by Chen Weidong, Jiang Xi-Min and Zhou Xiaolai

11 February 2014

This Special Report was originally published as a Working Paper 2013-6 by the Center for Energy, Governance and Security at Hanyang university, Seoul.

I. Introduction

The energy sector of China is facing three challenges. This includes ensuring energy supply, reducing carbon emission, and furthering international cooperation. Advancing the E&P of natural gas is the most realistic and effective answer to the challenges, as it is necessary to smash the trammels of Chinese current oil & gas industrial system and pursue courageous reforms. China has become a net oil & gas importer over the years. Even worse, last year she joined the net coal importers. It is no doubt that China will depend more and more on importing the three main fossil energies as she is taking big steps towards a “whole well-off society‟ and her energy consumption is evolving from “for basic needs‟ to “for comforts‟. The advancement of society constantly increases the per capita energy.

Chen Wei-Dong is a senior energy researcher for the China National Offshore Oil Corporations (CNOOC). Jiang Xi-Min is the vice president of the vice president of the Energy Research Institute. Zhou Xiaolai is the president of the China Energy Forum (ECF).

The views expressed in this report do not necessarily reflect the official policy or position of the Nautilus Institute. Readers should note that Nautilus seeks a diversity of views and opinions on significant topics in order to identify common ground.

II. Special Report by Chen Weidong, Jiang Xi-Min and Zhou Xiaolai

China’s Shale Gas: Current Perspectives

The energy sector of China is facing three challenges. This includes ensuring energy supply, reducing carbon emission, and furthering international cooperation. Advancing the E&P of natural gas is the most realistic and effective answer to the challenges, as it is necessary to smash the trammels of Chinese current oil & gas industrial system and pursue courageous reforms.

China has become a net oil & gas importer over the years. Even worse, last year she joined the net coal importers. It is no doubt that China will depend more and more on importing the three main fossil energies as she is taking big steps towards a ‘whole well-off society’ and her energy consumption is evolving from ‘for basic needs’ to ‘for comforts’. The advancement of society constantly increases the per capita energy.

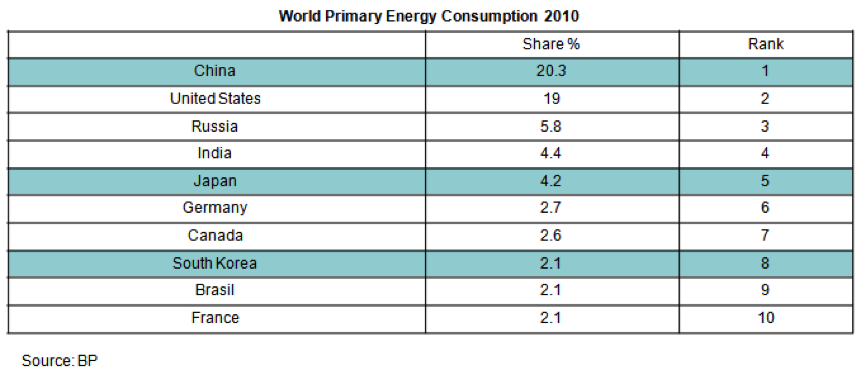

Last year, China’s energy consumption exceeded more than 2 billion tons of standard oil equivalent, accounting for about 20% of the world total. The USA consumed roughly the same amount, but with less dependence on imported oil & gas than before. The country’s consumption curve has been running slightly downstream from the peak in recent years.

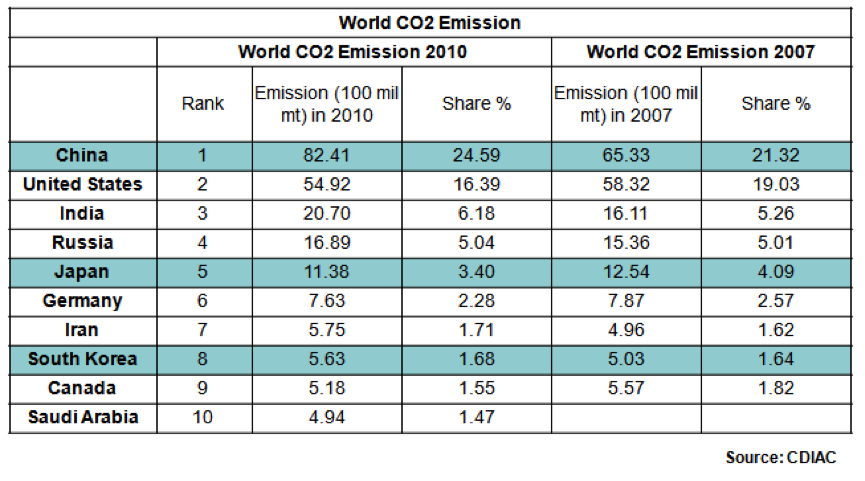

Although the two giants got to deuce on the total energy consumption race, China is troubled by more carbon emissions than the opponent. China is the world’s largest greenhouse gas emitter. She was used to hiding behind the USA in order not to be the first to bear the brunt, but now she has to be. Since the past few years, China has become the focus of attention in international climate-related conferences.

In the Chinese primary energy consumption structure, coal accounts for as high as 70%, oil 18%, while the third largest fossil energy, also being the lowest carbon energy–– natural gas, only accounts for 4%. By contrast, in 2010, the set of shares in the world was 29%, 24%, 33%, and 32%,24%, 29% in the USA. The total share of fossil energy reaches 92% in China, compared to 85% in the USA, and the world average of 86%. Therefore, China is leading a ‘high carbon economy’ in the world.

Statistics show that to get the same calorific value, if the amount of CO2 emission by natural gas is standardized to be 1, oil must be 1.5 and coal, 2. Simply by counting and combining with the set of shares of the three fossil energies, the CO2 emissions by China and the USA could be 171 (2 × 70 + 1.5 × 18+1 × 4) and 131.5 (2 × 32 + 1.5 × 29 + 1 × 24), respectively. That is to say, though China and the USA consume the same amount of energy, China emits the CO2 30% more than the USA. Using the same calculation method, if China consumes 10% less of coal, which is replaced with natural gas, then the CO2 emission will be 6% less. Taken into account the potential technical progress, China can keep economic growth and improve people’s living quality by stabilizing CO2 emission, potentially even emitting less.

Unconventional natural gas in China

In fact, the increase of the proportion of natural gas in the primary energy consumption structure has already achieved consensus in China. The question now is how. Two approaches can be applied. One is to raise the domestic production; the other is to import more.

As for the first approach, conventional and unconventional natural gas can be considered respectively. Producing more conventional natural gas depends firstly on the abundance and availability of resources, and secondly on investment and infrastructure. Both cannot give producers confidence in the growth of Chinese domestic gas production.

Unconventional natural gas does not strengthen confidence either. In the 1990s, the central government had great zest in exploiting coalbed methane (CBM). Drawing upon the experience of granting exclusive franchise right to CNOOC to exploit and produce oil & gas in the mode of international cooperation in China’s sea areas (in the 1980s), the CUCBM was established in 1996 and granted similar rights of coalbed gas E&P. It is hard to find applauding results of CUCBM operation during the 15 years. Foreign investment has been in short and has been far from being effectively used. The equity gas occupied by foreign investors is still very limited in quantity. Meanwhile, domestic investment has been restrained by regulations. As consequence, up to last year, Chinese domestic coal bed gas production was less than 2 billion m3 per year, a big gap to the target – 10 billion m3 per year – set in the 11th five-year-plan. By contrast, in 2010, the coalbed methane production in the USA was 50 billion m3, accounting for 8% of the country’s gas production. China is not in short of coalbed gas reserve. The necessary technologies, techniques and skills for coalbed gas E&P are not too hard to master for Chinese personnel. Why is the result of coalbed gas E&P not optimistic in China? Institutional restraints should be criticized in terms of the mineral rights – the right of exploration and the right of exploitation – and the permission regulations.

The recent Shale Gas Revolution again spurs the Chinese government and investors to return to the unconventional natural gas play. Generally speaking, the investment and operation mechanisms for shale gas and coalbed gas are similar. More importantly, China is as rich in shale gas endowment as in coalbed gas.

Unconventional natural gas has a fundamental difference from conventional natural gas: after the migration and accumulation processes, conventional natural gas is finally preserved in traps with high porosity and permeability, making the resource abundance in per unit volume is high. Unconventional natural gas, like shale gas and coalbed gas, is preserved in the source rock, e.g. shale or coal. As the source rock is very low in porosity and permeability, gas cannot be migrated or assembled but only can be attached or isolated in the source rock. Hence, resource abundance is low. However, source rocks are widespread and large in volume in the earth. It is easy to imagine how big the unconventional natural gas resource is.

The geological characteristics of Shale gas decide its E&P model, which is not the same to that of conventional natural gas at all. For oil companies, exploration risk is very high. Significant investment in exploration is easy to sink with regard to the low success rate. Once a large conventional oil & gas field (bonanza) is found, it may keep producing for several decades, like a ‘real money-spinner’. High input, high risk, and high profit is a basic feature of conventional oil & gas E&P. While considering shale gas E&P, areas of higher yields and areas where declining rate of production well is slower are called ‘sweet spots’, not bonanza or money-spinner. The practices in the USA show that the production of shale gas well declines very quickly, a large part of production wells remains only 10% of the peak capacity two years later. True, the wells can be maintained to produce for some more years, but the only way to maintain the production capacity is to keep drilling. The number of wells matter. For example, in Barnett (USA), there are about 200 rigs drilling tens of thousands of well a year.

Exploration, development, and production are distinct stages for conventional natural gas exploitation, but less so for the unconventional. Moreover, the ODP report for a conventional natural gas field should be ready before production begins, while it is not the case for the unconventional. In some sense, the shale gas exploitation seems like the operation of manufacturing company, rather than of the traditional oil company. This might explain why in the USA, thousands of small and middle enterprises promoted the Shale Gas Revolution while the oil giants like ExxonMobil, Chevron and ConocoPhillips, initially did not join the ‘revolutionary army’.

The shale gas has been exploited in the USA for more than 30 years. Practices help form the investment management mode and scale up the industry. It is then when the oil giants enter the industry on the way of generous M&A and, unintentionally or intentionally,go back to their homeland.

There must be economic laws and rules for the occurrence and development of an industry, which cannot be completely replaced with the government planning. True, ‘the visible hand’ (i.e. the government intervention) may accelerate the industrial development through some kinds of support. However, it is difficult to say that ‘the visible hand’ always does ‘good’. Negative effects are also visible. The failure of developing Chinese coalbed gas and the success of the American Shale Gas Revolution are both valuable references for China to innovate institutions and regulations in order to promote the emerging shale gas E&P on the mainland.

Opening up helps import more

In addition to the domestic E&P, natural gas import will also do China a great favor. Removing the current institutional restraints is also necessary. China’s energy sector, especially the oil & gas industry, went on a very unique path in building a petroleum industry system for the past 60 years. Independence and autonomy, self-reliance, hard work, and self-sufficiency are the soul of the system. The Spirit of Daqing and the Spirit of Iron Man both well illustrated the soul in the 1960s and 70s. When People’s Republic state was founded, China totally depended on imported oil and had almost nothing in the oil industry. Two decades later, through this soul and people’s hard work, oil export became the most profitable foreign trade for the country thirsty of foreign currency. The country soon developed into a thousand-million-ton-level producer. The oil industry contributed outstandingly to the construction of the People’s Republic state.

