is located in Dancheon City. Twenty million tons of tailings disposal, the waste remaining after separating the valuable parts of the ore, at a grade of 1.44g/t of gold is heaped in this plant yard.

Holdong Mine (Gold)

The Holdong Mine is located in the Holdong labor district in Yeonsan-gun, Hwanghaebuk-do, and is managed by the Geumgang Mining Company in Hwanghaebukdo, which holds the mining rights granted by the central government. The Holdong Mine has been in operation since 1893.

[6]

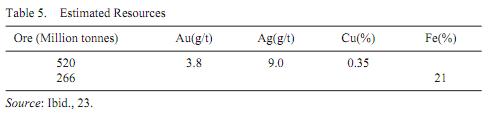

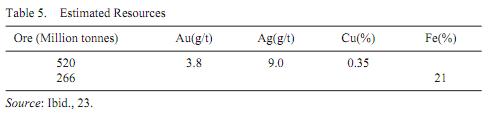

The Holdong deposit is subdivided into the following seven zones based on the mining block: Holdong, Unjin, Sanbakgol, Namun, Gadok, Unnan and Satji. The ore bodies are comprised with a total strike of 1,200m. It contains pyrite, native gold, and native silver. The mine’s resource data are summarized in Table 5.

This mine is currently operating with underground mining methods. Annual mining production is unknown. Gold bearing concentrates are processed through conventional flotation and cyanidation methods. The plant was designed with a capacity of 2 tons per annum of gold, 2.5 tons per annum of silver, and 80,000 tons per annum of copper concentrate. Annual production was 0.85 tons of gold, 1.674 tons of silver, and 893 tons of copper concentrate in 1991.

The power required to operate the mine is supplied by the Bukchang Thermoelectric Power Plant and Taecheon Hydroelectric Power Plant. The fresh water supply for the plant site facilities is obtained from the Holdong River. There is a 170km roadway from the Holdong Mine site to the Port of Nampo.

Hyesan Mine (Copper Mineral)

The Hyesan Mine is located in Masan-dong, Hyesan-si, Ryanggang-do, and is managed by the Ryanggang-do Mining Company and the North Korean Ministry of Mining, which holds the mining rights granted by the central government. The Hyesan Mine began operations in 1970.

[7] However, this mine did not operate from 1994 to 2009 due to underground flooding. In 2010, it was again put into partial production by pumping the underground water with the aid of the China’s Northern Heavy Industries Group Co., Ltd (NHI) and is again producing copper concentrate.

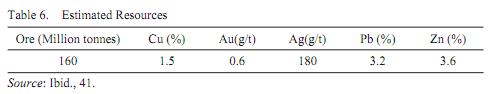

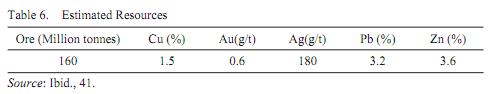

The mine contains chalcocite, chalcopyrite, galena, and sphalerite. It consists of three mine blocks named Chengeun, Bonsan, and Masan. The Hyesan Mine is the largest copper mine in North Korea. Table 6 summarizes the resource data of this mine.

The Hyesan Mine is currently operating with underground mining methods; however, production data is unavailable. At present, copper concentrate is recovered through conventional flotation methods. The plant was designed with a capacity of 1,200,000 tons per annum of copper ore. The annual production was approximately 90,000 tons of concentrate at a 16% grade of copper in 1993. The copper concentrate is hauled by truck to the Unheung Smelter. The Unheung Smelter produces electrolytic copper and is one of the largest copper smelters in North Korea.

The power required to operate the mine is supplied by the Heocheon River and the Bujeon River Hydroelectric Power Plant. A fresh water supply for the plant site facilities will be obtained from a reservoir that will be developed by damming a natural valley in a catchment area at the Heocheon River. The power line is connected to a substation in China. The mine site is only 5 km away from the Chinese border. There is a 190km railway from the Hyesan Mine site to Gimchaek Port. The loading capacity of Gimchaek Port was about 800,000 tons in 2007.

