by Andrew De Wit

26 October 2015

II. Introduction

The present article argues that the LDP’s green-energy proponents aim at revitalizing local economies through renewable energy, growing strategic sectors of the economy, bolstering national security (especially energy security), enhancing resilience in the face of natural and other disasters, as well as dealing with the threat of climate change. Their ranks include such LDP heavyweights as Ishiba Shigeru, current Minister for Local Revitalization and possibly the next LDP President. Given their conservative politics, they are elaborating a national-security, “local revitalization”-focused paradigm of green power, quite distinct from the idealistic, small-is-beautiful emphasis common among Japan’s left-liberal proponents of renewable energy. Yet the LDP’s approach to diffusing renewables also centres on local-government agency, which could not only accelerate the diffusion of renewable energy but also bolster Japanese democracy in the bargain. In light of the alarming state of global climate change, energy markets, and economic inequality, this article asserts that what the LDP are doing is far too important to ignore.

Andrew DeWit is Professor in Rikkyo University’s School of Policy Studies and an editor of The Asia-Pacific Journal. His recent publications include “Climate Change and the Military Role in Humanitarian Assistance and Disaster Response,” in Paul Bacon and Christopher Hobson (eds) Human Security and Japan’s Triple Disaster (Routledge, 2014), “Japan’s renewable power prospects,” in Jeff Kingston (ed) Critical Issues in Contemporary Japan (Routledge 2013), and (with Kaneko Masaru and Iida Tetsunari) “Fukushima and the Political Economy of Power Policy in Japan” in Jeff Kingston (ed) Natural Disaster and Nuclear Crisis in Japan: Response and Recovery after Japan’s 3/11 (Routledge, 2012). He is lead researcher for a five-year (2010-2015) Japanese-Government funded project on the political economy of the Feed-in Tariff.

This article was initially published in the Asia-Pacific Journal, Vol. 13, Issue. 39, No. 2, October 5, 2015

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

II. Report by Andrew De Wit

For nearly three years, global attention has focused on the three arrows of Japanese Prime Minister Abe Shinzo’s “Abenomics” as well as his aggressive new security policies. Yet beneath the radar, his government has begun to vigorously promote renewable energy and efficiency. Its initiatives accelerated over the summer of 2015, and the momentum continues to increase. The measures include not just ample fiscal, regulatory and other policy support for renewable generation and energy-harvesting technology. The Abe regime is also investing heavily to build a renewable-based hydrogen economy as well as expand the smart-grid and district heating systems that are core network infrastructures for a low-carbon economy. Moreover, the Abe regime is adopting new governance mechanisms, including inter-ministerial task forces and widening the ambit of local public corporations, to accelerate the deployment of renewables. In addition, de facto energy policymaking is becoming more inclusive, eroding the Ministry of Economy Trade and Industry’s (METI) dominance while simultaneously advantaging pro-renewable factions in other ministries as well as within METI itself.

The present article argues that the dismissive approach overlooks important fiscal, organizational and other evidence, which we shall explore below. The LDP’s green-energy proponents aim at revitalizing local economies through renewable energy, growing strategic sectors of the economy, bolstering national security (especially energy security), enhancing resilience in the face of natural and other disasters, as well as dealing with the threat of climate change. Their ranks include such LDP heavyweights as Ishiba Shigeru, current Minister for Local Revitalization and possibly the next LDP President. Given their conservative politics, they are elaborating a national-security, “local revitalization”-focused paradigm of green power, quite distinct from the idealistic, small-is-beautiful emphasis common among Japan’s left-liberal proponents of renewable energy. Yet the LDP’s approach to diffusing renewables also centres on local-government agency, which could not only accelerate the diffusion of renewable energy but also bolster Japanese democracy in the bargain. In light of the alarming state of global climate change, energy markets, and economic inequality, this article asserts that what the LDP are doing is far too important to ignore.These claims will surely seem dubious, if not absurd, in light of Abe’s support for nuclear energy and the recent restart of the Sendai nuclear reactor in the face of majority public opposition.1 Indeed, most Japanese left-liberal commentary on the Abe regime’s energy strategy – especially as codified in the 2014 Energy Basic Plan and its targets for 2030 – derides it as reliant on nuclear and coal,2 inadequately supportive of efficiency, and “less accommodating to renewables” than the previous Democratic Party of Japan (DPJ) administration.3 Some overseas analysts also dismiss Japan’s hydrogen strategy as a “fraud” based on “low-grade coal” in Australia.4

The Evidence: Budgets

In addition, the expanded energy-related project requests are in part to be funded by extra revenues gleaned by increased “green” taxation of fossil fuels. This gives the spending programmes additional protection, because one rationale for the taxes is to increase incentives for the development and deployment of alternative energy. In spite of continuing steel-industry pressure to have such taxes axed,7 the LDP did not roll back the carbon taxes that were introduced in October of 2012, and have since been raised in stages. The taxes are set to reach YEN 289/ton of CO2 with the scheduled April 1, 2016 increase.8Some of the most persuasive evidence of the LDP’s expanding commitment to renewable energy and efficiency is found in the central government’s budget, particularly the central agencies’ requests for the coming fiscal year (April 1, 2016 to March 31, 2017). During the summer of 2015, Japan’s fiscal process was notable for energy-related requests that mushroomed over the previous year. One standout example is the Ministry of Environment’s (MoE) submission for renewable energy and efficiency projects, which is fully 62% higher than its fiscal year 2015 spending.5 We shall explore these and related requests in greater detail presently, comparing them with budgets under the DPJ. But first, it is important to point out that these budget outlines are preliminary. In Japan’s fiscal process, central agencies submit their initial budget requests to the Ministry of Finance (MOF) by the end of August, which is followed by negotiations among MOF’s budget examiners and the various ministries and agencies. These negotiations generally last until about December, and result in a draft budget. It is likely that about YEN 5 trillion will be trimmed from the YEN 102 trillion budget request. But according to an analysis in the September 5, 2015 Asahi Shimbun these cuts are likely to be centred on social security.6 It is highly unlikely that the Abe cabinet did not approve the dramatic increases in proposed spending on renewable energy and efficiency, and thus they are probably not going to be sacrificed.

Local Revitalization Minister Ishiba Shigeru inspecting a biomass plant in Okayama Prefecture, June 13, 2015

The MoE is, of course, not the only central agency with a prominent role in directing public finance at renewable energy and efficiency projects undertaken by Japan’s local governments, private firms, NPOs and other actors. The METI is another major supplier of subsidies for such projects. In the energy field, the METI’s requests for 2016 total just under YEN 976 billion. This figure is a significant increase on the YEN 796.5 billion in the fiscal 2015 initial budget, and efficiency and renewables receive striking increases. To be sure, one of Japan’s leading journalists on energy-related matters, Ishida Masaya, criticizes the METI’s fiscal 2016 request for including about YEN 200 billion in spending on nuclear (including YEN 133 billion in support to local sites of nuclear reactors). This figure is roughly the same as the nuclear spending in fiscal 2015, which totals YEN 185 billion. Ishida regards maintaining this level of support for nuclear as being inconsistent with the new (from 2014) energy basic plan’s explicit commitment to maximize renewables and minimize nuclear.As described above, the MoE’s energy-related fiscal request for 2016 was 62% higher than its fiscal 2015 initial budget. The MoE’s total request for 2016 was YEN 1.68 trillion, a 33% increase over the fiscal 2015 appropriation. One of the factors driving this overall increase is the Japanese government’s commitment to reducing its carbon emissions by 26% by 2030 versus 2013 levels. As a major part of this overall aim, the MoE’s renewable and efficiency-related spending requests for 2016 amount to just under YEN 176 billion.