It is notable that the resource abundance of oil & gas depends on the geographical and geological conditions formed millions of years before the appearance of man. What people need to do today is just to find reserves and get them out of the earth. The soul and spirits may help facilitate the process, but will not work out any reserve. The strength of the soul and spirits should not be exaggerated. No reserve, no product. In 2009, China’s dependence on imported oil for the first time surpassed 50%. It was 55% in 2010. This year, the figure will certainly be greater. It is the problem of diminishing domestic oil reserve.

Over the past decade, the world average replacement rate of natural gas has always been greater than one, meaning the newly found exploitable reserve is greater than production. The Shale Gas Revolution has greatly modified the world map of natural gas supply and demand. Transportation and storage of natural gas are not as easy as for petroleum. Pipelines are the traditional means of transport. Its primary characteristic is that the inlet and outlet must be strictly equivalent. Hence, gas producer will invest in production only if they conclude contracts with buyers; buyers will invest in gas utilization only if they are sure to obtain adequate, long-term, and stable gas supply. The exploitation of a large-scale gas field needs both sides to agree and sign a detailed, strictly implemented, long-term contract. The “take-and-pay clause” is the rule widely used in international trade of natural gas. A strong “exclusive” sense in this clause makes the gas trade different to the crude oil trade. The development of technology and the increasing demand for natural gas also stimulate the LNG market, as gas needs to be liquefied for transoceanic shipping. LNG shipping may be analogous to mobile offshore pipeline, connecting local gas markets to build up a global market system like how a giant oil tanker does. But compared with the oil tanker that has developed more than a hundred years ago, the LNG ship is too young. The liquefaction and gasification facilities and infrastructures are only adequate in a few advanced countries. Most countries are just arriving at the initial stage. The natural gas market is still regionally divided, while the oil market is already globally based and global oil pricing and trade systems are currently in operation.

To trade means to exchange. A buyer’s market pattern will be formed once supply exceeds demand. Then, resources are allocated according to needs so that the most reliable and economical suppliers win; in reverse, when supply cannot meet demand, a seller’s market pattern will be formed, where resources are allocated according to prices so that the highest bidders win. The international crude oil market is almost in the pattern of “seller’s market” – price matters. Political forces and the ‘principle of power’ frequently make impressions on the market, but the principle of resources allocated according to prices dominates the daily play.

The natural gas market is not globally unified, but is obvious of regional patterns. The American market turns into being the buyer’s market pattern – oversupply and low price; the Asian market however is featured by high demand and high price. Japan affords the expensive LNG so as to ensure the stable supply as she has a strong rigid demand and national economy as well. Europe and Russia play as buyer and seller for many years and the local market achieves a balance. Furthermore, Europe has vigorously developed renewable and alternative energies in recent years, due to which European natural gas is pricing between USA and Asia (Japanese price as reference).

According to BP statistical analysis, in the past five years, the global LNG supply cumulatively grew by 58% and in 2010 alone grew by 22.6%. This growth rate is four times that of piped natural gas supply, and three times the gas supply. The weight of LNG in the international trade of natural gas rose from 23% in 2005 to 31% in 2010. With the improvement of infrastructure in Europe and the increasing export capacity of Qatar, LNG posed a revolutionary impact on European natural gas market. A spot LNG market emerged consequently. In 2010, the gap between the NBP price (the most liquid gas trading point in Europe) and the AGIP price (piped gas price linked to the oil index) widened to 22%, heavily influencing the Russian pipeline gas export to Europe. In 2011, the European LNG import increased by 18 billion m3, 27% more than in 2009, and reduced 15 billion m3 of piped gas from Russia, accounting for 1% of 2009 import volume. 1% is not great, but it enabled Europe to find more sources for natural gas import, thereby reducing the European natural gas price.

As a result of the fast growing supply of shale gas, the USA nearly achieves self-sufficiency in natural gas supply and may possibly transit to a gas exporter. Dozens of LNG production lines that were previously built or planned to be built for exports to the USA now lose the buyers. For a period, oversupply is observable in the world’s LNG markets. LNG price is no longer rigid, and fluctuation is possible. The European spot LNG price once went down to 1/3 of Russian piped gas price. Gazprom, the Russian gas company feels heavy pressure.

The natural gas market is experiencing globalization. Qatar is the world’s largest LNG exporter. In 2010, she exported to LNG to 19 countries, 4 more than in 2009. The volume grew by 53%. The number of exporters who supply the top four LNG importers increased from 9 in 2009 to 14 in 2010. During 2005 to 2010, the LNG buyers group was also expanding. The number of important buyers for each exporter nearly doubled.

To be noted, the emergence of the spot LNG market is as significant as the emergence of the spot oil market in 1972. The spot oil market broke the monopoly of the petroleum trade with transnational petroleum companies and promoted the growth of National petroleum companies, so that buyers and sellers both have choices in markets. As a result, the global oil market was developed. The emergence of the spot LNG market also marks the globalized marketization of LNG that enters a new growth phase. Half of the annual crude oil production has been traded in the spot market, 13 years since the spot market emerged. When boldly said, if 2010 is marked as the first year of the spot LNG trade, the world will enter natural gas era in the third decade of the 21st century; the trade of LNG and other liquefied gas products will rival the present crude oil trade, and current regional markets will be globally unified.

China’s booming demand for LNG is subtly changing the world natural gas market pattern. China may have the capability to pay the bills of LNG in place of the USA, or play a decisive role on the market. Last year, China imported 16.6 billion m3 and the dependence import amounted to 11.7%. LNG accounted for nearly 80%. In the fall of 2009, CNOOC welcomed the first LNG ship – from Malaysia, and initiated a new epoch of Chinese LNG import. As a new comer in the fast changing world LNG market, China has to pay bills of different pricing caused by many factors – the lack of experiences of doing business in the specific market is one factor, opponents of negotiation, transaction timing, and market supply-demand situation are other factors. The prices that China can afford are relevant not only to competitors and their affordability, but also to the quite different natural gas prices and pricing mechanisms in China. à

China’s natural gas import has shown a characteristic of diversity on many aspects, e.g. export countries and import channels, domestic consumers and pricing mechanisms. It is a ‘good’ timing for China to participate into international competition in the natural gas market. The core concept is ‘diversity’. Domestic regulated monopoly obliges a ‘one-to-many’ game, in which the one may win a lot but at very low probability. Open competition permits a ‘many-to-many’ game, in which everyone may win or lose and reaching an overall balance. Therefore, in resource-import countries, domestic oil markets are open to competition and oil companies are mostly privately operated.

The Chinese giant oil companies are making great efforts to “go out”. After tens of billions of dollars of investment, they have obtained 60 million tons/year of share oil overseas. But China has yet to join the International Energy Agency. Chinese oil companies participate actively in the global competition for oil & gas projects, but the Chinese government still enjoys the domestic oligopoly market, maintains the strict admittance threshold to domestic oil & gas projects. Criticized by a lot of oversea experts and media, the government is more or less “The Lonely Bulldog”.

If reforming the whole oil & gas industry to open up is too comprehensive to put into practice, China should at least open the newly emerged natural gas industry. Remove trade access restrictions and open the E&P processes to internal and external enterprises for competition are necessary. Unlike the oil industry and not fit with the system of oil industry, the natural gas industry should be regulated in an innovated, specific institution. The Chinese government should support as actively the institutional innovation as the technological innovation. Among the experiences drawn upon from the Shale Gas Revolution, the effective institutions in the USA are the prime. Such institutions inspire entrepreneurship, in turn encourage technological innovation, which led the breakthrough in the American unconventional natural gas development.

To accelerate the natural gas development is the most efficient approach for China to meet the three challenges – ensuring energy supply, emission reduction and international cooperation. The world is stepping into the new era of natural gas. China needs to exploit the natural gas so as to enter a new development phase – opening up and going out. Removing institutional obstacles in the way of investment, encouraging more capital and technology into natural gas production and trade, relaxing the restrictions on going out, China needs to participate into the global cooperation as a global citizen.

Development Polices of Shale Gas in China

Present Status of Shale Gas Development in China

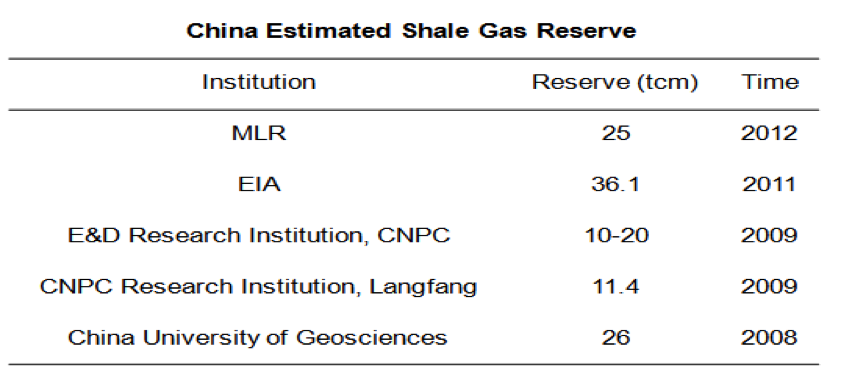

China is very rich in shale gas with the recoverable reserves of 25 trillion m3, which is more than conventional natural gas. In June 2011, the Ministry of Land and Resources carried out public bidding of shale gas exploration rights for the first time and released the list of second batch of bidding unit in January 21, 2013. Also, they have the third round under preparation. More and more competitive participants will be introduced into shale gas for open bidding of exploration and mining rights. More and more powerful and private enterprises will take part in the bidding for shale gas. The Twelfth Five-Year Energy Development Plan, issued in December 2012, emphasized that the production of shale gas will reach 65 billion m3 in 2015.

Resource Investigation

Table 1. Shale gas resource distribution in china

*The black marks represent shale gas demonstration zones in production. The red mark means shale gas enrichment region which are not developed

Although it is still in the initial stage, the resource investigation in China has got preliminary progress. China has started the shale gas investigation and divided resources prospecting area, and preliminarily assessed some organic-rich shale distribution. The investigation also established the main layer of shale gas, and selected a number of shale gas enriching area based on the initially mastered parameters and optional selection standard of shale gas profitable target zone.

Resource Management

In December 3, 2011, the Ministry of Land of Resources has released the newly discovered minerals bulletin with the approval of the State Council, and strengthened the management of shale gas as an independent mineral resource. According to the characteristic of shale gas and the world successful experience, the government proposed the mind with Investigation Priority, Planning Management, Competition Transference, Contract Management and Accelerating Breakthrough. China has drawn up the proposal of shale gas exploration rights based on selected favorable shale gas prospecting areas and objectives of exploration management. The government has introduced the market mechanism and provided innovation on resource management of shale gas, and also carried out transferring tender of shale gas exploration rights.