Geomdeok Mine (Zinc)

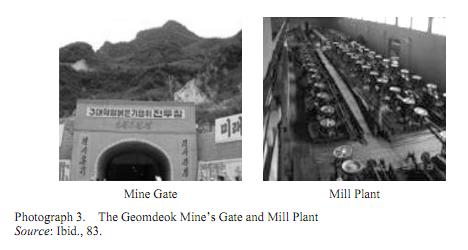

The Geomdeok Mine is located in Geumgol-dong, Dancheon-si, Hamgyeongnam-do, and is managed by the mining bureau of Dancheon, which holds the mining rights granted by the North Korean central government. The Geomdeok Mine has been in operation since 1932.

[8]

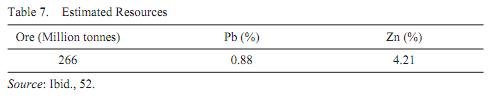

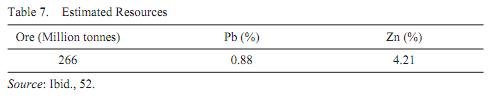

The mine contains sphalerite, chalcopyrite, and galena. It consists of seven mine blocks, which are called west Jungtojang, east Jungtojang, footwall Jungtojang, Takgol, Geomdeoksan, Muhakdong, and Bonsan. Also, the Geomdeok Mine is classified as within the mine zone. This mine zone consists of 10 mines: the Geumgol Mine, 7.1 gang, Geomdeok gang, the Chengyeun Mine, the Nampung Mine, the Roeun Mine, west Budgol, Geomdeoksan, Muhak, and Bonsan. The Geomdeok Mine is the largest zinc mine in East Asia. Table 7 summarizes the resource data of this mine.

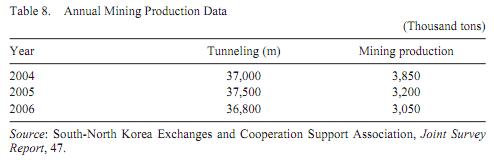

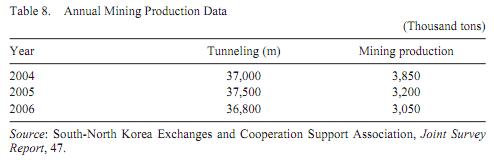

This mine is currently operating with underground mining methods. Table 8

shows the annual mining production data.

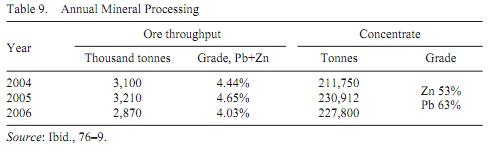

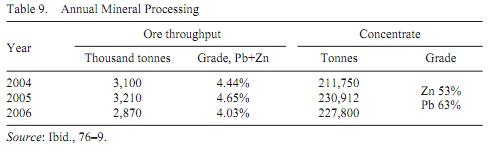

The lead and zinc concentrates are recovered through conventional flotation methods. The Geomdeok Mine has three mill plants. Among these, however, the second plant has only been in operation since 2007. The mill plants were designed with a total capacity of 10 million tons per annum of zinc ore. In 2006, the annual production was 196,000 tons of zinc concentrate with a 53 percent grade and 31,800 tons of lead concentrate with a 63 percent grade. Table 9 shows the annual mineral processing data.

The zinc concentrate is hauled by railway to the Dancheon Zinc Smelter. The Dancheon Smelter is 68km from the Geomdeok Mine. The lead concentrate is hauled by railway to the Muncheon Smelter, which is located at Gangwon-do. The Dancheon smelter is the largest zinc smelter in North Korea. The Dancheon Smelter was designed with a total capacity of 100,000 tons per annum of zinc ingot.

The power required to operate the mine is supplied by the Heocheon River Hydroelectric Power Plant, which is 40km from the Geumgol Substation in the Geomdeok Mine. The fresh water supply for the plant site facilities is obtained from a reservoir that was developed by damming a natural valley on the Bukdaecheon River. There is a 98km railway from the Geomdeok Mine site to the Gimchaek Port. The railway capacity was about 550 thousand tons in 2007. The loading capacity of Gimchaek Port was about 800, 000 tons in 2007.

