by Kae Takase

28 May 2014

(Originally published February 9, 2014 for Hanyang University Energy Governance and Security (EGS) Center.)

I. INTRODUCTION

In the tragic aftermath of the March 2011 earthquake (the Great East Japan Earthquake) and tsunami, and the resulting Fukushima nuclear plant disaster, as all of Japan’s fleet of nuclear reactors were shut down, apparently indefinitely, for safety checks. At that time, it seemed that the citizens of Japan, and particularly those in the northern part of the island of Honshu, would be destined to endure power shortages, perhaps for years. Since the earthquake, although there have been some brief periods of rotating blackouts and brownouts in some areas served by the utilities most affected by the earthquake and its aftermath, these have not been as severe as expected due in part to the ramping up of fossil-fueled generation to compensate for off-line nuclear plants, but also, significantly, to a combination of a huge effort on the part of the people of Japan to save electricity, and to rapidly expand electricity generation from renewable sources.These changes have in part been driven by need and in part due a change in attitudes nationally, arguably building upon a change in attitude that was already underway before the March of 2011. The changes have also, however, been significantly driven by government policies such as feed-in tariffs, with some of the policy changes formulated and initiated before the earthquake, but for which implementation was after 3/11/11. The high cost of electricity in Japan also served as a significant driver of these changes. Accelerated deployment of energy efficiency and renewable energy would seem to be trending Japan towards a low-greenhouse gas emissions, clean energy future, though Japan still faces significant technical and policy hurdles as it seeks to progress towards sustainability goals.

Just after the Fukushima disaster, the author of this article collaborated with Dr. David von Hippel and other colleagues to estimate that a combination of rapidly deployed energy efficiency and renewable energy options could replace the nuclear and fossil-fueled capacity disabled by the earthquake and tsunami faster and at a likely similar or lower cost than fossil-fueled alternatives.[1] Since that time, renewable energy developments in Japan have accelerated, with sales of home combined heat and power units and of solar photovoltaic systems in particular markedly higher in recent months and years. A number of technological hurdles remain to be overcome for Japan to meet a large portion of its electricity needs from renewable energy sources, including the storage of electricity from intermittent sources such as solar and wind power plants, and the integration of intermittent resources into the existing electricity grid. Options such as large-capacity hydrogen-based systems are under development, and ideas such as using battery-powered cars not only for transit, but to store electricity for use homes and businesses are also being explored by businesses and government organizations in Japan.

The central policy in Japan in support of renewable electricity deployment in Japan is the system of Feed In Tariffs (FIT). Japan started its Feed-in Tariff policy for most sources of renewable electricity in July, 2012. The development and implementation of the FIT policy was accelerated by the nuclear accident at the Fukushima daichi power plant following the Great East Japan Earthquake on March 11th, 2011. With the implementation of the new policy, FIT tariffs are now high enough to encourage many kinds of companies to enter the renewable power generation business. 6 GW of renewable power capacity was put into operation between the 2012 start of the new FIT policy through the end of October, 2013.[2] The total renewable generation capacity installed before implementation of the 2012 FIT policy was 21 GW, about 10 GW of which was non pumped-storage hydroelectric capacity of different sizes.[3] As a consequence, the 6 GW of renewable generation capacity added in the 19 months through the end of October 2013 represents approximately a 30 percent addition to renewable generation capacity in Japan, and is thus highly significant. The total electricity generation capacity in Japan was 231 GW as of the end of fiscal year 2012, so the total of 26.5 GW of renewable capacity as of late 2013 is more than 10% of total capacity in Japan, although, as noted, correcting for the fraction of capacity that is pumped storage hydro brings the actual capacity using fossil or renewable resources down to just over 200 GW, and the fraction of renewable generation up to about 15 percent. The capacity factor (fraction of the hours of the year that a plant runs to full capacity) for some of the renewable generation is, however, relatively small in comparison to the typical capacity factors of most fossil-fueled and nuclear plants, particularly for the photovoltaic and wind power that has constituted the bulk of renewable generation in the past two years (typical capacity factors are 10-15% for photovoltaics, 20% for wind, and 40 to 60% or more for other renewables, such as some hydroelectric plants and biomass or waste-fired plants). As a result, the 26.5 GW of renewable capacity equate to only about 13 GW of conventional power generation capacity.[4] This is still the equivalent of 13 typical sized (1 GW) nuclear power plant units, and is thus significant, but the comparison does indicate how far renewables in Japan have to go to equal the electricity output of Japan’s fleet of fossil-fueled and nuclear plants. The 6GW of renewable generation capacity added since the start of the FIT policy is dominated by photovoltaics capacity, and so is the equivalent of about one modern nuclear power unit (1 GW).

FIT tariffs for the fiscal year 2014 (starting from April, 2014) are under discussion as of this writing, and changes to the tariff rates will have an impact on the future volume of deployment of renewable electricity systems. The remainder of this Working Paper provides a detailed explanation of the current FIT policy in Japan, and provides a summary of the latest data on the status of the FIT program. Also provided is a review of the renewable electricity potential in Japan, as calculated by government agencies in 2011, introduces estimates of future deployment prepared by the Ministry of Environment, and compares those estimates to previous versions prepared by the Energy and Environment Council at the time when the Democratic Party of Japan (DPJ) was in power. A concluding section provides a discussion of the importance of renewable energy, as well as energy efficiency, in achieving a low carbon society in Japan.

