by Samantha Mella and Geoff James

8 June 2015

I. Introduction

Samantha Mella and Geoff James write “The (Australian Energy) White Paper’s framework of competition, productivity and investment provides a good platform for discussion, but a number of important issues are not addressed. These include the development of Australia’s abundant renewable energy resources, the consideration of carbon constraints, the growth in renewable energy investment overseas compared to a decline in Australia, and the potential impacts of the fossil fuel divestment movement.”

“Australia’s future prosperity is [best] served by the development of a vital, healthy renewable energy sector that competes alongside fossil fuels in a fair and open energy market.”

Samantha Mella is a freelance writer and research consultant based in the Hunter Valley, New South Wales, Australia. She has been following trends in international electricity grid integration, HVDC interconnection and the emergence of the renewable energy trade since 2010.

Geoff James is a clean energy consultant based in Sydney and Hobart, Australia. After 22 years of research with the CSIRO, he now pursues commercial opportunities for energy storage, teaches electrical engineering, and seeks new ways for Australia to participate in Asia’s energy economy.

This paper was originally published with support from the Hanyang University’s Energy, Governance and Security (EGS) Center, available in Global Energy Monitor Vol. 3, No. 4 (April 2015).

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

II. Policy Forum by Samantha Mella and Geoff James

Opportunities beyond the Australian Energy White Paper

Australia’s Energy White Paper released in April focused on the development of fossil fuels in Australia’s domestic and export energy markets. The paper has been well received by the mineral and resources sector and some industry groups, while others have expressed dismay in its treatment of Australia’s energy and environmental future.[1] [2] The White Paper’s framework of competition, productivity and investment provides a good platform for discussion, but a number of important issues are not addressed. These include the development of Australia’s abundant renewable energy resources, the consideration of carbon constraints, the growth in renewable energy investment overseas compared to a decline in Australia, and the potential impacts of the fossil fuel divestment movement.

The White Paper states “Australia’s energy sector underpins a modern economy and a high standard of living[3]”. This statement goes to the heart of Australia’s anxiety about the low-carbon economy. The tension between Australian energy exports and its domestic energy markets on one hand, and required action to reduce greenhouse gas emissions on the other, has plagued and paralysed successive Australian governments. The 2012 Energy White Paper, authored by the previous Labour government, also focused on fossil fuels, although that government did introduce some domestic reforms such as the Clean Energy Finance Corporation and carbon pricing. On energy exports, their importance to Australia’s economy is such that there has been bipartisan support for the ‘business as usual’ approach expressed in the White Paper. Indeed, Australian energy exports accounted for $71.5 billion in 2013-2014[4], and 7% of Gross Domestic Product (GDP). Addressing or replacing the income accounted for by those exports is a significant issue for discussion.

This paper discusses the opportunities for the evolution of the Australian energy sector beyond those expressed in the White Paper, within the Paper’s framework. Australia is blessed with an abundance of diverse energy resources. We argue that a single-minded focus on fossil fuels is not in the national interest, in the short, medium, or long term. Rather, Australia’s future prosperity is better served by the development of a vital, healthy renewable energy sector that competes alongside fossil fuels in a fair and open energy market.

Competition

The White Paper argues that unnecessary barriers and subsidies have distorted domestic energy markets and diluted competition. It highlights the Renewable Energy Target (RET) and solar feed-in tariffs as current policies that distort market signals and thus disrupt competitive markets.

Subsidies are an important point. The International Energy Agency (IEA) discourages subsidies in general. It estimates that $548 billion in subsidies supported fossil fuels globally in 2013. The IEA states “fossil fuel subsidies were over four times the value of subsidies to renewable energy and more than four times the amount invested globally in improving energy efficiency”.[5] Australia’s fossil fuel subsidies are valued at $A4 billion annually or 5.6% of the value of its energy exports.[6] While advocating a free-market approach, with market signals determining the direction of energy commodity markets in general, the White Paper is silent on how to address fossil fuel subsidies.