Daeheung Mine (Magnesite)

The Daeheung Mine is located in Daeheung-dong, Dancheon-si, Hamgyeongnamdo, and is managed by the mining bureau of Dancheon, which holds the mining rights granted by the central government. The Daeheung Mine has been in operation since 1982.

[9]

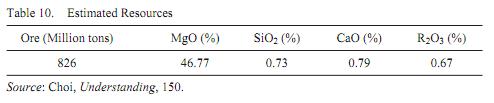

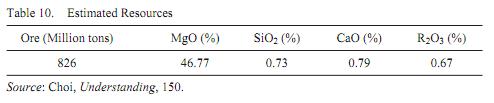

The deposits in the Daehyeung project are magnesite deposits. The ore bodies are comprised with a total strike of 1,600m. This mine consist of four mine blocks, named Hyeoksin, Baksan, 6.22, and Red-flag. The Daeheung Mine is the largest magnesite mine in the world. The resources data are summarized in Table 10.

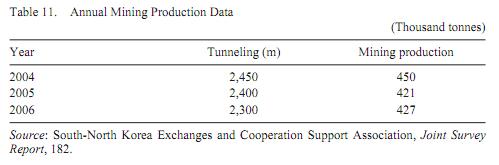

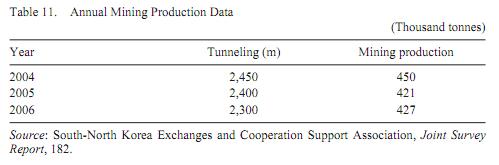

This mine is currently operating with open-pit and underground mining methods. In the winter season, it employs underground mining methods. The ratio of mine production is 70 percent open-pit mining and 30 percent underground mining. Table 11 shows the annual mining production data.

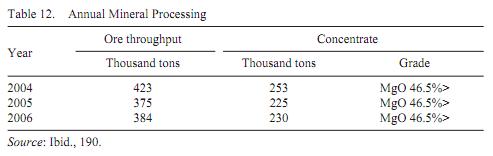

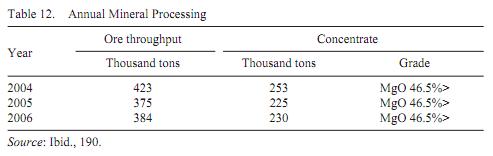

The magnesite is beneficiated through the crushing and classification methods. The magnesite ore is the raw material for magnesia. The Daeheung Mine has a magnesia manufacturing plant. The mill plants were designed with a total capacity of 600,000 tons per annum of magnesite ore. Annual production was 230,000 tons of magnesite at a grade of up to 46.5 percent of MgO in 2006. Table 12 shows annual mineral processing data.

The magnesite ore is hauled by railway to the Dancheon Magnesia Manufacturing Plant. The Dancheon Magnesia Manufacturing Plant is 98km from the Daeheung Mine and is the largest magnesia manufacturing plant in North Korea. The Dancheon Magnesia Manufacturing Plant was designed with a capacity of 2 million tons per annum of magnesia.

The power required to operate the mine is supplied by the Heocheon River Hydroelectric Power Plant, which is 40km from the Geumgol Substation. This mine site is 30km from the Geumgol Substation. There is a 128km railway from the Daeheung Mine site to the Gimchaek Port and railway capacity was about 550,000 tons in 2007. The loading capacity of Gimchaek Port was about 800,000 tons in 2007.

Musan Mine (Iron Ore)

The Musan Mine is located at Musan-gun, in the Changryeol labor districts, Hamgyeongbuk-do, and is managed by the Musan Mining Company, which holds the mining rights granted by the central government. The Musan Mine was built in 1935 by Japan’s Mitsubishi Mining Company.

[10]

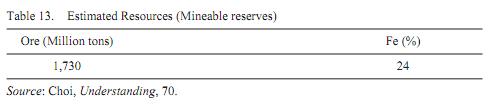

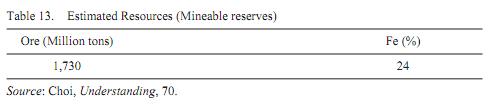

The deposits in the Musan project fit magnetite type deposits. The ore bodies are comprised with a total strike of 1,400m. It contains magnetite, hematite, pyrite, and ilmenite. This mine consist of seven mine blocks named No. 1, No. 2, No. 3, No. 4, No. 5, No. 6, and Yangyenggol. Among these, however, it is mainly the No. 1 and No. 3 mine blocks that are still in use today. The resource data is summarized in Table 13.