II. RECENT HISTORY OF POLICY FOR RENEWABLES

The Great East Japan Earthquake on March 11th, 2011 has raised consciousness about energy supply and demand issues among the people of Japan. A broad program of Feed-in tariffs (FIT) for renewable electricity sources was initiated starting in July of 2012. Before this FIT program for all renewable sources, a limited FIT for rooftop PV (photovoltaic) power systems existed. This programs, initiated in November 2009, offered to buy only surplus electricity from small-scale household PV systems, and was very effective in encouraging the addition of significant PV capacity in the household market, but significant capacities of wind power and so-called mega-solar systems were still not being installed as a result of a pricing structure for their power output that failed to create an attractive business environment for potential investors in renewable energy. A comprehensive and more generous FIT program was a originally dream of the “Green” (environmental) movement in Japan, but as the Japanese population in general learned more about their energy system after the earthquake, the call for a broader FIT was taken up by many more voices in Japan. As a result, the electricity companies and heavy industrial firms that had for so long opposed significant FIT policies were unable to stop the development and implementation of a broader FIT program. The FIT law was established in mid-2011, when the Democratic Party of Japan (DPJ) was in power. Although the Liberal Democratic Party (LDP) regained the majority in the Diet in December, 2012, and the tariff rates for the FIT were set during the LDP administration, the FIT rates were still set high enough to attract investment in renewable electricity in part because the LDP had changed their attitudes with regard to supporting renewable energy. Before the FIT for surplus electricity from rooftop PV systems was initiated, electricity companies had offered to buy electricity from rooftop PV systems at the same price they sold electricity to households (that is, essentially, they offered a net-metering arrangement). This was a voluntary offer on the part of the utilities, and electricity companies did not think that PV electricity could be relied upon to meet changing power demand. As such, electricity companies set the value of electricity generated by PVs at less than 5-7 yen/kWh, which was equivalent to the prices utilities paid for fuel for power plants using fossil fuels, and never extended their net-metering offer to larger PV generators, nor to wind power companies. In 2008, Former Prime Minister Fukuda (from the LDP) proposed to reduce Japanese GHG emissions by 60-80% by 2050, as a part of what is called the “Fukuda Vision” [1]. Prime Minister Aso, who took power after Fukuda, in 2009 described a plan to increase the deployment of low carbon technologies; his focus was on photovoltaics [2]. Aso proposed the deployment of more than 20 times as much PV capacity as had been installed as of that date. At the time that Prime Minister Fukuda showed his “vision” in 2008, the Japanese PV market was suffering from the discontinuation of subsidies that had been previously been offered for initial investments in PV systems.

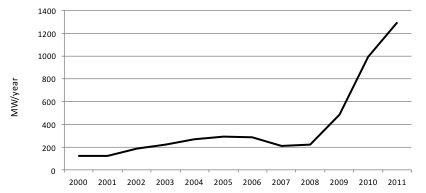

Japan’s PV production volume had previously reigned as the largest in the world, thanks in large part to the subsidy and voluntary net-metering scheme. Because the subsidy was designed to be reduced as the market price of solar systems decreased, the level of the subsidy was structured to be diminished until the price reached the level that net-metering could pay back the PV owner for the up-front capital costs within 20 years of PV installation. Since many consumers would prefer a larger initial benefit, receiving, for example, a significant up-front of subsidy toward system capital costs meant much more to potential PV buyers than same amount of price decrease on their utility bills. The net result of these changes in the structure of Japanese PV subsidies was very low deployment of PV systems after 2005. At about that time, Germany and Spain started FIT programs with high tariff rates, and Japan lost its leading position among nations in PV deployment and production. As a result of the implementation of FIT in many countries, however, the international PV market began to rapidly expand. In response, the Ministry of Economy, Industry and Trade (METI) restarted the subsidy program in January, 2009, to attempt to regain Japan’s position as the major producer of PV systems. Figure 1 shows the annual domestic sales of PV systems from 2000 through 2011 in Japan, clearly showing the decrease after 2005, when subsidies were reduced, and the subsequent increase again since 2009 as subsidies were reinstated, and the limited FIT for small scale PV systems was initiated.  Figure 1: Annual VOLUME OF photovoltaics Deployed in Japan (MW/year) [3] As a result of pressure from the Prime Minister’s office, and also from METI, to deploy more PV systems, a limited FIT program for surplus electricity from rooftop PVs was started in November, 2009. The FIT tariff was 48 yen/kWh, which is very high compared to the approximately 23 yen/kWh previously offered under net-metering, but electricity companies were only obliged to purchase surplus electricity, which meant the amount that the household did not use. Even though the 2009 program offered only a limited FIT, PV deployment increased very rapidly as result of the new programs, as shown in Figure 1.

Figure 1: Annual VOLUME OF photovoltaics Deployed in Japan (MW/year) [3] As a result of pressure from the Prime Minister’s office, and also from METI, to deploy more PV systems, a limited FIT program for surplus electricity from rooftop PVs was started in November, 2009. The FIT tariff was 48 yen/kWh, which is very high compared to the approximately 23 yen/kWh previously offered under net-metering, but electricity companies were only obliged to purchase surplus electricity, which meant the amount that the household did not use. Even though the 2009 program offered only a limited FIT, PV deployment increased very rapidly as result of the new programs, as shown in Figure 1.

The possible introduction of a FIT for power suppliers, which would cover mega-solar, wind power, geothermal power (including hot spring geothermal power), biomass power, and small and medium size hydropower installations, was under discussion after the limited FIT for surplus electricity from rooftop PV systems was started, but opposition to such programs by the Japanese utility industry and its allies remained powerful in the period before the earthquake. In a recent interview with Jennifer Steffensen of the National Bureau of Asian Research,[1] Professor Koichiro Ito noted that Japan’s regional monopoly system of electric utilities, in which ten regional utilities “control most power generation, transmission, and distribution networks, and other large-scale consumers can choose their electricity provider” has served as an impediment to change, including to the large-scale implementation of renewable energy. President Abe has proposed deregulation that could help to even the playing field for renewable electricity generation and energy efficiency, but deregulation, on the books for more than ten years, has proceeded but slowly, as the political power of the utilities and their regulators, many of whom are closely aligned to the utilities, tends to promote the status quo. The more recent emphasis on deregulation, however, would seem likely to benefit both by a lower public opinion of the utilities in the wake of the Fukushima accident, as well as from stronger political leadership. A lack of deregulation of the power sector is in part responsible for restricting access of potential third-party power developers, including those developing renewable power systems, to the transmission and distribution grid. Deregulation, together with regulation and monitoring of competitive markets for power to ensure that deregulated electricity markets do not results in unfair pricing (as in California in 2000-2001), is likely to help to smooth the path to domestic renewables.