Current Exploration Status of Shale Gas

The exploration of shale gas in China is mainly concentrated in the Sichuan Basin and its periphery, Erdos Basin, and other northwestern basins. By the end of 2011, China National Petroleum Corporation(CNPC) has selected Weiyuan, Changning, Zhaotong and Fushun-Yongchuan as four favorable blocks around the southern part of Sichuan and Northern part of Yunnan, and drilled 11 delineation wells, including 4 vertical wells with industrial gas. China Petroleum & Chemical Corporation( Sinopec) has drilled 5 delineation wells in eastern part of Guizhou, southern part of Anhui and northeast of Sichuan, including 2 wells with industrial gas, and selected Jiannan and Huangping as optional blocks. China National Offshore Oil Corporation(CNOOC) has carried out preparatory work for shale gas in Anhui and Zhejiang area. Shaanxi Yanchang Petroleum Corporation has obtained continental shale gas in 3 wells in Shaanxi Yanan. China United Coalbed Methane Corporation has put forward Shouyang, Qinyuan and Jincheng as 3 favorable areas of shale gas in Shanxi Qinshui Basin.

Till the end of 2011, the petroleum companies in China carried out 15 shale gas vertical wells fracturing gas test, with 9 wells already with gas, and completely drilled 2 horizontal wells named Wei 201-H1 and Jianye HF-1. The companies mastered the fracturing technology of shale gas vertical wells, and confirmed the development prospects of shale gas in China.

Foreign Cooperation

In 2009, China signed a memorandum of understanding of the Sino-US cooperation in shale gas field, and proposed a work scheme on resource assessment, technical cooperation and policy exchange. China`s petroleum companies have signed joint evaluation assignment on Fushun-Yongchuan, and established joint research cooperation with Norway, ConocoPhillips, Chevron, BP and Exxon Mobile Corp, that acquired part of oil shale gas blocks interests abroad.

Technology Tackling

China has established the National Energy Shale Gas R&D (Experiment) Center to enhance the research on key technology in shale gas exploration. The center has supported the Project of Key Technology of Shale Gas Exploration, which is a special project in one of China National Science and Technology Projects, Development of Large Scale Oil and Gas Field and Coal Seam Gas.

Main problems and contradiction on shale gas development

Nowadays, shale gas development in China meets the following problems

Much exploration input should be thrown in to make resources condition clear

China has a massive shale gas accumulation of the basic conditions, but did not yet systematically develop in the national scope shale gas resource investigation and evaluation, resource amount and distribution has not yet fully known.

Shale gas technologies in packages are not mature

Introduction of core techniques remain to be localized. Our country has some foundations on shale gas exploration and exploitation equipment. Techniques in packages, systematically on shale gas exploration and exploitation, haven’t formed. Some key technologies, for example, shale gas unit horizontal drilling, well completion, test, segmenting fracturing treatment, formulation study of fracturing fluid with different geological conditions and good economic benefits, remain to be improved.

Ground condition is unfavorable for constructing, pipe network does not match related infrastructure

Transmitting natural gas by assembling a pipe network is one of most highly efficient ways to solve natural gas utilization large scale. Natural gas pipe network and supporting infrastructure have basically formed networked structures that are underdeveloped. Length of natural gas pipeline in China accounts 10% of natural gas pipeline in America within the same period. Pipeline is far behind of American natural gas pipe network system. Most of shale gas resources in China mainly exist in mountain areas of middle and west China. Pipe network construction is difficult and costly, which is unfavorable for utilizing shale gas and expanding downriver markets.

Industrial management needs to be strengthened; policies and regulation remain to be improved

Chinese government clearly manages shale gas as an independent natural resource. When Ministry of land and resources, State Development and Reform Commission, Ministry of Finance, and many functional departments involved bidding for exploration and mining rights, policy of project development and assistance, these functional departments should strengthen communication and coordination to form a scientific and efficient industrial management mechanism. On construction of standard system, technique standard of exploration and exploitation and standard system are seriously backward. Economic and technical evaluation index system of Shale gas development has not formed.

Lack of environment supervision system, Shale gas development may risk in environmental pollution

Compared to shale gas in America, shale gas in China is buried deep in the earth. Some rich shale gas minerals are in densely populated and liable to geological disasters districts. Whether shale gas exploitation by hydraulic fracturing technology can bring about a series of problems, which remains to be observed and studied. Constructing a pack of efficient supervision mechanism to prevent environment problems, especially for ground water resources pollution, fracturing liquid recycling and prevention of geological disasters is extremely urgent.

Shale gas developmental prospects and goals in the future

Prospects analysis of natural gas development during the 12th Five year plan in China

The production of natural gas was 107.7 billion cubic meters in 2012 in China, and the apparent consumption is 147.1 billion cubic meters, which has increased from 4.4% in 2010 to 5.5% of total energy consumption. Natural gas takes a small part in China`s energy structure, and its proportion is far below 24% of the average level developed countries, China will enhance the supply of natural gas to increase the proportion of natural gas in the primary energy. To increase the supply of natural gas, Twelfth Five-Year Energy Development Plan emphasis that China should optimize the development of conventional fossil energy, and focus on coal-bed methane, shale gas, other unconventional oil and gas resources, and cultivate new growth point of energy supply.

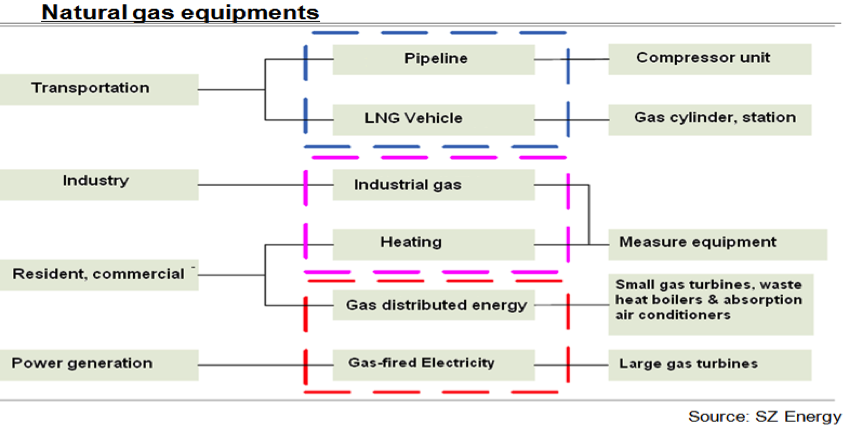

Natural gas is mainly used in industrial fuel and city gas, and the new exploitation covers the natural gas power generation, distributed energy and gas-fueled vehicles. In 2012, the natural gas pipeline will cover 31 provinces in China, and more than 95% cities will have access to natural gas.

Conventional natural gas consumption will be more than 230 billion cubic meters by 2015, compared to the supply goal of 260 billion cubic meters; there still is a large gap. The Shale Gas and Coal-bed Methane Twelfth Five-Year Plan has pointed out that the production target is 6.5 billon and 30 billion respectively, and according to the estimation, the external dependence of natural gas will be over 35% by the end of the Twelfth Five-Year.

Shale Gas Development Goals in the Future

China will complete survey and evaluation of national shale gas potential, grasp shale gas distribution and potential. Chinese government will optimize a batch of shale gas exploration and exploitation zone, and produce it in a large scale primarily by the year of 2015.

Key technologies on shale gas make a great breakthrough. Main equipment can be produced by ourselves. China forms national shale gas technologies standards, which is to build shale gas industrial policy and make a steady foundation for shale gas development quickly during the Thirteenth Five-Year. The Twelfth Five-Year will achieve the following goals in detail.

- Basically, complete the survey and evaluation of shale gas resource potential. Grasp primarily national shale gas reservoir amount and distribution. Optimize 30 to 50 shale gas prospects area and 50 to 80 favorable target area.

- Explore shale gas geological reserves of 600 billion cubic meters, and recoverable reserves of 200 billion cubic meters. Shale gas output by the year of 2015 gets 6.5 billion cubic meters.

- Form shale gas geological survey and resource evaluation technological manner, key technologies and supporting equipment on shale gas exploration and exploitation that fits the conditions of China.

- Form Chinese shale gas technological standard and norms in the field of surveying and evaluatin,resources reserve, experimental analysis and tests, exploration and exploitation, and environmental protection.

During the Thirteenth Five-Year, Chinese government increases investment further, and raises reserves, output of 19 exploration, and exploitation zones by a large margin. At the same time, the government promotes shale gas exploration in Hubei Province Hunan Province, Jiangsu Province, Zhejiang Province, Anhui Province, Ordos, Southern North China, Song-Liao Plain, Dzungarain, Tuha, Tarim and Bohai Bay. China will build anew shale gas exploration and development area and work hard for making the shale gas output 60-100 billion cubic meters in 2020.

China’s supporting policies on shale gas development

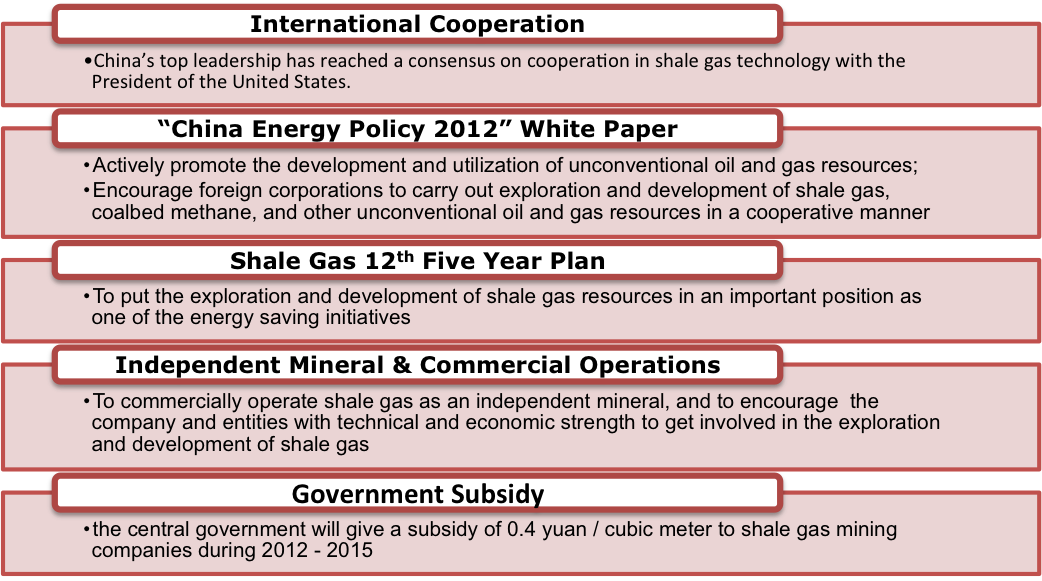

China attaches great importance to shale gas development in strategic level. In the Twelfth Five -Year Plan for national economic and social development, China puts forward “promoting the development and utilization of shale gas and other unconventional oil gas”. Shale gas was listed as an independent mineral resource. Chinese government asks that formulate plans, do well in resource survey, study exploitation techniques and manners, and strengthen basic research.

Trial on Biding for Exploration Rights

The Ministry of Land and Resources innovate the model of shale gas management, undertake transferring and bidding mining rights, and break through the simple “first to file “way. In the first round of trial on biding for exploration rights, Sinopec won the bidding of Yuqiannanchuan Shale Gas Unit, Henan Province coalbed methane CO., and Ltd won the bidding of Yuqian Xiangxiu Moutain Unit in July, 2011. The second round of trial on biding for exploration rights of shale gas began in Sep, 2012. Two private enterprises, six central enterprises and Eight Local State-owned Enterprises won the bid. Besides, Ministry of Land and Resources has planned to lunch the third shale gas bidding in 2013.