This mine is currently employing open-pit mining methods. The mining equipment fleet at this mine includes rotary drilling machines, 4m3 and 8m3 (bucket capacity) excavators, mine trucks (42 tons) and a conveyor system. The mine was designed with a capacity of 10 million tons per annum of iron ore; however, annual mining production data is unknown.

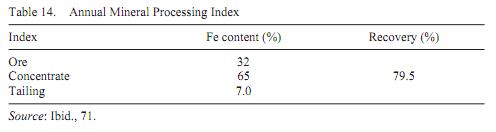

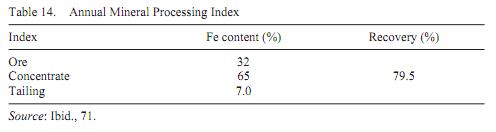

The iron concentrates are recovered through wet-type magnetic separation methods. The Musan Mine has two mill plants. The first mill plant was designed with a capacity of 3.5 million tons per annum of iron concentrate. The second mill plant was designed with a capacity of 3 million tons per annum of iron concentrate. The annual production rates were 2,000,000 tons of iron concentrate with a grade of 65%. Table 14 shows the annual mineral processing index.

The iron concentrate is hauled by railway and pipeline to the Gimchaek Steel Mill, which is 102km from the Musan Mine. The Musan Mine now exports the iron to China, with its border only about 5km away.

The power required to operate the mine is supplied by the Seodusu Hydroelectric Power Plant and a Chinese Nanping Substation. The fresh water supply for the plant site facilities is obtained from a reservoir that was developed by damming a valley in a catchment area at the Duman River. The Musan Mine Mill Plant has dumped its wastewater into the Duman River without pollution control and has created significant environmental damage. There is a 102km railway from the Musan Mine site to the Port of Cheongjin.

Oryong Mine (Iron Ore)

The Oryong Mine is located in Ryongcheon-ri, Hyeryeong City, Hamgyeongbuk-do, and is managed by the Ferrous Mining Bureau of the Ministry of Metal and Mining Industry, which holds the mining rights granted by the central government. The Oryong Mine has been in operation since 2007.

[11]

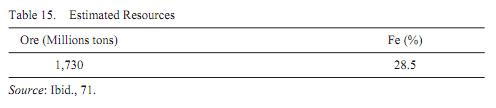

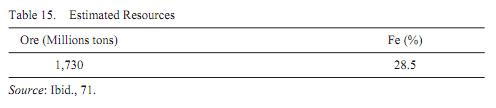

The Oryong deposit is embedded in the Musan group and Liwon-am group. The host rock of the Oryong deposit is granite. It contains magnetite, hematite, and ilmenite. The resources data of the mine is summarized in Table 15.

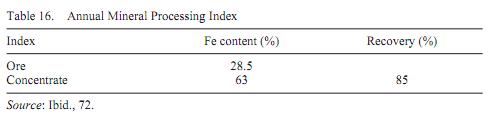

This mine is currently operating with open-pit and underground mining methods. The annual mining production was 3,000 tons in 2007. There is no mill plant at the mine site and the iron ore is hauled by truck to an unknown Chinese mill. At the Chinese mill the iron concentrates are recovered through wet-type magnetic separation methods. The designed capacity of the mineral processing plant in China is not known. Table 16 shows the mineral processing index as obtained by a pilot test.

The Oryong Mine is located about 42km from the Chinese border and exports its iron ore to China. The power required to operate the mine is supplied by the Seodusu Hydroelectric Power Plant and is scheduled to connect the electric cable to the substation in China. The fresh water supply for the mine site facilities is obtained from the Oryong River. There is a 156km railway from the Oryong Mine site to the Port of Cheongjin.