But Ishida devotes considerably more attention to the METI’s aim to nearly double its support of efficiency and conservation, raising its fiscal 2015 YEN 127.7 billion spending in this category to YEN 242.9 billion. He adds that this spending to cut greenhouse gas emissions and reduce power consumption is largely targeted at factories, which are the most costly venues for achieving gains in energy efficiency and conservation. The METI’s spending on this category will thus nearly triple, from YEN 50 billion in 2015 to YEN 135.6 billion in 2016. Ishida rightly focuses on this initiative, as the METI itself describes the current need for efficiency and conservation as comparable to the period in the immediate wake of the 1970s oil shocks.9

METI is generally seen as powerfully influenced by vested energy interests, including the nuclear village and those focused on fossil fuels. So it is also telling that METI plans to more than double its spending in support of renewable-energy projects, from YEN 35.8 billion in 2015 to YEN 81.8 billion in 2016. METI will also raise its R&D on efficiency from YEN 50.7 to YEN 63.2 billion and its R&D on renewables from YEN 49.3 to YEN 53.7. METI is also asking for a tripling in its funding on hydrogen-related deployment (fuel cells and hydrogen stations) and research (including renewable power to gas10), from fiscal 2015’s YEN 11.9 billion to YEN 37.1 billion.11

Another central agency with a strong role in fostering the diffusion of renewables and efficiency is the Ministry of Infrastructure, Land, Transport and Tourism (MLIT). Since 2011, it has been undertaking one of the most interesting of Japan’s waste-heat related initiatives, through its “B-DASH” (Breakthrough by Dynamic Approach in Sewage High Technology) Project.12 Japan’s potential for waste-heat capture in its sewerage systems has been assessed at 15 million households’ worth of heat-energy use.13 The fiscal 2016 request for the B-DASH project aimed at exploiting this energy potential is YEN 3.6 billion, and via the initial fiscal 2015 budget the MLIT already has a YEN 901.2 billion fund for waste-heat recovery and other renewable-energy (e.g. methane) from Japan’s 460,000 kilometres of sewers, via the MLIT social infrastructure development disbursements.14 This project has already led to such initiatives as Toyota City’s “Future Challenge City” partnership, announced on August 26, 2015, with Sekisui Chemical on heat-recovery in the city’s sewers.15

Other central agencies with a direct interest in the diffusion of renewable energy and efficiency include the Ministry of Internal Affairs and Communications (MIC) as well as the Ministry of Agriculture, Farms and Forestry (MAFF). Their roles in fostering the deployment of renewable energy focus less on the technology per se than on the coordination of local governments (MIC) as well as primary-sector producers, such as forestry firms in biomass (MAFF). Their proposed spending on energy projects generally did not leap as noticeably as the cases surveyed above, save for the MIC’s special programme of fostering the deployment of largely biomass-fired district heating and cooling systems in local areas. This programme is the “Distributed energy infrastructure project.” It received YEN 240 million in fiscal 2015, but is slated to more than triple to YEN 700 million in fiscal 2016. The bulk of MIC’s large-scale spending increases are centred on the ICT infrastructure that is one of the core network technologies in Japan’s nationwide rollout of the smart community, internet of things, and related projects that cross multiple agency jurisdictions.17 The MIC spending on ICT in the fiscal 2015 initial budget is YEN 115.3 billion but is slated to increase to YEN 137.8 in fiscal 2016.18Moreover, one of the increased efficiency-related fiscal requests by the MLIT is for housing and building stock. The MLIT fiscal 2015 budget for this category totals YEN 116 million, but the request for 2016 is YEN 32.2 billion, or well over 300 times more. This prodigious increase apparently reflects a powerful commitment to raise efficiency in the country’s building stock after new, but non-obligatory, efficiency standards introduced in 2013 had little effect.16

Screen Shot from Takaichi Sanae’s October 18, 2011 well-informed talk (in Japanese) on “The Potential for Renewable Energy and Efficiency”

Was the DPJ More Renewable-Friendly than the Abe Regime?The above projects are in themselves good reasons to pay close attention to the MIC. But in addition, the current MIC Minister, Takaichi Sanae, has been a very strong proponent of renewable energy for several years. Under her leadership, the MIC bureaucracy have continued with their significant organizational initiatives to put local governments in charge of energy. We shall examine these initiatives in the subsequent section on institutional changes the LDP has made to foster the accelerated diffusion of renewables and efficiency. But for the present, note that the MIC collated the distributed and renewable-energy project spending – by the MIC itself as well as METI, MoE, and MAFF – relevant to local government. Takaichi presented the results of the MIC survey on these matters at a September 4, 2015 press conference. She pointed out that there are 31 subsidy programs, worth a total of YEN 102.7 billion in fiscal 2015 as well as an additional YEN 126 billion via the 2014 fiscal year’s supplementary budget.19

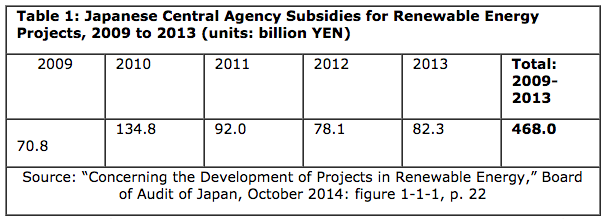

The recent budget requests, described above, are not the entirety of the Abe regime’s planned investments in renewables, efficiency and related projects. There are several other central agencies – such as the Ministry of Education, Culture, Sports, Science & Technology (MEXT) – whose programmes are important. Even so, these preliminary budget numbers for 2016 offer an instructive contrast with Japan’s central-government fiscal expenditures on renewable energy between 2009, the first year of the DPJ government, and 2013, the first year of the Abe government. Those expenditures were analyzed in an October, 2014 report by the Board of Audit of Japan, which surveyed renewable energy subsidies by Japan’s 7 main central agencies (METI, MoE, MAFF, MLIT, MEXT, the Cabinet Office, and NEDO). Some of its findings are presented in table 1, which displays the 7-agency totals for each year between 2009 and 2013, in addition to the total over the five years. The survey found that total spending on renewable energy deployment by the 7 main central agencies for the entire 5 year period was YEN 468 billion, with 56.7% of the spending, or YEN 265.6 billion, represented by METI, followed by MoE at 16.6%, or just under YEN 78 billion.

As we also see in table 1, the peak year for renewable spending under the DPJ was 2010, when a total of YEN 134.8 billion was devoted to renewable-energy projects by the 7 central agencies. This figure was nearly double the previous fiscal 2009 total of YEN 70.7 billion. The gap between the two figures suggests that there was a strong contrast between the LDP, under whose government the 2009 budget was drafted, and the DPJ. The DPJ was committed to nuclear prior to 3-11, but it also included strong advocates of renewable energy.20 Hence, we should not be surprised at the increase.

Yet note that under the current Abe regime, the fiscal 2016 request for renewables by the METI alone totals YEN 81.8 billion. The figure would be considerably greater were we able to take the Board of Audit of Japan’s approach and add the MoE and other agencies’ and ministries’ slated spending to that of the METI. That calculation will have to await the passage of the 2016 budget, early next year. But the numbers at present strongly suggest that the LDP in 2015 has changed quite strikingly in its approach to renewable energy, compared to 2009 as well as 2013 (when the LDP intervened late in the budget cycle to reshape fiscal priorities by increasing public works).21 At least on some measures, the LDP of 2015 may even be more pro-renewable than the DPJ was.

The Evidence: Institutional Changes

As we shall see below, institutional changes undertaken by the Abe regime are also increasingly important in promoting renewable energy and efficiency. Virtually none of these changes have caught the attention of the regime’s many critics or even the many business analysts hoping to divine Japanese policymakers’ intentions on energy policy.