China came out shale gas exploration subsidies policy

The Ministry of Finance of People’s Republic of China,National Energy Administration issued a notice on shale gas for exploration and exploitation. According to the policy, the subsidies will be 0.4 RMB per cubic meter between 2012 and 2015. Specific standard in the future will adjust according to the shale gas industry development

Increasing funds of shale gas investigation and assessment

Set up national specific funds for shale gas assessment and exploration. Firstly, implement the investigation and assessment of shale gas resources and potential. Secondly, carry out target area optimization and exploration of shale gas technology research demonstration. Thirdly, take into practice research and international cooperation and exchange of the shale gas geological theory.

Make great efforts to tackle key problem on shale gas exploration and exploitation technologies

To increase support for shale gas exploration and exploitation of related technologies by National Science and Technology Major Project . In grand special project of large oil and gas fields and coal bed gas development, key technologies on shale gas exploration and exploitation enter the list of main construction. Demonstration projects of shale gas development are added at the same time. It is important to strengthen the construction of Chinese national shale gas research center and other key shale gas laboratories. It is also important to establish high-level talents training base and academic exchange base. Domestic enterprises and institutes, and foreign research institute should be encouraged to carry out key technologies joint research. To learn, adapt, assimilate foreign scientific and technological achievements, and form China’s own core technologies with Chinese characteristics by introducing foreign techniques and service, foreign cooperation.

Establish a new mechanism for shale gas exploration and development

Encouraging more powerful companies to explore and exploit shale gas, to promote main bodies of investment diversify. Set the admissions households and qualifications for shale gas industry. Improve operational mechanism of supervision on shale gas industry. To promote tendering and bidding system for mineral rights, unit withdrawal mechanism and contract management are needed. Increasing considerably minimum exploration input, so as to forestall Enclosure Movement phenomena. Rights holders of coalbed methane, petroleum and natural gas should explore and exploit comprehensively shale gas resource within their mineral rights. Shale gas exploration and exploitation should interconnect with other solid mineral mining rights and integrated exploration demonstration, solve multiple mining rights properly through negotiation, and make sure shale gas is produced safely. Shale gas exploration and exploitation enterprises passed Ministry of Land and Resources’ advanced review, were approved by State Council, and were submitted by National Development and Reform Commission cooperate with foreign experienced companies and introduce technologies on shale gas exploration and exploitation. This was done in order to improve supervision mechanism on shale gas exploration and exploitation.

Implement Incentive policy in shale gas industry

According to the shale gas exploration subsidies policy, to ensure full implementation of the policies and measures already introduced. Mineral industry right holder who legally get shale gas exploration right and exploitation right can apply for remission of exploration right and mineral right according to related regulations. The ex-factory price of shale gas is decided by market. Give priority to the land use of shale gas. As for some advanced equipment of shale gas exploration and exploitation that we cannot produce in China, customs could be reduced.

To improve the shale gas supporting infrastructure

Building gas field gathering and transmission network and transporting the shale gas into pipeline network when the natural gas pipeline infrastructure is in good condition. Building LNG and CNG use device when the exploration and development area is far away from the natural gas pipeline network. Construct export pipeline according to the exploration and exploitation progress.

The Korean Investors’ Opportunity in The Shale Gas Industry in China

China Shale Gas policies – Macropolicy

Discuss the business opportunity of shale gas in China from two aspects: the policy and the reality of the shale gas development in China. First, the policy will be considered. Chinese government regards the shale gas as an independent mineral, which means that the exploration and development can avoid the restriction of monopoly from Petrochina and other state-owned enterprises. On the other hand, the participation of private capital in such energy industry with huge potential will realize the market competition of the shale gas industry.

According to the Notice of Strengthening Shale Gas Exploration and Supervision, announced by Ministry of Land and Resources, the exploration of shale gas in China should be in line with the principle of Open Market, and varieties of social investors should be encouraged to enter the field of shale gas exploration by operation of law. Chinese government advocates the entitled private companies to invest, explore, and exploit the shale gas, which differs from the threshold of exploiting the conventional petroleum and natural gas. At the same time, we encourage the foreign corporations with relevant technology to participate the exploration and mining in China. It is pointed out that China Ministry of Land and Resources is in charge of registration of the shale gas investigation and sell the right of exploiting the shale gas mainly by tend.

As 80% of the shale gases in China are distributed in the petroleum and gas areas that has already been registered, the Notice encourage the state-owned petroleum enterprises to investigate and exploit the shale gas in its own area. In terms of those areas they won’t mine, the companies are to sell the right of exploiting the shale gas to other investors without the influence of petroleum and natural gas exploration. For the area lacking in the investment of petroleum, natural gas exploration, and bright future, but is featuring the potential of shale gas resources, the relevant personnel owning the right of mining industry is demanded to withdraw from the area and the right of shale gas investigation will be set up.

For the huge cost and risks of the shale gas exploration and development at present, as well as the low economic benefits in the short term, the Notice stipulates to reduce and cancel the shale gas mining rights royalty and mineral resources compensation fees according to law and ensure the supporting measures of shale gas investigation and mining. Recently the Chinese government unveiled a lot of relevant policies, which you can see on the charts. It is about the great support of Chinese government and the encouragement of foreign corporations and capitals. The related policies are under way and more open and encouragement policies will be introduced.

It is expected that by the year 2015, the assumption volume of natural gas in China will be about 230 billion cubic meters. We will improve the popularity of using natural gas and the supply capacity will be over 260 billion cubic meters (including coal gasifier, shale gas, coal-derived natural gas, and other unconventional natural gas and imported natural gas).

Why should Korea participate in China’s shale gas industry?

I focus on the foundation of cooperation in the energy industry between China and Korea. There are many similar situations facing the two countries. First, we are confronted with the same problem about the energy and resources. The energy output cannot satisfy the demand of domestic market and we are both the big energy and resources importer. According to the China Land and Resources Communique 2010, issued by China Ministry of Land and Resources, China oil ratio of import dependence reached 54.8%. Based on the statistics from World Bank, the ratio of import dependence of primary energy consumption exceeded 80%. From the chart, we can see that in 2010, China and Korea are the major energy consumer in the world and they rank as first and eighth respectively in the primary energy consumption.

China, Japan, and Korea all rely greatly on imported resources: 2010 China oil ratio of import dependence reached 54.8%; the ratio of import dependence of preliminary energy for both Japan and Korea reached 80%, according to World Bank data.

Second, both China and Korea have heavy pressures on emission reduction of carbon dioxide. This chart shows us that in 2010 carbon dioxide emission of China and Korea respectively is 8.241 billion tons and 0.563 billion tons, ranking first and eighth in the world. Therefore, we have the common issues of ensuring the stable supply of energy and resources, improving the utilization efficiency, and reducing the pollutant discharge.

It is extremely important to Japan and Korea to ensure stable energy resource supply while China is under lots of pressure on energy efficiency and carbon emission.

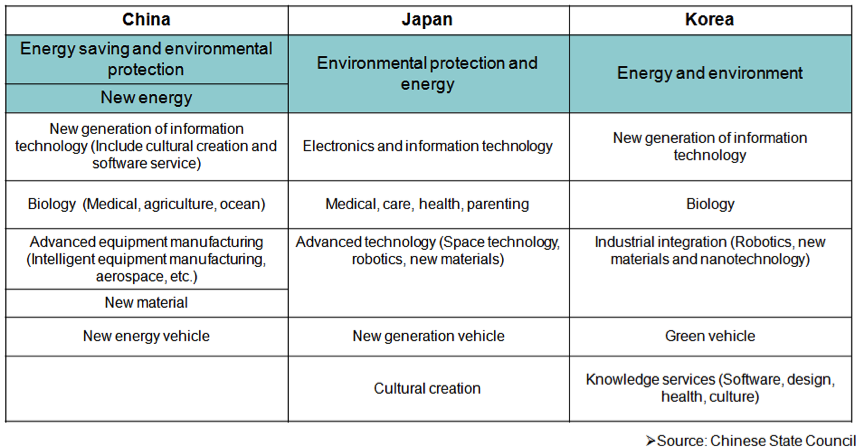

Latest industry development plan & comparison: China, Korea, Japan

During the recent two years, both China and Korea have set up the new industry development planning and the key industry. The following chart compares the key development fields of the latest industrial policies in China, Japan, and Korea. China and Korea will devote efforts to environment protection, new energy resource, the advanced manufacturing equipment, and automobiles with new energy. Moreover, the two countries make policies containing international cooperation. The collaboration in the shale gas and other energy resources between China and Korea is not only in line with the two countries’ reality and the benefit principles, but also has huge probability.

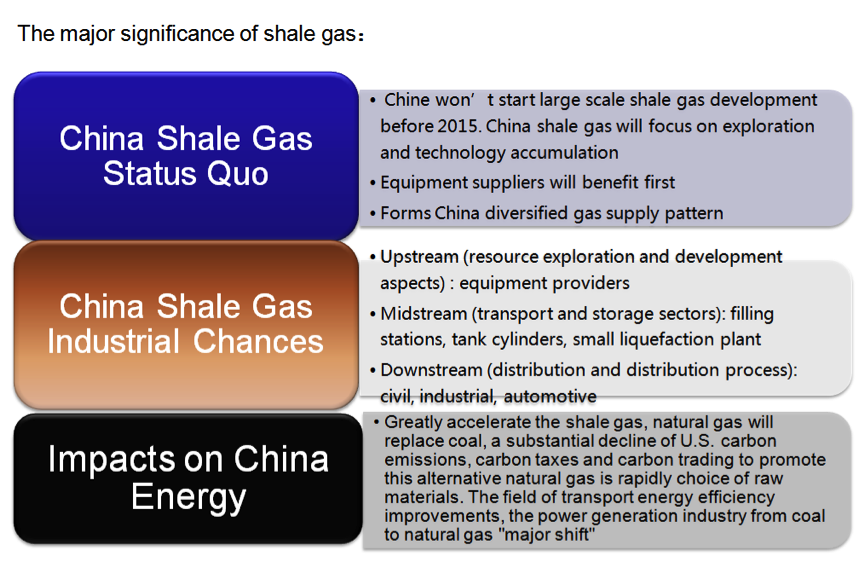

China shale gas status quo

Just now we have introduced the policy and reality basis for Korean companies to invest in the shale gas industry in China. Now, we will analyze the investment opportunity of shale gas industry from the status quo in China. The development of the shale gas is on the occasion of the burst-development in natural gas industry. The gap between the supply and requirement of natural gas keeps widening so the exploitation of shale gas has a wonderful future.