It can be argued that the RET is hardly a subsidy. It is a target that mandated 41,000 gigawatt hours (GWh), or 20% of Australia’s electricity generation, come from renewable sources by 2020. The government appointed an expert panel to review the RET in 2014, and the RET Review[7] and other analyses have found that the RET delivers a net saving to energy consumers, due to its downward influence on wholesale electricity prices. It is therefore consistent with the goal of cost effectiveness that is central to the National Electricity Law. It has puzzled many commentators that, despite this finding, the Review’s recommendations favoured the coal-fired generators, and proposed cutting renewable generation to 26,000 GWh[8]. This will deliver a potential $A9 billion windfall to coal-fired generators.[9] Solar feed-in tariffs were financial incentives designed to spur implementation of rooftop solar photovoltaic (PV) generation. They distort the market very little at present as the high-value tariffs used early in the program are being phased out. Rooftop solar PV systems are now cost-effective in Australia without a subsidy.

Productivity

Energy productivity is an important topic in the White Paper, and strategies to improve Australia’s energy productivity by 40% by 2030 occupy much of the discussion. Energy productivity is the amount of economic output per unit of energy input, usually calculated as the GDP divided by the primary energy consumption. The target proposed in the White Paper may not be a very ambitious target compared to other countries,[10] but it does establish a clear focus on energy as a driver of economic activity. This is a good focus that can motivate the transformation of Australia’s energy sector in a carbon-constrained world. As discussed, the White Paper does not choose this path, and instead sees Australia’s economy as continuing to be largely supported by fossil fuels. It is important to construct and validate a Plan B for Australia by considering alternative energy sources and their impact on energy productivity.

Primary energy consumption is the denominator of the energy productivity quotient, and thus has a multiplying effect. In contrast, the cost of energy has only an indirect and additive effect: GDP is a measure of value added, so decreasing the cost of energy that is used to make a product or deliver a service will linearly increase the added value of that product or service. Primary energy consumption rather than energy cost is therefore the stronger lever with which to achieve the desired target for improvement. And this is a lever that renewable energy generation can pull very effectively.

Here is why.

In our electrified society an increasing share of GDP is dependent on electricity, which is classified as a ‘derived fuel’ generated from a primary energy feedstock such as coal or natural gas[11]. The energy conversion efficiency from fossil fuels to electricity is about 42% for black coal, 32% for brown coal, 50% for a closed-cycle gas turbine, and 35% for an open-cycle gas turbine such as a peaking plant[12]. This means that at least half and usually more than half of the primary energy is lost in conversion.

Renewable energy from biomass, wind, solar, and hydro resources are included as primary indigenous energy supplies in the source documents used by the White Paper[13]. All of the wind and hydro energy and half of the solar energy are used to generate electricity, and the quantity of primary energy is the quantity of electrical energy, because any other measure of a resource that is renewed and not depleted would be ambiguous. There is no conversion loss for primary renewable energy. Electricity generated from renewable sources will be subject to transmission and distribution losses before it is consumed, just as electricity generated from fossil fuels, but this is a relatively small loss compared to the energy conversion from fossil fuels.[14]

The effect on energy productivity is profound. Switching to renewable energy sources can at least double the energy productivity of electrically driven industry sectors. The different capital and operating costs of renewable energy generation will also influence the energy productivity, though less directly as discussed above, and perhaps positively as costs of wind and solar generation technology continue to plunge. Developing countries, notably India, are already deciding that wind and solar generation make more economic sense than new-build coal-fired generation.

As an alternative to supply-side replacement, renewable energy can also be introduced on the demand side, as demonstrated by the huge popularity and growth of rooftop solar PV generation in Australian suburbs and rural areas from Hobart to Townsville. In the electricity industry this is often regarded as a form of energy efficiency rather than an increase in generation capacity. This is because, in balancing energy flows at a system level, the effect of local generation is a reduction in demand. Taking the same viewpoint with regard to energy productivity would mean that using local renewable energy directly reduces primary energy consumption by the same amount.

