by Roger Cavazos and David von Hippel

The Center for Energy Governance & Security

Seoul, Korea

19 August 2014

I. INTRODUCTION

The Democratic Peoples’ Republic of Korea (DPRK) uses special economic zones as a mechanism for engaging in commercial activity with other nations without substantially converting its economy to a market model; earning hard currency while reducing some of the social and political risks associated with a broader opening of the DPRK economy. The DPRK recently announced its intent to increase the number of Special Designated Zones, including Special Economic Zones (SEZ) and Special Administrative Regions (SAR) in the country by fourteen.[1] In most cases, these Special Designated Zones (we will use “Special Zone”, or “SZ”,as the generic term in this Working Paper to apply to Special Designated Zones) will require energy supply (and demand) infrastructure that is now missing, or insufficient, at all existing and proposed Special Zone sites. Even though past is not prologue—and the mechanisms for supplying energy needs to new SZs may be different than those used in the past, this paper seeks to briefly describe already existing Special Zones in terms of their present energy requirements. Present requirements provide rough estimates of the energy requirements of the newly proposed zones. Specifically we examine: the Rason Special Economic Zone and Special Administrative Region, the Hwanggumphyong Special Economic Zone, the Wihwado Special Economic Zone, the Kumgang Mountain Tourist Area, and finally, the Kaesong Industrial Zone. These specially designated zones ideally contribute to economic development in North Korea as well as provide economic benefits to the Chinese and Russian provinces bordering North Korea. Chinese plans to resuscitate and/or invigorate the economies of their three Northeast provinces bordering North Korea would certainly be moved forward by trade with a richer North Korea and access to strategic North Korean ports just across the border. Although this paper does not cover Russian plans, the motivations for Russian investments in North Korean SZs are likely similar—the desire to boost the economies of the areas of the Russian Far East that adjoin the DPRK, and to improve access to markets in Asia.

There is a limited but growing amount of information available to understand how these Special Zones are defined by North Korean policy, how they are currently faring in terms of economic performance, and what future zones will likely require in terms of energy usage. There is also a growing body of rules and regulations by which North Korea and China plan to govern these zones. Except for the Kaesong industrial complex, it appears that all these zones are significantly short on the energy infrastructure necessary to supply their modest current demands, let alone any future projected demands. North Korea’s decision to declare several such zones in North Korea’s interior may possibly indicate a desire to stitch together North Korea’s electrical transmission and distribution networks which are currently more a patchwork of regional grids rather than a unified national grid. Previous Special Zones have always been on or near North Korea’s periphery. Because previous zones were located on the DPRK’s frontiers, they were largely able to “plug in” to already developed electricity transmission and distribution systems on the other side of the border (in China, Russia or South Korea). While we present no specific calculations here, the cost to renew the DPRK’s entire transmission and distribution (T&D) system will certainly cost billions to tens of billions of dollars which could consume on the order of 10 percent or more of North Korea’s GDP for 5 to 10 years, assuming, as estimated by Republic of Korea (ROK) sources, that North Korea’s GDP is in the neighborhood of 40 billion dollars. The costs of T&D renewal are thus well beyond anything North Korea is likely to be able to afford to do in the short-term on anything but a piecemeal basis.

Despite gaps in our knowledge of how Special Zones in the DPRK have formed and operate or will operate, there is a substantial amount of information available from English, Chinese and Korean-language sources describing the basic plans for investment and the businesses that North Korean, Chinese, and in some cases Russian partners hope to develop in some Special Economic Zones. What is missing from the plans for which information is available, however, are detailedplans for building the energy infrastructure required to support the amount of economic activity (in factories, ports, hotels, workers quarters, and other elements of the SZs) envisioned. The electricity infrastructure required to support the economic plans is modest by most industrial standards. The existing infrastructure in most of the SZs, however, is grossly inadequate, and thus will require significant international investment to allow the SZs to operate as planned.

Investing in SZ infrastructure is likely to be more complex than a typical industrial investment. Sources of investment funds for SZ infrastructure could include businesses from a number of nations, and/or government or multilateral funds. Each potential lender/investor will have its own criteria for deciding on whether a given investment is reasonable or too risky. In theory, involving a number of different actors from different nations in DPRK SZ infrastructure investments would help to diversify the risk borne by any given company or nation, and to create a broader constituency for working with North Koreans using business practices that comply with international law and standards. In part, a broader constituency of coordinated investors could also help to discourage the “rent-seeking” by officials that is often a part of projects in the DPRK (and in many other countries). Because the amount of infrastructure-building required is high, there is significant potential for illegal rent-seeking, that is, for example, for DPRK authorities to inflate the price of “surveys” or permits, or the cost of securing import rights for equipment needed for the SZs, in order to gain personally from the transaction.

Working conditions in SZs will be another area of concern for investors and for foreign firms seeking to operate facilities in new or existing SZs. Anecdotal reports suggest that industrial facilities in general in the DPRK tend to operate with limited evident concern for worker safety. In the absence of pressure from investing companies, it is also likely that working conditions will remain poor and dangerous, as there does not appear to be a significant set of DPRK regulations related to industrial safety. Nor, for that matter, does there appear to be a well-established and well-funded government body dedicated to establishing, monitoring and enforcing industrial safety regulations.

This paper describes several of the Special Zones now operating in or in the advanced planning process in the DPRK, together with what is known about plans for their development. For each, it provides a description of the likely energy requirements, based on what can be determined regarding planned activities at each site, and examines adjoining energy infrastructure to identify probable degrees of energy shortfalls that foreign investors, working with DPRK counterparts, will need to overcome. Some of issues and policies that policymakers inside and outside of the DPRK will need to consider in order to arrange for the financing and construction of the requisite infrastructure to operate the SZs.

II. DPRK Special Economic Zones and Their Energy Requirements

The DPRK has defined many types of Specially Designated Zones, including Special Economic Zones, Special Administrative Regions, and Tourist Areas.[2] For the purposes of this paper, we call them all “Special Zone” or “SZ”.North Korea states that it has “constituted a series of laws for ensuring free business activities in the zones”.[3] The actual laws that have been promulgated so far can be found in North Korea in Korean and English language versions. North Korean investment laws pertaining to the Rason SZ are also available in Chinese-language sources.[4] Laws pertaining to Rason are also publically available, but have not so far been publicly promulgated via an official North Korean government website. This practice is in contrast to China, where most provinces and many municipalities post such references on their websites. Copies of North Korea’s investment regulations are, however, availableonline from a number of different Western Sources.[5,6,7] In various news articles, North Korea acknowledged the contributions the SZs have played in the economic development of China and Vietnam. That North Korea would choose to name both those countries likely indicates that they consider those approaches successful (as opposed to say, Romanian approaches, where political reform preceded economic reform), and thus following the lead of China and Vietnam with regard to development of SZs is considered a worthy approach to North Korean economic development. However, North Korea also clarifies that “improving economic management methods” is meant to “consolidate the socialist economic system”. As such, the DPRK expresses its opposition to any pervasive political reforms that might accompany the hosting of SZs. Rather, North Korea is interested in experimenting with economic reform, with SZs as the laboratories for doing so, in order to strengthen its existing political system. Other analysts have more simply, though with significant justification, described SZs as primarily a way to attract much-needed foreign investment to the DPRK.[8]