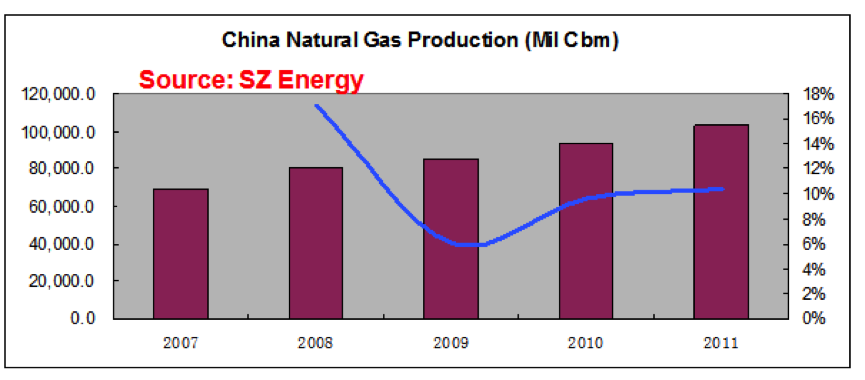

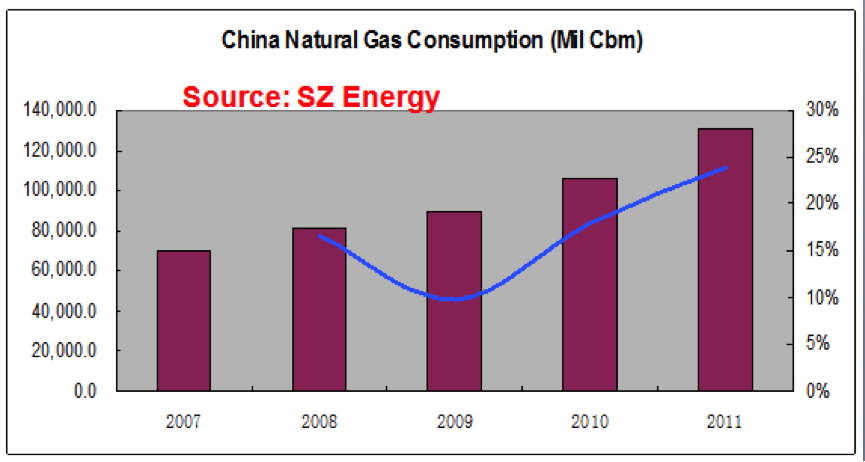

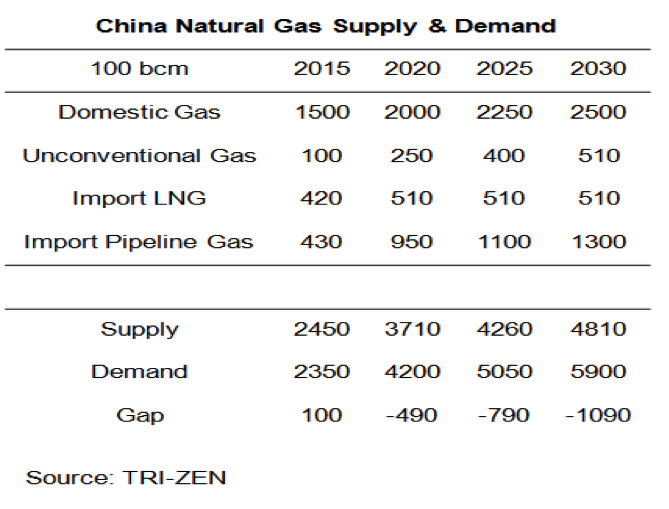

In year 2000, the domestic natural gas consumption in China totalled 24.5 billion cubic meters, but in 2011, the number reached 131.3 billion cubic meters, an increase of 16.5 % annually; 30.3 billion cubic meters of domestic natural gas output in 2001 was higher than the consumption of 27.4 billion cubic meters. 2011 domestic natural gas production was 103 billion cubic meters; its average annual growth rate is 13%, which is lower than the growth of domestic consumption. This map is the comparison between China’s natural gas output and consumption in recent 5 years. It shows that the gap of domestic natural gas consumption is further widening and China has a strong urge of natural gas with economic advantages. There is rich storage of unconventional natural gas (coal gas and shale gas) in China. It is expected to have the burst-development after breaking through the limitation of price system and technology.

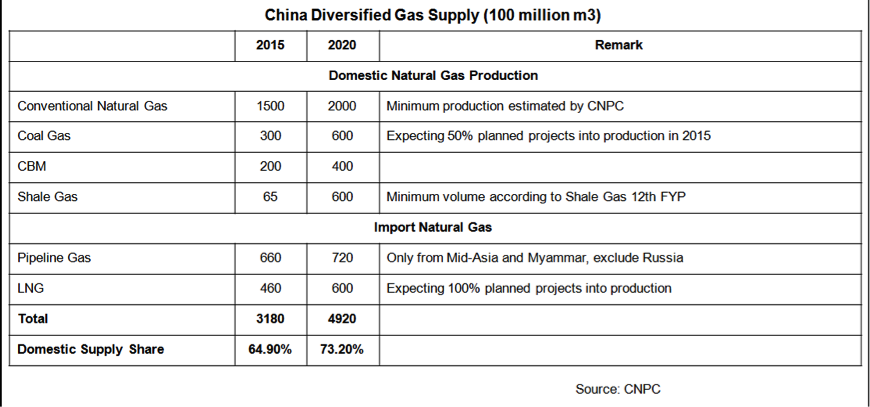

——China gas supply is mainly formed by domestic gas, imported LNG, imported Central Asia gas, Russia gas, and Myanmar gas

Therefore, China’s diversified gas supply pattern gradually comes into shape. From this chart, we can see that the imported natural gas is predicted to account for 35% of the total energy supply, and the domestic shale gas output makes up 2% of the total in 2015, while in 2020 the respective data is 26.8% and 12%, showing an 8.2 percentage decline of imported natural gas and around 10 percentage increase of shale gas output. It shows that the Chinese government plans to depend more on the domestic natural gas to meet the requirements, which is to increase the production of the unconventional oil and gas resources mainly as the shale gas.

It also demonstrates the government’s confidence in the storage capacity and the exploiting technology of the unconventional oil, gas resources, and its determination of mining the resources.

The expanding supply gap, domestic energy conservation requirements, and huge reserves of shale gas resources in China triggered a high degree of attention from the government and social capital for exploration and development of shale gas. According to the 12th Five-Year Plan in March 2012, the increasing of tax subsidies, the implementation of market-oriented pricing, and the encouraging of private capital participation will all become important methods to promote the development of domestic shale gas.

And this sheet shows the widening gap between demand and supply, the energy conservation and emission reduction, and the rich storage of shale gas that have triggered the great attention to the shale gas exploration and development from Chinese government and social capital.

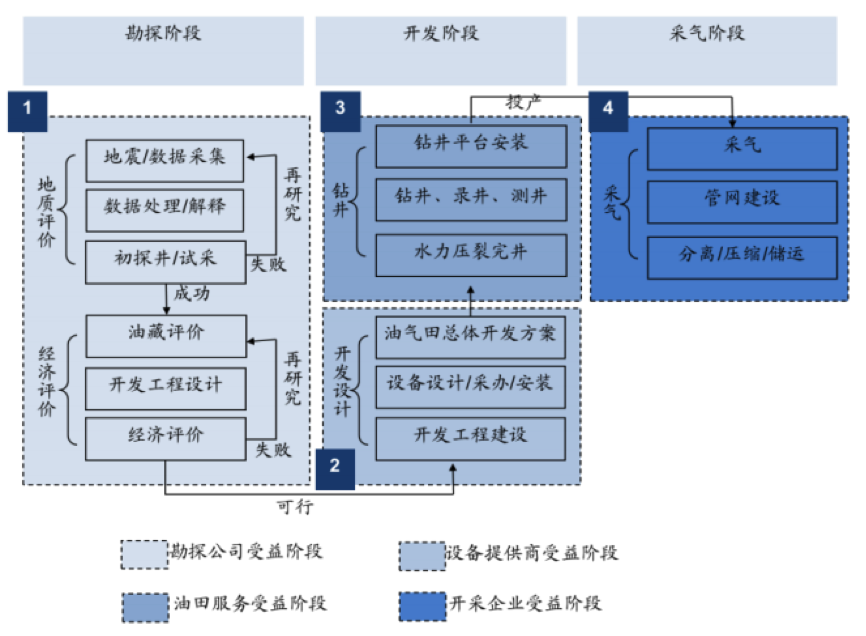

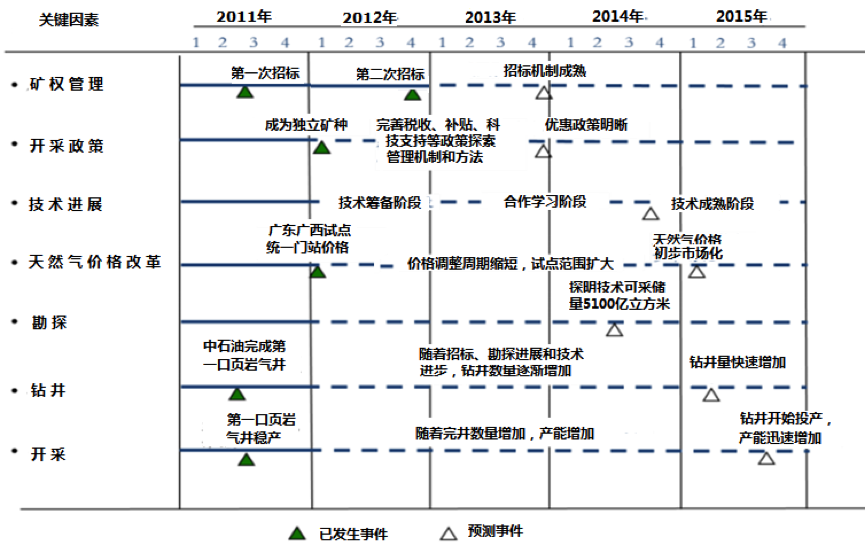

We have introduced the developing period of China shale gas industry, the gap of domestic natural gas consumption, rich storage, and the expected burst-development of unconventional natural gas (coal gas and shale gas) in China. This chart is the preliminary schedule of the shale gas exploitation from 2011 to 2015. Years prior to 2015 are mainly the exploration and thereafter is the well drilling stage. We can basically estimate the timetable of the industrial investment.

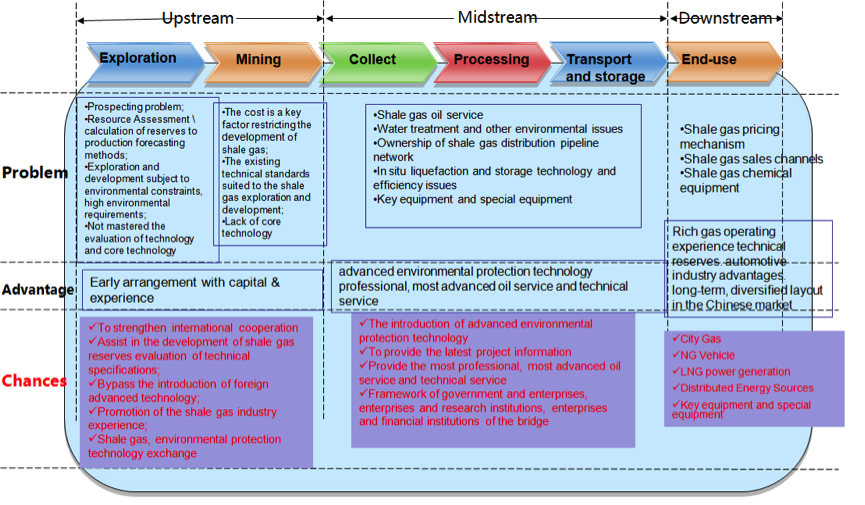

Next, we will detail the industrial chain of China shale gas from the upstream, midstream, and downstream to analyze the investment opportunity.

Upstream—- Chine won’t start large scale shale gas development before 2015. China shale gas will focus on exploration and technology accumulation.

Midstream—-The investment for China, Korea, Japan, and Europe LNG facilities will embrace a peak as “US Energy Independence” achieves, as well as possible investments on US LNG export facilities.