Transitioning modern electricity systems to renewable sources has been the subject of many studies. A 100% renewable energy study commissioned by the Federal Government[15] in 2013 stands out because it combines a multidisciplinary analysis of renewable energy resources and technologies with a preliminary consideration of power system security and intermittency by the power system operator for eastern Australia. There is no serious resource or technical impediment. Interestingly, the 2013 study suggested that biomass-fired power could play a large role during periods of low solar and wind availability.

Electrifying the transport sector is an associated and important strategy, considering that oil accounts for 38% of primary energy consumption and is the largest single component. Australia has only 7-10 years of crude oil reserves remaining at current extraction rates.[16] Australia’s current oil and oil products stockholdings do not meet its obligations under the International Energy Agency (IEA) treaty to hold an emergency supply of petroleum fuel. Australia’s energy imports were worth $40.7 billion in 2012-13, predominately for crude oil and refined petroleum products, which offset 56% of its energy exports. In this context, electrifying the transport sector would improve our energy security and balance of trade, and also dramatically increase our energy productivity if powered by electricity from renewable sources.

Investment

The White Paper refers to the International Energy Agency’s (IEA) New Policies Scenario to outline its case to secure investment in coal, LNG and uranium exports. Australian Economics Professor Ross Garnaut explains that IEA says that the New Policies Scenario is unsustainable and that its “projections of Chinese and global demand for coal are already obsolete.”[17] The China National Coal Association has just announced that coal sales have dropped 4.7% in the first quarter of this year. [18] China dropped its thermal coal consumption last year by 3% while increasing its electricity output by 3.8%.[19] Key investment houses are advising investors of thermal coals’ “structural decline”.[20] [21] The Economist reports that prices for thermal coal have been in decline for 18 months, and the growth rate for new coal-fired capacity is also in decline.[22]

One big story in the 2014 World Energy Investment Outlook is the remarkable growth in renewable energy investment occurring in most countries except Australia. For example, even in the New Policies Scenario, projected global investment in power plants fuelled by gas and coal combined ($2,582 billion) is exceeded by plants based on wind and solar resources ($3,265 billion) from 2015 through 2035.[23] Mongolia, also large a coal producer, has its eye on Australia’s coal markets – Japan, China and Korea – as potential markets for wind and solar energy from the Gobi desert.[24] There is now an ongoing discussion in North Asia about grid integration and the development of the Asia Super Grid powered by renewable energy.

The White Paper states correctly that, “Divestment campaigns targeting shareholdings in coal, oil and gas resources are a new challenge.” Divestment is an active investor decision to withdraw funds from the fossil fuel sector with the aim of restricting its access to capital. Since 2012, more than 220 institutions have fully or partially divested. Returns on fossil-free portfolios perform comparably and, in some cases, are reported to outperform portfolios with fossil fuel stocks.[25] Divestment is an emerging market signal indicating that a proportion of investors are increasingly prepared to deny capital to energy projects that contribute to global climate targets not being realised.