The electrical power and other sources of energy required to turn SZ dreams into reality vary, of course, by the type and extent of economic infrastructure to be supported, but are actually fairly modest by most international industrial standards; somewhere in the neighborhood of megawatts to tens or hundreds of megawatts, if power supplies to Kaesong can be used as a guide. Despite these relatively modest requirements, North Korea presently falls well short of being able to provide consistent and reliable supplies of electricity to SZs from its existing domestic infrastructure, particularly without diverting power from existing critical elements of the domestic economy, because the DPRK’s generating, transmission, and distribution system is in generally poor condition. The Bank of Korea assesses that the entire country of North Korea has a total generation capacity of 6.97 million kilowatts (kW), and generates 23 billion kWh (kilowatt-hours) per year. Nautilus estimates, however, suggest that the actual operable DPRK capacity in recent years is much less, perhaps 2 to 3 million kW, with output in the range of 15 to 16 billion kWh. Even taking North Korea’s capacity at the nominal levels estimated by the Bank of Korea, which are about nine percent of South Korea’s, because of constraints on coal supply, operability of power plants, hydroelectric resources, and the age and poor condition of most transmission and distribution infrastructure, North Korea does not (or cannot) generate power with the same capacity factors as are used in the Republic of Korea. Consequently, North Korea only generates a few percent of what their Southern counterparts generate per year.[9] Even if the DPRK were able to use its generating units at their nominal full capacity, due to the aforementioned difficulties with the DPRK transmission and distribution grid (which, though nominally a national grid, in fact operates as a set of nearly separate regional grids centered around major power plants) it would likely not be possible to distribute the power to all of the places where it is needed. The fact that North Korea’s national transmission and distribution system is presently a patchwork of local grids means that it is almost impossible, as an example, to generate excess electricity in one Special Zone and then transfer that power to another zone or to a neighboring municipality. Therefore, one of our suggestions later is to focus on developing local transmission and distribution grids to feed the SZs themselves. Once such grids are developed, they can be gradually expanded to supply the local areas around the SZs, and ultimately linked into the national grid when the latter is strong enough to support such integration.

Of the energy sources available inside North Korea, unsurprisingly, coal is by far, the most available, and the most commonly used source of commercial energy.[10,11] The DPRK’s coal reserves are large—large enough that it now exports over 10 million metric tons of coal annually to China. In theory, coal-fired power plants using North Korean coal could be built too, in a matter of a few years, to power SZs, possibly, assuming the use of Chinese technology, at costs in the range of $800 to $1200 per kW of rated capacity. As such, the cost of coal-fired power plants would be higher than, for example, diesel-fueled units, and would take considerably longer to build and commission, but would have much lower running (especially fuel) costs. Coal’s drawbacks include the emissions of air pollutants with local and regional health impacts, as well as greenhouse gases, when burned, though that can be said of coal regardless of the source. Of perhaps more direct and immediate importance in the DPRK, coal mining is often restricted by a lack of power to run mining equipment, as well as by mine infrastructure and safety equipment that is often inadequate to support reliable production. The impact of lack of electricity on coal production, and of lack of coal on electricity production, is one of several inter-related issues North Korea must address if they are to source energy needs for SZs from inside North Korea in a sustainable fashion.

That the DPRK cannot, at present, reliably provide energy infrastructure sufficient to run SZs has not escaped the notice of potential SZ investors. For instance, it has been reported that North Korea reached out to several Chinese investors, in an effort to develop SZs in part to earn hard currency. The Chinese investors contacted found that the infrastructure on the North Korean side was inadequate to support joint plans for SZ development.[12]

Although coal mines are nominally supplied with power from eight major thermal power plants in the DPRK, and those plants have nominal capacities ranging from a 100 to 1600 Megawatts (the latter the Pukchang Thermal Power Plant),[13] in practice, the combination of lack of fuel, obsolete and often inoperable equipment, and the poor state of the transmission and distribution grid mean that coal mines typically do not receive the amount of power they need. As a result SZ coal and electricity needs are unlikely to be met, at least in the near term, from North Korea’s domestic coal and power supplies; even though some light industrial zones have energy requirements that are likely to be measured in megawatts or less.

The Kaesong Industrial Zone, located about 10 kilometers north of the South Korean border, is a mature functioning industrial zone, and as such provides a benchmark for the amount of energy required to produce a unit of industrial output. This benchmark is, of course, an imperfect match to other proposed and future SZs, as each SZ will have its own industrial or commercial focus, and different industries have different intensities of energy use (for example, kWh per unit of value added). Inputs in the Kaesong Industrial Zone include the labor of 53,000 North Korean workers, coupled with inputs (imported via transmission line from the ROK) of up to 100,000 kilowatts of power. Combined, this labor, power, and the accompanying industrial and related infrastructure produced about $2 billion worth of labor-intensive goods last year.[14] The 53,000 North Korean laborers earned a collective $90 million per year, or around $1,700 annually per worker, in salary from South Korean firms, while their labor produced about $38,000 worth of goods per worker annually.

III. Descriptions of Current and Proposed SZs in the DPRK

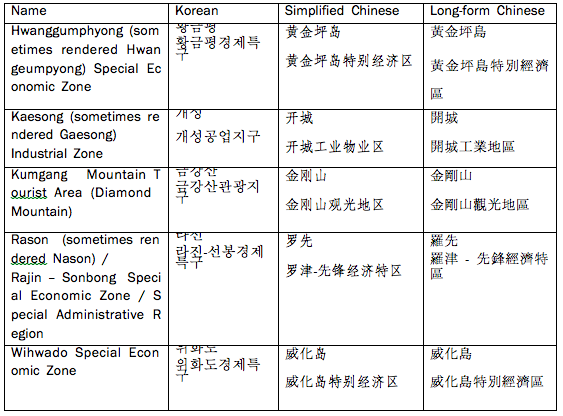

In the interest of standardizing terms and facilitating future multi-lingual research, Table 1cross-references the English, Korean and Chinese names and terms used to apply to the SZs discussed below. Koreans on either side of the Military Demarcation Line refer to their language in Korean by two different names. In this paper, we only use the English term “Korean” to describe their language. Figure 1 provides a map showing the locations on the Korean peninsula of the SZs discussed.

Table 1: Standardized Names of Specially Designated Zones in English, Korean, and Chinese

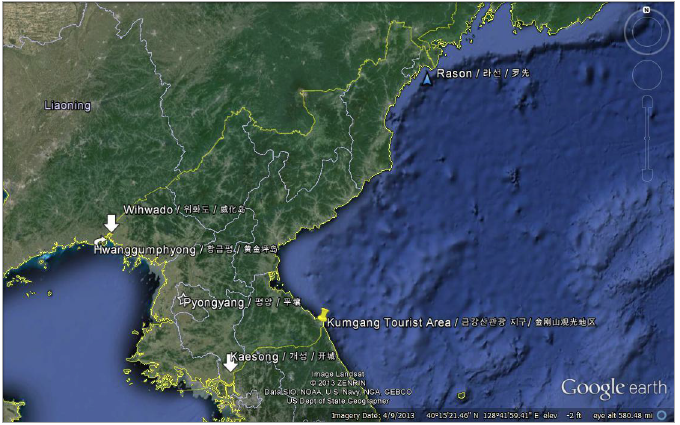

Figure 1: Specially Designated Zones in North Korea.

Source: Google earth V 7.1.2.2041. (April 4, 2013). North Korea. 41° 15’ 21.46”N, 128° 41’ 59.41”E, Eye alt 580.48 miles. SIO, NOAA, U.S. Navy, NGA, GEBCO. TerraMetrics 2013, DigitalGlobe 2013. http://www.earth.google.com (Accessed November 3, 2013).