Downstream—-Gas distributors such as CNPC & Sinopec actively popularize gas appliance facilities in the downstream, which provides great opportunities for LNG facility makers & distributors.

The upstream of the shale gas is mostly the investigation, development and gas production stage. Equipment suppliers will benefit first during China shale gas exploration stage.

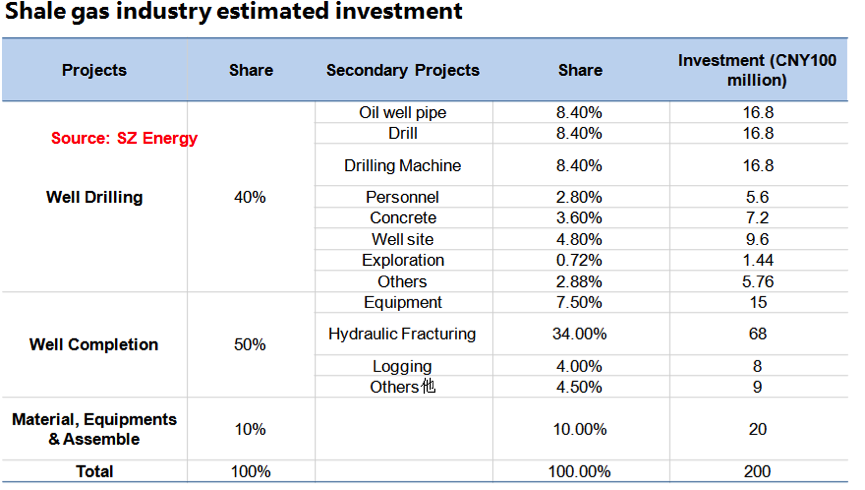

The most important operation at stage is the shale gas exploration and development. It is predicted that the total scale of investment in the shale gas exploration and development is about 20 billion before 2015, which is based on the capacity demonstration, block bid inviting, the cost of a single well, and the well number. Classified by the development mode, the capacity demonstration areas having or basically having entered the development stage value 16-18 billion, the biding blocks at the evaluation period value at 2-4 billion. Classified by the fine particle industry investment, the exploration is 150 million, the oil well pipe is 1680 million, drilling machine leasing is 2240 million, well site preparation is 1 billion, the cement 7200 million, completion equipment and tools 1.5 billion, fracturing services 6.8 billion, and logging 0.8 billion. The chart shows the detail.

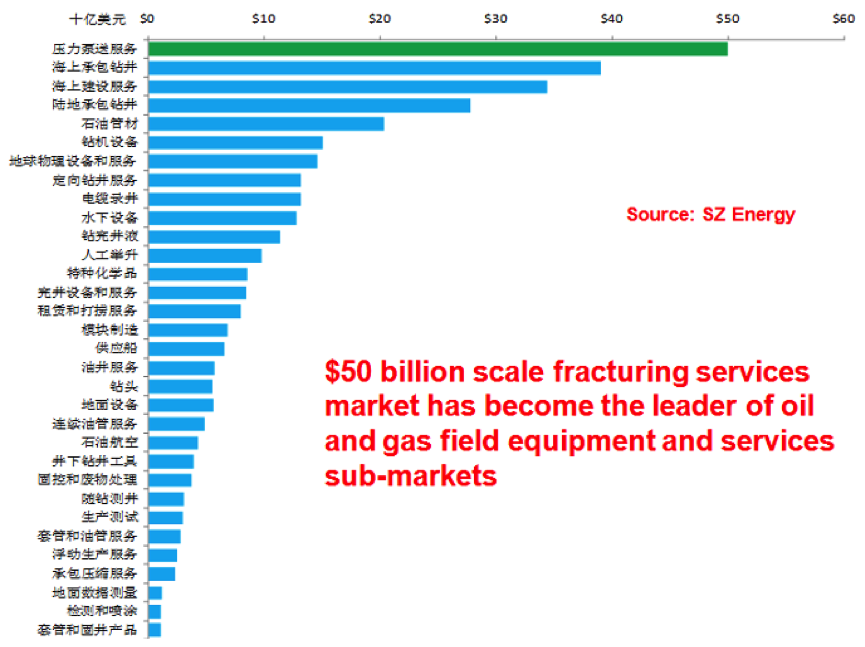

Estimated global fracturing service market will reach USD50 billion in 2012

2011 witnessed the new trend in global oil and gas field equipment and service market. Fracturing services have exceeded the offshore drilling and marine construction, becoming the leader of subsidiary markets of the oil and gas field equipment and services, compared to whose stock growth, we attach more importance on the fracturing service markets that benefit from the production growth of the declined oil and gas field, the large space of the new low permeability reservoir shaft building, and features high flexibility. The estimation of global fracturing service market scale is 50 billion dollars in 2012. For the stock growth of the general equipment of petroleum and natural gas exploration and development, we favor the popularity and growth of special equipment. For instance, the fracturing truck applied in the unconventional oil and gas exploration and development have been popularized in advance of the tight gas development training, prior to the large-scale development of the shale gas. It is predicted that the domestic market will accumulate to 20 billion before 2015.

From the analysis above, we could find those Korean corporations that enjoy advantages in the upstream of the shale gas industry: with early layout and the advantage in capital and experience, Korea has carried out the overseas mineral resources development with the next-door neighbor with rich mineral resources, China, as the primary development goal. Several large financial groups in Korea such as SK, Samsung, and LG have joined in developing resources in China. As early as the year 2004, with the encouragement of Korea Resources Corp, Samsung corp. invested 28 million dollars with Qinghai Western Mining Industry in developing mineral projects. Korea also set up the strategy of investing the four major minerals in China according to the target “by the year 2020, the self-sufficiency rate of major minerals will reach 40%”.

Midstream Chances

LNG receiving, storage facilities, gas stations, gas cylinders & small scale liquefaction device technology.

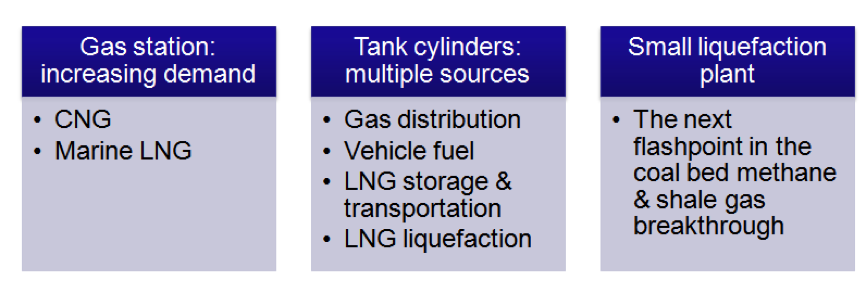

Gas distributors such as PetroChina & Sinopec are actively promoting natural gas in the downstream applications and launching LNG liquefaction plant project, which brings good investment opportunities to LNG equipment companies and gas distributors. Since we have touched the upstream situation, now we will analyze the situation of midstream of the shale gas industry. Just now we talked how the investment of shale gas would focus on exploration and evaluation before 2015 and thereafter enter the exploiting stage. At the same time, the opportunity of the midstream layout is also coming. It’s mainly about LNG reception and the investment in storage facility. The midstream investment in shale gas is mostly in natural gas pipeline network, LNG receiving station, LNG ship, gas station, storage tank, and small liquefaction plant. It is known that China’s natural gas pipeline network as well as the 90% of the LNG receiving station is basically in the management of the state-owned petroleum corporation, making it difficult for foreign and private capital to join in. But there are many opportunity of investment in LNG ship, gas station, storage tank, and small liquefaction plant. On the other hand, since China makes efforts to expand the supply of natural gas, the construction of natural gas pipeline network and LNG receiving station is at an amazing speed. So in the overall process, a lot of chances in equipment and technology investment are waiting for you.

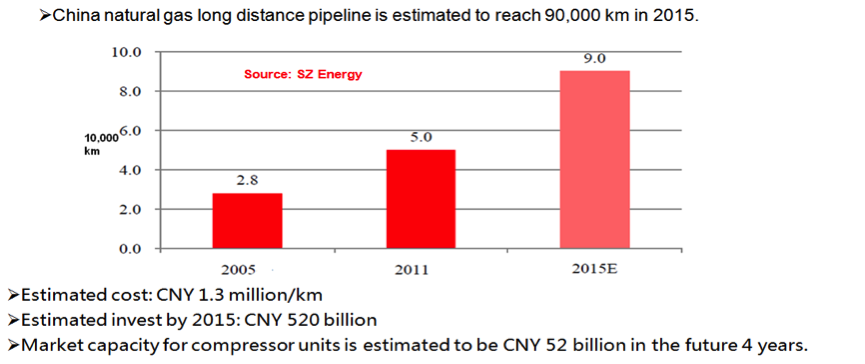

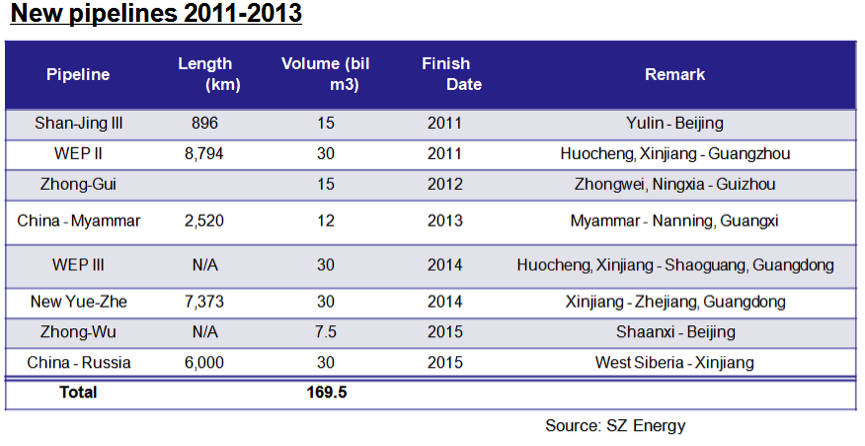

China pipeline gas will increase 16% per year from 2011 to 2015

From 2011 to 2015, China pipeline gas will grow at a speed of 16%. The next 5-10 years are the rapid growing period of natural gas pipeline construction. It is estimated that length of the pipeline will be nearly 90 thousand kilometers by the year 2015. During the four years from 2011 to 2015, it will grow 40 thousand kilometers, 15.8% of average annual increase and the long-distance pipeline investment will reach 520 billion RMB. In terms of equipment, the pipeline construction will generate the requirement of natural gas compressor unit. The investment in compressor station makes up 20% of the total, among which the compressor unit investment is the 50% ratio of compressor station. The market capacity of the compressor unit in the next four years is at least 52 billion RMB. Three key equipment of natural gas pipeline are large gas compressor units, armature compressor units, and heavy caliber all-welded ball valves.