In addition, in the longer-term future, deregulation may help to lead to the realization of long-discussed large-scale transfers of renewable electricity from the resource-rich regions of the Russian Far East (hydroelectricity) and Mongolia (solar and wind power from the Gobi desert, as proposed in the “Gobitec” and “Desertec” concepts, though these international transfers of renewable energy are not the focus of this Working Paper. As noted above, public opinion changed in the aftermath of the earthquake, and as a result it was possible to implement a full-scale FIT. Former Prime Minister Kan from the DPJ was eager to pass the law before his resignation from office, which was precipitated by his inadequate handling of the response to the earthquake and nuclear accident. The FIT law was passed in August, 2011, and PM Kan resigned in September of that year. In early 2012, the Commission for Procurement Cost of Renewables was organized to set tariffs levels for the FIT. After the replacement of the Chairman of the Commission—the initial Chairman was from the iron and steel industry,[2] and his replacement was a University Professor—the tariff was set in June, 2012, and the FIT scheme started operation in July 1st, 2012.

III. CURRENT SITUATION

FIT and other support for renewable power

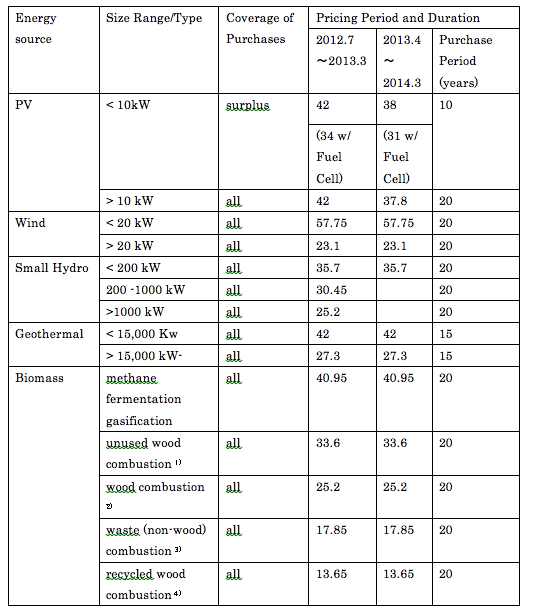

Table 1 shows the 1st term tariff levels set under the FIT for the period from July, 2012 to March 2013, and the 2nd term tariff levels for the period from April, 2013 to March 2014. The tariff is high enough to provide a strong incentive for renewable electricity system deployment, and electricity from most renewable sources is guaranteed to be purchased at the prices shown for 20 years. Rules for PV systems smaller than 10 kW per installation remain under the conditions set by the previous rooftop PV scheme, in which only surplus electricity is purchased at the price shown for 10 years.

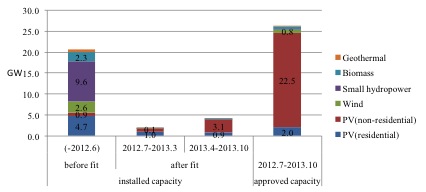

Table 1: Japanese FIT tariff levelS (Prices in YEN/kWH)  2) Using wood other than “unused” or “recycled”, such as waste wood from lumber milling or and imported waste wood, and agricultural residues such as palm chaff, and rice husks.1) Using timber from forest thinning or regeneration cuts, approved as “unused”. 3) Burning biomass such as domestic wastes, sewage sludge, food waste, RDF (refuse-derived fuel), RPF (refuse paper and plastic fuel), and black liquor from wood pulp production. 4) Burning biomass such as construction and demolition waste. In addition to FIT support, there are subsidies available for some renewable energy system capital costs, and tax credits for households and commercial sector consumers that install renewable energy systems. There are also special loan schemes for small business who want to install renewable power facilities. A listing of subsidies, tax credit, and special loan schemes for renewable electricity deployment that have been implemented to support the FIT policy is shown in Table 2.

2) Using wood other than “unused” or “recycled”, such as waste wood from lumber milling or and imported waste wood, and agricultural residues such as palm chaff, and rice husks.1) Using timber from forest thinning or regeneration cuts, approved as “unused”. 3) Burning biomass such as domestic wastes, sewage sludge, food waste, RDF (refuse-derived fuel), RPF (refuse paper and plastic fuel), and black liquor from wood pulp production. 4) Burning biomass such as construction and demolition waste. In addition to FIT support, there are subsidies available for some renewable energy system capital costs, and tax credits for households and commercial sector consumers that install renewable energy systems. There are also special loan schemes for small business who want to install renewable power facilities. A listing of subsidies, tax credit, and special loan schemes for renewable electricity deployment that have been implemented to support the FIT policy is shown in Table 2.