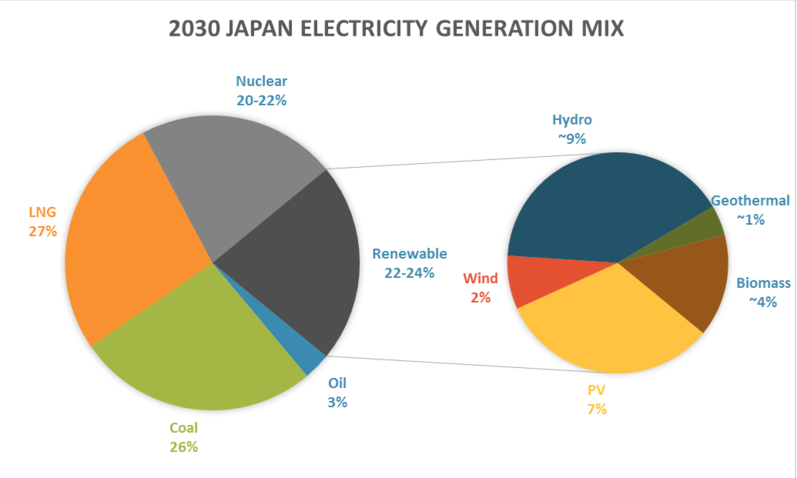

Admittedly, recent official Japanese government policy decisions concerning mid-term targets for nuclear, renewables, and other power generation would seem to indicate an LDP coolness towards renewables. That is, on June 1, 2015, the METI released its targets for Japan’s “best mix” of power generation for 2030. This report supplements the April 2014 Basic Energy Plan, which lacked specific targets. As seen in figure 1, the new targets for 2030 include securing between 20-22 percent of total power by nuclear generation. Other elements of the projected 2030 power mix include a 27 percent share for liquid natural gas (LNG), 26 percent for coal, and 3 percent for oil.

The Politics of the 2030 “Best Mix”As for renewables in the 2030 power mix, their total share is set at 22-24 percent of power. The smaller sphere in figure 1 shows that much of this renewable energy is to be conventional hydro (meaning large dams), which is forecast to supply between 8.8 percent and 9.2 percent of power. Solar, wind and other renewable sources are limited to between 13.4 percent and 14.4 percent of the power mix, with solar being 7 percent, wind 2 percent, biomass under 4 percent and geothermal less than 1 percent. Thus, the previous 2010 Basic Energy Plan’s aim of securing roughly 20 percent of power from renewables (including hydro) by 2030 was only marginally increased under the new plan, to a maximum of 24 percent. The new plan also foresees intermittent solar and wind comprising just 9 percent of the 2030 power mix whereas conventional hydro, small hydro, geothermal, biomass and other non-intermittent renewables are slated to be as much as 15 percent of the mix.22 The new energy plan’s proposal to increase the renewable share roughly 4 percent, compared to the 2010 plan, certainly does not suggest the LDP is going green with gusto. Indeed, many Japanese renewable-power supporters lamented that the revised policy represented “a total defeat of the sustainable energy camp.”23

Yet the 2030 “best mix” targets reflected desperate lobbying by vested energy interests. They remain influential in key committees in METI, and were able to shape the outcome during several months (from January to June of 2015) of vigorous debate over the power mix, resulting in these numbers for the 2030 power-mix. Yet their victory, so to speak, may have been pyrrhic. For one thing, few observers – even within METI – expect nuclear power’s share to reach the 20% target let alone get past it. And even were the target to be achieved, the 20-22 percent nuclear share in the 2030 power mix represents a significant reduction in nuclear power. This reduction is both relative to the actual 28.6 percent share that nuclear had just before 3-11 (as shown in figure 2) as well as to the over 50 percent share nuclear was to achieve by 2030 under the 2010 Basic Energy Plan. It is very likely that, at best, only 20 reactors (of Japan’s 43 viable reactors) will be restarted between 2015 and 2024. This would leave nuclear power providing perhaps 10 percent of total power generation by 2030.24 Indeed, the August 11, 2015 Wall Street Journal, warned that more stringent nuclear safety measures and an independent regulator had resulted in only 5 of Japan’s 43 potentially viable reactors being approved for restart as of August 2015.25 As Temple University Professor Stephan Lippert suggests in a July 15, 2015 analysis of the new energy plan and its predecessor, the new version needs to be read in light of its very different political context. Lippert argues that Abe’s LDP is trying to find a politically viable path between aggressive re-nuclearization and a German-style exit from nuclear: public opposition prevents a return to the ambitious nuclear targets that preceded 3-11, but at the same time Japan lacks an organized and influential political force (like the German Greens) that could compel a complete exit from nuclear. By choosing a compromise path, one of “small-scale re-nuclearization,” the Abe regime avoids, on the one hand, unduly alienating public opinion as well as, on the other hand, losing the support of the utilities and other business interests that want restarts.26

Political calculations are often like that, which is one reason America’s Obama administration has professed an “all of the above” energy strategy27 while making incremental moves to marginalize coal and maximize renewables. But Japan has minimal conventional energy resource endowments and a deeply delegitimated nuclear fleet. In order to “keep the lights on,” while limiting costs and risks, it has to grapple with tough choices that restrict its ability to finesse for long in day-to-day power policy as opposed to targets 15 years away. And unlike the Obama White House, which is part of a fragmented federal system with no clear locus of effective authority on energy, the buck stops at Japan’s central government. The cabinet is thus compelled to make fiscal and institutional choices in the here and now. So it is no surprise that the Abe regime’s political compromise on the power mix is belied by the fiscal and institutional initiatives we examine in this article.

This trail of facts leads to another reason the “victory” of Japan’s vested energy interests may have been pyrrhic: policymakers and analysts learned a great deal during the months of debate over the power mix. Their cynicism about the feasibility of the nuclear numbers is now a corrosive element at work on the fiscal and regulatory institutions that shape Japan’s power economy, still the world’s fifth largest. Expectation for renewables and efficiency provide a strong contrast to the dubious attitudes towards the nuclear role. Most energy analysts believe the renewable share of the power mix could easily exceed the new Basic Energy Plan’s 22-24%, and reach well over 30%. The MoE itself released a study (done by the Mitsubishi Research Institute) that projected renewables could reach between 33-35 percent of the power mix by 2030.28 On May 5, 2015, the Governor of Kanagawa Prefecture, Kuroiwa Yuuji, wrote directly to the Abe government’s Chief Cabinet Secretary, Suga Yoshihide, arguing that 35 percent renewables by 2030 should be made the target.29The respected Institute for Sustainable Energy Policies even argued that Japan could achieve 50% renewable energy by 2030.30 And one of Japan’s formerly quite pro-nuclear energy experts, Kikkawa Takeo, a member of the METI power-mix committee, has quite publicly and repeatedly insisted that renewables could achieve at least a 30 percent share and that the new Energy Plan’s numbers derive from furious lobbying by the nuclear village rather than an objective assessment of Japan’s best options on energy.31

The Geopolitical Context of the 2030 “Best Mix”