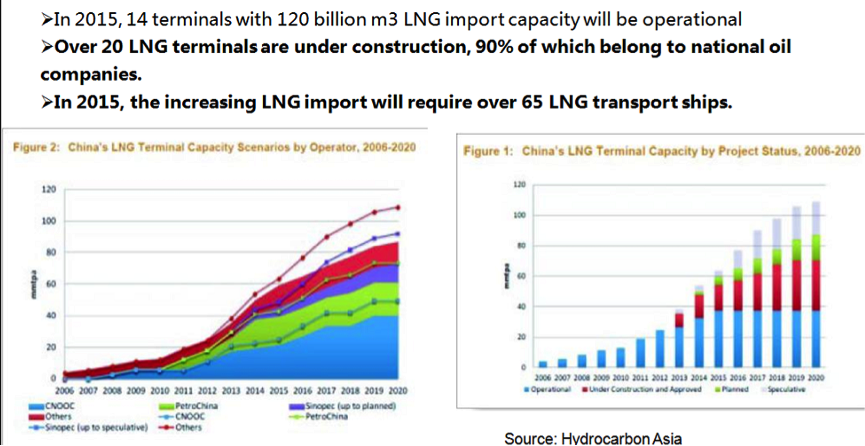

China LNG Terminals 2006-2020

The development of LNG receiving station is similar to that of natural gas pipeline network. In 2015, there will be 14 LNG receiving station put into use and over 120 billion cubic meters of natural gas will be imported annually. At the same time, more than 20 LNG receiving stations are under construction. Over 65 LNG transport ships are needed to support the planned LNG import growth in 2015. China has showed increasing interest in floating vessel and FSRU.

Midstream Chances – Advantages for Korea

- Korea leads the LNG vessels manufacturing for a long time

- As the largest LNG importer, Korea has a mature gas industry.

- LNG-RV Daewoo Shipbuilding & Marine Engineering

- Korea has accelerated investment mechanism on LNG receiving, storage facilities, gas stations, gas cylinders, and small scale liquefaction device technology.

From the analysis of shale gas midstream layouts, we can find that Korea has an obvious advantage in midstream: Korea has superiority in manufacturing liquefied natural gas transport ships. As the biggest liquefied natural gas importer in the world, Korea has a mature natural gas industry.

Downstream Chances

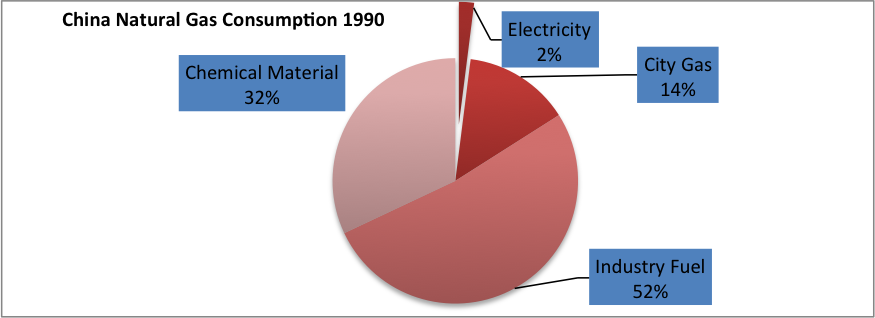

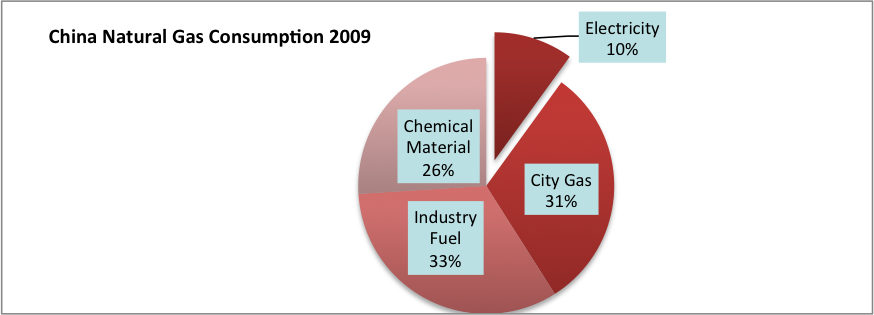

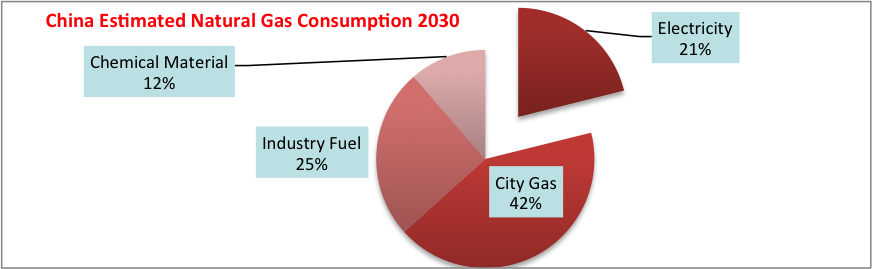

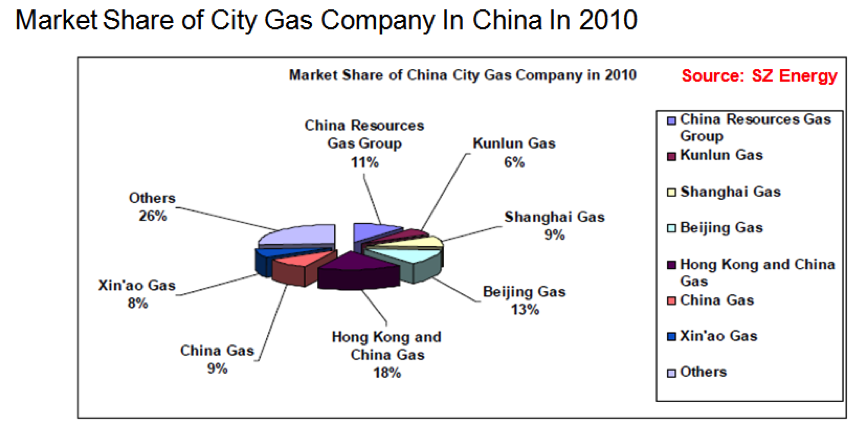

The downstream of shale gas industry chain mainly involves the operation. Chances of the downstream between shale gas and natural gas are basically same. At present, application of China natural gas is at the stage “the simultaneous rise of quantity and price”. The following maps will show you the recent changes in the consumption structure of natural gas. China natural gas consumption is turning to city gas & power generation from industrial gas dominance.

Transmission & distribution for civil, industrial & CNG use.

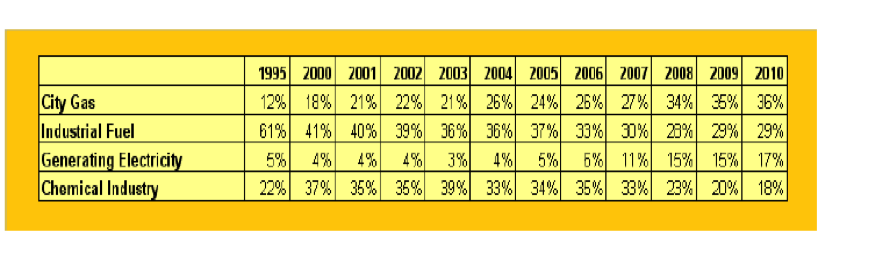

China Demand Structure of Natural Gas In 1995-2010

Since 2004, foreign invested enterprises, private enterprises and stated owned enterprises such as Hong Kong and China Gas, ENN, China Gas and PetroChina, China Resources, Beijing Gas, and Shanghai Gas entered into city gas industry. And in China, central enterprises, local enterprises, foreign invested enterprises, and private enterprises formed the competition Patten. Hong Kong and China Gas ranked as the biggest city gas operation enterprise: sales volume for 2010 topped 8.54 billion cu m, up 24.3% year over year. Beijing Gas ranked second in this market: sales volume for 2010 reached 6.5 billion cu m, up 31% year on year. China Gas’s sales volume was 4.5 billion cu m, up 31.7% year on year. ENN’s sales volume was 3.81 billion cu m, up 44.9% year on year.

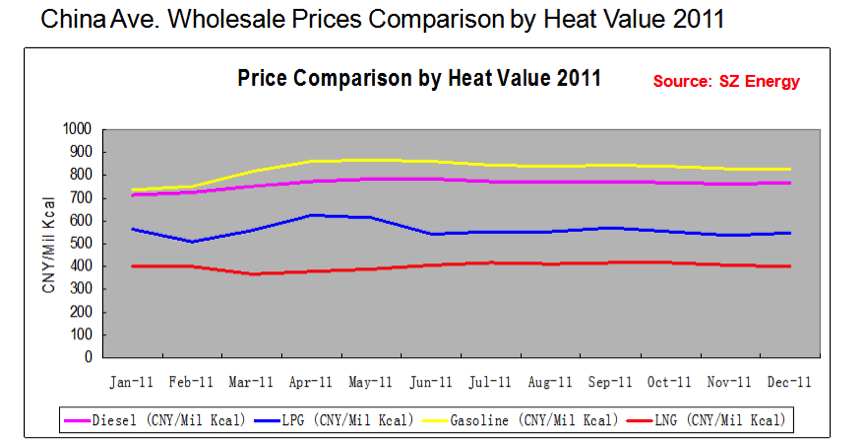

In China, Natural gas price has advantages against gasoline, diesel & LPG

The reality of “the simultaneous rise of quantity and price” is that natural gas has advantages in price, environmental protection, and the consumption in some areas is restricted. Compared with naphtha and diesel oil and LPG, natural gas has strong consumption potential in China. (PM2.5 has become the new driving force of natural gas popularity in China).

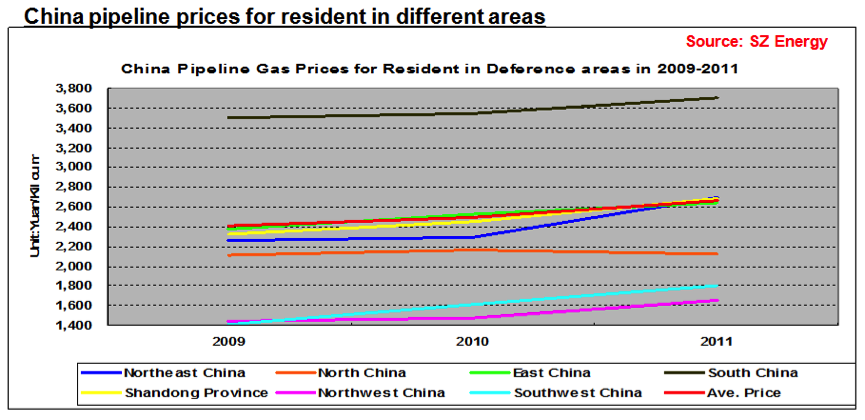

China’s lacking of long distance pipelines restrain gas supply & consumption in North, East & South China

Most of the primary long-distance transport pipes of natural gas haven’t come into operation, leading to the insufficient pipeline gas supply with low costs in the Northern China, Eastern China, and Southern China –the economically developed regions, where natural gas consumption has been restrained.

At the same time, from 2011 to 2013, with the operation of Third Shan-Jing Pipeline project, second pipeline of West-East natural gas transmission, China-Burma oil and gas pipeline, the Central Asia gas, and the Middle East LNG ensuring the large quantity of supply enter the consumption field, where sales volume of the natural gas distributor will generate rapid growth constantly.