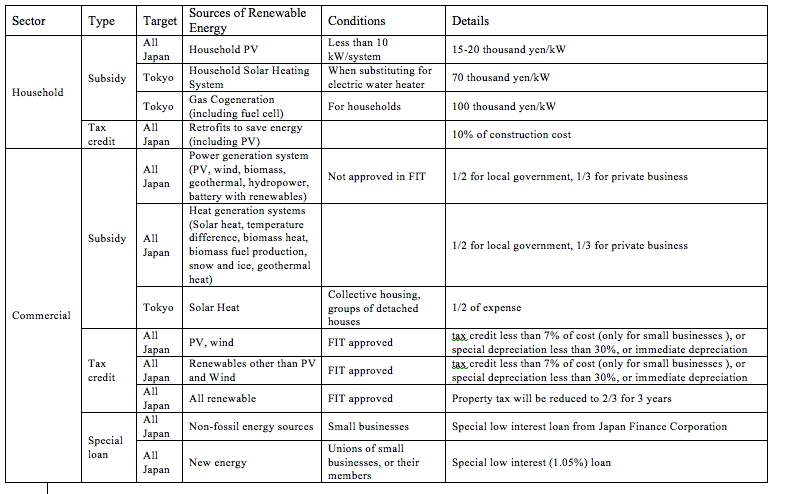

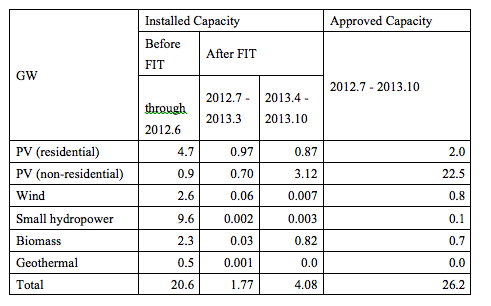

Table 2: Policies other than the fit implemented to support households and businesses installing renewable Electricity systems [4]  Deployment of renewable energy under FIT Since the FIT program started in July of 2012, 26.2 GW of renewable capacity has been approved, and 5.9 GW had already been built by the end of October, 2013. The total accumulated installation of renewable electricity generation capacity before the implementation of the FIT was 20.9 GW, so the approved renewable capacity during the 1 year and 4 months under the new FIT program exceeded the total capacity installed before the FIT. As shown in Figure 2, and Table 3, 1.9 GW out of the 5.9 GW installed as of the end of October, 2013 has been residential PV, which can be installed within short period of time after the decision to install has been made. Table 4 indicates the typical time from project initiation to completion for different renewable electricity systems. In addition, the installation of non- residential PV systems, including Mega-Solar projects, increased markedly in fiscal year 2013 (2013.4-2013.10), and dominated the overall deployment of systems under the FIT, with 76% of total installations. Approved wind power capacity under the FIT, on the other hand, has been rather limited. This is in part due to the time required for environmental assessments of wind projects. As of this writing, recent resource assessment environmental assessments have been completed for wind power systems totaling 7.5 to 10 GW. The Japanese government is working to shorten the time required for environmental assessment of wind power systems.

Deployment of renewable energy under FIT Since the FIT program started in July of 2012, 26.2 GW of renewable capacity has been approved, and 5.9 GW had already been built by the end of October, 2013. The total accumulated installation of renewable electricity generation capacity before the implementation of the FIT was 20.9 GW, so the approved renewable capacity during the 1 year and 4 months under the new FIT program exceeded the total capacity installed before the FIT. As shown in Figure 2, and Table 3, 1.9 GW out of the 5.9 GW installed as of the end of October, 2013 has been residential PV, which can be installed within short period of time after the decision to install has been made. Table 4 indicates the typical time from project initiation to completion for different renewable electricity systems. In addition, the installation of non- residential PV systems, including Mega-Solar projects, increased markedly in fiscal year 2013 (2013.4-2013.10), and dominated the overall deployment of systems under the FIT, with 76% of total installations. Approved wind power capacity under the FIT, on the other hand, has been rather limited. This is in part due to the time required for environmental assessments of wind projects. As of this writing, recent resource assessment environmental assessments have been completed for wind power systems totaling 7.5 to 10 GW. The Japanese government is working to shorten the time required for environmental assessment of wind power systems.

Figure 2: Approved and installed renewable capacity before and after FIT (GW) [5]  Table 3: Approved and installed renewable capacity before and after FIT (GW) [5]

Table 3: Approved and installed renewable capacity before and after FIT (GW) [5]  Table 4: Development periods by renewable sources [6]

Table 4: Development periods by renewable sources [6]  As shown in Figure 2, the gap between “approved” and “installed” systems under the FIT is quite large. One problematic reason for this is that many potential commercial-sector PV power producers have applied for approval under the FIT at times when higher tariffs were available, but wait to buy solar panels for their installations later when the prices for solar panels decrease. Policymakers have been discussing potential solutions of this problem of “early approval and late installation”, and the Ministry of Economy, Trade, and Industryis conducting a survey to better understand the reasons for late installations. In the near future, once survey results are available, countermeasure will be developed to address the problem.

As shown in Figure 2, the gap between “approved” and “installed” systems under the FIT is quite large. One problematic reason for this is that many potential commercial-sector PV power producers have applied for approval under the FIT at times when higher tariffs were available, but wait to buy solar panels for their installations later when the prices for solar panels decrease. Policymakers have been discussing potential solutions of this problem of “early approval and late installation”, and the Ministry of Economy, Trade, and Industryis conducting a survey to better understand the reasons for late installations. In the near future, once survey results are available, countermeasure will be developed to address the problem.

Detailed situation by resource type

As shown above, photovoltaics are currently the dominant technology for new renewable electricity installation under the FIT. There are, however, ongoing projects for using other renewable energy sources that are taking years to be approved and installed. Details on the deployment situation for non-PV energy sources are described below. Most of these data are taken from a recent METI paper [7].

Wind Power (Onshore)

Large scale (over 20 kW)

There are 10 large scale wind power projects which have recently started operation under the FIT. As it typically takes 4 to 7 years to build and commission wind power projects, work on these 10 projects were underway before the new FIT program started. There are 76 project whose current status is approved, and these projects will be phased into operation when as permitting and construction on the projects is completed. The government is considering accelerating procedures for environmental assessment of these projects, which currently can take 3-4 years.

Small Scale (Less than 20 kW)

There is only one small-scale wind power project that has started operation under the new FIT. Small wind power system manufactures are trying to get approval from the certification body that their products meet the standards for FIT facilities.

Wind Power (Offshore)

Currently, there are no tariffs set for offshore wind power plants. There are two types of offshore wind power, which are “floating” and “fixed-base” (bases fixed to the sea floor) wind power turbines. Two demonstration “fixed-base”-type plants at Kitakyushu and Choshi (Chiba) started operation in 2012 and 2013, respectively. Information about the cost of these plants will be examined to set tariffs for fixed-base-type wind power. Floating-type wind turbines have been under development near Nagasaki and Fukushima since 2013, but will not be in commercial operation for at least 3 years.