Jeongchon Mine (Graphite)

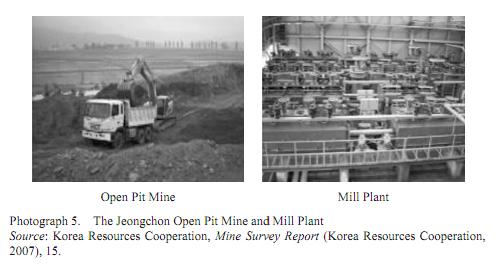

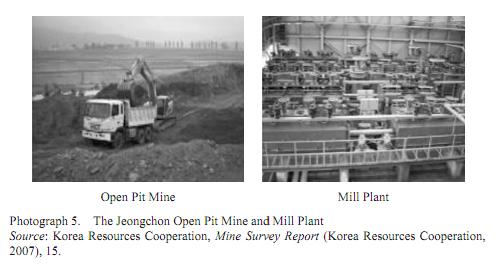

The Jeongchon Mine is located in Jeongchon-gun, Hamgyeongnam-do, and is managed by the Myeongji Mining Company, which holds the mining rights granted by the central government. The Jeongchon Mine was the first inter-Korean development project in the mining industry and was started in 2006. South Korea provided the mining facilities and technology and receives 50% of the graphite produced.

[12]

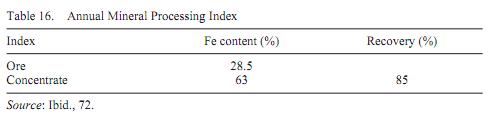

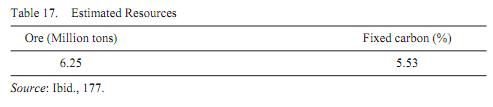

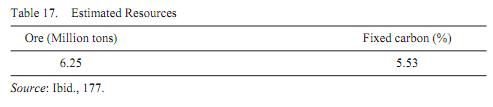

The ore bodies are comprised of a total strike of 700m. The resource data of this mine are summarized in Table 17.

This mine is currently operating with open-pit mining. The mining equipment fleet is comprised of a 3m3 (bucket capacity) excavator and mine trucks (with capacities of 20 tons). The mine was designed with a capacity of 75,000 tons per annum of graphite ore. The annual production was 40,000 tons in 2009.

Graphite concentrate is recovered through conventional flotation methods. The plant was designed with a capacity of 3,000 tons per annum of graphite concentrate. The annual production was 1,500 tons of concentrate at a 90 percent grade of graphite in 2009. The mine was not at full production capacity due to a shortage of electricity.

The power required to operate the mine is supplied by the Dongpyeongyang Thermoelectric Power Plant. The fresh water supply for the plant site facilities is obtained from the Guam Reservoir. There is a 76km roadway from the Jeongchon Mine site to Haeju Port.

Jikdong Mine (Anthracite Coal)

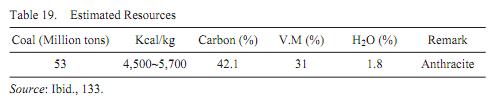

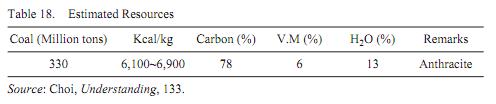

The 2.8 Jikdong Coal Mine is located in Jikdong, Suncheon-si, Pyongannam-do, and is managed by the Suncheon District Coal Company and the Ministry of Coal Industry, which holds the mining rights granted by the central government. The 2.8 Jikdong Coal Mine has been in operation since 1977.

[13] The resources data for this mine is summarized in Table 18.

This mine is currently operating with underground mining methods. The coal mined at this location is transported by a haulage device (conveyor belt) without the coal being prepared. The mine was designed for a capacity of one million tons per.annum of coal. The annual production was 30,000 tons of coal per year. The coal is hauled by truck to the Dongpyeongyang Thermoelectric Power Plant. The power required to operate the mine is supplied by the Pyongyang and Bukchang Thermoelectric Power Plants. There is a 100km railway from the site of Shuncheon Mine to Nampo Port.