3.1 The Rason SEZ 라선/罗先/羅先

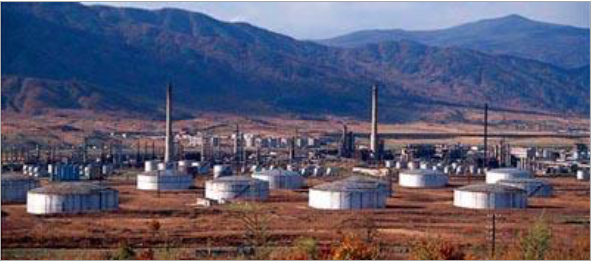

The Rason SEZ, as shown in Figure 2, is located on the Northeast coast of the DPRK, just south of the area where the borders of the DPRK, Russia, and China meet. The Rason area has about 185 square kilometers suitable for development, although the total land area of the zone is far larger. The Rason area hosts one of the DPRK’s two major oil refineries. The Sungri Oil Refinery is located in the town of Unggi, near Sonbong, has a reported capacity of 42,000 barrels per day (bpd) (about 2.1 million tons/yr—though other sources suggest capacity of 2.5 million tons/yr), with a reported fluid cracking facility of 7,300 bpd.[15, 16] The refinery was built circa 1968 by the Former Soviet Union (FSU), and expanded in 1970. As of 1990, this refinery probably processed much or all of the oil imported to the DPRK from the FSU and from Middle Eastern countries. Sources suggest that inputs from the FSU arrived by train, with imports also received by ship from Saudi Arabia, Indonesia, Malaysia, and Iran. A Japan-based North Korean organization lists the storage capacity of the plant at 2 million ton (it is unclear whether this is ton of oil products, of crude oil, or both—but is most likely for crude oil and oil products combined).[17] A separate source reports much lower storage capacity of 30,000 ton of crude oil, 40,000 ton of diesel, 30,000 ton of heavy oil, 20,000 ton of gasoline, and 5,000 ton of lubricants.[18] A “panorama” of the “Sungri Chemical Plant Oil Refinery, Sonbong” from the “The People’s Korea” (source as above) is provided below as Figure 3. As of this writing, the Sungri refinery has reportedly been mostly idle since the mid-1990s, and it is unclear how much work and what scale of investment would be required to bring the refinery back on-line. In mid-2013, HBOil JSC, a Mongolian oil trading and refining company, announced the purchase of a 20 percent stake in the Sungri refinery, with the intent of refining oil products for the Mongolian domestic market, possibly by way of an oil products trade with Russia.[19] It is somewhat unclear what this purchase means for implementing the repairs/refurbishment required to restart the refinery.

Figure 2: Rough Limits of Main Rason Area Showing Rajin and Sonbongas Two Distinct Ports

Google earth V 7.1.2.2041. (June 17, 2013). North Korea. 42° 18’ 18.56”N, 130° 19’ 50.14”E, Eye alt 18.06 miles. SIO, NOAA, U.S. Navy, NGA, GEBCO. TerraMetrics 2013, DigitalGlobe 2013. http://www.earth.google.com. (Accessed November 3, 2013)

Figure 3: Photo of Sungri Chemical Plant Oil Refinery

A key set of parameters determining the way that the oil refinery at Rason can be operated are related to the capacity of the port. It is beyond the scope of this paper to explore in detail port specifications at Rason such as the draft depth at the entrance to the harbor and pier-side, or the length of the piers that exist or could be developed, but these parameters in large part determine the range and size of civil and military ships that can call at the port. The types of civil and military ships that can be accommodated at Rason may reveal military as well as commercial intentions on the part of the DPRK and its partners for the strategically-located harbor at Rason.

Adjacent and associated with the Sungri Oil Refinery is a power plant with a generating capacity of 200,000 kilowatts. This plant was built to use heavy fuel oil (HFO) from the refinery, and to provide heat for refinery operations. When HFO was provided to the DPRK by the international community as part of the 1990s “Agreed Framework” and later Six-Party agreements on the DPRK’s nuclear weapons program, some of the HFO supplied was stored at and used in this power plant. The power plant has been reported to be in poor condition due to the use of aggressive fuels and lack of spare parts, and it is unclear how much the power plant has operated, if at all, in recent years, so it seems unlikely to be a significant power source for the Rason area without significant capital investment and renovation.

Apart from the needs for energy infrastructure, it is expected that North Korea will have to make some changes in infrastructure of various types and/or adjustments in policies at the county level in order to more fully support the Special Economic Zones it has planned. Although the DPRK has promulgated English-language investment laws for the Rason area, no detailed list of specific development plans has been identified by the authors that are on par with the five-year plans produced on the Chinese side. But the level of change ongoing and the level of effort that China expended to develop its municipalities and prefectures just on the other side of the border may offer an indication of the range of changes and investments one might observe in North Korea’s portion of the Rason area. For example, in China’s Yanbian prefecture, near the border with Rason, the local government has formulated and issued 20 specific policies in order to accelerate development in and around the prefecture in support of regional five-year plans.[20]

3.2 China’s Economic Development Activities in the Rason Area

As a result of Chinese policies, the Chinese border city of Tumen/도문/图门/圖門 has quickly become a major regional logistics hub. The Haihua Trade Group operates the Chinese side of the North Korean port at Rajin with a 40 ton crane and 195 special purpose vehicles across some 36,000 square meters of hardened port surface.[21] China and North Korea are linked in the Rason area by a 158 kilometer railway line to Rajin. Another 171 kilometer rail line to Chongjin is under development, and will provide China with access to two strategic ports. China leased piers 3 and 4 in Chongjin for 30 years. Tumencity signed a framework agreement on joint construction of a DPRK industrial park in Rason. The industrial park will eventually be 5 square kilometers, but it is starting out at only 1 square kilometer – with a 2 billion yuan (~330 million USD) price tag for initial investment. Presumably, costs for the entire project will not be directly scalable. In other words, developing all 5 square kilometers should not cost 10 billion yuan (~3.3 billion USD) or about 8% of North Korea’s estimated GDP, but it is clear that developing even one relatively modest Special Zone is a significant investment. When that investment is multiplied to account for the DPRK’s aspirations to develop 14 other zones, however, it is manifestly clear there is presently a large difference between DPRK plans and the realities of available domestic investment capital (though of course different SZs will have different price tags). Initial investment costs are always much higher, due to the need to build basic infrastructure, with follow-on investments in SZs usually being less costly. The zone also signed an employment contract with the DPRK Investment and Joint Venture Committee to employ 20,000 people in projects like animation and cartoon production (a low energy-intensity, and thus low-environmental impact activity). Plans to produce up to the 22,000 minutes of animated films per year have been described in the Chinese media. The joint venture industrial zone in Rason has already brought in 625 North Koreans to work on various projects, including construction of barracks to house an additional 1, 500 people.[22] Residential buildings accommodating 1,500 people would normally require on the order of hundreds of kilowatts to perhaps a few megawatts to provide for residential energy needs, with additional power for associated commercial/communal facilities and any industrial activities.

With regard to other infrastructure at Rason, the Chinese leased two piers at Rajin port while the Russians leased a third pier from the North Koreans.[23] North Korea courted both countries and allowed the Russians to build a rail line from Khasan, Russia to Rajin. North Korea also allowed China to pave a road from the Chinese border town of Hunchun to Rajin. Both China and Russia likely perceive that North Korea owes them a debt for their respective efforts, while North Korea likely perceives both China and Russia are now locked into making the most of their investment, and will continue to fund other investment projects in North Korea.

China’s Jilin province, and especially the border area around Rason, engaged in infrastructure development, and made legal, security and other arrangements to prepare for what they hope will be a booming economic trade with the Rason SEZ. North Korea seems to participate in some of these planning efforts, but has not really initiated many of the actions. The Jilin Provincial Public Security Bureau had already started examining, approving and providing tour documents (but not foreigner visas or residence permits) as of 28 June 2013.[24] The Bureau can issue up to 700-1,000 Chinese passports, 500-1,000 tour permits to the DPRK, and 300-500 visas a day.[25] There have been around 320,000people crossing the border in the Rason area per year for the past two years.[26] Jilin (China) newspaper reports also clarify that Rason is important to Chinese plans as an growth engine for the CHANGJITU, which is short for the Changchun – Jilin – Tumen/장 춘 – 길림–도문/ 长春-吉林-图门/ 長春- 吉林- 圖門area.[27] The Chinese city of Hunchun/훈춘/珲春/琿春is near the North Korean border and serves as the last Chinese transit point en route to Rason and to parts of Russia. In 1992, Hunchun was designated as the “bridgehead” to open up (China’s Northeast) to the world.[28] China has detailed a progression of power supply projects to meet Rason’selectricity needs. The first project was a construction survey for two 66 kilovolt (kV) lines stretching almost 100 kilometers from power sources in China.[29] The transmissionline includes about 52 kilometers of 66 kV line inside China, and 40.5 kilometers of line in North Korea. In addition, China plans to build33 kilometers of 220 kVpower lines passing through mountainous areas. Clearly this is a priority for China and for the regional Chinese authorities as evidenced by the financial, technical, managerial, and human resources dedicated to develop the area.