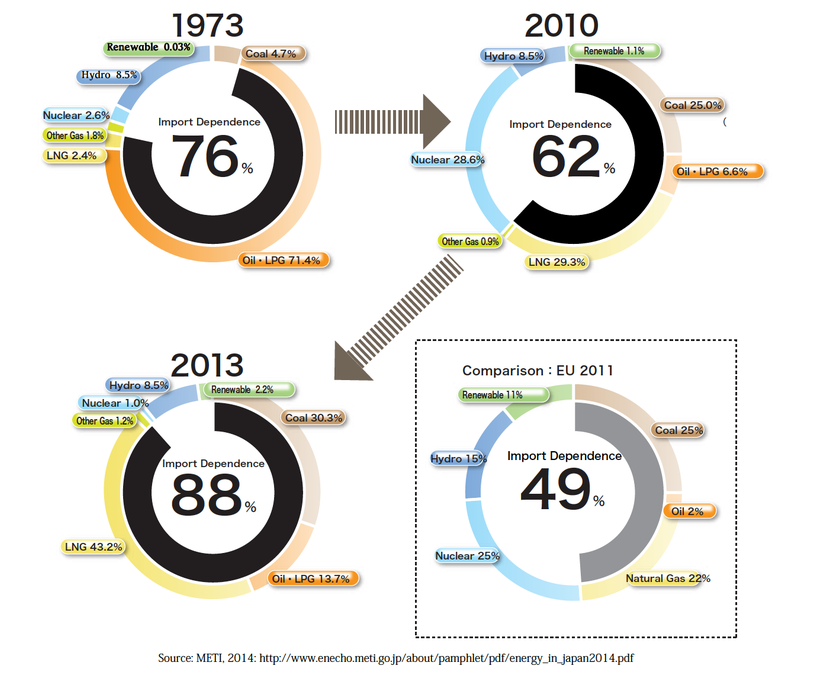

So consider where Japan is. The country has just adopted mid-term energy targets that few find credible. It has also done this in the midst of enormous uncertainty on conventional energy supplies, prices, geopolitics and other factors. It bears keeping in mind that Japan is not just the world’s fifth-largest power market, but also the world’s largest importer of LNG, the second largest importer of coal, and the third-largest net importer of oil and oil products.32 Figure 2 on “Changes in Japan’s Power Mix” shows that the country’s import dependence on conventional fuels to produce power greatly increased between 2010 to 2013, when nuclear’s share shrank and LNG’s role ballooned from 29.3 percent of power to 43.2 percent, coal increased from 25 percent to 30.3 percent, and oil and liquid petroleum gas (LPG) more than doubled from 6.6 to 13.7 percent. Virtually all of these fuels are imported, so Japan’s import dependence increased dramatically, from 62 percent in 2010 to 88 percent in 2013. The comparison with the average EU power mix in 2011 is striking, as the EU’s overall dependence on imports is 49 percent.

Figure 2 shows that Japan in 2013 was even more import dependent than it was in 1973. That was the year of the first oil shock, which is still such a benchmark for vulnerability among Japanese policymakers that – as noted earlier – the METI emphasizes it in its fiscal and regulatory planning for efficiency and conservation and indeed uses when it produces figures (figure 2 is a direct translation of METI’s work). Admittedly Japan’s power mix in 2013 was less dependent on a single energy source, in contrast to the over 70 percent dependence on oil and LPG in 1973. At the same time, the geopolitical, climate and other risks of using fossil fuels in the present far exceed those of 1973.

Indeed, it is hard to exaggerate the scale of contemporary risks. For example, the September 21, 2015 Financial Times warns that current low prices for oil have put as much as USD 1.5 trillion of investment in energy projects in question. This constriction in the infrastructure of supply brings profound risks of dramatic price escalations as early as 2017.33 And in spite of continuing optimism concerning unconventional oil and gas reserves, especially the US “shale revolution,” a growing number of objective and rigorously empirical studies of the actual resource base and costs of production suggest that shale’s important addition to the global supply portfolio is better measured in years than decades.34 Indeed, the shale boom was in large measure driven by a doubling of US high-yield “junk bond” debt to USD 2 trillion, a bubble that appears to be imploding.35 Meanwhile, demand for energy continues to grow: China’s gasoline consumption in July of 2015 was up 17 percent over the previous year.36 One respected expert’s extrapolation of present trends in oil warns that just China and India alone will be “theoretically consuming 100% of global net exports around the year 2032.”37

In short, 3-11 and all that has happened since has reduced nuclear to at best a minor role in Japan’s power mix. Certainly nuclear appears incapable of displacing much of Japan’s environmentally damaging, expensive and geopolitically risky reliance on fossil fuels in the power mix. So the real question for LDP policymakers is whether they will allow vested energy interests to dominate investment decisions and income streams in the country’s power economy, its most critical infrastructure. The energy vested interests’ performance during the 2030 “best mix” debate showed that unchecked, their self-interest would turn Japan into an energy- and climate-technology Galapagos while the rest of the world embraces renewable energy and efficiency. This argument is not wishful thinking: on October 2, 2015, the International Energy Agency (IEA) announced that “[r]enewable energy will represent the largest single source of electricity growth over the next five years, driven by falling costs and aggressive expansion in emerging economies.” The IEA believes the coming five years will see renewables provide two-thirds of net additions to global power systems, representing over 700 gigawatts or over twice Japan’s installed power capacity. This forecast suggests that by 2020 renewable power generation will be supplying a volume of electricity “higher than today’s combined electricity demand of China, India and Brazil.”38

The budget numbers reviewed above suggest that the LDP’s renewable-energy supporters are determined not to allow vested interests and incrementalism to ruin the country’s fortunes. They are using the Abe regime’s explicit commitment to maximize the share of renewables as an opportunity to use state finance to accelerate the diffusion of renewable energy and efficiency. But they are not doing this willy-nilly. It would seem that the Abe regime and Japan’s energy bureaucracy have also learned important lessons from various experiences, including the Board of Audit of Japan survey noted above. The survey assessed the return on directly subsidized renewable project spending. It found that 63.7% of total spending was devoted to solar, producing only 38.6% of total installed capacity. By contrast, a mere 0.8% of total subsidies spent on geothermal has resulted in projects that (once in operation) will represent 19.5% of installed capacity. For biomass, the return was not as powerful as geothermal. But even then, 25.3% of subsidy spending resulted in 17.6% of total installed capacity. And with both geothermal and biomass, the power output does not depend on the time of day or the weather.39

Balancing the Blend of Renewables

Hence, the LDP renewable energy initiatives also seek to balance the country’s portfolio of renewables. For example, one of the especially noteworthy items in the MoE’s programme request is a new initiative, in tandem with the METI, for a YEN 7 billion “Renewable Energy Electricity and Heat Autonomous Diffusion Promotion Works.” This collaborative item not only reflects increased inter-agency collaboration (on which, more below), but is also a very innovative programme for supporting the non-standard deployment of renewable-energy projects as well as incentivizing the exploration of local biomass, geothermal, ground-source heat and other heat-energy initiatives. It is aimed at fostering the diffusion of renewable power generation and heat-related projects that do not rely on the feed in tariff (FIT)40 system of incentivizing renewable deployments and do not require connection to the traditional power grid. The policy rationale is to use subsidies to encourage green-energy projects whose potential is significant, in terms of resource endowments, but have not yet developed to any significant extent for lack of the catalyzing intervention of fiscal incentives to encourage cooperation among local government, business and other actors.41

These projects will help relieve pressure on the FIT, whose costs are already up to about YEN 1 trillion in 2015, or roughly YEN 350/month per household, based on an average household power charge of YEN 7000. This burden is not enormous, but it is a significant increase over the 2012 cost of YEN 190 billion (YEN 87/month per household).42Measures that expand non-intermittent renewables while also not further burdening the FIT and extant transmission infrastructure make eminent sense at any time. But they are especially valuable when vested-energy interests are still keen to suppress the diffusion of distributed, renewable energy.

Another aim of such projects is to expand the local-government role in power and heat businesses. As the MoE’s Environmental White Paper of 2015 pointed out, in a detailed survey of the city of Minamata, local energy demand is roughly 8% of the local economy. The MoE underscores the fact that most of the local-area money spent on energy (power as well as fuels) flows to the regional power monopoly and other external suppliers, including overseas sources of fossil fuels.43 The MIC and other agencies have been collaborating to remedy this, taking advantage of the upcoming (April 2016) deregulation of Japan’s retail power markets as an opportunity to expand the local public corporations’ role in energy as well as otherwise maximize local returns from energy. They are well aware that the more local public corporations enter the power economy, the greater the access to finance for infrastructure, the more effective is lobbying pressure in the face of the power monopolies, and the more equitable the energy shift (since local public corporations represent the local community). The policy streams involved in this overall initiative are quite numerous, and come under such rubrics as “disaster-resilient community building,” “local revitalization,” “national resilience,” “distributed energy,” and several others.