Gogeonwon Mine (Anthracite Coal)

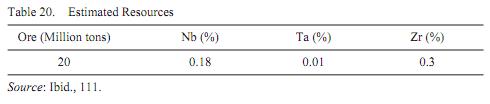

The Gogeonwon Coal Mine is located in the Gogeonwon labor district, Kyeongwongun, Hamgyeongbuk-do, and is managed by the Gogeonwon Labor District Coal Company and the Ministry of Coal Industry, which holds the mining rights granted by the central government. The Gogeonwon Coal Mine has been in operation since 1920.

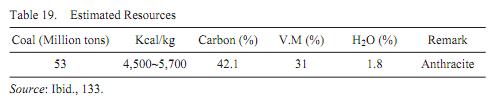

[14] The resource data for this mine is summarized in Table 19.

This mine is currently employing underground mining methods. The coal mined at this location is transported using a haulage device (rail or mine car) without the coal being prepared. The average depth of the coal seam is four meters. The main production level is at 580 meters below sea level. The mine was designed with a capacity of one million tons per annum of coal; however, the actual annual mining production data is unknown. The coal is hauled by railway to the Cheongjin Thermoelectric Power Plant and the Seongjin Steel Company.

The power required to operate the plant is supplied by the Chengjin Thermoelectric Power Plant and Seodusu Hydroelectric Power Plant. There is a 100km railway from the Gogeonwon Mine site to the Najin Port.

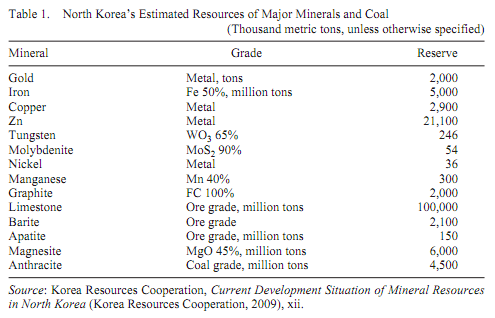

Apdong Mine (Tantalum)

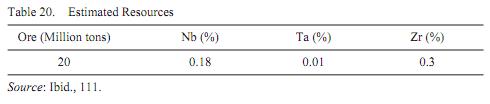

Apdong Mine is located in Apdong-ri, Pyeonggang-gun, Gangwon-Do, and is managed by the Metal Mining Bureau of the Ministry of Mining Industry, which holds the mining rights granted by the central government. Apdong Mine was established in 1987; however, it has not been in operation since 1997 due to restricted financial assistance.

[15]

The deposits in the Apdong project fit the zirconium and niobium deposits. The body zone appears to consist of several thin sheets of low-grade mineralization. The ore bodies are comprised with a total strike of 4,000m. It contains zirconium and pyrochlore. The resource data for this mine is summarized in Table 20.

In 1997, this mine utilized open-pit mining. The open-pit mining was undertaken in the order of drilling-blasting-mining-hauling. The mining production rates in 1997 are unknown. The mill and hydrometallurgy plant was designed with a capacity of one million tons per annum of ore. However, this mine has stopped operations due to poor electricity infrastructure and a lack of materials after pilot testing.

The powerline for the mine is connected to the Bokgye Substation, which is located within 5km of the mine site. The fresh water supply for the plant site facilities is obtained from the Hantan River. There is 156km roadway from the Apdong Mine site to the Wonsan Port.

The North Korean Mining Business Project

Inter-Korean Mining Projects

The first joint mining project with North Korea began in 2001 and later about 10 mineral development projects were undertaken through 2009. Eight out of these 10 projects have been stopped and only two of them were invested in by South Korean companies.

[16]

The Apdong Mine (Tantalum) was the first inter-Korean project in the mining industry. The Apdong Mine is located in Pyeonggang-gun, Gangwon-do. A South Korean private company carried out mine surveys twice in 2002. According to the survey report, the Apdong Mine resources were 20 million tons of ore grade. The mine was designed using open-pit mining methods; in addition, it has a mineral processing plant and a pilot-scale hydrometallurgy plant. In 1996, the mine produced 12,000 tons of ore, and 350 kg of oxide at a grade of 98.5 percent according to a pilot test in 1996. Since 1997, this mine ceased to operate due to substandard electricity and a lack of materials. In 2002, the Federal State Research and Design Institute of Rare Metal Industry (Giredmet) was sponsored by a South Korea company, Sungnam Electrics, to produce a prefeasibility study of the mine. The prefeasibility study showed that this project is not economically feasible because of the low grade of the tantalum ore. Apdong Mine’s ore contains only 0.01 percent of tantalum grade, and the first inter-Korean’s project was stopped in 2004.