Chinese experts in power line measurement, geology and hydrology surveyed the path of the 30 kilometer, 220kV power line from Hunchun, China to Rason, North Korea. The route had to parallel the original Hunchun-Rason line since the original route contained three underground cables: one for military use, one for telecommunications, and one for the internet.[30] The surveys also had to traverse military-administered zones, active mines, highways, dense forests and snow-covered slopes. The fact that this survey took place despite the challenging terrain and potentially politically sensitive facilities along the route is another indicator that the effort is high priority enough to force different Chinese ministries to overlook potential inter-ministerial conflicts at a minimum, and quite possibly cooperate in limited instances.

In order for North Korea to make a reciprocal effort to take advantage of the intensity of the Chinese interest in developing Rason, we can see that DPRK will, at a minimum, need a trained, capable technocratic corps with numerous skills such as electrical engineers, geologists and hydrologists to survey and plan the future growth of North Korea’s electrical grid and other infrastructure needed to support each Special Zone. It is highly likely that the DPRK has engineers and other technical workers with basic background in those disciplines, but in the required areas, but that those workers will need further training in the application of up-to-date tools and methods in order to be able to play an active role in development of an SZ with modern, competitive infrastructure. In another article describing Chinese work in the Rason area is the report that China spent about 1.1 billion yuan (~167 million USD) primarily constructing energy infrastructure, but also undertaking other projects such as constructing 220kV substations to facilitate the movement of power from China’s interior to Hunchun,and from Hunchun to the DPRK border.[31] Although the costs of infrastructure development may be slightly less in North Korea, due to lower labor costs, this example provides a rough order-of-magnitude cost in terms of capital and capabilities that North Korea will need to come up with in order to provide energy to a relatively modest economic zone.

An unknown, however, with regard to whether the announced joint-venture activities outlined above will actually come to fruition, is what impact the recent news that Jang Song-taek, who was considered the second highest official in the DPRK,has been found guilty of official malfeasance and executed would have on the DPRK’s planned projects with China.[32] Jang Song-taek was Kim Jong-un’s uncle and the primary North Korean interlocutor with China on commercial matters. Jang was also head of the powerful DPRK Investment and Joint Venture Committee. As such, Jang represented technocratic, financial, and most importantly, family connections for those seeking to do business with North Korea, particularly Chinese business interests. It is possible that China will pull back from joint venture projects with the DPRK as a result of Jang’s conviction, but it is not yet clear how China will respond.

3.3 Potential for Russian and South Korean Engagement with the DPRK in the Rason SEZ

There are some very real possibilities for engaging North Korea in a business sense through certain activities, such as cooperation between Russia and both Koreas. Based on reports of preliminary discussions, it appears that instead of developing a gas pipeline from Russia via North Korea to South Korea, South Korea may be interested in pursuing the rail option for importing Russian gas, oil and other goods to the ROK. All South Korean investments that might be made in North Korea would have to be made in Russia, with Russian firms or ministries then investing in the DPRK on South Korea’s behalf. Another investment option for South Korean firms is to use the Russian branch offices of Korean firms to make the investments as a legal maneuver to navigate around the numerous sanctions on investing in North Korea imposed by both the United Nations and South Korea authorities.[33,34]

IV. The Hwanggumphyong SEZ

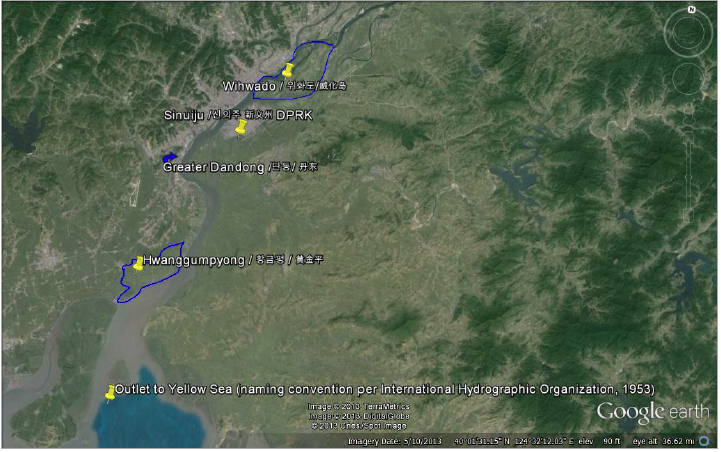

The Hwanggumphyong SEZ 황금평/黄金平/黃金坪is an area near the North Korean border city of Sinuiju신의주/新义州新義州, located in the DPRK’s Northwest along the Amnok gang/압록강or Yalu River/鸭绿江.[35] Figure 4 shows the relative locations of both SZ’s located in the Sinuiju area, of which Hwanggumphyong is one.

Figure 4: Sinuiju area showing the relative locations of Hwanggumphyong, Wihwado, Sinuiju, North Korea and Dandong, China

Google earth V 7.1.2.2041. (May 10, 2013). North Korea. 40° 01’ 31.15”N, 124° 32’ 12.03”E, Eye alt 36.62 miles. SIO, NOAA, U.S. Navy, NGA, GEBCO. TerraMetrics 2013, DigitalGlobe 2013. http://www.earth.google.com (Accessed November 3, 2013)

4.1 Basic Overview of Hwanggumphyong SEZ

The DPRK law on Hwanggumphyong and Wihwado was adopted in December 2011. According to the (North) Korea Central News Agency, investors in the Hwanggumphyong SEZ receive preferential treatment with regard to payment of DPRK tariffs, enterprise income taxes and use of land.[36,37] There are additional incentives for operating businesses in the location for more than 10 years – an indication of the DPRK authorities’ desire to see long-term investment in addition to the “get rich quick” emphases often associated with North Korea’s perceived needs for immediate capital injections.

As indicated from a satellite view of the area (Figure 5), Hwanggumpyeong is an island barely separated from China, and is located almost all the way across the Yalu River from North Korea. The 14.4 square kilometer island is predominantly used for agriculture at present.[38] The island is in close proximity to Chinese road and rail connections, although it is not yet physically connected to China. The presence of this relative density of infrastructural connections to China likely indicates that the DPRK knows that China will control the “on-off” switch for energy provision to the Hwanggumphyong Special Zone, and is comfortable with the arrangement. That there is not a North Korean power station near the island, and only one electricity transmission and distribution substation on the island, further indicates that the DPRK expects China to “light the path” (provide for the energy requirements) of the SEZ to be developed on the island.

Figure 5: Hwanggumpyong Special Economic Zone (Note proximity to China and relative distance from North Korea.)

Google earth V 7.1.2.2041. (May 10, 2013). North Korea. 39° 57’ 36.41”N, 124° 18’ 37.07”E, Eye alt 27,718 feet. SIO, NOAA, U.S. Navy, NGA, GEBCO. TerraMetrics 2013, DigitalGlobe 2013. http://www.earth.google.com (Accessed November 3, 2013)

The island is ideally situated to allow raw materials and parts to be shipped from China and assembled by extremely cheap (even by Chinese labor standards) North Korea labor. From there, finished goods can be moved in about 17 hours of transit time via coastal marine vessels to Incheon, South Korea, and from there to South Korean and worldwide markets. Chinese plans for the island, however go beyond simply manufacturing. In addition to industrial concerns such as garment processing, China also has indicated that it wishes (together with the DPRK) to pursue modern and efficient agriculture, electronic information businesses, business services and cultural and creative industries (emphasis added) in the Hwanggumphyong SEZ.