Local Revitalization Via Energy

Indeed, while following Japan’s 2015 fiscal process as it related to energy projects, it proved useful to read an August 7, 2015 research report, titled (in Japanese) “Local Economic Revitalization Via the Comprehensive Use of Renewable Energy.” The report, by Fujitsu senior research analyst Watanabe Yuko, argues that Japan is in the midst of restructuring its policy support for renewable energy. Watanabe detailed the problems ensuing from the fact that, in the four years since 3-11, Japan’s deployment of renewable energy has focused almost entirely on solar power. The FIT incentive system that was adopted in the wake of 3-11 and came into effect from July 1 of 2012 has – as of the end of March 2015 – subsidized the deployment of 8263 kW of solar power generating capacity. This is about 95% of total renewable power generation capacity supported by the FIT. Wind, geothermal, biomass and other forms of renewable power generation are supported by the FIT, but the highest level of support is given to solar power. In addition, solar power is relatively quick to install. The result is that solar projects have received the bulk of private-sector investor attention.

However, from 2015, policy changes saw the FIT’s special tax measures eliminated, together with deep cuts in the support for solar power. Subsidization rates for solar power projects above 10 kW dropped from YEN 40 per kilowatt in July 2012 to YEN 27 per kilowatt in July 2015. In addition, from mid-2014 the power monopolies argued that they were facing grid stability problems, and began en masse to reject applications to the power grid.44 In consequence, the FIT power purchase guarantee was amended to allow extended periods during which the utilities may, pleading capacity limits, refuse the purchase of FIT-sponsored renewable energy. Watanabe’s analysis suggests that the increased business risk is likely to strongly undermine the incentives for installing large-scale solar power.

Watanabe’s report also points out that significant endowments of renewable energy resources are distributed among local areas. Solar and wind are very attractive to private-sector businesses because installation times are short and thus it is possible to earn revenues from the FIT quickly. At the same time, the initial investment costs of these installations are high and it is not easy to arrange the financing. Therefore, the projects tend to be initiated by large businesses. As a result, local areas have limited capacity to participate in planning projects and to derive returns from them. Local governments extend various tax exemptions and other special measures to attract private-sector renewable projects, but the local area’s direct economic benefit is in fact rather small.

By contrast, biomass has a very strongeconomic impact on the local area. Local sourcing of the raw materials, such as wood thinnings, delivers a stimulus to the local farming and forestry industries. Watanabe points out that Japan’s potential for biomass is very high. The country has roughly 6 billion cubic metres of forestry resources, among the highest in the world. It also has ample supplies of biogas throughout the country, via waste products from livestock as well as leftover food resources and the like. In addition, biomass projects are more efficient and make better use of otherwise wasted heat (from combustion) the more localized they are.

Admittedly, developing biomass projects takes time as well as significant investment. On the other hand, because they are based on local resources and the demand for the energy generated is permanent, returns are not subject to the vagaries of the economic cycle and prices of imported energy. In addition, and probably most important, the local area itself can be the central player in planning.

Watanabe echoes many of Japan’s energy technocrats in arguing that key to the local area’s success is selecting renewable energy projects most appropriate for local development and undertaking them through public agency.45 She argues that those that can be undertaken quickly should be. On the basis of such projects, a portion of the revenues derived by the FIT can be used as a fund to finance future energy investments, thus stimulating local industrial development. Conceding that these projects are small-scale, she adds that they are also potentially numerous and therefore in the aggregate can deliver a strong benefit to local economic development. Watanabe stresses that it is most important to look beyond the immediate economic return from the FIT and emphasize the long-term benefits to the local community’s economic revitalization. As the focus broadens beyond solar to the full range of renewable energy options, comprehensive deployment of renewable energy projects can be used to foster the sustainable development of local areas.46

As of August 26, 2015, the LDP Policy Affairs Research Council (PARC) made this policy approach official. The LDP “Committee on Expanding the Diffusion of Renewable Energy” drafted a proposal for “A Strategy of Local Revitalization Via Renewable Energy: Local Abenomics.” The Committee is chaired by the LDP Dietmember (and former MIC Vice-Minister) Shibayama Masahiko. Its proposal is quite detailed and emphasizes the value of the broad portfolio of renewable options (including the gamut of heat sources) to local revitalization at a time when Japan’s YEN 18 trillion power market (in 2013) is being deregulated. The submission emphasizes that even the official 2030 power-mix figure of 24 percent renewables equates to a YEN 4.3 trillion business, while 30 percent is YEN 5.4 trillion. The PARC approved the submission on August the 25th and then submitted it to Chief Cabinet Secretary Suga as well as the central agencies of government.

Building Local Power

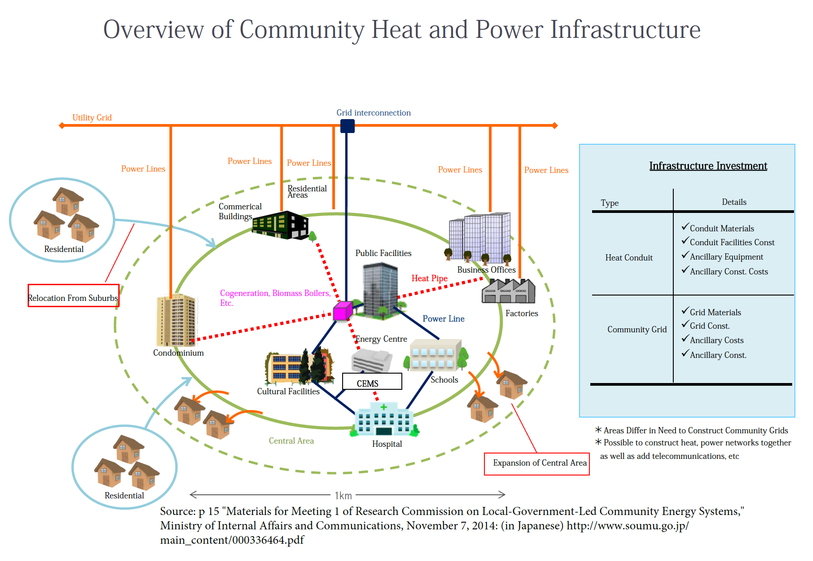

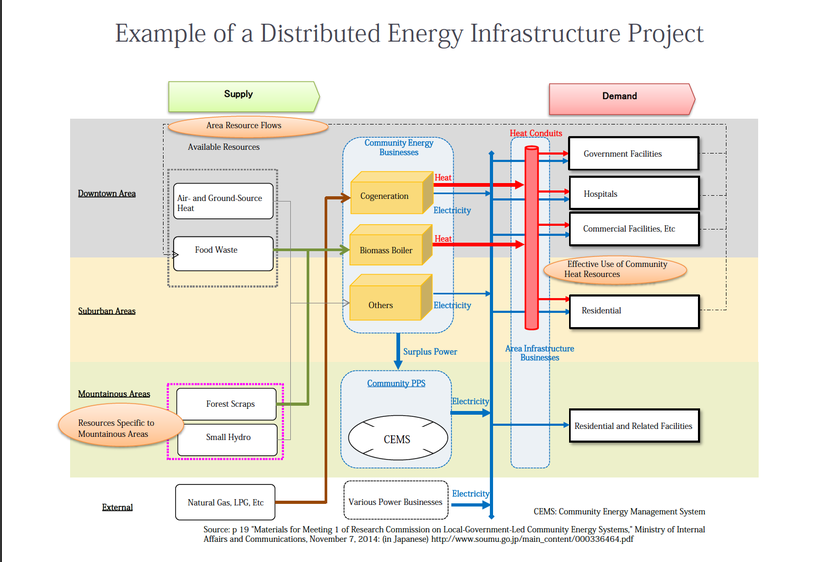

Moreover, Japan is already making headway on setting up local energy businesses. In 2013, the above-noted MIC program for district heating systems and other decentralized energy infrastructure selected 31 local communities for a survey of their energy potential. In 2014, 14 of these communities that had been deemed to have a high potential for decentralized energy development were selected. In both cases, the emphasis was on developing energy businesses thatfocus on the community’s internal demand for power and heat as the focus of local renewable energy projects. Another aim is to develop highly autonomous energy systems that are robust in the face of disasters and other potential disruptions to the conventional grid. Figure 3 on the “Overview of Community Heat and Power Infrastructure” illustrates the generalized model that MIC seeks to deploy in Japan’s local communities. As the figure shows, the systems include smart power and heat grids linking local community government facilities, businesses, and residences.