The Jeongchon Mine (Graphite) was the first medium-scale joint investment project in North Korea. The Jeongchon Mine is located in Yeonan-gun, Hwanghaenam-do. In March 2002, a MOU was signed between the Korea Resources Corporation (KORES) in South Korea and the Myeongji Company in North Korea. In May 2002, a KORES technology team carried out the Jeongchon Mine survey. According.to the survey report, the mine’s resources were 6.25 million tons of ore grade, it was operating with small-scale open-pit mining, and the annual production was 2,000 tons of ore. After the mine survey, the two parties agreed to invest in the mine. The J/V Company was created in July 2003 under an agreement between KORES and the Myeongji Company. KORES has invested about 5.3 million dollars since 2007. In April 2007, the construction of the mine was completed. This mine produces graphite concentrate; however, it has not operated at full capacity due to electricity shortages.

The first inter-Korean governmental mine project began in 2007 after an agreement was signed between the two countries. This agreement stipulated that South Korea was to provide North Korea with raw materials for light industry in exchange for the right to develop mines in Dancheon, the most important area of mineral resources in North Korea. Many mines, including large-scale magnesite, iron ore, and zinc mines are within 120km of Dancheon City, and produce more than 20 types of minerals. In 2007, a joint mines survey was carried out by the two Koreas in the Dancheon area. The Daeheung Magnesite Mine and the Geomdeok Zinc Mines were assessed. According to the mine survey report, the Daeheung Mine was operating using open pit and underground mining methods. The mine’s resources were 826 million tons of ore grade, and annual mining production was 427,000 tons of ore in 2006. In 2008, South Korea did a feasibility study that showed that the project could be economically viable. The mine survey of the Geomdeok Zinc Mine reported that the mine’s resources were 266 million tons of ore grade, that this mine was operating using underground mining methods, and that the annual production of this mine was 3.05 million tons of ore grade in 2006. The mill plants were designed with a total capacity of 10 million tons per annum of zinc ore, but annual production was 196,000 tons of zinc concentrate at a 53 percent grade and 31,800 tons of lead concentrate at a 63 percent grade in 2006. South Korea also did a feasibility study of this mine in 2008. According to that study, this project seemed to be economically viable. However, both projects were stopped due to the worsening political situation on the Korean peninsula. Figure 1 shows the location of mines in the Dancheon area.

North Korea’s mineral resources are distributed over about 80 percent of the country, and mineral resources are the most important industry in North Korea. However, there are many weak points, including a lack of sufficient electricity, materials, and equipment. There are many mines in North Korea, but according to our survey results, most of the mines are not fully operational due to electricity shortages, antiquated facilities, and poor maintenance.

In North Korea, South Korean companies are considered neither a foreign company nor a domestic company. With no status, they cannot enter into and stay in North Korea without prior approval. North Korea’s investment laws are abstract and vague, and generally do not allow South Korea access to North Korean mines. North Korea also does not provide mineral information without a prior investment agreement. During the survey stage, it is very difficult to survey the mine sites, especially the electric facilities.

[17]

South Korea depends on imports of mineral commodities from overseas due to its own poor supply of mineral resources. South Korea’s import costs for mineral commodities have significantly increased as the mineral costs have risen. The inter-Korean mining projects in North Korea have stopped since 2008, but investments will eventually be continued, because mineral development cooperation will provide mutual benefits to the two Koreas.

Foreign Company Mining Projects

Several mining projects have been undertaken by foreign companies in North Korea. In 1986, the Japanese Nagagawa Company carried out mine surveys of the Holdong Gold Mine and the Unsan Gold Mine. The two parties signed an agreement to set up a joint management company. However, both of these projects were terminated without any tangible results.