To attract business interests, both sides have agreed to a flexible foreign exchange policy and to allow both China and North Korea to establish branches of financial institutions in the Special Zone. Given, however, United Nations and US sanctions affecting the DPRK’s financial sector, and North Korea’s extremely limited access to the International Banking System, it seems likely that Chinesebanks will be the major providers of financial services in the Zone for the first few years, at least, of the Hwanggumphyong SEZ’s operation.

China already started the process of assembling the human capital needed to run the SEZ, advertising for applicants for specific positions with an emphasis on management, (electrical) power engineering and various aspects of electrical power management, environmental management, tax collection and tax administration, legal counsel, and a wide variety of clerical positions associated with these job titles.

Among the types of infrastructure needed to operate Hwanggumphyong as an SZ will be the development of flood control systems, as the island is apparently subject to flooding. As noted above, the currently mostly agricultural island lacks sufficient electrical infrastructure to supply an SEZ, as it has only one power substation of unknown capacity. It is conceivable that the one substation is enough for North Korean purposes, at present (likely for some residential use and agricultural pumping) but that it is very likely that North Korea’s energy plan for the area is to ask the Chinese to provide the necessary energy infrastructure, probably including a connection to the Chinese electrical grid, although an analysis of satellite imagery of the area as of mid-2013 suggests that the electricity requirements for the first (customs) buildings on the site appear to be supplied from DPRK sources.[39] The same analysis notes a number of infrastructural improvements underway on the site, including moving of roads and drainage ditches, construction of buildings, and other activities, most, apparently, carried out by Chinese firms.

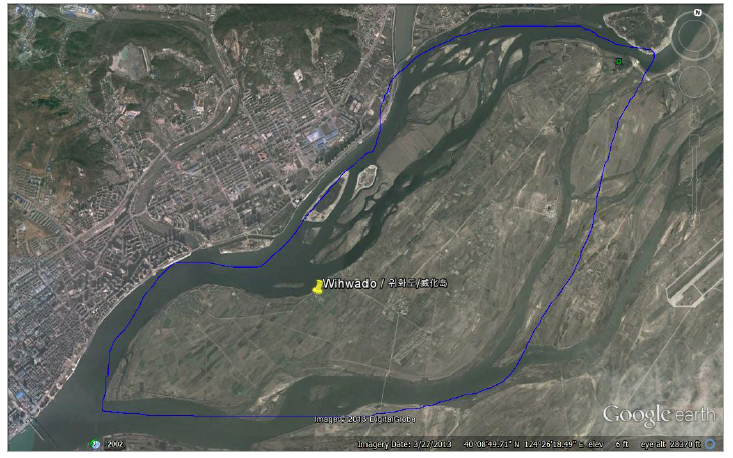

V. Wihwa Island Economic Zone

Located just upriver on the Yalu to the northeast of the Hwanggumpyong SEZ is theWihwaIslandEconomic Zone/위화도/威化岛/威化島, also within the Sinuiju신의주/ 新义州新義州area (see Figure 6). The island is historically notable in that it is the site of the “the Wihwado Retreat” in the 14th century when General Yi Seonggye of the Koryo kingdom changed his mind about invading China, and returned to his capital (then Kaesong) to stage a successful coup against the Koryo regime and found the Joseon Dynasty.[40] The same tax and visa exemptions arranged for the Hwanggumpyong SEZ apply to the Wihwa as well. North Korea’s laws and guidelines for development provide more robust guidance on how the zone should be developed and managed, but associated or detailed plans beyond those originally promulgated on 3 December 2011 have not yet been published.[41] Still, the laws and the associated organizational structures to be established clearly demonstrate there were some lessons learned by DPRK authorities from experience in developing previous zones. Precious few shovelfuls of dirt, however, have been turned in either the Wihwa Island or Hwanggumpyong SEZ. The Chinese side of the border shows a great deal of development consistent with China’s growth. Once development on the DPRK side in the Sinuiju area does move forward, China can rapidly connect the area to the dense regional road, rail, and power infrastructure on the Chinese side of the border.

Figure 5: WihwadoIsland (Note single power substation in upper right quadrant marked by a square.)

Google earth V 7.1.2.2041. (March27, 2013). North Korea. 40° 08’ 49.71”N, 124° 26’ 18.49”E, Eye alt 28,370 feet. SIO, NOAA, U.S. Navy, NGA, GEBCO. TerraMetrics 2013, DigitalGlobe 2013.http://www.earth.google.com (Accessed November 3, 2013)

VI. The Mount Kumgang Tourist Area

The Mount Kumgang Tourist Area/금강산/金刚山/金剛山, located on the Southeast coast of the DPRK just North of the Military Demarcation Line and the ROK border, was one of the first joint ventures between the ROK and the DPRK, with ROK tourists visiting the area starting in 1998. Kumgang Mountain, one of the major mountains on the Korean peninsula, is of cultural significance for Koreans on both sides of the DMZ.The tourist area has been mostly inactive for the past five years following the 2008 death of a South Korean tourist at the hands of North Korean soldiers. Formerly a tax-free zone, DPRK authorities have recently changed the tax structure for the Mount Kumgang Zone such that income received by Korean and foreigners in the zone is now taxable.42 This change in regulations may affect future investment in the Zone by South Korean firms and others.

With respect to infrastructure in the Kumgang Mountain Tourist Area, there are at least two hotels capable of hosting 740 people within a range of 3 kilometers of Gosung port, the entry point for tourists to the Zone. Unfortunately, many of these buildings have not been used in five years and deferred maintenance means it will take time and investment to refurbish them for further use. The HAEKUMGANG, a floating hotel, has not been used at all for at least five years, and will reportedly require a lengthy maintenance period before it can be put into service.43It is unclear how much refurbishment and maintenance was done recently to prepare the facilities for their newest guests—Chinese tour groups—which started touring the area beginning on 14 April 2013.44 No statistics have been put forward by either the Chinese or the North Koreans with regard to infrastructure upgrades to accommodate Chinese tour groups.

Figure 6: Selected areas of Kumgang Mountain Tourist Area

Google earth V 7.1.2.2041. (October 3, 2010). North Korea. 38° 41’ 14.09”N, 128° 16’ 17.61”E, Eye alt 15.16 miles. NASA.TerraMetrics 2013, DigitalGlobe 2013. http://www.earth.google.com (Accessed November 3, 2013)

When the Mount Kumgangsan resort was running, it supported at least 11 restaurants, 2 shopping centers, at least 3 buses running for 12 hours per day, plus another bus running approximately 50 kilometers per day, as well as lodgings containing at least 959 rooms, each designed to accommodate anywhere from 2 to 8 people.[45] The original plans for the Kumgang area also called for enough energy to support 1.2 million visitors per year, or an average load of just under 3,300 people per day.[46] Relative to the amount of power required in an urban or major industrial center, the required power for the area, perhaps in the range of a few megawatts, would not be considered too significant. The Kumgang area, however, is remote, so all of the electricity required by facilities in the zone would need to be generated nearby, since there do not appear to be long distance high tension power lines to connect this area with anywhere other than the relatively lightly-populated Tongchon area (on the Korea East Sea/Sea of Japan coast to the North and West of Kumgangsan), and it is unclear whether those power lines are sufficient (or receive sufficient power from local or regional grids) to supply the Kumgang resort.