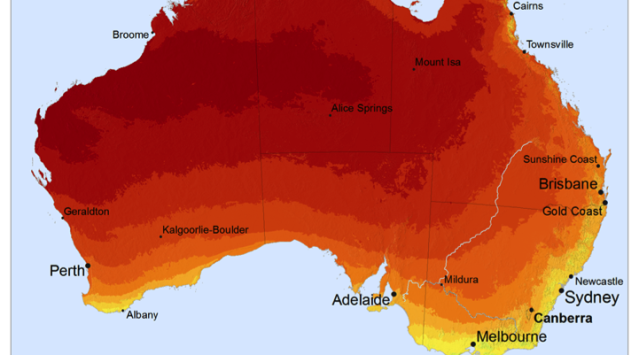

Despite acknowledging that Australia has “world class” renewable energy resources—Australia’s excellent solar resources, for example, are illustrated in the figure below[26]—the White Paper avoids any discussion of renewable energy development. Rather, it discusses the decision to abolish the Australian Renewable Energy Agency and the Clean Energy Finance Corporation that “invests in projects using a commercial approach.” Australia has deliberately created an unstable environment for renewable energy investors in order to protect the coal and gas sectors. This has led to Australia to being one of the few nations not enjoying growth in the renewable energy sector.[27] [28]

The White Paper acknowledges that in international markets, coal and gas will be increasingly exposed to competition from renewable energy. This is seen as a threat to Australian energy exports and to a strong national economy, an interesting contradiction to the stated goal of competitive markets.

Conclusion

The foundations of the 2015 Energy White Paper – competition, productivity and investment – have the potential secure a prosperous energy sector for Australia. The biggest threat to Australia’s future prosperity is Australia’s failure to develop its renewable resources due to policy decisions designed to protect the fossil fuel production sector.

It is well established in evolutionary science that an inability to adapt to change leads to extinction. Changes in the global energy sector as well as in the global climate are underway, whether Australian policymakers like it or not, and Australia must adapt. A vibrant and robust renewable energy sector in Australia is an intelligent future focussed strategy that will both improve productivity and attract investment. Australia must investigate ways to export renewable energy, including participating in the Asian Super Grid when it comes to fruition. Real competition, productivity and creating a stable investment environment for all energy investors will allow Australia to claim its fair share of the global growth in renewable investment and make Australia’s energy sector diverse, resilient and strong.

III. REFERENCES

[1] Orchison K (2015), “Missing sparks in the energy white paper”, Business Spectator, April 13, 2015 accessed at https://www.businessspectator.com.au/article/2015/4/13/resources-and-energy/missing-sparks-energy-white-paper.

[2] Sydney Morning Herald Editorial (2015), “Energy Paper has some huge black holes”, Sydney Morning Herald, April 12, 2015 accessed at http://www.smh.com.au/comment/smh-editorial/energy-white-paper-has-some-huge-black-holes-20150412-1mjflr.html.

[3] Department of Science and Industry (2015), 2015 Energy White Paper, Commonwealth of Australia, 2015 accessed at http://ewp.industry.gov.au/.

[4] Bureau of Resources and Energy Economics (BREE, 2014), Energy in Australia 2014, BREE Canberra, November, accessed at http://www.industry.gov.au/industry/Office-of-the-Chief-Economist/Publications/Documents/energy-in-aust/bree-energyinaustralia-2014.pdf.

[5] The International Energy Agency (IEA, 2015), Energy Subsidies, World Energy Outlook (2015), accessed at http://www.worldenergyoutlook.org/resources/energysubsidies/.

[6] Lannin, S. (2014), “Australian coal, oil and gas companies receive $4b in subsidies: report” ABC News, 11 Nov 2014, accessed at http://www.abc.net.au/news/2014-11-11/coal-oil-and-gas-companies-receive-4-billion-dollar-in-subsidie/5881814.

[7] Warburton, D, Fisher, B, In’t Veld, S, and Zema, M (2014), Renewable Energy Target Scheme report of the Expert Panel, Commonwealth of Australia, August 2014, accessed at https://retreview.dpmc.gov.au/papers.

[8] Berry, M (2015), “Going Backwards: Australia’s renewable energy investment bucks world trend”, Independent Australia, January 22, 2015, accessed at https://independentaustralia.net/environment/environment-display/going-backwards-australias-renewable-energy-bucks-world-trend,7285.

[9] Edis, T (2014), “Dick Warbuton’s 10 minutes of woe”, Business Spectator, September 2, 2014, accessed at http://www.businessspectator.com.au/article/2014/9/2/policy-politics/dick-warburtons-10-minutes-woe.