In 1995, American company, Mobile carried out a mine survey for the Unsan Gold Mine. This project was also abandoned. In 1999, the American company Kegel planned an exchange program of magnesite for grains. This program was also stopped due to issues with antiquated infrastructure. In 2000, the American ORO mine company agreed to set up a joint venture company, which would deal with mineral marketing and mine investment; however, this project was also terminated without any results.

Foreign companies have participated in about 25 mining projects in North Korea. Among these projects, about five were known to have been actualized, and have been in operation. At present, China, Japan, the United States, and the United Kingdom have participated in North Korean mining projects. Chinese companies have been aggressively participating in North Korean mine projects since 2003. China has participated in about 20 mining projects, followed by Japan with four projects, and then the United States and the United Kingdom with one project each. China remains North Korea’s leading investment partner in mining projects. With the exception of Chinese companies, foreign companies have not succeeded in North Korea. Foreign companies have focused mainly on gold and iron ore mines (with 10 projects each), followed by copper mines (seven projects), anthracite mines (five projects), molybdenite mines (two projects), zinc mines (one project), and magnesite mines (one project). Almost all of these foreign companies (including those from China) have been interested in gold, iron, copper, and coal mining projects in North Korea.

It is presumed that the North Korean government has granted mining development rights to Chinese companies. In 2007, the government of North Korea granted development rights for the Musan Iron Ore Mine to China’s Tonghwa Iron and SteelGroup for a period of 50 years. In 2009, the Government terminated that agreement without offering any reason. Under the previous agreement, Tonghwa had reportedly agreed to invest about $1 billion in the mine and had also planned to produce 10 million metric tons per year of iron ore. Of the total investment, about $240 million was for building roads and railways from Musan to Tonghwa.

China’s Cheon-u group and the Hyesan Copper Mine Company in North Korea also established a joint management company. The Cheon-u group agreed to invest about CNY 200 million and to reopen the mine. In 2010, the mine began to process 1,200 tons of copper ore per day.

The UK’s Ericon Company and the Dancheon mining bureau in North Korea had also agreed to set up a joint management company. According to the agreement, the Ericon Company was to invest about 400 million Euros in a mine, magnesium plant, and the Dancheon Port; however, this project was terminated without any results.

It is difficult for foreign investors to participate in the management of joint companies with North Korea. Foreign investors want to establish their own companies and operate the mines. The rights of investors to ownership, exports, and other key business arrangements related to the North Korea mining industry are unclear. North Korea is not forthcoming about its mining projects and will not provide information without prior investment agreements with foreign companies. Additionally, the antiquated infrastructure (including power, rail, and ports) and resulting low productivity make mining operations difficult for foreign investors. North Korea needs to create favorable conditions for investors.

The Outlook for Inter-Korean Mining Cooperation

The UN and South Korea continue to place pressure on the North Korean government. South Korea refuses to provide any assistance to North Korea unless the North Korea government apologizes for its recent military attacks. However, North Korea is still likely to want to develop the mines with aid of foreign capital investment, including funds from South Korea companies.

It is hoped that relations will normalize between the two Koreas in the near future and joint mining projects can continue. South Korea is ready to resume mining negotiations once certain security preconditions have been met. The first mining project between the Koreas will begin in the Dancheon district. In 2007, a joint mine survey was carried out by the two Koreas in this area. Therefore, it can easily resume the mining cooperation. These mines, the Daeheung Magnesite Mine and the Geomdeok Zinc Mine are viable projects. If North Korea addresses the investment risk and barriers to entry, South Korea companies would consider investing in these mines. Inter-Korean mining cooperation is very important for both sides. North Korea can increase mine production and stimulate its economy while South Korea can secure nearby mineral commodities. It is probable that in the future South Korea will provide mining facilities and technology, while North Korea will provide the mines and workers. To facilitate South Korean investment, North Korea will likely suggest developing new mines, reopening non-operating mines (such as the Daedaeri Apatite Mine) and improving existing mines (such as the Musan Iron-ore Mine and the 2.8 Jikdong Anthracite Coal Mine) and metallurgy plants (such as the Dancheon Zinc Smelter). For this situation to be realized, it is important that North Korea create favorable conditions for foreign investment and uphold its contracts with South Korean companies.