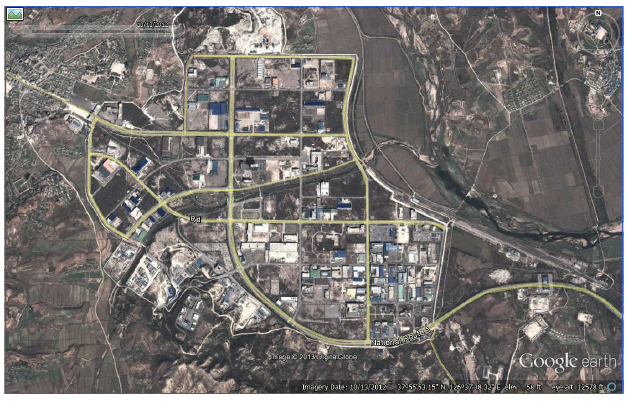

VII. The Kaesong Industrial Zone

The Kaesong Industrial Zone개성/开成 /開城, located just north of the Demilitarized Zone in the southwest corner of the DPRK (see Figure 7), was set up as a joint-venture manufacturing zone where South Korean companies employ largely North Korean workers. The initial DPRK authorizations creating the zone were put in place in 2002, and manufacturing at Kaesong by South Korean companies began in 2005. The experience gained in operating Kaesong since that time provides the most detailed and verifiable set of data on energy use and infrastructure needs available for SZs in the DPRK, since Kaesong constitutes a relatively mature Special Zone. At Kaesong, all of the electricity and as far as one can tell, all significant other fuel requirements required for the industrial zone are sourced from the ROK. One substation in Munsan, South Korea sends electricity to a 100,000 kW substation in Kaesong. Two LPG (Liquefied Petroleum Gas) companies from the ROK reportedly supply an average of 550 tons of LPG per month by truck and in small containers from the ROKto 93 businesses in the Kaesong Industrial Zone.47 Since there are more than one hundred and twenty businesses in Kaesong, the other 25 or so businesses either do not use LPG,receive LPG from a different supplier, or use another fuel (besides electricity). Even if the amount of LPG reportedly supplied is increased by another twenty-five percent to account for fuel use by other companies, total monthly LPG usage at Kaesong is still less than 700 tons, or about 400 TJ (terajoules) of LPG per year. Adding in the electricity supplied over the 100 MW power line to Kaesong from the ROK, which we have roughly estimated was about 540 GWh (gigawatt-hours), or about 1950 TJ as of 2010, yields a total annual energy supply for Kaseong of around 2400 TJ. In 2010, the value of goods from the Kaesong complex was 323.3million USD.48More than half of this output value was from textile/apparel firms. The overall implied energy intensities for Kaseong were therefore about 1.2 kJ of LPG and 6.0 kJ of electricity per dollar of output in 2010. These figures are no more than very rough indicators for the general energy requirements of SZs, since energy intensities for manufacturing tend to be very product-specific.Moreover, the agriculture, high tech, tourism and other activities planned for some of the other SZs under development are generally less energy-intensive, per unit of output value, than manufacturing.

Figure 7: Satellite Photo of the Kaesong Industrial Zone

Google earth V 7.1.2.2041. (October 13, 2012). North Korea. 37° 55’ 53.15”N, 126° 37’ 38.32”E, Eye alt 12,578 feet. SIO, NOAA, U.S. Navy, NGA, GEBCO. TerraMetrics 2013, DigitalGlobe 2013. http://www.earth.google.com (Accessed November 3, 2013)

The infrastructure required to supply the forms of energy used in Kaesong, and required, in some quantities, in any type of SZ, includes energy transfer using bulk Lorries (for coal and LPG, for example), power lines, pipelines, and roads. Energy provision using bulk Lorries offers relatively low infrastructure costs (apart from roads), but is feasible mostly over relatively short distances and for relatively small to medium annual volumes of fuels. To the extent that SZs serve as hosts to larger enterprises, requiring larger volumes of fuels or electricity, infrastructure costs (for example, for gas pipelines, terminals for ocean-going tankers, and transmission lines) will increase appreciably.

VIII. Future Zone

North Korean authorities have indicated that they will establish up to 15 additional Special Zones. 14 possible future zones were identified in an announcement in late November 2013.49At about the same time, the possibility of developing 15th Special Zone in the vicinity of the Northern Limit Line was mentioned.50 With regard to this 15th Special Zone, it is possible that there is some confusion since the exact outlines and boundaries of this Zone were not clearly defined, and as a consequence, this particular Special Economic Zone may simply be an extension of a previously identified zone.

IX. Governance and policy issue to consider for all locations

For SZs to function laws and regulations governing their operation must be developed and promulgated. These regulations include tariff, customs, visa, employment, and other relevant rules by which the SZs will be run and economic relationships between DPRK and foreign partners will be defined. Developing these laws and regulations is mostly an internal DPRK process, but partly a process of negotiation with partners to assure that the resulting governance structure is one that partners can live with, and is attractive to foreign investors. In SZs where Chinese firms are the principal partners, there is evidence that Chinese authorities have had some influence over the process of developing the DPRK’s rules for the SZs.[51] It is possible to argue that the DPRK adapted parts of its SZ laws from those of China and Vietnam based on the English-language readings, but it is also clear that DPRK also amended and tried to adapt the laws to their specific conditions. For example Sections, sub-sections and terms are not wholesale copied from the Chinese or Vietnamese laws to the North Korean laws.[52,53,54,55]

Whatever the origin of the regulations governing SZ operations, a trained cadre experienced in interpreting and applying the various investor laws is crucial to the smooth operation of the SZ, consistent with interpretations of the law and with building the confidence of outside investors in partnering with the DPRK. This means that on the DPRK side, training must be provided for the officials that will operate the customs and other functions associated with each SZ. In addition, both foreign and, if allowed, North Korean intermediaries, including lawyers, would need to be trained in SZ regulations so as to be available to help potential foreign investors/operators and DPRK partners working in the SZs to navigate the relevant SZ regulations.

X. Conclusion and Policy suggestions

Both China and North Korea have promulgated plans of varying degrees of specificity for Special Zones located in the DPRK, including plans for increased joint industrial and commercial activities within those zones. In most cases, the locations of the zones are such that little in the way of the infrastructure required to provide reliable supplies of energy, particularly electricity, to the zones yet exists. By the standards of energy requirements for modern industry and urban areas, the energy needs for the SZs are likely to be relatively modest. Modest as these requirements are likely to be, there is presently a significant deficit of capacity and infrastructure in the areas of the DPRK where the Zones are to be located, indicating a gap between what the governments say they would like to develop in the way of productive facilities, and what energy infrastructure actually exists to operate these zones at the moment. This gap represents a flag of caution that must be observed by any firm seeking to invest in or develop facilities in a new DPRK SZ.

For the international community, however, the need to develop energy infrastructure to enable operation of DPRK SZs can be seen as an opportunity for engagement with DPRK. For example, providing power to a particular SZ might be used as an opportunity to work with DPRK actors on development of pilot projects for renewable energy (small hydro, wind, and/or solar power, for example), to demonstrate building and industrial technologies that are highly energy-efficient, so that the supply-side energy investment requirements are reduced, and to demonstrate the construction of new local electricity grids as guides to the eventual replacement of the DPRK’s existing, and in some cases, failing, system of electricity transmission and distribution substations and transformers. Collaborating with the DPRK on energy provision, if carefully structured, can be viewed as moral value independent in that even if energy efficiency technology or concepts are transferred to the North Korean military, the benefits of using less energy and reducing greenhouse emissions still accrue to the “global commons”. It is possible that the DPRK would be sufficiently motivated—by the need for hard currency that SZs generate—to participate in these cooperative energy projects, which in turn, by their nature, would offer more North Koreans experience in working with foreigners in a cooperative sense as partners rather than competitors.