Small and medium-sized hydropower

There have been 22 small and medium-sized hydropower plants smaller than 200 kW in capacity per plant approved under the FIT, along with 7 plants over 200 kW and less than 1000 kW per plant. No plants larger than 1000 kW had been approved as of October, 2013. Small and medium hydro projects previously abandoned due to their high cost were put back on the table after the new FIT scheme began. Also, some older small- and medium-sized hydropower plants are now being repaired to generate power again as a result of the incentives offered under the FIT program.

Geothermal Power

For the category of large-sized geothermal power plants (above 15 MW), no plants have started operation under the FIT. There is growing interest in geothermal power production, however, and 9 potential plant locations are under investigation with a combination of resource assessments carried out at the surface and through exploratory drilling. An additional plant is in the exploration process, with one more in the environmental assessment process. Among this total of 11 potential geothermal sites, the first plants are likely to be put into operation no earlier than 6-7 years from now. For the small-sized geothermal power plants (less than 15 MW), one plant has started operation under the FIT. The operating plant is a 48 kW binary generation plant, and there are several additional “hot spring” power plants under development.

Biomass Power

Four wood-fired biomass power plants have started operations since the implementation of the new FIT policy. Some of the companies with wood-fired generating units were experiencing difficulties obtaining stable supplies of wood fuel, but there several plans are under development for enhancing wood supplies, and new plants will start operating soon. With respect to power plants fueled with waste biomass, 12 plants have started operating under the FIT policies. Most of these plants are rebuilt garbage disposal facilities, retrofitted for power generation, and it is likely that there will be more of this type of plant placed into operation under the FIT in the near future. A total of 12 power plants using methane fermentation gasification as a source of fuel have started operating under the FIT. Most of these plants are utilizing livestock excreta, and they are sited mostly in Hokkaido. There are several plans ongoing to utilize food garbage and sewage sludge as substrates to produce biogas to power generation that would qualify for FIT and other incentives.

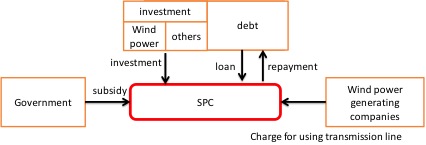

Upgrading Regional Transmission Lines to Support Renewable Generation

There are regions of Japan, such as Hokkaido and Tohoku, where wind regimes are favorable and are in other respects very suitable for wind power generation. Upgrading regional transmission lines within these regions will be necessary to allow the deployment of more wind power. It is difficult, however, for the power utilities in the region (namely, Hokkaido electric and Tohoku electric) to pass through the costs of the required transmission upgrades to their limited customer bases, and as a consequence additional funding from national sources may be needed to fund the transmission upgrades, which would serve to benefit a larger area of Japan. To help to bridge this funding gap, a newly established subsidy has been developed by the national government to fund special purpose companies (SPC) to demonstrate upgrading of transmission lines in areas of concentrated wind power resources suffering from inadequate transmission support. One transmission upgrading project started in Hokkaido during the 2013 fiscal year, and there will be another in the Tohoku area during the 2014 fiscal year. The goal of this demonstration project is to charge transmission fees to wind power companies, as they will use and make money from the use of the upgraded transmission line. Figure 3 shows a schematic of the transmission line financing scheme under the SPC program.  Figure 3 Financing Scheme under SPC for upgrading transmission lines in areas with rich wind power Resources and Inadequate transmission Capacity In the Hokkaido area, 2 SPC projects had been established for upgrading transmission lines as of October, 2013. These projects have begun with investigations regarding possible development approaches, with issues such as the route of any new transmission lines to be determined later.

Figure 3 Financing Scheme under SPC for upgrading transmission lines in areas with rich wind power Resources and Inadequate transmission Capacity In the Hokkaido area, 2 SPC projects had been established for upgrading transmission lines as of October, 2013. These projects have begun with investigations regarding possible development approaches, with issues such as the route of any new transmission lines to be determined later.

Upgrading Interregional Connection

To solve the problem of concentrated renewable power deployment in certain areas out of proportion to local demand, one of the potential solutions is upgrading large interregional transmissions connections in Japan. The Japanese electrical grid operates on two different frequencies—60 Hertz (Hz, or cycles per second) in the south and 50 Hz in the north, with the dividing line just to the west and south of Tokyo and with limited interchange capacity between the two systems. This technical issue limits the amount of power that can be transmitted between the regions of Japan, as does, the limited transmission capacity between some islands of Japan. These physical impediments also serve to help to insulate utilities from competition from outside their region, which may have, at least in the past, provided another reason for utilities to resist policies to promote renewable generation. In addition to the 50 Hz/60 Hz interconnection, one of the key connecting points where interregional transmission capacity needs to be fortified is between Hokkaido Island, with its abundant wind resources, and Honshu, the main island of Japan. It is estimated that it will cost 900 billion yen for transmission improvements that would enable 5.9 GW of wind power to be deployed in the Hokkaido and Tohoku areas. If the upgrading of transmission capacity between Hokkaido Island and Honshu is realized, there will be much more capacity available to deploy renewable power systems. Upgrading operating technologies for transmission lines is also under investigation, and utilizing batteries for bulk electricity storage to complement renewable energy generation is the subject of a demonstration programs. Two projects, with battery arrays capable of storing 60 MWh and 20 MWh, respectively, have been set up at transmission substations in Hokkaido and Tohoku.

Influence of the FIT program on electricity prices

Under the FIT scheme, the tariffs paid to producers by the utilities, minus the average avoided cost of conventional power generation (which was 9.55 yen/kWh in November, 2013) are added to the electricity price (FIT surcharge). The FIT surcharge as of in FY 2012 was calculated to increase the average electricity bill for residential consumers by 66 yen/household/month if the household uses 300 kWh of electricity per month. The surcharge increased to 105 yen per month in FY 2013, as it reflects the estimated cost of paying tariffs in the year 2013, and the full FIT started in 2012. METI estimates that FIT surcharge in 2020 will increase to 276 yen per household per month, assuming 28 GW of PV, 5GW of wind power, and 0.53 GW of geothermal power are on line by then and receiving FIT payments, as shown in Figure 4. The assumptions METI made to estimate future renewable installations seem somewhat conservative, but since 2014 is only 6 years from the time of this writing, this assumption could be reasonably close to actual renewables deployment by 2020.  Figure 4: Renewable ratio to electricity generation, and current and future estimated surcharge Based on METI Estimates [8] According to the Energy and Environment Council Final Report, however, the amount of installed renewable capacity in 2030 will triple compared to current levels, which implies that the surcharge level could double even if, as is under consideration, lowering tariffs levels are implemented in the future under the FIT program. Additional details on forecasts for renewable energy deployment are provided in the following section of this Working Paper.