Figure 4 displays an “Example of a Distributed Energy Project,” showing the supply and demand parameters that the MIC-led committee aims at for local areas. The itemization of supply factors shows that energy inputs are diverse as well as geographically dispersed, spreading the economic opportunity across the community and out into the rural areas. As envisioned by the MIC, the local energy projects have their head offices situated in the local community and focus on developing local energy resources as well as local human resources. They also pull the investment from within the community as well as outside, and therefore make a significant economic contribution to the local area.

In April of 2015, the Japan Research Institute’s Takiguchi Shinichiro reported in detail on the MIC’s initiatives. He noted that assessments of the benefits from this kind of energy development were based on Japan’s roughly 200,000-person population centers in all regions of the country (there are about 200 local areas nationwide with populations between 100,000 and 300,000 residents). One that is undertaking this kind of energy program is the city of Tottori in TottoriPrefecture. Takiguchi’s paper analyzed in detail the extent to which the benefits from this project extend beyond the city and throughout the prefecture.

The calculation in Takiguchi’s paper assume (based on the German model of “stadtwerke” local public corporations) the local energy businesses to have a 20% share of electricity sales, with 40,000 residents (about 20% of all residents) serviced by the energy firm in 2030. In addition, public facilities and participating businesses are assumed to represent about 10,000 kW of demand. The result is that by 2030 power sales reach YEN 2 billion, and over the 15-year period 2016 to 2030 represent an average of YEN 1 billion per year. Moreover, assuming that 80% of the power is produced through cogeneration with a 50% efficiency of heat to power, heat sales over the 15-year period from 2016 to 2030 are an annual YEN 370 million.

In other words, even under conservative estimates, a locally established energy business in a community of roughly 200,000 residents, one that installs both heat and power infrastructure, could provide an annual direct economic benefit of YEN 1.4 billion to the community. Infrastructure investment – spending on biomass, small hydro, cogeneration and other infrastructure – both within the city as well as in the surrounding area would amount to about YEN 500 million. In addition to the cogeneration of heat and power, investment in energy efficiency equipment to encourage the efficient use of energy is estimated to be roughly YEN 100 million. The above assumptions lead to a total direct economic benefit of about YEN 1.9 billion.

In other words, even under conservative estimates, a locally established energy business in a community of roughly 200,000 residents, one that installs both heat and power infrastructure, could provide an annual direct economic benefit of YEN 1.4 billion to the community. Infrastructure investment – spending on biomass, small hydro, cogeneration and other infrastructure – both within the city as well as in the surrounding area would amount to about YEN 500 million. In addition to the cogeneration of heat and power, investment in energy efficiency equipment to encourage the efficient use of energy is estimated to be roughly YEN 100 million. The above assumptions lead to a total direct economic benefit of about YEN 1.9 billion.

This direct economic benefit leads to a YEN 600 million result in primary stimulus effect (the inducement of production internal to the prefecture). For example, substitution of locally sourced forest biomass for imported fossil fuel is a positive effect for the forestry industry. (This effect has been calculated on the basis of using biomass for 12% of fuel, which is a conservative assumption.) In addition, the local energy firm’s investments in power facilities and other construction also produce a stimulus effect. This economic stimulus is assumed to provide a YEN 400 million secondary stimulus effect to service industries (a production stimulus effect within the prefecture). Added together, the direct effect as well as the primary and secondary ripple effects are expected to amount toYEN 3 billion per year, or YEN 43 billion over 15 years, for Tottori City and its neighboring local communities.

In terms of employment effects, the local energy firm directly employs about 80 people, with roughly 50 people employed through primary ripple effects and a further 30 employed through secondary ripple effects in the service sector. This leads to a total of 160 persons employed, and over 15 years of employment for just under 2500 people, a considerable employment benefit for the locality.

A further special feature of the local energy business is that these effects extend over the long term. This is quite different from the short-term economic stimulus effects of public works, and is yet another reason local energy is of great interest to the LDP and bureaucracy. Energy infrastructure delivers a continuing benefit to the local community. In addition, if forest biomass is used as fuel, the income is recycled through the forest industry and leads to a revival of the forestry sector. Since Japan is roughly two-thirds forested, many local areas can reasonably expect benefits from this kind of program.47

And as already noted, the potential portfolio of renewables is much larger than biomass from forestry or farming. The diversity of Japan’s renewable-energy endowments exceeds that of most countries, as Amory Lovins and other experts highlight. Lovins and his researchers at the Rocky Mountain Institute combined assessments of all renewable resources, including the intensity of sunlight, average wind speeds, geothermal potential, available biomass, and other pertinent elements. They converted the totals into one common comparison of the annual number of gigajoules of renewable energy potential per square meter (GJ/y/m2). The result shows that Japan is a global leader: Japan’s endowment of 63.1 GJ/y/m2 is far more plentiful than the18.8 in China, India’s 45.5, the EU’s 20.4, North America’s 30.4, and South America’s 28.1.48

What has been lacking is robust agency to exploit these resources. Alienated from the state, and with no serious party vehicle, the Japanese liberal-left idealizes people-power initiatives that lack the deep pockets and organizational discipline to build and maintain large-scale energy infrastructure. And private business evidently finds it difficult to overcome the regulatory and other strategies deployed by the power monopolies, which exacerbate business risk. Moreover, private businesses are not incentivized to act on behalf of the public interest. It is telling in this respect that Softbank, once seen as the spearhead agent for eviscerating the bloated monopolies of Tepco and the rest, is in fact now collaborating with Tepco.49

Certainly there are new energy firms springing up. But they are overwhelmingly devoted to solar and too small to play a powerful role in investment as well as push back against the various stratagems of vested energy interests. An August 27, 2015 news release from Tokyo Shoko Research (TSR) indicates that between January and December 2014 there were 3,283 new firms created in the electric power industry. This represented an increase of 180 percent over the previous year, and nearly 50 times the 66 new firms in 2011. Yet the TSR survey also shows that 2536 (77.2 percent) of these new firms were in solar. Much smaller numbers were involved in other areas of renewable energy. Wind energy saw only 251 (7.6 percent) new firms. Small hydro attracted only 122 (3.7 percent) new business starts. And only 84 new firms (2.5 percent) were in biomass and other bio-related renewable energy business areas.

And most were far too small to be effective. There were 1,805 firms capitalized at less than YEN 1 million, or 54.9% of the total number of new starts. Only 232 firms (7 percent) were capitalized at over YEN 10 million, and just 65 (1.9 percent) with over YEN 100 million. The report points out that this predominance of very small, scantily capitalized firms reflects the low barriers to entry.50

There will clearly be a lot of destruction of power businesses in Japan, in the wake of deregulation. Whether it will be a Schumpeterian, creative destruction is an open question. So the LDP’s effort to make the community the engine of deploying renewable energy, by putting fiscal and institutional resources into the hands of local governments and their public corporations, is very promising indeed.