China Natural gas prices is estimated to increase

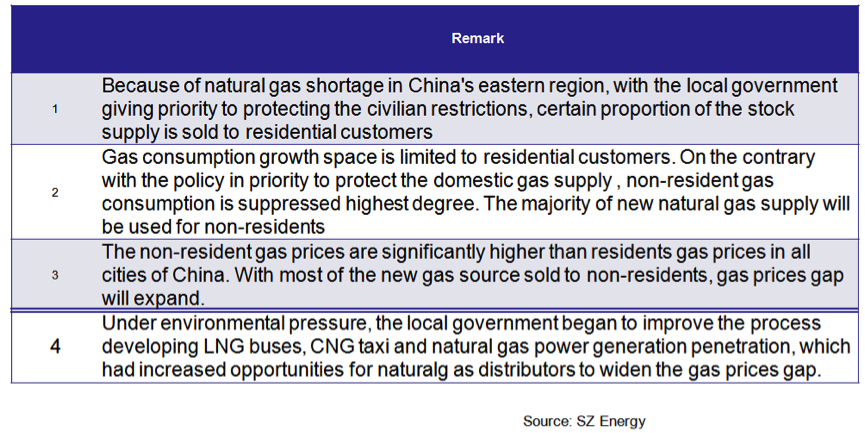

This sheet demonstrates the predict reason of rising price of the natural gas middle market.

1) At present, the natural gas in Eastern China cannot maintain the balance of supply and demand. Under the limitation of the local government so as to guarantee the civil use, large ratios of the stock supply have been sold to the residential users.

2) The growing space of the residential using gas volume is limited; on the contrary, with the policy of giving priority to the residential gas supply, the consumption of the industrial, commercial industry, and other non-residential use gas, the new added natural gas will be mostly applied in the non-residential field.

3) Wherever any city is in China, price of non-residential gas is higher than the residential ones. Therefore, comprehensive price gap of natural gas distributor will be expanded.

4) Pressured by the environmental reality, the local government steps up the course of LNG bus, CNG taxi, and the increasing popularity of natural gas power generation, offering chances for the widening price gap.

China natural gas: cheaper than oil, more expensive than coal

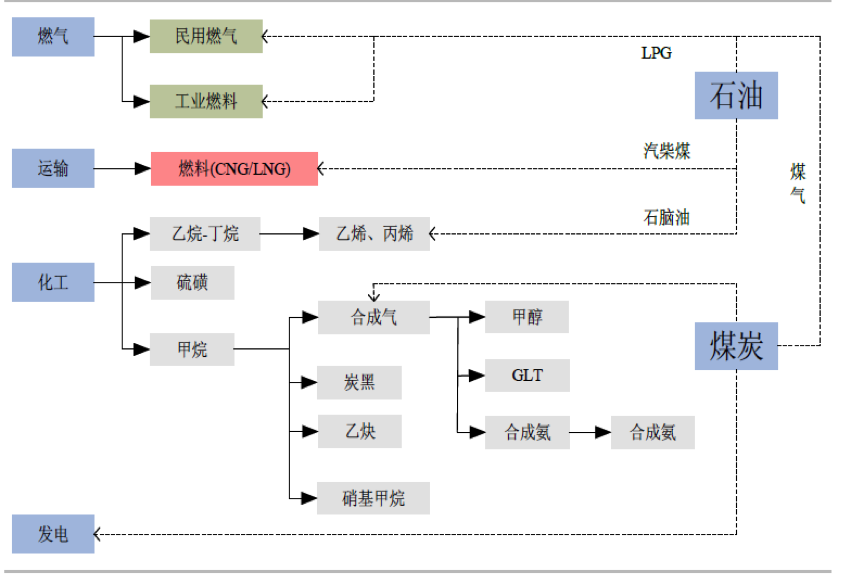

Deep processing of the shale gas is the downstream application. Different from American natural gas industry, the gas price in China is lower than petroleum and higher than coal. With the large-scale exploiting of shale gas, the natural gas price will decline and there will be the opportunity of chemical application in the downstream.

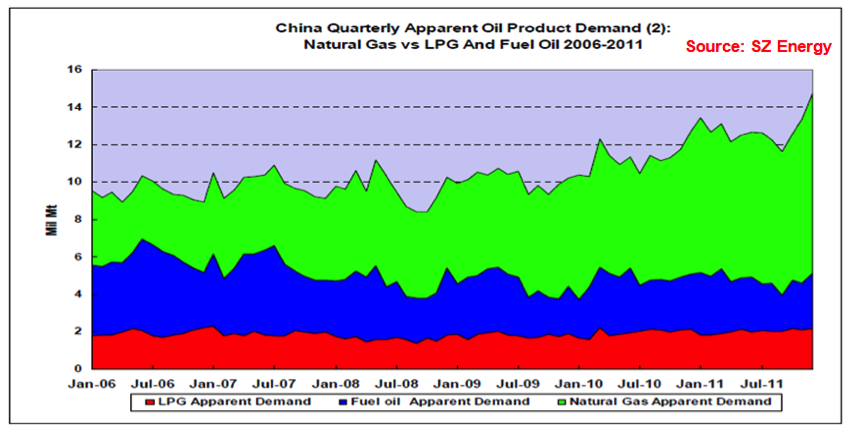

China city gas demand is estimated to have 19% annual increase from 2011 to 2015 and 9% from 2011 to 2030. The following maps are introducing the comparison of the requirement changes among natural gas, LPG, coal oil and other alternative energy since demand for natural gas as natural gas is growing.

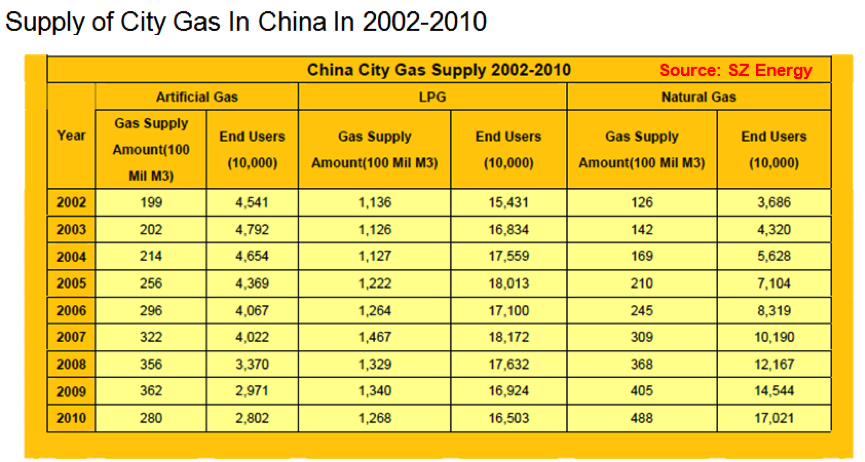

China city gas demand is expected to rise 19% annually from 2011 to 2015, and 9% from 2011 to 2030. From the maps and data we can see that China gives priority to the residential city gas and the automobile use in line with the latest policy of natural gas utilization. Natural gas users have become the largest population among the city gas consumers. Natural gas is gradually taking the leadership in place of LPG and artificial coal gas.

In 2010, the city natural gas consumption in China reached 44.8 billion cubic meters, 20.5% of the year-on-year growth; the city gas usage population is 0.363 billion, among which natural gas consumers are 0.17 billion, surpassing LPG for the first time and become the largest user. The population using artificial coal gas and LPG is experiencing a decline. In the large and middle-sized cities covered with the natural gas pipeline network, the portion of LPG is getting reduced and artificial coal gas is withdrawing from the market.

According to Power Industry 12th FYP, China centralized natural gas capacity will reach 60 million kw with CNY 79.2 million fixed investments. Gas turbine, steam turbine and power generator are major equipment, which takes 65% of investments. China is lacking technologies of gas turbine design and manufacturing. Of the potential markets of the downstream, the first is the power generation by natural gas. The draft of the Twelfth Five-year Plan pointed out that in 2015 China centralized natural gas capacity will reach 60 million kw, a growth of about 24 million kw compared with 26.42 kw in 2010. Calculated on the equipping cost of 3300 yuan per kw, the fixed asset investment will reach 79.2 billion RMB. The three machines (gas turbine, stream turbine, and electric generator) are major equipment in natural gas centralized power generation investment, making up 65% of the total, plus 5% investment of heat recovery boiler. The design and production of gas turbine is the weak area of China.

China plans to have 50 million kw of distributed energy sources lading in 2020, which requires CNY 200 million. Small micro gas turbine, HRSG, absorption air conditioning units will benefit from the plan. Meanwhile, distributed energy resources are the important direction of utilizing shale gas in cities. China plans to initially realize 50 million kw of the equipping scale by the year 2020. Calculated by the investment of 4000 RMB per KW, 200 billion RMB will be needed. Facilities benefiting from such investment include the small and micro gas turbine, heat recovery boiler, and the absorption air conditioning units. In the natural gas combined heating and power system having been put into use in the world, small and micro gas turbine, gas stirling engine, and gas engine are the major thermoelectric generate devices, imported from other countries at present.

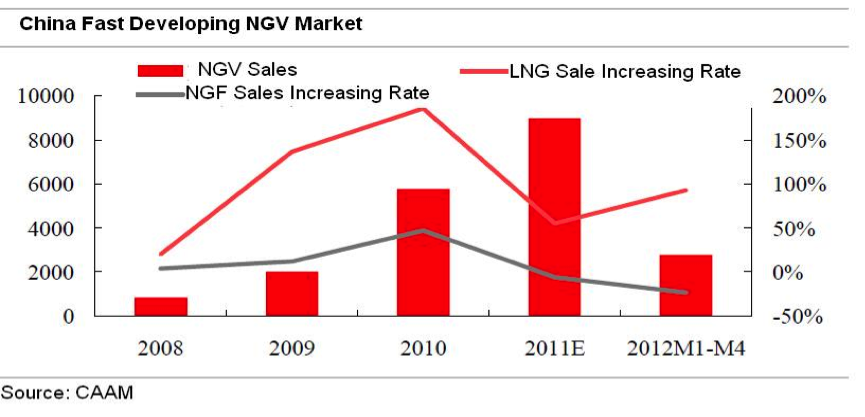

CNG has obvious price advantages against gasoline & diesel.

The LNG vehicle equipment includes LNG engine, LNG cylinders, as well as natural gas vehicles matching LNG filling station equipment and LNG small liquefaction devices. Natural gas for vehicle is also an important market. From the year 2008, LNG automobile industry has started the burst-development, far beyond the growth of passenger car and heavy truck industry. The LNG vehicle development will promote the rapid growth of related facilities. LNG vehicle equipment includes LNG engine, LNG cylinders as well as natural gas vehicles matching LNG filling station equipment and LNG small liquefaction devices.

This map shows the relevant equipment of natural gas application. At present stage, the economical and pragmatic application directions are natural gas pipeline transmission, natural gas vehicle, and gas used in production processes and city gas; it is necessary to develop the natural gas distributed energy resources and centralize power generation, but considering its low economic benefits, the government will arrange the system management to improve its economic return. Obviously, Korean corporations’ chances in the downstream: the strong advantage of natural gas vehicle and Korea has rich gas operation experience and technology storage. This map briefly summarize the development stage of shale gas in China, the advantage and investment opportunities of Korean corporations.

We have analyzed the situation, development direction, and industrial opportunity of the shale gas in China. We have also analyzed the risks in exploration, policies, gas price, and the competition. Although we are optimistic about the shale gas industry, there are different opinions. We need to analyze the development of shale gas in an objective and calm way and be prudent to choose the investment direction.

III. Nautilus Invites Your Responses

The Nautilus Peace and Security Network invites your responses to this report. Please leave a comment below or send your response to: nautilus@nautilus.org. Comments will only be posted if they include the author’s name and affiliation.