Figure 4: Renewable ratio to electricity generation, and current and future estimated surcharge Based on METI Estimates [8] According to the Energy and Environment Council Final Report, however, the amount of installed renewable capacity in 2030 will triple compared to current levels, which implies that the surcharge level could double even if, as is under consideration, lowering tariffs levels are implemented in the future under the FIT program. Additional details on forecasts for renewable energy deployment are provided in the following section of this Working Paper.

IV. Potential and Future Deployment of Renewables in Japan

The Potential for Renewables

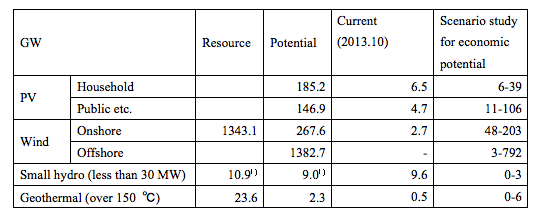

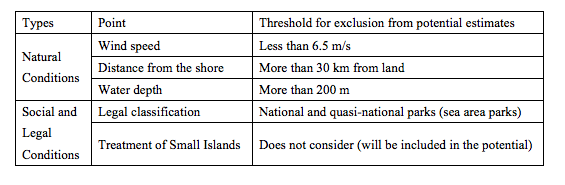

The Ministry of Environment (MOE) has since 2009 published several compilations describing Japan’s renewable resources and their power generation potential. The terms “Resource” and “Potential” are defined here as follows. – Resource: This identifies the maximum available resources calculated by area that are suitable for renewable energy installation, based on average wind speeds or river flow rates. – Potential: In this definition, areas where energy systems cannot be installed due to physical constraints such as altitude or gradient, or where installations would be restricted by law, such as protected (sanctuary) regions, are excluded from the total. – Economic Potential: Amount of generation capacity that is likely to be able to obtain an adequate return on investment (ROI) under reasonable scenarios. Table 5 shows estimates of these different categories of resources based on recent assessments, as well as, for comparison, current deployment of renewable electricity systems in Japan.  Table 5: Resource and Potential of Renewable sources Source: MOE [9] for Resource, potential, and scenario study, METI [5] for level of current deployment.1) In addition to plants already built. The largest potential for renewable electricity in Japan is from offshore wind power, which is sufficient, in theory, to supply Japan’s entire electricity demand. Japan’s total electricity generating capacity stood at 230 GW at the end of FY 2011. The conditions used for calculating offshore wind power potential are shown in Table 6, below, focusing on the thresholds for considering wind resources in the potential calculation. Half of the potential identified can be realized as economic potential in the most optimistic scenario, in which the capital cost of wind power plants falls to 600 thousand yen per kW for the floating turbines (for the fixed-base turbine, the cost is smaller according to the depth of the water they are set)..

Table 5: Resource and Potential of Renewable sources Source: MOE [9] for Resource, potential, and scenario study, METI [5] for level of current deployment.1) In addition to plants already built. The largest potential for renewable electricity in Japan is from offshore wind power, which is sufficient, in theory, to supply Japan’s entire electricity demand. Japan’s total electricity generating capacity stood at 230 GW at the end of FY 2011. The conditions used for calculating offshore wind power potential are shown in Table 6, below, focusing on the thresholds for considering wind resources in the potential calculation. Half of the potential identified can be realized as economic potential in the most optimistic scenario, in which the capital cost of wind power plants falls to 600 thousand yen per kW for the floating turbines (for the fixed-base turbine, the cost is smaller according to the depth of the water they are set)..  Table 6: THRESHHOLDS UNDER WHICH WIND RESORUCES ARE EXCLUDED FROM potential ESTIMATE [9]

Table 6: THRESHHOLDS UNDER WHICH WIND RESORUCES ARE EXCLUDED FROM potential ESTIMATE [9]

Forecast for future renewables deployment

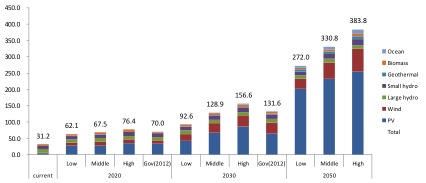

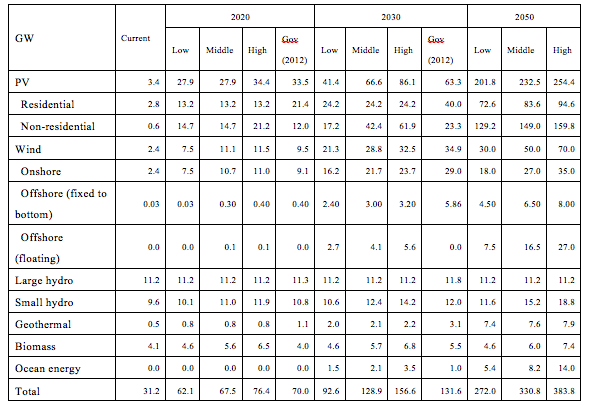

A New Strategic Energy Plan is now under discussion at the Advisory Committee on Energy and Natural Resources of METI, so as a result the latest outlook for renewable energy deployment as of this writing was done at the time that the Democratic Party of Japan was in power by the Energy and Environment Council. The Ministry of Environment has since 2009 regularly published forecasts for deployment through 2050, but these forecasts are not approved by the Cabinet, and will never be. Shown below (Figure 5 and Table 7) are the outlook for renewable electricity deployment by the Energy and Environment Council, which is compared with the outlook by the Ministry of Environment [10]. Capacity for renewable power generation in Japan is forecast to more than double by 2020, and will reach almost 10 times its current level by 2050. PV dominate the forecast capacity, accounting for 50% of the total in 2020 and 2030, and 70% in 2050. Thus offshore wind power has the largest potential, but PV power dominates the outlook for deployment. Note: ”Current” includes data from 2010 for PV, wind, and geothermal, 2009 for hydropower, and 2005 for biomass power.  Figure 5: Outlooks by The Ministry of Environment (2013) and The Energy and Environment Council (2012), IN GW, FOR RENEWABLE GENERATION capacity IN JAPAN Table 7: Outlook by THE Ministry of Environment (2013) and The Energy and Environment Council (2012), IN GW, FOR RENEWABLE GENERATION capacity IN JAPAN