The MIC and the Energy Task Force

The institutional changes, and their implications, do not stop there. In her September 4, 2015 policy statement, noted earlier, MIC Minister Takaichi pointed out that the ministry is assisting local governments in developing master plans. She described them as templates through which communities can not only make use of their respective energy resource endowments, but also take a leadership role in working with regional financial institutions and other actors in developing distributed energy infrastructure. As pointed out above, Takaichi also detailed that her ministry’s survey of its and other central agencies’ (METI, MAFF, and MoE) subsidy programs for the diffusion of renewable energy found that there are 31 separate programmes that totaled YEN 102.7 billion in fiscal 2015 on top of YEN 126 billion in the fiscal 2014 supplementary budget.

What is particularly important for this section on institutional changes is that Takaichi also announced new collaborative measures: in order to further the efficient deployment of energy across the regions, the relevant central agencies have set up a task force and have agreed to pool their resources in order to focus most effectively on achieving the desired result of energy deployment. The task force is composed of the METI’s natural resources and energy agency, the Forestry Agency, the MoE, and the MIC. She also stressed that efforts will be made in conjunction with local financial institutions and business groups to set up local energy business platforms at the prefectural level. She describes this coordination among central agencies as maximizing the prospects for local areas. The aim is to help local communities seize the opportunity afforded by the April, 2016 liberalization of power markets, revitalizing local economies as quickly and as maximally as possible. Takaichi refers to this MIC-centred initiative as a new element of “local Abenomics, echoing the LDP Committee on Expanding the Diffusion of Renewable Energy’s “Strategy of Local Revitalization Via Renewable Energy: Local Abenomics.”51

National Resilience and Distributed Energy

As noted earlier, the Abe government has initiated a variety of policy streams, including “disaster-resilient community building,” “local revitalization,” “national resilience,” “distributed energy,” and several others. These programmes have received virtually no attention from enthusiasts of Abenomics, from Japanese liberal-left critics of the Abe, or virtually all other actors. Outside of specialist analyses that do understand the significance of these projects, and how they are coalescing on building robust smart communities, the reigning assumption appears to be that they are simply wasteful porkbarrel spending.

Yet the Abe regime is quite serious about “national resilience.” From 2012, it engineered several reversals of DPJ-era decentralization of intergovernmental finance, in order to put subsidies back into the hands of MLIT and other agencies. The rational was the need to bolster the nation in the face of climate and other threats. The LDP has since evolved a well-funded national resilience strategy that incorporates renewable energy and smart grids as a means of ensuring power is available in disasters.52

The Japanese Cabinet office published the budget requests for national resilience-related expenditures for fiscal 2016 during the month of August. The total fiscal request for 2016 isa little over YEN 4.53 trillion, which represents a substantial increase over the previous year’s expenditure of slightly more than YEN 3.8 trillion. The amount devoted to public works in the fiscal 2016 requests is just under YEN 3.77 trillion, again a substantial increase over the previous year’s YEN 3.15 trillion expenditure in public works.

The MLIT is the single largest recipient agencyin the budget allocation, as its appropriation is slated to total just under YEN 3.36 trillion, a 120% increase over the previous year’s figure of just under YEN 2.8 trillion. The available documents do not yet break down the MLIT expenditures into specific categories complete with numbers, the description of where the spending is directed highlights first and foremost measures to deal with the increasing threat of floods and landslides due to climate change and other factors. These measures to be taken in the face of flood and landslide threats from climate change are itemized as YEN 788.2 billion, a substantial increase over the previous year’s allocation of YEN 664.5 billion.

It is not only MLIT that is to receive allocations for bolstering the nation’s communities and infrastructure in the face of natural disasters and other threats. Another significant recipient of funding is the MAFF. This ministry’s appropriations are second to the MLIT, and total YEN 545.8 billion for 2016, a 121% increase over the previous year’s allocation of just over YEN 450 billion. Some of the projects to which the MAFF’s funding is devoted include the production of “hazard maps” around ponds and reservoirs that are subject to flooding. The budget for this activity is the lion’s share of YEN 179 billion, which in itself is a significant increase over the previous year’s YEN 139.5 billion (in this case, the entire budget is not devoted to this particular allocation. The Japanese usage is “uchisuu,” which means “inclusive of” rather than a total per se). Other expenditures included in the MAFF’s budget is bolstering of afforestation to reduce disaster threats. One example is the strengthening of seaside forests to deal with such natural disaster threats as tsunami. This expenditure totals YEN 66 billion (inclusive), versus the 2015 total of YEN 55.8 billion (again, inclusive).

An important expenditure category where both the MLIT and MAFF have significant expenditures is in the construction of roads and facilities to be used in the event of evacuation. The MAFF budget for this particular set of activities totals YEN 355.6 billion (inclusive), versus the previous year’s expenditure total of YEN 292.5 billion (again inclusive). The MLIT’s expenditure for roads and facilities to be used in the event of evacuation totals just under YEN 1.265 trillion (inclusive) for 2016, versus just over YEN 1.08 trillion (inclusive) for 2015.

Again, an important feature of the national resilience program is its progressive integration with programs for local revitalization, distributed energy, and the like. The minister for “Building National Resilience,” Yamatani Eriko, made this link explicit in an August 12, 2015 interview in the SME-oriented magazine HanjoHanjo.53

Conclusions

The evidence indicates that core elements of Abe’s Liberal Democratic Party (LDP) are increasingly enthusiastic about the potential for renewable energy and efficiency. After the March 11, 2011 (3-11) natural and nuclear disasters in the Tohoku region made “Fukushima” as notorious as “Chernobyl,” the pro-renewable faction’s numbers and influence expanded. With the exception of such LDP Dietmembers as Kono Taro,54 they are not opposed to nuclear power, which has rendered them politically invisible in the deeply polarized “nuclear vs solar” post-3-11 debate over Japanese energy policy and politics. But they are now quite openly using the power of the state against vested energy interests and on behalf of local governments and their residents.

Japan’s evolving strategy seems a pragmatic response to extreme import dependence on energy (especially fossil fuels), vulnerability in the face of extreme weather and natural disasters, and the desperation of Abenomics. In addition, the powerful discourse of “disaster resilience” has presumably helped sell renewables and their associated networks (local grids, district heating, etc) within the conservative LDP. If so, it may also be helping to override opposition from the monopolies, the nuclear village, and other interests potentially threatened by the shift to local agency. In any event, it is certainly instructive, and encouraging, to watch Abenomics be driven in a potentially sustainable direction.

III. References

Related article,

- Eric Johnston,Kyoto forum’s leaders warm up to renewables.

Notes

1 See Aaron Sheldrick and Issei Kato “Japan restarts reactor in test of Abe’s nuclear policy,” Reuters, August 11, 2015.

2 See, for example Japan Renewable Energy Federation Executive Director Ohno Teruyuki (in Japanese) “Coal-Fired Generation New Build is a Risky Business that Runs Contrary to International Promises,” JREF Natural Energy Update, June 11, 2015.

3 Note the comments from Japan’s Kiko Network and other observers cited in David McNeill “Japan’s emissions have soared since Fukushima nuclear disaster,” The Irish Times, September 21, 2015.

4 On this, see Steve Hanley “Japan Pushes Forward With Hydrogen Society Ahead Of Olympics,” Gas2, September 18, 2015.

5 See (in Japanese) “Ministry of Environment 2016 budget for energy-related spending up 62%, for renewable and efficiency projects in local areas,” Kankyou Bijinesu Onrain, September 2, 2015.

6 See (in Japanese) “Initial budget requests at highest even YEN 102 trillion, with special account of YEN 3.8 trillion,” Asahi Shimbun, September 5, 2015.