[10] Pears, A (2015), “Australia’s productivity plan, great idea but is it ambitious enough?”, The Conversation, April 10, 2015 accessed on http://theconversation.com/australias-energy-productivity-plan-great-idea-but-is-it-ambitious-enough-39925.

[11] BREE (2014) ibid.

[12] Bureau of Resources and Energy Economics (BREE, 2012), Australian Energy Technology Assessment, BREE Canberra, Tables 3.1.1 and 3.2.1, accessed at http://www.industry.gov.au/industry/Office-of-the-Chief-Economist/Publications/Documents/aeta/australian_energy_technology_assessment.pdf.

[13] BREE (2014) ibid, Table 3.4.

[14] In fact, to the extent that renewable generation is accomplished at or near consumers’ sites, for example, via rooftop solar photovoltaic systems, transmission and distribution losses are also reduced relative to central-station power plants.

[15] Australian Energy Market Operator (AEMO, 2013), 100 per cent renewables study – modelling outcomes, AEMO, July 2013, accessed at http://www.environment.gov.au/climate-change/publications/aemo-modelling-outcomes.

[16] BREE (2014) ibid, Table 2.1.

[17] Garnaut, R. (2015), Abbott’s government’s Energy White Paper fails to face reality, Australian Financial Review, April 15, 2015 accessed at http://www.afr.com/opinion/columns/abbott-governments-energy-white-paper-fails-to-face-reality-20150414-1mkroh

[18] English News China (2015), “China’s Q1 Coal Output down by 3.5%”, China English News, April 13, 2015 accessed at http://news.xinhuanet.com/english/2015-04/13/c_134147463.htm.

[19] Potter, B (2015), “China cuts thermal coal by 3 pc”, Australian Financial Review, January 27, 2015 accessed at http://www.afr.com/Page/Uuid/6a490ad8-a5ce-11e4-9dae-b62d84451404.

[20] Goldman Sachs (2013), The window for thermal coal investment is closing, dated July 24, 2013, accessed at http://thinkprogress.org/wp-content/uploads/2013/08/GS_Rocks__Ores_-_Thermal_Coal_July_2013.pdf.

[21] Institute for Energy Economics and Financial Analysis (2014), Briefing Note Fossil Fuels, Energy Transition, and Risk, dated April 18, 2014, accessed at http://ieefa.org/briefing-note-fossil-fuels-energy-transition-risk/

[22] The Economist (2015), “As more countries turn against coal, producers face prolonged weakness in prices”, The Economist, March 28, 2015 accessed at: http://www.economist.com/news/business/21647287-more-countries-turn-against-coal-producers-face-prolonged-weakness-prices-depths.

[23] IEA (2015), ibid.

[24] Mano S, Ovgor B, Samadov Z et al (2014), Gobitec and Asian Super Grid for Renewable Energies in

North East Asia, Energy Charter Secretariat, accessed at http://www.encharter.org/fileadmin/user_upload/Publications/Gobitec_and_the_Asian_Supergrid_2014_ENG.pdf.

[25] Cormack, L. (2015), “Fossil Free Super Funds pay off for investors”, Sydney Morning Herald, April 10, 2015 accessed at http://www.smh.com.au/environment/climate-change/fossil-fuelfree-super-funds-pay-off-for-investors-20150410-1mhpiu.html.

[26] Global Horizontal Irradiation map from http://solargis.info/doc/_pics/freemaps/1000px/ghi/SolarGIS-Solar-map-Australia-en.png, dated 2013.

[27] Parkinsons, G. (2014), “Clean energy investors abandon Australia, head overseas”, Renew Economy, March 10, 2014, accessed at http://reneweconomy.com.au/2014/clean-energy-investors-abandon-australia-head-overseas-38631.

[28] Berry (2015), ibid.

One thought on “Opportunities beyond the Australian Energy White Paper”