Figure 5: Outlooks by The Ministry of Environment (2013) and The Energy and Environment Council (2012), IN GW, FOR RENEWABLE GENERATION capacity IN JAPAN Table 7: Outlook by THE Ministry of Environment (2013) and The Energy and Environment Council (2012), IN GW, FOR RENEWABLE GENERATION capacity IN JAPAN  Figure 6: Outlook by Ministry of Environment (2013) and Energy and Environment Council (2012), TWh of Power GenerationLooking at the expected renewable power generation in TWh (Figure 6, below), and comparing these projections of renewable with the current total annual electricity generation in Japan of around 1,000 TWh—which is forecast to change relatively little, given Japan’s mature economy and declining population—the percentage of electricity generation from renewable power is estimated to be in the range of 15 to 18% in 2020, 20 to 30% in 2030, and 45 to 70% in 2050. These proportions are quite a large, and achieving these levels of renewable power penetration in Japan will require many changes to the electricity system by 2050.

Figure 6: Outlook by Ministry of Environment (2013) and Energy and Environment Council (2012), TWh of Power GenerationLooking at the expected renewable power generation in TWh (Figure 6, below), and comparing these projections of renewable with the current total annual electricity generation in Japan of around 1,000 TWh—which is forecast to change relatively little, given Japan’s mature economy and declining population—the percentage of electricity generation from renewable power is estimated to be in the range of 15 to 18% in 2020, 20 to 30% in 2030, and 45 to 70% in 2050. These proportions are quite a large, and achieving these levels of renewable power penetration in Japan will require many changes to the electricity system by 2050.

V. Conclusion

After the Great East Japan Earthquake and nuclear accident, most Japanese conservative policymakers changed their public stance from “reluctant toward renewables, positive toward nuclear”, to “positive toward both renewable and nuclear” or “positive toward renewables, negative to nuclear.” It is an interesting indicator of the profound impact of the Fukushima accident on the Japanese public psyche that politicians such as former Prime Minister Koizumi are now supporting a “no nuclear”, or no further nuclear, energy future for Japan, given their strong support for nuclear power in the past. Feed-in tariff started for all renewable sources of electricity in July, 2012. The tariff rates are set high enough to encourage many kinds of companies, from small to large, to enter the renewable power business. Since it has been only less than 2 years since the FIT started, the majority of newly operating renewable power plants are photovoltaic systems, because other types of renewable electricity sources require longer lead times for development and installation before they begin generating power.

There are, however, many projects going on for other sources of renewable electricity, and if the Japanese government does its best to deploy renewables in the way that current policies direct, Japan can overcome deployment issues and reach a future in which a large percentage of the electricity used in Japan is generated from renewable resources. Even at high levels of renewable electricity deployment, the surcharge on retail electricity tariffs associated with the FIT will be less than 300 yen per household per month in 2020, for an average household use of 300kWh per month. This estimate incorporates an assumption that the installed capacity of renewable power will double by 2030, but capital cost decreases, for example, for PVs and wind power plants, could lower the expected surcharge. In order to achieve success in transitioning the Japanese energy system to mostly renewable energy, a stable and fair level FIT tariff is needed to ensure the renewable energy business of stable profits until the capital costs of renewable technologies decline sufficiently to make them cost-competitive with conventional electricity options.[1] The cost of renewable power, especially wind power, is reported to be less than fossil-fueled power in other countries, and thus has the potential to be very chap energy.

If the cost of renewable energy decline to levels similar to the costs of fossil fuels, then power grid upgrades, and/or new types of systems to support the addition of renewable electricity sources to the grid, need to be realized. The Japanese government is conducting several demonstration projects for upgrading transmission lines and interconnection points to strengthen the power grid. Along with the deployment of batteries, hydrogen production and conversion systems, pumped storage hydroelectric plants, undersea compressed air storage, and/or other technologies for storing surplus renewable electricity for use during periods of higher demand, we can expect Japan to obtain 50-70% of its electricity from renewable sources in 2050. A policy to encourage deployment of renewable heating systems is also under discussion in Japan. Here, the goal is to deploy more solar heating systems, biomass cogeneration systems, and similar technologies. In Japan, however, district heating is not as popular as in some of the other countries of the region (including the Koreas and northern China) due to high construction costs, thus there will need to be some changes in technologies and/or policies if renewable heating systems are to be widely deployed. In the meantime, there has not yet been any practical policy discussion regarding the large-scale deployment of renewable heating sources. To shift to a low carbon society, for example, one in which GHG emissions are 60-80% less than current levels, the first step will be to improve end-use efficiency—the efficiency with which electricity and other fuels are used to meet society’s needs for energy services—as much as possible. To encourage energy efficiency, it is very important not to lower tariffs too early, even as renewable electricity costs decline, and not to change the promised FIT rates, and to in tandem implement a comprehensive policy for promoting energy efficiency improvements.