7 See (in Japanese) “Japan Iron and Steel Federation presents requests for reductions in corporate tax burden in 2016 tax reform,”Nikkan Kougyou Shimbun, September 17, 2015.

8 On the taxes, and Japan’s green taxes in comparative perspective, see (in Japanese) Motoki Yuko and Naitou Aya, “Recent Developments in Japan and European Greening of the Tax System,” Mizuho Information Research Report Vol 9, 2015.

9 A thorough discussion of METI’s spending plans and institutional changes to enhance their effectiveness can be found (in Japanese) in Yoshioka Hi, “Subsidies for efficiency to YEN 126 billion: METI resolved to triple them,” Nikkei Ecology,October 2015.

10 On the use of renewable power to generate hydrogen gas, see the 4-minute video at “Power to Gas,” Deutsche Welle, June 28, 2015.

11 See (in Japanese) Ishida Masaya, “METI’s fiscal requests for 2016 centre on efficiency, with spending on energy overall at YEN 975.7 billion,” Smart Japan, September 1, 2015. The detailed METI request (in Japanese) is available here.

12 The B-DASH project is described (in Japanese) here.

13 On this, see (in Japanese) “Using the 15 million households’ worth of heat energy buried in the cities,” Nikkei Smart City Consortium, January 30, 2015

14 See the itemization (in Japanese) on p. 9 of the material studied at the May 11, 2015 meeting MIC research committee on Local-Government-Led Local Energy Systems

15 See (in Japanese) “A sewerage heat-recovery test project with Sekisui Chemicals: Toyota City’s future-challenge city partnership is concluded,” Toyota City News Release, August 27, 2015

16 See (in Japanese) “The 2016 solar subsidies are for self-consumption and zero-energy homes? We explain the METI and MLIT budget requests,” Solar Partners, September 11, 2015

17 On these, see Andrew DeWit, “Japan’s Resilient, Decarbonizing and Democratic Smart Communities”, The Asia-Pacific Journal, Vol. 12, Issue 50, No. 3, December 15, 2014

18 On this, see (in Japanese) p. 3 of “Fiscal 2016 MIC ICT-related major projects,” Ministry of Internal Affairs and Communications, Japan, August, 2015

19 On this, see (in Japanese) the transcript of the September 4, 2015 press conference with MIC Minister Takaichi Sanae

20 On this, see Andrew DeWit and Iida Tetsunari, The “Power Elite” and Environmental-Energy Policy in Japan, The Asia-Pacific Journal Vol 9, Issue 4 No 4, January 24, 2011

21 On this, see (in Japanese) “The LDP proceeds towards the Abe government with a budget revision that increases public works,”Yomiuri Shimbun, December 14, 2012

22 See “Japan plans more renewables, less nuclear,” April 29, 2015

23 The comment is by Arakawa Chuichi, University of Tokyo professor of engineering, and is cited in Martin Foster, “Best-Mix a Misnomer for Japanese Energy Future,” The Journal, June 2015

24 On this, see BMI “Japan Renewable Report,” Business Monitor International, October 1, 2015.

25 Alexander Martin, “Japan Restarts Nuclear Power After Two-Year Shutdown,” Wall Street Journal, August 11, 2015

26 See Stephan Lippert, “Energy: Uncertainty over nuclear reactors in Japan’s 15-year energy strategy,” United Europe, July 7, 2015

27 See Jason Furman and Jim Stock, “New Report: The All-of-the-Above Energy Strategy as a Path to Sustainable Economic Growth,”The White House, United States, May 29, 2014

28 An English-language summary of the study and its background is available at “MOE Forecasts 33% Renewables by 2030, Nuclear Plants Not Prerequisite for Energy Mix,” Japan for Sustainability, July 3, 2015

29 See (in Japanese) “Concerning the Target for Renewable Energy,” Kuroiwa Yuuji, Governor of Kanagawa Prefecture, May 13, 2015

30 See (in Japanese) ISEP, “Towards an Energy Shift in Line With Historic Trends: A Policy Submission on the Energy Mix,” Institute for Sustainable Energy Policies, April 28, 2015

31 See, for example, Kikkawa Takeo (in Japanese) “The Government’s Calculations and the 2030 Level of Nuclear Power,” Politas, May 23, 2015

32 See “Japan: International energy data and analysis,” Energy Information Agency, January 30, 2015

33 See Christopher Adams, “Plunging oil prices put question mark over $1.5tn of projects,” Financial Times, September 21, 2015

34 See for example the analysis by Art Berman and Ray Leonard, “Years Not Decades: Proven Reserves and the Shale Revolution,”Presentation to Houston Geological Society Houston, Texas, February 23, 2015

35 See Jesse Colombo, “Keep your eyes on this junk bond chart,” Forbes, September 30, 2015

36 See “China’s Oil Refining Climbs to Satisfy Robust Gasoline Demand,” Bloomberg News, September 13, 2015

37 The calculation can be found in the transcript of a September 13, 2015 interview of Jeffrey Brown, the originator of the “Land Export Model” in oil studies. See Adam Taggart, “Jeffrey Brown: To Understand The Oil Story, You Need To Understand Exports,” September 13, 2015

38 On this, see “Renewables to lead world power market growth to 2020,” International Energy Agency, October 2, 2015

39 See (in Japanese) “Concerning the Development of Projects in Renewable Energy,” Board of Audit of Japan, October 2014

40 On the FIT, see Andrew DeWit, “A New Japanese Miracle? Its Hamstrung Feed-in Tariff Actually Works”, The Asia-Pacific Journal, Vol. 12, Issue 38, No. 2, September 22, 2014

41 A Japanese-language description of the programme is available here.

42 See (in Japanese) p. 14 of “Energy, Environment and SME-related materials,” Budget Bureau, Ministry of Finance, Japan, November 7, 2014

43 See (in Japanese) “Environment White Paper 2015,” MoE, , pp. 53-5

44 See James Topham, “Japan’s Kyushu Electric shuts off renewable suppliers from grid,” Reuters, September 25, 2015

45 See Andrew DeWit, “Japan’s Radical Energy Technocrats: Structural Reform Through Smart Communities, the Feed-in Tariff and Japanese-Style ‘Stadtwerke'”, The Asia-Pacific Journal, Vol. 12, Issue 48, No. 2, December 1, 2014

46 Watanabe Yuko (in Japanese), “Local Economic Revitalization Via the Comprehensive Use of Renewable Energy,” Fujitsu Research Institute, August 7, 2015

47 See (in Japanese) Takiguchi Shinichiro, “Local Energy Works Responding to Local Revitalization and Energy Deregulation,” Japan Research Institute, April 2015

48 Cited in Andrew DeWit, “A New Japanese Miracle? Its Hamstrung Feed-in Tariff Actually Works”, The Asia-Pacific Journal, Vol. 12, Issue 38, No. 2, September 22, 2014

49 See (in Japanese) Weekly Daimond Editors, “Tepco and Softbank to set up a new firm in the small-retail power sector,” Weekly Daimond, May 11, 2015

50 See (in Japanese) “The 2014 Survey of new firms in the power sector,” Tokyo Shoko Research, August 27, 2015

51 On this, see (in Japanese) the transcript of the September 4, 2015 press conference with MIC Minister Takaichi Sanae

52 Andrew DeWit, “Japan’s “National Resilience Plan”: Its Promise and Perils in the Wake of the Election”, The Asia-Pacific Journal, Vol. 12, Issue 51, No. 1, December 22, 2014

53 See (in Japanese) “Interviewing National Resilience Minister Yamatani: Bolstering the Government’s Policies for National Lands Management and Local Revitalization,” HanjoHanjo, August 12, 2015

54 See for example, Cheng Herng Shinn, “Taro Kono, LDP Rebel with a Cause,” Wall Street Journal, August 12, 2011