Another potential application of DPRK SZs, and another way of generating hard currency to help to move the process of redevelopment of the DPRK economy along, might be to establish Special District-Industrial Complexes to develop mineral resources in North Korea.56 The DPRK has extensive mineral resources57 with ready markets in the ROK, China, and worldwide reachable via port cities such as Rason (assuming adequate infrastructure development). North Korea’s mineral wealth can be used to help to sustainably redevelop the DPRK economy. For the energy sector, coupling minerals production activities, for example, in Special District-Industrial Complexes, with the types of energy infrastructure pilot projects described above might be a recipe for sustainable economic ventures that can be built upon over time, while offering opportunities for outside firms and organizations to usefully engage with DPRK officials and technical staff in positive and apolitical ways.

XI. REFERENCES

[1] Huffington Post, “North Korea Plans to Expand Special Economic Zones”, 16 October 2013. Available as: http://www.huffingtonpost.com/2013/10/16/north-korea_n_4108265.html

[2] For a more thorough and legalistic categorization see, Adam Xiangtong Kong, “Chinese Aided Special Economic Zones as a Means for North Korean Reform”, Master’s Research Thesis The Ohio State University, April 2013. Available as: http://kb.osu.edu/dspace/bitstream/handle/1811/54558/Special_Econ_Zones_NK_Reform_Adam_Kong _Senior_Thesis.pdf?sequence=1. See also Megan Murray, “What are Special Economic Zones”, 9 February 2012. Available as: http://ebook.law.uiowa.edu/ebook/faqs/what-are-special-economic-zones

[3] (North) Korea Central News Agency, “International Conference on SEZ Development Opens in DPRK”, 16 October 2013. Available as: http://www.kcna.co.jp/item/2013/201310/news16/20131016-23ee.html

[4] 中华人民共和国驻朝鲜民主主义人民共和国大使馆, “朝鲜民主主义人民共和国 罗先经济贸易区法”. Available as: http://kp.chineseembassy.org/chn/zxxx/P020120524339572663360.doc.

[5] Eric Yong-Joong Lee, The Special Economic Zones and North Korean Economic Reformation with a Viewpoint of International Law, 27 Fordham Int’l L.J. 1343 (2003). Available as: http://ir.lawnet.fordham.edu/ilj/vol27/iss4/5

[6] (North Korean) Foreign Trade Laws 1997-2005, ChosonSinbo website. Available as: http://www1.korea-np.co.jp/pk/economy/category13.htm

[7] Compilation of (North Korea ) Laws and Regulations (For Foreign Investment), hosted on North Korea Econ Watch website. Available as: http://www.nkeconwatch.com/category/policies/law-on-the-rajin-sonbong-trade-zone/

[8] Leonid Petrov (2012), “Pyongyang’s newest SEZ just another shortcut”, Asia Times, dated June 22, 2012, and available as http://www.atimes.com/atimes/Korea/NF22Dg01.html.

[9] ChosunIlbo, “Can N. Korea Take Over the Kaesong Industrial Complex?”, 29 April 2013. Available as: http://blogs.wsj.com/korearealtime/2013/04/03/a-rundown-of-the-kaesong-industrial-complex/http://english.chosun.com/site/data/html_dir/2013/04/29/2013042901345.html

[10] David von Hippel and Peter Hayes, “Foundations of Energy Security for the DPRK: 1990-2009 Energy Balances, Engagement Options, and Future Paths for Energy and Economic Redevelopment”, 18 December 2012. Attachment 1, figure A1-1. Available as: https://nautilus.org/napsnet/napsnet-special-

reports/foundations-of-energy-security-for-the-dprk-1990-2009-energy-balances-engagement-options-and-future-paths-for-energy-and-economic-redevelopment/#axzz2kMlxEBEs

[11] Edward Yoon, “Status and Future of the North Korean Minerals Sector”, 6 January 2011, pg 19. Available as: https://nautilus.org/wp-content/uploads/2011/12/DPRK-Minerals-Sector-YOON.pdf

[12] Sun Yang, “探秘朝鲜招商“驻京办”后台可上推至朝鲜二号人物”, “Revealing the mystery of North Korea’s Investment Solicitation Office in Beijing, may have been pushed to DPRK’s number two”, 21 April 2013. Available as: http://finance.ifeng.com/news/hqcj/20130421/7938380.shtml

[13] Yoon, p 26.

[14] Jun Kwanwoo, “A Rundown of the Kaesong Industrial Complex”, Wall Street Journal Korea Realtime, 3 April 2013. Available as: http://blogs.wsj.com/korearealtime/2013/04/03/a-rundown-of-the-kaesong-industrial-complex/

[15] Some information about this refinery, and plans for its expansion, was at one time available on the UNIDO (UN Industrial Development Organization) World-wide Web site at http://www.unido.org, though it is unclear if that information remains available.

[16]International Petroleum Encyclopedia, 1996. Tulsa, Oklahoma Petroleum Publishing Company, Tulsa, OK.

[17] Web page http://www1.korea-np.co.jp/pk/095th_issue/99051905.htm, dated 1999, by “The People’s Korea”, and titled “Rajin-Sonbong Region”.

[18] Sonbong port, which serves the refiner, is reported to have two underwater pipelines from the end of the wharf to a loading buoy for crude oil (3500 m), plus (apparently) one each for loading and unloading gasoline, diesel and fuel oil, with a crude oil (presumably) pipeline transit capacity of 2-3 million tons/year. The port is described as having docking capacity for two 6,000 ton, one 15,000 ton, one 30,000 ton, and one 250,000 ton tankers, plus storage tanks for crude oil in the following sizes: 9 tanks of 20,000 m3, 10 tanks of 22,000 m3 and one tank 400,000 m3.

[19] See, for example, Michael Kohn and Yuriy Humber (2013), “Mongolia Taps North Korea Oil Potential to Ease Russian Grip”, Bloomberg Sustainability, dated June 18, 2013, and available as

http://www.bloomberg.com/news/2013-06-17/mongolia-taps-north-korean-oil-potential-to-ease-russia-reliance.html.

[20] “Yanbian Prefecture Issued Policies to Support the Development of Hunchun International Cooperation Demonstration Zone”, Jilin Province Government website, 18 October 2013. Available as:

http://english.jl.gov.cn/News/GeneralNews/201310/t20131018_1541776.html

[21] “图们依托至朝鲜铁路优势将实施借港出海战略” “Tumen to become foreign trade center, import-export processing and international logistics base”, DMU Logistics website, 21 June 2013. Available as: http://www.dmu.com.cn/news_show.aspx?id=3411.

[22] “在长吉图建设中节点城市图们的做法” “In the midst of Changjituconstruction,Tumen is becoming a node”, YanbianRibao, 5 August 2013. Available as:

http://www.hybrb.com/index.php?m=Article&a=show&id=36239#

[23] Sabine Van Ameidjen, “Revolution on the Margins? Surveying the Trade Environment in Rason”, Sino-NK, 25 May 2012. Available as: http://sinonk.com/2012/05/25/revolution-on-the-margins-surveying-the-trade-environment-in-rason/

[24] “全国首家省级公安出入境派出机构落户吉林珲春” “Jilin Province Public Security Bureau Administration Exit and Entry Administration Sets up office in Hunchun”, Changchun Culture Net, 28 June 2013. Available as: http://news.xwh.cn/news/system/2013/06/28/010367171.shtml

[25] Ibid

[26] Ibid

[27] Li Shujuan and Zhang Zhuo, “绿色能源:“长吉图”新引擎” “Green Growth: CHANGJITU’s new engine”, Jilin Daily, 2 August 2013. Available as: http://jlrbszb.chinajilin.com.cn/html/2013-

08/02/content_92129.htm?div=-

[28 ]“Hunchun: the “bridgehead” to open up the world”, Jilin Province Government website, 5 March 2013. Available as: http://english.jl.gov.cn/News/GeneralNews/201303/t20130305_1425250.html

[29] Dong Sheng and Yin Zhijun, “吉林院开展对朝供电线路中国侧选线勘测” “Jilin Electric Power Survey & Design Institute, 26 February 2013. Available as: http://www.jlepsdi.com/qykx_view.htm?id=498

[30] Pei Shanguang, “吉林院完成对朝供电中国段220kV输电线路终勘” “Jilin Institute completed final survey of China segment of 220 kV transmission lines to North Korea” 3 April 2013. Available as: http://www.jlepsdi.com/qykx_view.htm?id=510

[31] Li Shujuan and Zhang Zhuo, “绿色能源:“长吉图”新引擎” “Green Growth: CHANGJITU’s new engine”, Jilin Daily, 2 August 2013. Available as: http://jlrbszb.chinajilin.com.cn/html/2013-

08/02/content_92129.htm?div=-

[32] See, for example, Jethro Mullen (2014). “North Korea’s Kim Jong Un lauds purge of executed uncle Jang Song Thaek”. CNN.com, dated January 1, 2014, and available as

http://www.cnn.com/2013/12/31/world/asia/north-korea-kim-jong-un-speech/.