Ultimately, Japan’s high electricity prices, kept so both by the structure of the electricity industry and by the need to purchase expensive imported liquefied natural gas (LNG) to fuel additional power generation since the nuclear fleet has been off-line, are both a spur to the development of renewable energy, but also a reason for utilities to seek to retain control over generation and hence, pricing. Reducing electricity costs would relieve an economic burden on Japan’s businesses and consumers, and help to make Japanese industry more economically competitive, but doing so may be somewhat at odds with incentivizing renewable energy through high feed-in tariffs and other support. And of course, implementing renewable energy also accomplishes other important long-term goals, namely reduction of greenhouse gas emissions and other pollutants.

The outcome of the push and pull between the forces in favor of and resisting the restart of Japan’s nuclear fleet will also affect the urgency and pace with which energy efficiency and renewable energy are deployed in Japan. Improving the efficiency of energy use and implementing renewable energy would benefit not only future generations, but current households and businesses as well would profit from by saving energy (and associated energy costs), as well as profiting from the sale of renewable energy outputs. Further, if Japan can establish a path to realization of a low carbon energy system, the lessons learned in doing so will benefit Japanese industries, as they will be able to provide goods and services associated with energy efficiency and low carbon energy not only domestically, but to other nations as well.

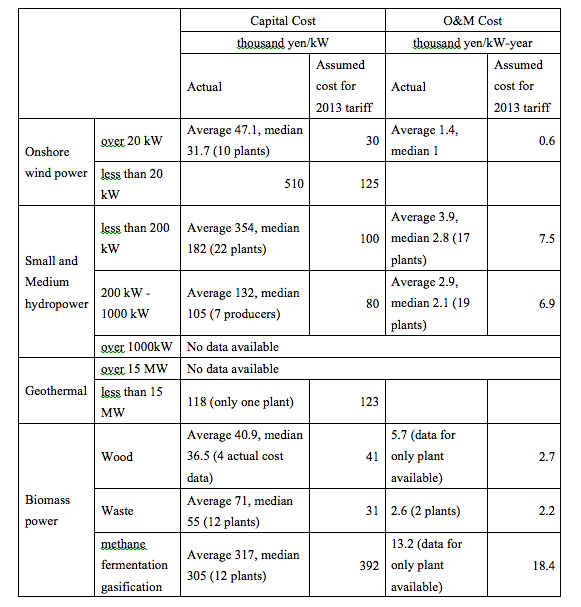

VI. Appendix: Cost by sources

Under the FIT scheme in Japan, renewable power producers have to submit information on the costs of their renewable generation facilities. The data collected through the regulatory office of the FIT since the start of the FIT scheme in July, 2012have therefore been published for real projects in Japan, which constitutes a very valuable information resource [7]. The Table below compares the averages of the cost data collected in comparison with the assumed cost data used to calculate the tariff rates for the previous year of the FIT program. The number of plants for which data were submitted is provided in parentheses in the “Actual” columns.

VII. references

1. The office of the Prime Minister. Speech of Prime Minister Fukuda. The office of the Prime Minister. [Online] 6 20, 2008. [Cited: 1 18, 2014.] http://www.kantei.go.jp/jp/hukudaspeech/2008/06/09speech.html.

2. Speech of the Prime Minister Aso. The office of the Prime Minister. [Online] 6 10, 2009. [Cited: 1 18, 2014.] http://www.kantei.go.jp/jp/asospeech/2009/06/10kaiken.html.

3. Institute of Energy Economics, Japan. Handbook of Energy & Economics Statistics. s.l. : The Energy Conservation Center, Japan, 2013. 4879734071.

4. Ministry of Economy, Trade and Industry. Support Scheme of renewables. Feed-in tariff portal. [Online] [Cited: 1 31, 2014.] http://www.enecho.meti.go.jp/saiene/support/index.html.

5. Approved and Installed renewable power by the end of October, 2013. Feed-in Tariff Portal. [Online] 1 10, 2014. [Cited: 1 31, 2014.] http://www.enecho.meti.go.jp/saiene/kaitori/#setsubi.

6. Commission for Procurement Cost of Renewables, Energy and Environment Council. Report of the Commission for Procurement Cost of Renewables. Agency for Natural Resources and Energy, Ministry of Economy, Trade, and Industry. [Online] 12 19, 2011. [Cited: 1 30, 2014.] http://www.enecho.meti.go.jp/info/committee/kihonmondai/8th/8-3.pdf.

7. Agency for Natural Resources and Energy ,Ministry of Economy, Trade and Industry. Current Renewable Energy Market Status. Agency for Natural Resources and Energy ,Ministry of Economy, Trade and Industry. [Online] 1 10, 2014. [Cited: 1 30, 2014.] http://www.meti.go.jp/committee/chotatsu_kakaku/pdf/012_02_00.pdf.

8. Agenda about Renewable Energy and Suggested Actions. Agency for Natural Resources and Energy ,Ministry of Economy, Trade and Industry. [Online] 11 18, 2013. [Cited: 1 31, 2014.] http://www.enecho.meti.go.jp/info/committee/kihonseisaku/10th/10th-6.pdf.

9. Ministry of Environment. Study of Basic Zoning Information Concerning Renewable Energies (FY2012). Study of Basic Zoning Information Concerning Renewable Energies (FY2012). [Online] 8 2013. [Cited: 1 31, 2014.] http://www.env.go.jp/earth/report/h25-03/index.html.

10. Committee to Discuss Policy to Deploy Renewable Energy toward Low Carbon Society. Recommendation for Low Carbon Energy System toward Low Carbon Society. Ministry of Environment. [Online] 2013. [Cited: 1 31, 2014.] http://www.env.go.jp/earth/report/h25-01/index.html.

[1] Of course, increases in the costs of fossil fuels, either through application of national or global carbon taxes or through price increases due to fuel scarcity, could also improve the competitive position of renewable electricity sources.

VIII. NAUTILUS INVITES YOUR RESPONSES

The Nautilus Peace and Security Network invites your responses to this report. Please leave a comment below or send your response to: nautilus@nautilus.org. Comments will only be posted if they include the author’s name and affiliation.

Kae Takases´report is very interesting; please keep me informed if any new reports on Japan will be published!

Thanks a lot!

Prof. Dr. Peter Hennicke, Former President of the Wuppertal Institute, Germany