[33] Dong-A Ilbo, “North Korea considers suggesting joint use of Najin port”, 25 October 2013. Available as: http://english.donga.com/srv/service.php3?bicode=050000&biid=2013102505328

[34] Energy Korea.com, “Russia PNG business is cruising even with Kim Jung Il reef”, 27 February 2012. Available as: http://energy.korea.com/archives/22280?cat=11

[35] See, for example, 38 North (2010), “Spotlight on Sinuiju”, dated 23 July 2010, and available as , http://38north.org/2010/07/sinuiju-2/,

[36] Korea Central News Agency, “DPRK Law on Hwanggumphyong and Wihwado Economic Zone”, 7 June 2012. Available as: http://www.kcna.co.jp/item/2012/201206/news07/20120607-16ee.html.

[37] North Korea Econ Watch, “Law of the Democratic People’s Republic of Korea of the Hwanggumphyong and Wihwado Economic Zone”, 3 December, 2011. Available as: http://www.nkeconwatch.com/nk-uploads/Law-on-hwanggumphyong.pdf.

[38] Liu Yonggang, “Seeking Sino-North Korea Economic Zone, Hwanggumpyeong” “中朝黄金坪经济区探秘”, China Economic Weekly, 27 November 2012. Available as:

http://business.sohu.com/20121127/n358720905.shtml

[39] 38 North (2013), “New Construction Activity at the Hwanggumpyong Economic Zone”, dated 17 June 2013, and available as http://38north.org/2013/06/hgp061713/.

[40] See, for example, Leonid Petrov (2012), “Wihwado benefits China second time but leaves Korea divided”, Leonid Petrov’s KOREA VISION, available as

http://leonidpetrov.wordpress.com/2012/06/19/wihwado-benefits-china-second-time-but-leaves-korea-divided/.

[41] Law of the Democratic People’s Republic of Korea of the Hwanggumphyong and Wihwado Economic Zone, 3 December 2011. Available as: http://www.nkeconwatch.com/nk-uploads/Law-on-hwanggumphyong.pdf

[42] See, for example, North Korea Economy Watch (2013), “North Korea enacts new tax regulations in Mt. Kumgang tourist zone”, dated March 21, 2013, and available as

http://www.nkeconwatch.com/category/economic-reform/special-economic-zones-2/special-economic-zones/kumgang-resort/. This article was originally published by the Institute for Far Eastern Studies (IFES), 2013-3-21.

[43] The KynghhyangShinmun, “Hyundai Asan, ‘We Are Disappointed, but We Will Wait Instead of Reacting to Every Little Change’”, 23 September 2013. Available as:

http://english.khan.co.kr/khan_art_view.html?code=710100&artid=201309231758427

[44] Xinhuanet, “DPRK tourist site soon opens to Chinese visitors”, 21 March 2012. Available as:

http://news.xinhuanet.com/english/world/2012-03/21/c_131479048.htm

[45] Mount Kumgang Tourist Brochure, Charles-Wetzel.com, undated. Available as: http://www.charles-wetzel.com/site_backup/images/Geumgangsan/Geumgangsan_Brochure.jpg

[46] ChosonSinbo, “Mt Kumgang Development Project Gets into Gear”, Available as: http://www1.korea-np.co.jp/pk/080th_issue/99020307.htm

[47] Energy Korea, “Supply of LPG to Kaesong Industrial Complex in North Korea suspended for 4 months” 9 August 2013. Available as: http://energy.korea.com/archives/57502

[48] Dick K. Nanto and Mark E. Manyin (2011), The Kaesong North-South Korean Industrial Complex, United States Congressional Research Service, dated April 18, 2011, and available as http://www.fas.org/sgp/crs/row/RL34093.pdf.

[49] (North) Korean Central News Agency, “Provincial Economic Development Zones to be set up in DPRK”, 21 November 2013. Available as: http://www.kcna.co.jp/item/2013/201311/news21/20131121- 24ee.html

[50] “N. Korea’s NLL economic zone separate from 14 special biz zones: official”, Yonhap News Agency, 7 November 2013. Available as:

http://english.yonhapnews.co.kr/northkorea/2013/11/07/90/0401000000AEN20131107003000315F. html

[51] Curtis Melvin, “Preciseness emphasized for the tax investigation of special economic zones”, NKeconwatch blog, 18 January 2012. Available as:

http://www.nkeconwatch.com/2012/01/23/preciseness-emphasized-for-the-tax-investigation-of-special-economic-zones/

[52] Original 1993 and subsequent revisions as well as specific zone laws and regulations are available via NKEconwatch. Available as: http://www.nkeconwatch.com/2012/03/19/kcna-publishes-dprk-sez-laws/

[53] Vietnam’s reform and opening or “DoiMoi” began almost a decade after China’s experiment. This is the foundational document for Vietnam’s concept of “Special Export Processing Zones”. Decree on Special Export Processing Zones, 18 October 1991. Available as: http://park.org/Thailand/MoreAboutAsia/vninfo/docs/t280.html

[54] Here is an example of regulations for one of China’s first set of Special Economic Zones. Regulations on Special Economic Zones in Guangdong Province, 26 August 1980. Hosted on Asian Legal Information Institute. Available as: http://www.asianlii.org/cn/legis/cen/laws/rosezigp554/

[55] For those more interested in the legal aspects and early growing pains experienced by China, this article clarifies some of the legal questions and resulting governance structures that should be developing in the near future if North Korea indeed intends to hew closer to the Chinese line or the Vietnamese line of development. Henry R. Zheng, The Legal Structure of Economic and Technological Development Zones in the People’s Republic of China, 5 Int’l Tax &Bus. Law.70 (1987). Available at:

http://scholarship.law.berkeley.edu/bjil/vol5/iss1/3 or

http://scholarship.law.berkeley.edu/cgi/viewcontent.cgi?article=1065&context=bjil

[56] Energy Korea, “Korea Needs to Establish Special District-type Industrial Complex to Develop Underground Resources in North Korea”, 10 October 2012. Available as:

http://energy.korea.com/archives/36312?cat=25

[57] See, for example, Edward Yoon, “Status and Future of the North Korean Minerals Sector”, 6 January 2011. Available as: https://nautilus.org/wp-content/uploads/2011/12/DPRK-Minerals-Sector-YOON.pdf.

XII. NAUTILUS INVITES YOUR RESPONSES

The Nautilus Peace and Security Network invites your responses to this report. Please leave a comment below or send your response to: nautilus@nautilus.org. Comments will only be posted if they include the author’s name and affiliation.

One thought on “Supplying Energy Needs for the DPRK’s Special Economic Zones and Special Administrative Regions: Electricity Infrastructure Requirements”